TYPES OF ACCOUNTS AND RULES FOR DEBIT AND

TYPES OF ACCOUNTS AND RULES FOR DEBIT AND CREDIT Financial Management and Cost Accounting (DBM-422) A K JHA

Book Keeping The Double Entry System • Today's accounting system is based on the double entry system developed in the 15 th Century by Lucas Pacioli. • It states that each and every financial transaction that takes place in a business organization has two aspects (or two effects which are equal and opposite). – For example if furniture is purchased by cash, then furniture account increases but at the same time cash decreases by the same amount. • A dual or double entry system of accounting is defined as the system which recognizes and records both the aspects of transactions. • Double entry system is based on the principle that on a day, total amount debited is equal to the total amount credited.

Types of Accounts T-accounts (or Ledgers) • A given financial transaction has two aspects and it is bound to affect two concerned accounts. • The entries in the given account are made in a “T" – account. • It consists of two sides left side and right side. The left side is called debit side and the right side is called credit side. • Making an entry on the left side of T-account is called debiting the account, and in the same way making an entry on the right side of T- account is called crediting the account.

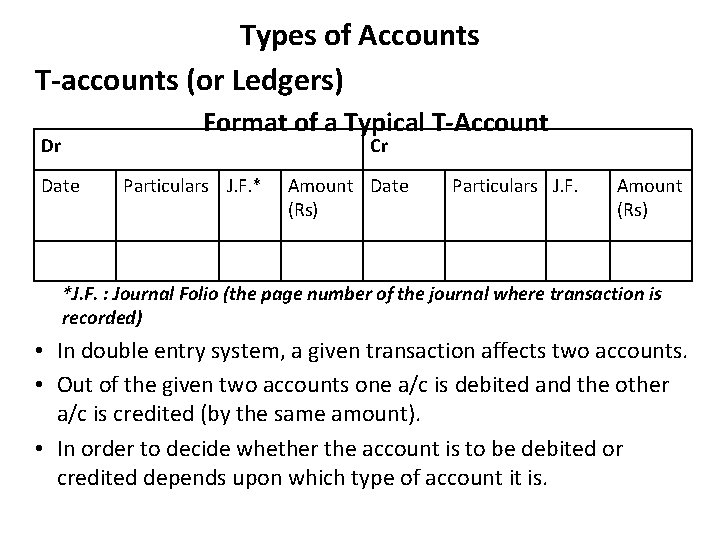

Types of Accounts T-accounts (or Ledgers) Format of a Typical T-Account Dr Cr Date Particulars J. F. * Amount Date (Rs) Particulars J. F. Amount (Rs) *J. F. : Journal Folio (the page number of the journal where transaction is recorded) • In double entry system, a given transaction affects two accounts. • Out of the given two accounts one a/c is debited and the other a/c is credited (by the same amount). • In order to decide whether the account is to be debited or credited depends upon which type of account it is.

Types of Accounts There are three types of accounts 1. Personal Accounts The accounts of all those persons organizations / entities from whom the company has either to receive money or has to pay money, are called personal accounts. 2. Real Accounts The firm also owns property like land, building, plant and machinery, stock, cash etc. The accounts of various assets or property acquired by the firm, are classified as Real account. 3. Nominal Accounts The accounts of various items which represent either income and gain or expenses and loss of the firm are nominal accounts. For example accounts of rent, wages, salary, telephone bills are classified as nominal accounts. Similarly dividend received a/c. interest earned a/c, commission a/c are also nominal accounts.

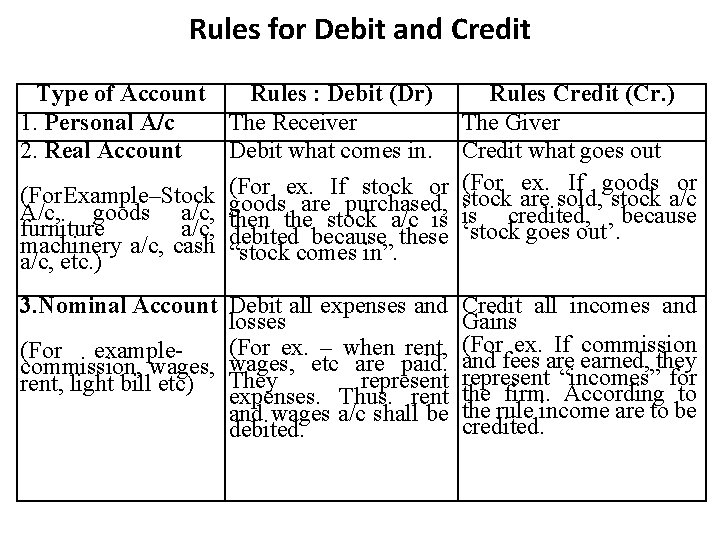

Rules for Debit and Credit Type of Account Rules : Debit (Dr) 1. Personal A/c The Receiver 2. Real Account Debit what comes in. ex. If stock or (For Example–Stock (For are purchased, A/c, goods a/c, goods the stock a/c is furniture a/c, then because these machinery a/c, cash debited “stock comes in”. a/c, etc. ) Rules Credit (Cr. ) The Giver Credit what goes out (For ex. If goods or stock are sold, stock a/c is credited, because ‘stock goes out’. 3. Nominal Account Debit all expenses and losses (For example- (For ex. – when rent, commission, wages, etc are paid. represent rent, light bill etc) They expenses. Thus. rent and wages a/c shall be debited. Credit all incomes and Gains (For ex. If commission and fees are earned, they represent “incomes” for the firm. According to the rule income are to be credited.

Document used to Record (or capture) the details of a given transaction are • Payment Voucher: A payment voucher records all the details of a particular transaction whenever a payment is made by the company. • Money Receipt: Whenever the company receives cash/cheque etc from any person / organization, then it gives a receipt to the person / organization. • Journal Voucher: An internal transaction of the company which does not involve cash receipt or cash payment is to be recorded in a journal voucher.

- Slides: 7