Unusual Options Activity Master Course Presented by Andrew

Unusual Options Activity Master Course Presented by Andrew Keene Past performance is not indicative of future results.

RISK DISCLAIMER Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. All trading operations involve serious risks, and you can lose your entire investment. No trades are recommendations or advice and can not get sued for losses of capital. All trades are for educational purposes only. People contact your broker or RAI for execution, merger, and other capital requirements. Everyone watching presentation adheres to ALL disclaimers on www. optionhacker. com and www. keeneonthemarket. com

Andrew Keene - I Studied Finance at the University of Illinois before becoming the biggest AAPL market maker on the trading floor at the CBOE from 2006 -2009 - I am down money this year but, I know this is a war not a battle

Understand the Problem 90% of all active retail traders lose money!

You’re On Your Way! You’re here today to invest in your education

A Short Review

The Master Course The Unsusual Options Activity Master Course is designed to educate our live trading room members, other active traders, members of the trading community and anyone interested in becoming faster, more consistent, and more profitable in their options trading. We watch a scanner called Trade. Alert and Option. Hacker. This software tracks over 1, 200 trades daily across all equity options exhanges. Option. Hacker gives the best potential Bullish and Bearish Signals Daily. These block orders are executed by the biggest Institutions, hedge funds, banks and traders in the market.

Why Trade Unusual Options Activity? These trades that hit the tape are public orders and the information can be used to trade. Why does a retail trader care about these orders? Institutional traders have better access to: • Information • Capital • Technology • Manpower Lets look at what these orders might look like…

Four Types of Option Orders That’s a lot of information to process right? For a professionsal trader it can be daunting to read, for a novice it can be impossible. To understand what is happening on the tape we have to understand what the basic orders are. • • A trader buys calls A trader sells calls A trader buys puts A trader sells puts That seems simple enough, but is it really that easy to understand?

Is that Trade Bullish or Bearish? While even simple orders seem easy enough to interpret they cannot be taken at face value. Calls being bought is not always bullish, puts being bought is not always bearish. • • A trader buys calls = Only bullish 70% of the time A trader sells calls = Bullish 50% of the time, bearish 50% of the time A trader buys puts = Actually bullish more often than bearish. 65% of the time its bullish A trader sells puts = Bullish 80% of the time, but can be neutral as well.

Why Some Trades Work and Others Dont

Different Terms Outright contracts aren't the only types of trades that will hit the tape in a given day. On the next few slides we will focus on Spreads but some other types of orders are: • Ex-Dividend Plays • Buy-writes • Sweeps • Opening Positions • Cancelled Trades

Ex-Div Trades are NOT UOA. Ex-Dividend Trade: Remember that call buyers do not receive the dividend, while owners of stock do receive the dividend payment. Market makers will run a strategy know as a dividend capture play where they inflate volume in order to take advantage of less sophisticated traders. This causes blocks of deep ITM calls to hit the tape in SIZE These types of orders should generally be IGNORED.

What is a Buy-Write? Buy-Write: Technically a buy-write is an options trade against stock at a ratio of 1: 1. Example: A trader sells 1, 000 XYZ Jan 100 calls for $2. 00, labeled as a buy-write. This is something that complicates the process of reading UOA. We can never determine a traders underlying stock position and when an order is labeled buywrite we know it may not be speculation. We want to trade with speculative orders!

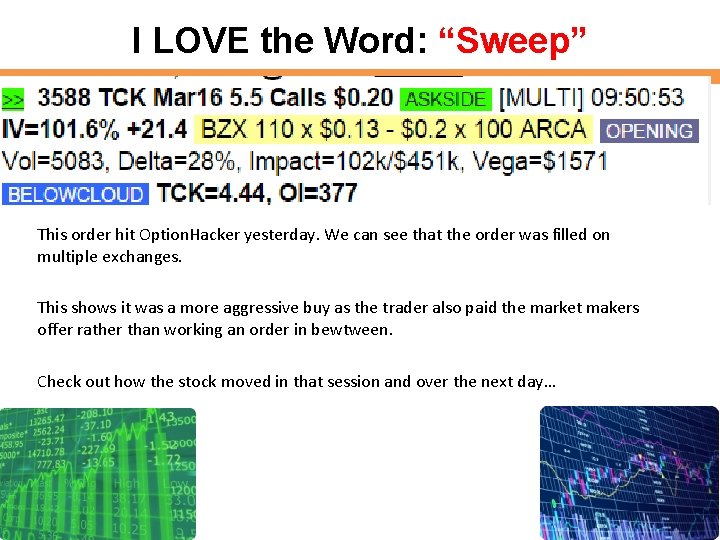

I LOVE the Word: “Sweep” Sweeps: This is an aggressive order. These orders are routed to different exchanges to buy or sell as many contracts as possible. Sweeps allow for a trader to fill large orders at once without having to clear smaller bids or offers first.

I LOVE the Word: “Sweep” This order hit Option. Hacker yesterday. We can see that the order was filled on multiple exchanges. This shows it was a more aggressive buy as the trader also paid the market makers offer rather than working an order in bewtween. Check out how the stock moved in that session and over the next day…

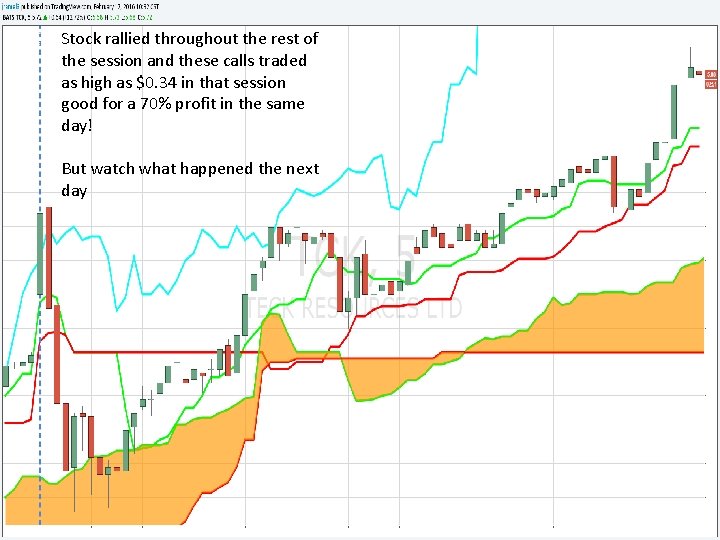

Stock rallied throughout the rest of the session and these calls traded as high as $0. 34 in that session good for a 70% profit in the same day! But watch what happened the next day

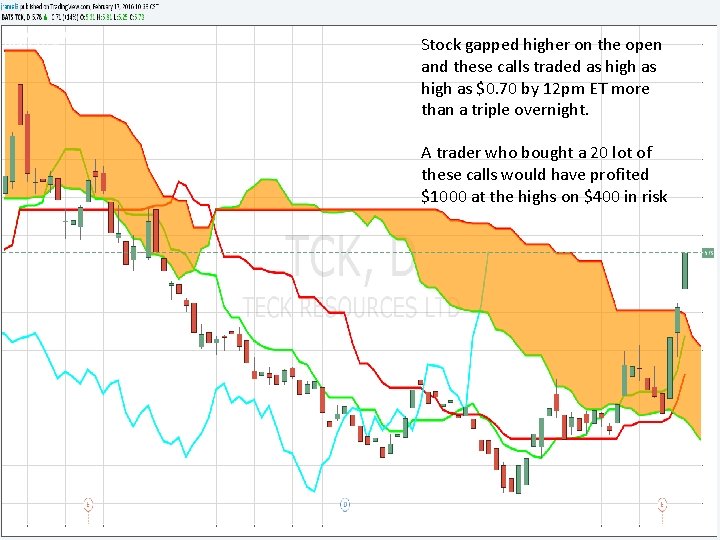

Stock gapped higher on the open and these calls traded as high as $0. 70 by 12 pm ET more than a triple overnight. A trader who bought a 20 lot of these calls would have profited $1000 at the highs on $400 in risk

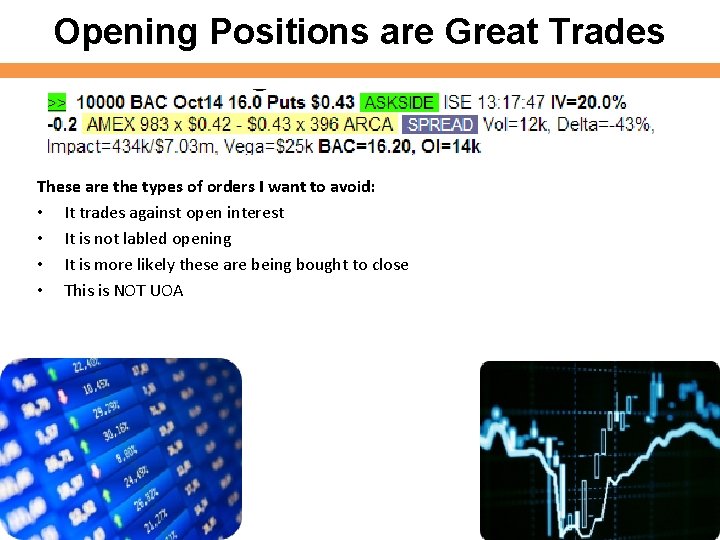

Opening Positions are Great Trades OPENING: This is the type of trade I want to follow. • Every opening position should be labeled as so but they aren't always. • Brokers can be lazy or forget to do this but there is a way to tell if a position is opening or not that we will talk about.

Opening Positions are Great Trades These are the types of orders I want to avoid: • It trades against open interest • It is not labled opening • It is more likely these are being bought to close • This is NOT UOA

What Percentage of Your Trades are Winners? Does That Matter?

What Makes a Winning Trade How do we determine if an options trade is a “winning” trade? Example: I buy an option for $0. 80 Before expiration the option goes to $1. 20 Then back to $0. 60 Then up to $2. 00 At expiration the option is worthless Was this a winning or losing trade for me?

Is Taking Off the Most Important Part?

I Am More Concerned With Landing!!

The New Trading Plan I have created a new trading plan that is going to help me trade better with better entries and exits: • As part of this plan I have concrete steps for both day and swing trades • I will NEVER deviate from the plan • It is the new plan that I will use every single day • The plan has concrete rules for managing trades on both intraday and longer time frames

This Plan Has Been Working!! I opened a new account with $120, 000 to trade this plan and am already up $11, 000 in 3 weeks trading this plan!

The Secret to Making Money with My New Day and Swing Trading Plan

UOA Signals Both Day Trade and Swing Trade Setups Do you know who this is?

UOA Signals for Day Trades Usain Bolt is the GREATEST Short distance runner of all time but probably wouldn’t win a marathon. Day trade setups are different than swing trades. We want trades that setup better for a “sprint” So for day trades we will look for UOA with less than 4 weeks left until expiry.

Considerations for Day Trades are meant to be open and closed in the same trading day. I will NOT hold a day trade setup overnight. I can also manage my intraday risk using stop losses. Beginner trader – 20% stop loss Intermediate trader – 50% stop loss Expert traders – No stop loss Expert traders don’t use stop losses because they can choose to add to a position. With all trades I will place my stops and profit targets right after I get filled.

Day Trade Profit Targets Day Trades are going to have tighter profit targets than swing trades. For example if I buy an option for $1. 00 my stop/profit structure would look like this: Entry Price $1. 00 Stop Loss $0. 80 Profit Target #1: $1. 10 Profit Target #2: $1. 20 Profit Target #3: $1. 30 Profit Target #4: $1. 40 Profit Target #5: $1. 50

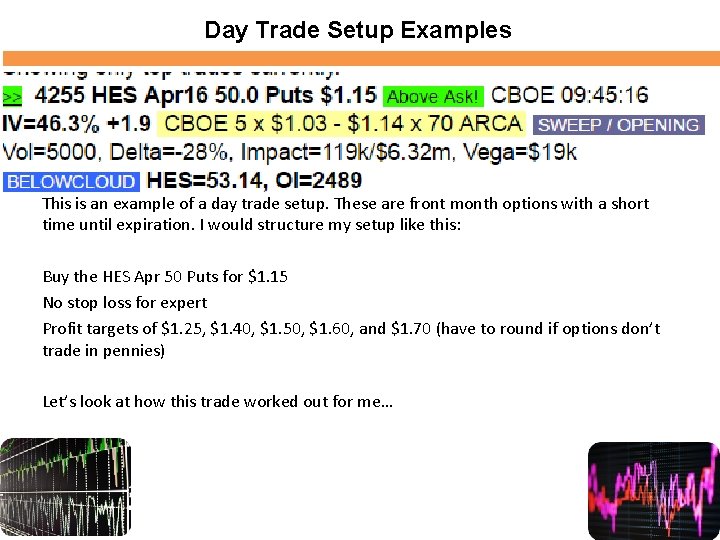

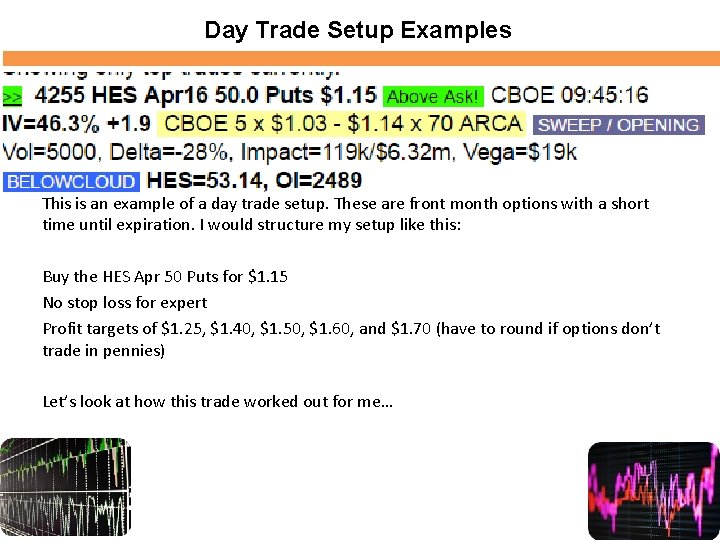

Day Trade Setup Examples This is an example of a day trade setup. These are front month options with a short time until expiration. I would structure my setup like this: Buy the HES Apr 50 Puts for $1. 15 No stop loss for expert Profit targets of $1. 25, $1. 40, $1. 50, $1. 60, and $1. 70 (have to round if options don’t trade in pennies) Let’s look at how this trade worked out for me…

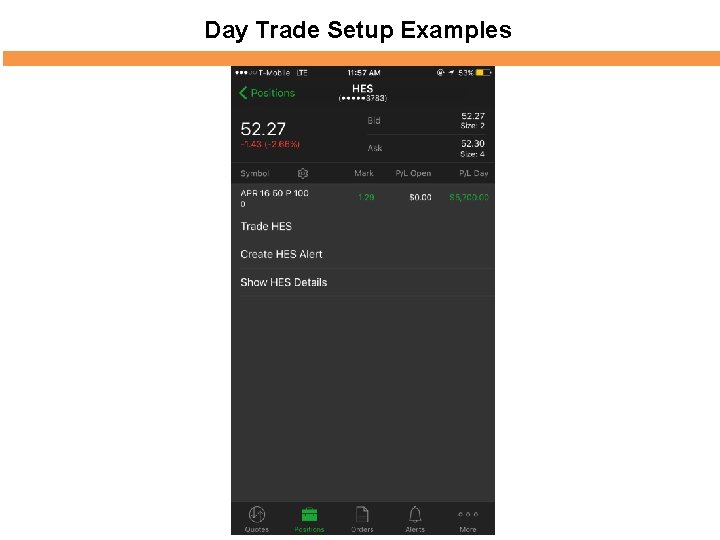

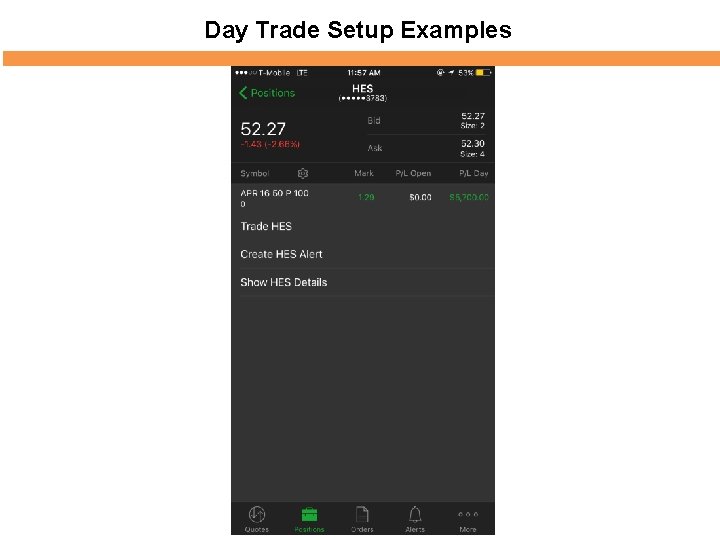

Day Trade Setup Examples

Let’s Look at Some Swing Trades

Swing Trading The Number 1 thing to remember about swing trades is… THEY HAVE LESS RISK!! • Swing trades have lower gamma • Lower time decay • Less daily risk • Smaller daily P/L Swings

UOA for Swing Trading How about him? Do you know who that is? He won the Boston marathon…

UOA Signals for Swing Trades A marathon runner like him prepares and plans for a race much differently than a splinter would. Just like these two runners the considerations for swing trades are much different than they are for day trades. Swing trades will have a much longer expiry so the management of the trade through stop losses and profit targets will have to change as well.

Stop Losses in Swing Trades Since swing trades have a longer time until expiry a position can experience much more movement between trade entry and expiration. This means that these trades need to be given a bit more room. Beginner trader – 30% stop loss Intermediate trader – 50% stop loss Expert traders – No stop loss Again a trader who is an expert may choose to add to a position. Adding to positions is more acceptable when swing trading than day trading.

Swing Trade Profit Targets Swing trades require wider profit targets due to the longer time until expiry. For example if I buy an option for $1. 00 my stop/profit structure would look like this: Entry Price $1. 00 Stop Loss $0. 70 Profit Target #1: $1. 20 Profit Target #2: $1. 40 Profit Target #3: $1. 60 Profit Target #4: $1. 80 Profit Target #5: $2. 00

Adding to Positions In Swing Trades With more time to expiry in swing trades a trader may choose to add to their position on a pullback if they are an expert If a UOA swing trade starts to move against me I can add to the position 35% and 65% lower from my entry price. Example: I buy the UPS May 100 Puts for $1. 77 and then take a profit target at $2. 00 I will look to add to the position at $1. 10 and $0. 50 If I am filled on these adds I would adjust my profit targets to include them: $. 60, $. 70, $. 85, $1. 00, $1. 25, $1. 40, $1. 60, $1. 80, $2. 00, $2. 20, $2. 40, $2. 60, $2. 80.

Using Past Experiences When I see a trade come across the tape the first question I ask myself is… • • Have I traded this stock before? Have I made money in it? Easy questions, If I have traded a stock on UOA in the past and made money in it, I will trade it again. Examples of stocks I don’t trade: STX, XRT, XLU Examples of stocks I do trade: HAL, HES, BHP

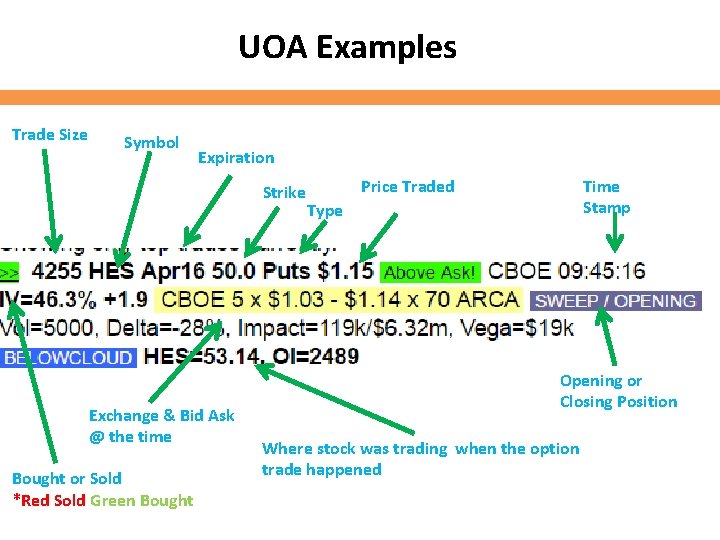

UOA Examples Trade Size Symbol Expiration Strike Exchange & Bid Ask @ the time Bought or Sold *Red Sold Green Bought Price Traded Type Time Stamp Opening or Closing Position Where stock was trading when the option trade happened

Trader buys HES Apr 50 Puts for $1. 15

As the Stock sold off these puts traded as high as $1. 70 in this session and have traded as high as $2. 55 since the initial trade!

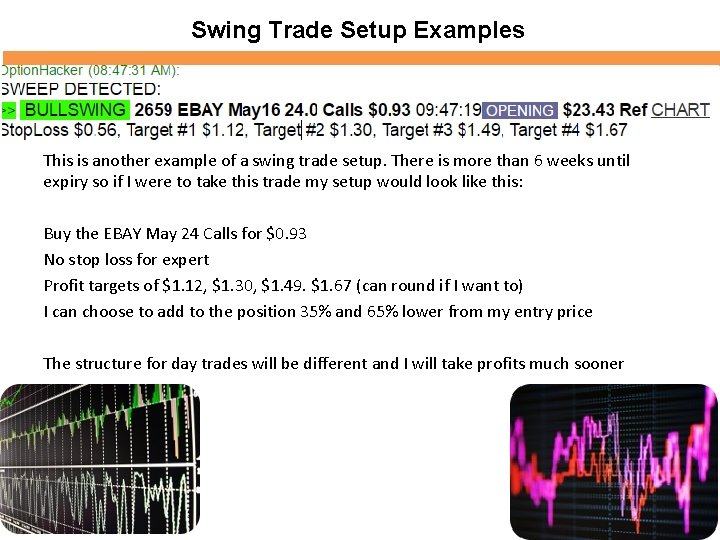

Swing Trade Setup Examples This is another example of a swing trade setup. There is more than 6 weeks until expiry so if I were to take this trade my setup would look like this: Buy the EBAY May 24 Calls for $0. 93 No stop loss for expert Profit targets of $1. 12, $1. 30, $1. 49. $1. 67 (can round if I want to) I can choose to add to the position 35% and 65% lower from my entry price The structure for day trades will be different and I will take profits much sooner

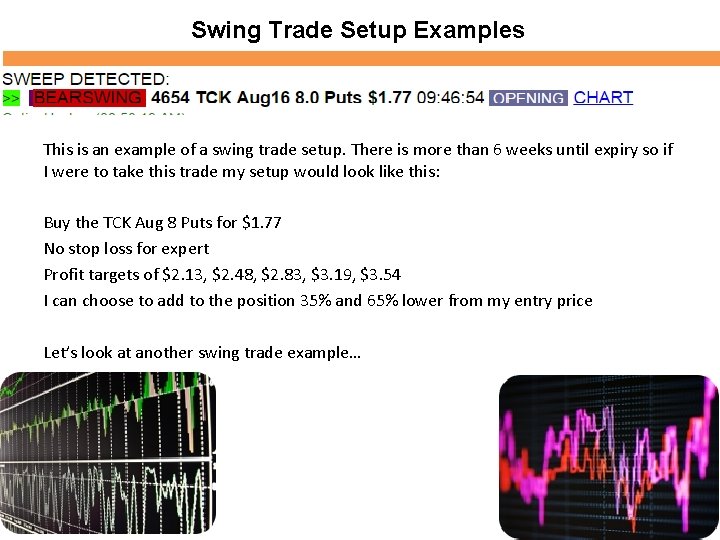

Swing Trade Setup Examples This is an example of a swing trade setup. There is more than 6 weeks until expiry so if I were to take this trade my setup would look like this: Buy the TCK Aug 8 Puts for $1. 77 No stop loss for expert Profit targets of $2. 13, $2. 48, $2. 83, $3. 19, $3. 54 I can choose to add to the position 35% and 65% lower from my entry price Let’s look at another swing trade example…

Day Trade Setup Examples This is an example of a day trade setup. These are front month options with a short time until expiration. I would structure my setup like this: Buy the HES Apr 50 Puts for $1. 15 No stop loss for expert Profit targets of $1. 25, $1. 40, $1. 50, $1. 60, and $1. 70 (have to round if options don’t trade in pennies) Let’s look at how this trade worked out for me…

Day Trade Setup Examples

Considerations for Both Day and Swing Trades Some considerations apply to both day and swing trades. These are things that a trader has to think about regardless of the expiration of the option. 1. The bid-ask spread: I will not trade an option market on the offer that is wider than $0. 10. This forces me to give up too much edge to the market maker. 2. Technical Analysis: Chart reading is important for trading UOA but I have to keep in mind which charts are actually relevant. 1. Day Trades – The daily bar DOES NOT matter. I will use the 5 and 15 min bar for all of my analysis. Remember these are short term trades! 2. Swing Trades – The short time frame charts do not matter. The only thing I should be looking at is the daily chart. These are longer term trades and longer term underlying trend is what's important.

The Unsusal Options Activity Trading Plan Those are some great trades, but how did I know how to get in them? I follow a trading plan. This is a plan that I have developed over a 12 year long career as an equity options trader. I call it the OCRRBTT Trading Plan O: Options Volume vs. Open interest C : Chart R: Risk R: Reward B: Breakeven T: Time T: Target Each of these components is important in its own right.

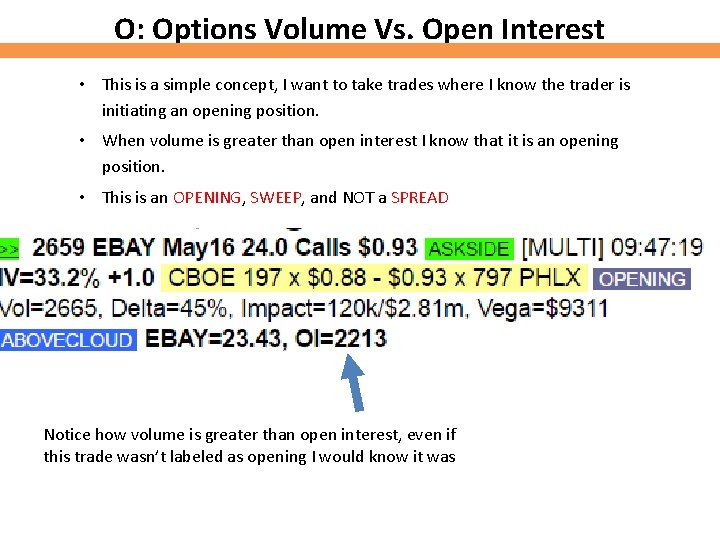

O: Options Volume Vs. Open Interest • This is a simple concept, I want to take trades where I know the trader is initiating an opening position. • When volume is greater than open interest I know that it is an opening position. • This is an OPENING, SWEEP, and NOT a SPREAD Notice how volume is greater than open interest, even if this trade wasn’t labeled as opening I would know it was

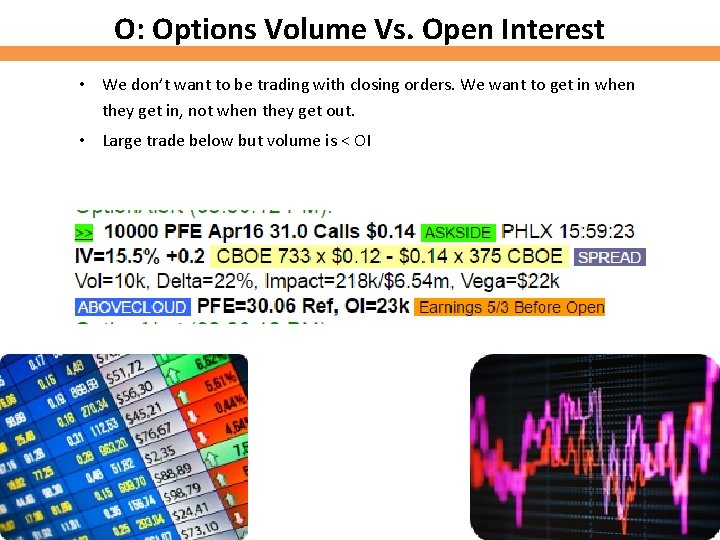

O: Options Volume Vs. Open Interest • We don’t want to be trading with closing orders. We want to get in when they get in, not when they get out. • Large trade below but volume is < OI

C: Chart: While I never used charts on the trading floor they have become a big part of my trading plan now. The main indicator I use is the Ichimoku Cloud, it a simple to use forward looking technical indicator. I have a simple set of rules for beginner traders to use. No long positions under the cloud No short positions under the cloud NO TRADE when stock is in the cloud

R: Risk: I can actually calculate risk two different ways. Risk is one of the most important concepts in any type of trading plan. Ways to measure risk: Dollar amount- what is the total amount of money I can lose. Percentage of Book: What is the largest percentage of my book I am willing to lose in this trade

R: Risk Confidence Scale: Notice that no single position can ever blow out my account. Confidence 5: Least confident trades, 0%-1. 00% of total book Confidence 4: 1%-3% of total book Confidence 3: 3%-5% of total book Confidence 2: 5%-10% of total book Confidence 1: Most confident trades, Above 10% of total book but never more than 20%

R: Reward: When do I want to take profits in a trade? Every trade and every trader is different but generally I have targets based on option expiration.

B: Breakeven: It is important to always know where my breakeven is in any trade. • Generally if target 2 is hit I will move my “stop” to breakeven. • One of the hardest things to do in trading is to exit a losing position.

T: Time: Most traders lose money because they don’t give trades enough time. To combat this I have one simple rule. Buy the same strike and expiration as paper Although nearer term options may be cheaper I Want to trade the same expiration as paper.

T: Target: I have my targets in place by need to consider what to do when those targets aren’t hit. Generally speaking if target #1 isn’t hit within a week of holding the position I will exit the trade.

Other Tips and Tricks There are some other things a trader should consider when trading UOA. These points are based on the experience I have had trading options. Stocks that Gap: Often times after a stock gaps higher a trader will sell their long stock position and buy calls. This is actually less bullish that it may seem. The trader is actually REDUCING their overall exposure to the name. Chasing trades: I have often lost money chasing trades that there was no need to chase. Remember how we talked about the number of trades that hit the tape in a day? There will always be another one.

When Should a Trader Day/Swing Trade? - Day Trade: There are certain signals that we believe create a better opportunity to take as a day trade and profits within hours if not minutes. - Swing Trade: There are certain signals that we believe create a better opportunity to take as a swing trade that profits over weeks if not days.

When to Day Trade Equity Options • Only with weekly or front month options that trade in pennies. (Options market is $. 87 -$. 90) • The goal is to make money in hours and not hold these positions overnight. • Take advantage of these SIGNALS and can try and “scalp” them. • It is very hard to day trading options that are nickel wide. (Options market is $. 85 -$. 95)

The Rules I Follow When Trading We are about to discuss a set of rules that I can apply to my trading plan. The rules for day trading and swing trading are different.

Rule #1 Day Trading Options Rule #1: Only implement this plan in options that trade in pennies. • Trader should have 4 targets. • Trader’s Stop will be 20% lower. If a trader pays $1. 00, the stop is $0. 80, if a trader pays $3. 00 the stop will be at $2. 40. • If trader’s stop on a $1. 00 option is $0. 20 lower their targets should be 10% profits, 20% profits, 30% profits and 50% profits. After target #2 is hit less aggressive trader can move their stop to breakeven. • The less stock that trades in a day the more risk/reward there is.

Rule #2 Day Trading Options Rule #2: Do not trade any signals labeled as “spreads” • Spreads can be against other options or tied to stock. • “OPENING” orders usually produce the best signal. • A trader must also keep an eye on the 5 minute chart, if the stock breaks the cloud in the opposite direction or see “rounding tops” a trader may exit early.

Swing Trading Options Rule #1: Setting Targets and Stop Losses. • With outright options a trader should have 5 targets. • Trader should have a stop loss at 30% of purchase price of the Option. • Targets will then be 15%, 30% 50% and 75% and 100%. If a stock gaps overnight, trader can take off multiple targets • If a trader is less aggressive, once Target #2 is hit, move stop to breakeven to guarantee profits.

More Swing Trade Rules Rule #3: Trader can add to losers when swing trading if the chart still lines up. • Charts are much more important to a trader when they are swing trading. • Again a trader should always have an eye on the chart looking for rounding tops. • Any break of the cloud in the wrong direction on the daily can be used as a signal to exit. • A trader can add to a position 35% lower if they are an intermediate trader.

Special Bonus Section!

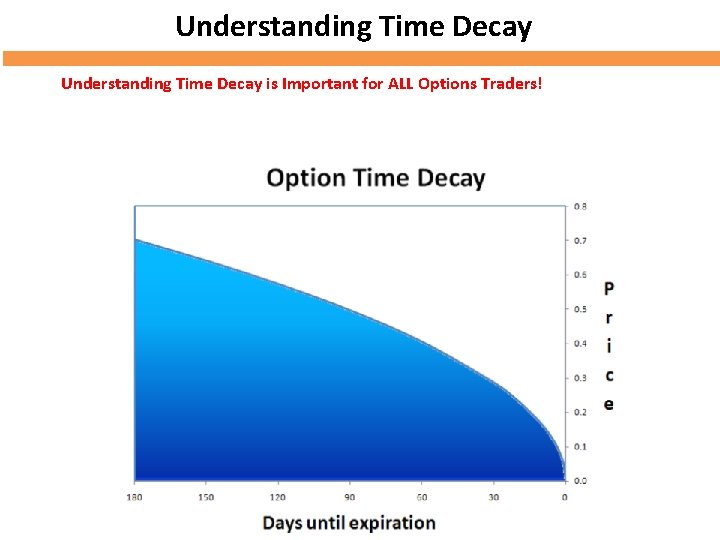

Understanding Time Decay is Important for ALL Options Traders!

Time Decay We now know that as part of my plan I am only day trading front month options however the back month at some point may become the front month: I buy the UPS May 100 Puts for $1. 77 If this swing trade goes wrong what do I do?

Exiting Bad Positions Trade: I buy the UPS May 100 Puts for $1. 77 Once this swing trade has less than 4 weeks to expiry it falls into my day trade time frame and I need to exit the position. I do not want to hold bad positions and expose myself to more time decay.

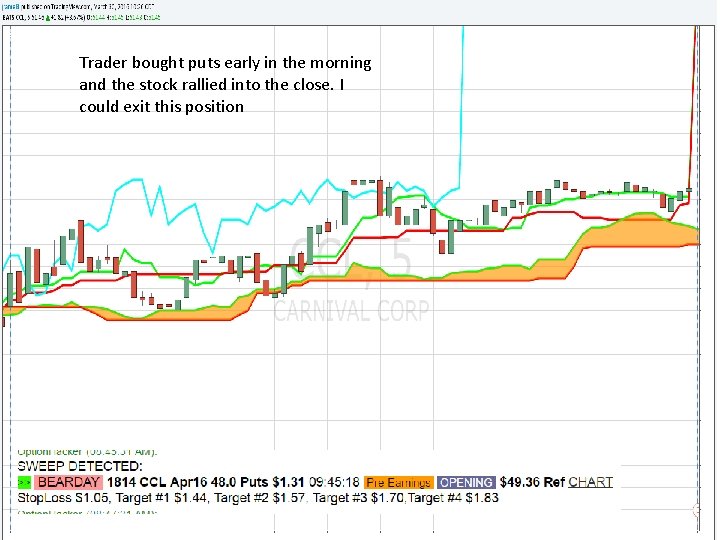

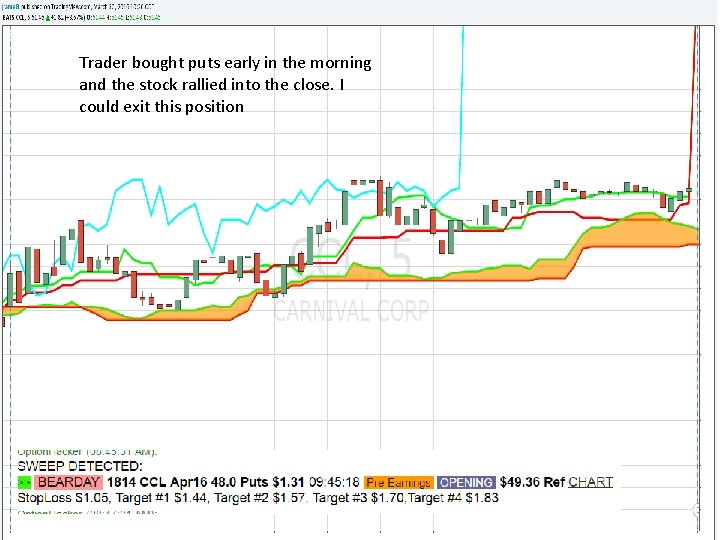

Trader bought puts early in the morning and the stock rallied into the close. I could exit this position

Exiting Bad Positions Once there is only 1 week left I MUST exit the “back month” bad positions I have on, “WLD”: “WLD” Stands for win, lose or draw because no matter what I MUST exit these losing positions. Time decay accelerates rapidly in the final week of expiration

Time Decay Secret There are times when a trader can get the most out of an option: • I can get ahead of time decay some by selling the options the Thursday one week before expiration. • Options decay fastest in the afternoon and on Monday’s and Friday’s as market makers roll out their models. This is a great tip to get more out of the options I am selling!

Another Added Special Bonus Section!

Managing Exits with Charts I can use the chart to help me manage exits: When day trading remember I am only looking at the 5 min bar: • • If the stock moves the other way I can exit quickly If there is a big technical move after options hit the tape I can exit Example: A trader buys a large block of puts and I follow him, shortly after the stock spikes on a 5 min bar. I would get out of the trade!

Trader bought puts early in the morning and the stock rallied into the close. I could exit this position

Managing Exits with Charts I can look for the same thing if I am long calls: Remember a trader buying calls could be hedging a short stock position. • • If I see a stock moving lower as calls are being bought I can exit the trade. I can give it some room, maybe 0. 5 -1% of the stock price After it moves that much the trade is more likely to be a hedge and I will get out The odds of it coming back my way are low The same thing applies to swing trades with some other considerations…

Managing Exits with the Daily Chart Remember shorter time frames do not matter when swing trading • • • Traders can be buying options on a longer time frame for hedges against stock positions. I can use similar rules for exiting but remember swing trading is a war not a battle, it could take longer for a trade to play out. However if it moves to far away the trade is more likely to be a hedge and I should exit.

Be the Best You Can Be • • • Unusual Options Activity HAS worked and will work in the future! Some trades need to be managed as swing trades and some need to be managed as day trades PERIOD! DO NOT be stubborn when trading UOA, have a plan and stick to it! Understand the differences in time decay, gamma, and chart analysis in day trades and swing trades. NO trader is smarter than the market, the market can remain irrational longer than I can remain solvent.

YOU ARE A MASTER NOW!! This course is a $999 value but I try to deliver 10 x that value to you! • • • You have mastered what has taken me over 12 years to learn with UOA! I have given you a Concrete Trading Plan that ANY trader can trade with, Beginner, Intermediate and Expert. I have proven with REAL money that this works, because I am up over $8, 000 in three with the stock market up and I am SHORT only Hope you enjoyed, learned, and most of ALL please email me with ANY questions: andrew@alphashark. com

- Slides: 84