USDA RURAL DEVELOPMENT LOAN GRANT FINANCING WATER WASTE

- Slides: 26

USDA, RURAL DEVELOPMENT LOAN & GRANT FINANCING WATER & WASTE FACILITIES Tim Rickabaugh, B&CP Specialist Rural Development State Office October 20, 2008

USDA - RURAL DEVELOPMENT Formerly: • Fm. HA (Farmers Home Administration) • RDA (Rural Development Administration) • RECD (Rural Economic & Community Development • Now - USDA, Rural Development

Purpose of Water and Waste Program Provide financing for water, sanitary sewage, solid waste disposal and storm wastewater facilities for rural residents

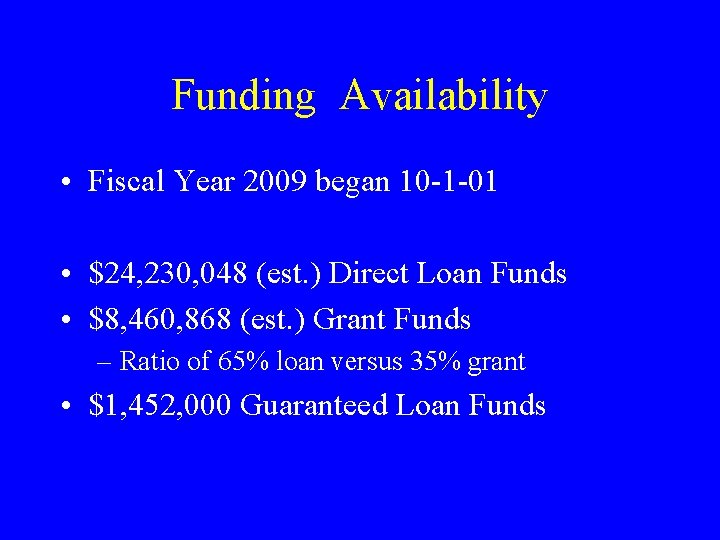

Funding Availability • Fiscal Year 2009 began 10 -1 -01 • $24, 230, 048 (est. ) Direct Loan Funds • $8, 460, 868 (est. ) Grant Funds – Ratio of 65% loan versus 35% grant • $1, 452, 000 Guaranteed Loan Funds

Allocations - General • RD charged to use both loan and grant funds allocated to Missouri • Continued pressure to reduce grant contributions on projects • Important to leverage project funds

Allocations - General • Rates adjusted to comparable rates to support adequate bonded indebtedness – 2% of Monthly Median Household Income • Loan and grant funds may not be used to finance “facilities which are not modest in size, design and cost”

General Eligibility Requirements • Public Bodies • Not-for-Profit Entities • Serve rural areas and communities not exceeding 10, 000 in population

Regulation Requirements • Loan and grant limitations: – Applicant unable to finance proposed project from their own resources or through commercial credit at reasonable rates and terms (The Test for Credit) – Funds can not be used to finance facilities which are not modest in size, design and cost

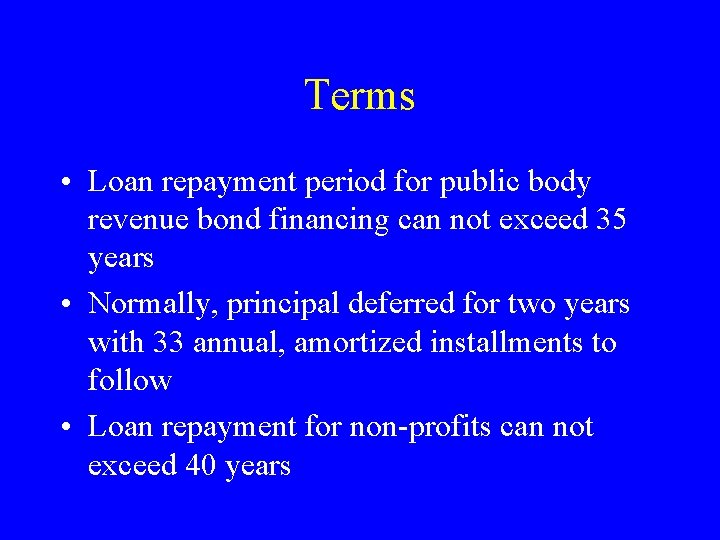

Terms • Loan repayment period for public body revenue bond financing can not exceed 35 years • Normally, principal deferred for two years with 33 annual, amortized installments to follow • Loan repayment for non-profits can not exceed 40 years

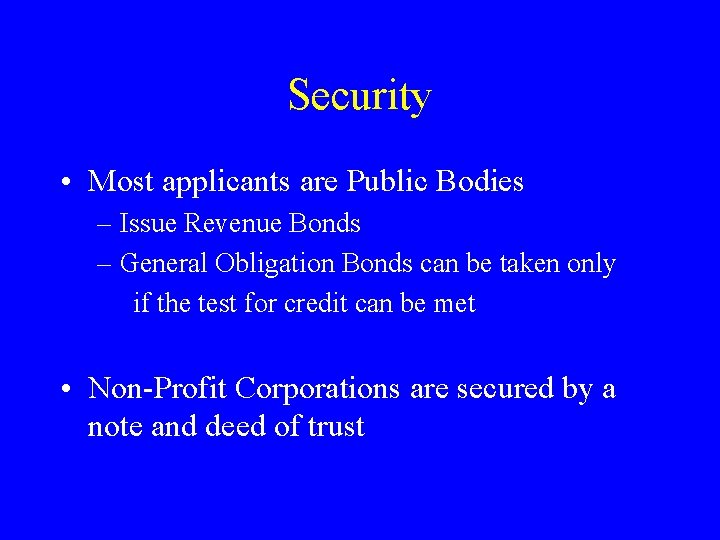

Security • Most applicants are Public Bodies – Issue Revenue Bonds – General Obligation Bonds can be taken only if the test for credit can be met • Non-Profit Corporations are secured by a note and deed of trust

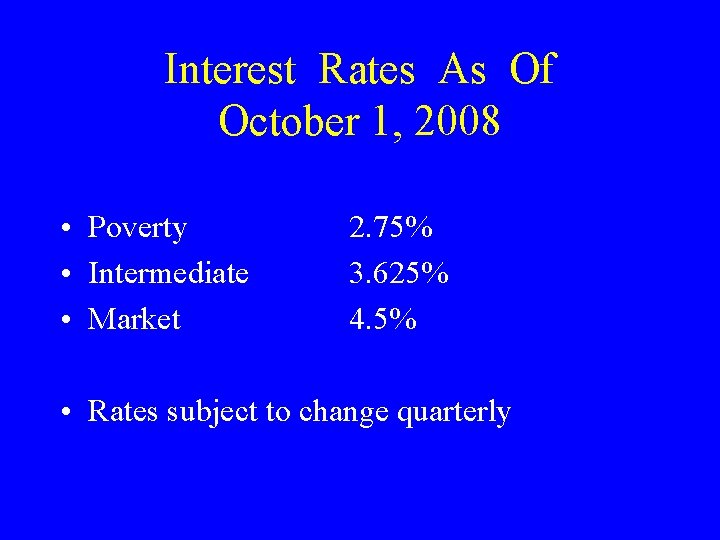

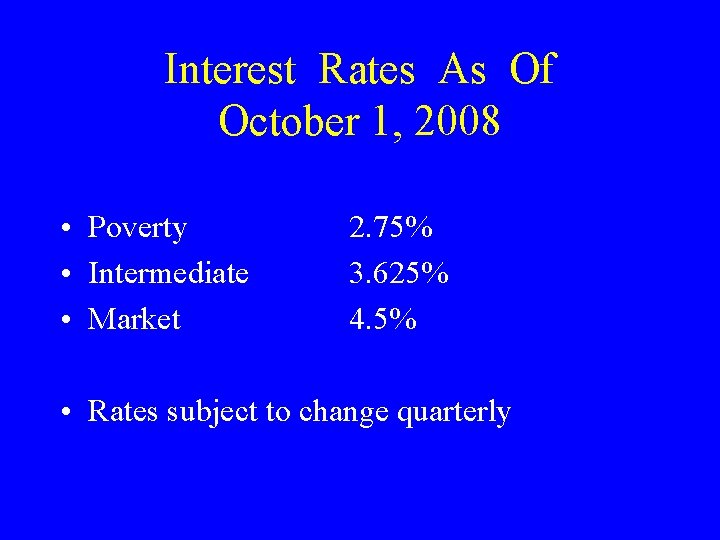

Interest Rates As Of October 1, 2008 • Poverty • Intermediate • Market 2. 75% 3. 625% 4. 5% • Rates subject to change quarterly

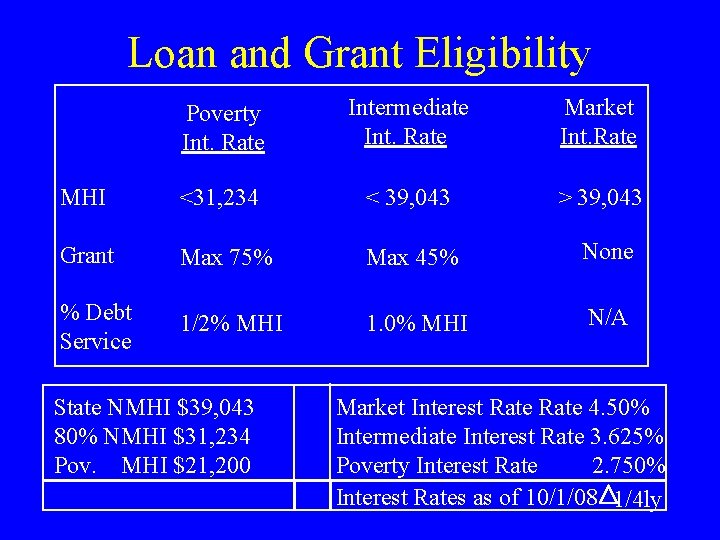

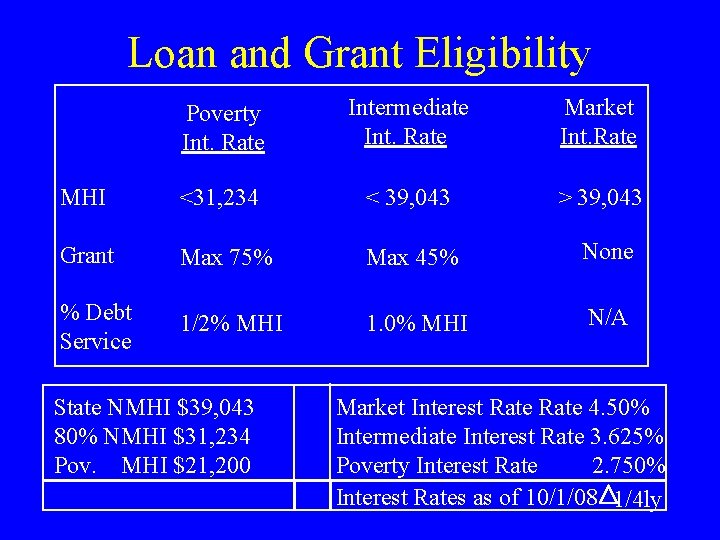

Loan and Grant Eligibility Poverty Int. Rate Intermediate Int. Rate Market Int. Rate MHI <31, 234 < 39, 043 > 39, 043 Grant Max 75% Max 45% None % Debt Service 1/2% MHI 1. 0% MHI N/A State NMHI $39, 043 80% NMHI $31, 234 Pov. MHI $21, 200 Market Interest Rate 4. 50% Intermediate Interest Rate 3. 625% Poverty Interest Rate 2. 750% Interest Rates as of 10/1/08 1/4 ly

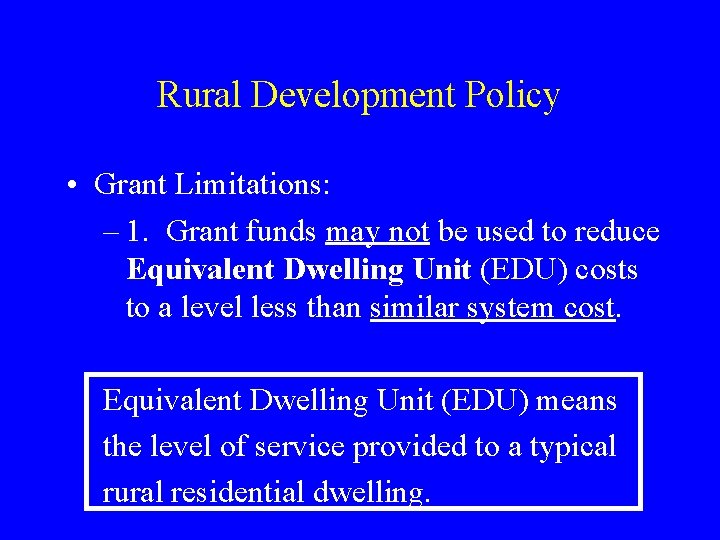

Rural Development Policy • Grant Limitations: – 1. Grant funds may not be used to reduce Equivalent Dwelling Unit (EDU) costs to a level less than similar system cost. Equivalent Dwelling Unit (EDU) means the level of service provided to a typical rural residential dwelling.

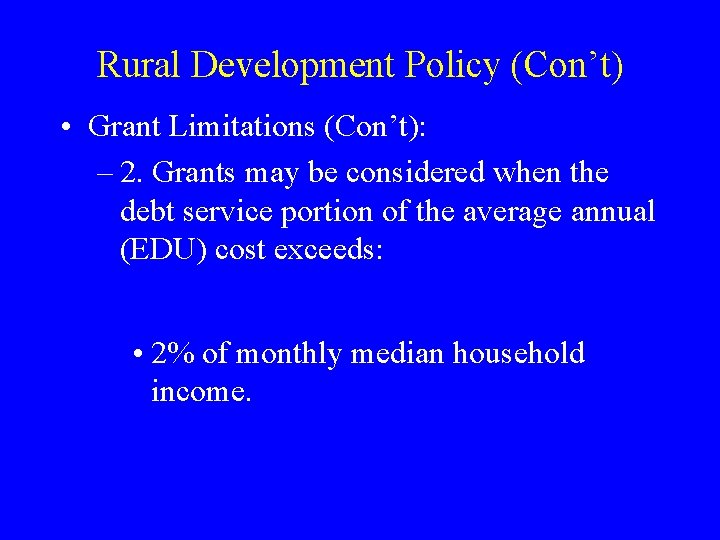

Rural Development Policy (Con’t) • Grant Limitations (Con’t): – 2. Grants may be considered when the debt service portion of the average annual (EDU) cost exceeds: • 2% of monthly median household income.

Rural Development Policy (Con’t) • Grant Limitations(Con’t) – 3. Grants limited to 75% when the MHI is below $31, 234 and necessary to alleviate health or sanitary problem – 3 a. Grants limited to 45% when the MHI is between $31, 234 and $39, 043 – 4. Not grant eligible if MHI greater than $39, 043 (MHI) Represents: State Non-Metro Median Household Income

Rural Development Policy (Con’t) • Grant Limitations(Con’t) – 5. Percentages listed in 3. and 3 a. are maximum amounts and may be further limited by availability of funds: For instance, this year our State’s allocation of loan and grant is in the ratio of 65% loan to 35% grant, which is a higher % of loan funds and very little additional grant funds.

RD National Office Policies • Funds should be directed to smallest communities with the lowest incomes • Priority should be given to the utilization of grant funds in areas which lack running water, flush toilets and modern sewage disposal systems.

MWWRC • Missouri Water and Wastewater Review Committee • Made up State and Regional/Area Office Employees: – Missouri Department of Natural Resources – Community Development Block Grant (CDBG) – Rural Development

MWWRC • Reviews all proposals for request for loan and/or grants for water and sewer projects in the State • Provides guidance on type of system best for the community • Provides direction on how project should proceed and type of funds/agency to work with.

MWWRC • Funding – Some projects may include a RD loan and RD grant – Department of Natural Resources SRF (State Revolving Fund) loan and DNR grant – Community Development Block Grant (CDBG) – Other funds such as applicant contribution

Other Items of Interest • We are giving additional focus to insure that applicants are charging comparable rates for their utilities. By keeping their rates adjusted, it should allow them to borrow more loan dollars.

Other Items of Interest (Con’t) • Sewers have been the big users of our grant funds in the past. Innovative and alternative designs will likely be necessary in the future for them to compete for our funds. • Water is still a high priority for us. If people without decent safe water and their sewer problems are not causing an immediate health threat, then water application might take priority over sewer application

Other Items of Interest (Con’t) • Regionalization of Water Supply Systems – To promote better use of public funds – Feasibility from operations standpoint – Where there is more than one system in a county – Additional priority given by Rural Development to projects that merge ownership, management, and operations of smaller systems for more efficient management and economic service.

Other Items of Interest (Con’t) • Regionalization – Sharing of facilities – Partnering – Operation and maintenance – Going away from small surface water treatment facilities--New EPA Rules hard to meet

APPLICATION PROCEDURES • • • Can be filed at any time during the year Have no deadlines for submission Funds received after October 1 each year Contact any Rural Development Office Area Offices responsible for processing Map of MO showing area boundaries included in your pack of material

Other RD Financing Available • Approximately 25 RD financing programs available - as well as technical assistance • Other major programs with financing – Business and Industry – Community Facilities – Rural Housing • Visit the RD booth in the Exhibition Hall – Pick up a fact sheet booklet about all programs