Value Chain Risk Management William Grey and Dailun

- Slides: 27

Value Chain Risk Management William Grey and Dailun Shi IBM T. J. Watson Research Center November, 2001

Key Business Trends • The pace of business is accelerating, and there has been a dramatic increase in uncertainty • A difficult business climate is exacerbated by heightened competition • Supply chains are not only more efficient – but also riskier • Customers (and the equity markets) are becoming increasingly unforgiving

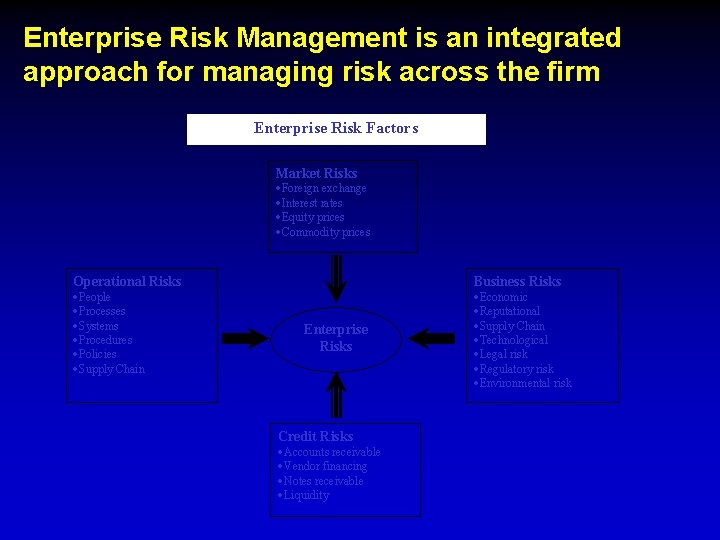

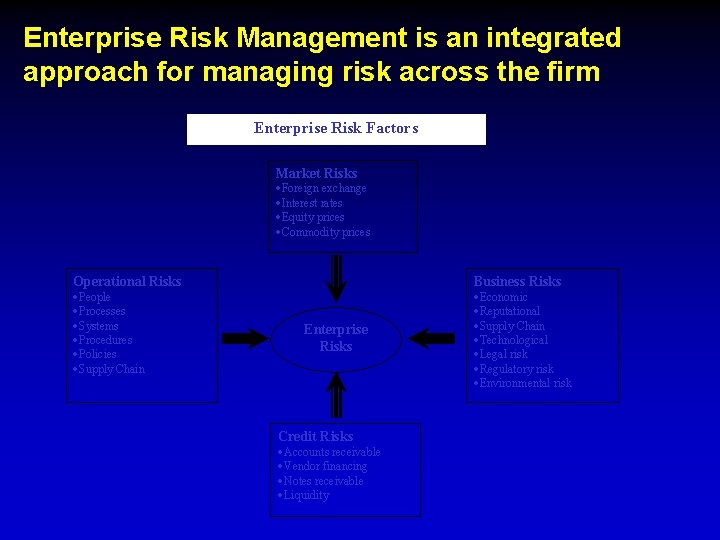

Enterprise Risk Management is an integrated approach for managing risk across the firm Enterprise Risk Factors Market Risks ·Foreign exchange ·Interest rates ·Equity prices ·Commodity prices Operational Risks ·People ·Processes ·Systems ·Procedures ·Policies ·Supply Chain Business Risks Enterprise Risks Credit Risks ·Accounts receivable ·Vendor financing ·Notes receivable ·Liquidity ·Economic ·Reputational ·Supply Chain ·Technological ·Legal risk ·Regulatory risk ·Environmental risk

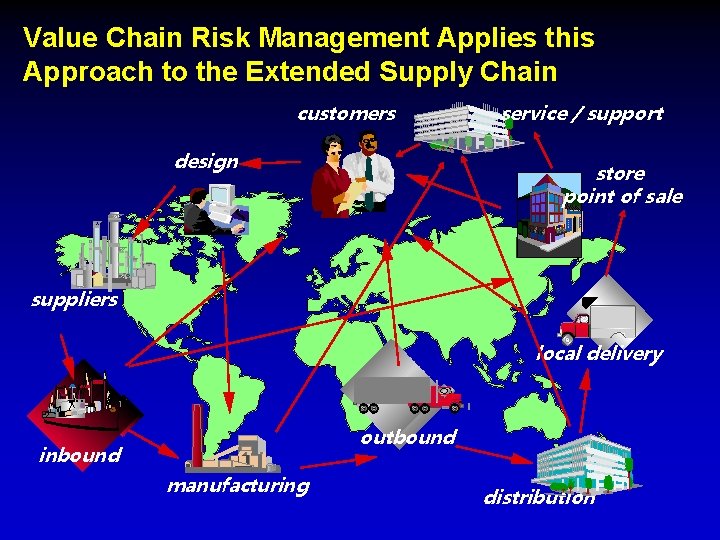

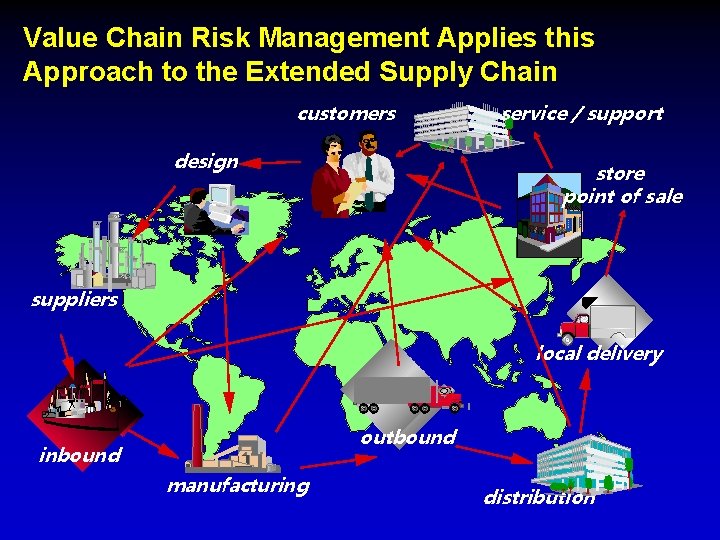

Value Chain Risk Management Applies this Approach to the Extended Supply Chain customers design service / support store point of sale suppliers local delivery outbound inbound manufacturing distribution

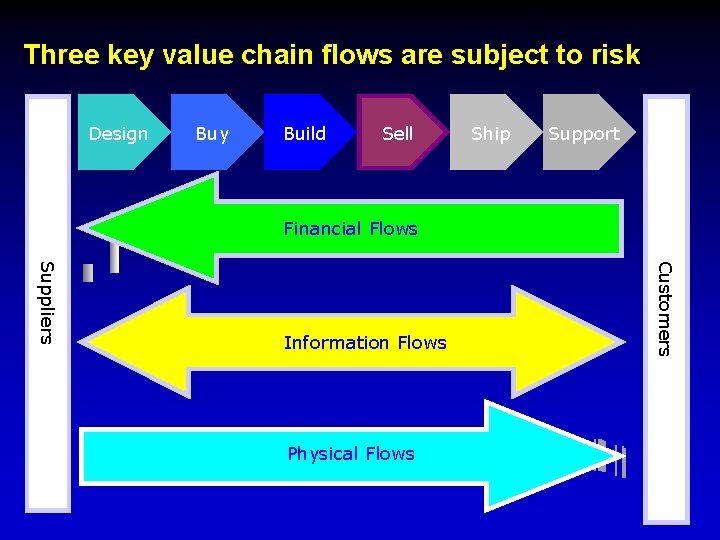

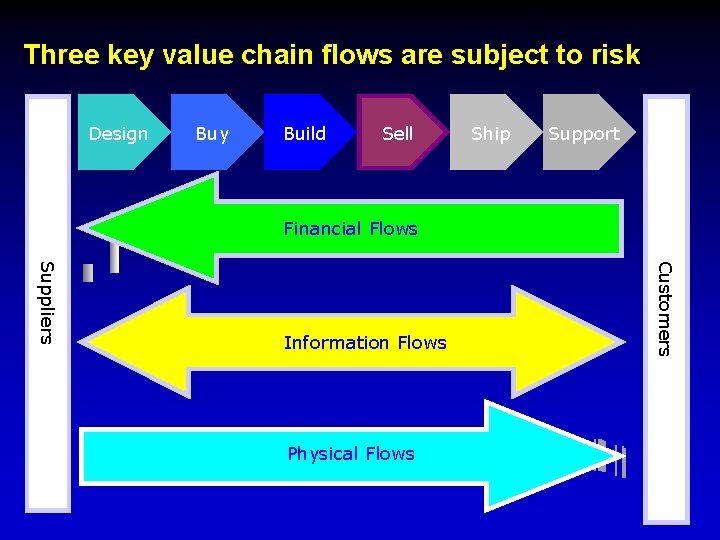

Three key value chain flows are subject to risk Design Buy Build Sell Ship Support Financial Flows Customers Suppliers Information Flows Physical Flows SCM

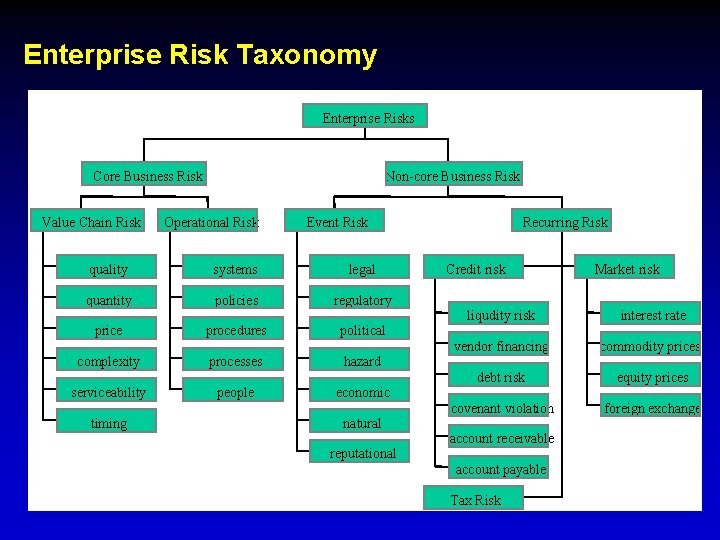

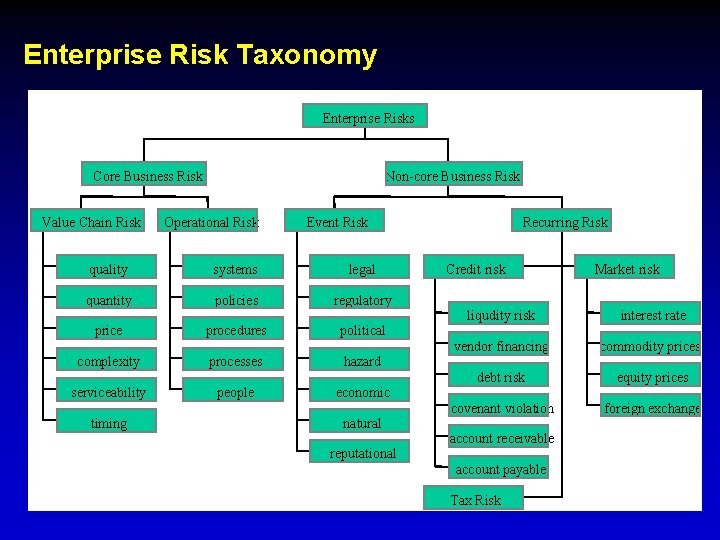

Enterprise Risk Taxonomy Enterprise Risks Core Business Risk Value Chain Risk Non-core Business Risk Operational Risk Event Risk quality systems legal quantity policies regulatory price procedures political complexity serviceability timing processes people hazard economic natural reputational Recurring Risk Credit risk Market risk liqudity risk interest rate vendor financing commodity prices debt risk equity prices covenant violation foreign exchange account receivable account payable Tax Risk

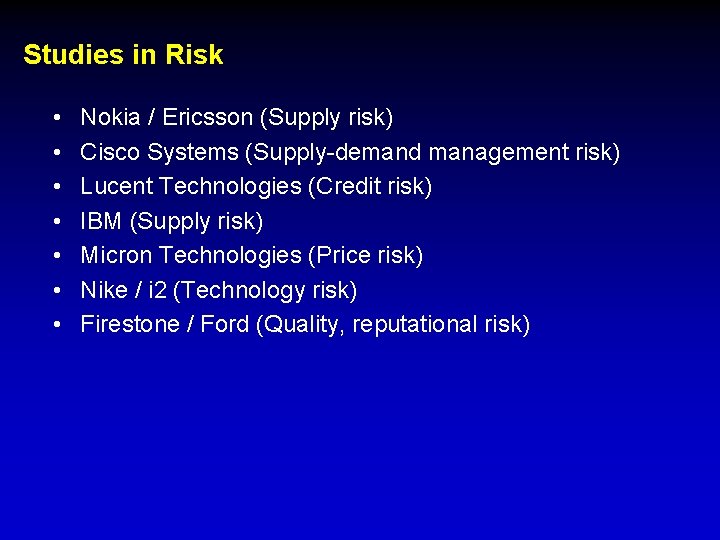

Studies in Risk • • Nokia / Ericsson (Supply risk) Cisco Systems (Supply-demand management risk) Lucent Technologies (Credit risk) IBM (Supply risk) Micron Technologies (Price risk) Nike / i 2 (Technology risk) Firestone / Ford (Quality, reputational risk)

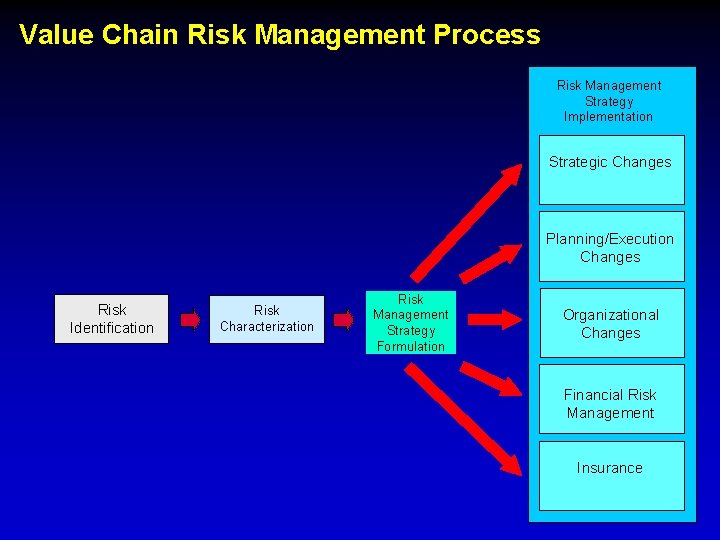

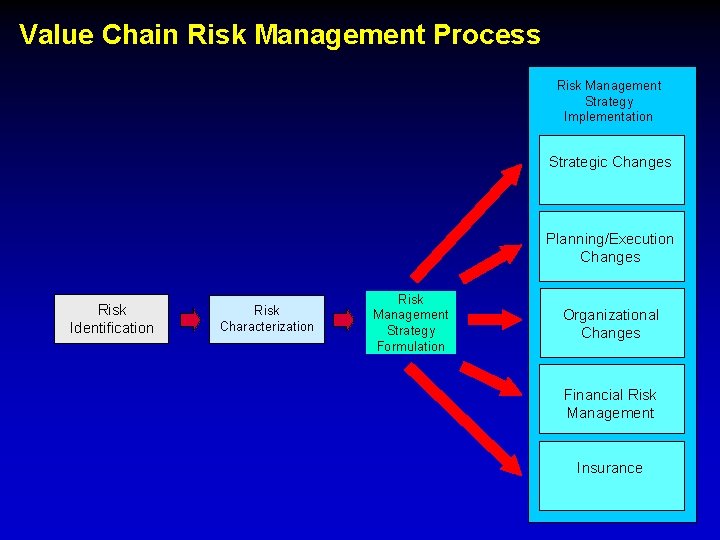

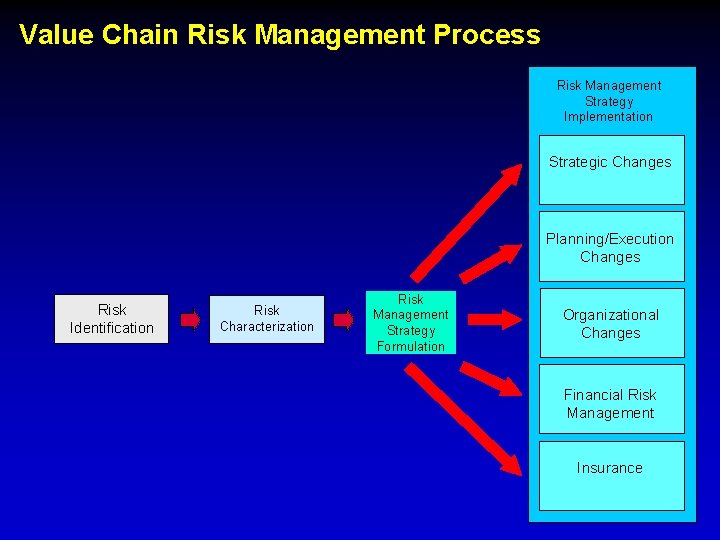

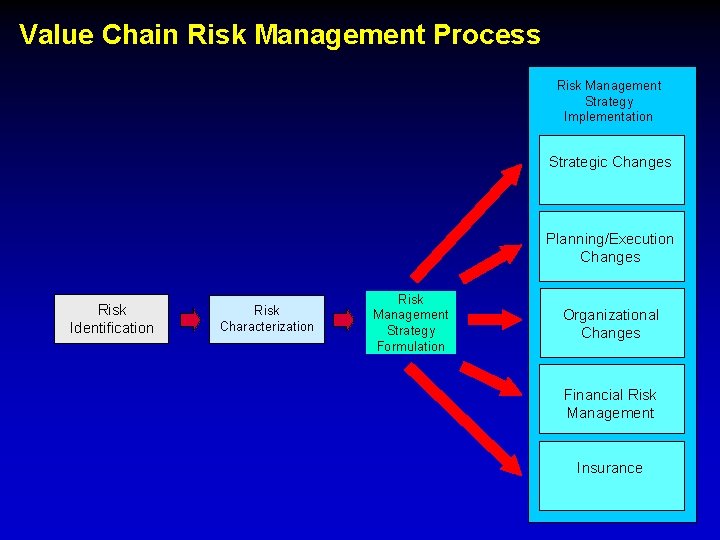

Value Chain Risk Management Process Risk Management Strategy Implementation Strategic Changes Planning/Execution Changes Risk Identification Risk Characterization Risk Management Strategy Formulation Organizational Changes Financial Risk Management Insurance

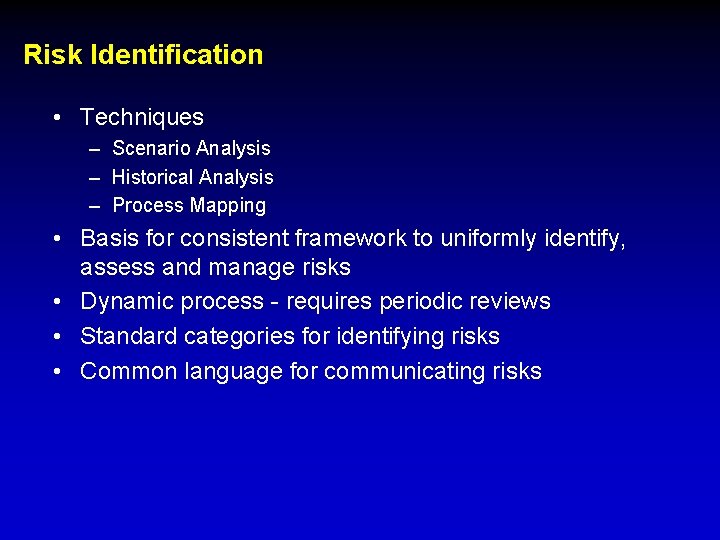

Risk Identification • Techniques – Scenario Analysis – Historical Analysis – Process Mapping • Basis for consistent framework to uniformly identify, assess and manage risks • Dynamic process - requires periodic reviews • Standard categories for identifying risks • Common language for communicating risks

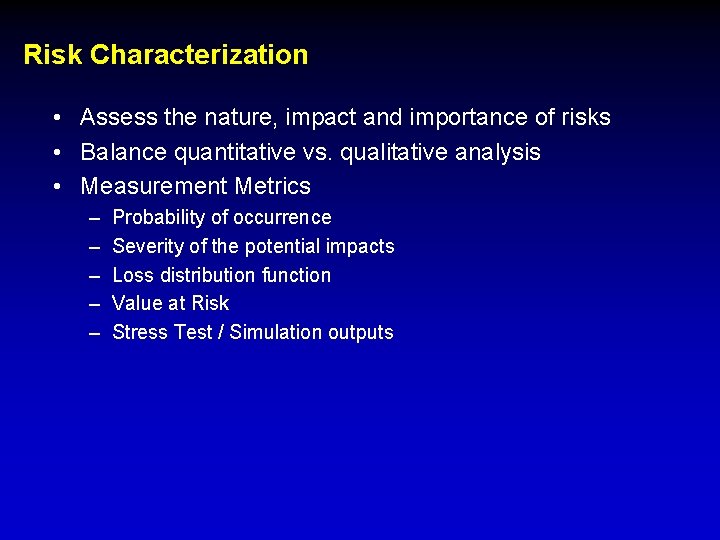

Risk Characterization • Assess the nature, impact and importance of risks • Balance quantitative vs. qualitative analysis • Measurement Metrics – – – Probability of occurrence Severity of the potential impacts Loss distribution function Value at Risk Stress Test / Simulation outputs

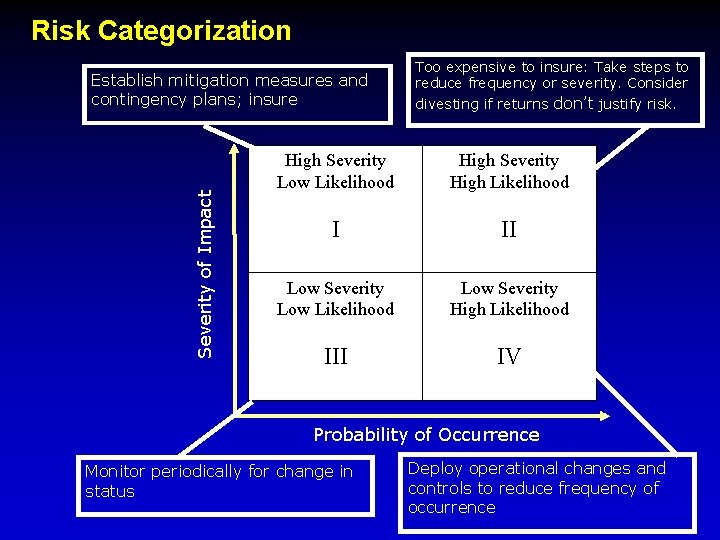

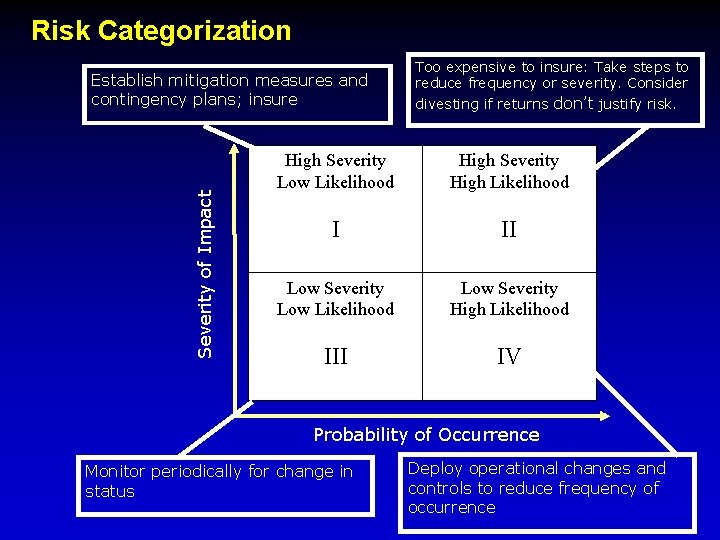

Risk Categorization Severity of Impact Establish mitigation measures and contingency plans; insure Too expensive to insure: Take steps to reduce frequency or severity. Consider divesting if returns don’t justify risk. High Severity Low Likelihood High Severity High Likelihood I II Low Severity Low Likelihood Low Severity High Likelihood III IV Probability of Occurrence Monitor periodically for change in status Deploy operational changes and controls to reduce frequency of occurrence

Interactions between risks and value chain processes (examples)

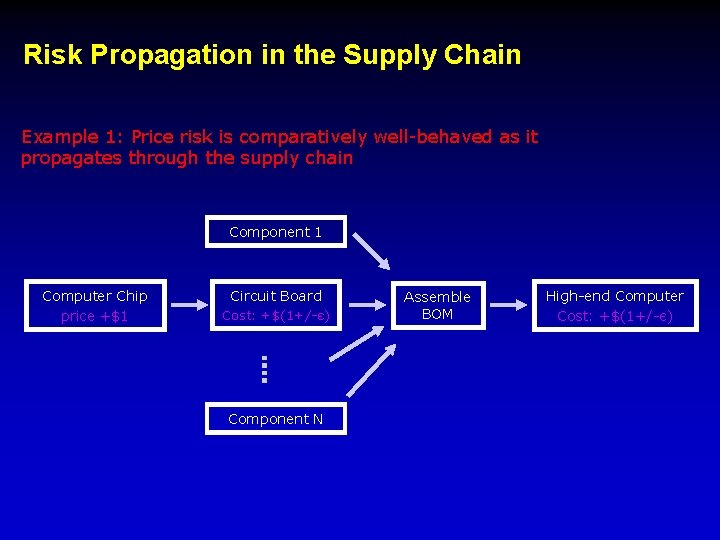

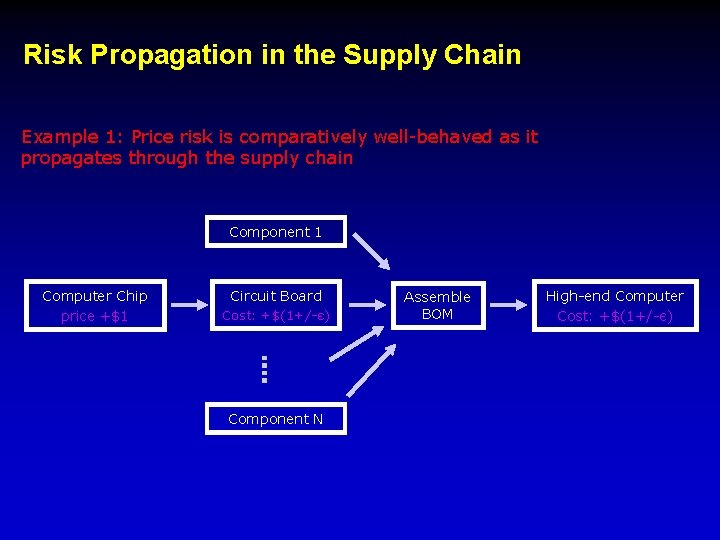

Risk Propagation in the Supply Chain Example 1: Price risk is comparatively well-behaved as it propagates through the supply chain Component 1 Computer Chip price +$1 Circuit Board Cost: +$(1+/-є) Component N Assemble BOM High-end Computer Cost: +$(1+/-є)

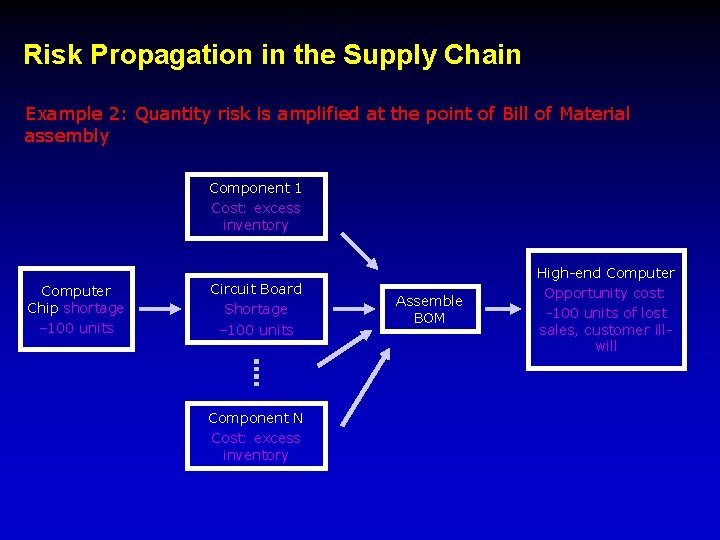

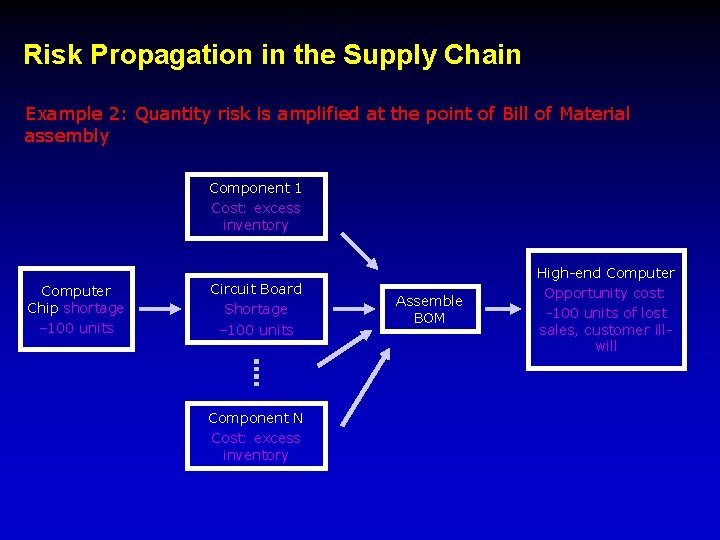

Risk Propagation in the Supply Chain Example 2: Quantity risk is amplified at the point of Bill of Material assembly Component 1 Cost: excess inventory Computer Chip shortage – 100 units Circuit Board Shortage – 100 units Component N Cost: excess inventory Assemble BOM High-end Computer Opportunity cost: -100 units of lost sales, customer illwill

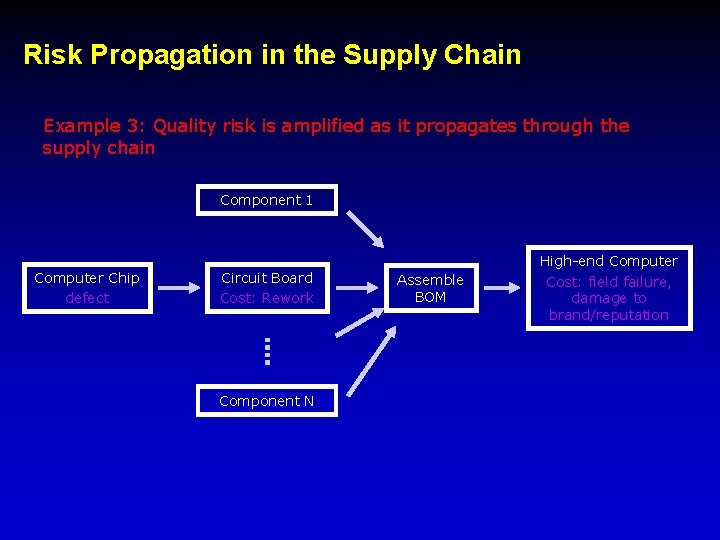

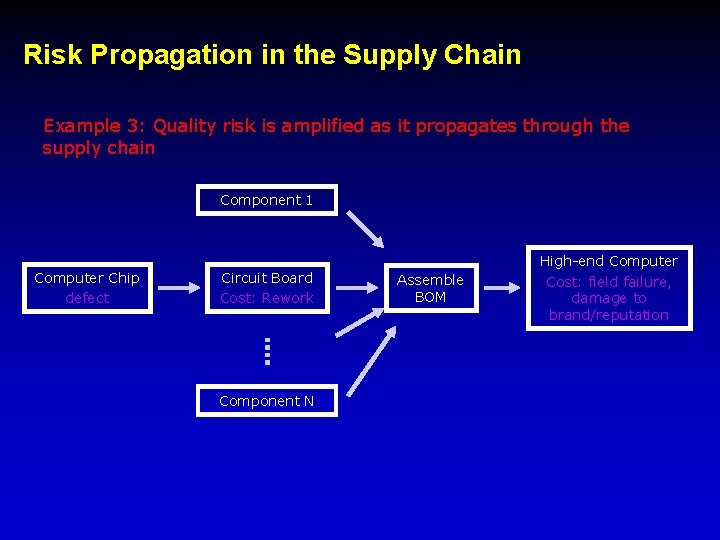

Risk Propagation in the Supply Chain Example 3: Quality risk is amplified as it propagates through the supply chain Component 1 Computer Chip defect Circuit Board Cost: Rework Component N Assemble BOM High-end Computer Cost: field failure, damage to brand/reputation

Value Chain Risk Management Process Risk Management Strategy Implementation Strategic Changes Planning/Execution Changes Risk Identification Risk Characterization Risk Management Strategy Formulation Organizational Changes Financial Risk Management Insurance

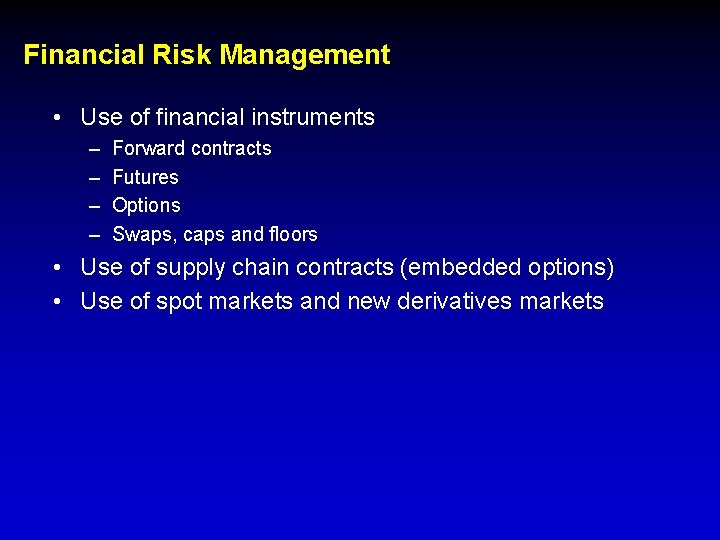

Financial Risk Management • Use of financial instruments – – Forward contracts Futures Options Swaps, caps and floors • Use of supply chain contracts (embedded options) • Use of spot markets and new derivatives markets

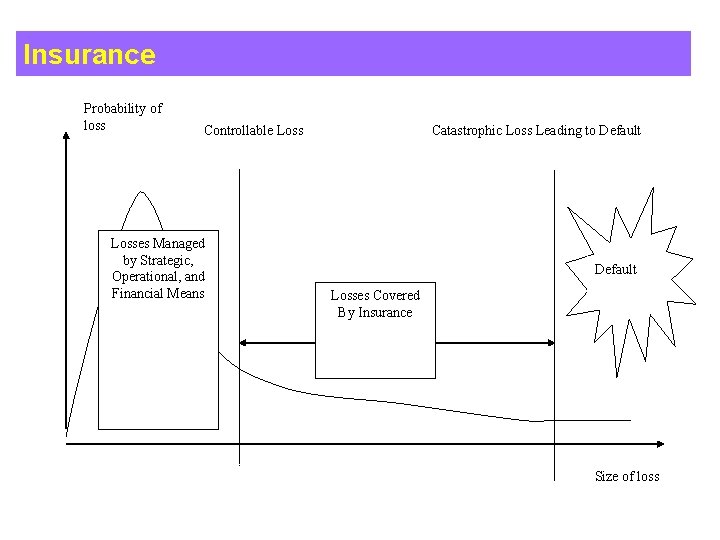

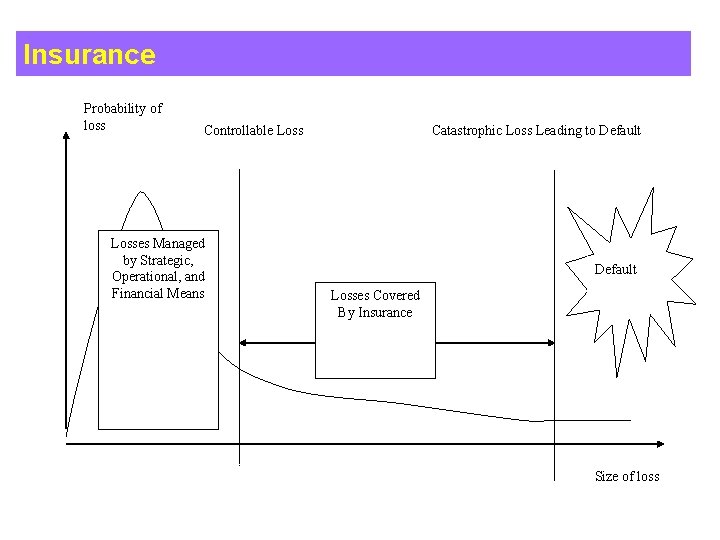

Insurance Probability of loss Controllable Losses Managed by Strategic, Operational, and Financial Means Catastrophic Loss Leading to Default Losses Covered By Insurance Size of loss

Strategic Risk Management • Application of financial management analogues to the value chain • Value chain restructuring • Risk-based modeling and analysis • Improved visualization

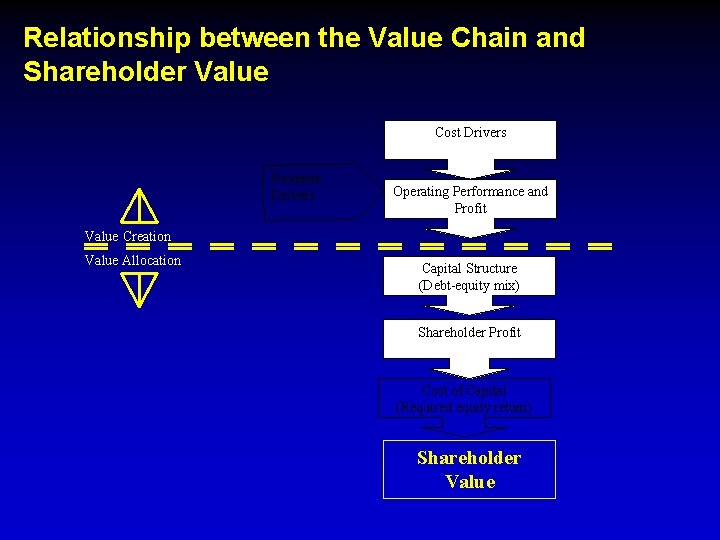

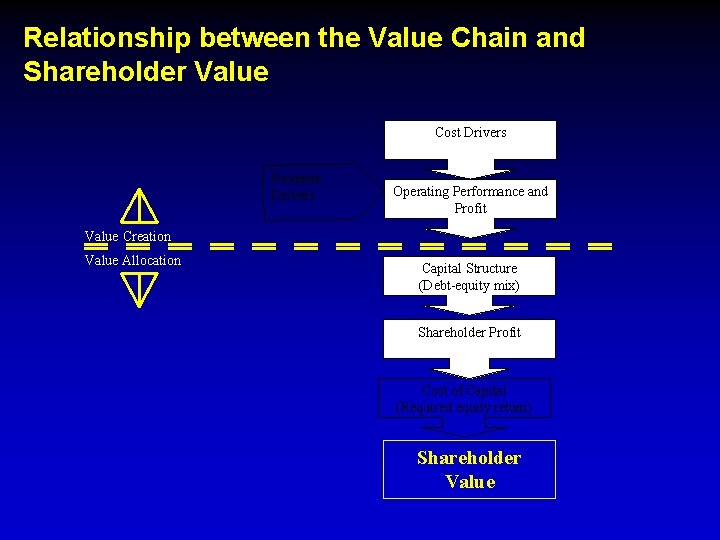

Relationship between the Value Chain and Shareholder Value Cost Drivers Revenue Drivers Operating Performance and Profit Value Creation Value Allocation Capital Structure (Debt-equity mix) Shareholder Profit Cost of Capital (Required equity return) Shareholder Value

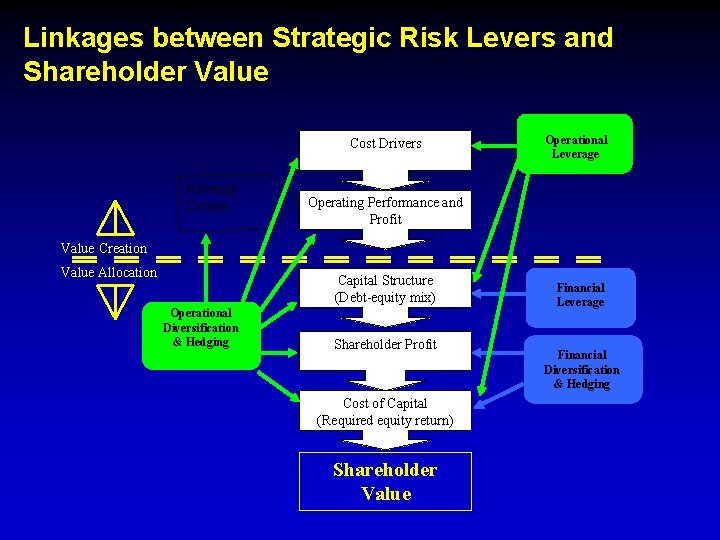

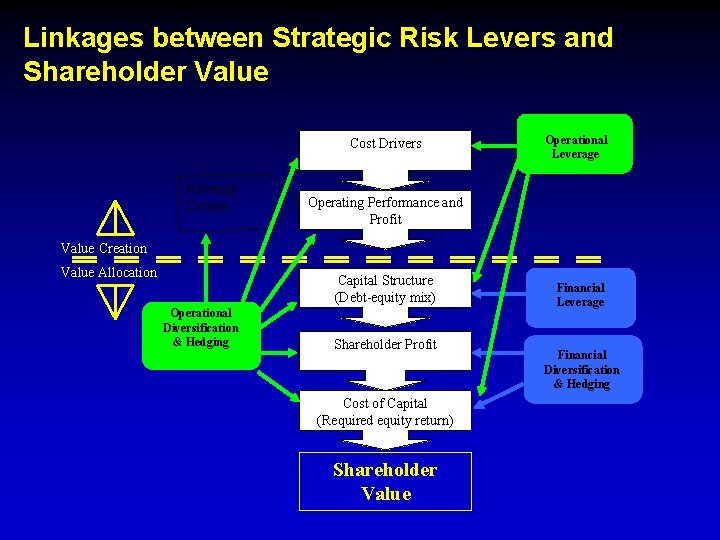

Linkages between Strategic Risk Levers and Shareholder Value Cost Drivers Revenue Drivers Operational Leverage Operating Performance and Profit Value Creation Value Allocation Capital Structure (Debt-equity mix) Operational Diversification & Hedging Shareholder Profit Cost of Capital (Required equity return) Shareholder Value Financial Leverage Financial Diversification & Hedging

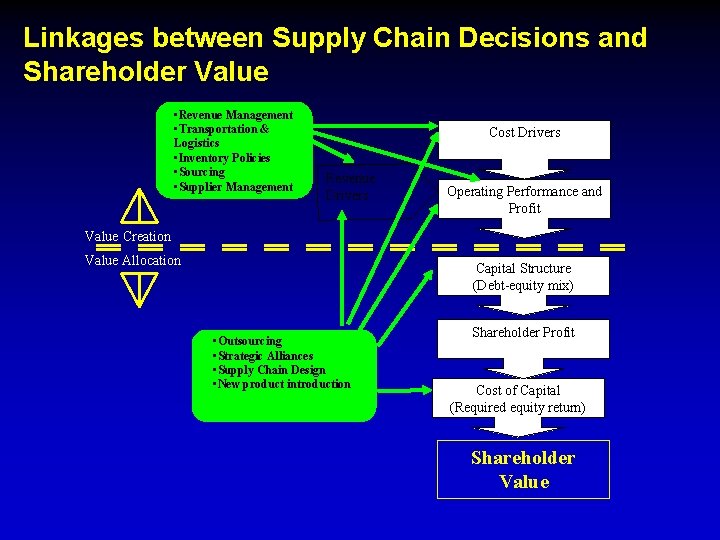

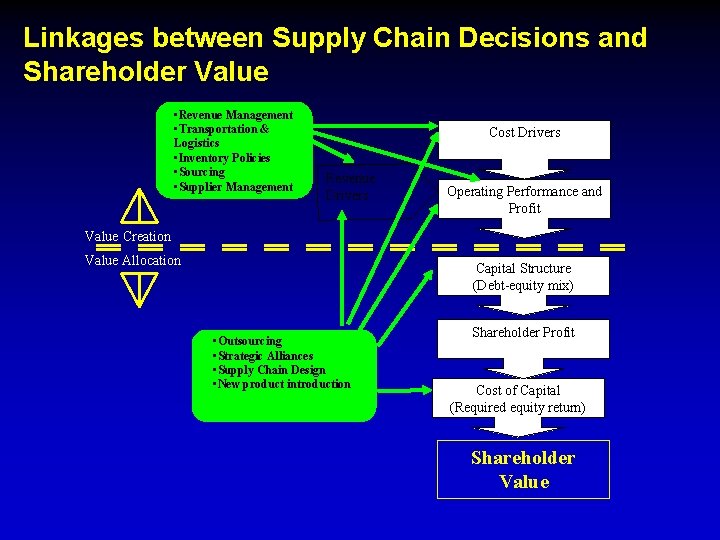

Linkages between Supply Chain Decisions and Shareholder Value • Revenue Management • Transportation & Logistics • Inventory Policies • Sourcing • Supplier Management Cost Drivers Revenue Drivers Operating Performance and Profit Value Creation Value Allocation Capital Structure (Debt-equity mix) • Outsourcing • Strategic Alliances • Supply Chain Design • New product introduction Shareholder Profit Cost of Capital (Required equity return) Shareholder Value

Examples of Strategic Risk Management

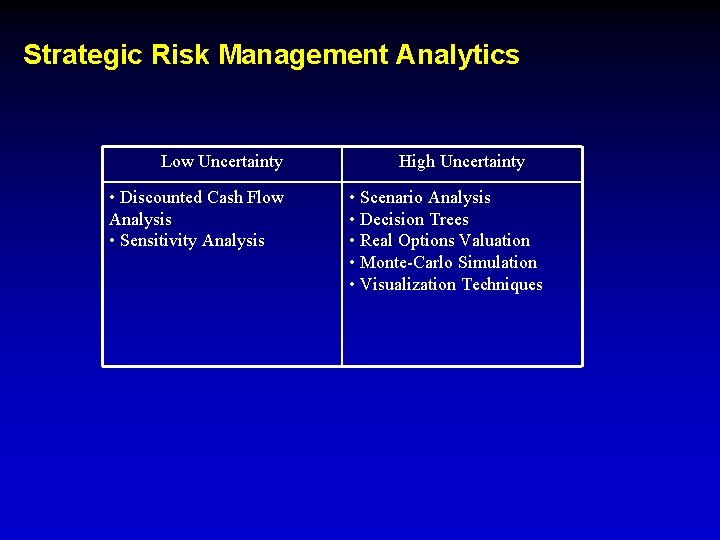

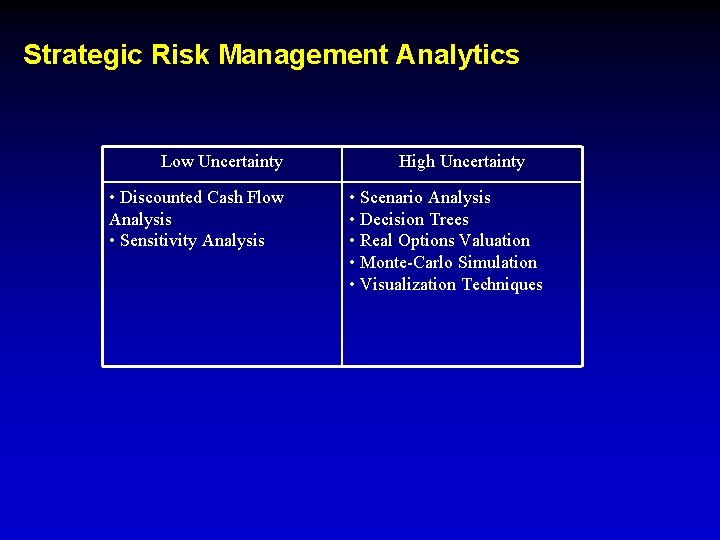

Strategic Risk Management Analytics Low Uncertainty • Discounted Cash Flow Analysis • Sensitivity Analysis High Uncertainty • Scenario Analysis • Decision Trees • Real Options Valuation • Monte-Carlo Simulation • Visualization Techniques

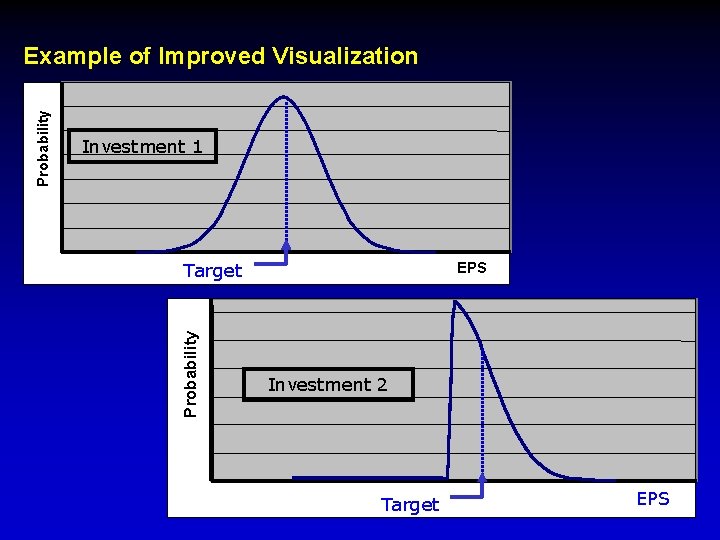

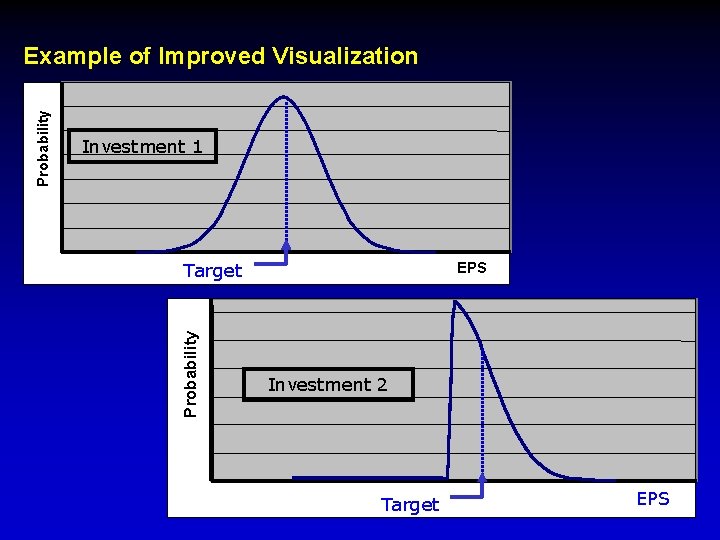

Investment 1 Target Probability Example of Improved Visualization EPS Investment 2 Target EPS

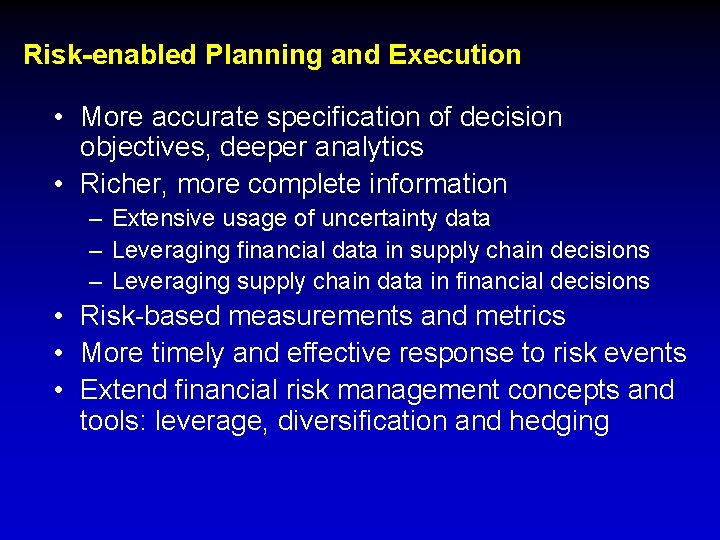

Risk-enabled Planning and Execution • More accurate specification of decision objectives, deeper analytics • Richer, more complete information – Extensive usage of uncertainty data – Leveraging financial data in supply chain decisions – Leveraging supply chain data in financial decisions • Risk-based measurements and metrics • More timely and effective response to risk events • Extend financial risk management concepts and tools: leverage, diversification and hedging

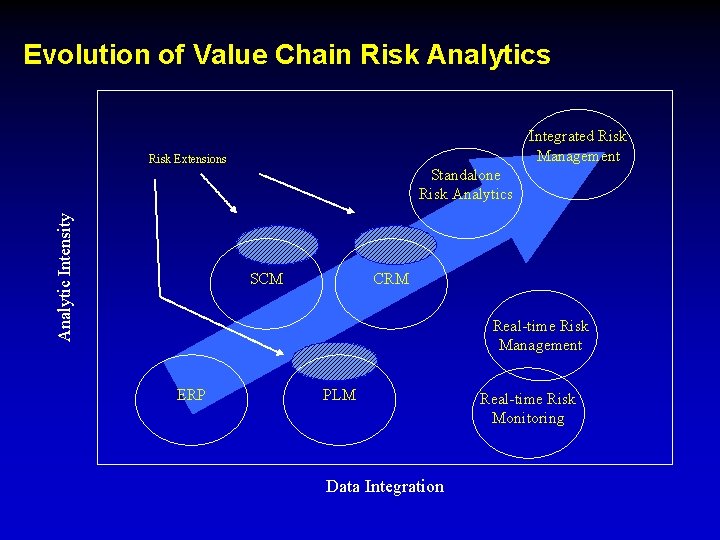

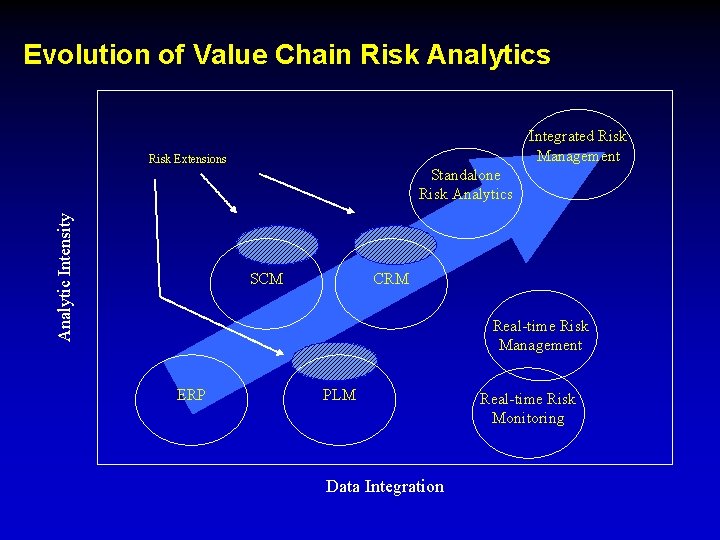

Evolution of Value Chain Risk Analytics Integrated Risk Management Analytic Intensity Risk Extensions Standalone Risk Analytics SCM CRM Real-time Risk Management ERP PLM Data Integration Real-time Risk Monitoring