Value Creation The Source of Pricing Advantage Value

- Slides: 31

Value Creation The Source of Pricing Advantage

Value l l Value (or use value): the overall satisfaction that a customer receives from using a product or service offering. Consumer Surplus = Value – Price

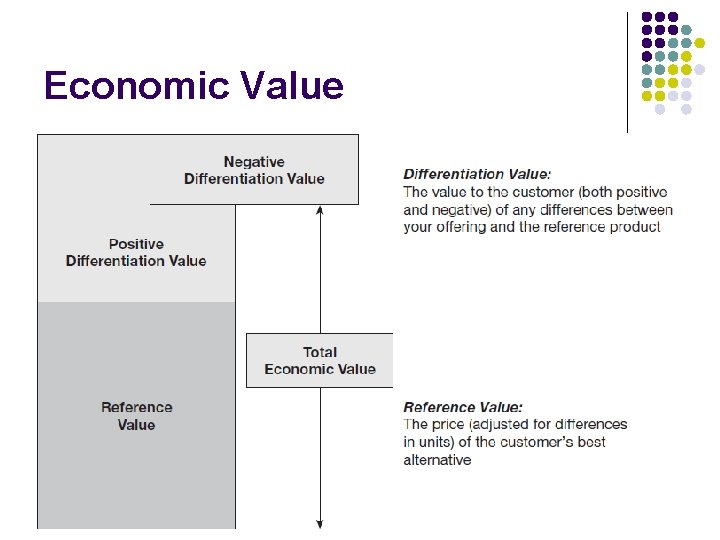

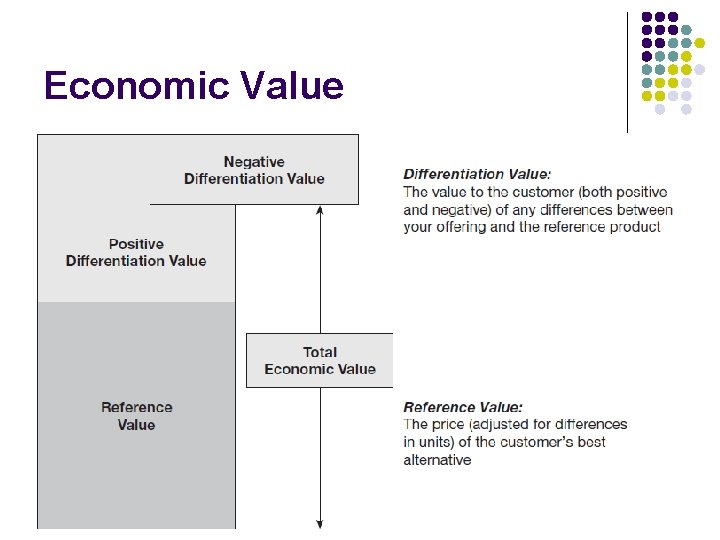

Economic Value l l The value at the heart of pricing strategy is not use value, but is what economists call economic value or exchange value. Economic Value = Reference Value + Differentiation Value

Economic Value

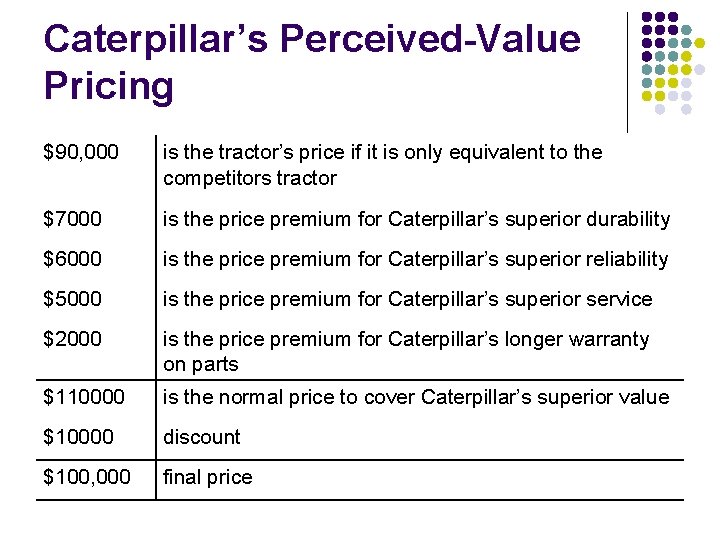

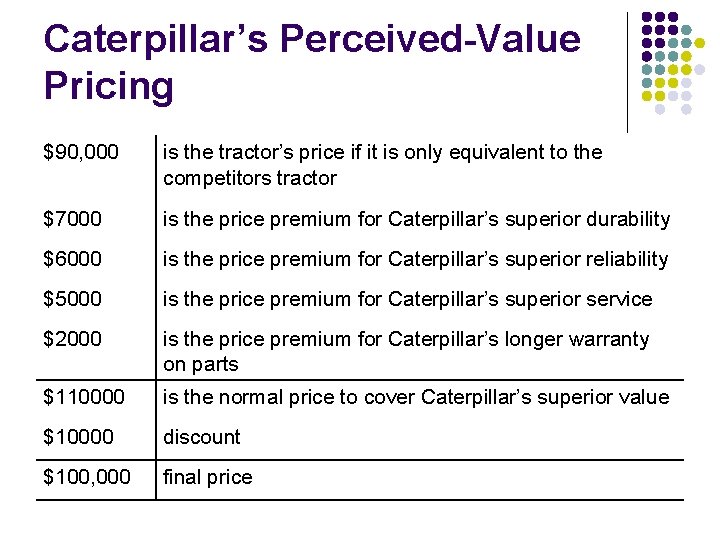

Differentiation Value l l Differentiation value is the net benefits that your product or service delivers to customers over and above those provided by the competitive reference product. Differentiation value comes in two forms: monetary and psychological. Monetary value: the total cost savings or income enhancements that a customer accrues as a result of purchasing a product. Psychological value: a product creates innate satisfaction for the customer.

Estimate Economic Value l l l Competitive reference prices Estimate monetary value Estimate psychological value

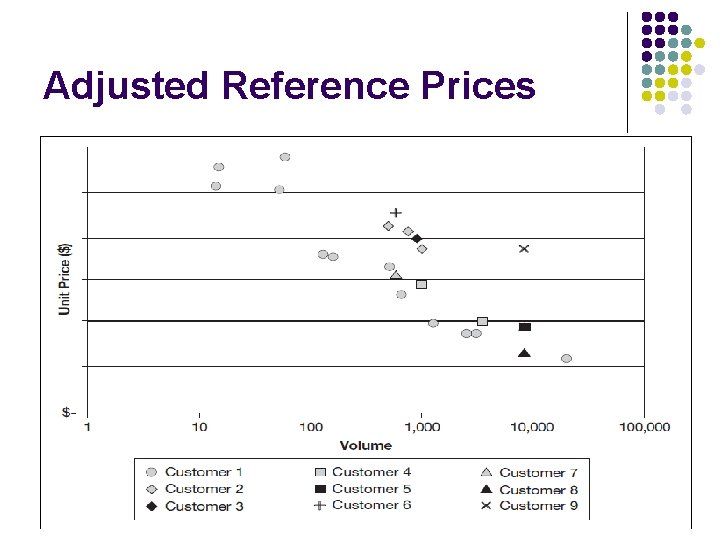

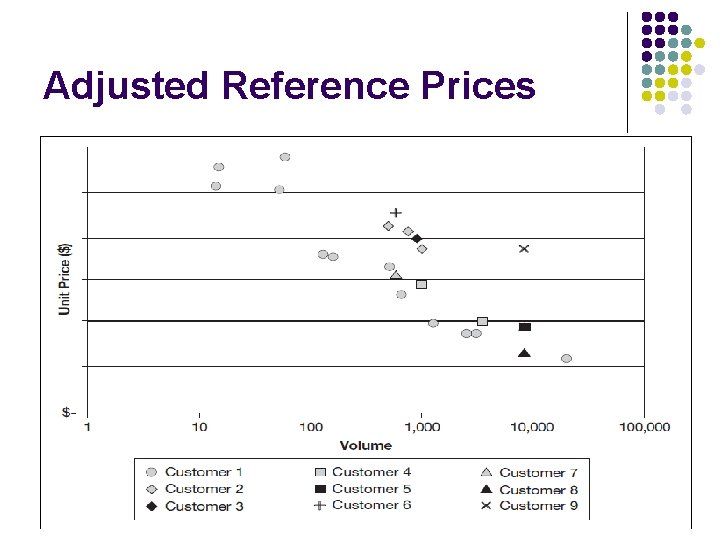

Competitive Reference Prices l l Some products may not have a single competing product that customers would consider a suitable alternative. Ex. 中華電信 vs. 威達. Another challenge to is gathering accurate price data and ensuring that it is comparable to the pricing for your product. You must ensure that competitive prices are measured in terms familiar to customers in the segment (for example, price per pound, price per hour) and are stated in the same units as your product.

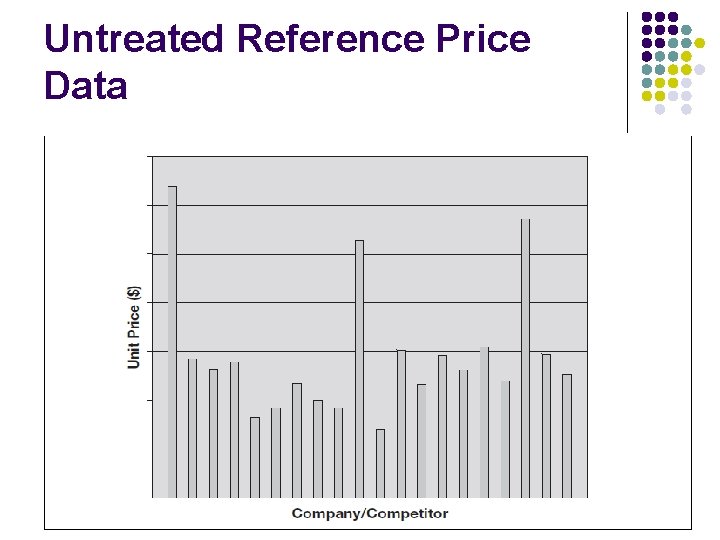

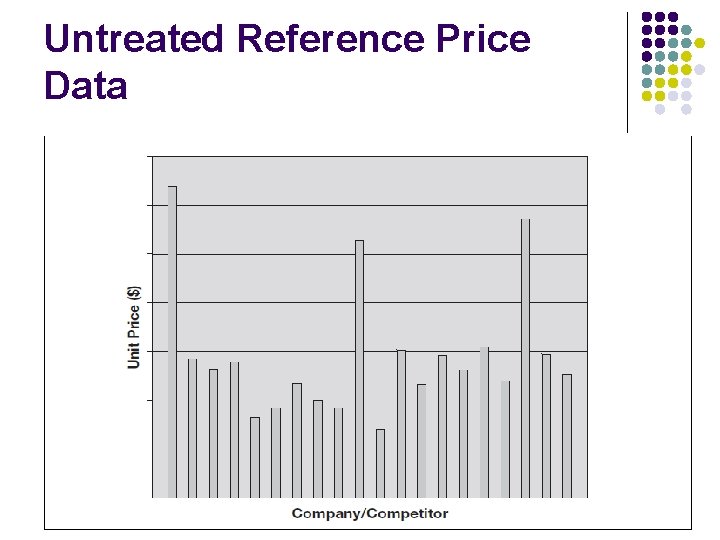

Untreated Reference Price Data

Adjusted Reference Prices

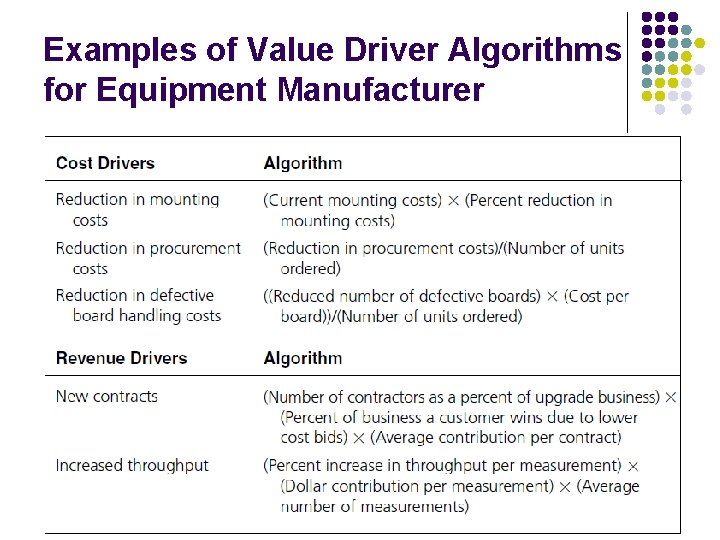

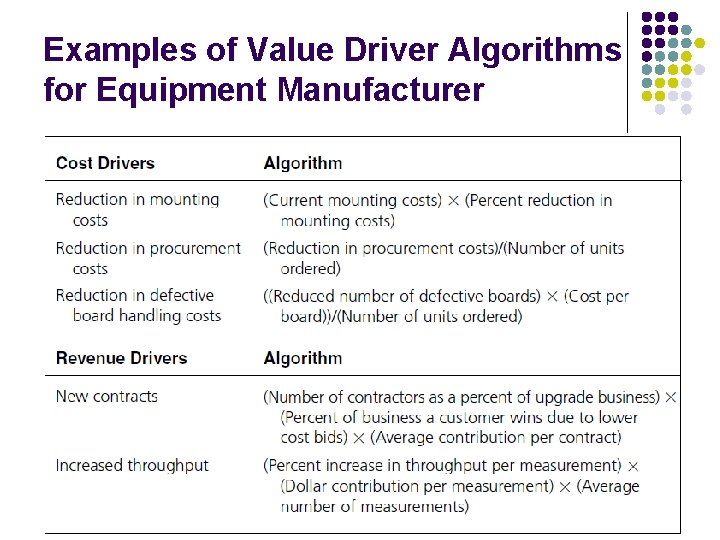

Estimate Monetary Value 1. 2. 3. Understand how the product category affects the customer’s costs and revenues, e. g. Distributor Co. . Collect specific data to develop quantified estimates. In-depth customer interviews are the best source of information. Sum the reference value and the differentiation value to determine the total monetary value.

Case: Distributor Co. l l l Distributor Co. buys technology products such as servers, software and network components and re-sells them downstream to value-added resellers. The management team believed that all customers valued its technical service and support highly – a belief supported by high service usage across all segments. Two segments: systems integrator vs. boxpusher.

Examples of Value Driver Algorithms for Equipment Manufacturer

Caterpillar’s Perceived-Value Pricing $90, 000 is the tractor’s price if it is only equivalent to the competitors tractor $7000 is the price premium for Caterpillar’s superior durability $6000 is the price premium for Caterpillar’s superior reliability $5000 is the price premium for Caterpillar’s superior service $2000 is the price premium for Caterpillar’s longer warranty on parts $110000 is the normal price to cover Caterpillar’s superior value $10000 discount $100, 000 final price

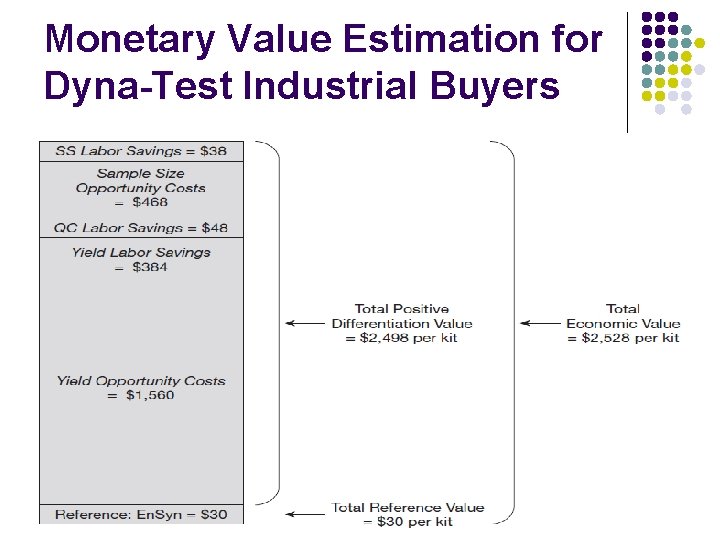

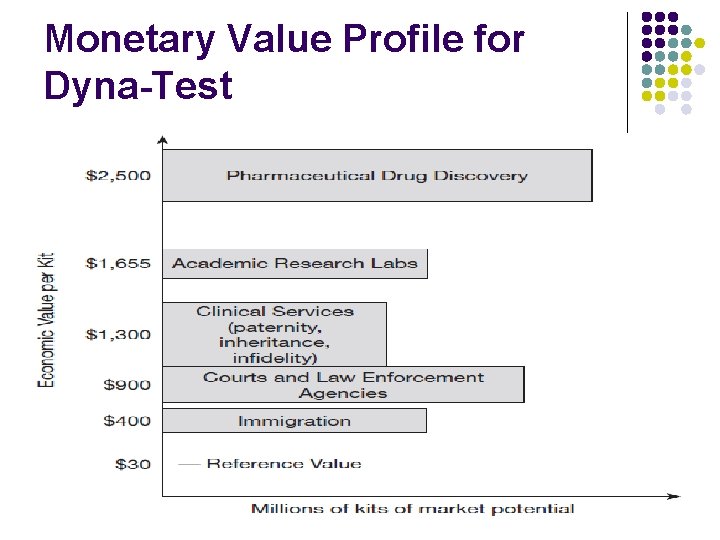

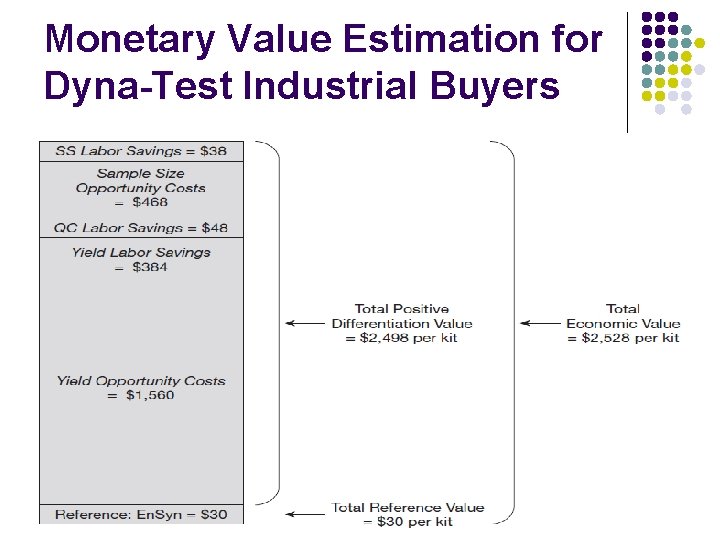

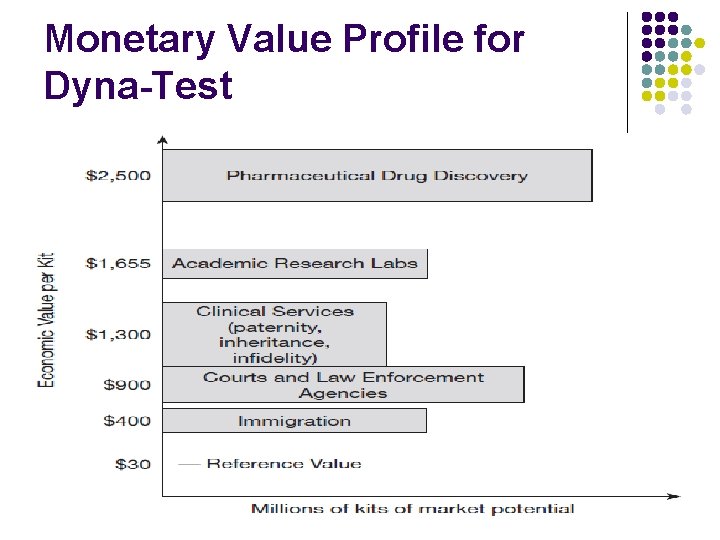

Case: Dyna-Test l l Dyna-Test synthesizes a complementary DNA strand from an existing DNA sample, significantly reducing DNA molecule degradation and enhancing the precision of a DNA analysis. Primary competitor: En. Syn Applications: criminal investigators, hospitals and medical professionals, and pharmaceutical manufacturers. In all applications, test failures can be costly.

Monetary Value Estimation for Dyna-Test Industrial Buyers

Monetary Value Profile for Dyna-Test

Several Guidelines for Estimating Monetary Value l Consider only the value of the difference between your product and the next best competitive alternative (NBCA) product. l The value of any benefits that are the same as those delivered by the NBCA is already determined by competition and incorporated into the reference value. You can charge no more for it than the price of the NBCA product, regardless of its use value to the customer.

Several Guidelines for Estimating Monetary Value l Measure the differentiation value either as costs saved to achieve a particular level of benefit or as extra benefits achieved for an identical cost. Don’t add both; that’s double counting.

Several Guidelines for Estimating Monetary Value l Do not assume that the percentage increase in value is simply proportional to the percentage increase in the effectiveness of your product. l Although your part might last twice as long as a competitor, it does not follow that your value is only twice as large.

Estimate Psychological Value l l l Psychological value drivers such as satisfaction and security, by virtue of their subjective nature, do not lend themselves to estimation via qualitative research techniques like in-depth interviewing. Instead, pricing researchers must rely on a variety of quantitative techniques to estimate the worth of a product’s differentiated features. The most widely used of these techniques is conjoint analysis.

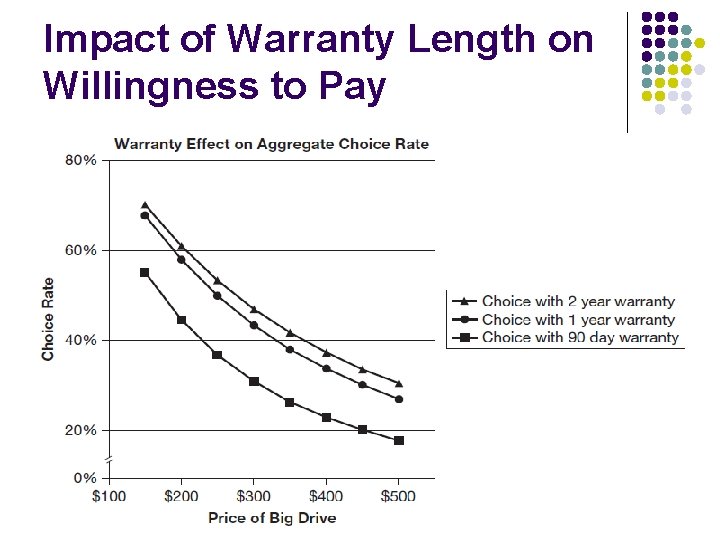

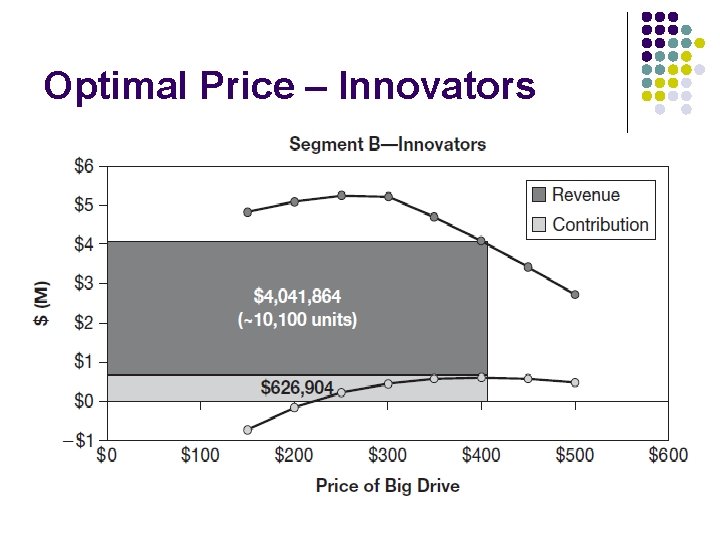

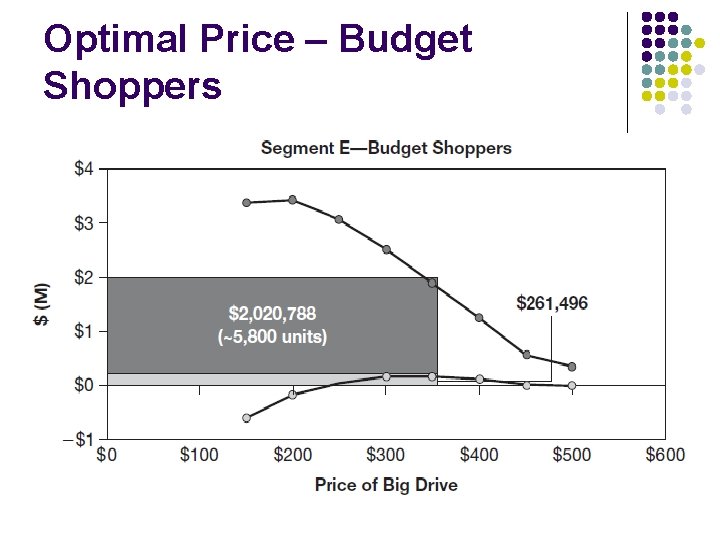

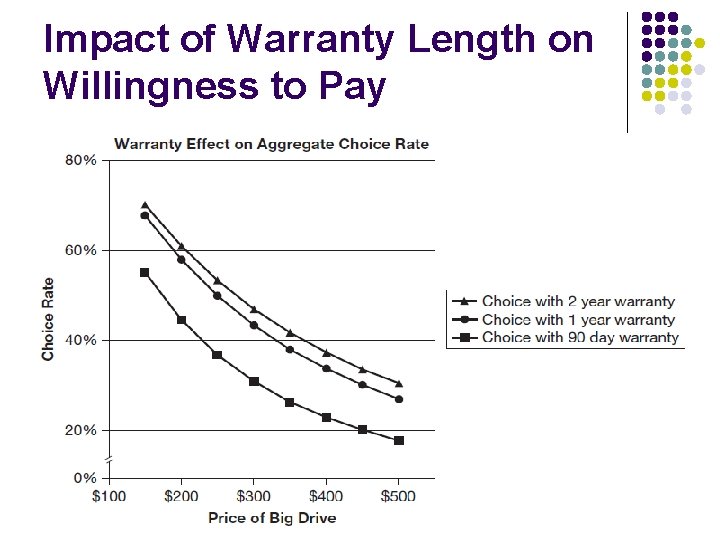

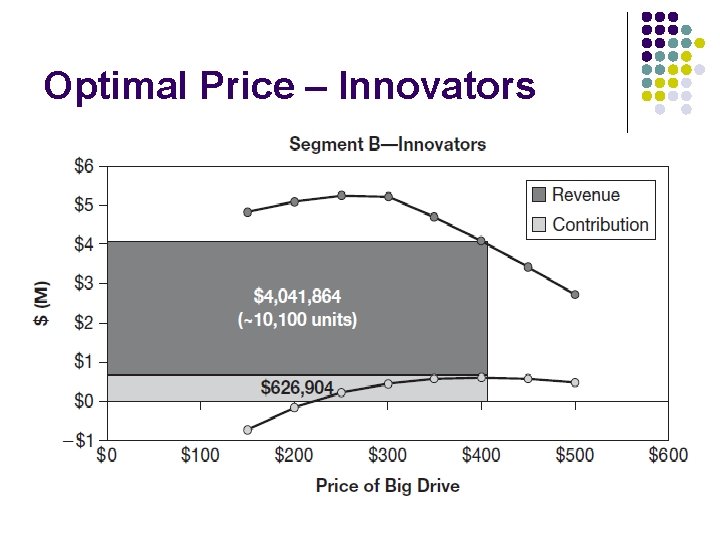

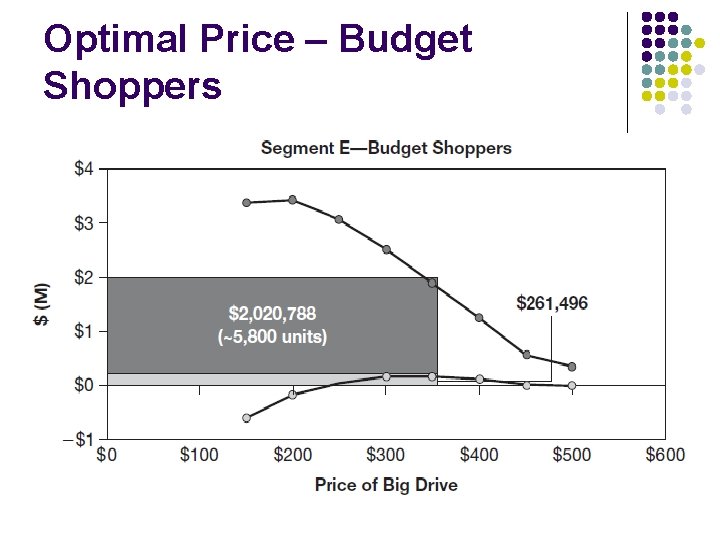

Case: Big Drive l l l Big Drive is a revolutionary golf club, and it has led to significant increases in distance and accuracy for both beginning and advanced players. Four segments: 1) Innovators; 2) Value Seekers; 3) Lost Players; 4) Budget Shoppers. Four attributes: 1) Distance; 2) Straightness; 3) Consistency; 4) Warranty.

Impact of Warranty Length on Willingness to Pay

Optimal Price – Innovators

Optimal Price – Budget Shoppers

Limitation of Conjoint Analysis l l l Where conjoint and other similar survey research techniques can fall short is when the differentiating benefits are innovative. Most people, even those deeply familiar with the technology, are not good at inferring the benefits of innovation. There is no reason anyone would ever want a computer in their home. (Ken Olsen, 1977)

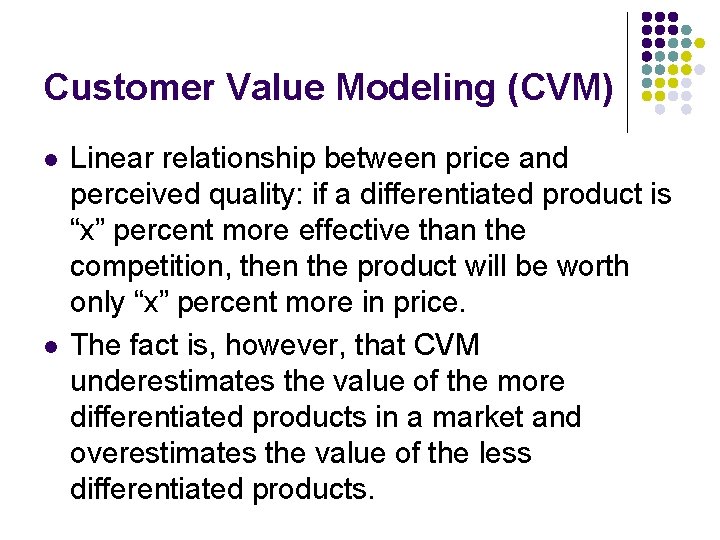

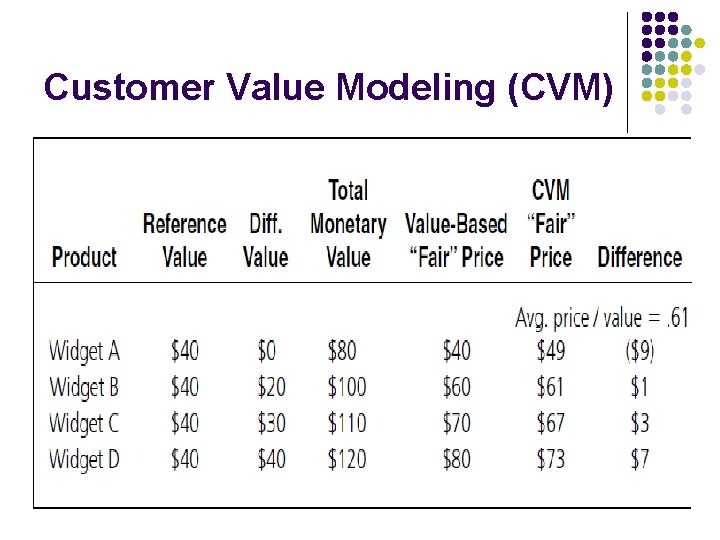

Customer Value Modeling (CVM) l l Assumption: customers seek to purchase the products that give them the greatest perceived benefit – which might be quantified in monetary terms, but need not be – per unit price. Related terminology: “fair-value line, ” “value equivalence line, ” or “indifference line. ”

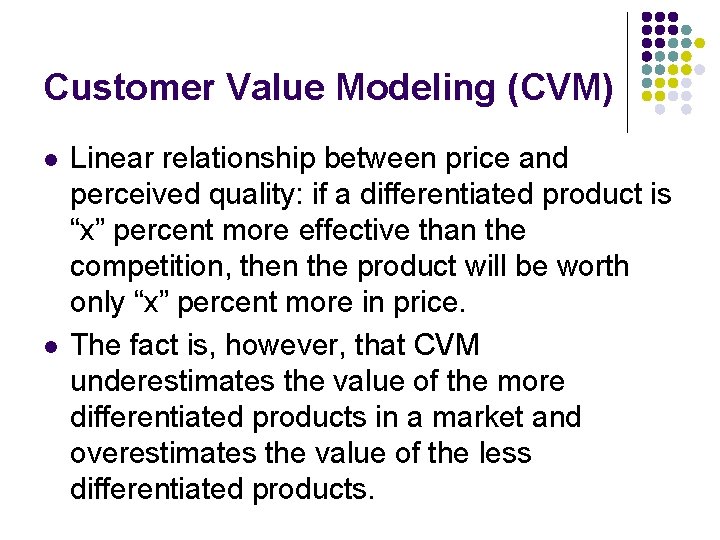

Customer Value Modeling (CVM) l l Linear relationship between price and perceived quality: if a differentiated product is “x” percent more effective than the competition, then the product will be worth only “x” percent more in price. The fact is, however, that CVM underestimates the value of the more differentiated products in a market and overestimates the value of the less differentiated products.

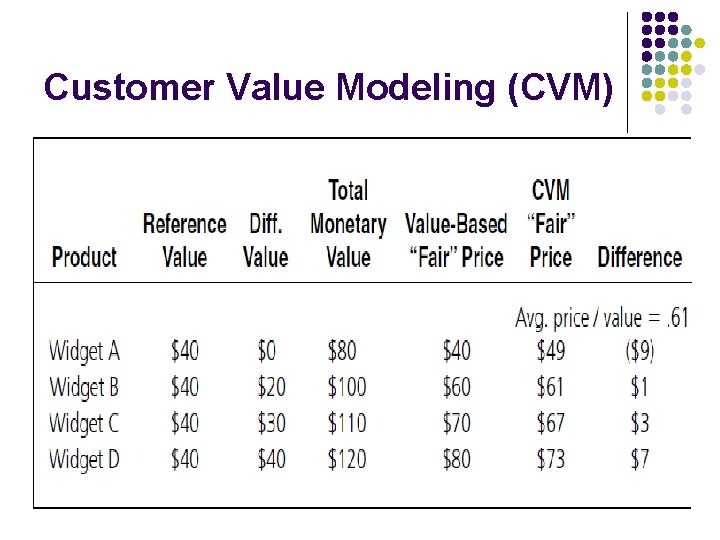

Customer Value Modeling (CVM)

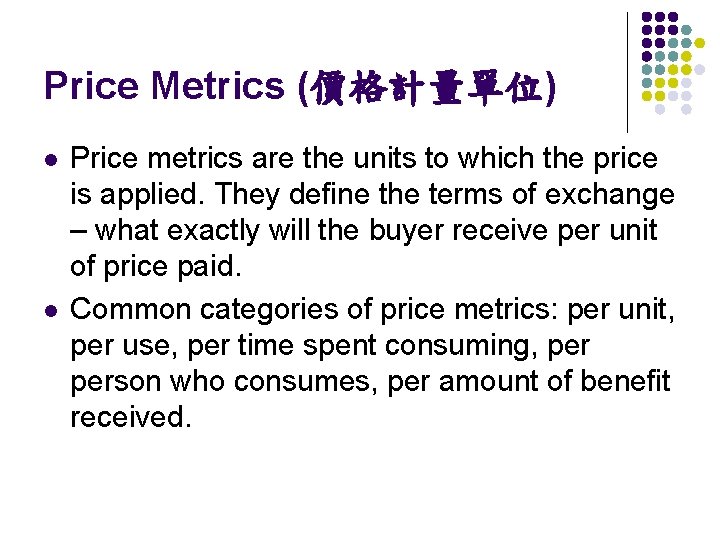

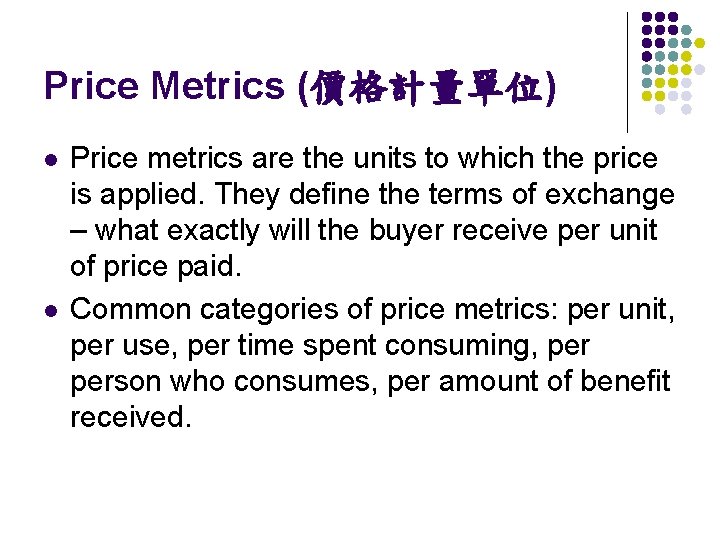

Price Metrics (價格計量單位) l l Price metrics are the units to which the price is applied. They define the terms of exchange – what exactly will the buyer receive per unit of price paid. Common categories of price metrics: per unit, per use, per time spent consuming, person who consumes, per amount of benefit received.

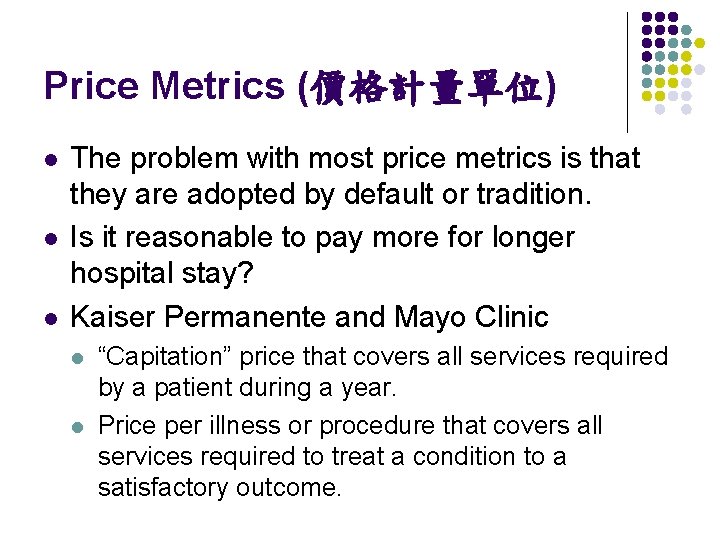

Price Metrics (價格計量單位) l l l The problem with most price metrics is that they are adopted by default or tradition. Is it reasonable to pay more for longer hospital stay? Kaiser Permanente and Mayo Clinic l l “Capitation” price that covers all services required by a patient during a year. Price per illness or procedure that covers all services required to treat a condition to a satisfactory outcome.

Criteria for Evaluating Price Metrics