Allstate Monthly Income Term Life Insurance Allstate comMonthly

- Slides: 6

Allstate Monthly Income Term Life Insurance Allstate. com/Monthly. Term © 2018 Allstate Insurance Company ALR 5554 -1 (5. 19) SM

What others are saying about Monthly Income Term "Life insurance should be paid out monthly. Someone might go through a lump sum in a year and half. If you're giving them a monthly check, you're allowing them to maintain the life they have been living. “ - Eric "My parents died when I was young, so I have been on the other end of this. It would have been so much better to have the monthly payments. “ - Sarah "I like Monthly Income Term because I know that my children will be taken care of. “ - Tasha

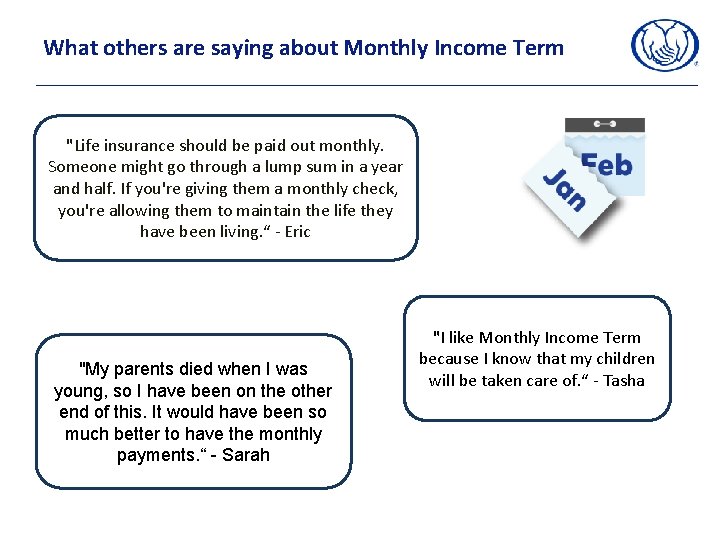

Allstate Monthly Income Term. SM Life Insurance Life insurance that pays out like a monthly paycheck Provide a monthly income to your loved ones even when you’re no longer around with our first of its kind life insurance that pays out each month, not just once. Product • Term Length: 10 or 20 years Overview • Payout Period: 3, 5 or 10 years • Initial $10, 000 payout for immediate expenses • Option to add up to $15, 000 to the initial payout

Quick Recap Term Length: The term length is how long you are protected. The options include 10 or 20 years, as long as premium payments are made. Monthly Death Benefit Payment: The monthly death benefit payment is the amount your beneficiaries would receive each month. Monthly Death Benefit Payment Period: The monthly death benefit payment period is the amount of time your beneficiaries will receive the monthly payment. The options include 3, 5 or 10 years. Initial Lump Sum Benefit This is a one-time initial payout of $10, 000 to help cover immediate expenses at the time of loss. You also have the option to add up to $15, 000, which could result in a total of $25, 000. This would require an additional premium cost.

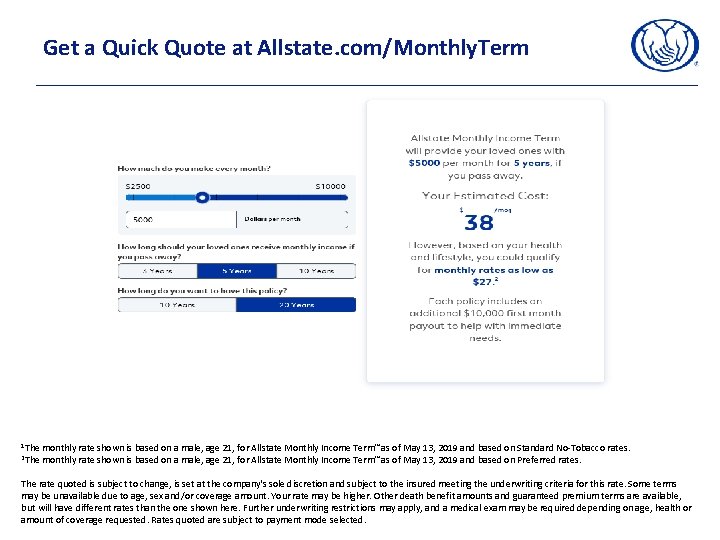

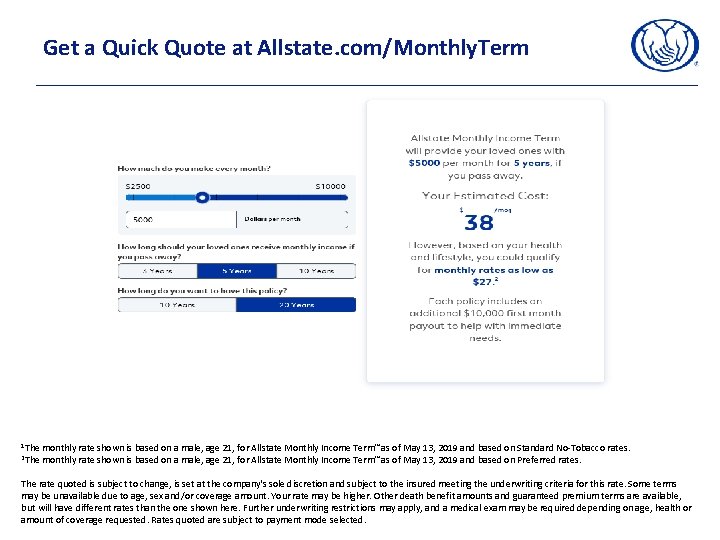

Get a Quick Quote at Allstate. com/Monthly. Term 1 The 2 The monthly rate shown is based on a male, age 21, for Allstate Monthly Income Term℠ as of May 13, 2019 and based on Standard No-Tobacco rates. monthly rate shown is based on a male, age 21, for Allstate Monthly Income Term℠ as of May 13, 2019 and based on Preferred rates. The rate quoted is subject to change, is set at the company's sole discretion and subject to the insured meeting the underwriting criteria for this rate. Some terms may be unavailable due to age, sex and/or coverage amount. Your rate may be higher. Other death benefit amounts and guaranteed premium terms are available, but will have different rates than the one shown here. Further underwriting restrictions may apply, and a medical exam may be required depending on age, health or amount of coverage requested. Rates quoted are subject to payment mode selected.

Disclosures Allstate Monthly Income Term℠ is a term life insurance policy issued by Allstate Assurance Company, 3075 Sanders Rd. , Northbrook IL 60062 and is available with contract series ICC 18 AC 11/NC 18 AC 11 and rider series ICC 18 AC 12/NC 18 AC 12. In New York, issued by Allstate Life Insurance Co. of New York, Hauppauge, NY with contract series NYLU 839 and rider series NYLU 840. Policy issuance is subject to availability and qualifications. This policy has exclusions, limitations and terms that may affect coverage, renewal, cancellation, termination, or other contractual rights and benefits. Guarantees offered are subject to the claims-paying ability of the issuing company. © 2018 Allstate Insurance Company ALR 5554 -1 (5. 19)