Understanding Securities and Securities Markets Chapter 22 Chapter

- Slides: 26

Understanding Securities and Securities Markets Chapter 22

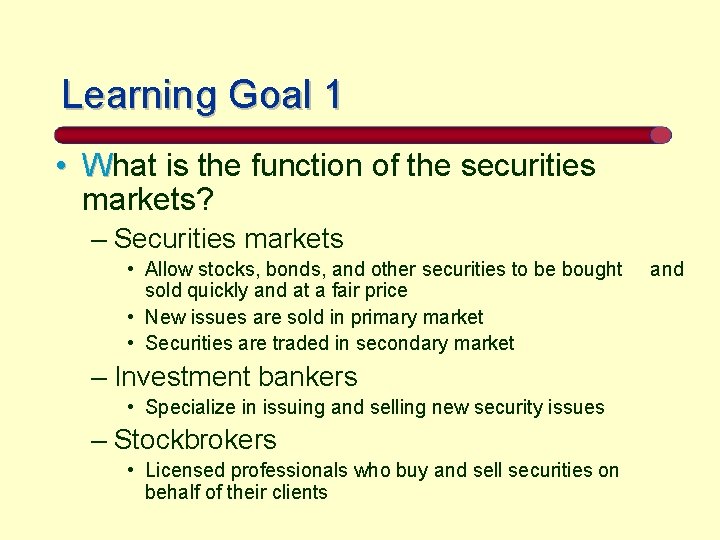

Chapter 22 Learning Goals 1. What is the function of the securities markets? 2. How do common stock, preferred stock, and bonds differ as investments? 3. What other types of securities are available to investors? 4. Where can investors buy and sell securities, and how are these securities markets regulated?

Chapter 22 Learning Goals (cont’d. ) 5. How do investors open a brokerage account and make securities transactions? 6. Which sources of investment information are the most helpful to investors? 7. What can investors learn from stock, bond, and mutual fund quotations? 8. What are the current trends in the securities markets?

Learning Goal 1 • What is the function of the securities markets? – Securities markets • Allow stocks, bonds, and other securities to be bought sold quickly and at a fair price • New issues are sold in primary market • Securities are traded in secondary market – Investment bankers • Specialize in issuing and selling new security issues – Stockbrokers • Licensed professionals who buy and sell securities on behalf of their clients and

Securities: Investment certificates issued by corporations or governments that represent wither equity or debt

Types of Securities Markets • Primary – new securities sold to the public – issuer gets proceeds • Secondary – already issued securities are traded – stock exchanges, commodities exchanges, over-the-counter market

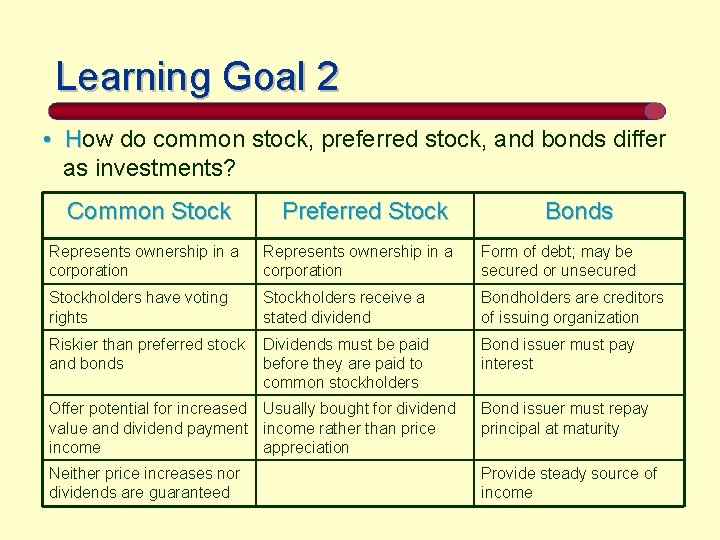

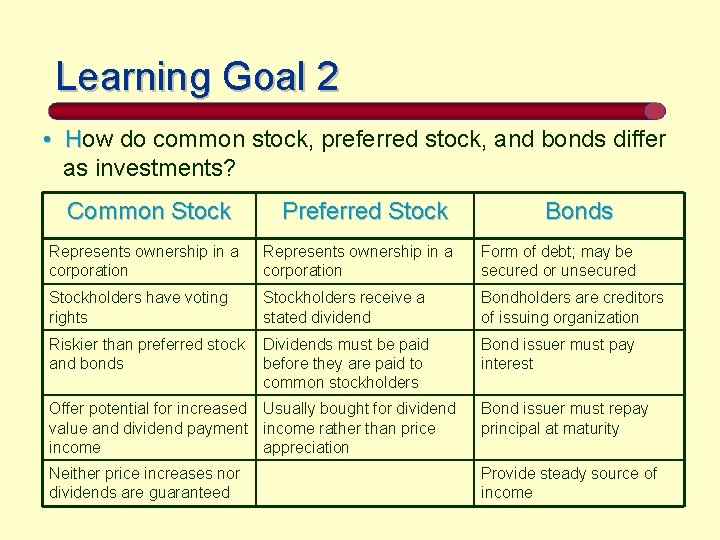

Learning Goal 2 • How do common stock, preferred stock, and bonds differ H as investments? Common Stock Preferred Stock Bonds Represents ownership in a corporation Form of debt; may be secured or unsecured Stockholders have voting rights Stockholders receive a stated dividend Bondholders are creditors of issuing organization Riskier than preferred stock and bonds Dividends must be paid before they are paid to common stockholders Bond issuer must pay interest Offer potential for increased Usually bought for dividend value and dividend payment income rather than price income appreciation Bond issuer must repay principal at maturity Neither price increases nor dividends are guaranteed Provide steady source of income

Stock: Equity Financing • Common stock – represents ownership interest – returns: dividends, stock-price increases • Preferred stock – represents ownership interest – receive dividends before common stockholders – provides fixed income

Bonds: Long-term debt obligations (liabilities) of corporations & governments • issuers must pay back: – principal (par value) – plus interest (coupon rate)

Bonds: Debt Financing • Corporate bonds – secured vs. unsecured – convertible bonds • US government securities – treasury bills, notes, bonds • Municipal bonds • Bond ratings – letter grades represent the risk

Learning Goal 3 • What other types of securities are available to investors? – Mutual funds • Financial service companies that pool the funds of many investors to buy a diversified portfolio of securities • Offer a convenient way to diversify • Professionally managed – Futures contracts • Legally binding obligations to buy or sell specified quantities of commodities at an agreed-on price at a future date • Very risky investments because price may change drastically

Other Popular Securities • Mutual funds – pools investors’ funds • Futures contracts • Options

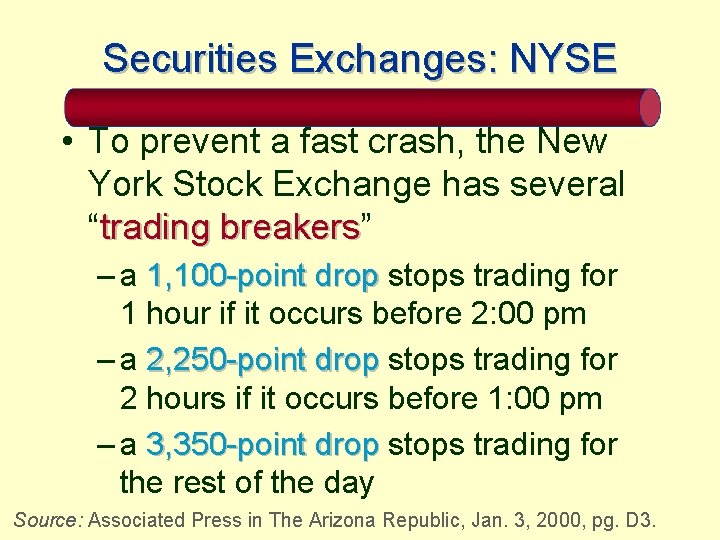

Learning Goal 4 • Where can investors buy and sell securities, and how are these securities markets regulated? – Securities are resold on: • Organized stock exchanges, such as the New York Stock Exchange • Regional stock exchanges • Over-the-counter market – Securities markets are regulated by • Securities Act of 1933 – Requires disclosure of important information on new securities issues • Securities Exchange Act of 1934 and 1964 amendment – Formally empowered the SEC to regulate organized securities exchanges and over-the-counter market • Investment Company Act of 1940 – Places investment companies such as mutual funds under SEC control • Self-regulatory groups such as the NASD • “Circuit breakers” to halt trading if the Dow Jones Industrial Average drops rapidly

Securities Exchanges • Organized stock exchanges – re-sell securities in an auction-type format – US stock exchanges • New York Stock Exchange • American Stock Exchange – Global trading & foreign exchanges • Over-the-Counter Market – electronic-based Nasdaq

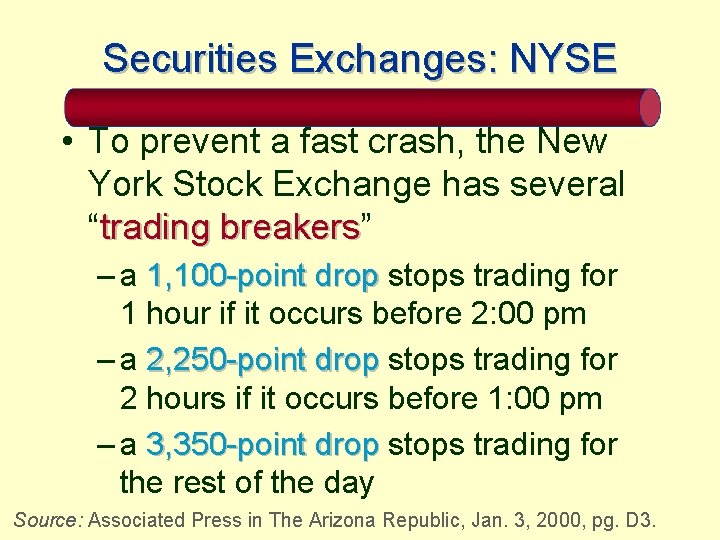

Securities Exchanges: NYSE • To prevent a fast crash, the New York Stock Exchange has several “trading breakers” breakers – a 1, 100 -point drop stops trading for 1 hour if it occurs before 2: 00 pm – a 2, 250 -point drop stops trading for 2 hours if it occurs before 1: 00 pm – a 3, 350 -point drop stops trading for the rest of the day Source: Associated Press in The Arizona Republic, Jan. 3, 2000, pg. D 3.

Learning Goal 5 • How do investors open a brokerage account and make securities transactions? – Choose a brokerage firm and stockbroker – Open a cash account or a margin account • Cash account - all securities transactions are paid in full • Margin account - allows investors to put up 50% of price of securities and borrow the rest from broker – Give an order to broker to buy or sell securities – Broker sends the order to the stock exchange to be carried out – If stock is an over-the-counter stock, broker finds the dealer with the best price

How to Buy and Sell Securities • Securities transactions – place order with broker – broker makes the transaction – blocks of 100 are round lots – market orders, limit orders, stop-loss orders • Online investing – lower transaction costs – 15% of people in a Consumer Reports survey had purchased stock or other investments online (Source: Consumer Reports, Dec. 1999, p. 10)

Learning Goal 6 • Which sources of investment information are the most helpful to investors? – Popular investment information sources: • Economic and financial publications – – – • • The Wall Street Journal Barron’s Business Week Fortune Smart Money Numerous Internet sites Subscription services Investment newsletters Security price quotations

Popular Sources of Investment Information • Economic & financial publications – Barron’s – Wall Street Journal – Business Week • Online information resources • Security price quotations – stocks, bonds, mutual funds • Market averages & indexes – Dow Jones Industrial Average

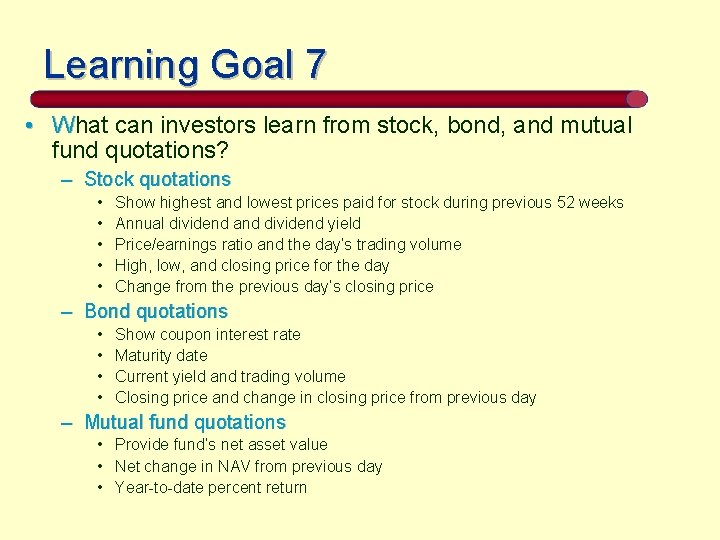

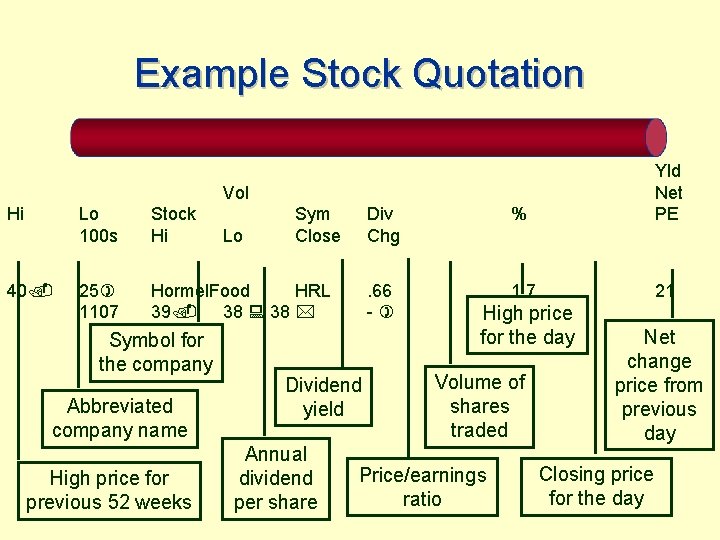

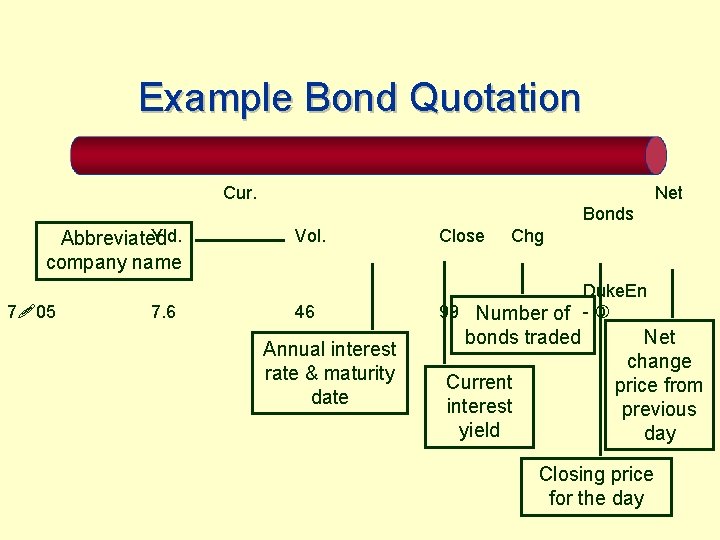

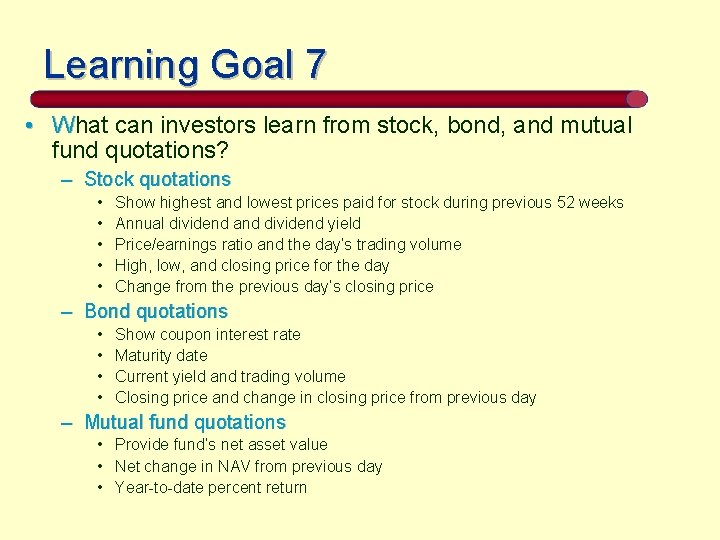

Learning Goal 7 • What can investors learn from stock, bond, and mutual fund quotations? – Stock quotations • • • Show highest and lowest prices paid for stock during previous 52 weeks Annual dividend and dividend yield Price/earnings ratio and the day’s trading volume High, low, and closing price for the day Change from the previous day’s closing price – Bond quotations • • Show coupon interest rate Maturity date Current yield and trading volume Closing price and change in closing price from previous day – Mutual fund quotations • Provide fund’s net asset value • Net change in NAV from previous day • Year-to-date percent return

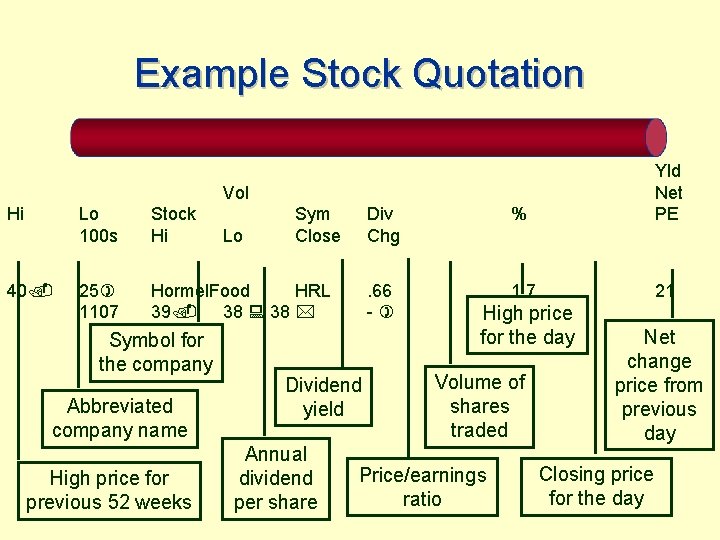

Example Stock Quotation Div Chg % Yld Net PE . 66 -) 1. 7 21 Vol Hi 40. Lo 100 s Stock Hi 25) 1107 Hormel. Food HRL 39. 38 : 38 * Symbol for the company Abbreviated company name High price for previous 52 weeks Lo Sym Close Dividend yield Annual dividend per share High price for the day Volume of shares traded Price/earnings ratio Net change price from previous day Closing price for the day

Stock Performance Some reasons why stock prices tend to increase every January: • small companies often record gains in late Dec. , which carries through Jan. • investors who sell ‘bad’ stocks late in the year (to deduct the losses on taxes) buy them back in Jan. Source: The Arizona Republic, Jan. 2, 2000, pg. D 2.

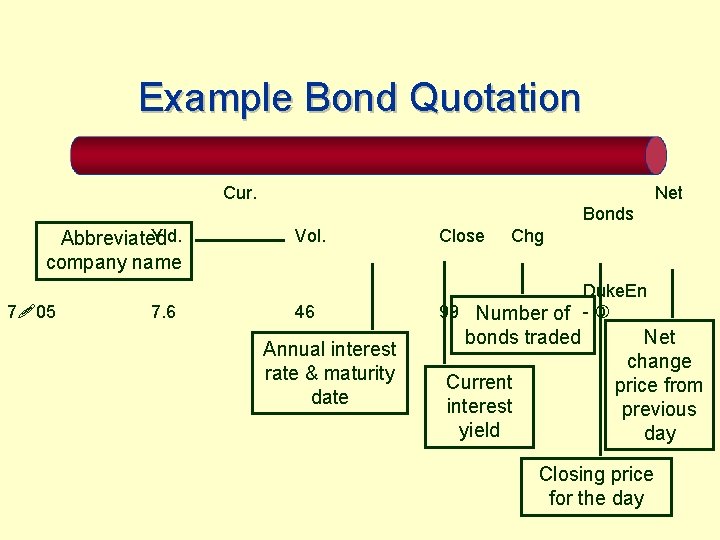

Example Bond Quotation Cur. Net Bonds Yld. Abbreviated company name 7!05 7. 6 Vol. Close 46 Duke. En 99 Number of - ) Annual interest rate & maturity date Chg bonds traded Current interest yield Net change price from previous day Closing price for the day

Learning Goal 8 • What are the current trends in the securities markets? – Securities markets and the investment industry are changing considerably • New York Stock Exchange no longer dominates equity market activity • Nasdaq is challenging the Big Board • Emergence of electronic exchanges – Individual investors are becoming a market force • Improved technology • Relative ease of online investing • Move toward self-management of retirement funds

Trends in Securities Market competition - Nasdaq, AMEX, NYSE electronic communications networks (ECNs) More individuals investing

Rise in Internet Investment estimated Money Invested in the Internet is Estimated to Rise to $700 billion by 2003 Source: Newsweek, Dec. 13, 1999, p. 63.