UDHR Discussion 5 Most important 3 Least important

- Slides: 19

UDHR Discussion 5 Most important 3 Least important

Bell Ringer Write down 2 questions you have about TAXES! Get into 10 Groups! (of 3 ish)

Cost of Living (Mr. Quam!) Rent $625 Food $250 Transportation: $450 Utilities: $50 Phone/Internet: $200 Student Loans: $250 Total: $1, 825 Min. Annual Expenditures: $21, 900 Salary: $36, 800=$14, 900 Other: Summer Vacation/Smaller Vacations, Car Repairs, Hospital Visits/ Drs. Apt. /Prescription, House Repairs, Clothes/Shoes, Gym Membership, Electronics/Toys, Plus Others:

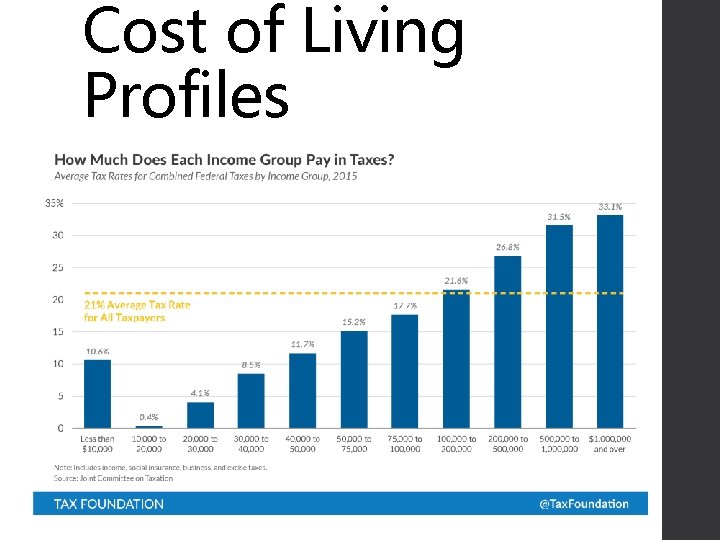

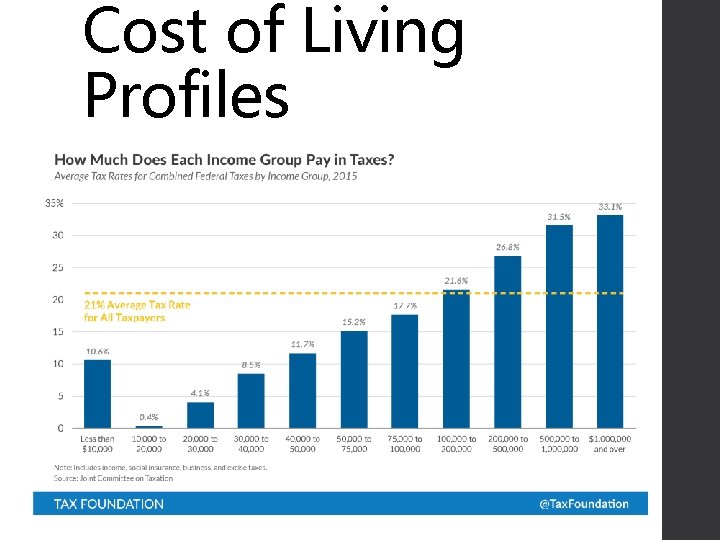

Cost of Living Profiles

How is the President involved in the budget and taxes? • The President submits a budget request to Congress • The House and Senate pass budget resolutions • House and Senate Appropriations subcommittees "markup" appropriations bills • The House and Senate vote on appropriations bills and reconcile differences • The President signs each appropriations bill and the budget becomes law A bill that specifies how much money can be spent on a given federal program. Reviewed by Appropriations subcommittees in both the House and Senate, appropriations bills must also be approved by the full House and Senate before being signed by the president to become law.

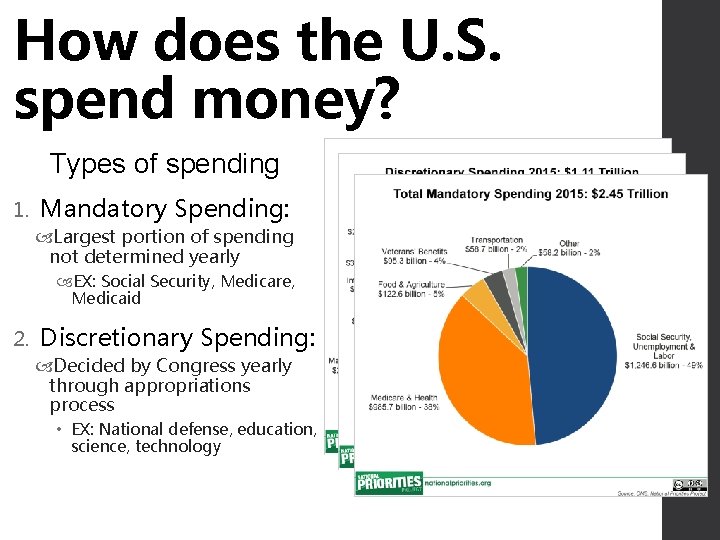

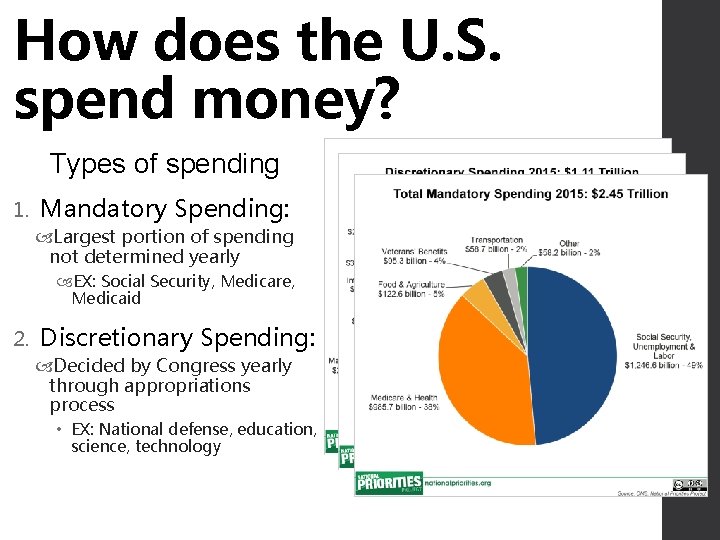

How does the U. S. spend money? Types of spending 1. Mandatory Spending: Largest portion of spending not determined yearly EX: Social Security, Medicare, Medicaid 2. Discretionary Spending: Decided by Congress yearly through appropriations process • EX: National defense, education, science, technology

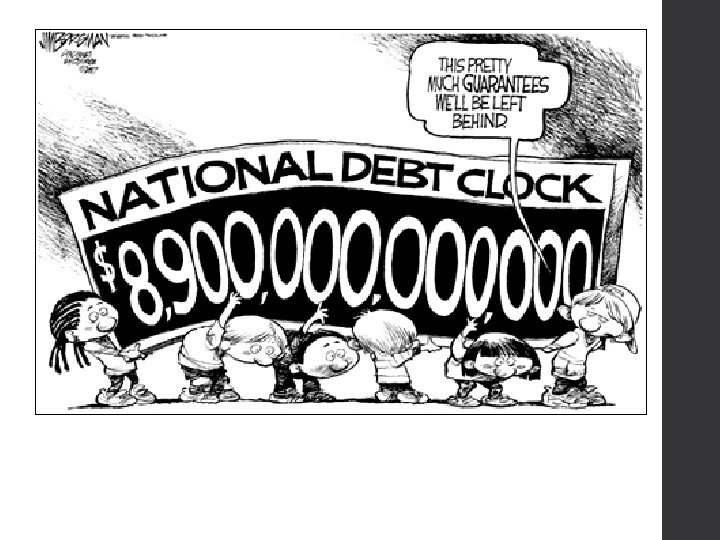

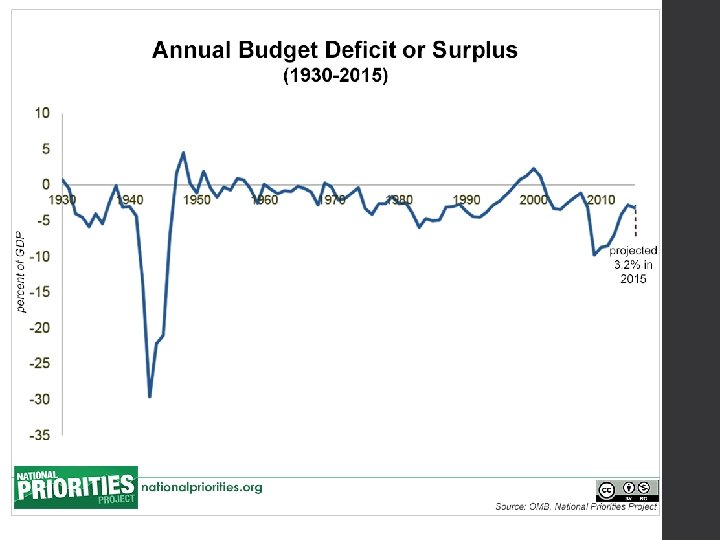

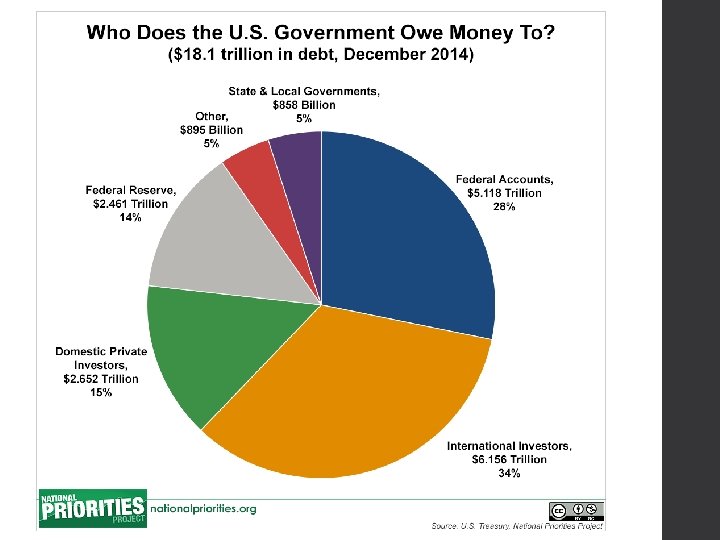

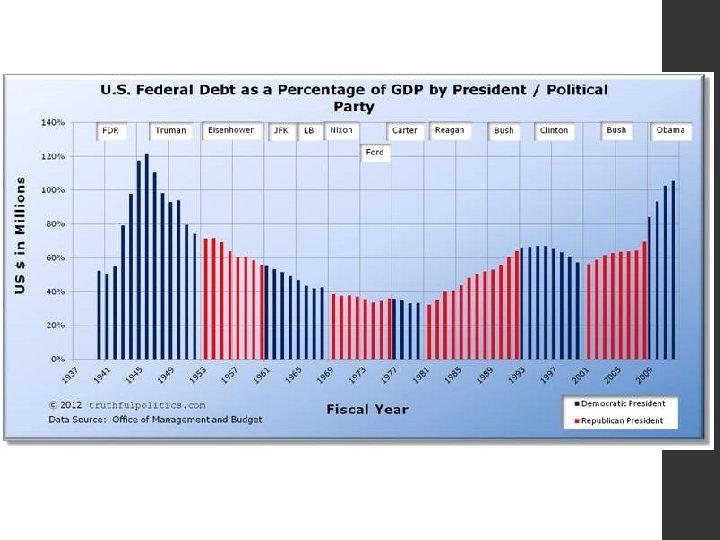

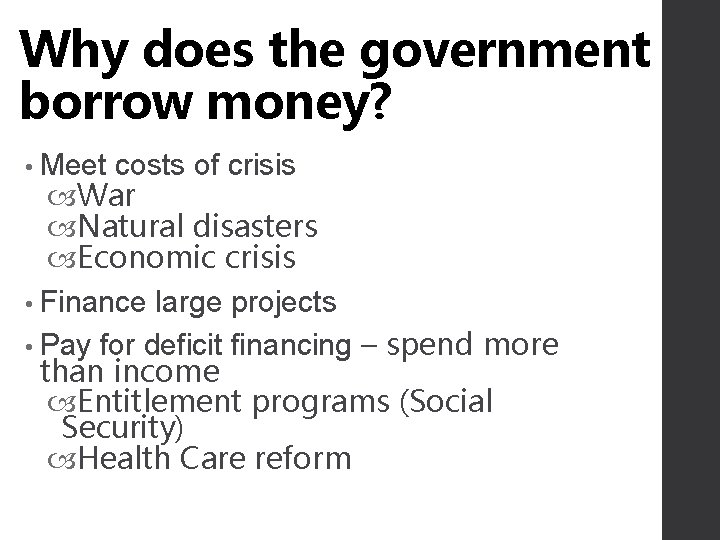

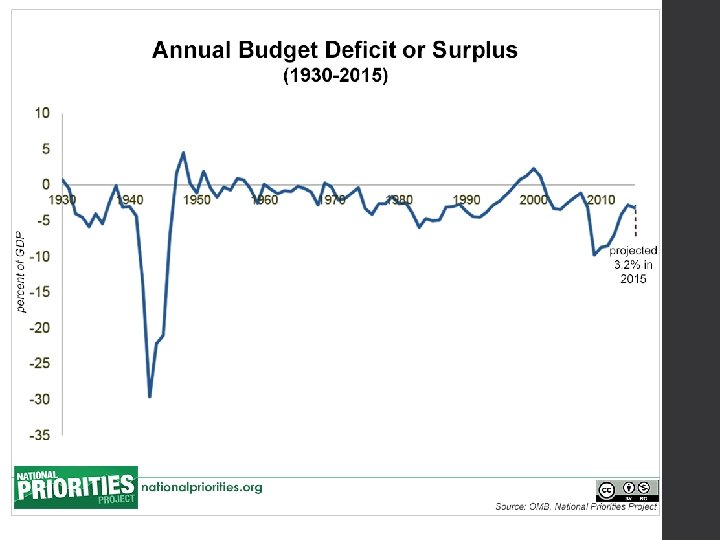

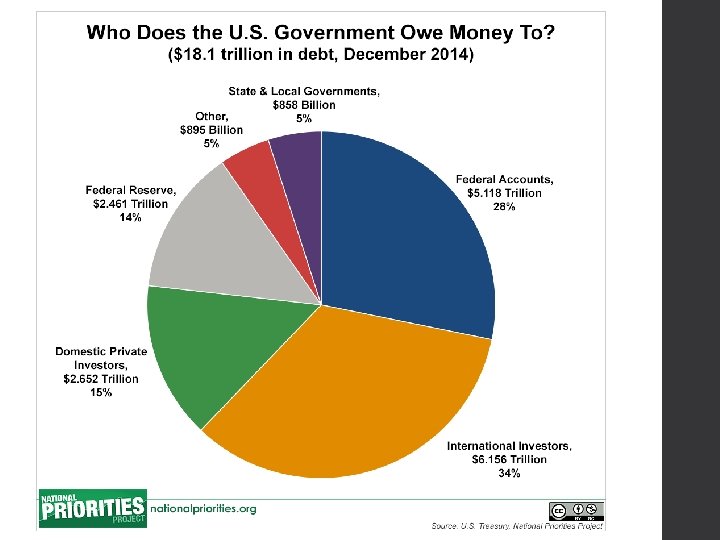

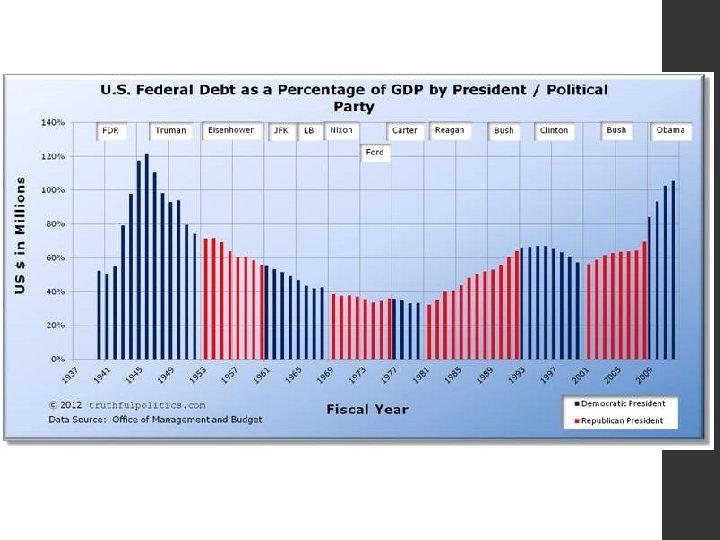

How does the government pay for things? • Taxes – spend what you have More of a traditional conservative idea Smaller government with less programs • Borrowing money – deficit spending Typically more of a liberal idea Provide more services to individuals • Both parties in recent years have deficit spent

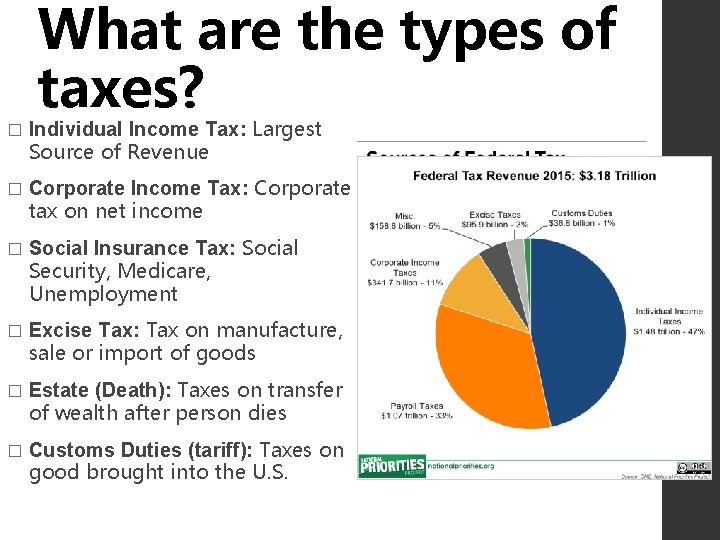

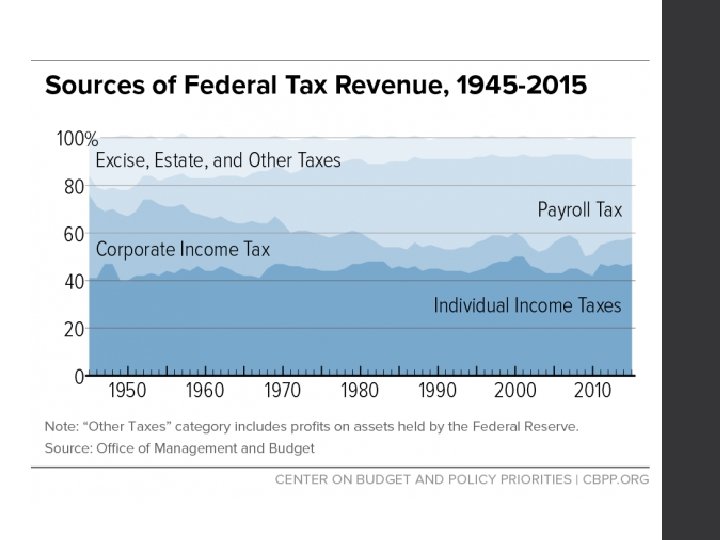

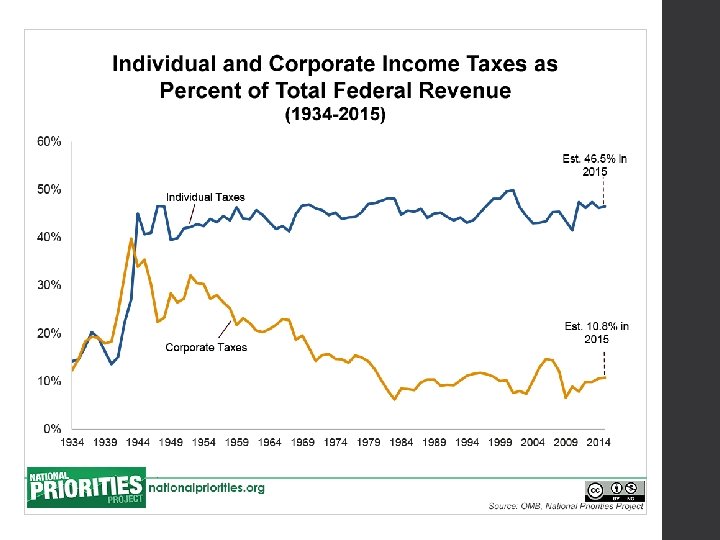

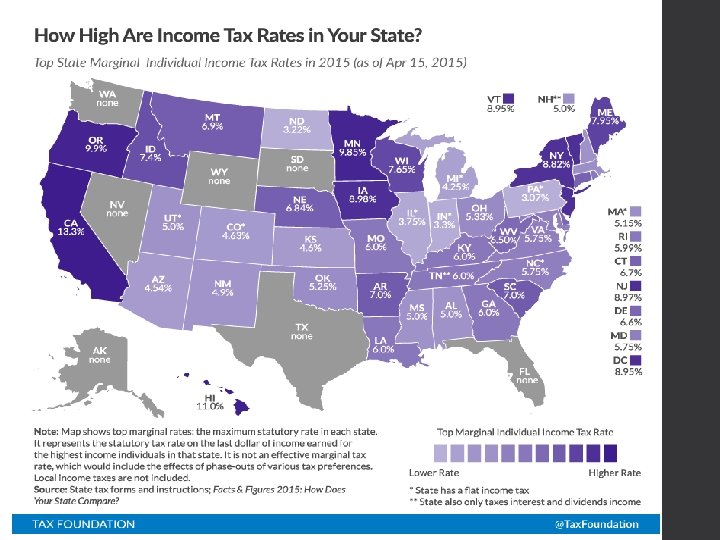

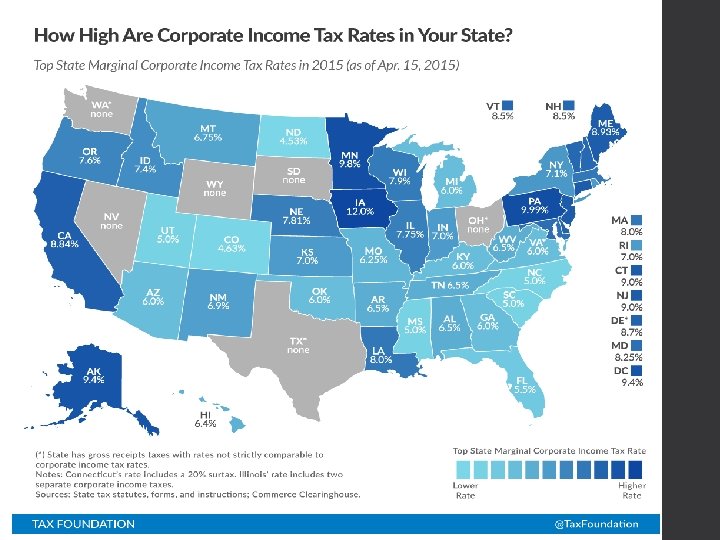

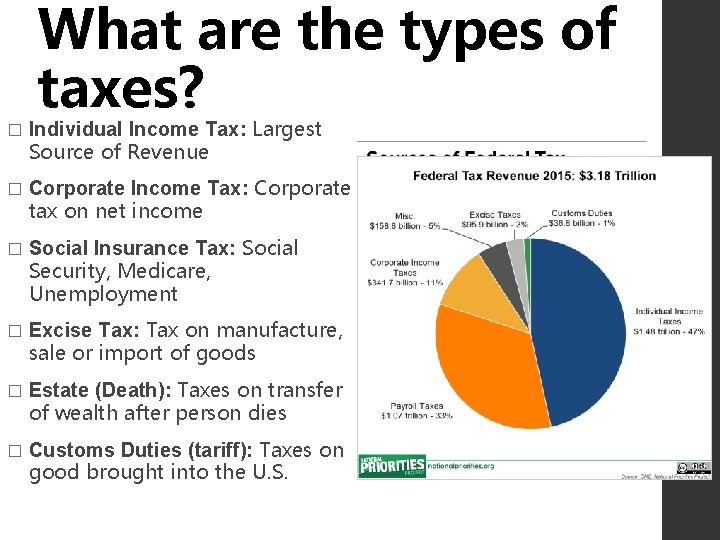

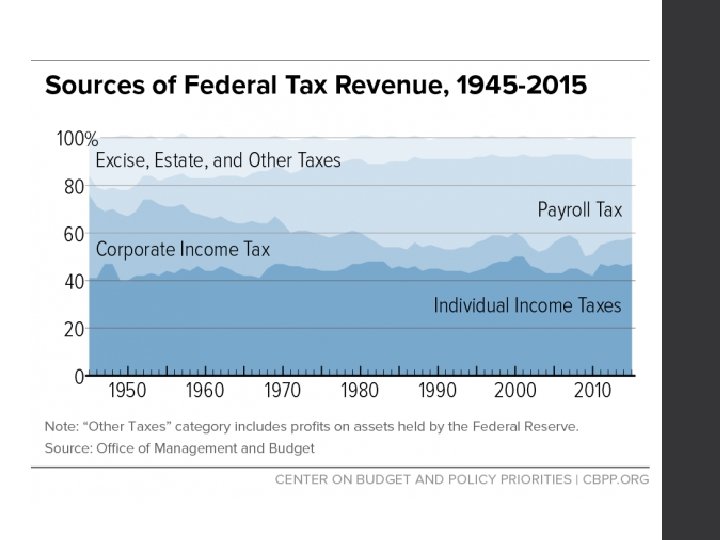

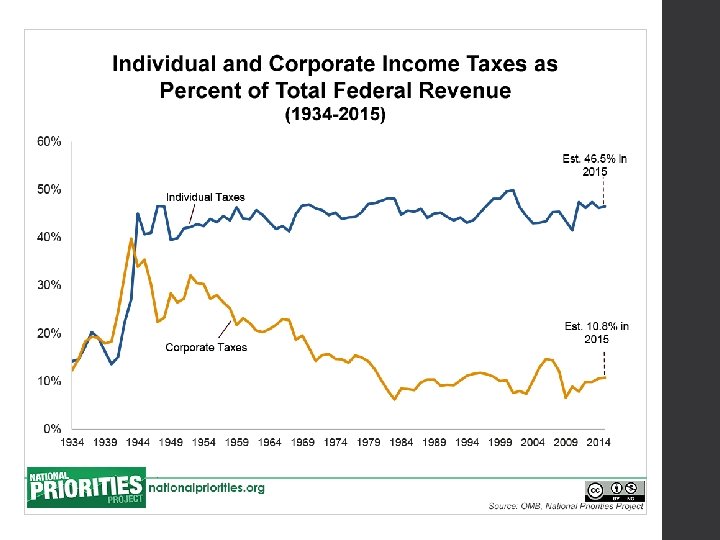

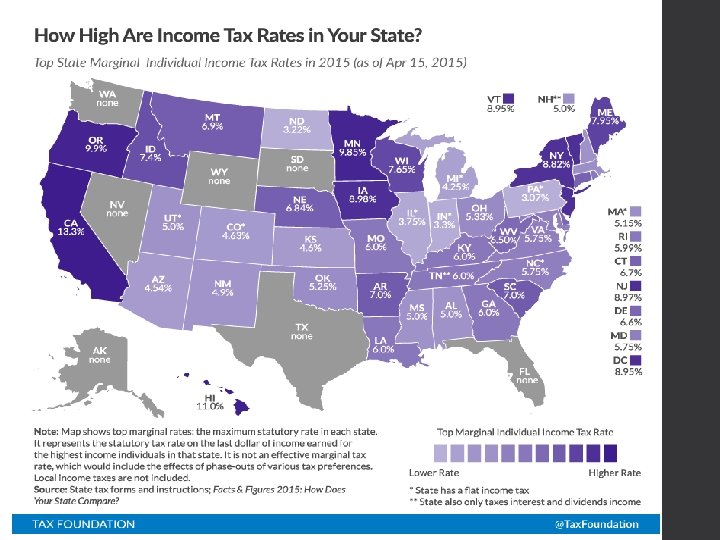

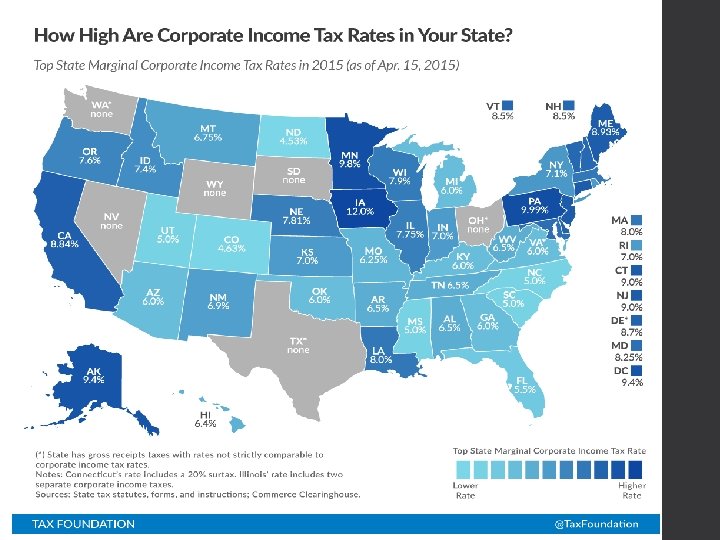

What are the types of taxes? � Individual Income Tax: Largest Source of Revenue � Corporate Income Tax: Corporate tax on net income � Social Insurance Tax: Social Security, Medicare, Unemployment � Excise Tax: Tax on manufacture, sale or import of goods � Estate (Death): Taxes on transfer of wealth after person dies � Customs Duties (tariff): Taxes on good brought into the U. S.

Why does the government borrow money? • Meet costs of crisis War Natural disasters Economic crisis • Finance large projects • Pay for deficit financing – spend more than income Entitlement programs (Social Security) Health Care reform

Complete your taxes! • Get with your groups from last class – push desks together so you look like you’re in a group! • File your taxes! 1040 EZ Instruction (google!) 1040 EZ Form Tax Scenario worksheet • What was challenging/easy about filing your taxes? • What is your overall impression of doing taxes?