Using link analysis to develop indirect and multitiered

- Slides: 40

Using link analysis to develop indirect and multi-tiered ownership structures Larry R. May Intelligent Business Solutions Group June, 2012 1

What is an Enterprise? • Enterprise structures are an attempt to identify all economic activity under the common control of a taxpayer. • Currently limited to flow-trough relationships, parent/subsidiary links, and primary/secondary SSN associations. • Also limited to structures with at least two business returns. 2

What is common control? • Control is direct and indirect ownership of 50% or more of another entity consistent with the rules set forth in IRC section 267(c) and section 707(b). • Allocation proportions are used as a proxy for ownership percentage. • Other items which may assist in identifying related parties include name similarities, TIN sequencing, common address and common preparer. 3

Icon Legend High Income High Asset A 4

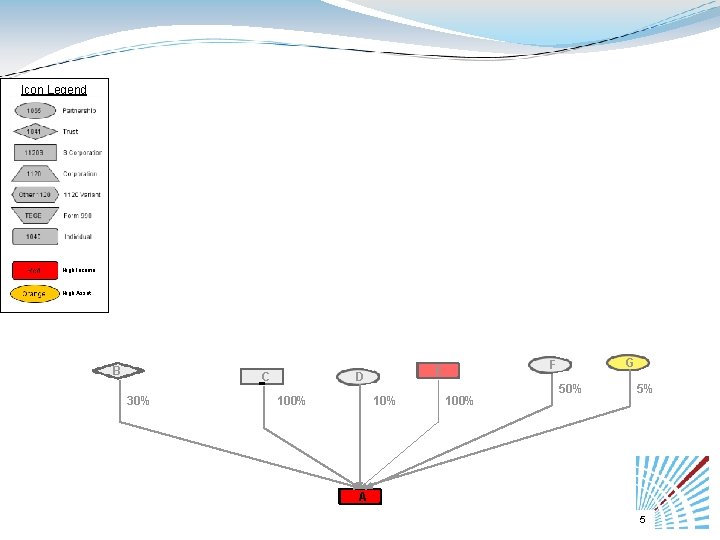

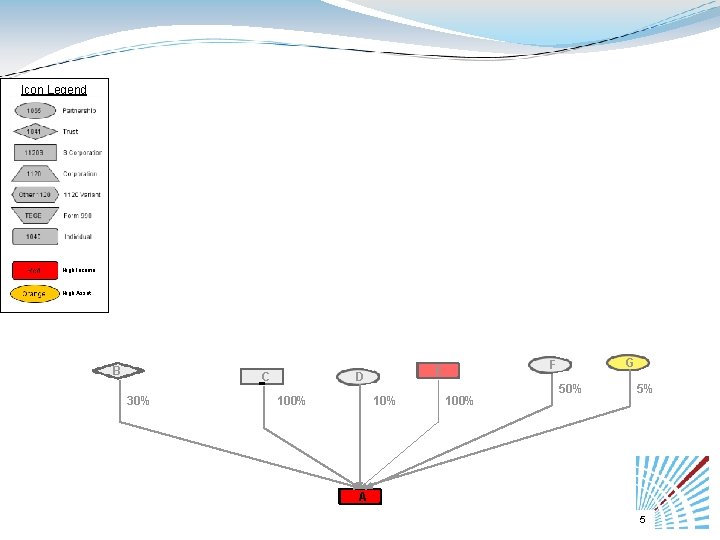

Icon Legend High Income High Asset B C 30% D 100% 10% G F E 100% 5% A 5

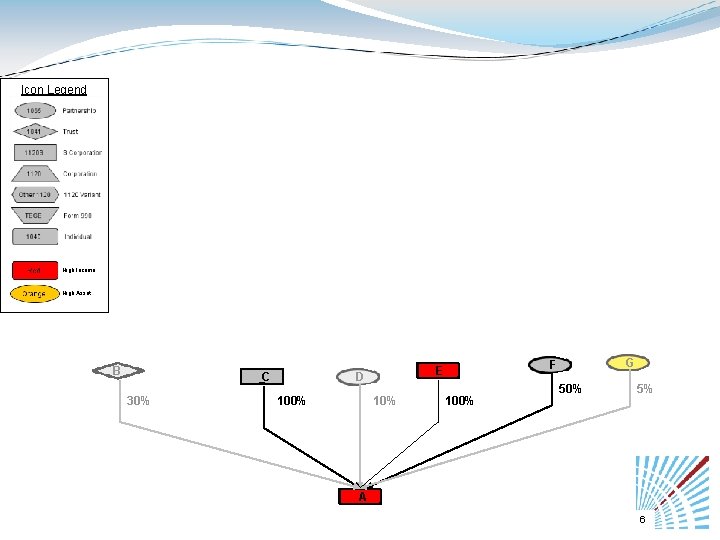

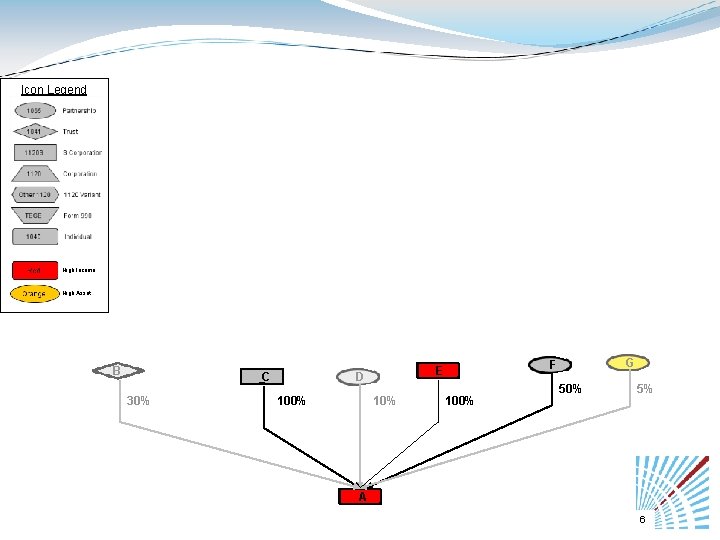

Icon Legend High Income High Asset B C 30% D 100% 10% G F E 100% 5% A 6

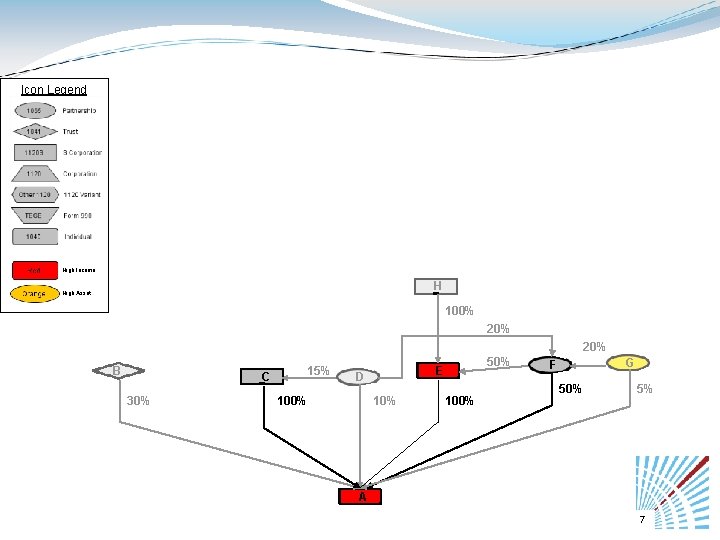

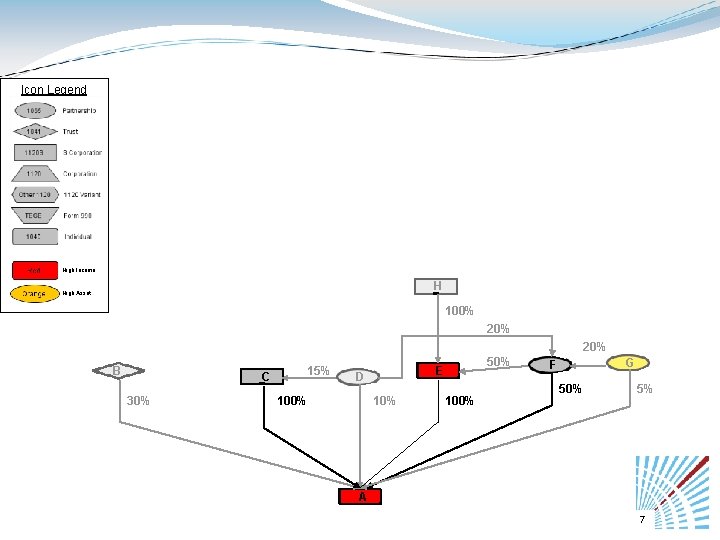

Icon Legend High Income H High Asset 100% 20% B C 30% 15% D 100% 50% E 10% 100% G F 50% 5% A 7

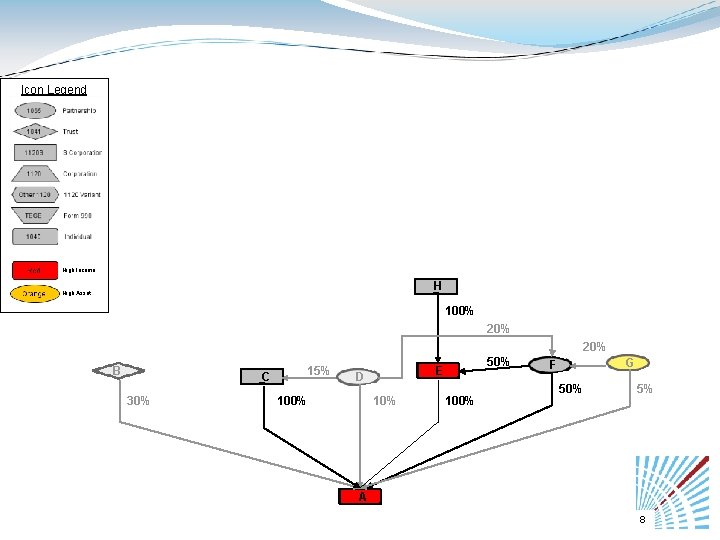

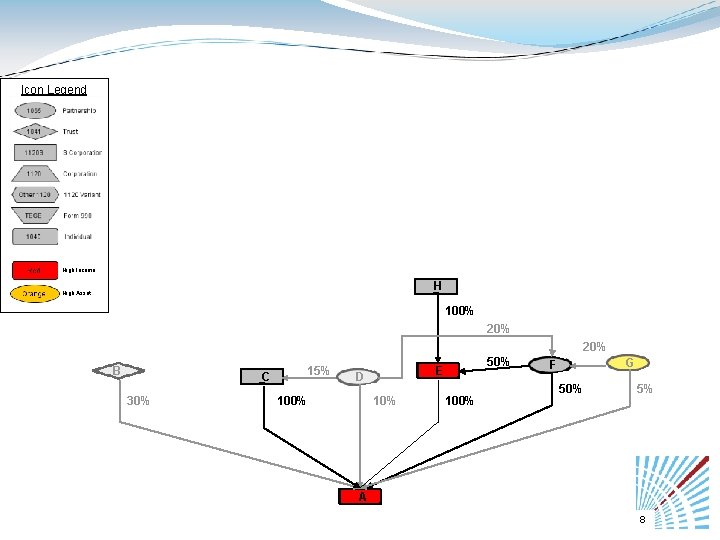

Icon Legend High Income H High Asset 100% 20% B C 30% 15% D 100% 50% E 10% 100% G F 50% 5% A 8

Icon Legend D G 20% 15% 5% High Income F H High Asset 100% B 50% E C 30% 50% 10% 100% A 9

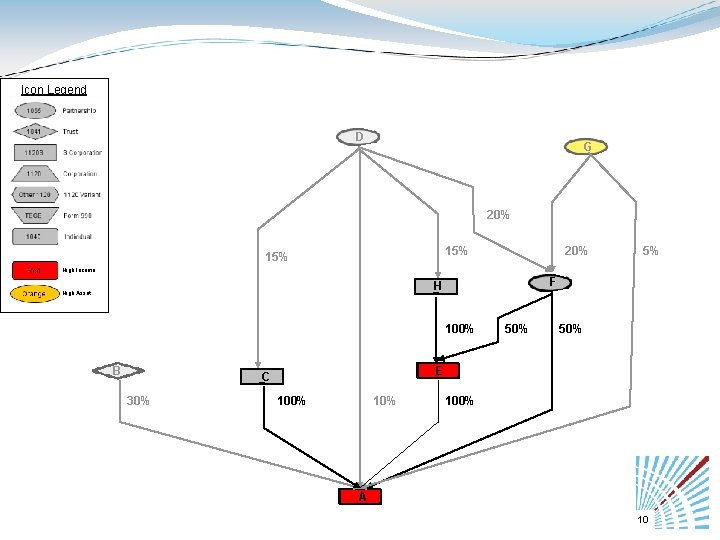

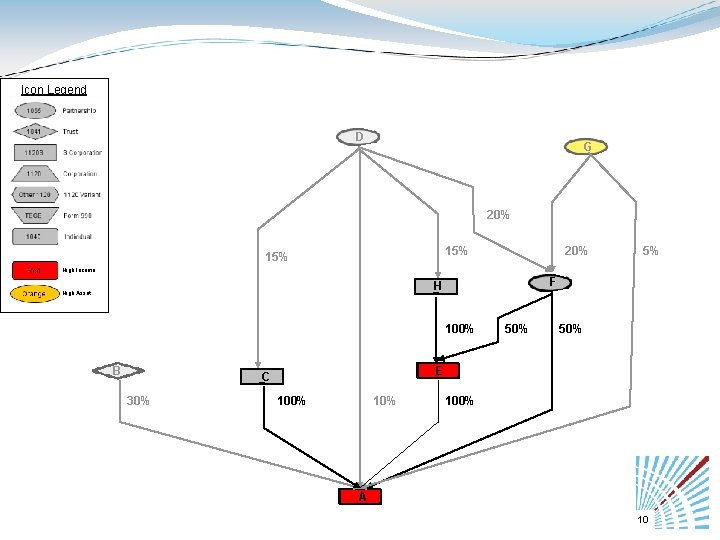

Icon Legend D G 20% 15% 20% 5% High Income F H High Asset 100% B 50% E C 30% 50% 10% 100% A 10

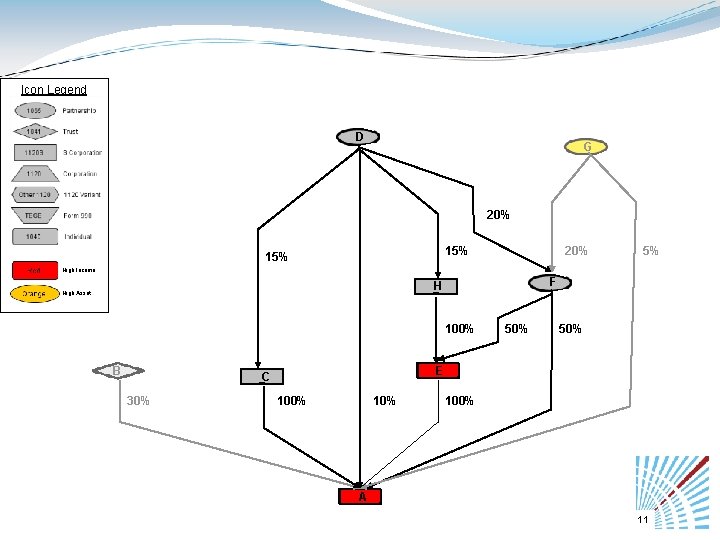

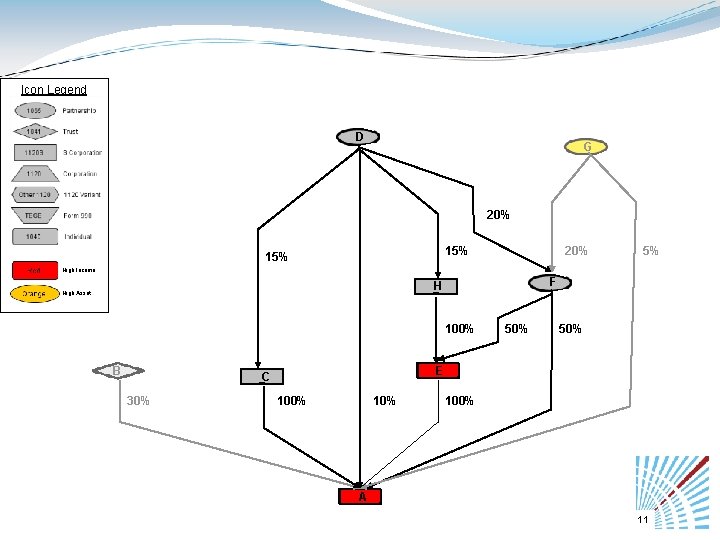

Icon Legend D G 20% 15% 20% 5% High Income F H High Asset 100% B 50% E C 30% 50% 10% 100% A 11

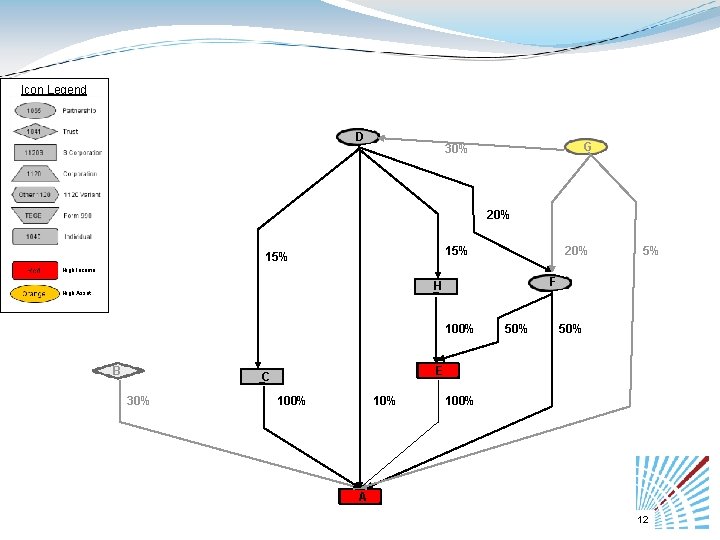

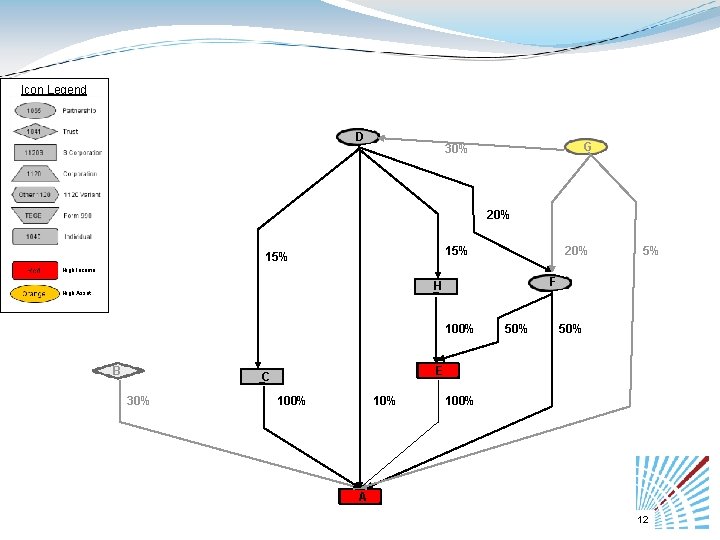

Icon Legend D G 30% 20% 15% 20% 5% High Income F H High Asset 100% B 50% E C 30% 50% 10% 100% A 12

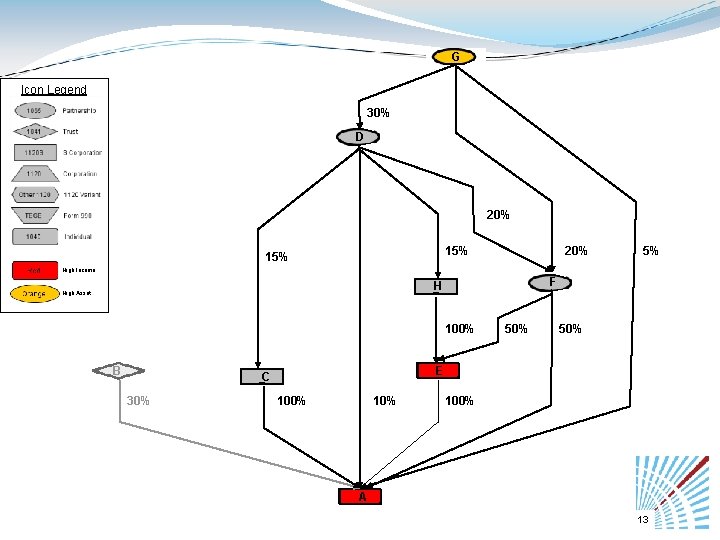

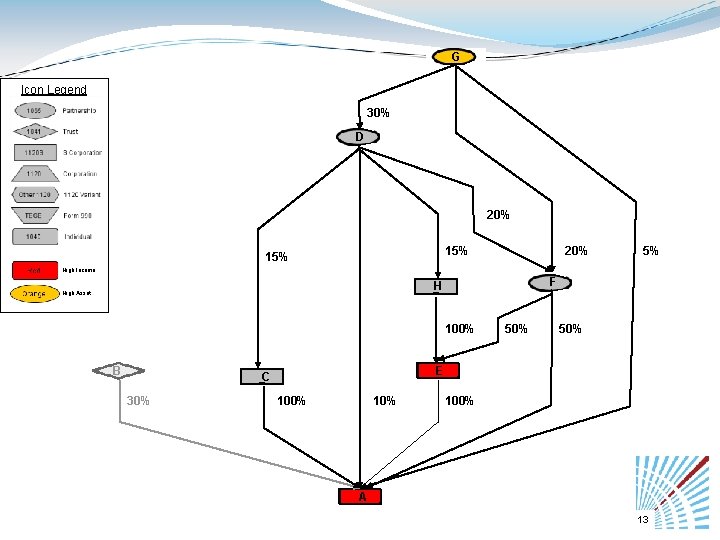

G Icon Legend 30% D 20% 15% 20% 5% High Income F H High Asset 100% B 50% E C 30% 50% 10% 100% A 13

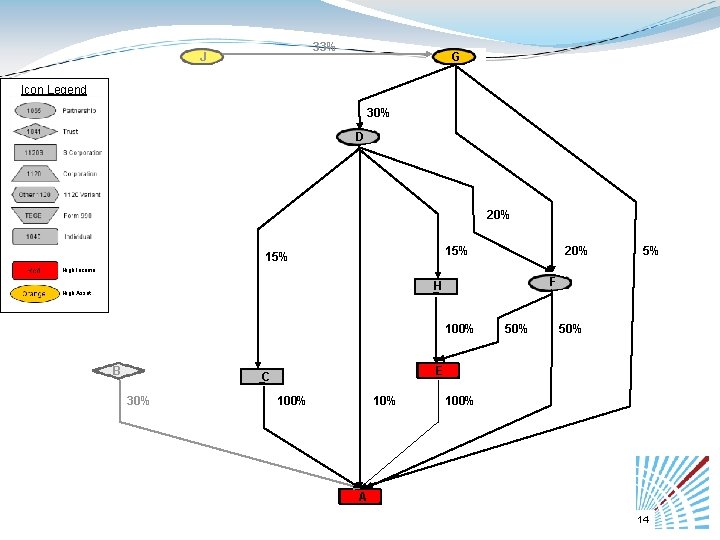

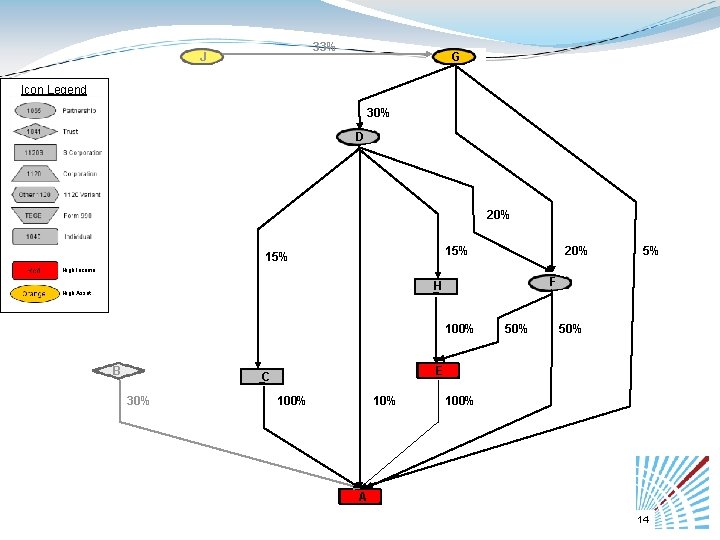

33% J G Icon Legend 30% D 20% 15% 20% 5% High Income F H High Asset 100% B 50% E C 30% 50% 10% 100% A 14

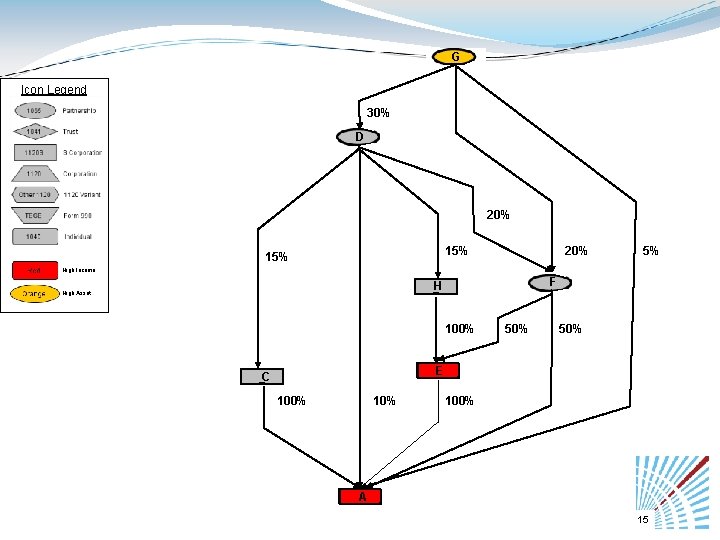

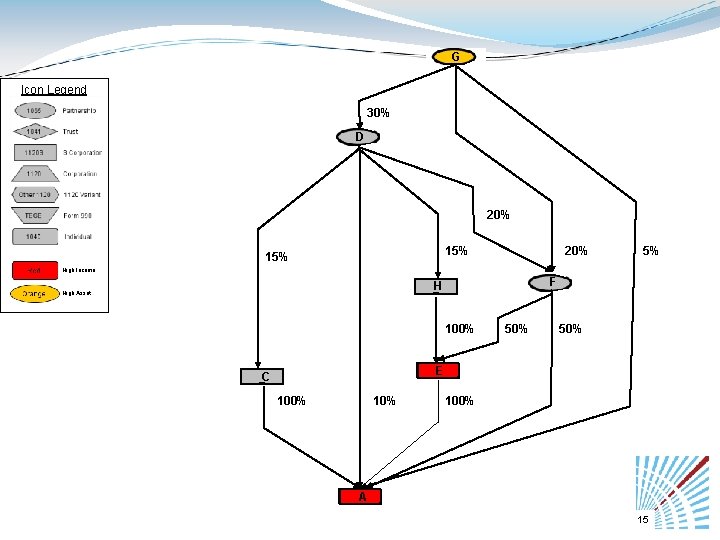

G Icon Legend 30% D 20% 15% 20% 5% High Income F H High Asset 100% 50% E C 100% A 15

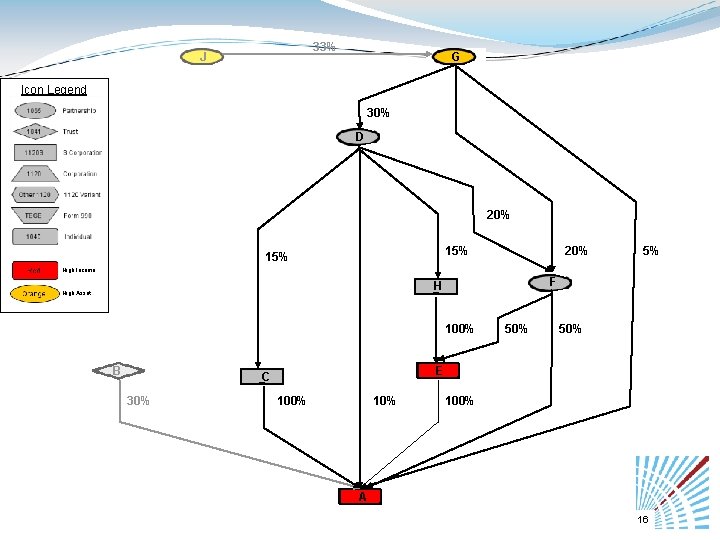

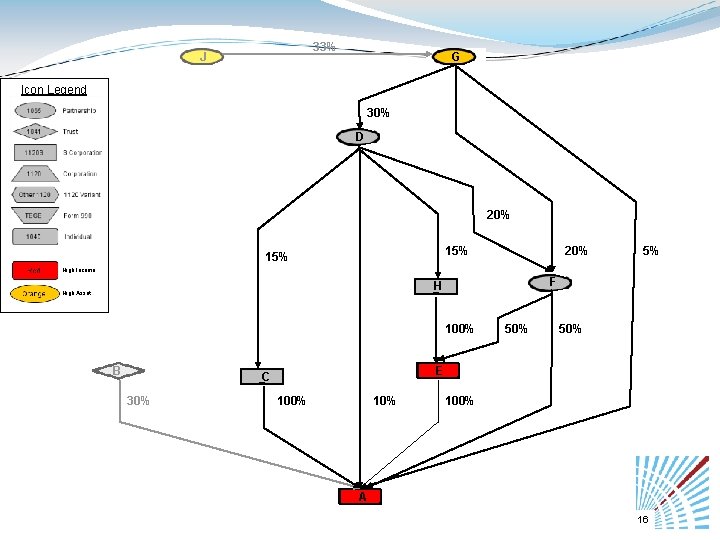

33% J G Icon Legend 30% D 20% 15% 20% 5% High Income F H High Asset 100% B 50% E C 30% 50% 10% 100% A 16

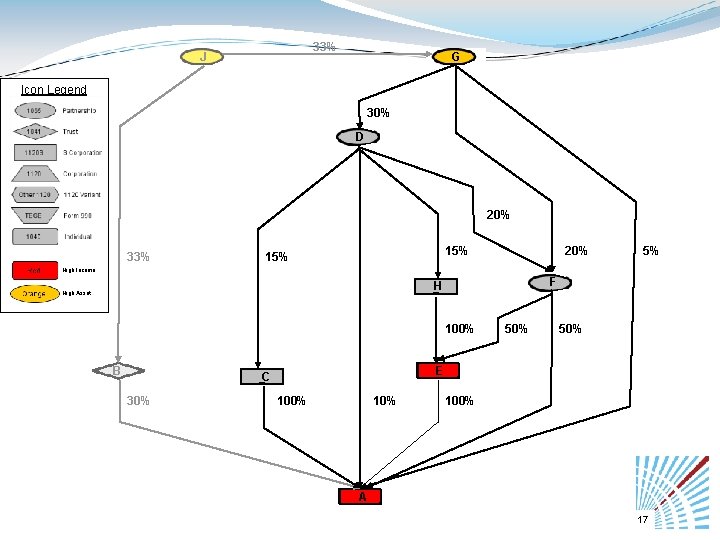

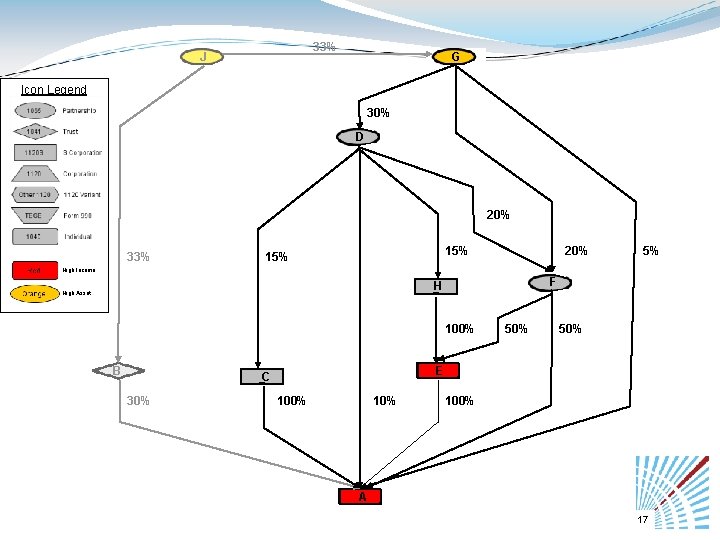

33% J G Icon Legend 30% D 20% 33% 15% 20% 5% High Income F H High Asset 100% B 50% E C 30% 50% 10% 100% A 17

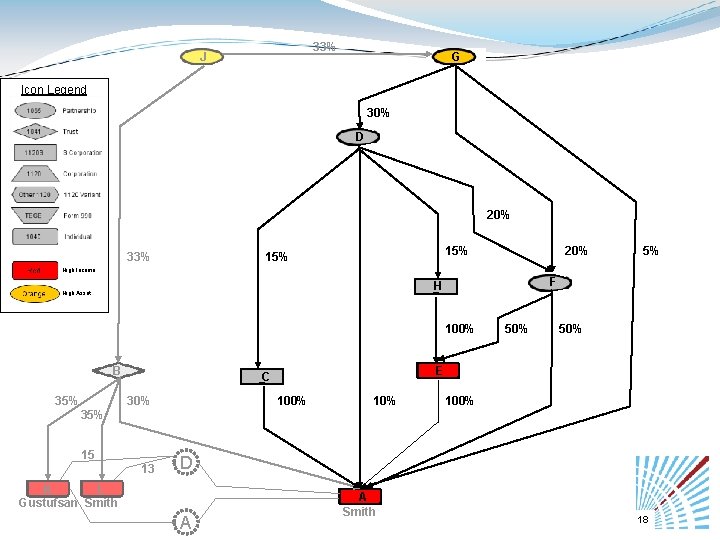

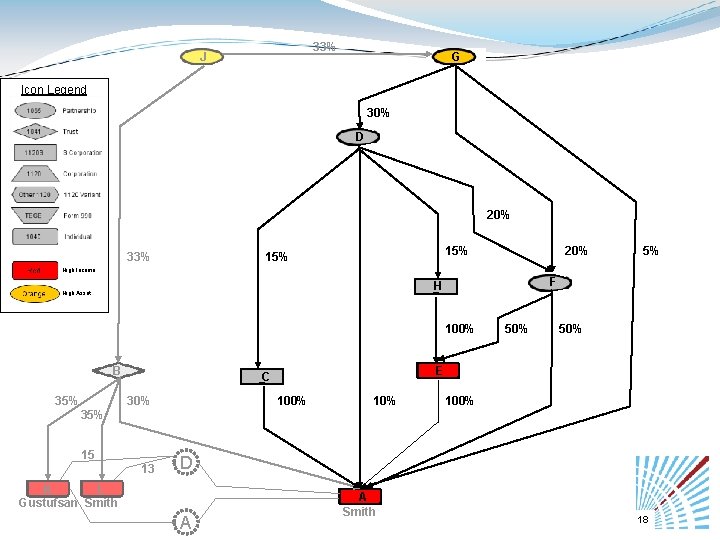

33% J G Icon Legend 30% D 20% 33% 15% 20% 5% High Income F H High Asset 100% B 35% 50% E C 30% 50% 10% 100% 35% 15 13 D L K Gustufsan Smith A A Smith 18

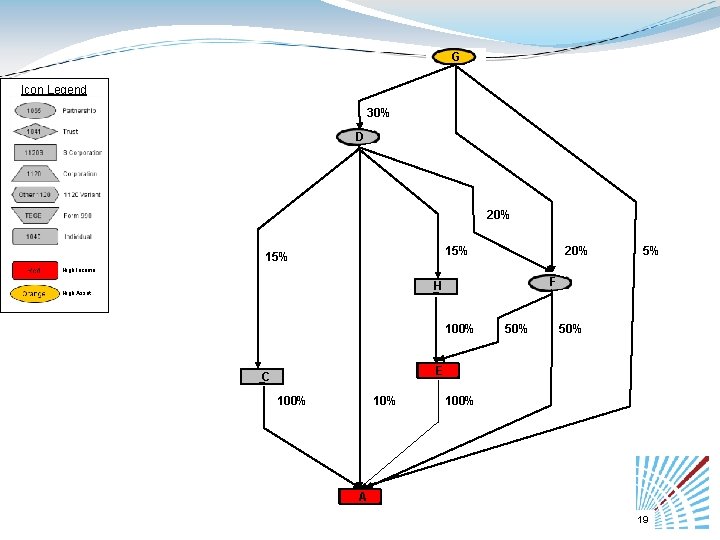

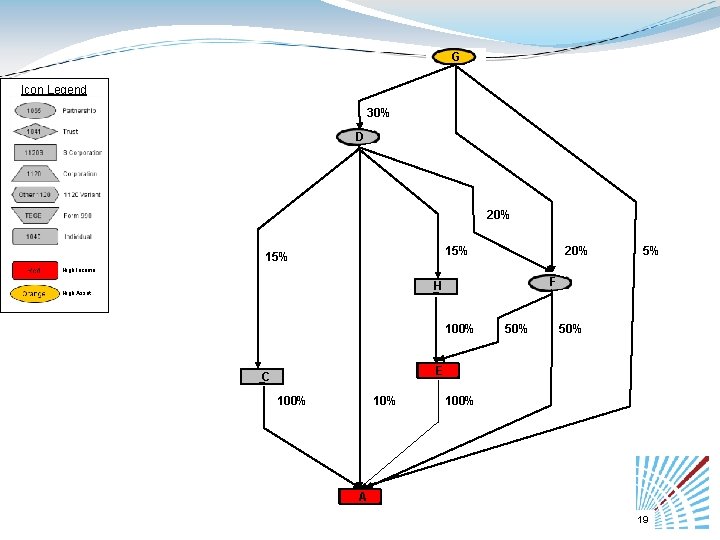

G Icon Legend 30% D 20% 15% 20% 5% High Income F H High Asset 100% 50% E C 100% A 19

20

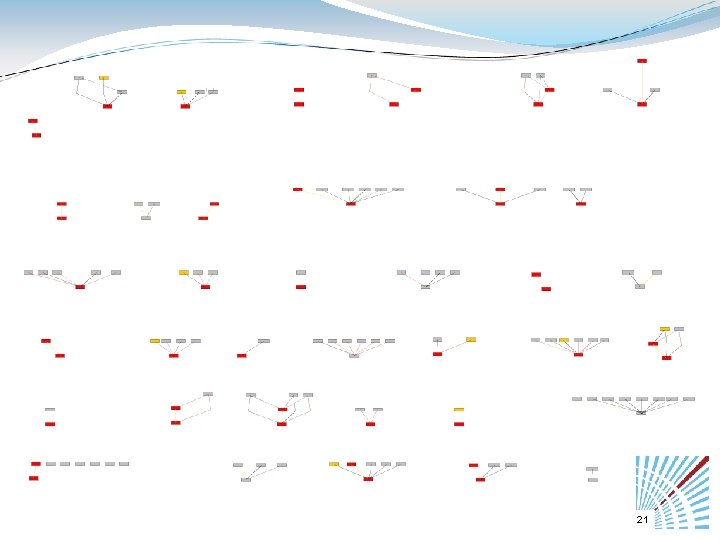

21

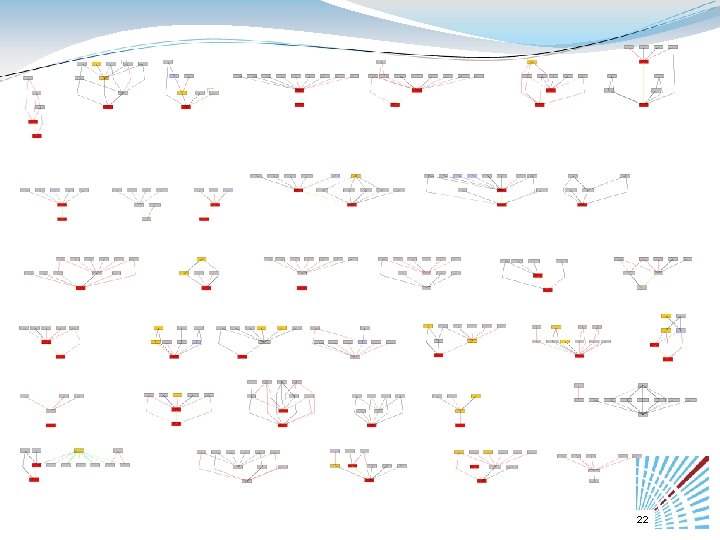

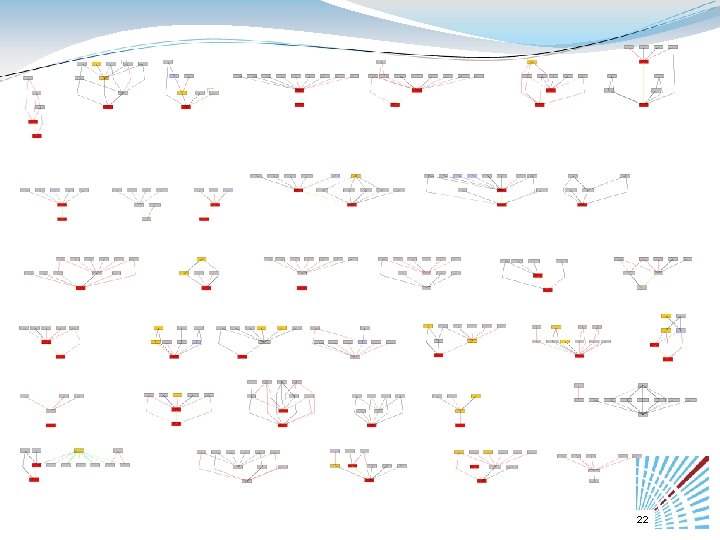

22

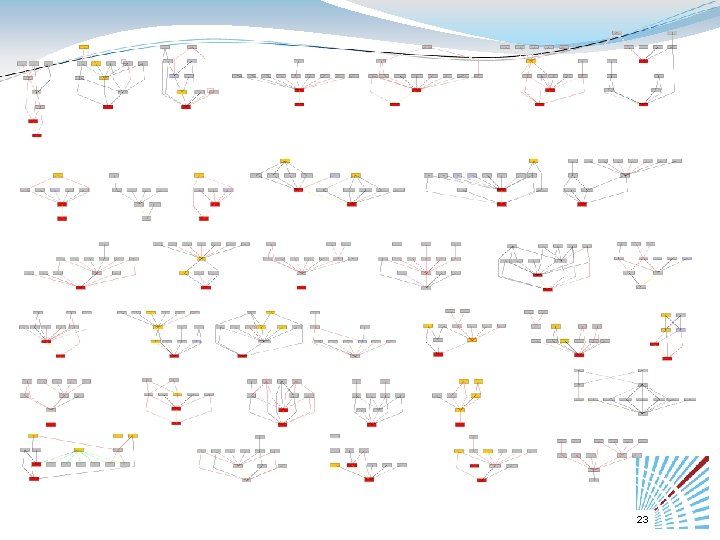

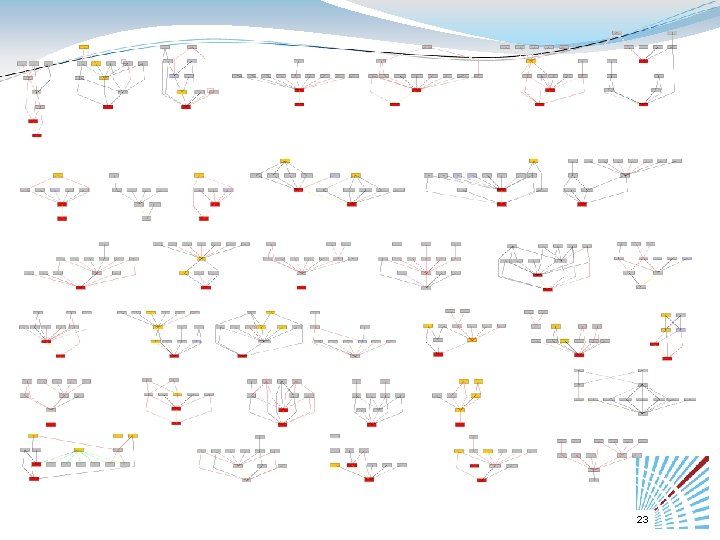

23

24

A Simple Enterprise There are 2 other investors (3 in total) in this partnership but this individual has more than 50% ownership This taxpayer has 5 investments but he has a controlling interest in only the 3 shown 25

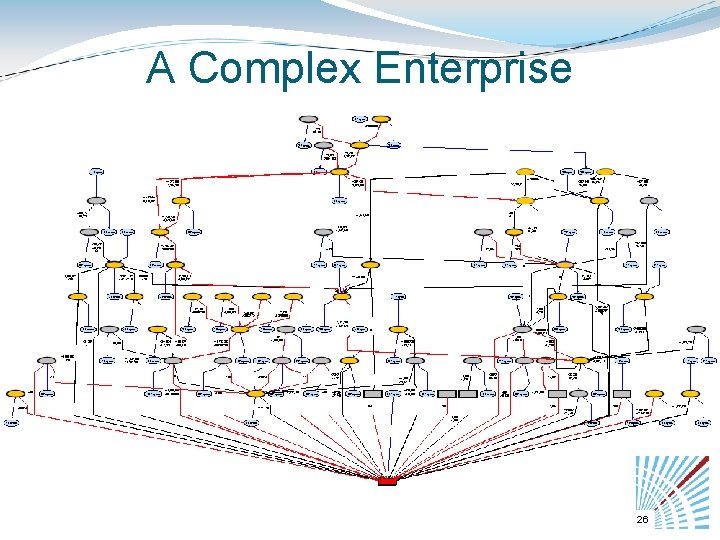

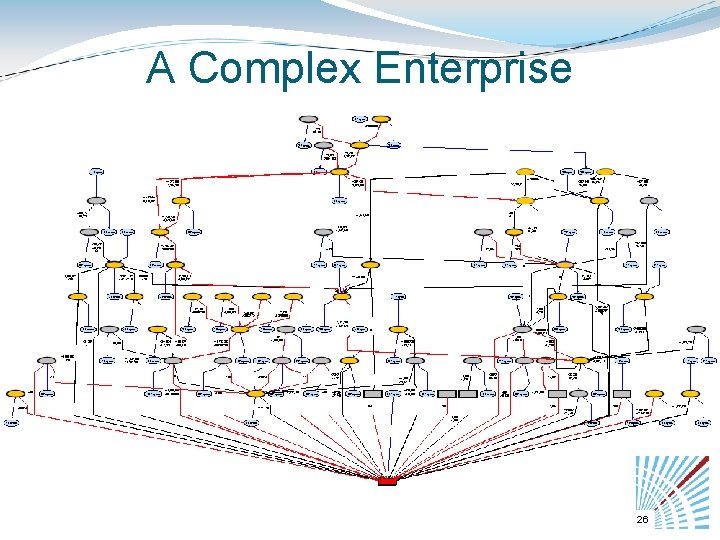

A Complex Enterprise 26

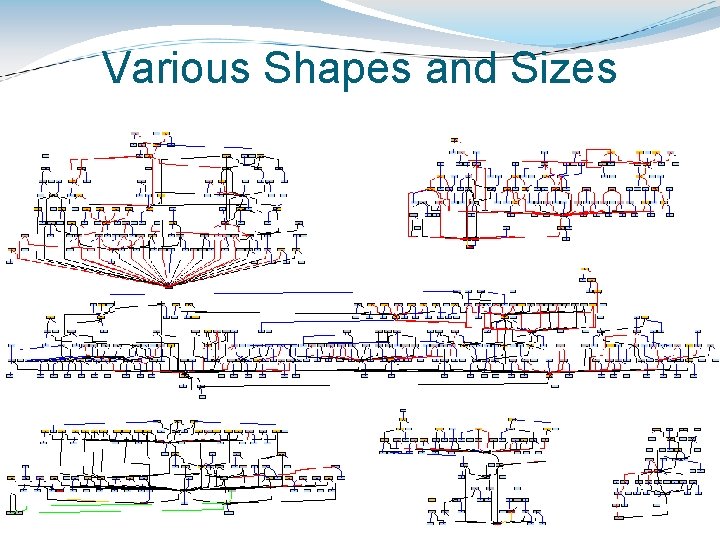

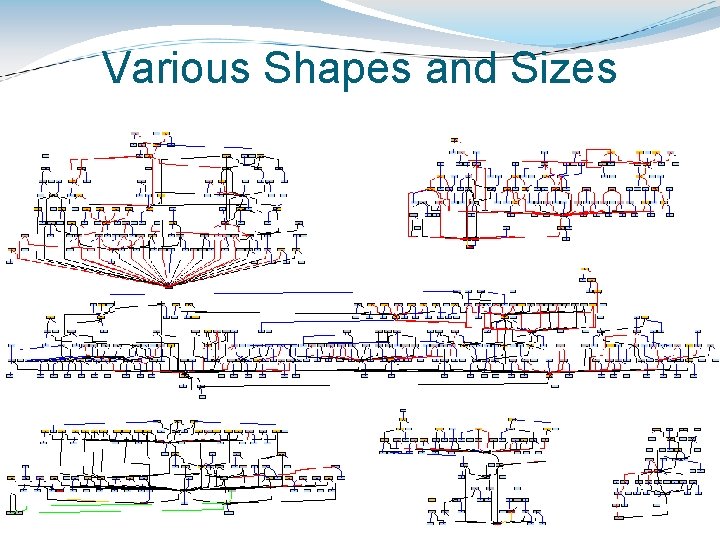

Various Shapes and Sizes 27

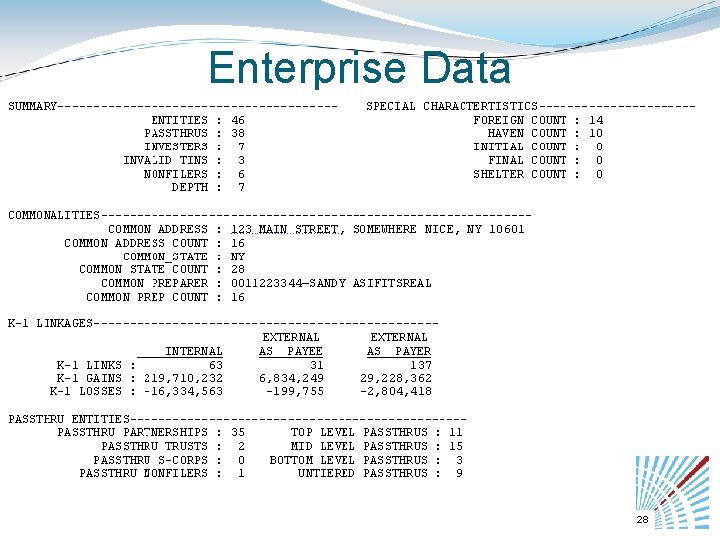

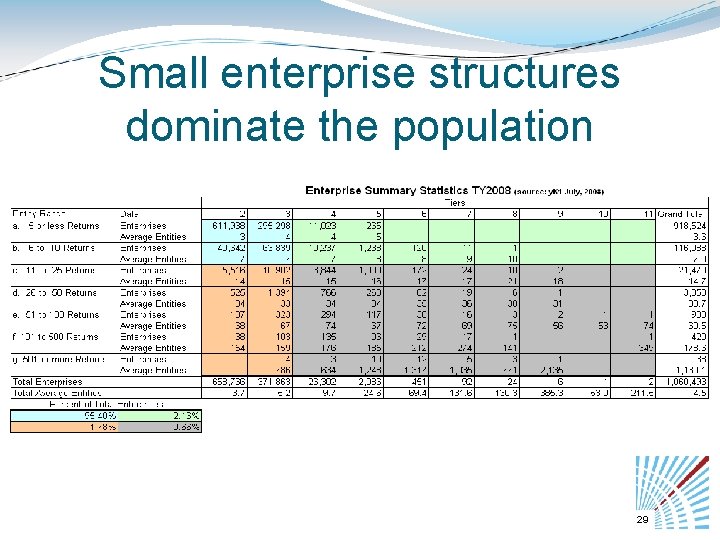

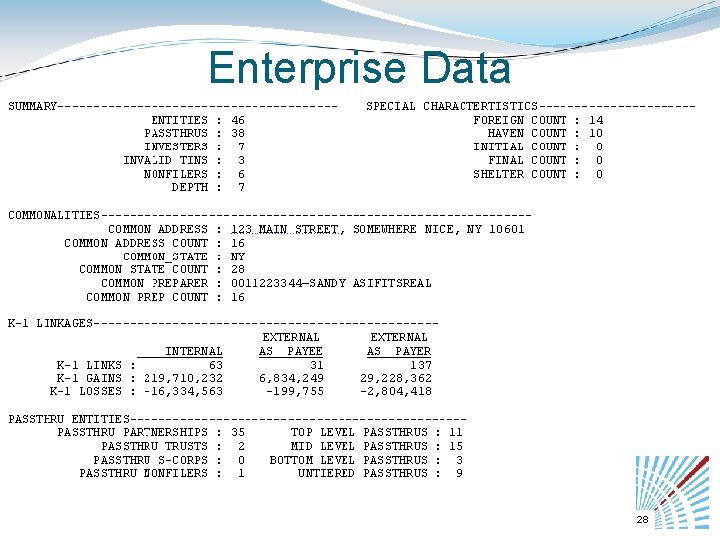

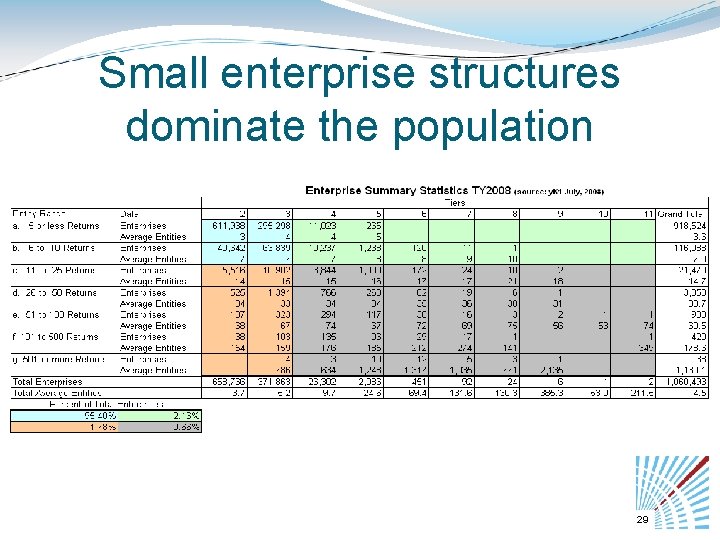

Enterprise Data 28

Small enterprise structures dominate the population 29

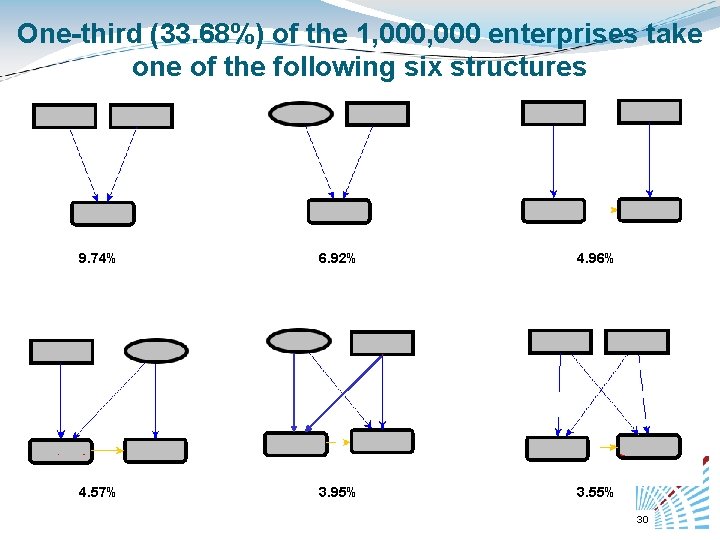

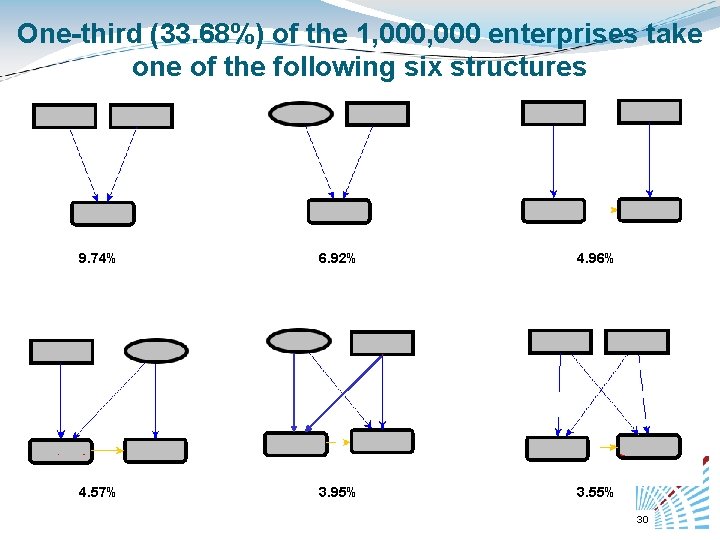

One-third (33. 68%) of the 1, 000 enterprises take one of the following six structures 9. 74% 6. 92% 4. 96% 4. 57% 3. 95% 3. 55% 30

Enterprise Highlights • Over 900, 000 are controlled by an individual. • About 50, 000 are LB&I controlled. • The Real Estate Industry dominates. • About 20% contained either an initial or final year return. • Usually the same preparer prepared most of the returns. • Enterprises usually have very few investors other than the controlling owner. 31

Related Areas of Research • Name Similarity analysis • Familial Relationships • Other Heuristics of Relationship and Control • Boundary Refinement (Merging Ent. ) • Aggregation methods for data • Risk Assessment • Enterprise Profile • Other… 32

Thank You for Your Time and Attention Larry R. May larry. r. may@irs. gov 33

Supplemental Tables 34

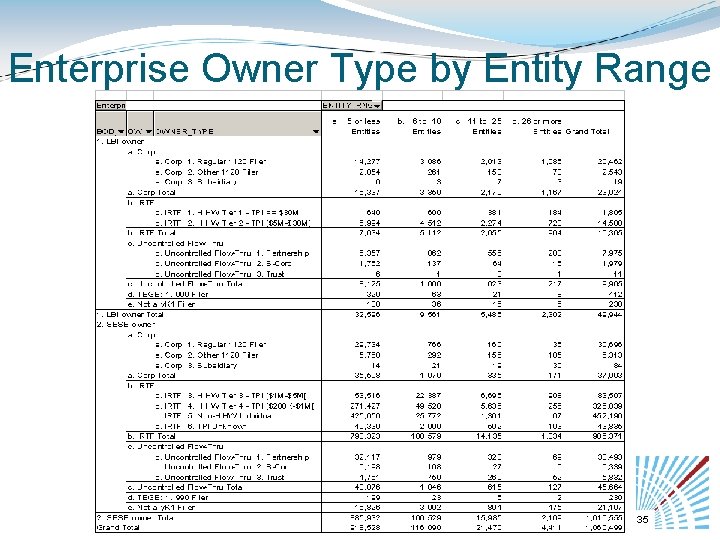

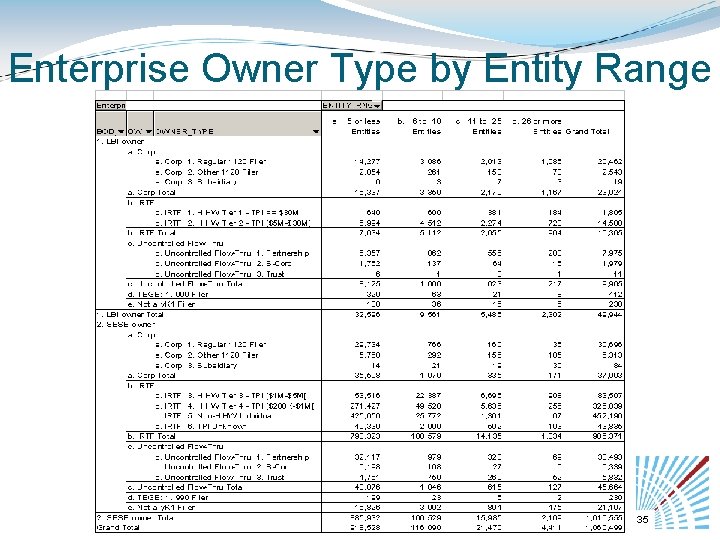

Enterprise Owner Type by Entity Range 35

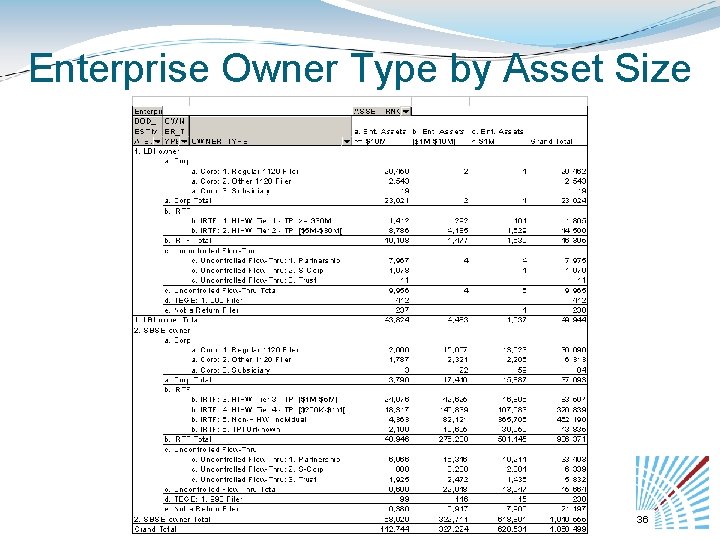

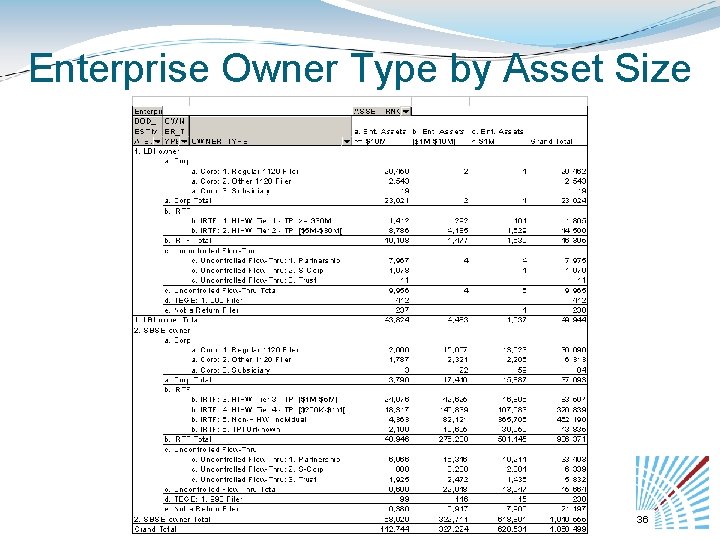

Enterprise Owner Type by Asset Size 36

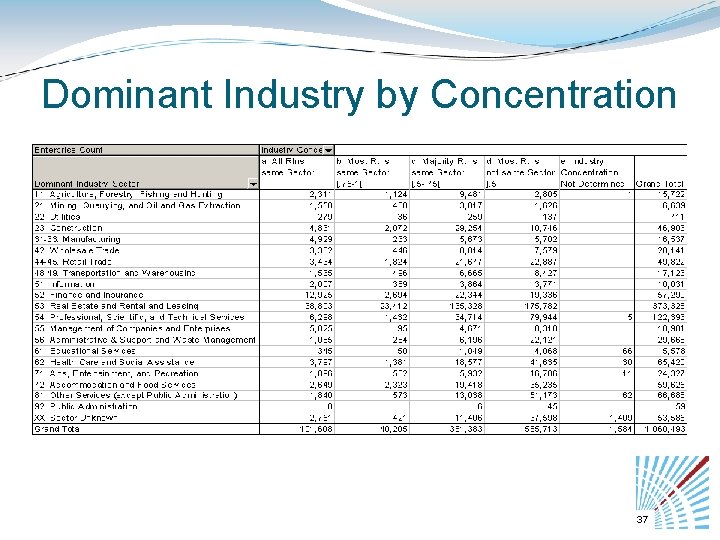

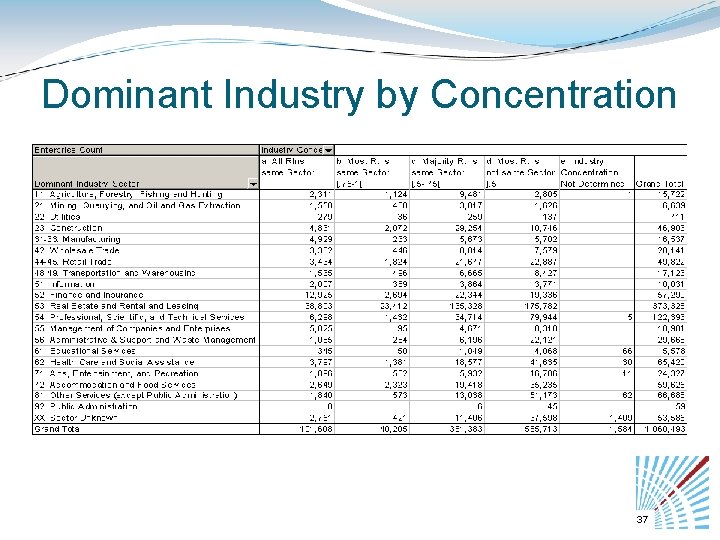

Dominant Industry by Concentration 37

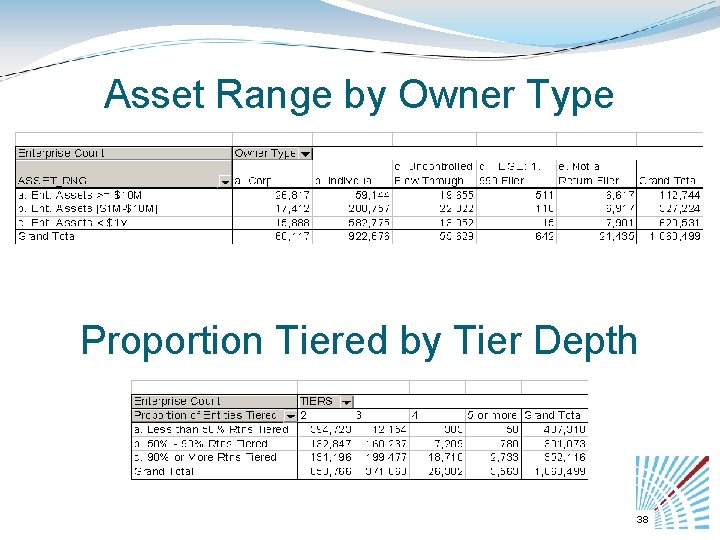

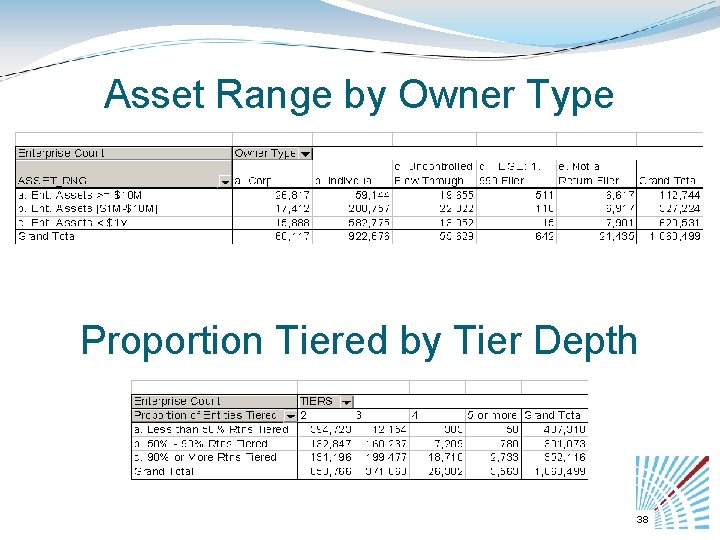

Asset Range by Owner Type Proportion Tiered by Tier Depth 38

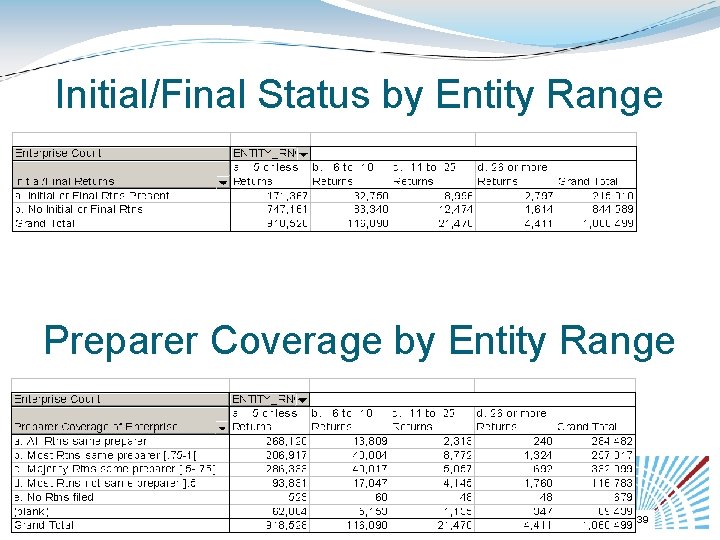

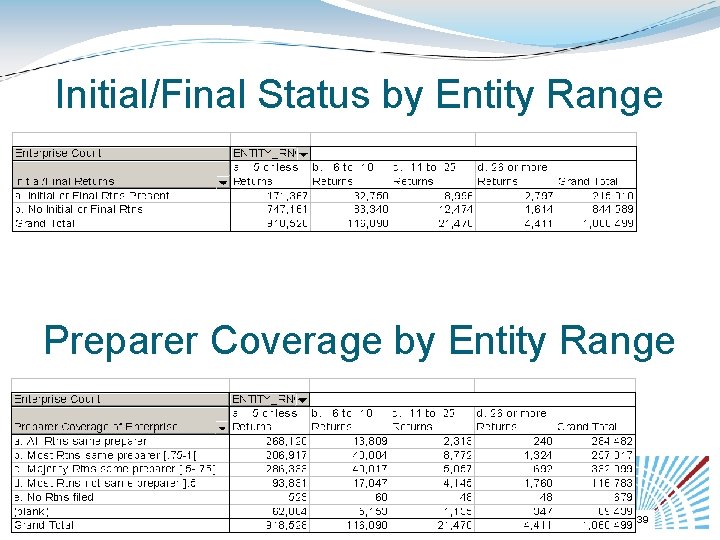

Initial/Final Status by Entity Range Preparer Coverage by Entity Range 39

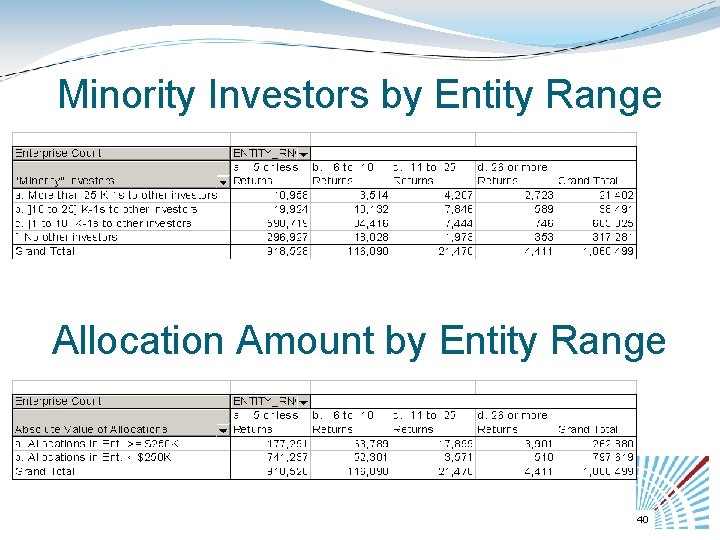

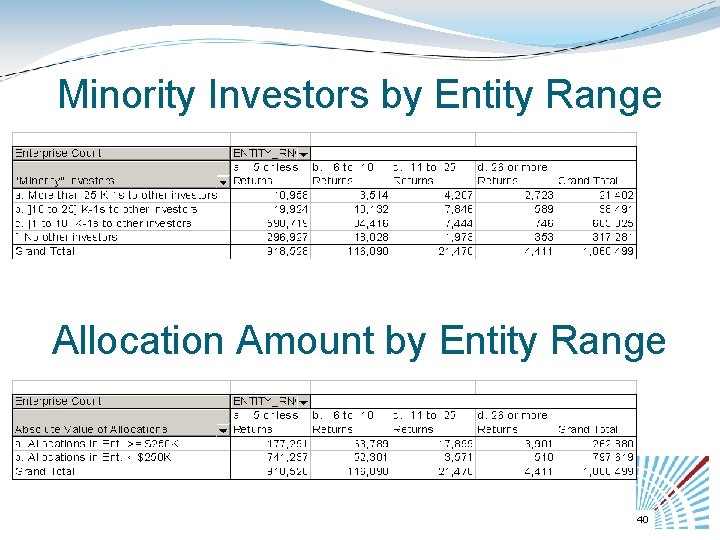

Minority Investors by Entity Range Allocation Amount by Entity Range 40