WORKING CAPITAL WORKING CAPITAL Working Capital represents operating

- Slides: 26

WORKING CAPITAL

WORKING CAPITAL • Working Capital represents operating liquidity available to a business. • This is short term capital or finance that a business keeps. • Working capital is the money used to meet day to day working in business concern such as salary, rent, energy bills, purchases etc.

Working Capital • Working capital is defined as • Working Capital = Current Assets – Current Liabilities.

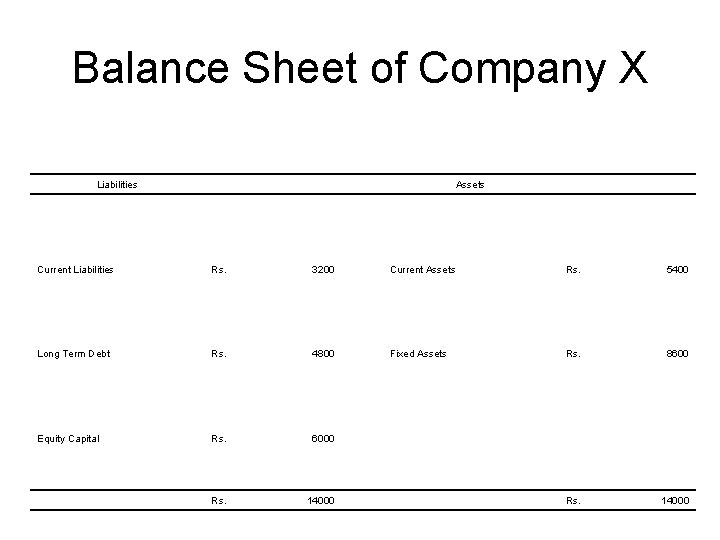

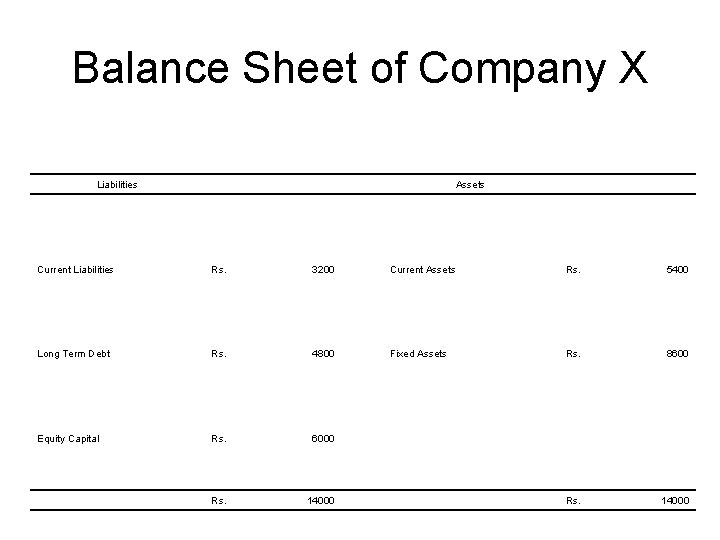

Balance Sheet of Company X Liabilities Assets Current Liabilities Rs. 3200 Current Assets Rs. 5400 Long Term Debt Rs. 4800 Fixed Assets Rs. 8600 Equity Capital Rs. 6000 Rs. 14000

Current Assets • Current assets are short term source of finance such as • Stocks / Inventories • Debtors • Cash Equivalent – these are short term and highly liquid investments which are easily and immediately convertible in to cash.

Current Liabilities • Current liabilities are short term requirements for cash. • trade creditors • Bills payable • Bank credit • Taxes • dividend

Working capital management • Task of the finance manager in managing working capital efficiently is to ensure sufficient liquidity in the operations of the business. • The liquidity of the firm is measured by its ability to satisfy short term obligations as they become due.

Measures of liquidity • The three basic measure of a firm’s overall liquidity are • 1) Current Ratio • 2) Acid Test Ratio • 3) Net Working Capital

Current Ratio • The current ratio is the ratio of total current assets to total current liabilities. Current Assets • Current Ratio = -------------Current Liabilities

CURRENT RATIO • Its measurement of short term solvency. • It indicates the rupee of current assets available for each rupee of current liability. • Conventionally a current ratio of 2 : 1 is considered satisfactory. •

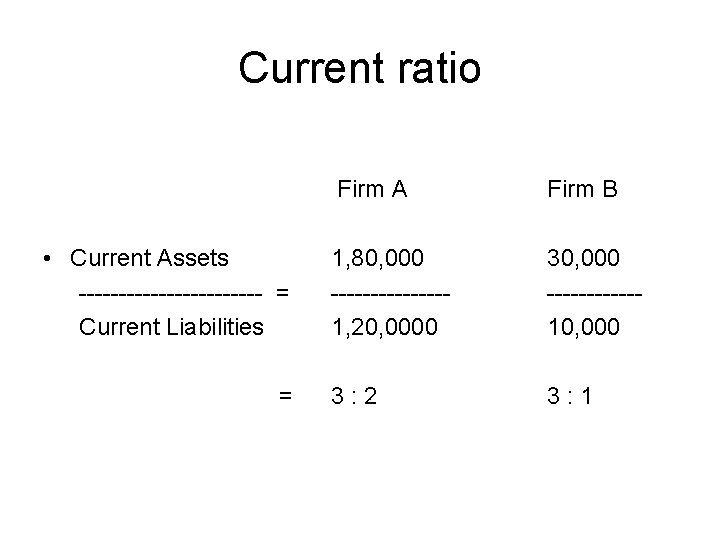

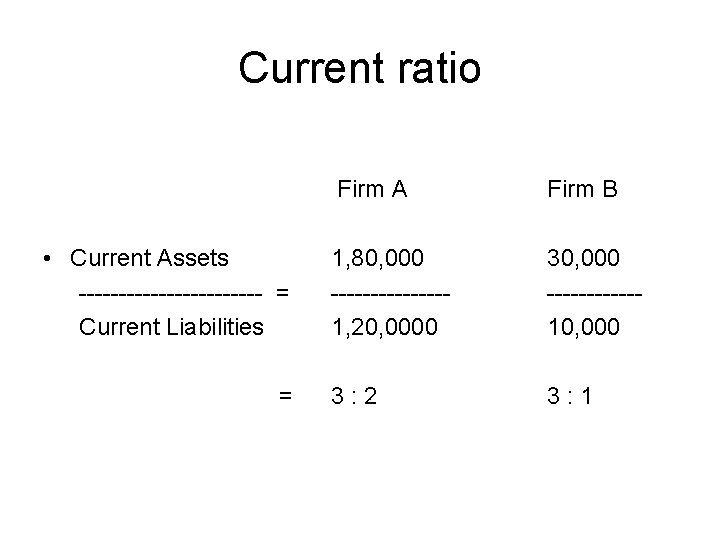

Current ratio • Current Assets ------------ = Current Liabilities = Firm A Firm B 1, 80, 000 -------1, 20, 0000 30, 000 ------10, 000 3: 2 3: 1

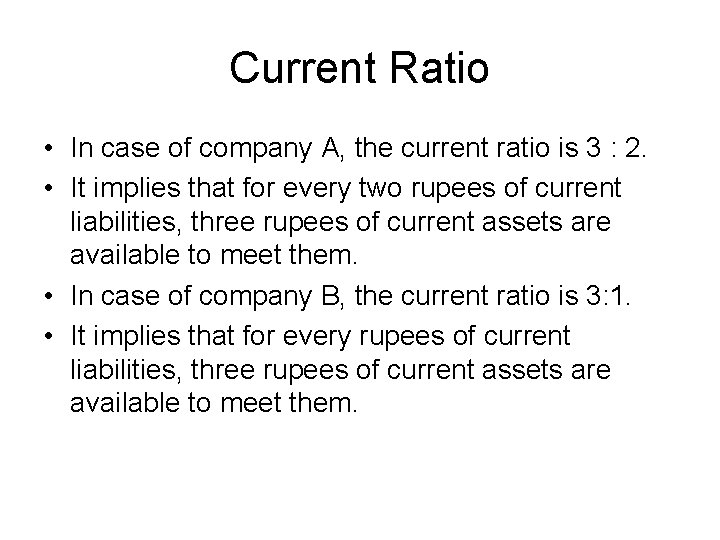

Current Ratio • In case of company A, the current ratio is 3 : 2. • It implies that for every two rupees of current liabilities, three rupees of current assets are available to meet them. • In case of company B, the current ratio is 3: 1. • It implies that for every rupees of current liabilities, three rupees of current assets are available to meet them.

Current ratio • The liquidity position, as measured by current ratio, is better in company B as compared to company A. • In inter firm comparison, the firm with higher current ratio has better liquidity / short term solvency.

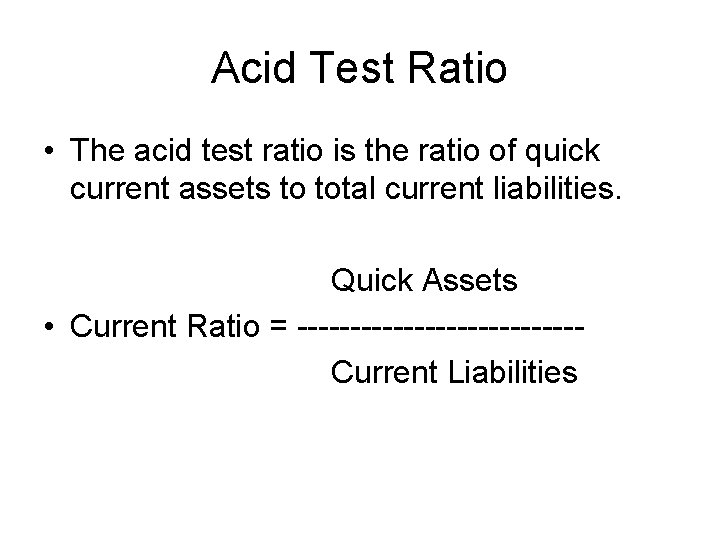

Acid Test Ratio • The acid test ratio is the ratio of quick current assets to total current liabilities. Quick Assets • Current Ratio = -------------Current Liabilities

Acid test ratio • Quick asset refers to current assets which can be converted into cash immediately or at a short notice without diminution of value. • It is a rigorous measure of a firm’s ability to serve short term liabilities. • An acid test ratio of 1: 1 is considered satisfactory.

Net Working Capital • Net working capital represents the excess of current assets over current liabilities. • Although NWC is really not a ratio, it is frequently employed as measure of a company’s liquidity position. • An enterprise should have sufficient working capital in order to be able to meet the claims of the creditors as well as daily needs of the business.

Need for working capital • Need for working capital arises because sales do not convert into cash immediately. • There is invariably a time lag between the sale of goods and the receipt of cash. • Therefore, sufficient working capital is necessary to sustain sales activity. • Technically, this is refereed to as operating cycle.

Operating Cycle • The operating cycle consists of three phases. • Phase 1 - cash get converted into inventory • Phase 2 – the inventory is converted into receivables as credit sales are made to customers. • Phase 3 – Receivables are collected.

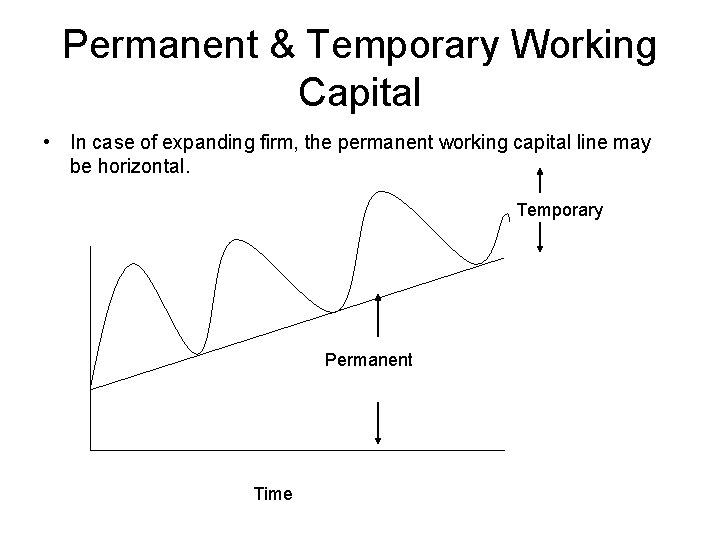

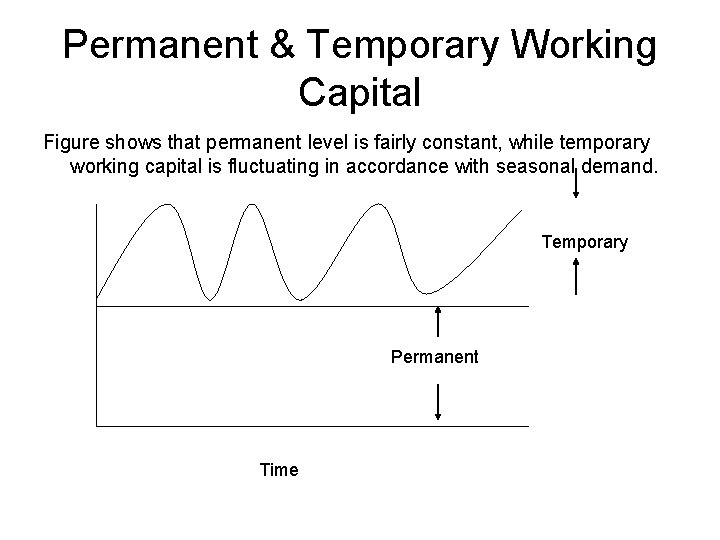

Permanent & Temporary Working Capital • To carry on business, a certain minimum level of working capital is necessary on a continuous basis. • This requirement will have to be met permanently. • Any amount above the permanent level of working capital is temporary, fluctuating or variable working capital. • Temporary working capital requirement arises due to seasonal fluctuation of business activity.

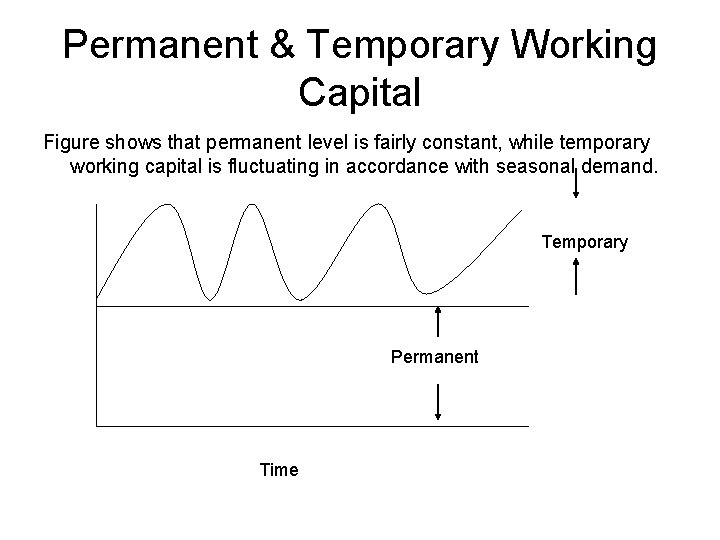

Permanent & Temporary Working Capital Figure shows that permanent level is fairly constant, while temporary working capital is fluctuating in accordance with seasonal demand. Temporary Permanent Time

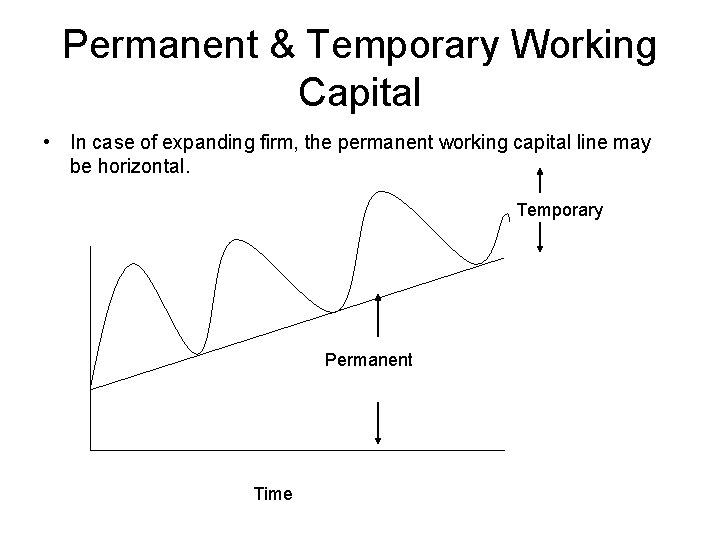

Permanent & Temporary Working Capital • In case of expanding firm, the permanent working capital line may be horizontal. Temporary Permanent Time

Financing of W. C. • The source of finance for working capital are mainly as under. • 1) Trade Credit • 2) Bank Credit • 3) Current provisions and non bank short term borrowings • 4) Long term source comprising equity capital and long term borrowings.

Financing of W. C. • In India the primary source for financing working capital are trade credit and short term bank credit.

Bank Credit • The bank credit is the primary institutional source of working capital finance. • To obtain short term bank credit, working capital requirement is estimated by borrowers and then banks are approached with necessary supporting data. • The bank determine the maximum credit based on the margin requirement of the security.

Bank Credit • The margin represents a percentage of the value of the asset offered as security by the borrower. • For ex, if the margin requirement on a particular item is 50%, the bank will provide credit upto Rs. 50, 000 against the security of an asset worth Rs. 1, 000.

Forms of Credit • After getting the overall credit limit sanctioned by the banker, the borrower draws fund periodically. The following forms of credit area available to him: • 1) Loan Arrangement • 2) Overdraft Arrangement • 3) Cash Credit Arrangement • 4) Term Loan for working capital