Your Commitment to Our Relationship Investment Products Full

- Slides: 2

Your Commitment to Our Relationship Investment Products • Full Service Brokerage Accounts held with Fidelity Investments • Stocks • Mutual Funds • Bonds • Corporate Pension Plans • I. R. A. , SEP, and Keogh Plans • Life Insurance Planning • Estate Planning • Financial Planning • Wealth Transfer Planning • College Tuition Planning • Philanthropic Advice • Annuities • Third Party Technical Market Analysis § § § Notify us of life events that impact your plan Patience and understanding when the market fluctuates Discipline to stay with your plan Commitment to remain invested for the long -term Referrals for new business An Introduction from Asset Management Strategies, LLC. Your Financial Journey Investing is a journey with now as your starting point and your dreams and goals as the final destination. As your advisor, I promise to be there with you the entire way. Our team will keep your interests first, and we’ll make sure you are always properly invested, relative to your goals. Asset Management Strategies, LLC. 10157 Cedarwood Drive Union, KY 41091 Phone: 859 -384 -8986 Fax: 859 -384 -8976 Toll Fr: 877 -657 -8986 Email: dferland@woodstockfg. com 10157 Cedarwood Drive Union, KY 41091 Ph: 859 -384 -8986 Fax: 859 -384 -8976 Email: dferland@woodstockfg. com Dawne A. Ferland President Registered Paraplanner Securities offered through Woodstock Financial Group, Inc. *Member NASD, SIPC, MSRB* 117 Towne Lake Parkway, Suite 200 Woodstock, GA 30188 (800) 478 -2602

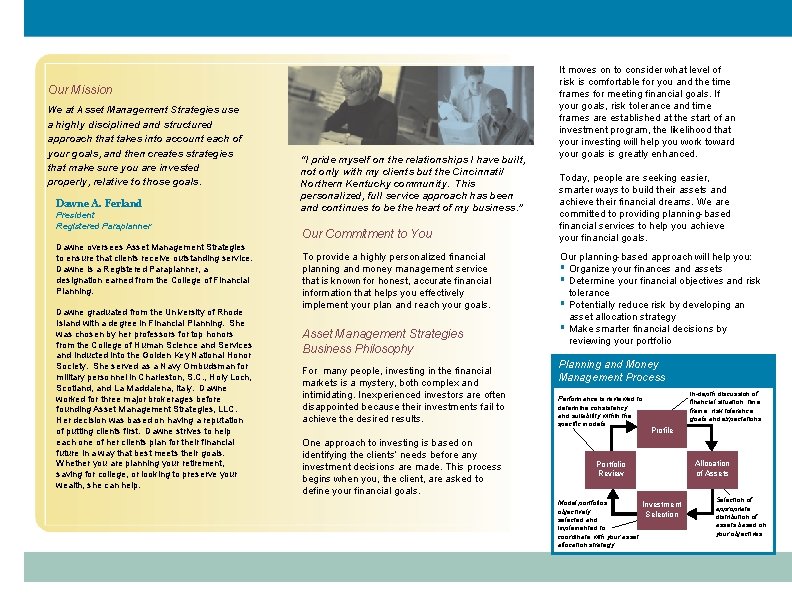

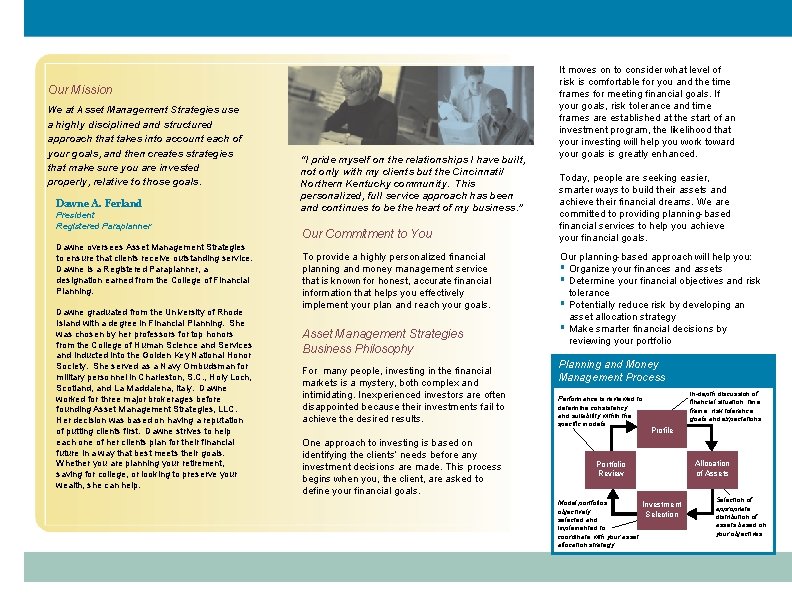

Our Mission We at Asset Management Strategies use a highly disciplined and structured approach that takes into account each of your goals, and then creates strategies that make sure you are invested properly, relative to those goals. Dawne A. Ferland President Registered Paraplanner Dawne oversees Asset Management Strategies to ensure that clients receive outstanding service. Dawne is a Registered Paraplanner, a designation earned from the College of Financial Planning. Dawne graduated from the University of Rhode Island with a degree in Financial Planning. She was chosen by her professors for top honors from the College of Human Science and Services and inducted into the Golden Key National Honor Society. She served as a Navy Ombudsman for military personnel in Charleston, S. C. , Holy Loch, Scotland, and La Maddalena, Italy. Dawne worked for three major brokerages before founding Asset Management Strategies, LLC. Her decision was based on having a reputation of putting clients first. Dawne strives to help each one of her clients plan for their financial future in a way that best meets their goals. Whether you are planning your retirement, saving for college, or looking to preserve your wealth, she can help. “I pride myself on the relationships I have built, not only with my clients but the Cincinnati/ Northern Kentucky community. This personalized, full service approach has been and continues to be the heart of my business. ” Our Commitment to You To provide a highly personalized financial planning and money management service that is known for honest, accurate financial information that helps you effectively implement your plan and reach your goals. Asset Management Strategies Business Philosophy For many people, investing in the financial markets is a mystery, both complex and intimidating. Inexperienced investors are often disappointed because their investments fail to achieve the desired results. One approach to investing is based on identifying the clients’ needs before any investment decisions are made. This process begins when you, the client, are asked to define your financial goals. It moves on to consider what level of risk is comfortable for you and the time frames for meeting financial goals. If your goals, risk tolerance and time frames are established at the start of an investment program, the likelihood that your investing will help you work toward your goals is greatly enhanced. Today, people are seeking easier, smarter ways to build their assets and achieve their financial dreams. We are committed to providing planning-based financial services to help you achieve your financial goals. Our planning-based approach will help you: § Organize your finances and assets § Determine your financial objectives and risk tolerance § Potentially reduce risk by developing an asset allocation strategy § Make smarter financial decisions by reviewing your portfolio Planning and Money Management Process Performance is reviewed to determine consistency and suitability within the specific models. In-depth discussion of financial situation, time frame, risk tolerance, goals and expectations. Profile Portfolio Review Model portfolios Investment objectively Selection selected and implemented to coordinate with your asset allocation strategy. Allocation of Assets Selection of appropriate distribution of assets based on your objectives.