Value Creation and Structure of Financial Services Industry

- Slides: 22

Value Creation and Structure of Financial Services Industry Week 1 J. K. Dietrich - FBE 525 - Fall, 2006

Target market for this course u Managers of financial service firms u Investment bankers doing deals u Strategic planners and researchers u Consultants and other business services u Users of financial services J. K. Dietrich - FBE 525 - Fall, 2006

Course goals and requirements u Readings u Class participation u Case analysis and discussion u Group project u Individual parts of project u Current periodicals J. K. Dietrich - FBE 525 - Fall, 2006

Financial service firms u Mergers and acquisitions – Banks and thrifts consolidate » e. g. Citibank and Cal. Fed – Financial firms form conglomerates » Citigroup out of Travellers and Citicorp – Multinational financial firms » Aegon (Holland) acquires Transamerica u International events – Chile, South Korea, Poland J. K. Dietrich - FBE 525 - Fall, 2006

Driving forces u Technology – Cheap telephony/satellites » Telephone service centers – Cheap computing » Internet u Regulation/taxation – Roth accounts, 401 Ks – Bank holding company/Glass-Steagall u Demographics J. K. Dietrich - FBE 525 - Fall, 2006

Key questions for management u Where are synergies, revenues or costs? – Economies of scale – Economies of scope – Cross-selling – Cost of inputs u More important: What are we good at? u Requires a rigorous framework for analysis J. K. Dietrich - FBE 525 - Fall, 2006

Approach taken in this course u Financial economics u Hands-on applications u Healthy skepticism u Examine the basics u Ask simple questions J. K. Dietrich - FBE 525 - Fall, 2006

Objective function for financial service firms u Maximize shareholders’ wealth u Stock-owned corporations – Commercial banks – Diversified financials u Mutual organizations – Thrifts – Insurance u Problem J. K. Dietrich - FBE 525 - Fall, 2006 with mutuals

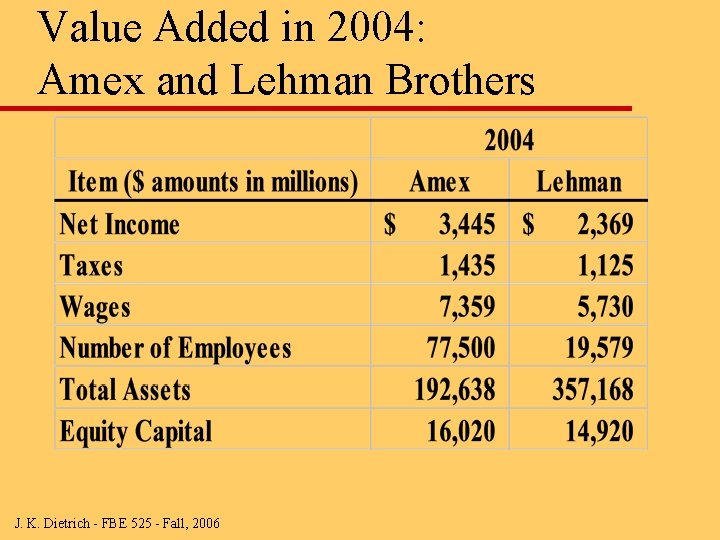

Value Added and Value Creation u Value added subtracts all costs of inputs from all revenues u Value added must cover any value added by the firm from use of labor and capital, and used to cover payments to tax authorities u In many countries, value added used as basis for taxes (e. g European Union) J. K. Dietrich - FBE 525 - Fall, 2006

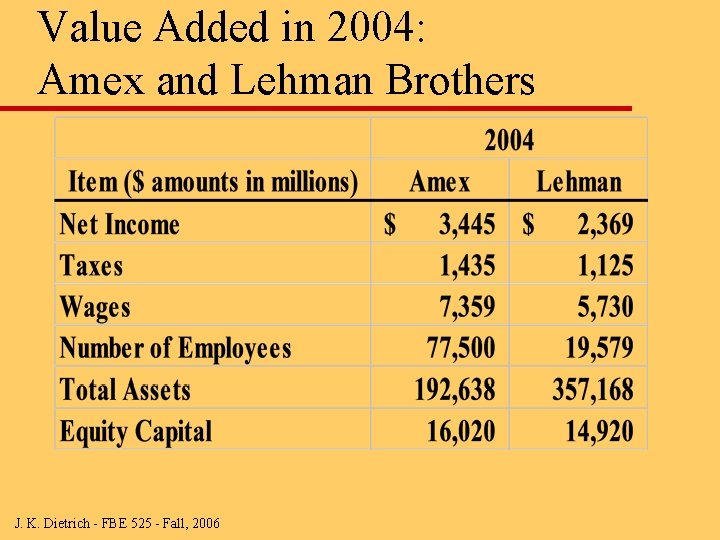

Value Added in 2004: Amex and Lehman Brothers J. K. Dietrich - FBE 525 - Fall, 2006

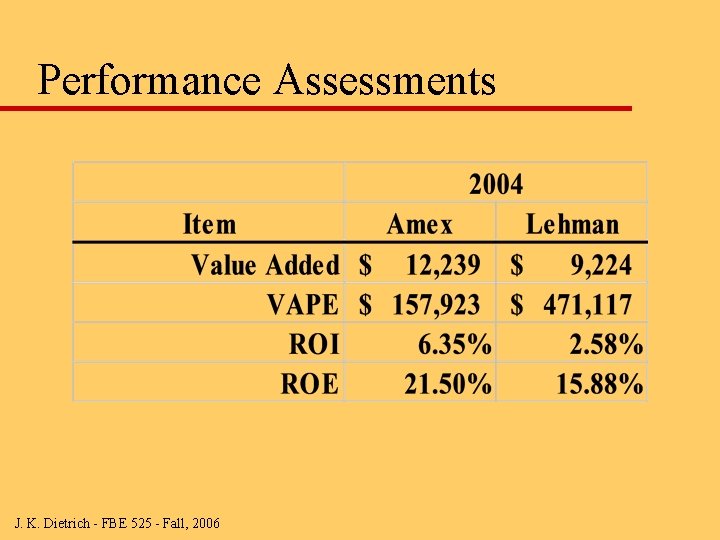

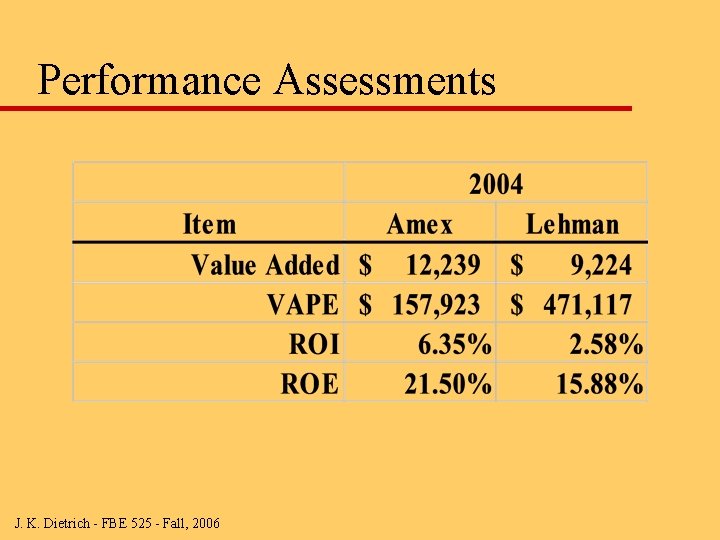

Performance Assessments J. K. Dietrich - FBE 525 - Fall, 2006

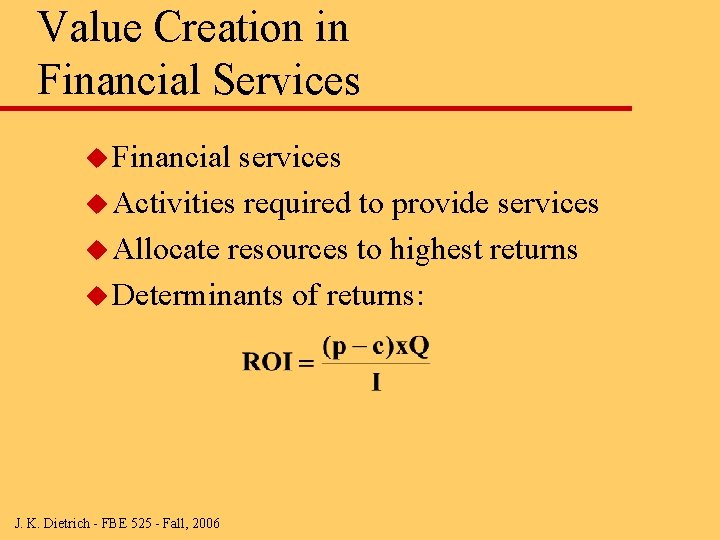

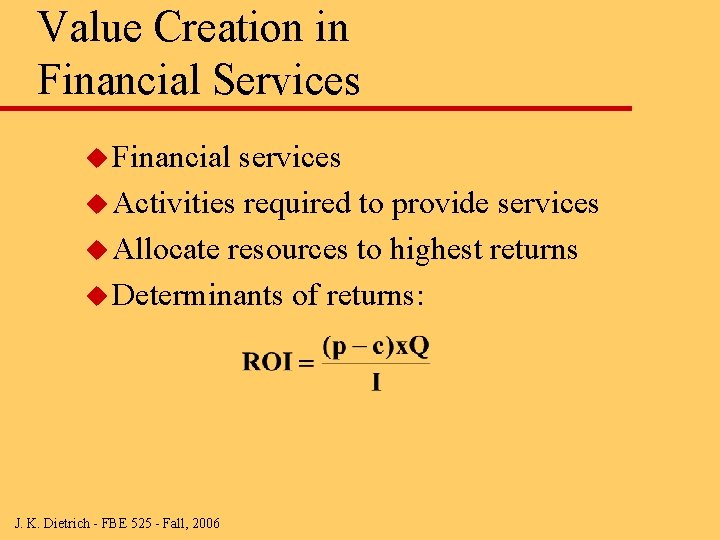

Value Creation in Financial Services u Financial services u Activities required to provide services u Allocate resources to highest returns u Determinants of returns: J. K. Dietrich - FBE 525 - Fall, 2006

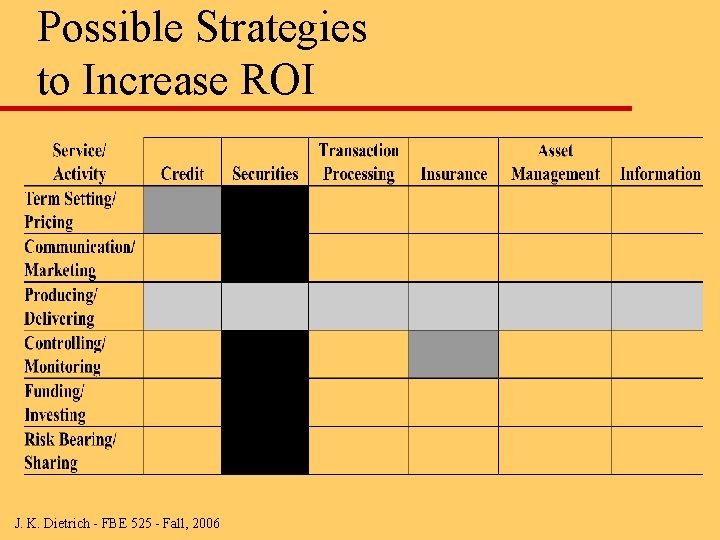

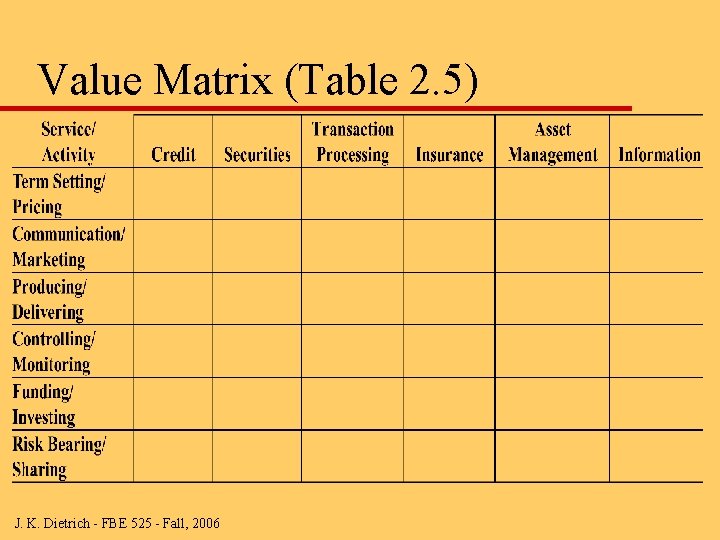

Financial Services u Credit (lending) u Securities u Transaction processing (payments) u Insurance u Asset management u Information J. K. Dietrich - FBE 525 - Fall, 2006

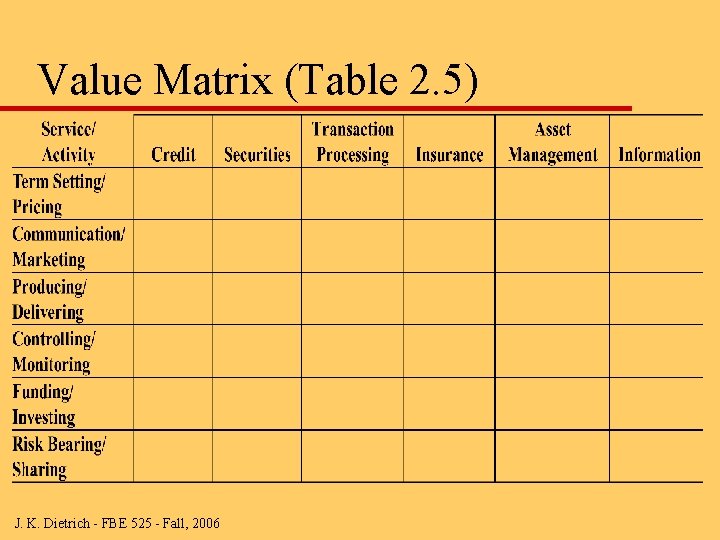

Activities to Provide Services u Setting Terms/Pricing u Communicating/Marketing u Producing/Delivering u Controlling/Monitoring u Funding/Investing u Risk Bearing/Risk Shifting J. K. Dietrich - FBE 525 - Fall, 2006

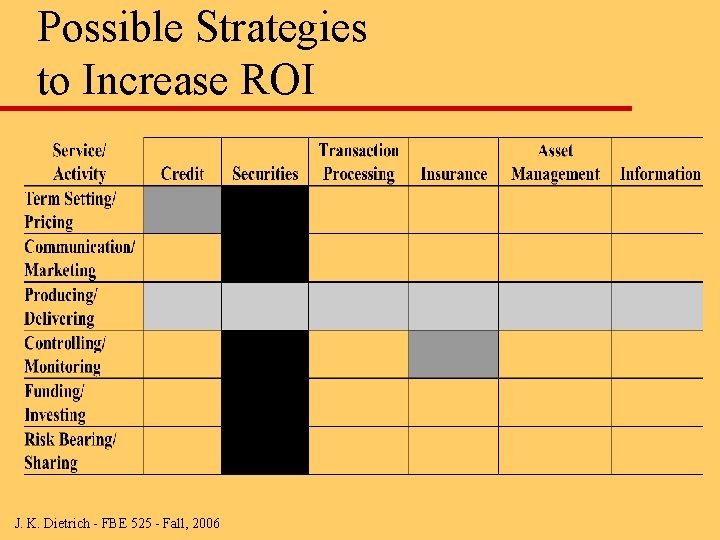

Value Creation Matrix u Columns = Services u Rows = Activities u Strategies = Concentration of activities u How to choose best strategies? J. K. Dietrich - FBE 525 - Fall, 2006

Value Matrix (Table 2. 5) J. K. Dietrich - FBE 525 - Fall, 2006

Possible Strategies to Increase ROI J. K. Dietrich - FBE 525 - Fall, 2006

Traditional Financial Services u Result of – Business specialization – Taxation – Regulation u Main – – types of firm Deposit-taking Insurance type Investment companies Securities firms J. K. Dietrich - FBE 525 - Fall, 2006

The Financial Services Industry u Basic – – types of institutions Deposit-taking Insurance type Asset management Securities u Representation in Flow of Funds u Institutional investors J. K. Dietrich - FBE 525 - Fall, 2006

Flow of Funds u Strategic overview u Primary sectors – Total wealth – Nature of real wealth – Role of financial intermediation u Major financial service sectors u Tracing changes in the Flow of Funds J. K. Dietrich - FBE 525 - Fall, 2006

Strategic challenges and the Flow of Funds u Baby boomers u Third world development u Differential savings rates u Trade flows and trading blocs u Domestic issues – Low-income customers – Community redevelopment J. K. Dietrich - FBE 525 - Fall, 2006

For Next Week u Review Chapter 2 discussed this week u Read Chapter 5 and Copeland et al “Valuation” chapters on banks and insurance companies for next week u Review example of FSI valuation u Choose firms for members of the group u Obtain basic financial data, Value Line Investment Survey, and other analyses J. K. Dietrich - FBE 525 - Fall, 2006