Using repeated measures data to analyse reciprocal effects

- Slides: 26

Using repeated measures data to analyse reciprocal effects: the case of Economic Perceptions and Economic Values Patrick Sturgis, Department of Sociology, University of Surrey Peter Smith, Ann Berrington, Yongjian Hu, Department of Social Statistics, University of Southampton

Reciprocal Causality Often viewed as a ‘nuisance’ to be removed (simultaneity bias). But can be of substantive and policy interest. Achievement/self-esteem Anti-social behaviour/depression Problematic to estimate with observational data.

Overview Approaches to estimating reciprocal effects. General Linear Model Instrumental variable approaches Cross-lagged panel models Errors of Measurement Unobserved variables and error covariance Example: economic values and perceptions Conclusions

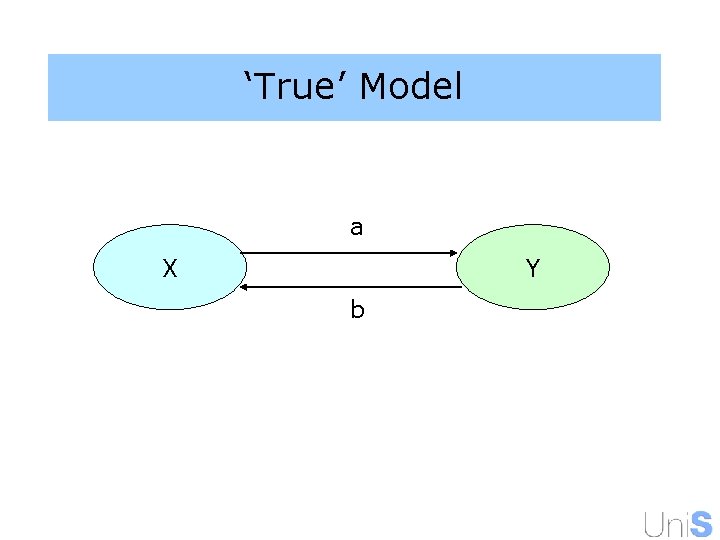

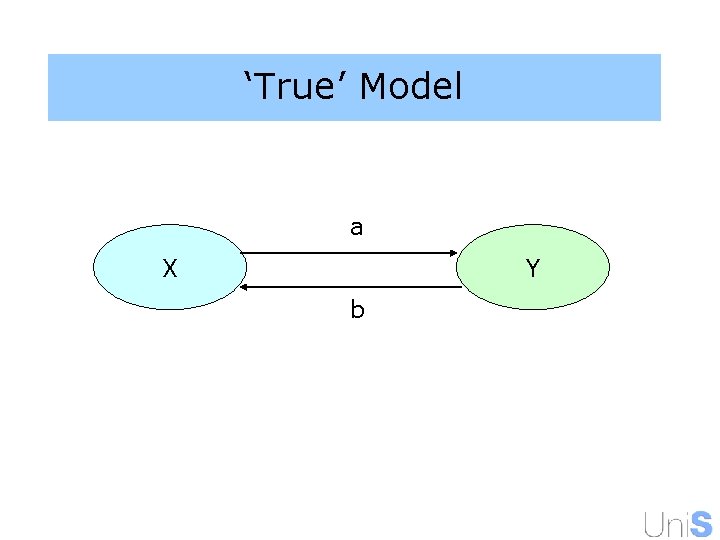

‘True’ Model a X Y b

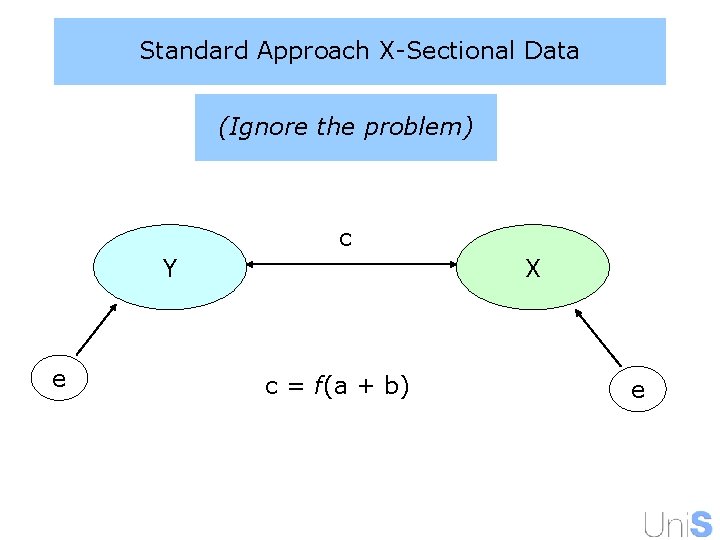

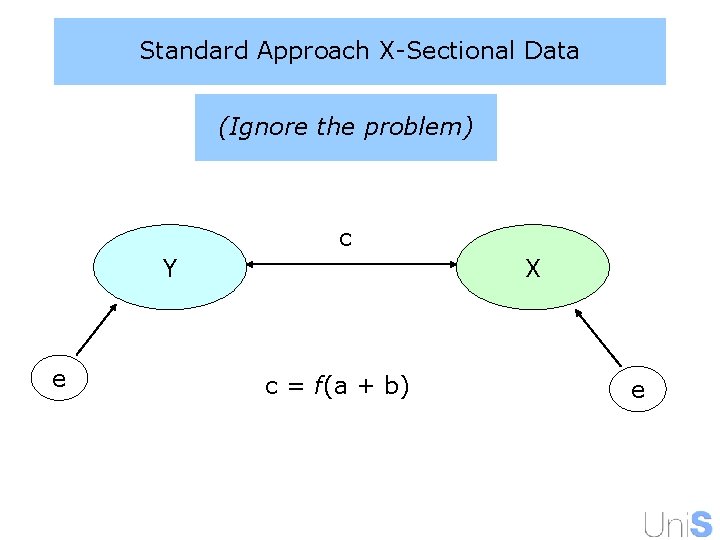

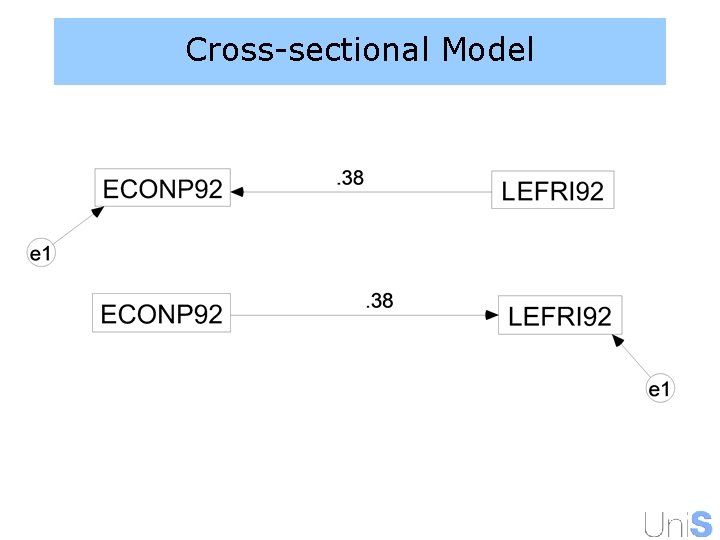

Standard Approach X-Sectional Data (Ignore the problem) c Y e X c = f(a + b) e

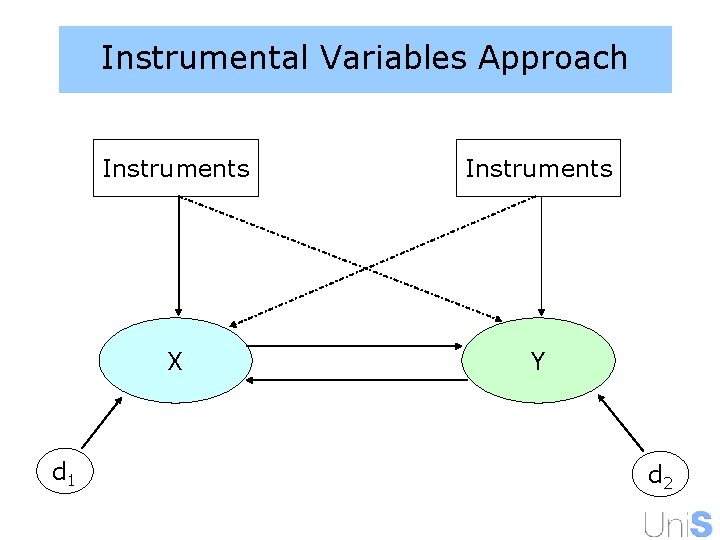

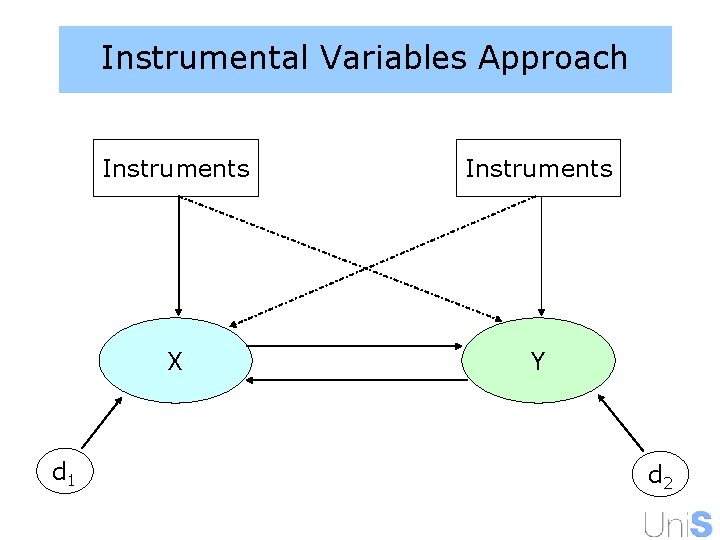

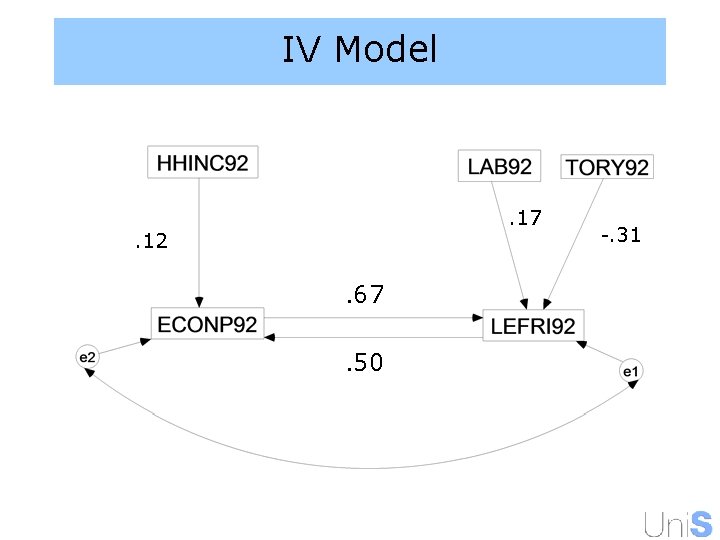

Instrumental Variables Approach d 1 Instruments X Y d 2

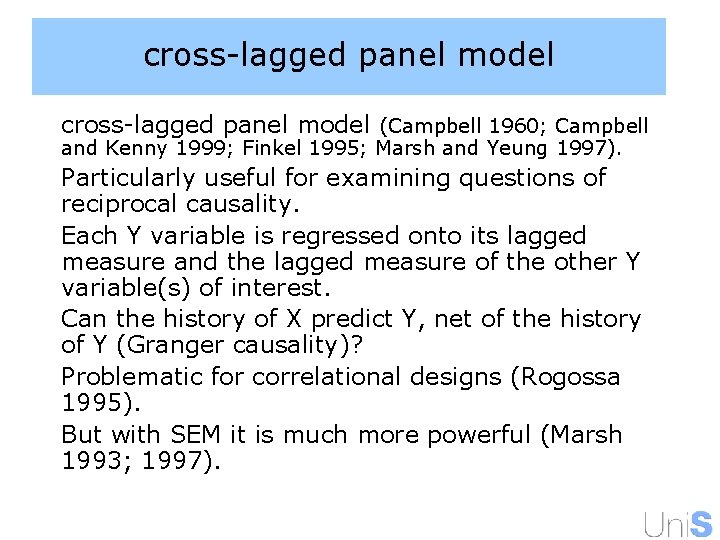

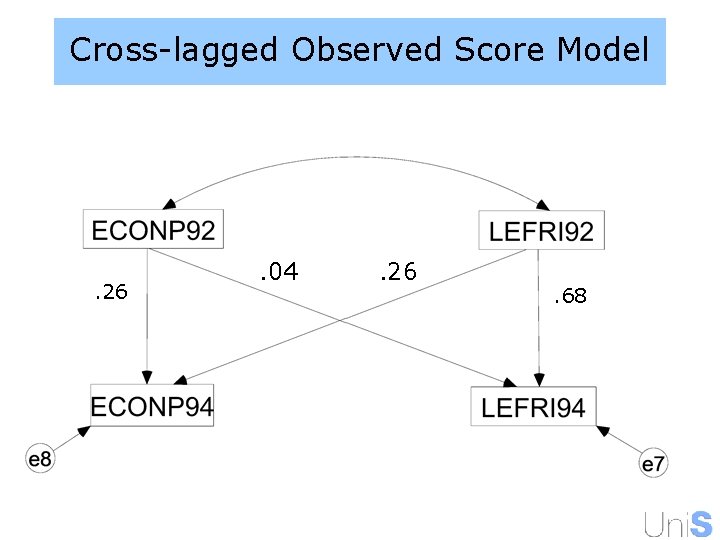

cross-lagged panel model (Campbell 1960; Campbell and Kenny 1999; Finkel 1995; Marsh and Yeung 1997). Particularly useful for examining questions of reciprocal causality. Each Y variable is regressed onto its lagged measure and the lagged measure of the other Y variable(s) of interest. Can the history of X predict Y, net of the history of Y (Granger causality)? Problematic for correlational designs (Rogossa 1995). But with SEM it is much more powerful (Marsh 1993; 1997).

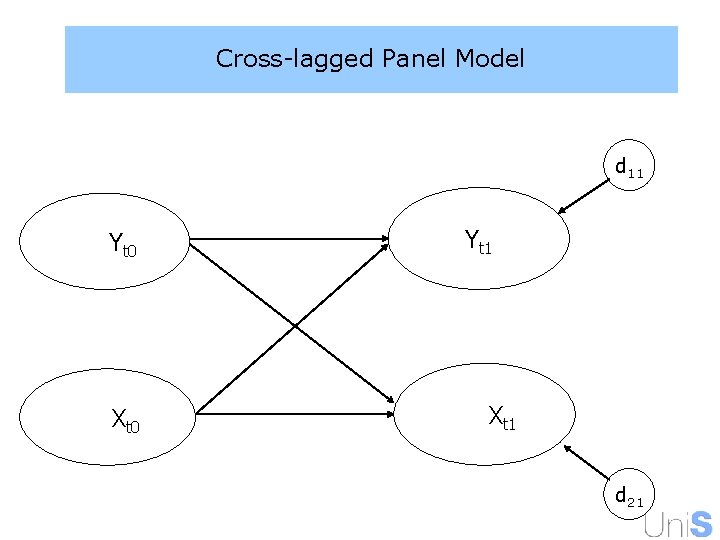

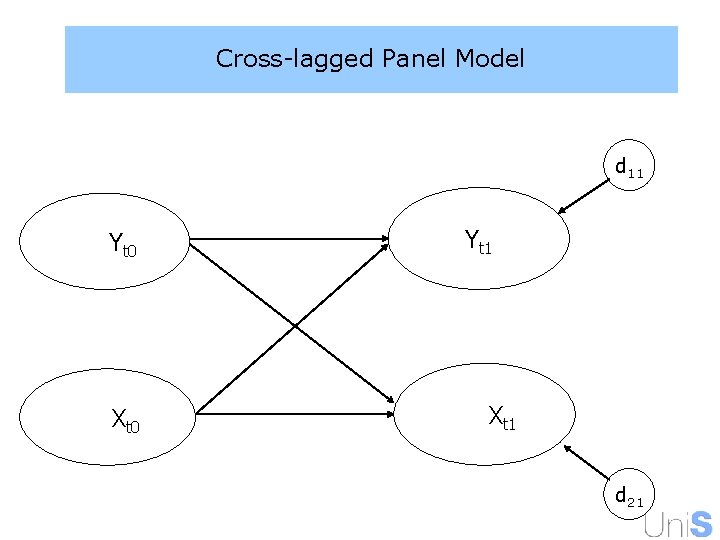

Cross-lagged Panel Model d 11 Yt 0 Xt 0 Yt 1 Xt 1 d 21

Problems with this model 2 waves = limited information about causal relationship. Concepts are assumed to be measured with zero error. No account taken of correlations between disturbances of endogenous variables.

Consequences of Measurement Error All measurements of abstract concepts will contain error. Error can be stochastic ( ) or systematic ( ). Systematic error biases descriptive and causal inferences. Stochastic error in dependents leaves estimates unbiased but less efficient. Stochastic error in independents attenuates effect sizes. Both problematic for hypothesis testing and causal inference.

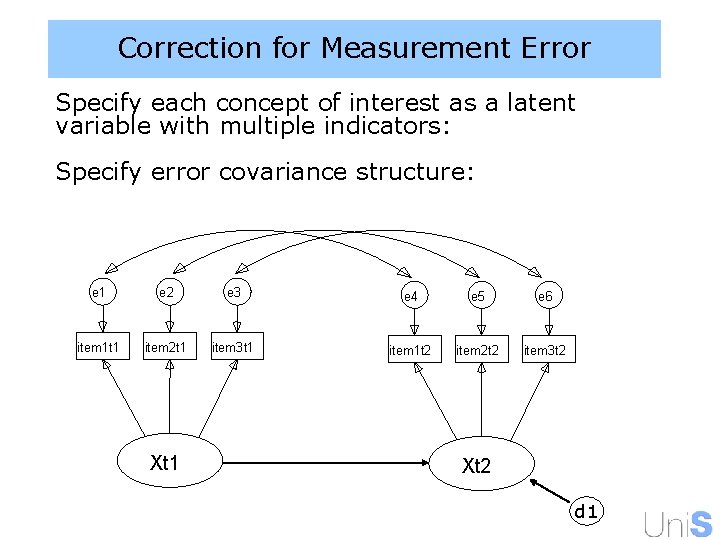

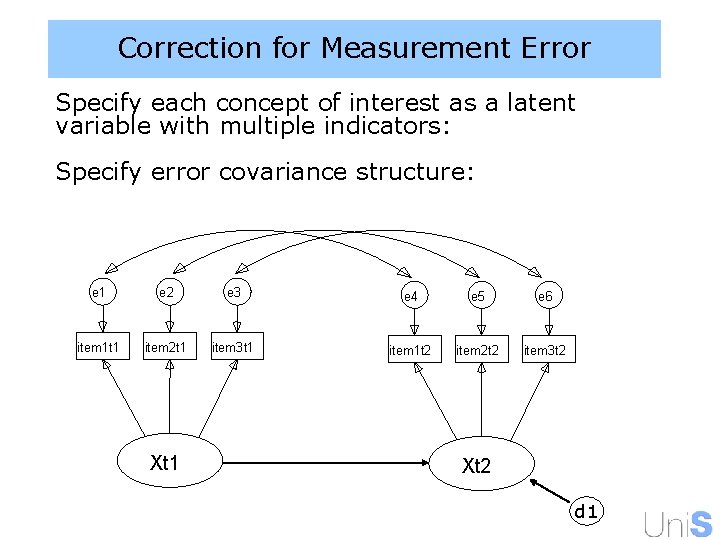

Correction for Measurement Error Specify each concept of interest as a latent variable with multiple indicators: Specify error covariance structure: e 1 e 2 e 3 e 4 e 5 e 6 item 1 t 1 item 2 t 1 item 3 t 1 item 1 t 2 item 2 t 2 item 3 t 2 Xt 1 Xt 2 d 1

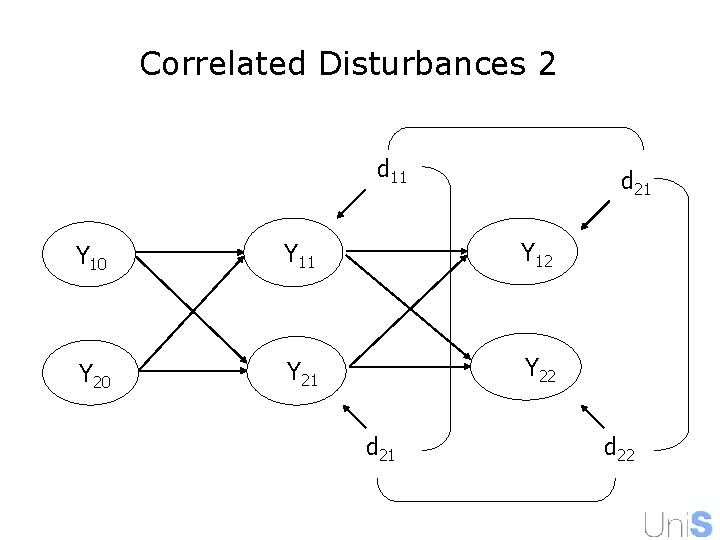

Correlated Disturbances 1 The disturbance terms for the same endogenous variable over time are likely to be correlated. Similarly, the disturbance term for the 2 endogenous variables are likely to be correlated at the same time point. Caused by unobserved variable bias; a third variable, Z, may be causing both Y variables simultaneously. Failing to consider these parameters can bias stability and cross-lagged estimates (Williams & Posakoff 1989; Anderson & Williams 1992).

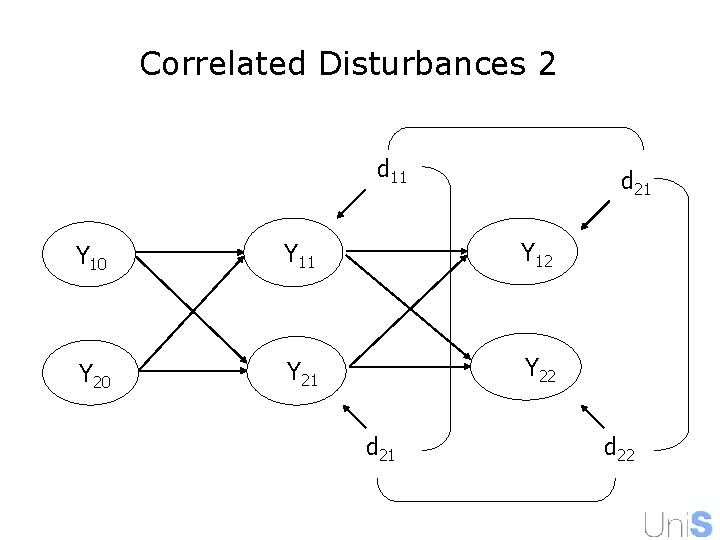

Correlated Disturbances 2 d 11 d 21 Y 10 Y 11 Y 12 Y 20 Y 21 Y 22 d 21 d 22

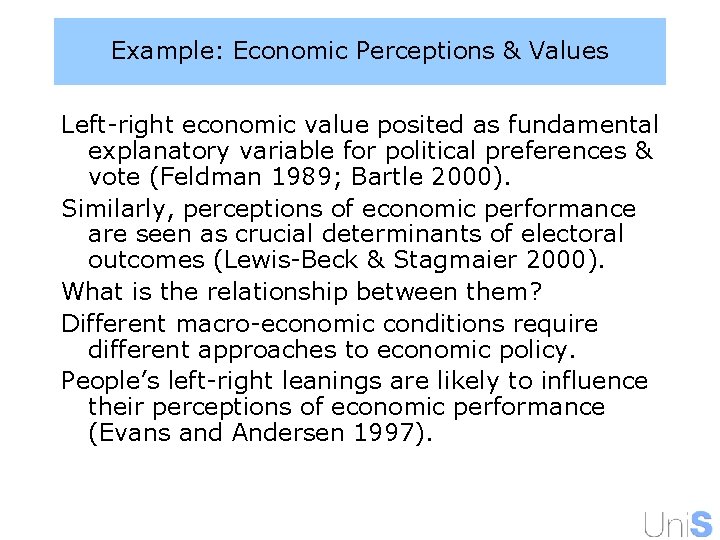

Example: Economic Perceptions & Values Left-right economic value posited as fundamental explanatory variable for political preferences & vote (Feldman 1989; Bartle 2000). Similarly, perceptions of economic performance are seen as crucial determinants of electoral outcomes (Lewis-Beck & Stagmaier 2000). What is the relationship between them? Different macro-economic conditions require different approaches to economic policy. People’s left-right leanings are likely to influence their perceptions of economic performance (Evans and Andersen 1997).

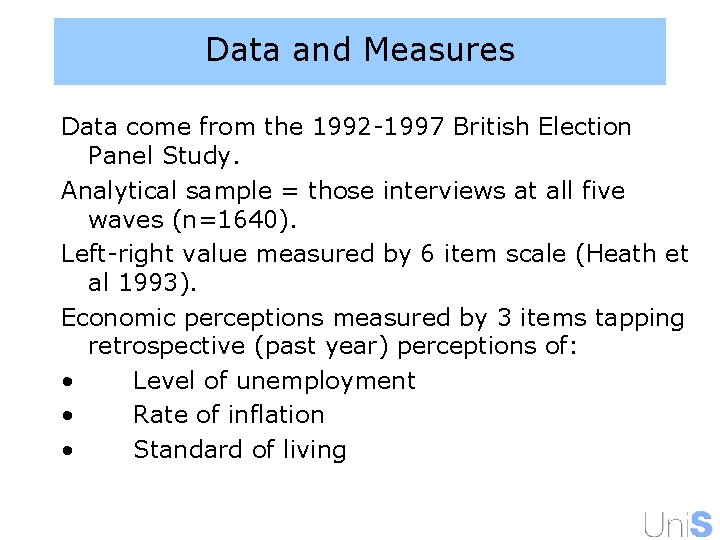

Data and Measures Data come from the 1992 -1997 British Election Panel Study. Analytical sample = those interviews at all five waves (n=1640). Left-right value measured by 6 item scale (Heath et al 1993). Economic perceptions measured by 3 items tapping retrospective (past year) perceptions of: • Level of unemployment • Rate of inflation • Standard of living

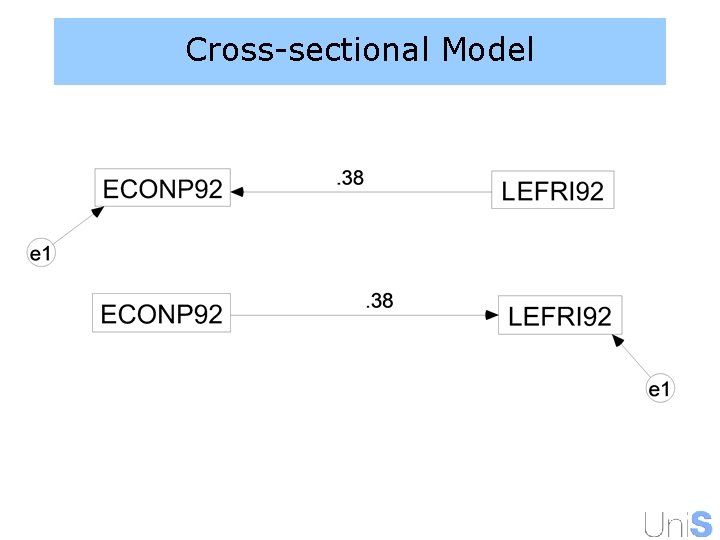

Cross-sectional Model

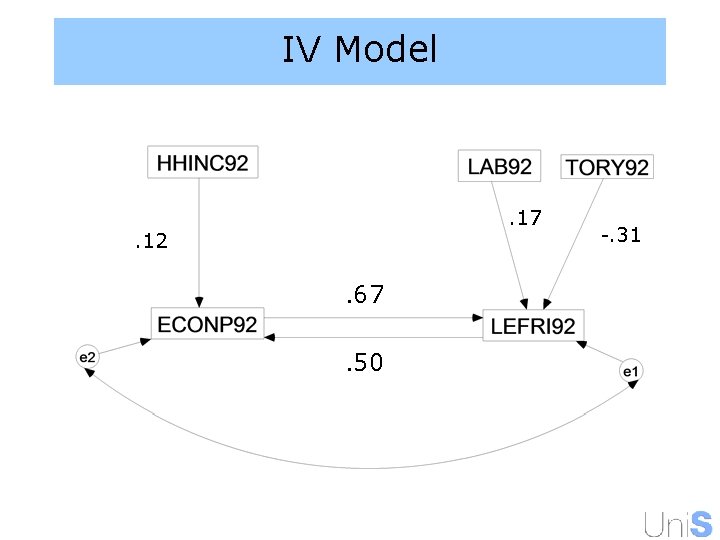

IV Model . 17 . 12 . 67. 50 -. 31

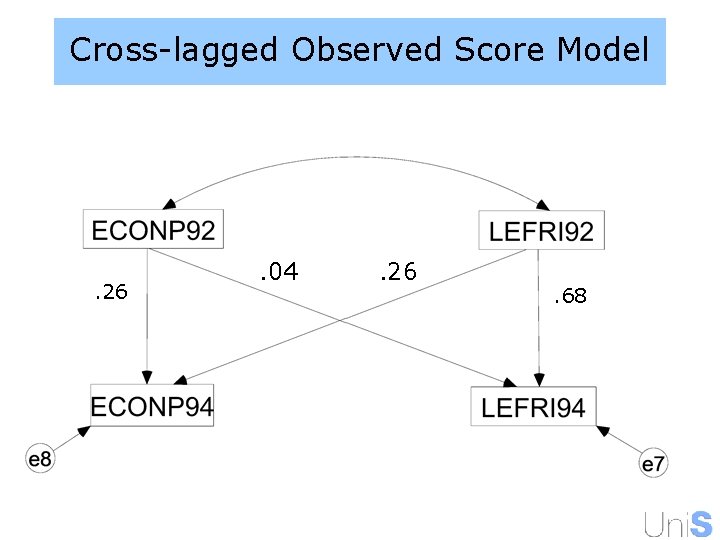

Cross-lagged Observed Score Model . 26 . 04 . 26 . 68

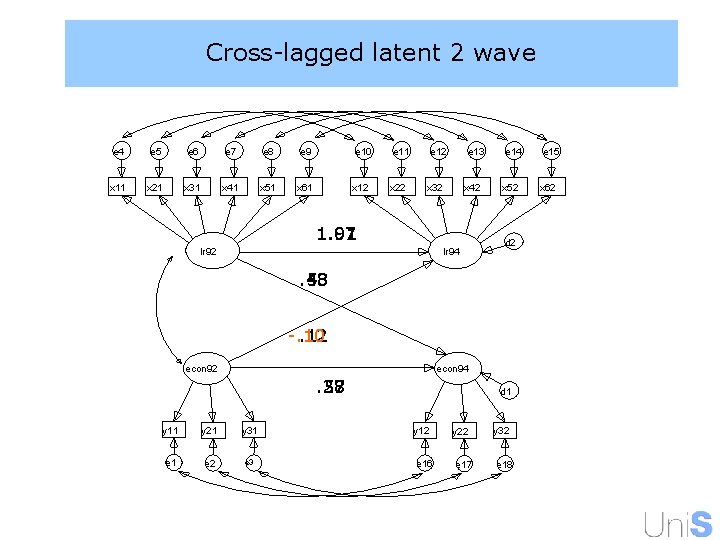

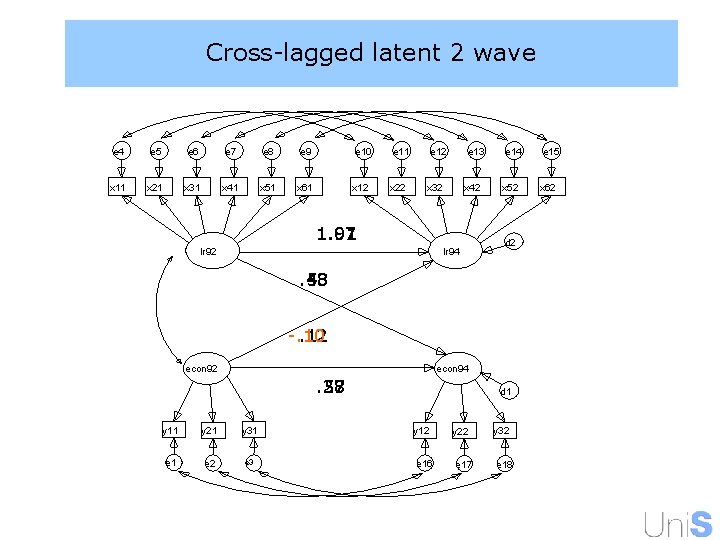

Cross-lagged latent 2 wave e 4 e 5 e 6 e 7 e 8 e 9 x 11 x 21 x 31 x 41 x 51 x 61 e 10 x 12 e 11 x 22 e 13 x 32 x 42 1. 01. 97 lr 92 lr 94 e 14 x 52 d 2 . 53. 48 -. 10. 12 econ 94 . 58. 27 y 11 y 21 y 31 e 2 e 3 d 1 y 12 y 22 y 32 e 16 e 17 e 18 e 15 x 62

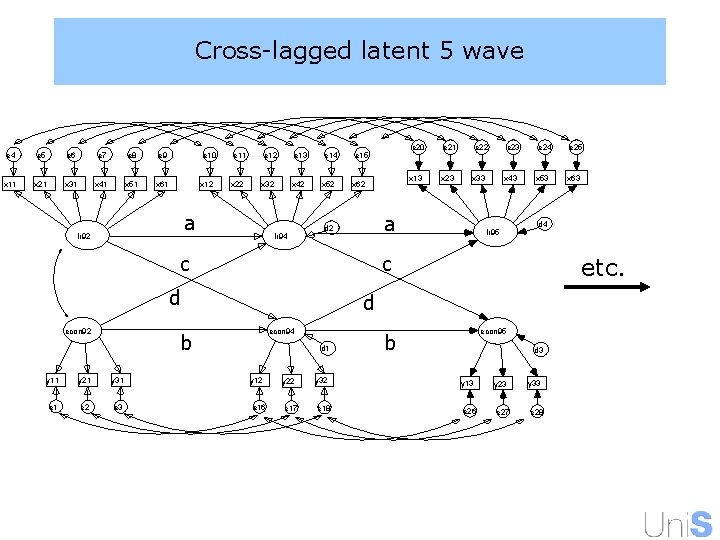

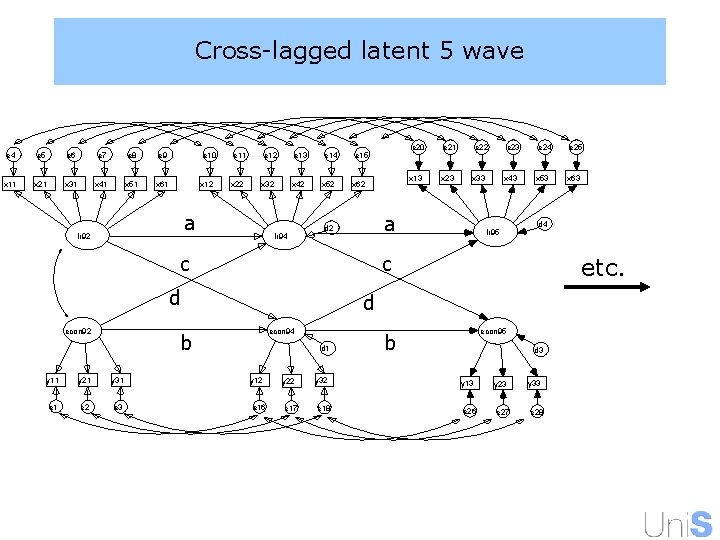

Cross-lagged latent 5 wave e 4 e 5 e 6 e 7 e 8 e 9 x 11 x 21 x 31 x 41 x 51 x 61 e 10 x 12 e 11 x 22 e 12 x 32 a lr 92 e 13 x 42 lr 94 e 14 x 52 e 15 x 62 y 31 e 2 e 3 e 23 x 13 x 23 x 33 x 43 lr 95 e 24 x 53 econ 94 d 1 y 12 e 16 y 22 e 17 y 32 e 18 e 25 x 63 d 4 etc. d b y 21 e 22 c d y 11 e 21 a d 2 c econ 92 e 20 econ 95 b d 3 y 13 y 23 y 33 e 26 e 27 e 28

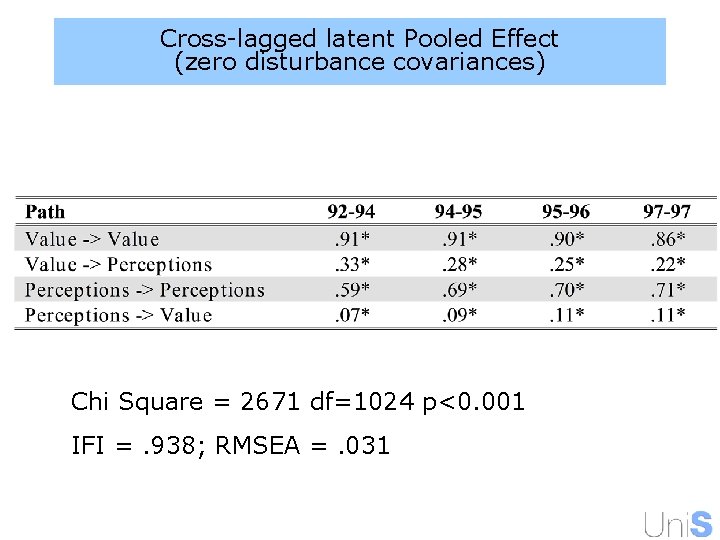

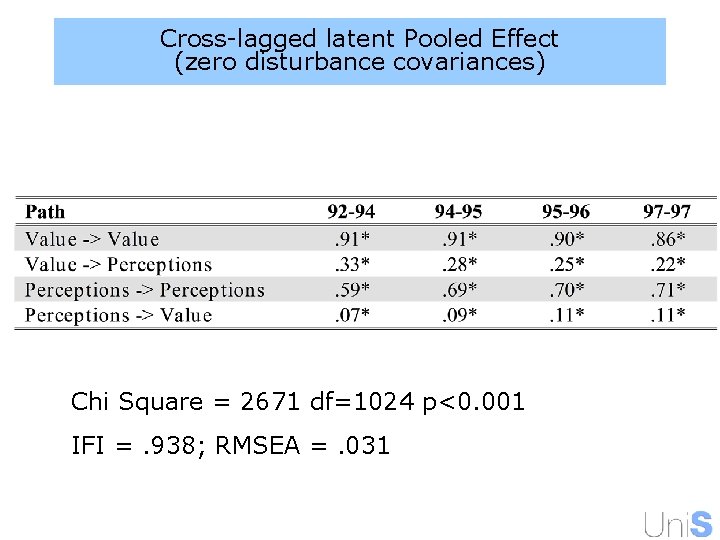

Cross-lagged latent Pooled Effect (zero disturbance covariances) Chi Square = 2671 df=1024 p<0. 001 IFI =. 938; RMSEA =. 031

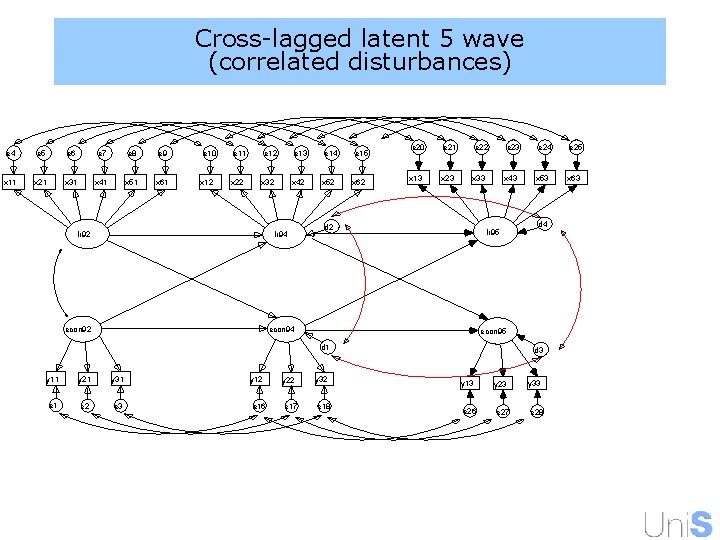

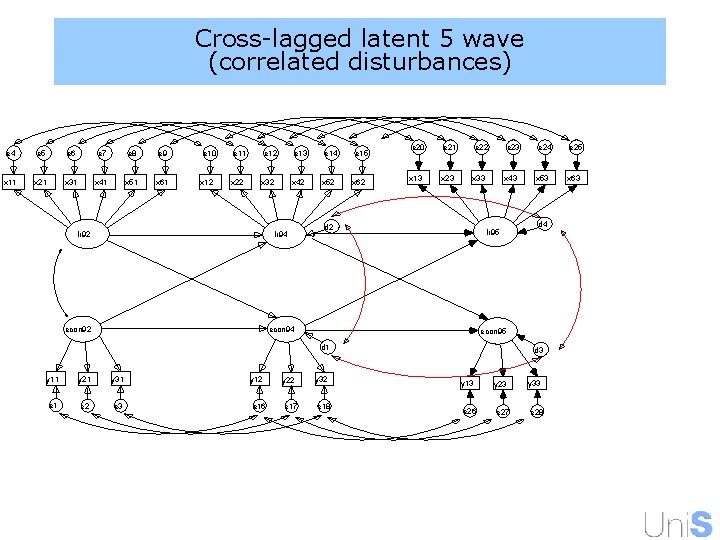

Cross-lagged latent 5 wave (correlated disturbances) e 4 e 5 e 6 e 7 e 8 e 9 x 11 x 21 x 31 x 41 x 51 x 61 e 10 x 12 e 11 x 22 e 13 x 32 lr 92 x 42 lr 94 econ 92 e 14 x 52 e 15 x 62 e 20 e 21 e 22 e 23 x 13 x 23 x 33 x 43 d 2 lr 95 econ 94 y 21 y 31 e 2 e 3 y 12 e 16 y 22 e 17 x 53 d 4 econ 95 d 1 y 11 e 24 y 32 e 18 d 3 y 13 y 23 y 33 e 26 e 27 e 28 e 25 x 63

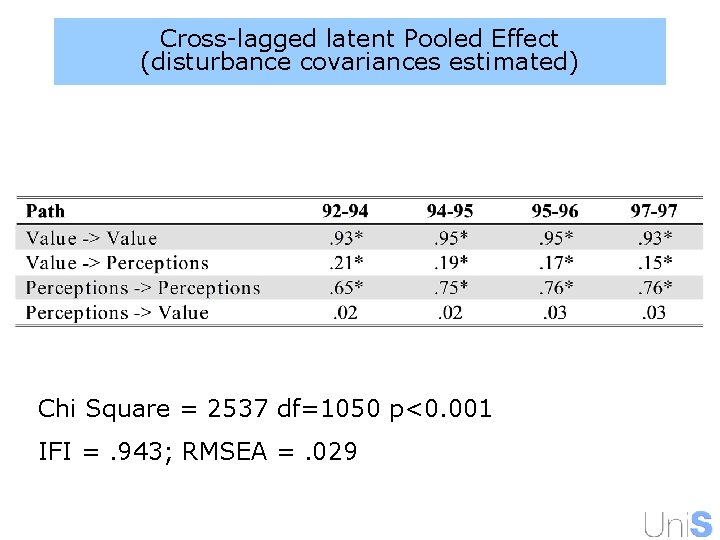

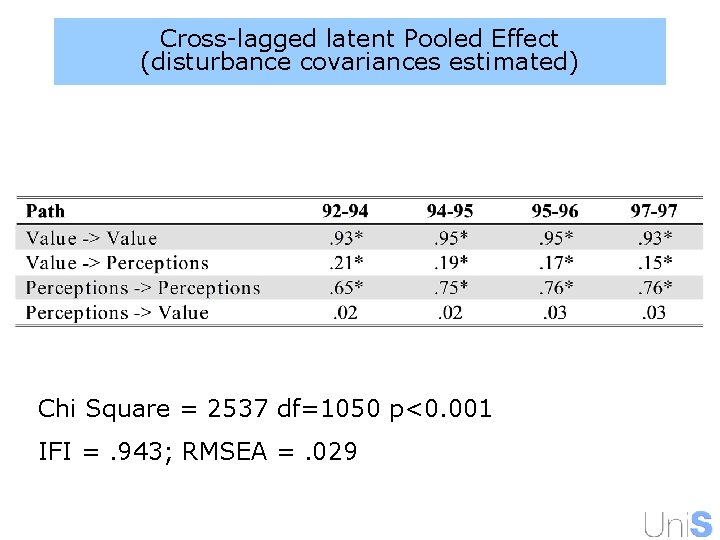

Cross-lagged latent Pooled Effect (disturbance covariances estimated) Chi Square = 2537 df=1050 p<0. 001 IFI =. 943; RMSEA =. 029

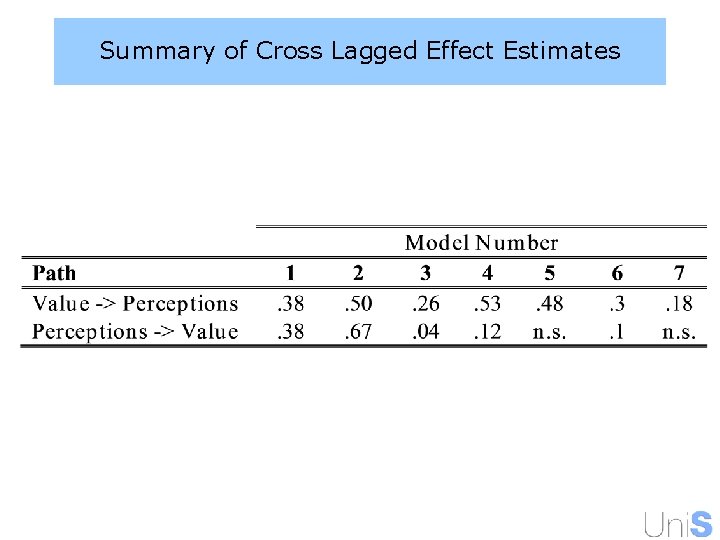

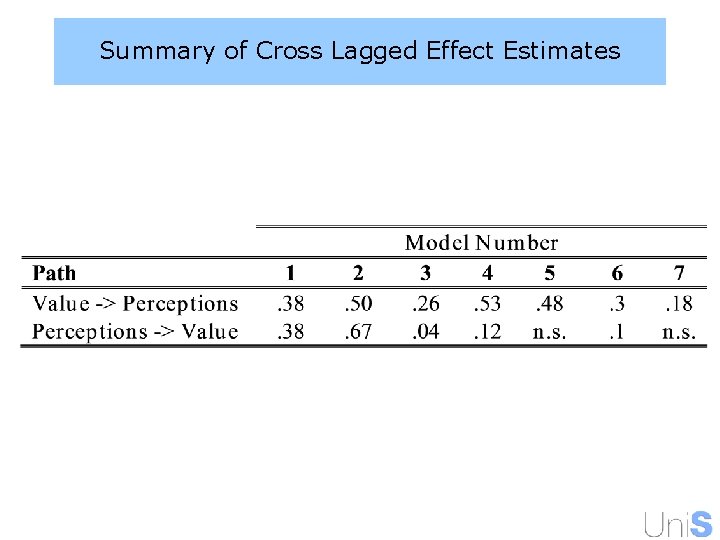

Summary of Cross Lagged Effect Estimates

Conclusions Reciprocal relationships can be seen as either a nuisance or of substantive interest. Either way, they are hard to model with observational data. Repeated measures data offers significant leverage relative to x-sectional. Problems of error variance and covariance much greater with panel data. Need to correct for errors in the measurement of abstract concepts. And estimate relationships between measurement errors over time.

Conclusions Unobserved variable bias likely to manifest through covariance between residuals. Failure to model these errors and their covariance structures can lead to seriously biased causal inference. Naïve analyses showed strong non-recursive relationship between economic values and perceptions. More appropriate treatment of error structures altered causal inference substantially.