Trade and Protectionism A 2 Economics revision presentation

- Slides: 14

Trade and Protectionism A 2 Economics revision presentation on aspects of protectionism in international trade

Main methods of trade barriers / import controls • Tariffs (import duties) - import taxes • Quotas - quantitative limits on the level of imports allowed • Voluntary Export Restraint Arrangements • Embargoes - a total ban on imported goods • Subsidies - a government payment to encourage domestic production by lowering their costs • Import licensing - governments grants importers the license to import goods • Exchange controls - limiting the amount of foreign exchange that can move between countries. The UK abolished foreign exchange controls in October 1979

Is There An Economic Rationale for Import Controls? • Changing comparative advantage • Infant-Industry Argument • Balance of Payments Adjustment • Desire to control the growth of imports to improve the trade balance • Response to “Dumping” • Predatory pricing by overseas suppliers • Off-loading of excess capacity at below cost-price • Employment protection • Fear of structural unemployment in declining sectors (I. e. occupational immobility of labour and capital) • Social costs of unemployment resulting from increased import penetration in particular industries • Desire to increase government revenue • Attempt to encourage import substitution

Dumping • If a company exports a product at a price lower than the price it normally charges on its own home market, it is said to be “dumping” the product. • In the short term, consumers benefit from the low prices of the foreign goods, but in the longer term, persistent undercutting of domestic prices will force the domestic industry out of business and allow the foreign firm to establish itself as a monopoly • The World Trade Organisation allows a government to act against dumping where there is genuine ‘material’ injury to the competing domestic industry

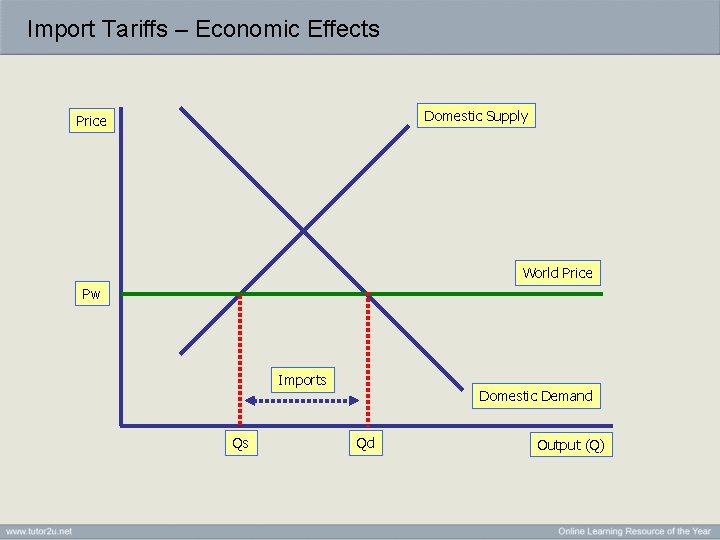

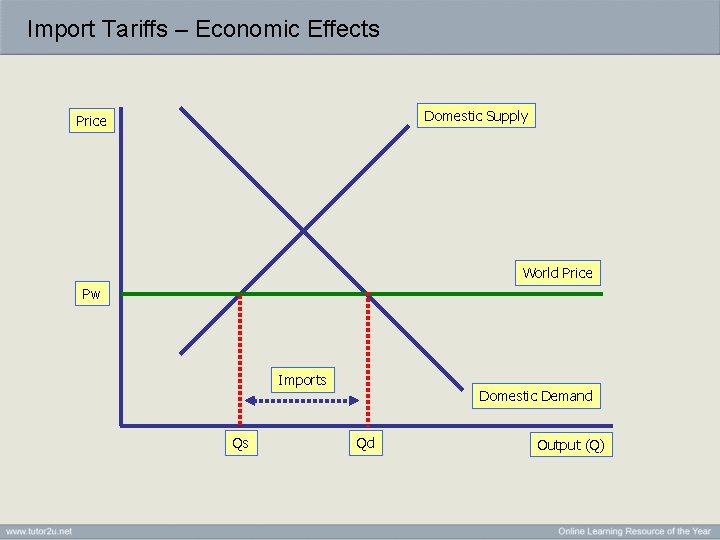

Import Tariffs – Economic Effects Domestic Supply Price World Price Pw Imports Qs Domestic Demand Qd Output (Q)

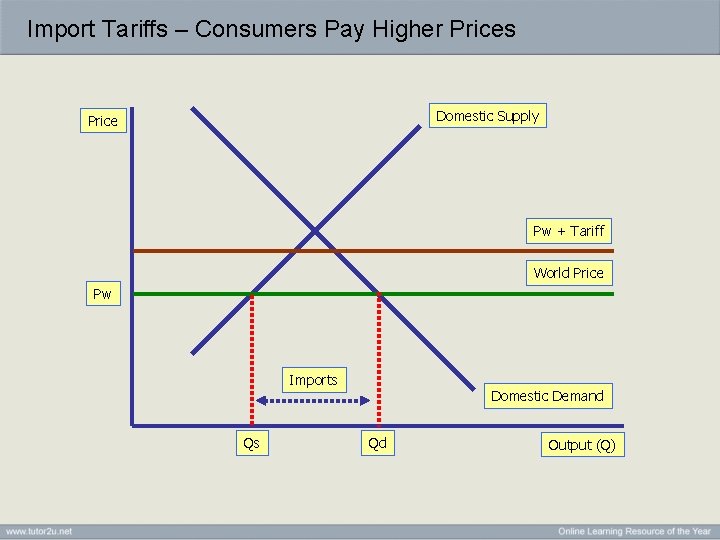

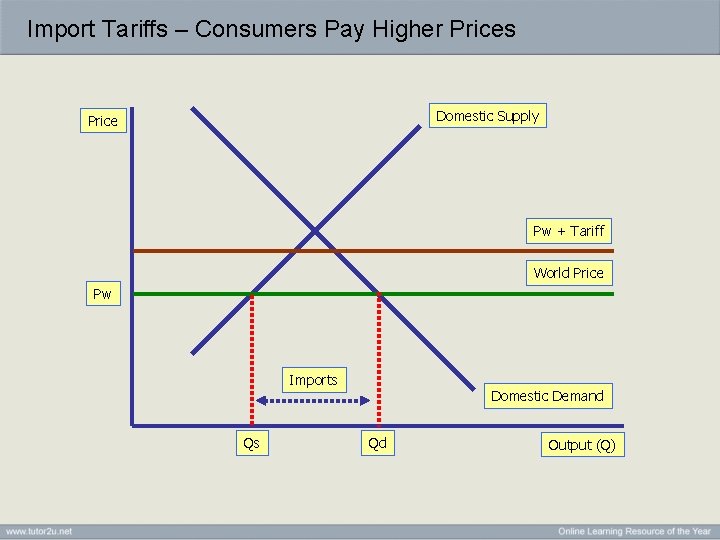

Import Tariffs – Consumers Pay Higher Prices Domestic Supply Price Pw + Tariff World Price Pw Imports Qs Domestic Demand Qd Output (Q)

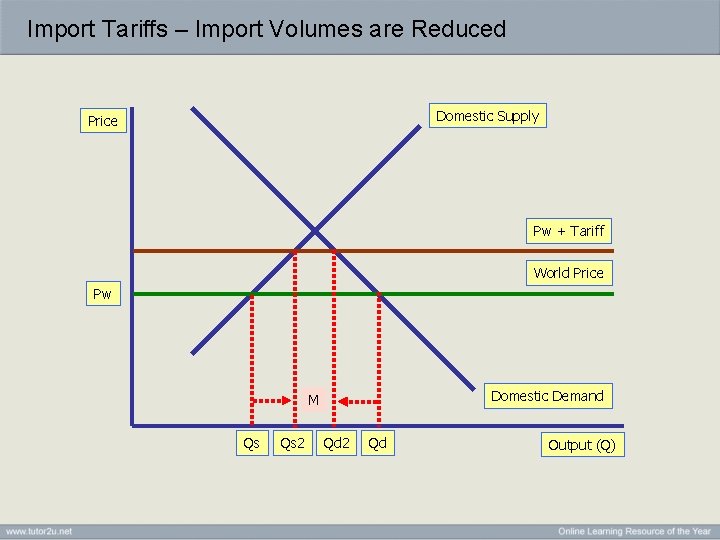

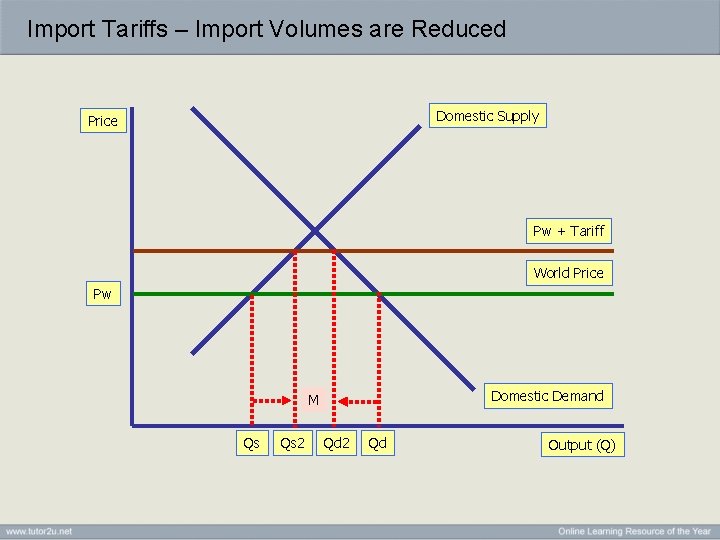

Import Tariffs – Import Volumes are Reduced Domestic Supply Price Pw + Tariff World Price Pw Domestic Demand M Qs Qs 2 Qd Output (Q)

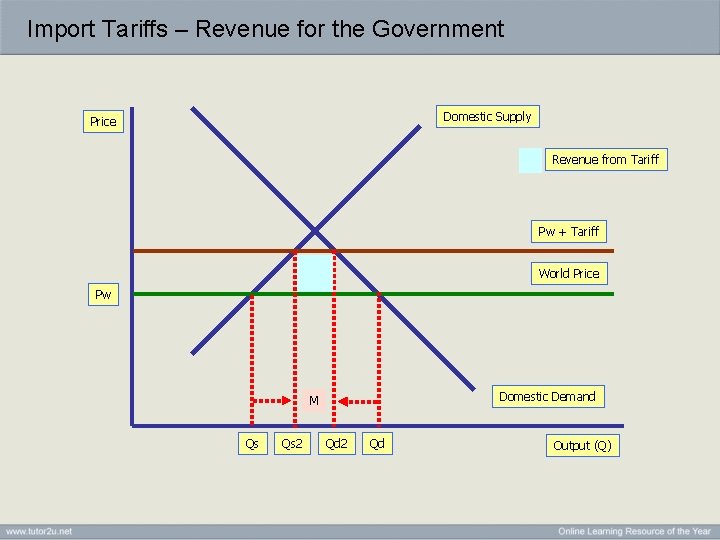

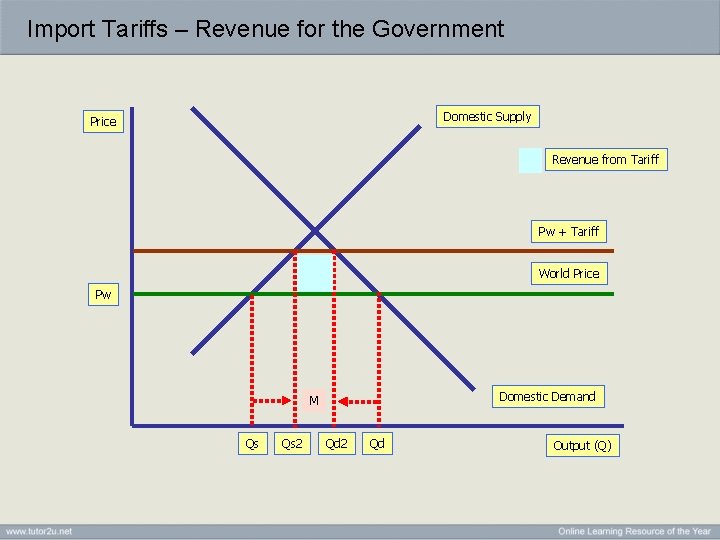

Import Tariffs – Revenue for the Government Domestic Supply Price Revenue from Tariff Pw + Tariff World Price Pw Domestic Demand M Qs Qs 2 Qd Output (Q)

The Case Against Import Controls • Protection is a ‘second best’ approach to controlling trade flows and improving the Bo. P • Welfare losses for consumers (higher prices) • World multiplier effects from reduction in trade • Threat of retaliation “beggar thy neighbour policies” • Import controls cushions producer “X” inefficiency – in this sense, import controls act as a “barrier to entry” in a market • Bureaucracy of administering import controls

Further Distortions to Trade – Non-Tariff Barriers • Non-Tariff Barriers (NTB) proliferate even when standard tariff barriers have been reduced / eliminated • Examples: – Different legal and technical standards between countries – Export Subsidies – Government procurement policies favouring domestic firms – Research and development subsidies – Different labour market regulations – Language barriers are also effectively a non-tariff barrier – particularly in industries where personal communication is important (e. g. when consumers are buying financial services)

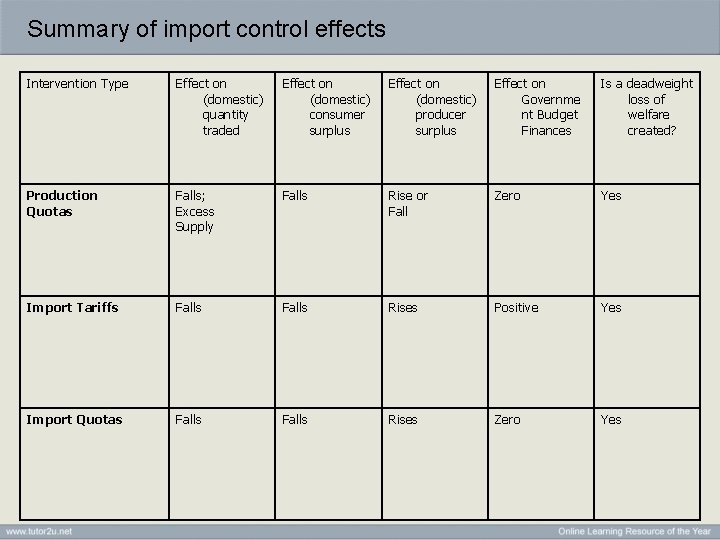

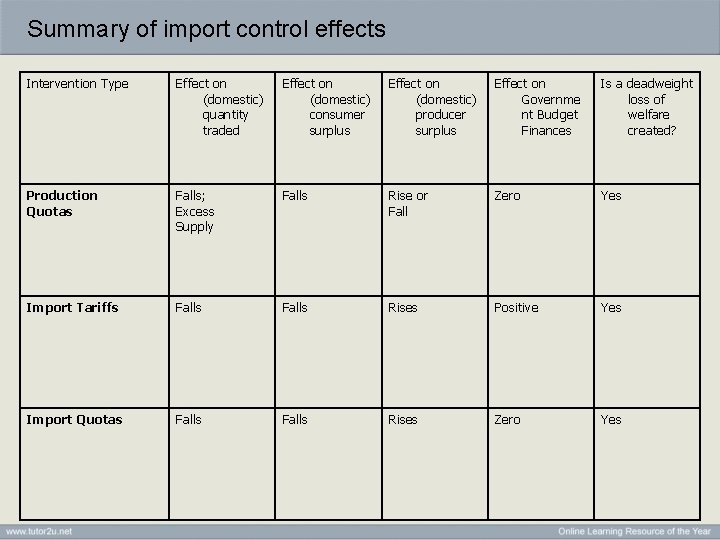

Summary of import control effects Intervention Type Effect on (domestic) quantity traded Effect on (domestic) consumer surplus Effect on (domestic) producer surplus Effect on Governme nt Budget Finances Is a deadweight loss of welfare created? Production Quotas Falls; Excess Supply Falls Rise or Fall Zero Yes Import Tariffs Falls Rises Positive Yes Import Quotas Falls Rises Zero Yes

DTI on the “folly of protectionism” • The folly of protection has been confirmed by a range of studies from around the world. These indicate that it has brought few benefits but imposed substantial costs. • Protection has proved an ineffective means of sustaining employment. Trade barriers in the form of tariffs distort domestic markets, pushing up the prices faced by consumers and insulating inefficient sectors from competition. They penalise foreign producers and encourage the inefficient allocation of resources both domestically and globally. • There are no rich closed economies. DTI Policy on International Trade

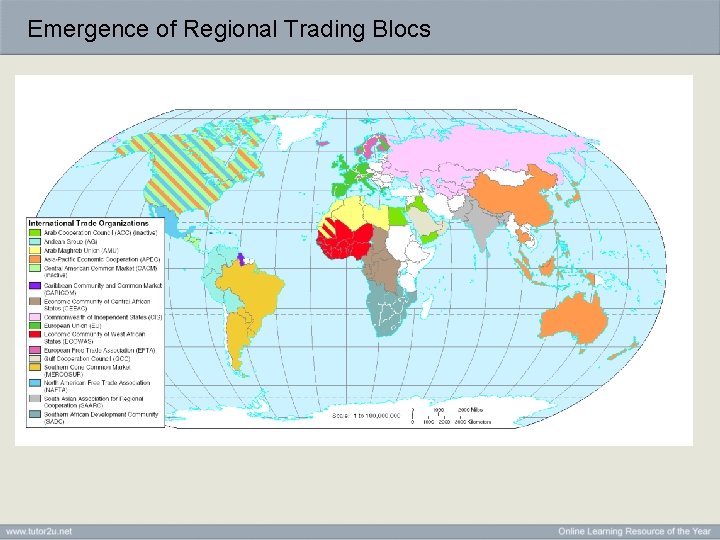

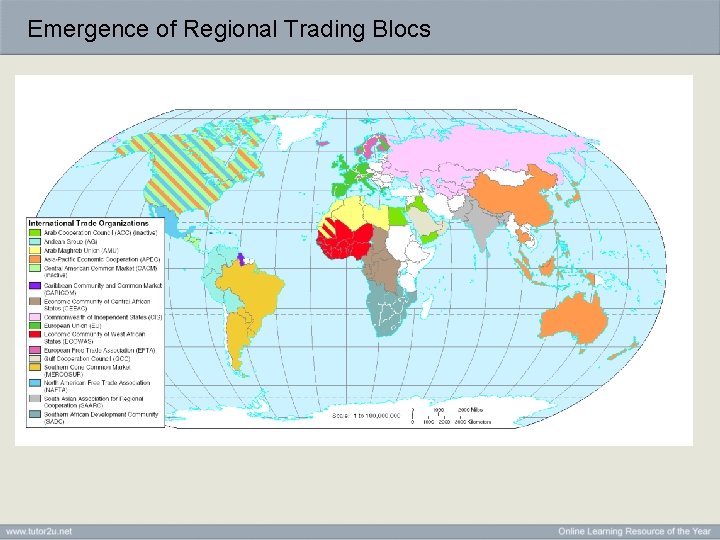

Emergence of Regional Trading Blocs

Regional Trading Agreements • The European Union • The European Free Trade Association (EFTA) • The North American Free Trade Agreement (NAFTA) • The Southern Common Market (MERCOSUR) • The Association of Southeast Asian Nations (ASEAN) Free Trade Area (AFTA) • The Common Market of Eastern and Southern Africa (COMESA)