Appendix 9 A Empirical Evidence for the RiskReturn

- Slides: 6

Appendix 9 A Empirical Evidence for the Risk-Return Relationship (Question 9)

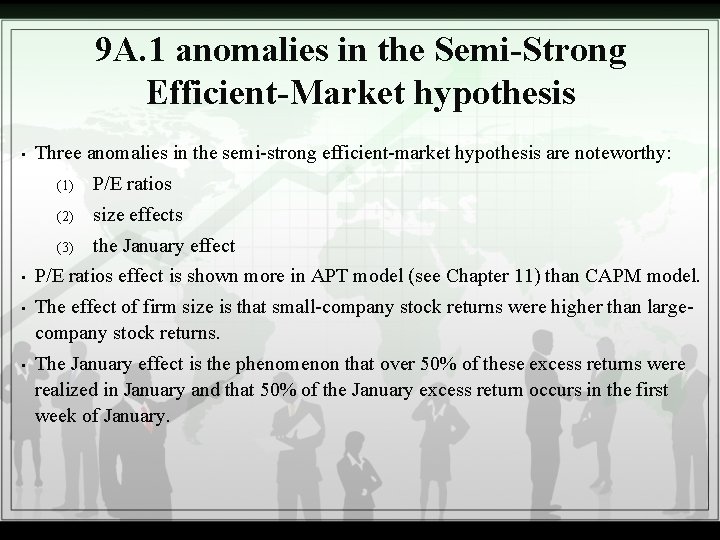

• The CAPM is a simple linear model expressed in terms of expected returns and expected risk. • In its ex-ante form: (9 A. 1) • Although many of the aforementioned extensions of the model support this simple linear form, others suggest that it may not be linear, that factors other than beta are needed to explain , or that the is not the appropriate riskless rate. • The first step necessary to empirically test theoretical CAPM is to transform it from expectations (ex-ante) form into a form that uses observed data. • On average, the expected rate of return on an asset is equal to the realized rate of return. This can be written as

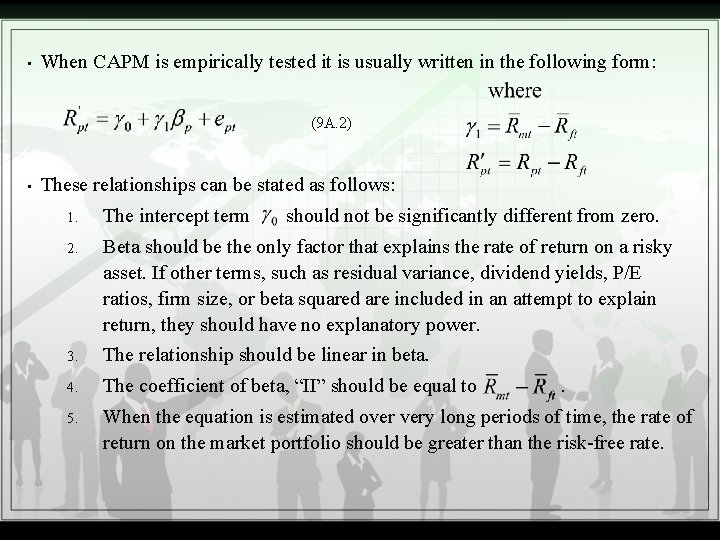

• When CAPM is empirically tested it is usually written in the following form: (9 A. 2) • These relationships can be stated as follows: 1. The intercept term should not be significantly different from zero. 2. Beta should be the only factor that explains the rate of return on a risky asset. If other terms, such as residual variance, dividend yields, P/E ratios, firm size, or beta squared are included in an attempt to explain return, they should have no explanatory power. 3. The relationship should be linear in beta. 4. The coefficient of beta, “II” should be equal to 5. When the equation is estimated over very long periods of time, the rate of return on the market portfolio should be greater than the risk-free rate. .

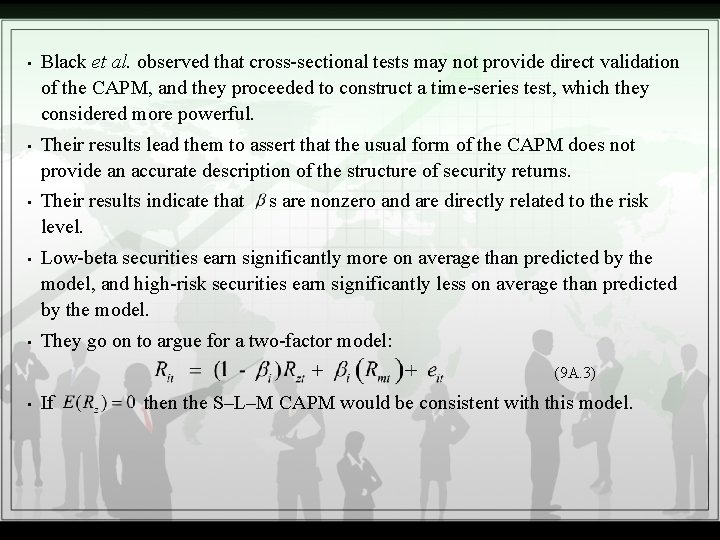

• Black et al. observed that cross-sectional tests may not provide direct validation of the CAPM, and they proceeded to construct a time-series test, which they considered more powerful. • Their results lead them to assert that the usual form of the CAPM does not provide an accurate description of the structure of security returns. • Their results indicate that level. • Low-beta securities earn significantly more on average than predicted by the model, and high-risk securities earn significantly less on average than predicted by the model. • They go on to argue for a two-factor model: s are nonzero and are directly related to the risk (9 A. 3) • If then the S–L–M CAPM would be consistent with this model.

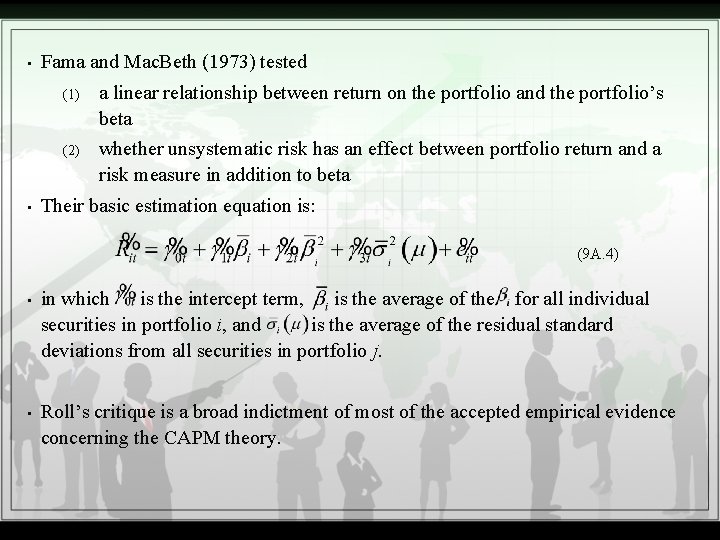

• • Fama and Mac. Beth (1973) tested (1) a linear relationship between return on the portfolio and the portfolio’s beta (2) whether unsystematic risk has an effect between portfolio return and a risk measure in addition to beta Their basic estimation equation is: (9 A. 4) • in which is the intercept term, is the average of the for all individual securities in portfolio i, and is the average of the residual standard deviations from all securities in portfolio j. • Roll’s critique is a broad indictment of most of the accepted empirical evidence concerning the CAPM theory.

9 A. 1 anomalies in the Semi-Strong Efficient-Market hypothesis • Three anomalies in the semi-strong efficient-market hypothesis are noteworthy: (1) P/E ratios (2) size effects (3) the January effect • P/E ratios effect is shown more in APT model (see Chapter 11) than CAPM model. • The effect of firm size is that small-company stock returns were higher than largecompany stock returns. • The January effect is the phenomenon that over 50% of these excess returns were realized in January and that 50% of the January excess return occurs in the first week of January.