UNIT 4 MONEY AND MONETARY POLICY Money Functions

- Slides: 28

UNIT 4: MONEY AND MONETARY POLICY Money: Functions and Measurement

MONEY FUNCTIONS AS STORE OF VALUE MEDIUM OF EXCHANGE UNIT OF MEASURE

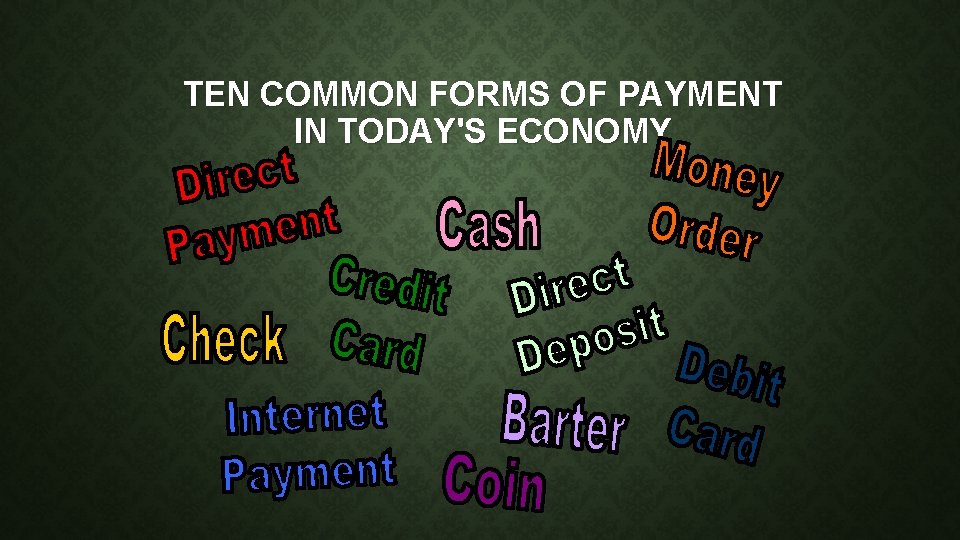

TEN COMMON FORMS OF PAYMENT IN TODAY'S ECONOMY

WHAT ARE SOME ADVANTAGES AND DISADVANTAGES OF CASH PAYMENTS?

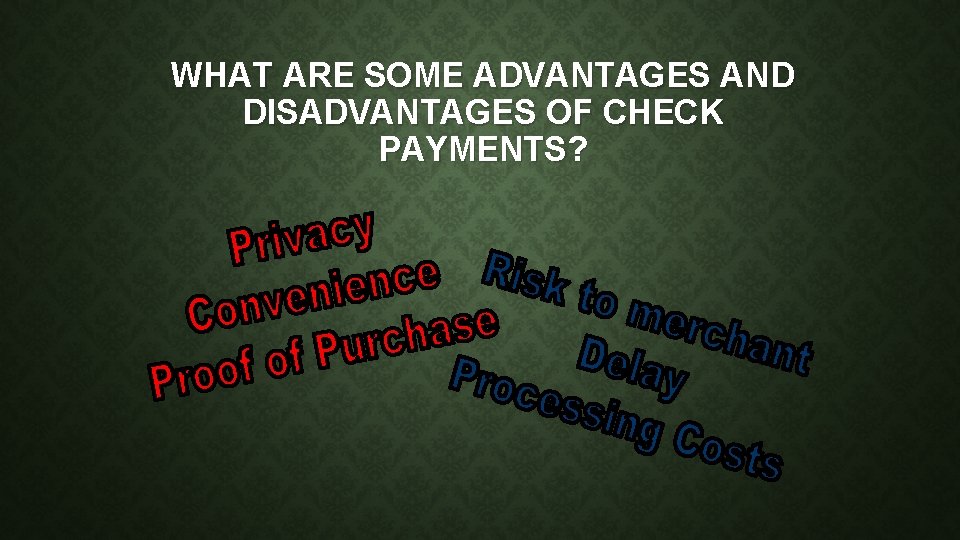

WHAT ARE SOME ADVANTAGES AND DISADVANTAGES OF CHECK PAYMENTS?

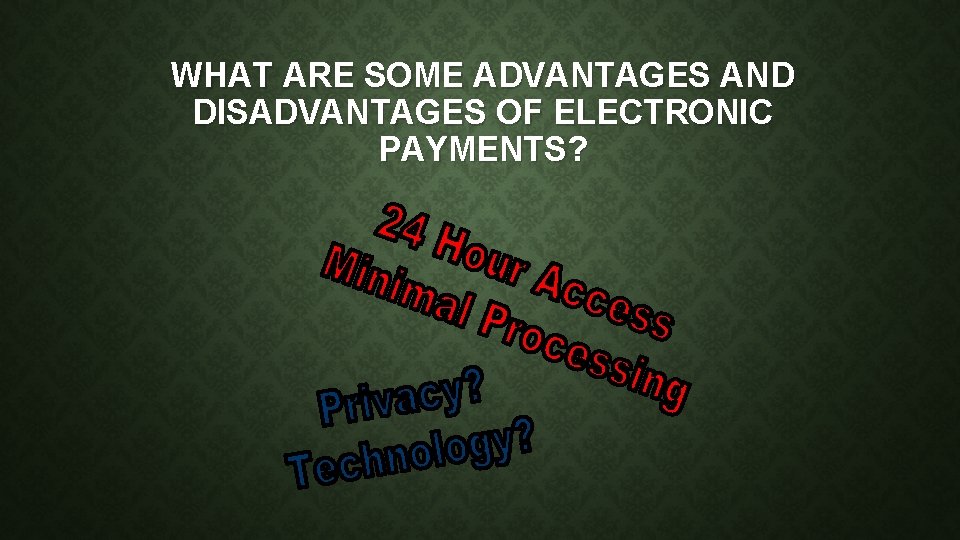

WHAT ARE SOME ADVANTAGES AND DISADVANTAGES OF ELECTRONIC PAYMENTS?

Types of Accounts: BANK SAVINGS ACCOUNTS: GOVERNMENT INSURED (FDIC) LOW RETURN MONEY MARKET ACCOUNT: BANKS TAKE MONEY, INVEST IN BONDS. HIGHER RETURN- MONEY UNTOUCHABLE

CD OR CERTIFICATE OF DEPOSIT (TIMED ACCOUNT): BANK KEEPS MONEY FOR A PERIOD OF TIME. HIGHER RETURN LONGER THE CD.

WHAT ABOUT THE M’S?

DEFINING AND MEASURING MONEY HAS BECOME AN INCREASINGLY DIFFICULT TASK BECAUSE PEOPLE AND BANKS HOLD MONEY IN DIFFERENT FORMS.

THE FEDERAL RESERVE DEFINES MONEY BY GROUPING ASSETS THAT THE PUBLIC USES IN ROUGHLY SIMILAR WAYS. IN OTHER WORDS, BY HOW “SPENDABLE” IT IS.

M 1 NARROWEST DEFINITION USED AS A MEDIUM OF EXCHANGE. CURRENCY AND COIN HELD BY THE PUBLIC (NOT BANK) AND CHECKABLE DEPOSITS.

M 2 BROADER MEASURE OF MONEY. USED AS A STORE OF VALUE. ALL OF M 1 AND SAVINGS, SMALL TIME DEPOSITS, AND MONEY MARKET ACCOUNTS.

M 3 BROADEST DEFINITION OF MONEY. USED AS A UNIT OF ACCOUNT. ALL OF M 2 PLUS ASSETS OWNED BY LARGE BUSINESSES- LARGE TIME DEPOSITS.

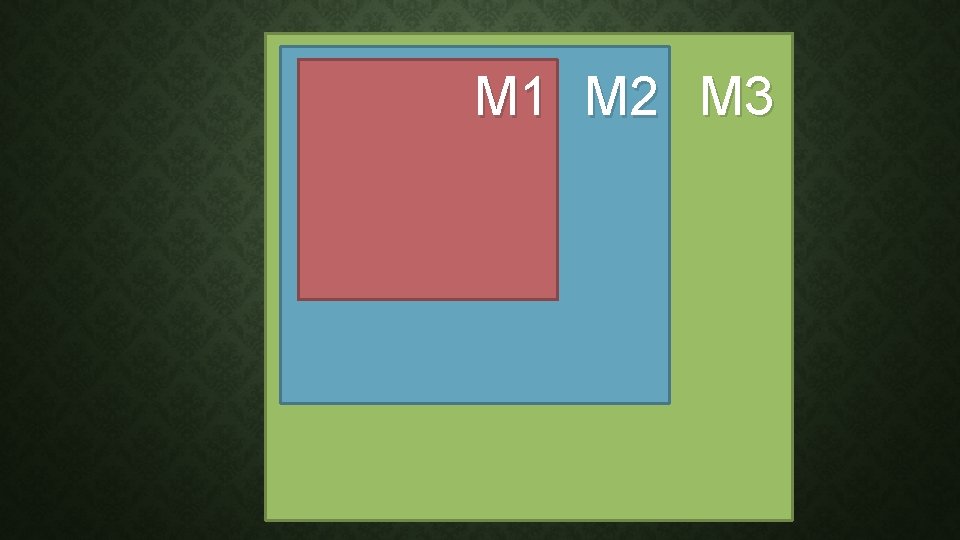

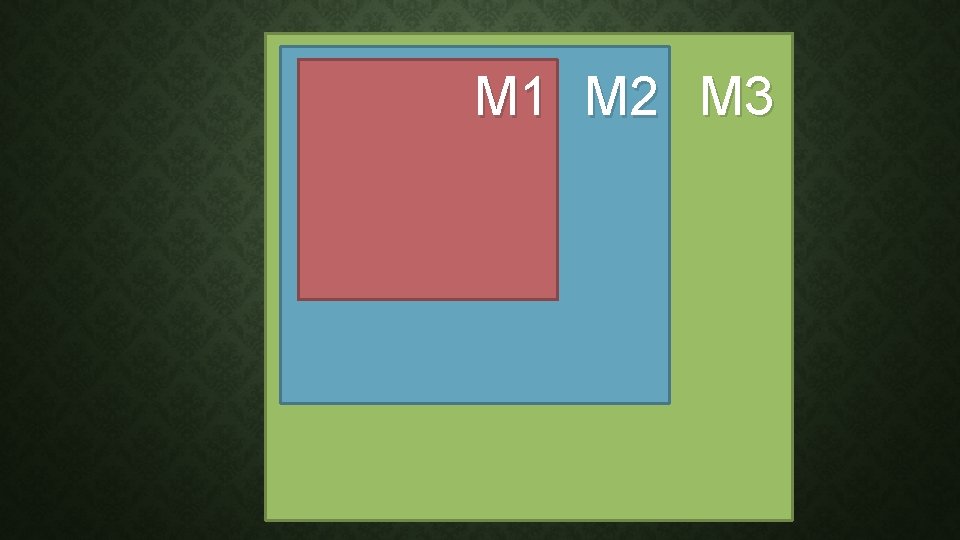

M 1 M 2 M 3

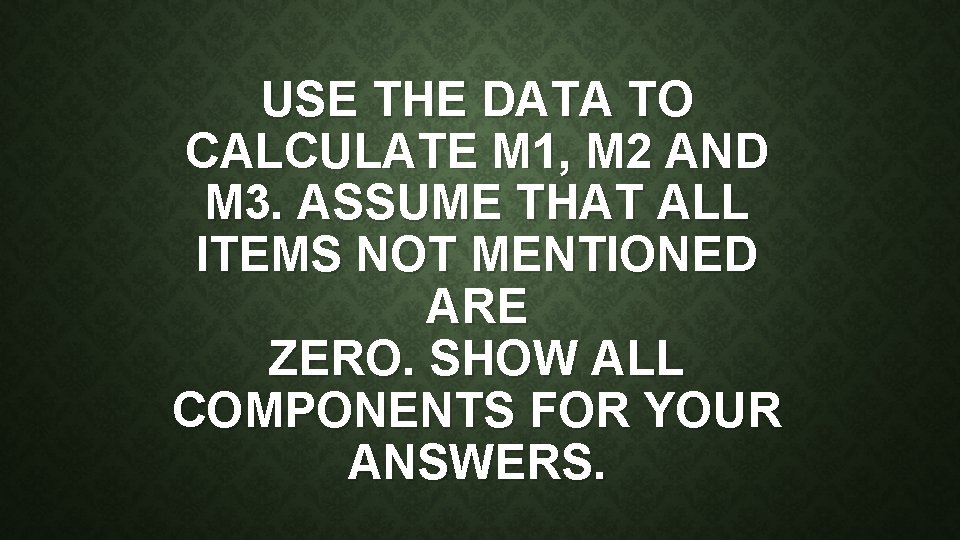

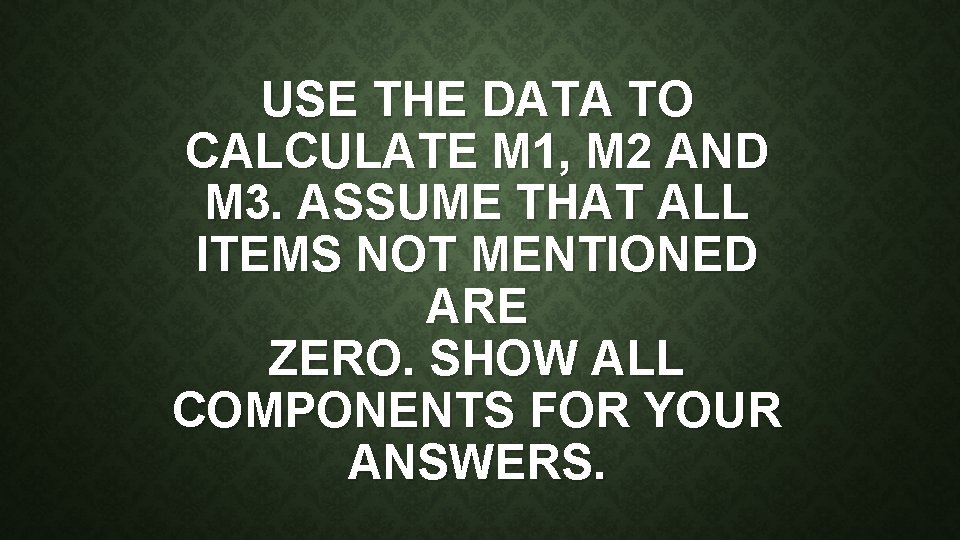

USE THE DATA TO CALCULATE M 1, M 2 AND M 3. ASSUME THAT ALL ITEMS NOT MENTIONED ARE ZERO. SHOW ALL COMPONENTS FOR YOUR ANSWERS.

Checkable Deposits $850 Currency $200 Large Time Deposits $800 Non-Checkable Savings $302 Small Time Deposits $1, 745 Institutional Money Markets $1, 210

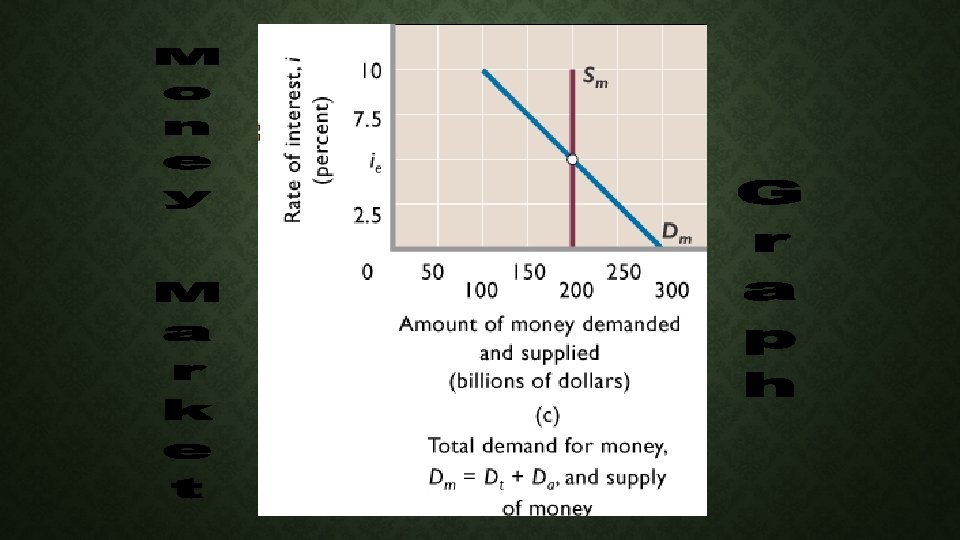

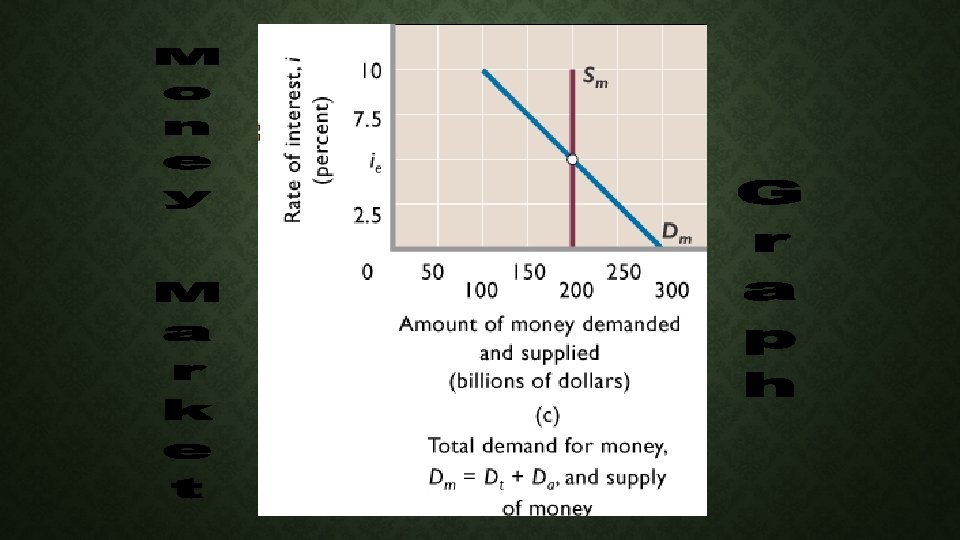

THE MONEY MARKET GRAPH The key to understanding this graph is to think of money as a commodity. We are discussing the supply and demand for money as we would the supply and demand of any other product.

THERE ARE TWO TYPES OR REASONS TO HAVE DEMAND FOR MONEY 1. TRANSACTIONS DEMANDED- MONEY ON HAND TO BUY GOODS. IF GDP INCREASES, DT INCREASES. DT IS CONSIDERED INDEPENDENT OF INTEREST.

2. ASSET DEMANDED- HOLDING MONEY AS A STORE OF VALUE- AN ASSET. HOLDING MONEY MEANS LIQUIDITY AND LACK OF RISK. HOLDING MONEY MEANS NO PROFITINTEREST.

WHEN INTEREST RATES ARE LOW, DA IS HIGH. PEOPLE WILL HOLD MONEY RATHER THAN INVESTING. WHEN INTEREST RATES ARE HIGH, DA IS LOW. PEOPLE WILL INVEST MONEY RATHER THAN HOLDING. IR IR DA DA

IN ORDER TO CALCULATE TOTAL MONEY DEMANDED, ADD UP THE DT AND DA.

MONEY SUPPLIED (SM) IS ALWAYS VERTICAL, AND THE EQUILIBRIUM IS THE INTEREST RATE.

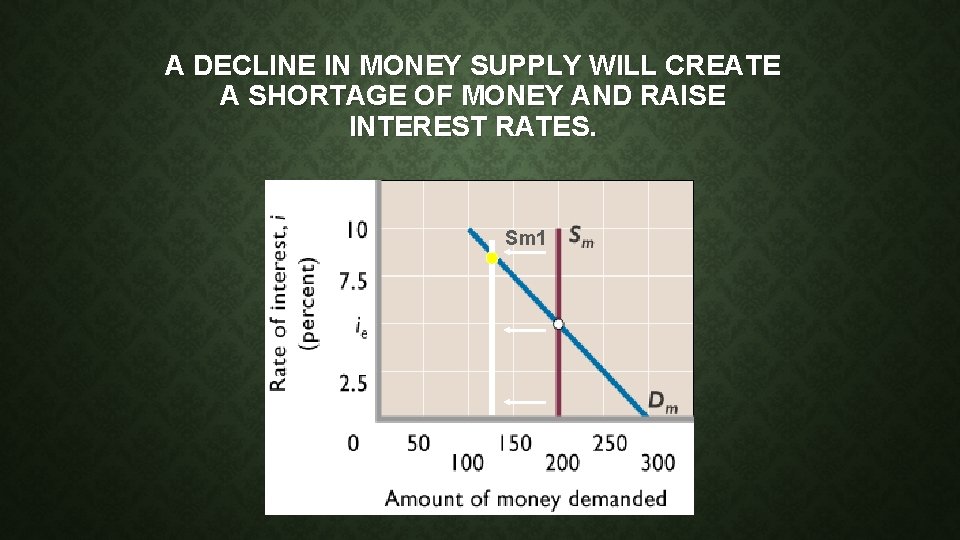

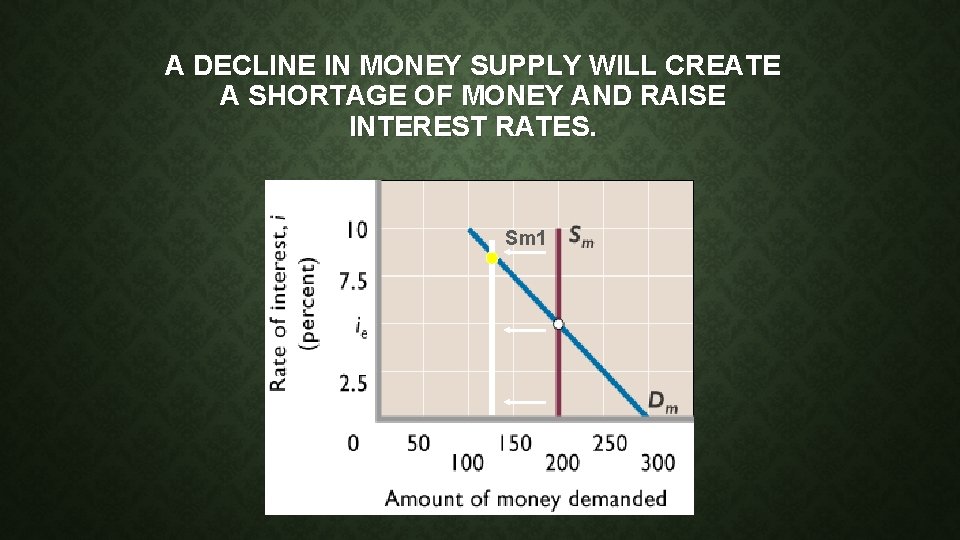

A DECLINE IN MONEY SUPPLY WILL CREATE A SHORTAGE OF MONEY AND RAISE INTEREST RATES. Sm 1

Due to this shortage of money…. PEOPLE TRY TO GET MORE MONEY BY CASHING THEIR BONDS. THIS LOWERS DEMAND FOR BONDS, LOWERS THEIR PRICE. WITH A HIGH INTEREST, MONEY DEMANDED (DA) DECLINES, AND NO MORE SHORTAGE.

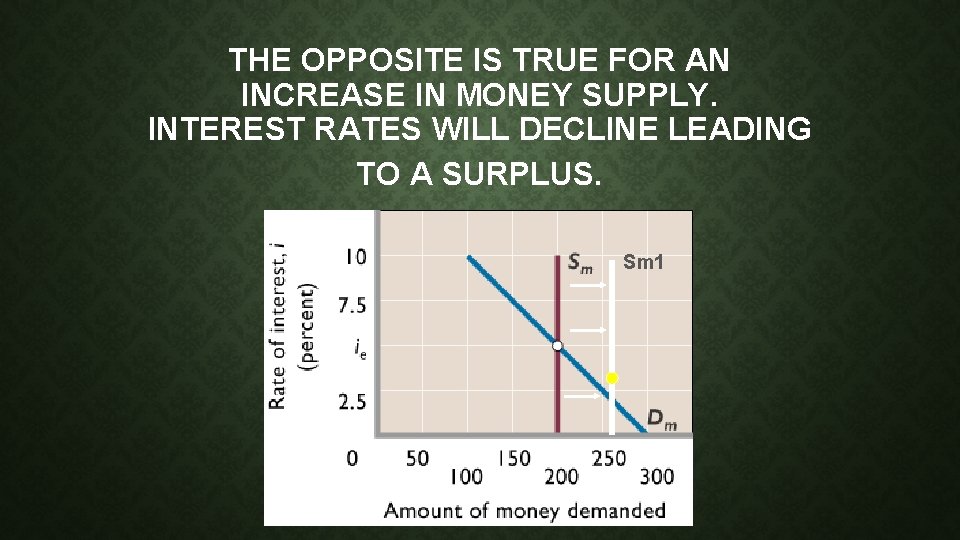

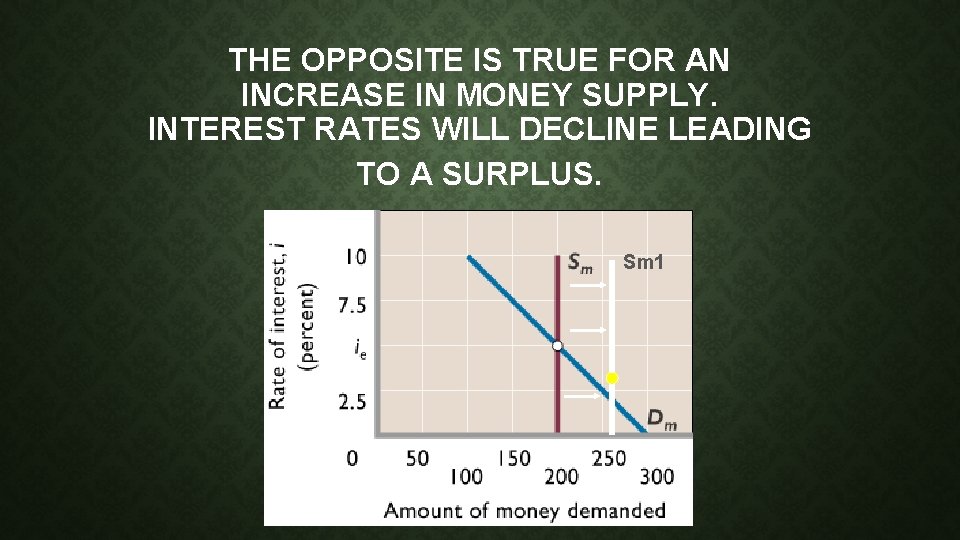

THE OPPOSITE IS TRUE FOR AN INCREASE IN MONEY SUPPLY. INTEREST RATES WILL DECLINE LEADING TO A SURPLUS. Sm 1

Due to this surplus of money…. PEOPLE WILL TRY TO GET RID OF MONEY BY PURCHASING BONDS. INCREASES DEMAND FOR BONDS, RAISE BOND PRICES. WITH A LOW INTEREST RATE, MONEY DEMANDED INCREASES (DA), BALANCING THE SURPLUS.