UK GAAP is dead long live UK GAAP

- Slides: 21

UK GAAP is dead, long live UK GAAP! May 2014 BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

Overview The current UK regime Outline of the new UK regime FRS 102 The Financial Reporting Standard Resources BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

Current UK financial reporting regime BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

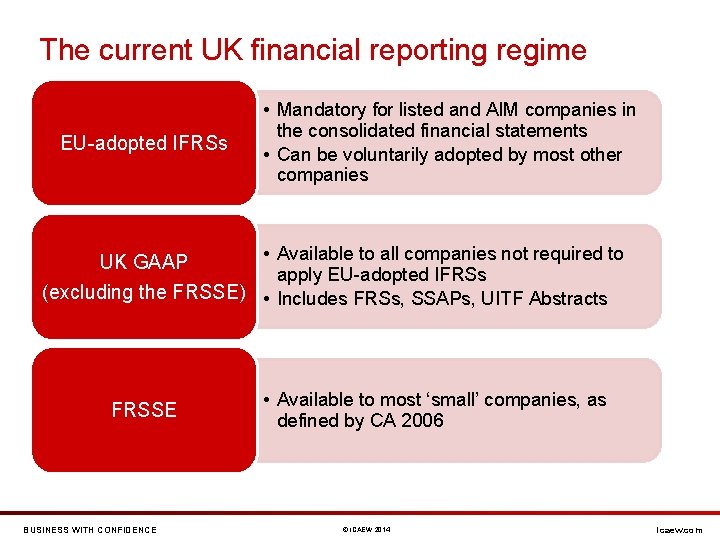

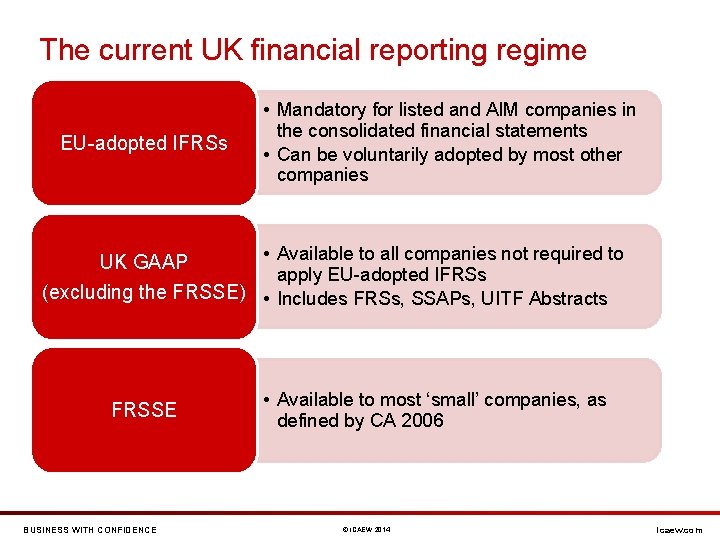

The current UK financial reporting regime EU-adopted IFRSs • Mandatory for listed and AIM companies in the consolidated financial statements • Can be voluntarily adopted by most other companies • Available to all companies not required to UK GAAP apply EU-adopted IFRSs (excluding the FRSSE) • Includes FRSs, SSAPs, UITF Abstracts FRSSE BUSINESS WITH CONFIDENCE • Available to most ‘small’ companies, as defined by CA 2006 © ICAEW 2014 icaew. com

New UK financial reporting regime BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

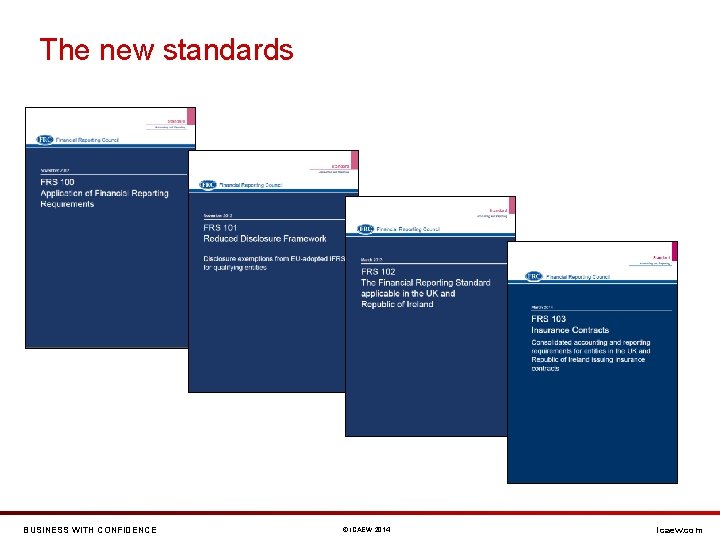

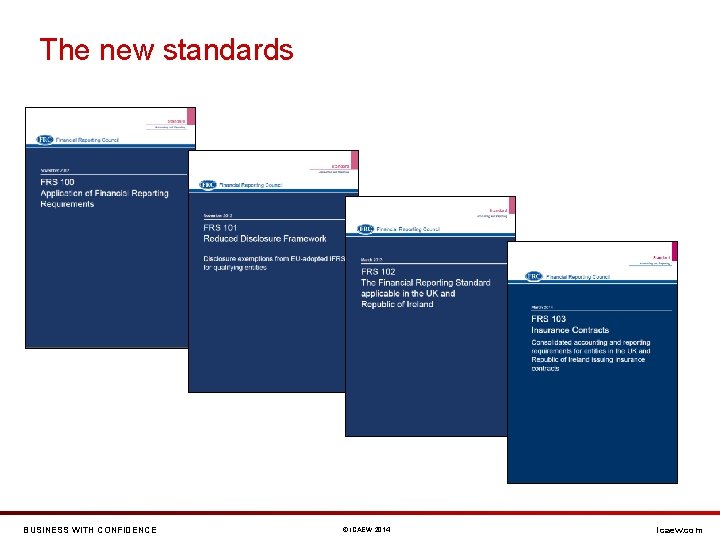

The new standards BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

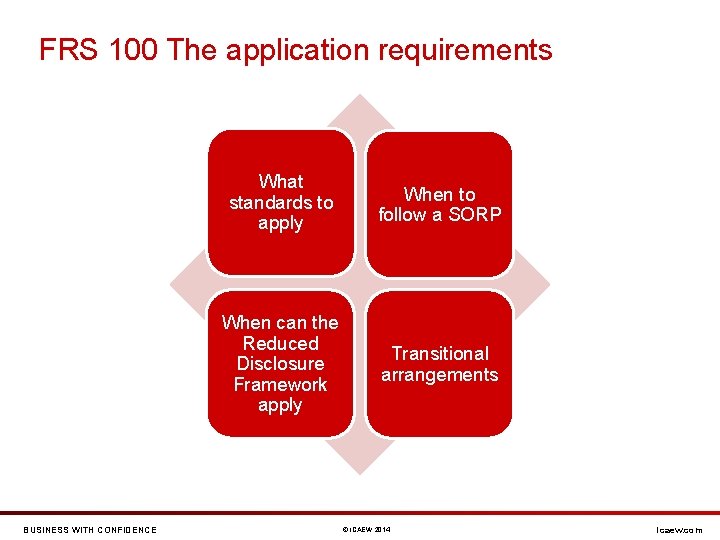

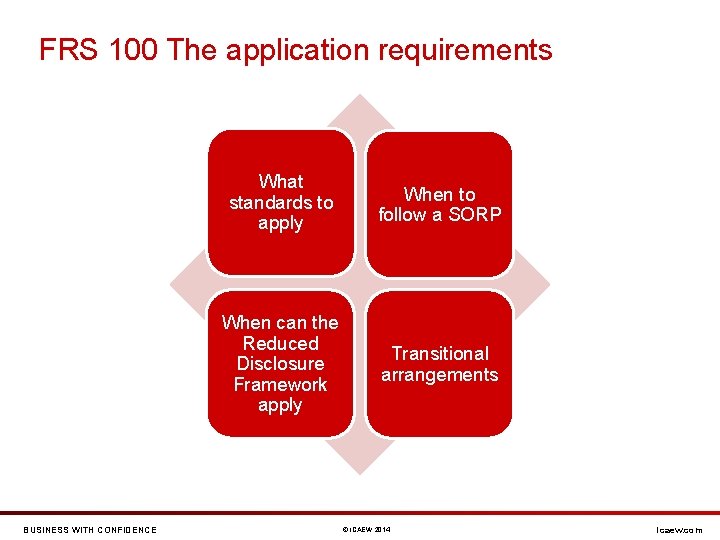

FRS 100 The application requirements BUSINESS WITH CONFIDENCE What standards to apply When to follow a SORP When can the Reduced Disclosure Framework apply Transitional arrangements © ICAEW 2014 icaew. com

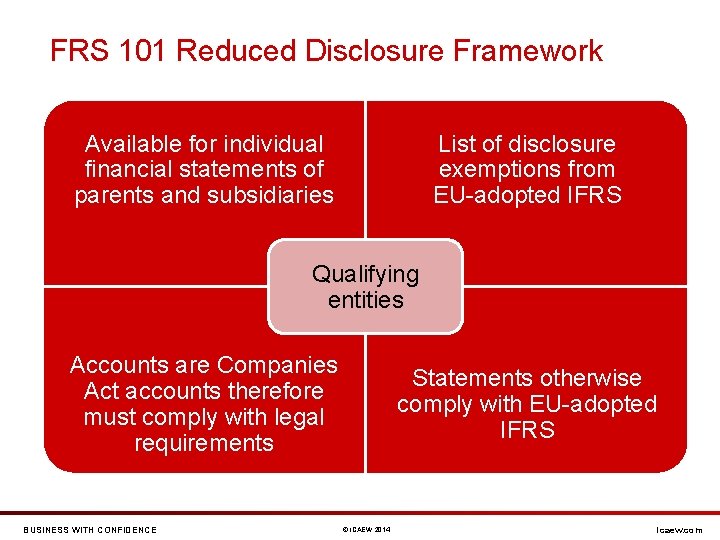

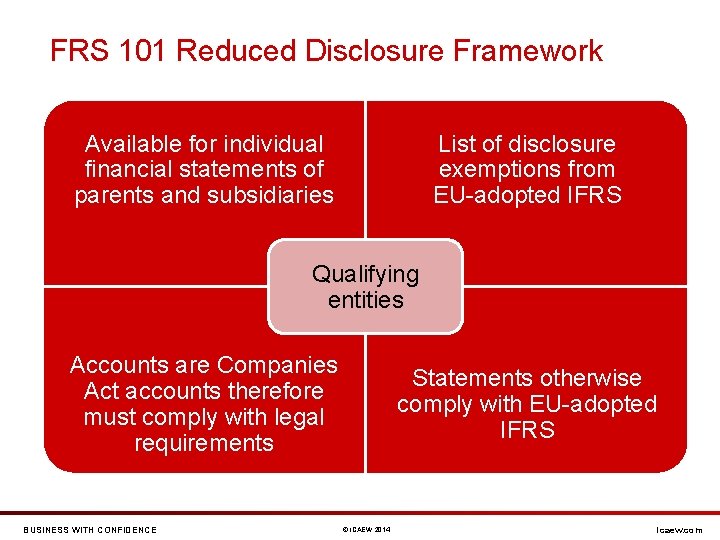

FRS 101 Reduced Disclosure Framework List of disclosure exemptions from EU-adopted IFRS Available for individual financial statements of parents and subsidiaries Qualifying entities Accounts are Companies Act accounts therefore must comply with legal requirements BUSINESS WITH CONFIDENCE Statements otherwise comply with EU-adopted IFRS © ICAEW 2014 icaew. com

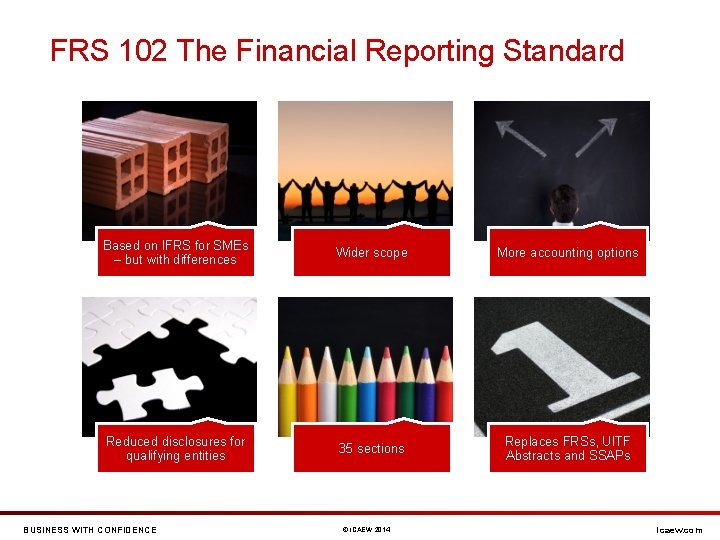

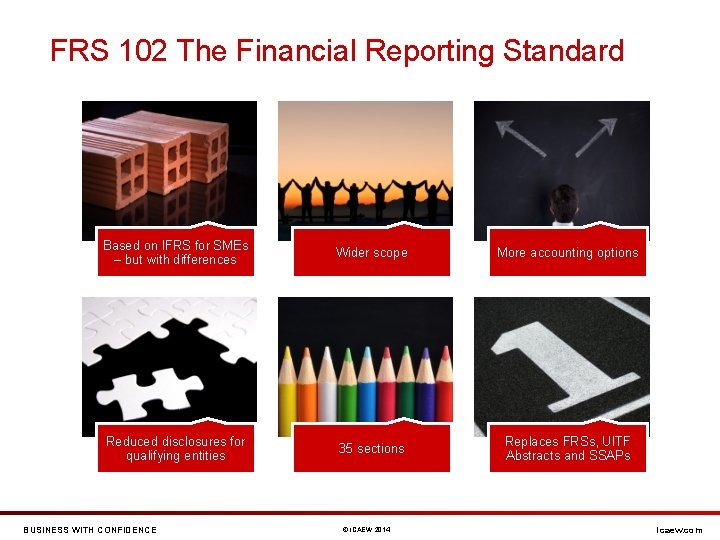

FRS 102 The Financial Reporting Standard Based on IFRS for SMEs – but with differences Wider scope More accounting options Reduced disclosures for qualifying entities 35 sections Replaces FRSs, UITF Abstracts and SSAPs BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

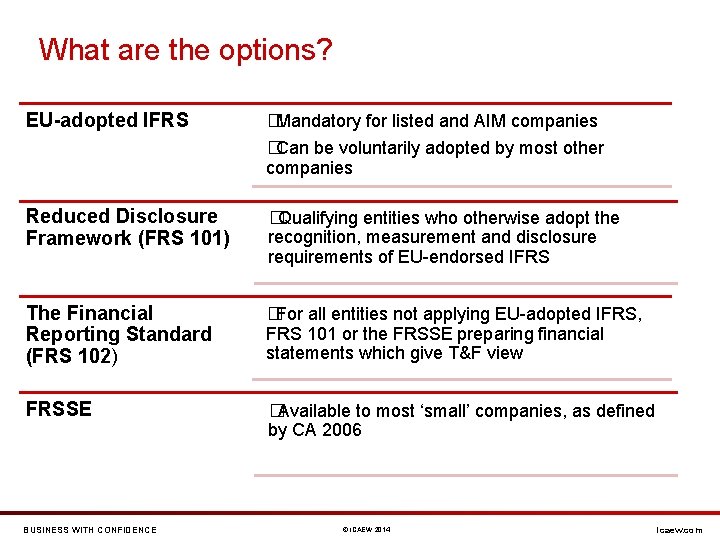

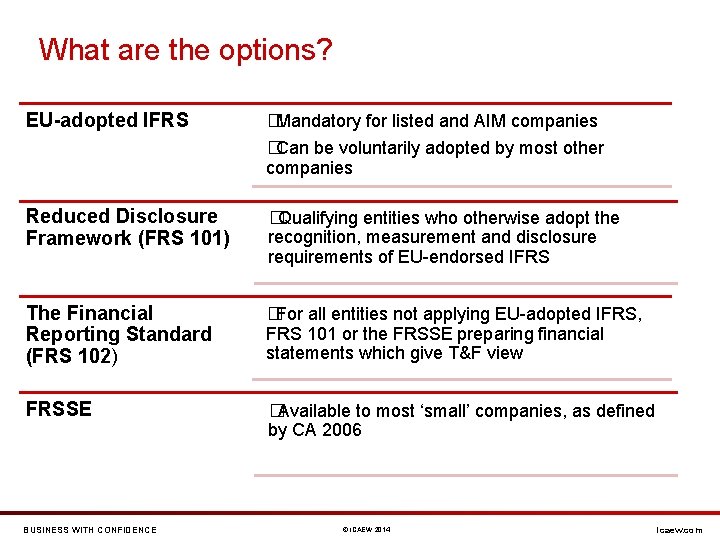

What are the options? EU-adopted IFRS �Mandatory for listed and AIM companies �Can be voluntarily adopted by most other companies Reduced Disclosure Framework (FRS 101) �Qualifying entities who otherwise adopt the recognition, measurement and disclosure requirements of EU-endorsed IFRS The Financial Reporting Standard (FRS 102) �For all entities not applying EU-adopted IFRS, FRS 101 or the FRSSE preparing financial statements which give T&F view FRSSE �Available to most ‘small’ companies, as defined by CA 2006 BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

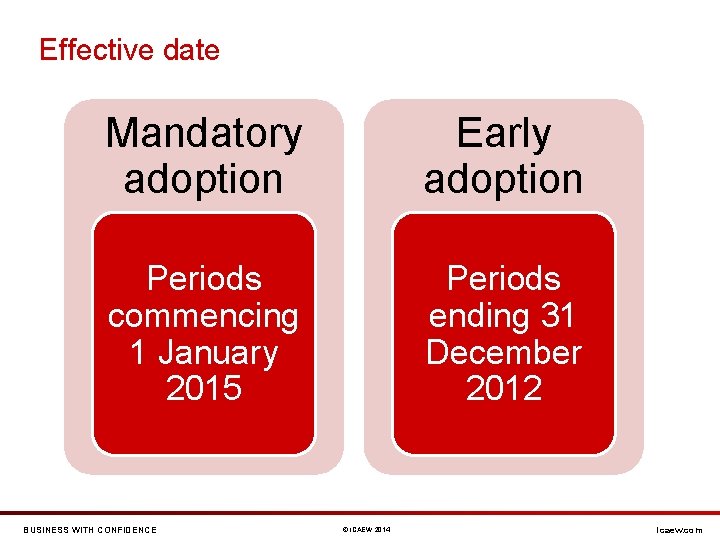

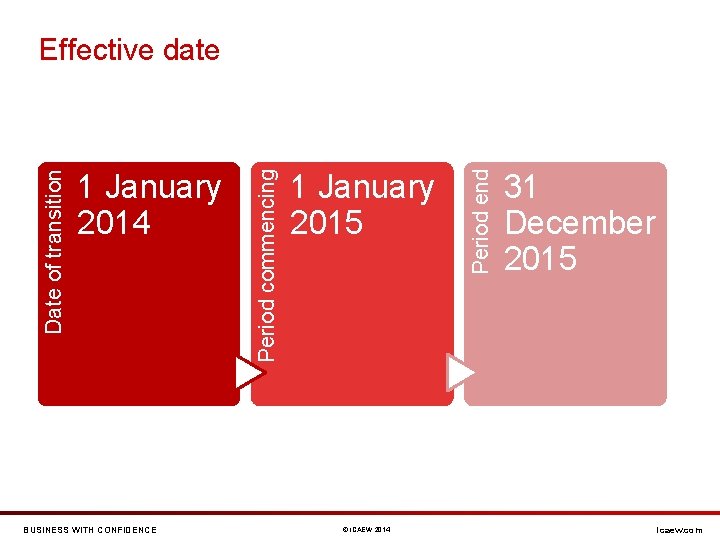

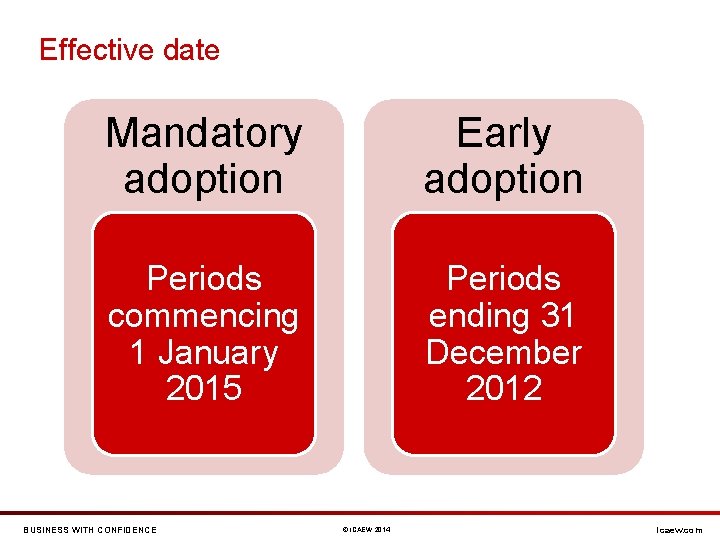

Effective date Mandatory adoption Early adoption Periods commencing 1 January 2015 Periods ending 31 December 2012 BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

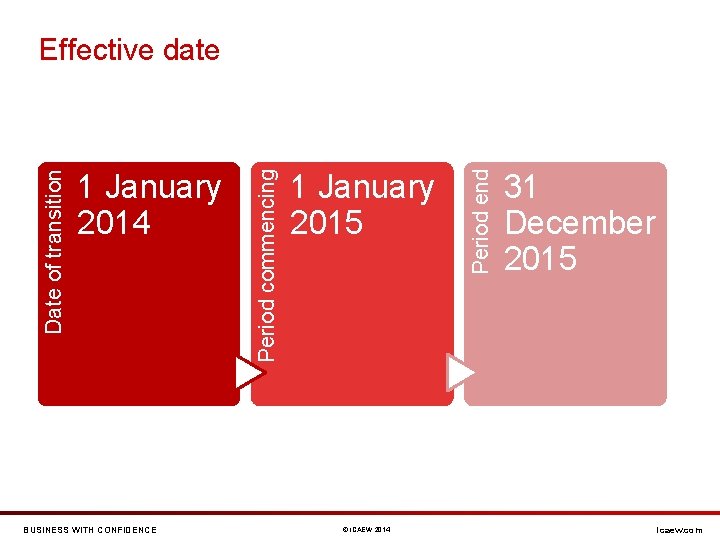

BUSINESS WITH CONFIDENCE 1 January 2015 © ICAEW 2014 Period end 1 January 2014 Period commencing Date of transition Effective date 31 December 2015 icaew. com

FRS 102 The Financial Reporting Standard applicable in the UK and ROI BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

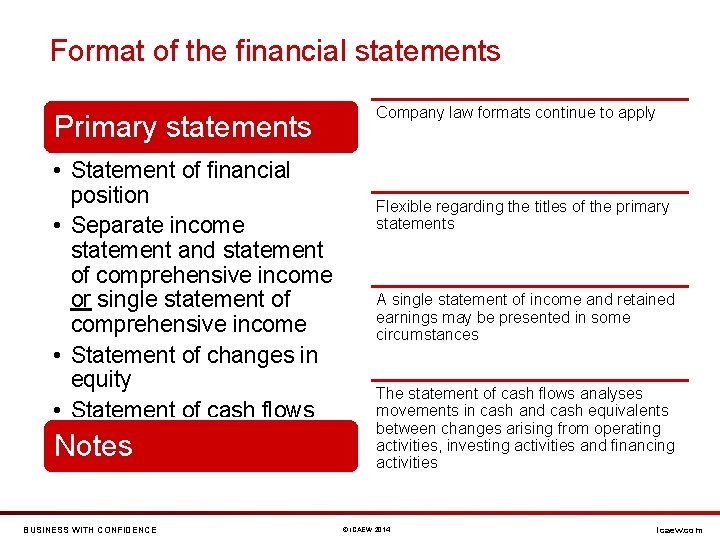

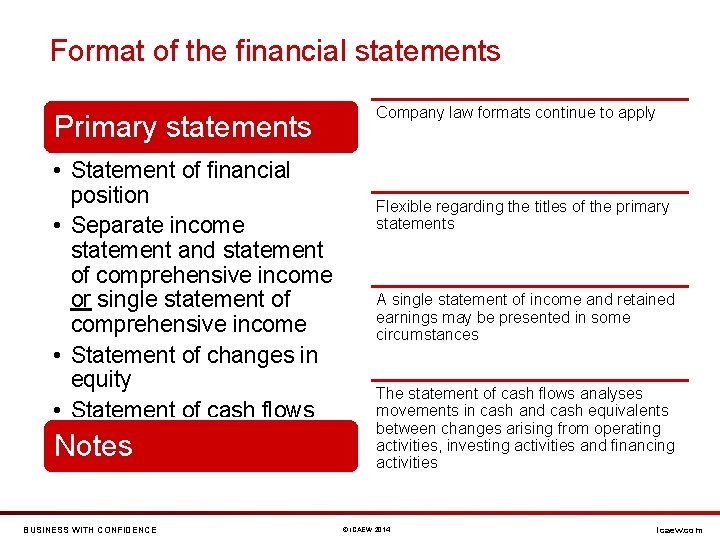

Format of the financial statements Primary statements • Statement of financial position • Separate income statement and statement of comprehensive income or single statement of comprehensive income • Statement of changes in equity • Statement of cash flows Notes BUSINESS WITH CONFIDENCE Company law formats continue to apply Flexible regarding the titles of the primary statements A single statement of income and retained earnings may be presented in some circumstances The statement of cash flows analyses movements in cash and cash equivalents between changes arising from operating activities, investing activities and financing activities © ICAEW 2014 icaew. com

Mind your language BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

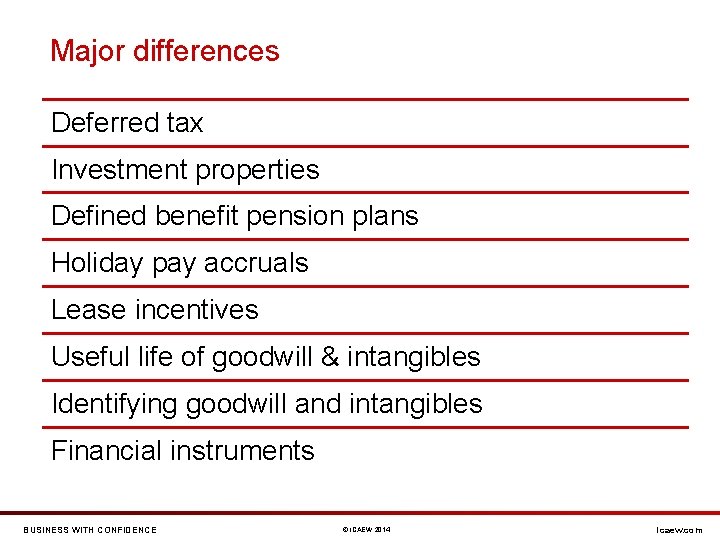

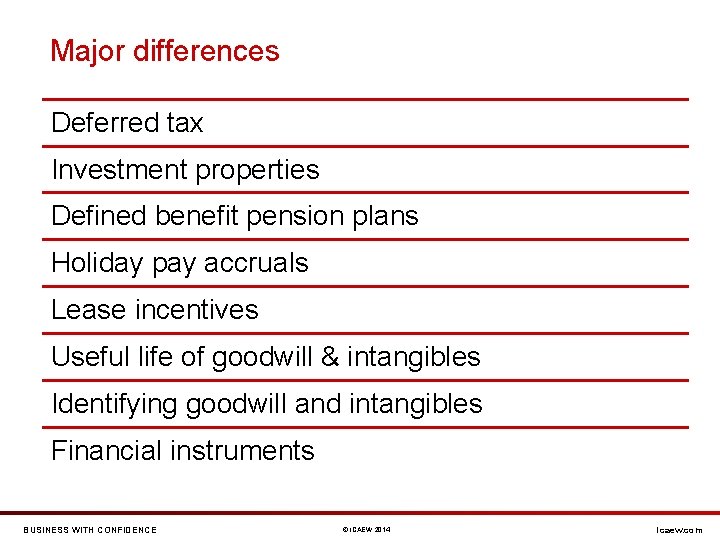

Major differences Deferred tax Investment properties Defined benefit pension plans Holiday pay accruals Lease incentives Useful life of goodwill & intangibles Identifying goodwill and intangibles Financial instruments BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

Financial Reporting Faculty resources BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

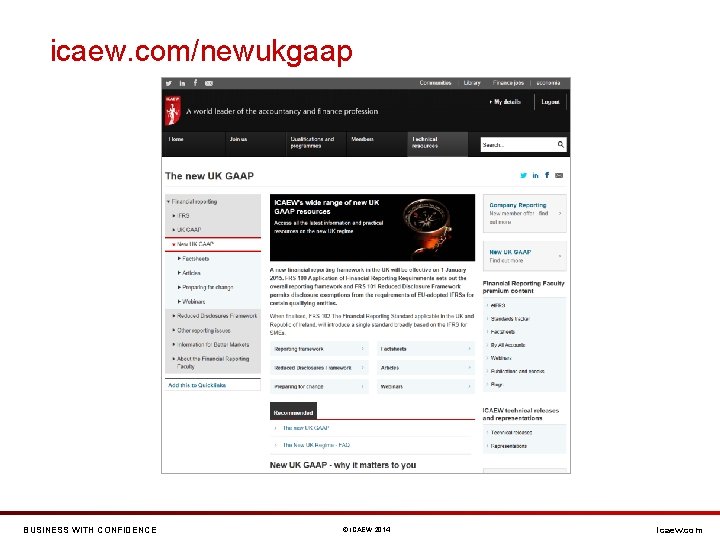

New UK GAAP Resources BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

icaew. com/newukgaap BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

New UK GAAP FAQs BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com

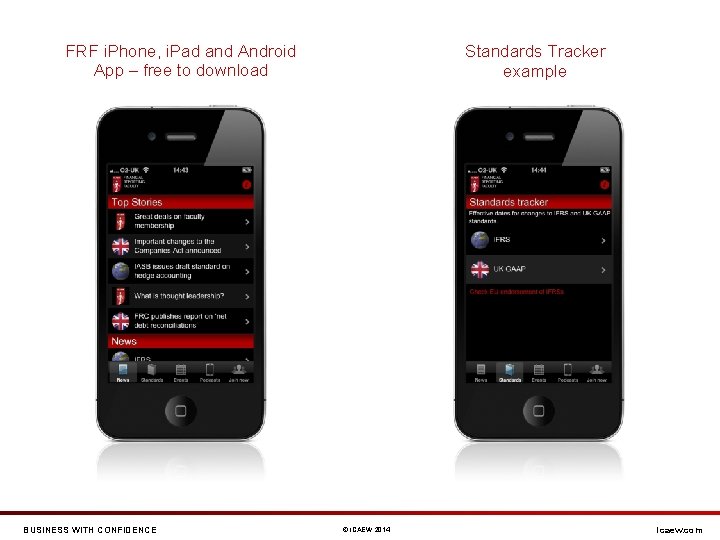

Standards Tracker example FRF i. Phone, i. Pad and Android App – free to download BUSINESS WITH CONFIDENCE © ICAEW 2014 icaew. com