Topic Uncertainty Uncertainty is Pervasive u What is

- Slides: 72

Topic Uncertainty

Uncertainty is Pervasive u What is uncertain in economic systems? – tomorrow’s prices – future wealth – future availability of commodities – present and future actions of other people.

Uncertainty is Pervasive u What are rational responses to uncertainty? – buying insurance (health, life, auto) – a portfolio of contingent consumption goods.

States of Nature u Possible states of Nature: – “car accident” (a) – “no car accident” (na). u Accident occurs with probability a, does not with probability na ; a + na = 1. u Accident causes a loss of Rs. L.

Contingencies u. A contract implemented only when a particular state of Nature occurs is state-contingent. u E. g. the insurer pays only if there is an accident.

Contingencies u. A state-contingent consumption plan is implemented only when a particular state of Nature occurs. u E. g. take a vacation only if there is no accident.

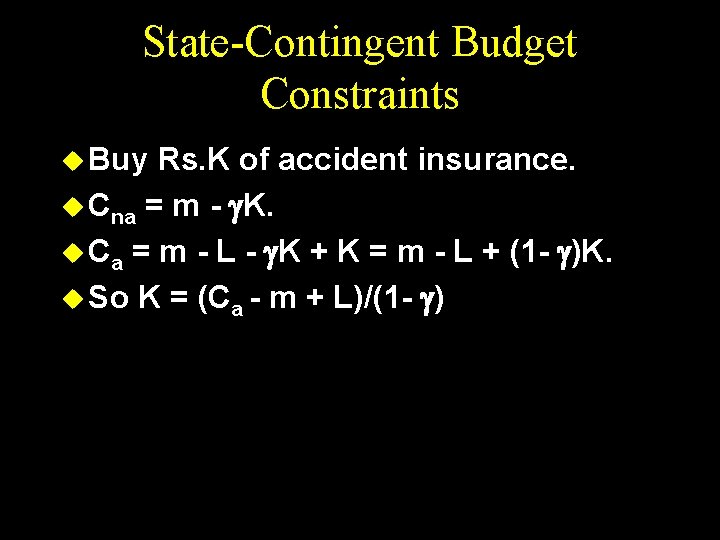

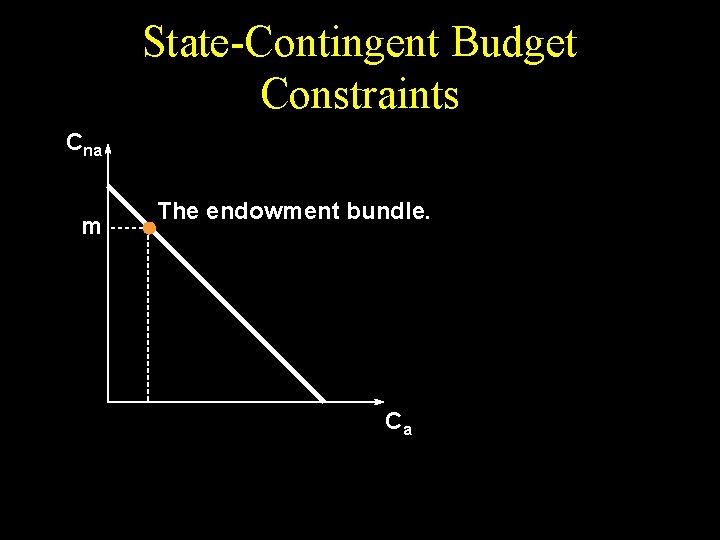

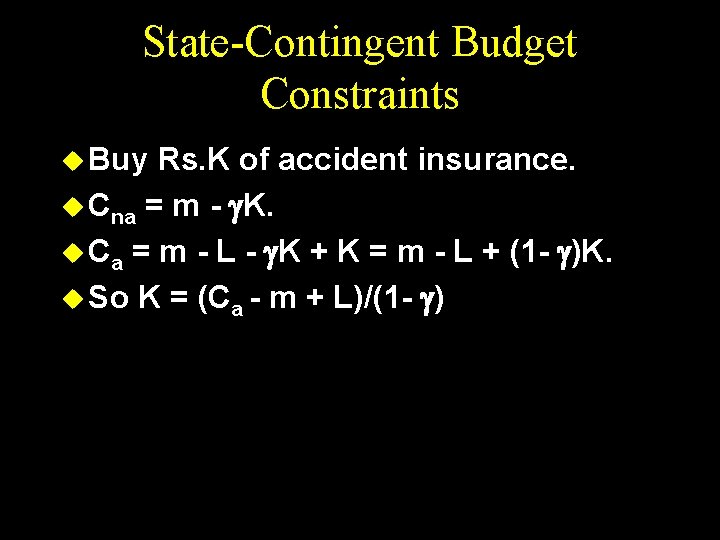

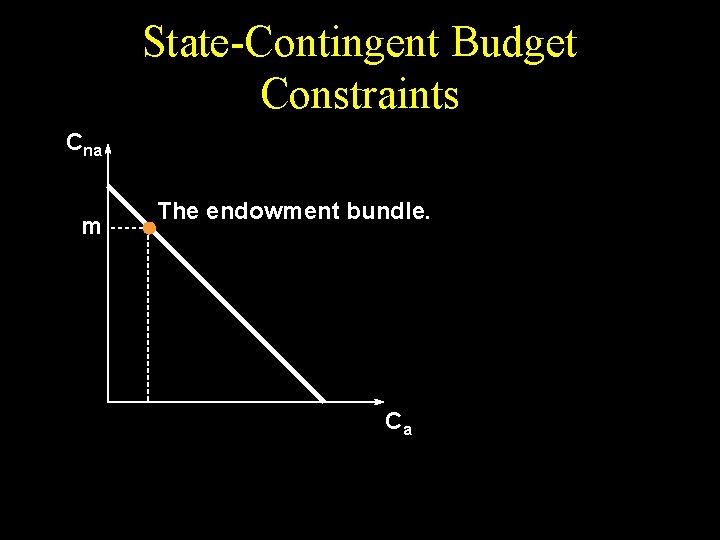

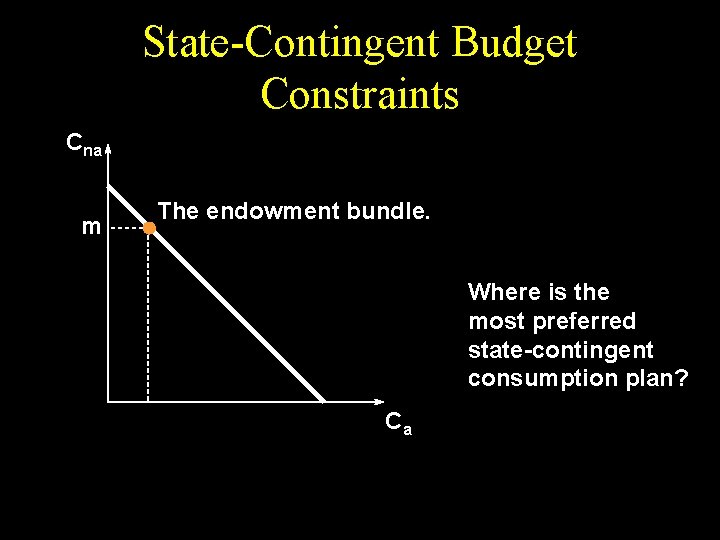

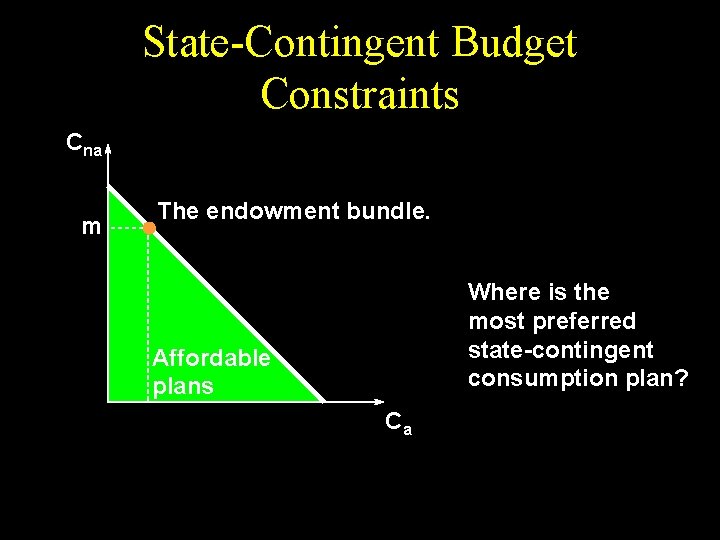

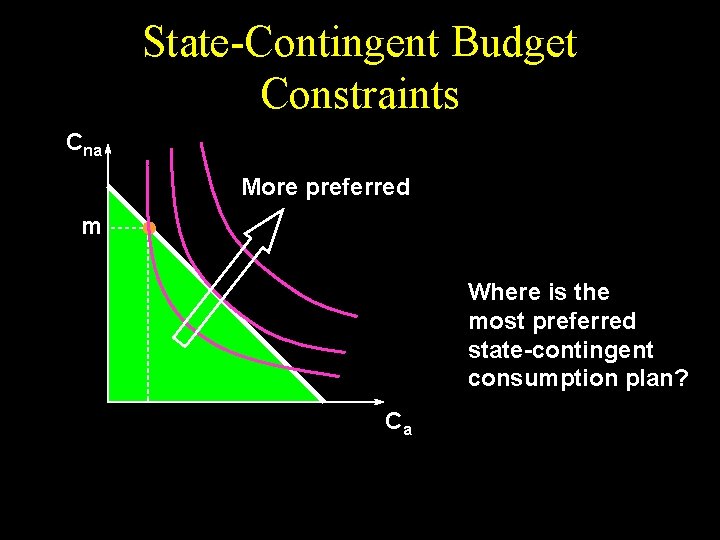

State-Contingent Budget Constraints u Each Rs. 1 of accident insurance costs . u Consumer has Rs. m of wealth. u Cna is consumption value in the noaccident state. u Ca is consumption value in the accident state.

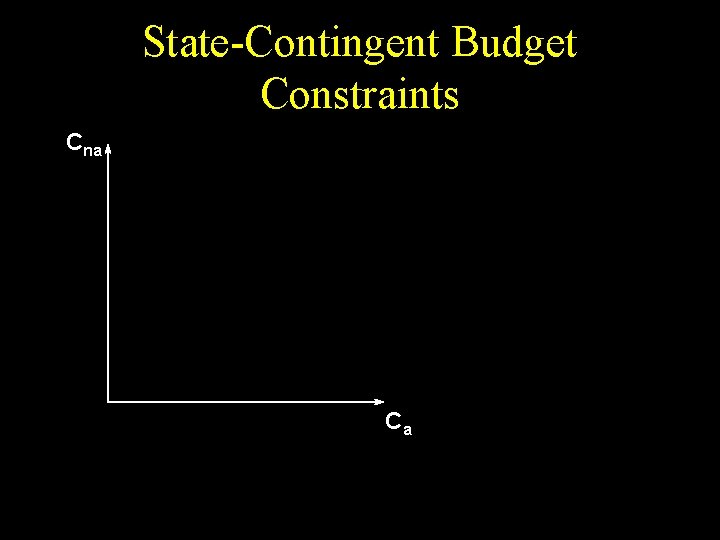

State-Contingent Budget Constraints Cna Ca

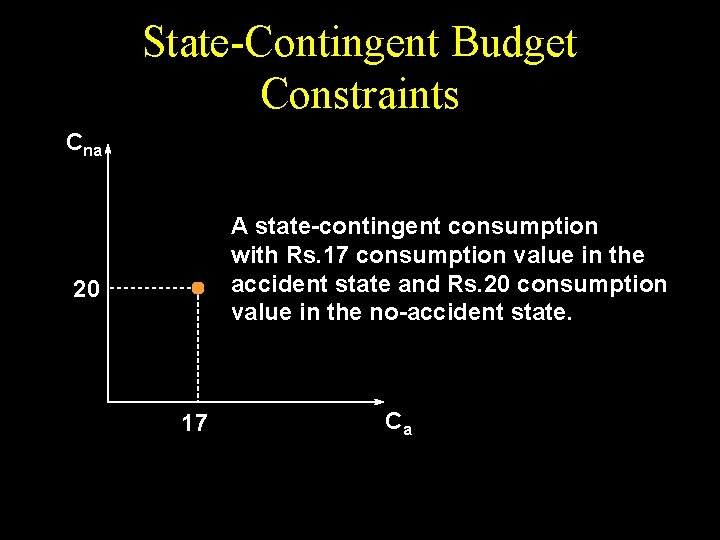

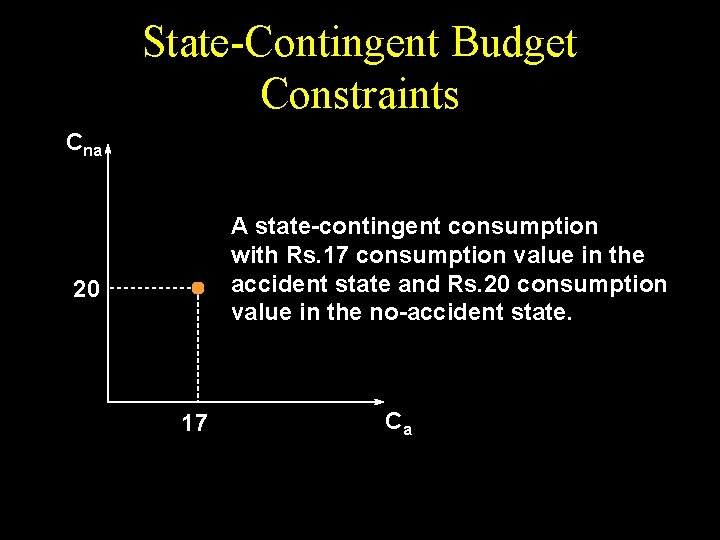

State-Contingent Budget Constraints Cna A state-contingent consumption with Rs. 17 consumption value in the accident state and Rs. 20 consumption value in the no-accident state. 20 17 Ca

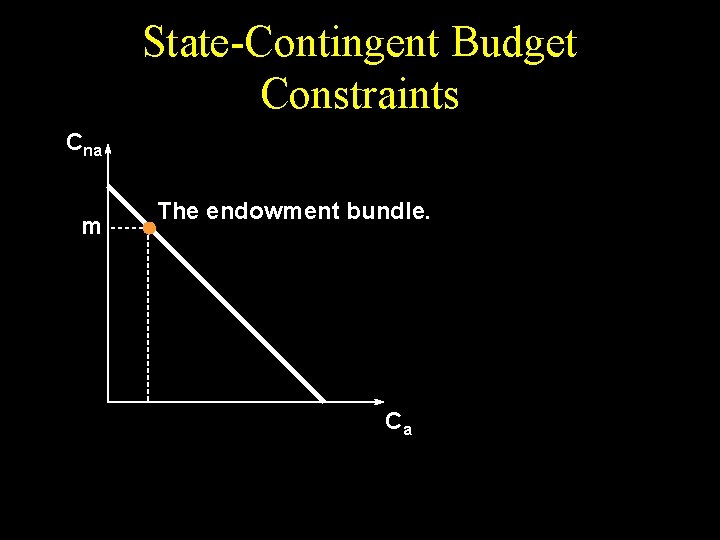

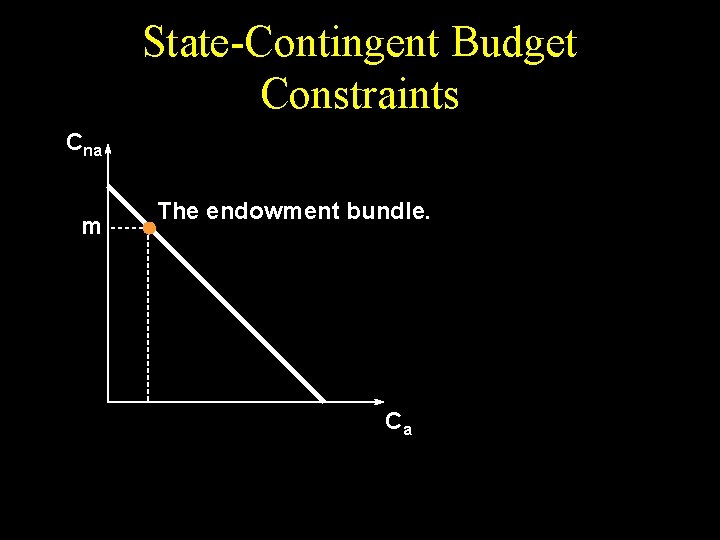

State-Contingent Budget Constraints u Without insurance, u Ca = m - L u Cna = m.

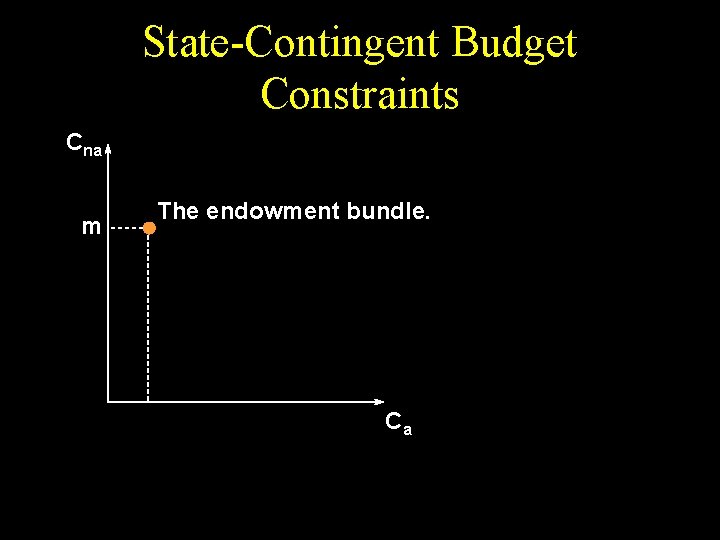

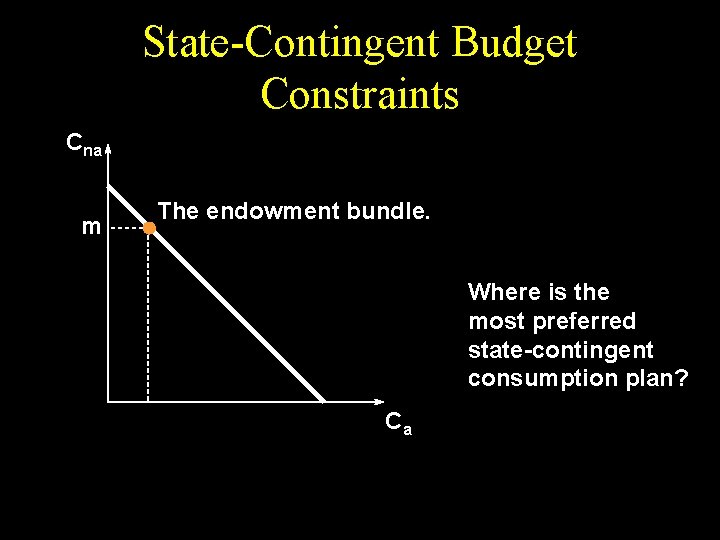

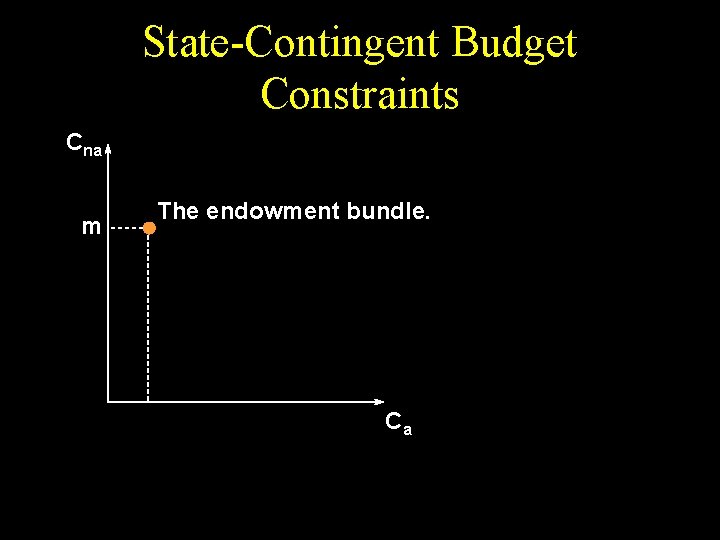

State-Contingent Budget Constraints Cna m The endowment bundle. Ca

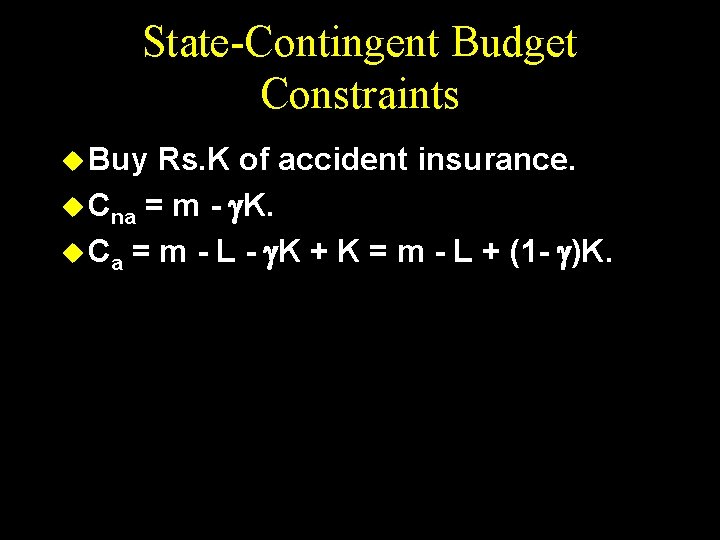

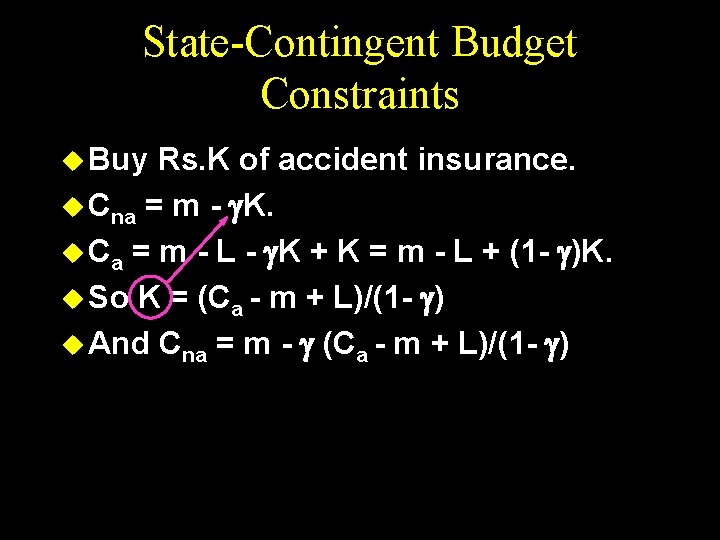

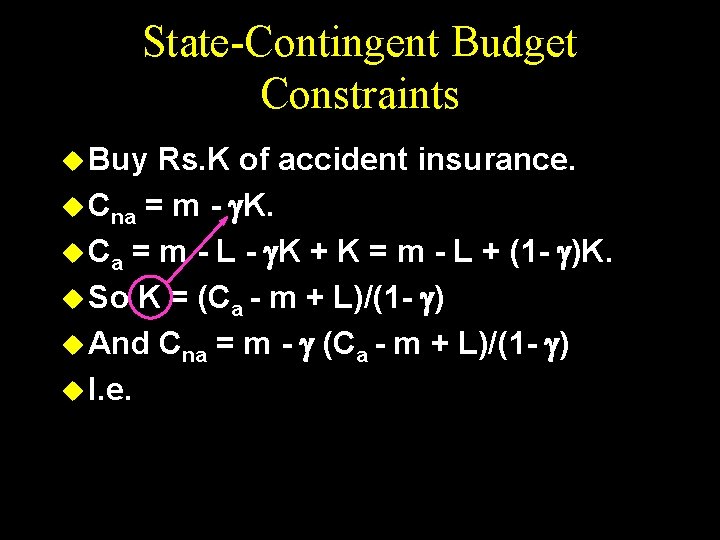

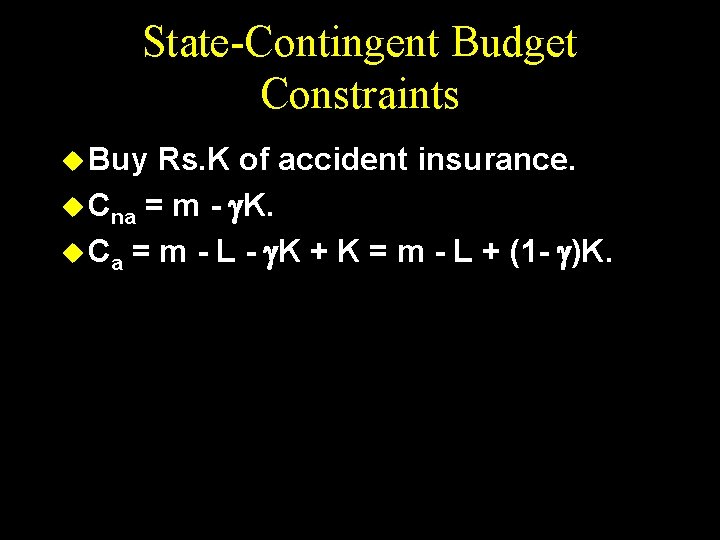

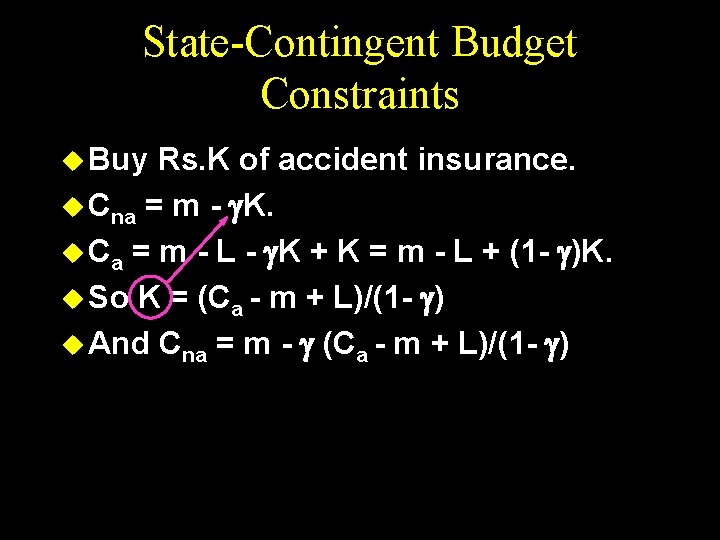

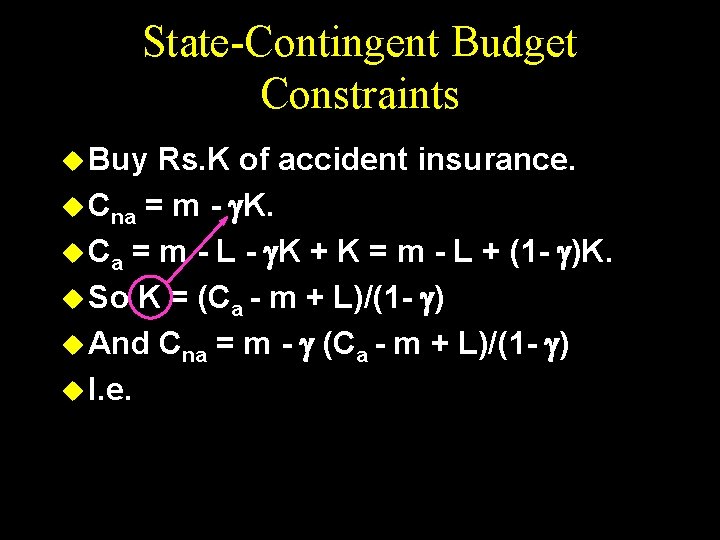

State-Contingent Budget Constraints u Buy Rs. K of accident insurance. u Cna = m - K. u Ca = m - L - K + K = m - L + (1 - )K.

State-Contingent Budget Constraints u Buy Rs. K of accident insurance. u Cna = m - K. u Ca = m - L - K + K = m - L + (1 - )K. u So K = (Ca - m + L)/(1 - )

State-Contingent Budget Constraints u Buy Rs. K of accident insurance. u Cna = m - K. u Ca = m - L - K + K = m - L + (1 - )K. u So K = (Ca - m + L)/(1 - ) u And Cna = m - (Ca - m + L)/(1 - )

State-Contingent Budget Constraints u Buy Rs. K of accident insurance. u Cna = m - K. u Ca = m - L - K + K = m - L + (1 - )K. u So K = (Ca - m + L)/(1 - ) u And Cna = m - (Ca - m + L)/(1 - ) u I. e.

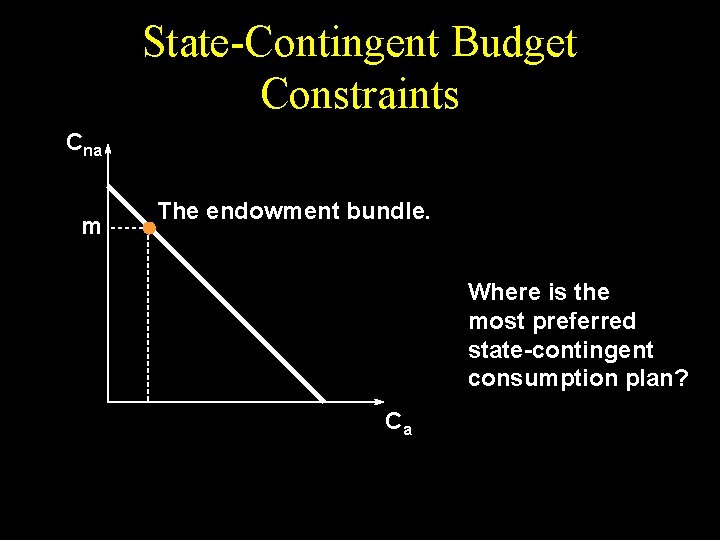

State-Contingent Budget Constraints Cna m The endowment bundle. Ca

State-Contingent Budget Constraints Cna m The endowment bundle. Ca

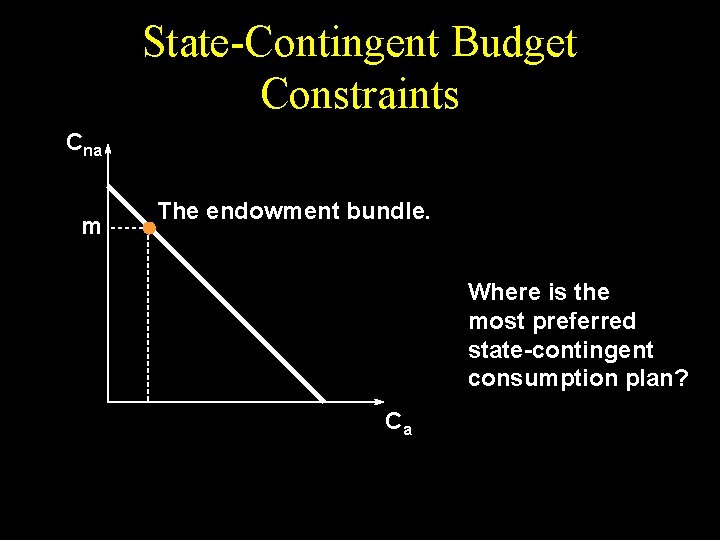

State-Contingent Budget Constraints Cna m The endowment bundle. Where is the most preferred state-contingent consumption plan? Ca

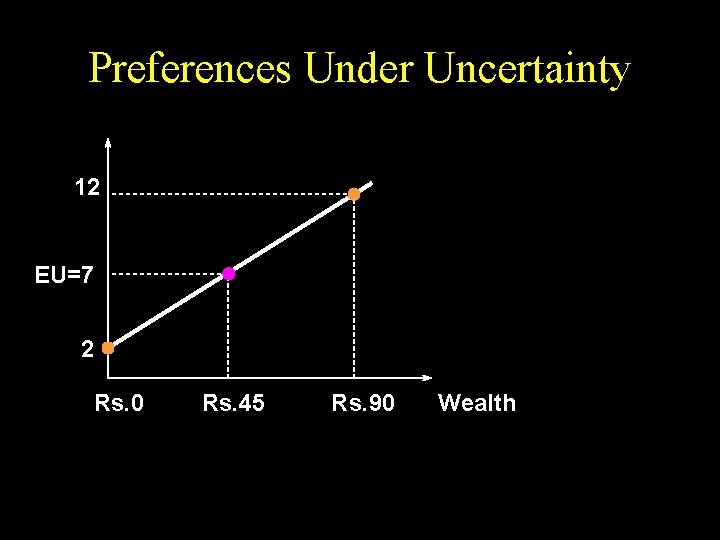

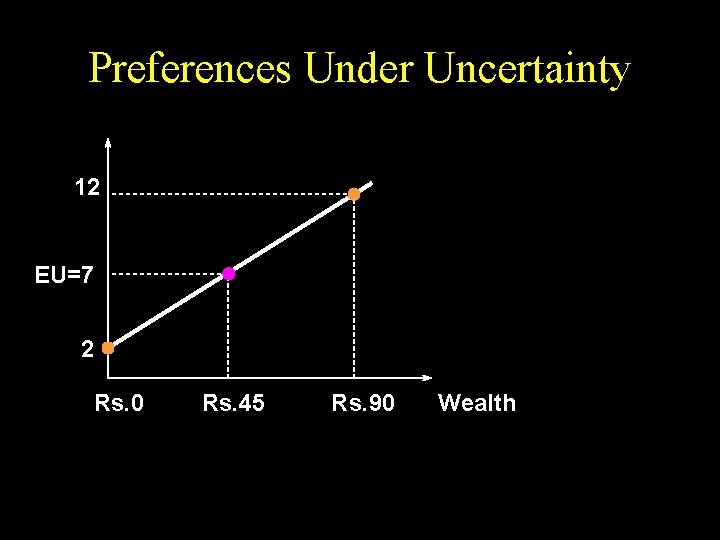

Preferences Under Uncertainty u Think of a lottery. u Win Rs. 90 with probability 1/2 and win Rs. 0 with probability 1/2. u U(Rs. 90) = 12, U(Rs. 0) = 2. u Expected utility is

Preferences Under Uncertainty u Think of a lottery. u Win Rs. 90 with probability 1/2 and win Rs. 0 with probability 1/2. u U(Rs. 90) = 12, U(Rs. 0) = 2. u Expected utility is

Preferences Under Uncertainty u Think of a lottery. u Win Rs. 90 with probability 1/2 and win Rs. 0 with probability 1/2. u Expected money value of the lottery is

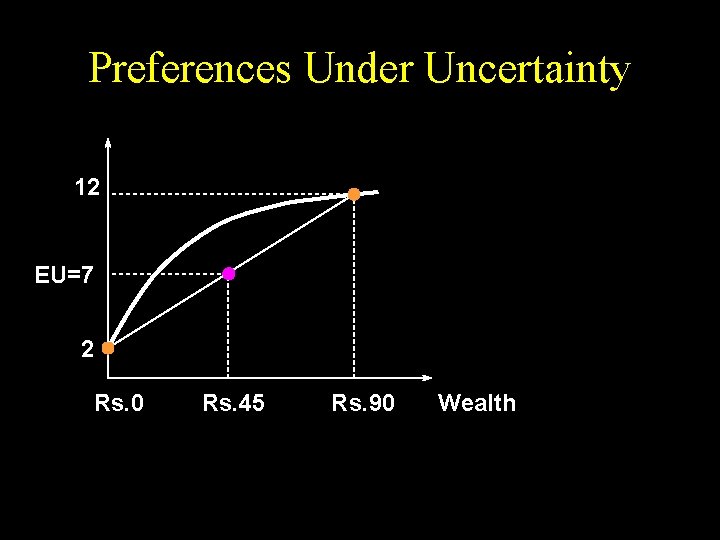

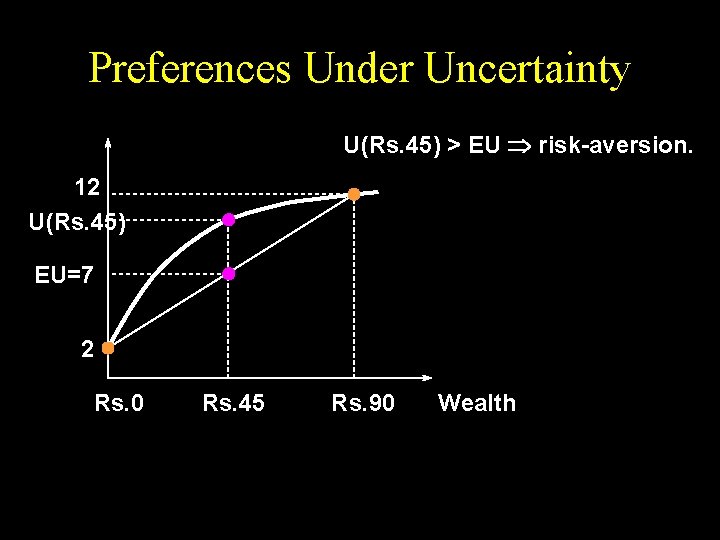

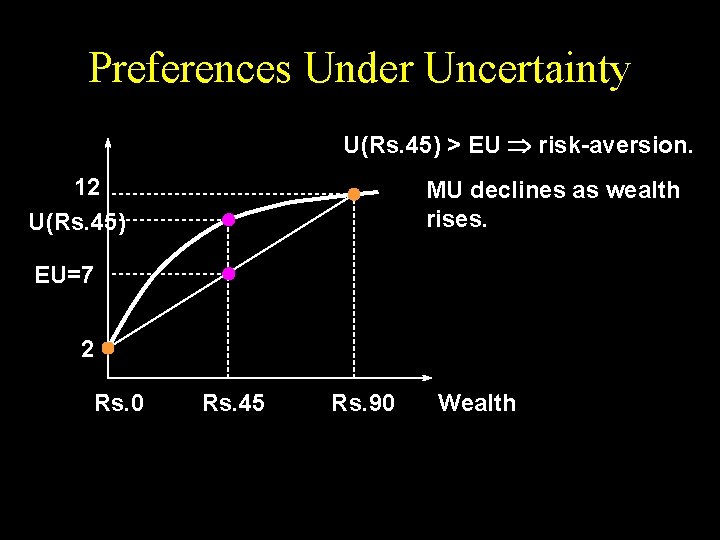

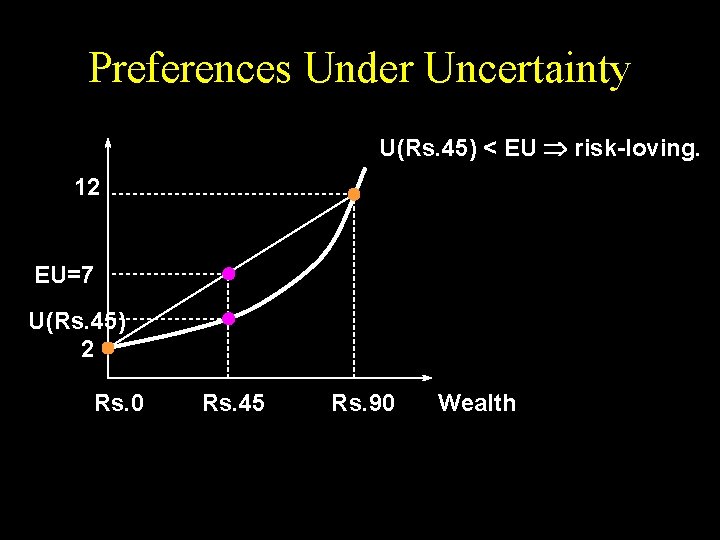

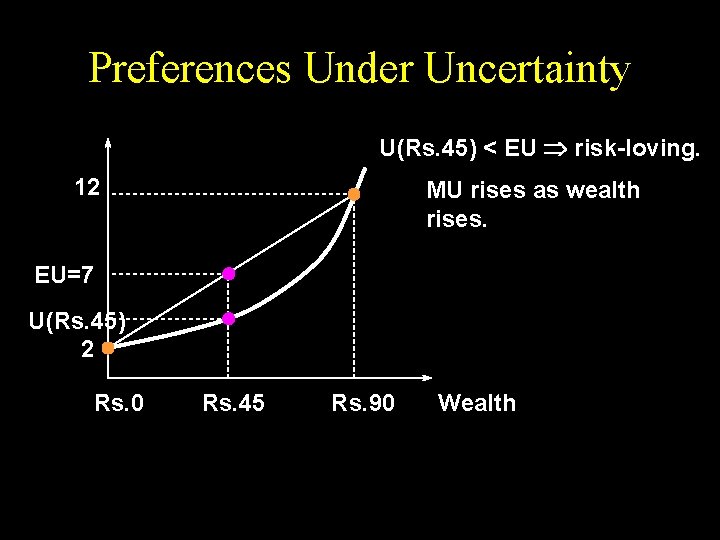

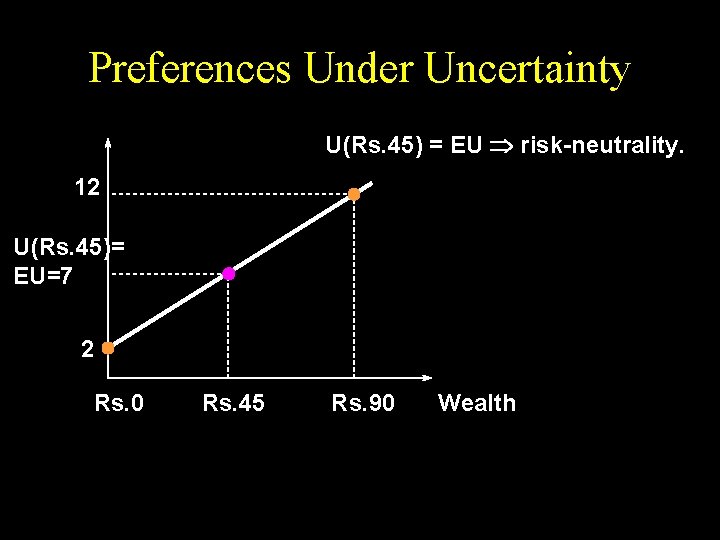

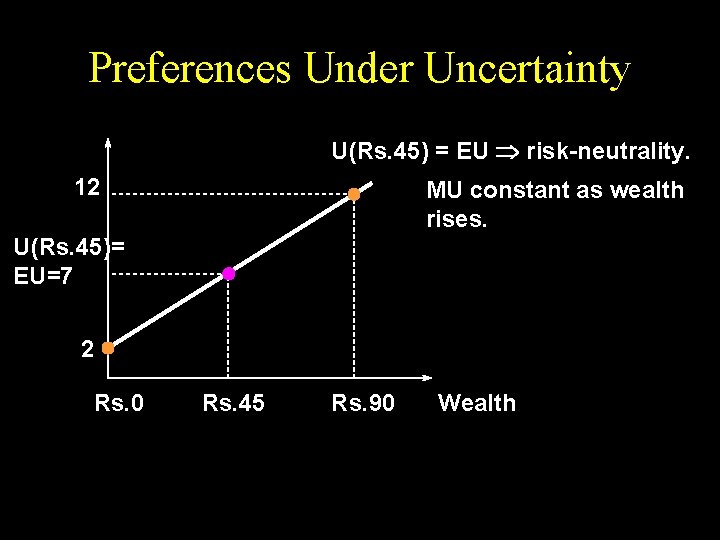

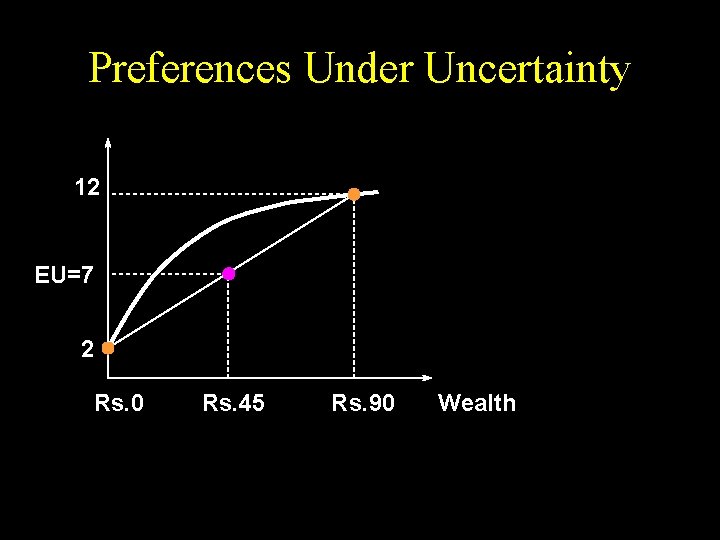

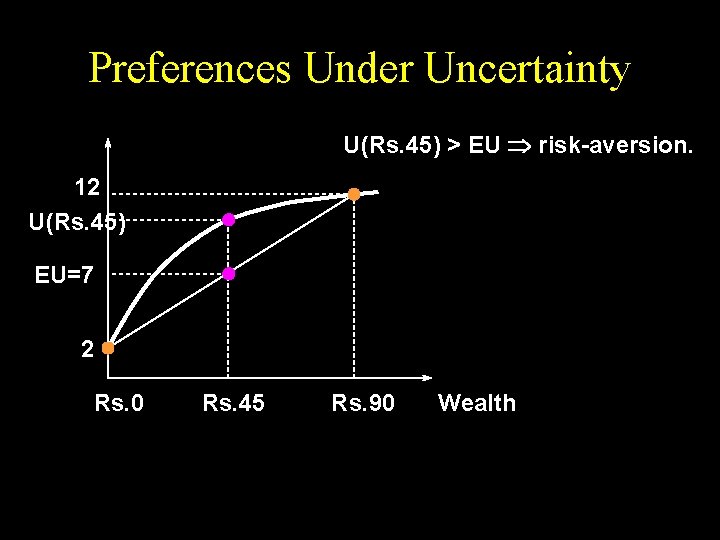

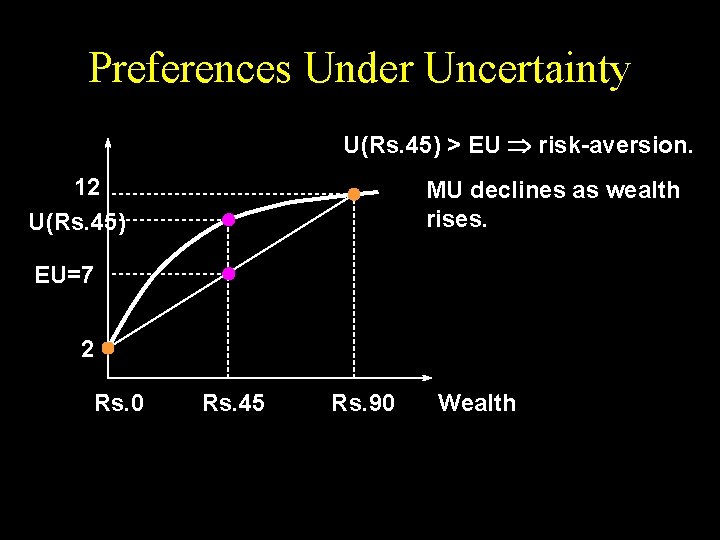

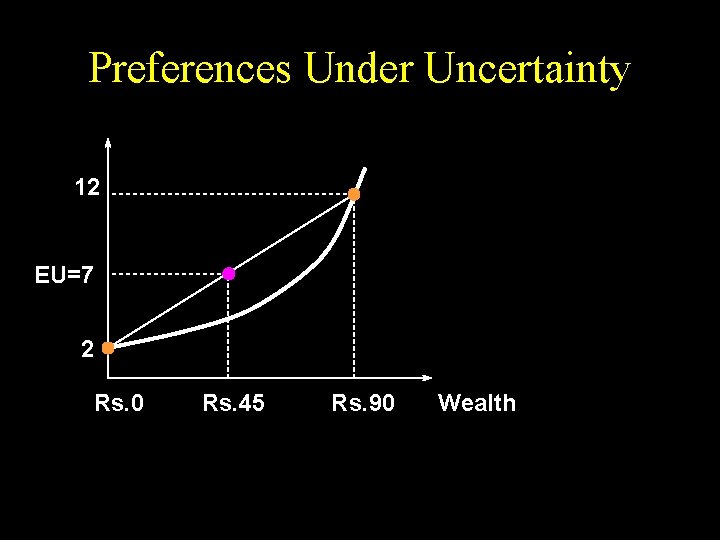

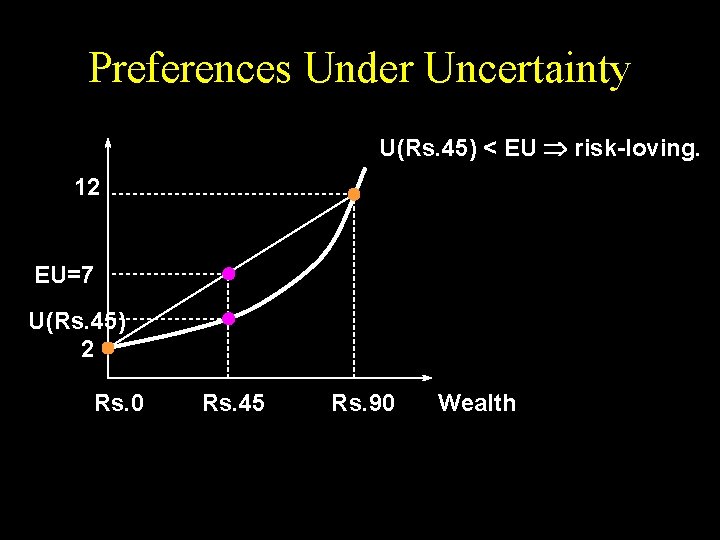

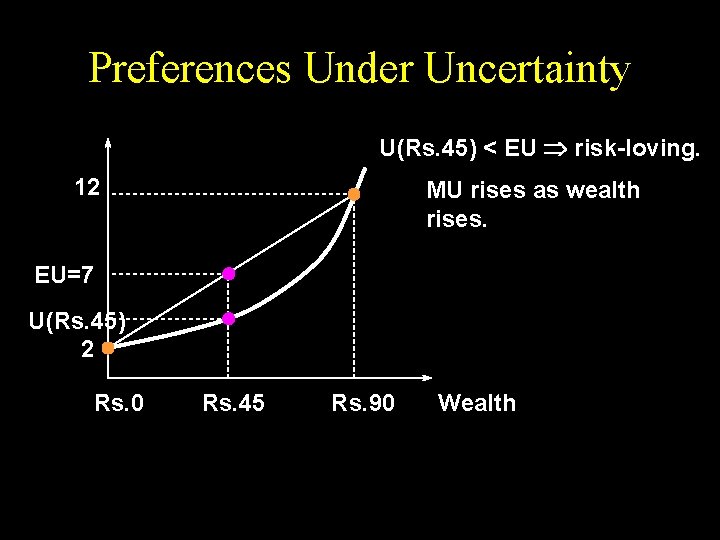

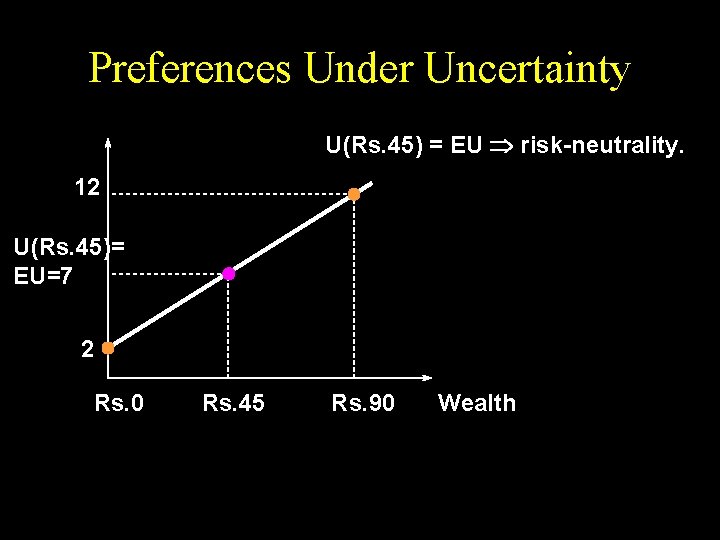

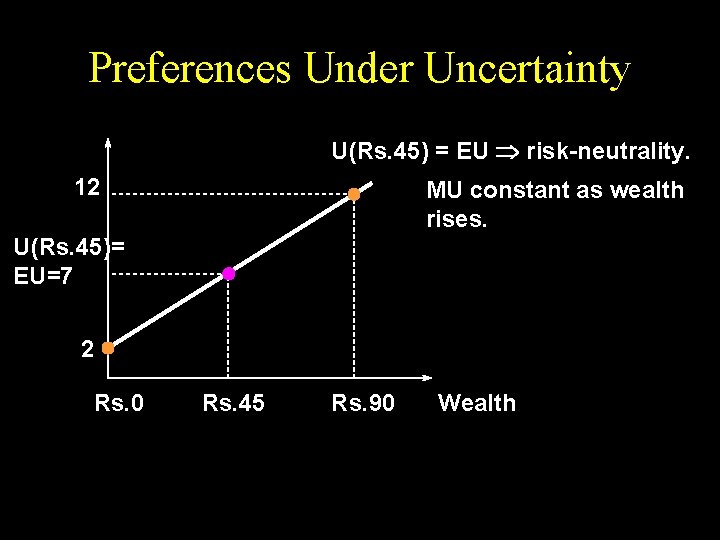

Preferences Under Uncertainty u EU = 7 and EM = Rs. 45. u U(Rs. 45) > 7 Rs. 45 for sure is preferred to the lottery risk-aversion. u U(Rs. 45) < 7 the lottery is preferred to Rs. 45 for sure risk-loving. u U(Rs. 45) = 7 the lottery is preferred equally to Rs. 45 for sure riskneutrality.

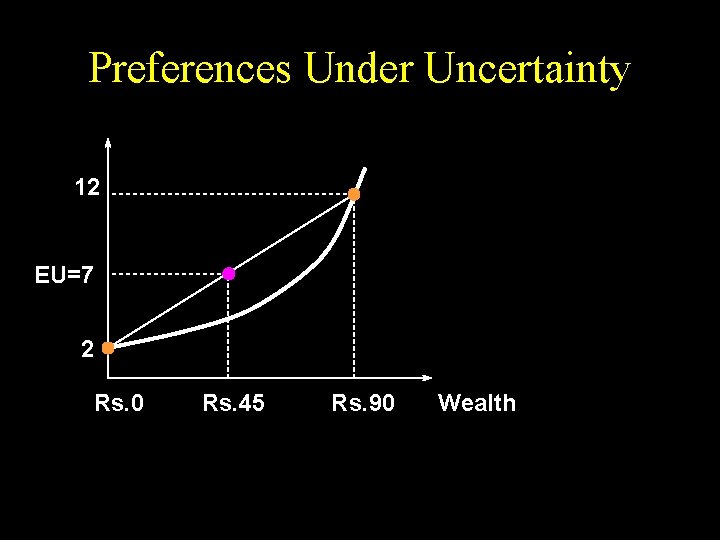

Preferences Under Uncertainty 12 EU=7 2 Rs. 0 Rs. 45 Rs. 90 Wealth

Preferences Under Uncertainty U(Rs. 45) > EU risk-aversion. 12 U(Rs. 45) EU=7 2 Rs. 0 Rs. 45 Rs. 90 Wealth

Preferences Under Uncertainty U(Rs. 45) > EU risk-aversion. 12 U(Rs. 45) MU declines as wealth rises. EU=7 2 Rs. 0 Rs. 45 Rs. 90 Wealth

Preferences Under Uncertainty 12 EU=7 2 Rs. 0 Rs. 45 Rs. 90 Wealth

Preferences Under Uncertainty U(Rs. 45) < EU risk-loving. 12 EU=7 U(Rs. 45) 2 Rs. 0 Rs. 45 Rs. 90 Wealth

Preferences Under Uncertainty U(Rs. 45) < EU risk-loving. 12 MU rises as wealth rises. EU=7 U(Rs. 45) 2 Rs. 0 Rs. 45 Rs. 90 Wealth

Preferences Under Uncertainty 12 EU=7 2 Rs. 0 Rs. 45 Rs. 90 Wealth

Preferences Under Uncertainty U(Rs. 45) = EU risk-neutrality. 12 U(Rs. 45)= EU=7 2 Rs. 0 Rs. 45 Rs. 90 Wealth

Preferences Under Uncertainty U(Rs. 45) = EU risk-neutrality. 12 MU constant as wealth rises. U(Rs. 45)= EU=7 2 Rs. 0 Rs. 45 Rs. 90 Wealth

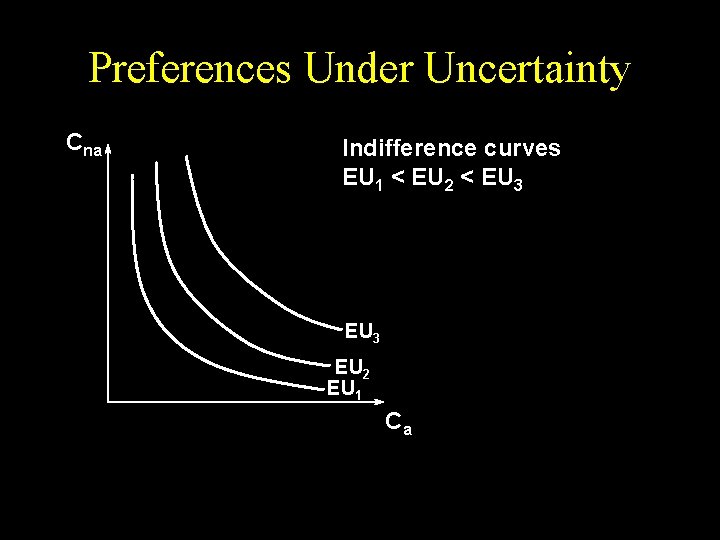

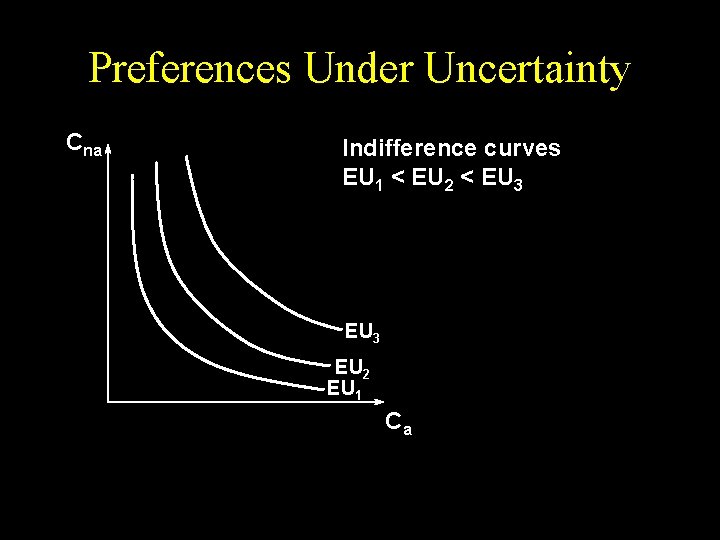

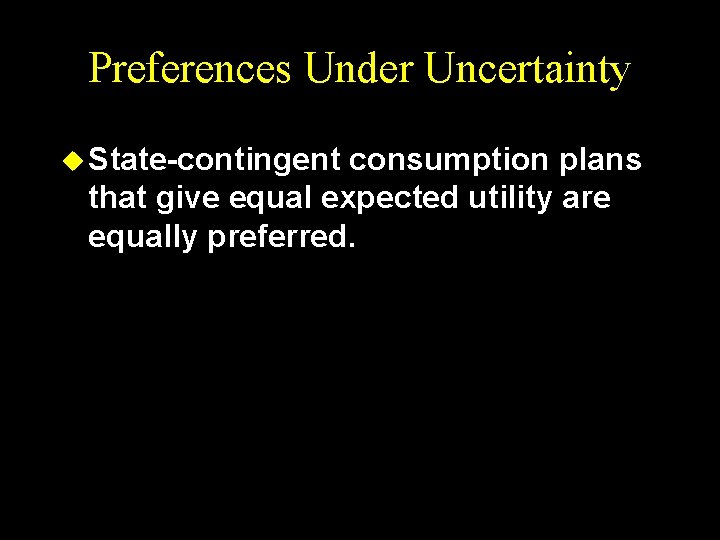

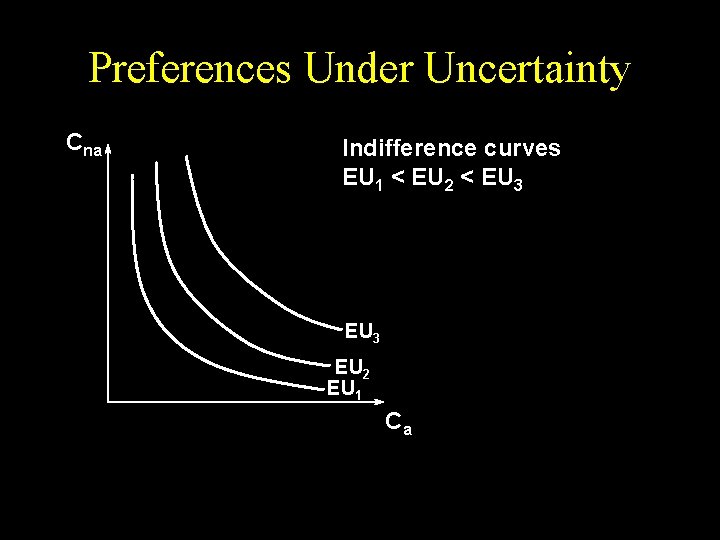

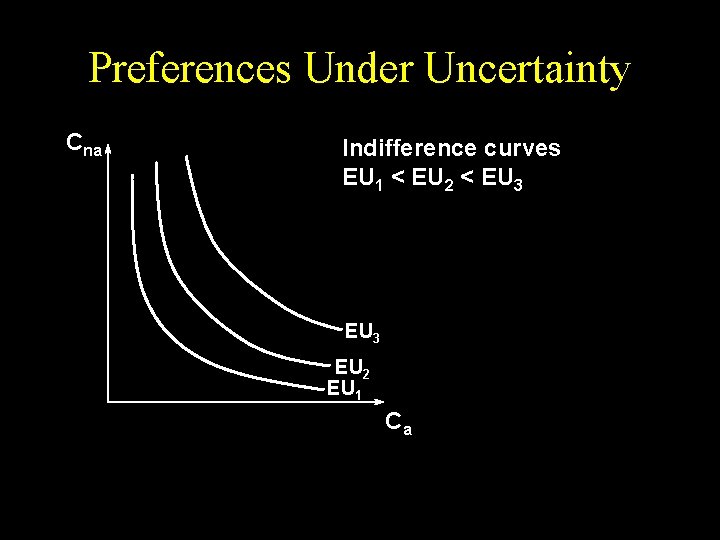

Preferences Under Uncertainty u State-contingent consumption plans that give equal expected utility are equally preferred.

Preferences Under Uncertainty Cna Indifference curves EU 1 < EU 2 < EU 3 EU 2 EU 1 Ca

Preferences Under Uncertainty u What is the MRS of an indifference curve? u Get consumption c 1 with prob. 1 and c 2 with prob. 2 ( 1 + 2 = 1). u EU = 1 U(c 1) + 2 U(c 2). u For constant EU, d. EU = 0.

Preferences Under Uncertainty

Preferences Under Uncertainty

Preferences Under Uncertainty

Preferences Under Uncertainty

Preferences Under Uncertainty

Preferences Under Uncertainty Cna Indifference curves EU 1 < EU 2 < EU 3 EU 2 EU 1 Ca

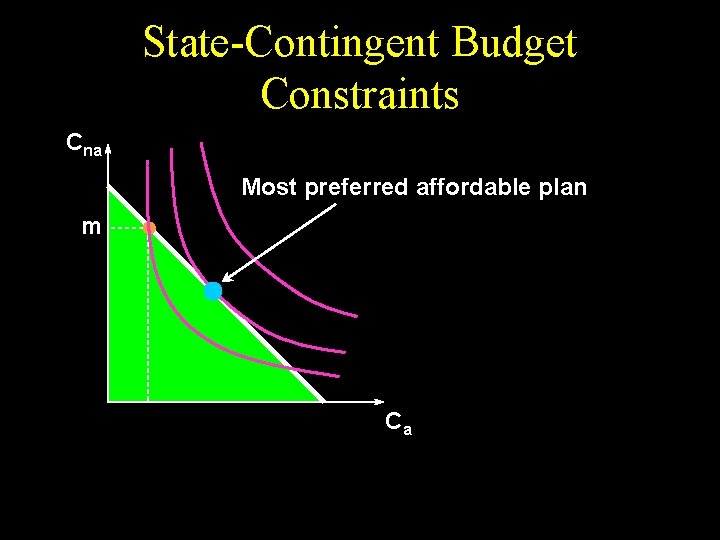

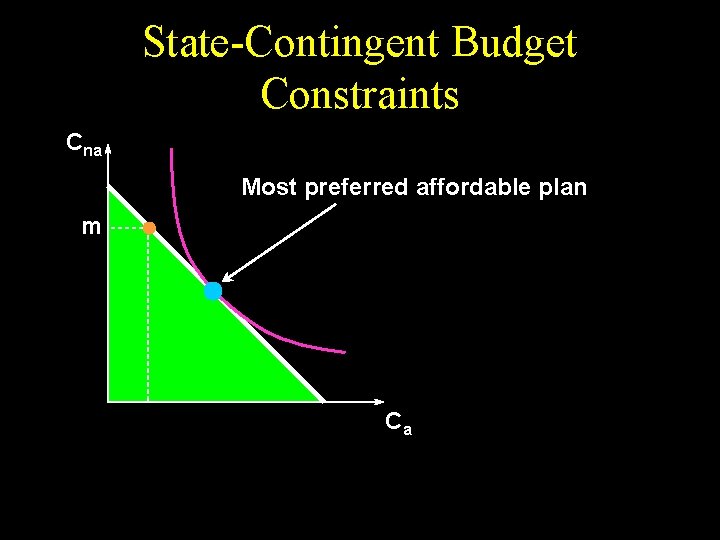

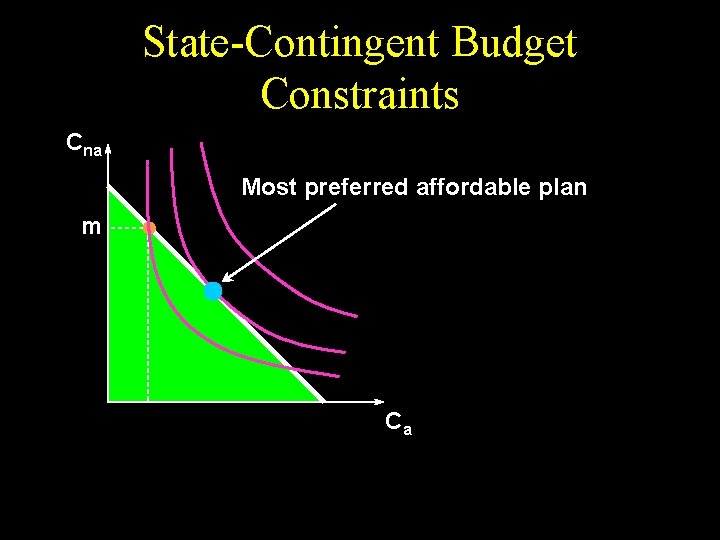

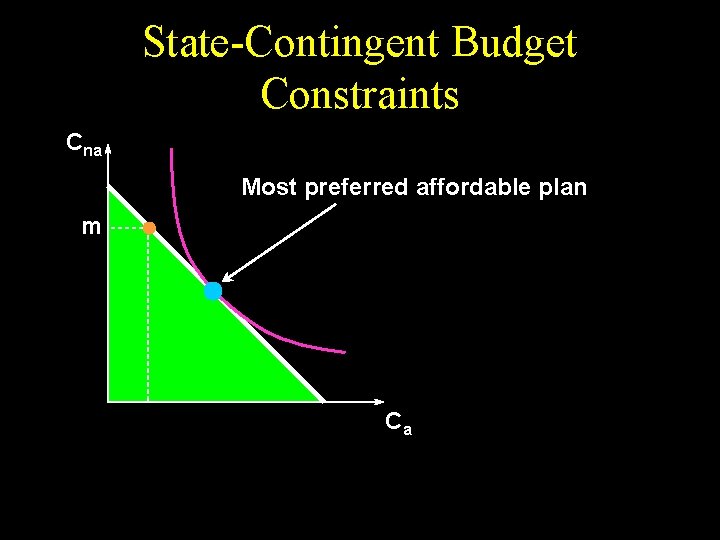

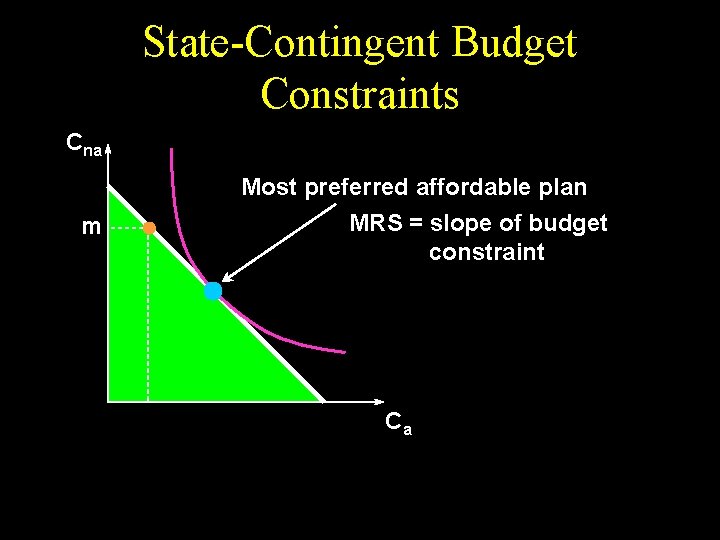

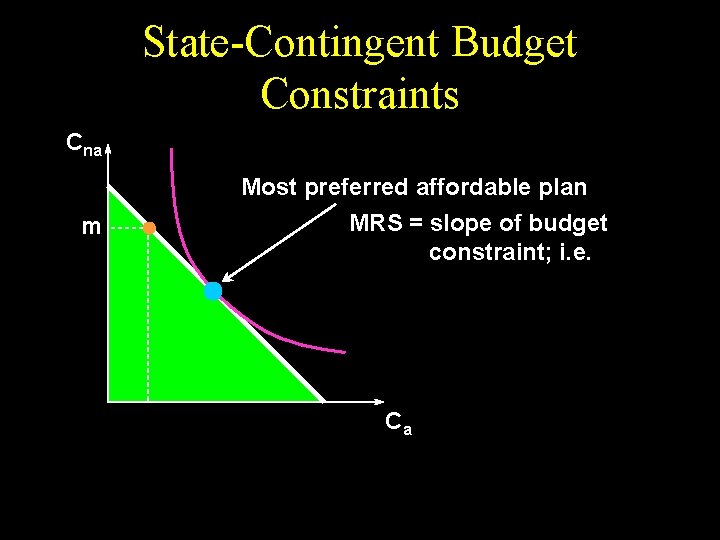

Choice Under Uncertainty u Q: How is a rational choice made under uncertainty? u A: Choose the most preferred affordable state-contingent consumption plan.

State-Contingent Budget Constraints Cna m The endowment bundle. Where is the most preferred state-contingent consumption plan? Ca

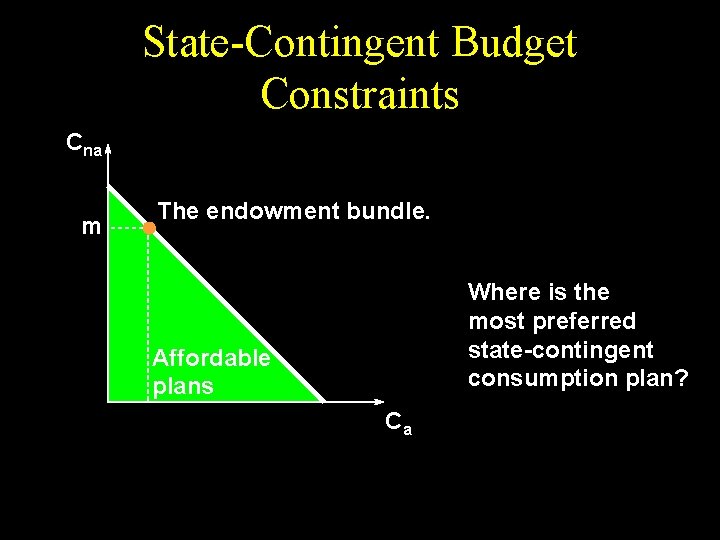

State-Contingent Budget Constraints Cna m The endowment bundle. Where is the most preferred state-contingent consumption plan? Affordable plans Ca

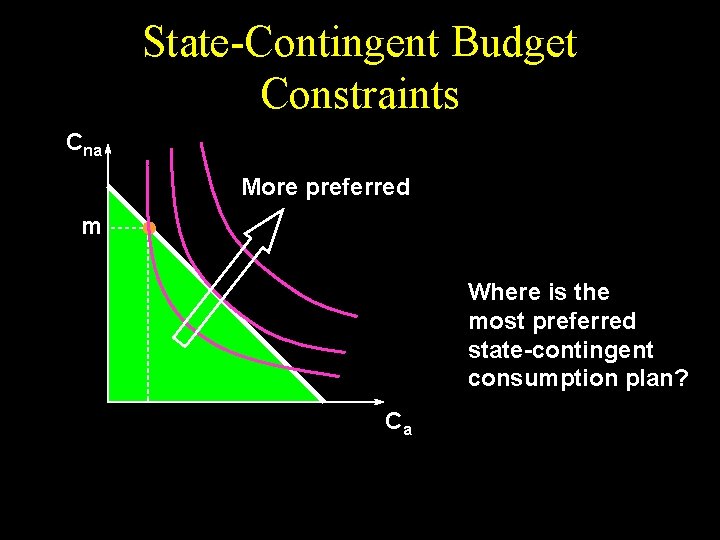

State-Contingent Budget Constraints Cna More preferred m Where is the most preferred state-contingent consumption plan? Ca

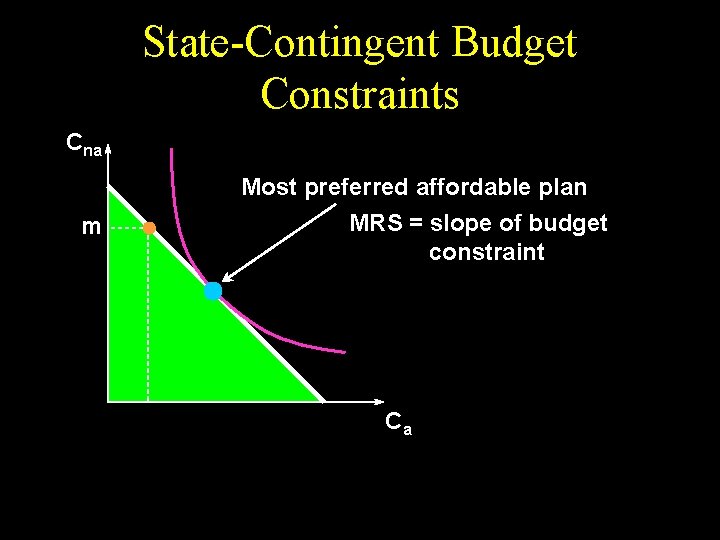

State-Contingent Budget Constraints Cna Most preferred affordable plan m Ca

State-Contingent Budget Constraints Cna Most preferred affordable plan m Ca

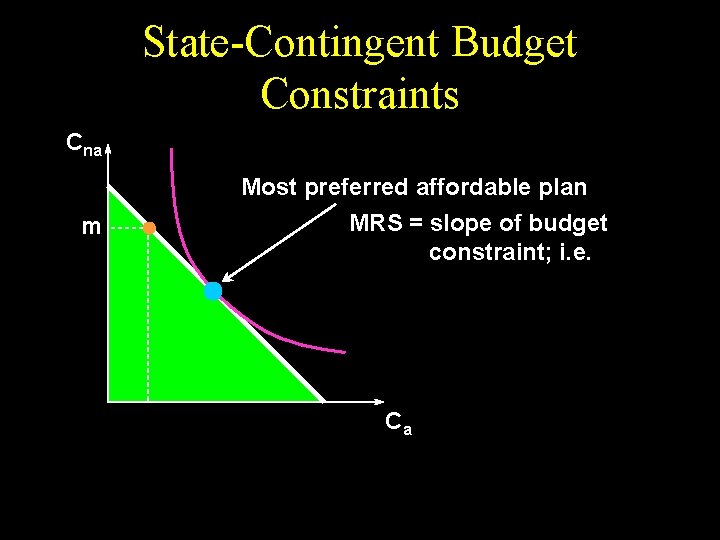

State-Contingent Budget Constraints Cna m Most preferred affordable plan MRS = slope of budget constraint Ca

State-Contingent Budget Constraints Cna m Most preferred affordable plan MRS = slope of budget constraint; i. e. Ca

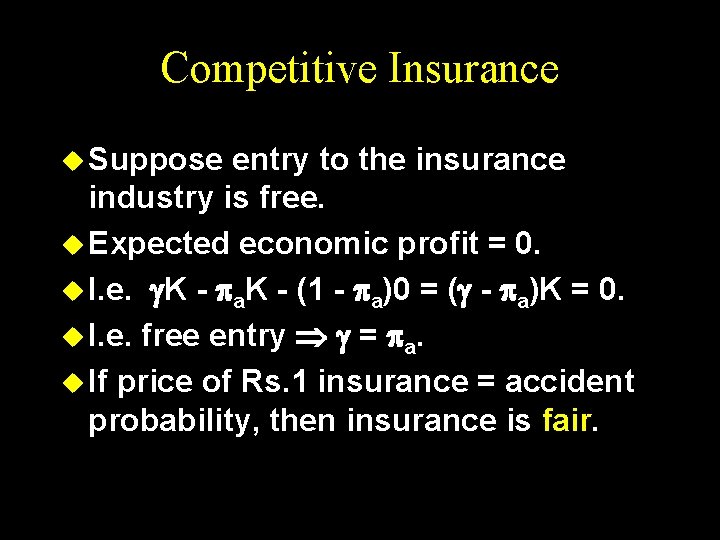

Competitive Insurance u Suppose entry to the insurance industry is free. u Expected economic profit = 0. u I. e. K - a. K - (1 - a)0 = ( - a)K = 0. u I. e. free entry = a. u If price of Rs. 1 insurance = accident probability, then insurance is fair.

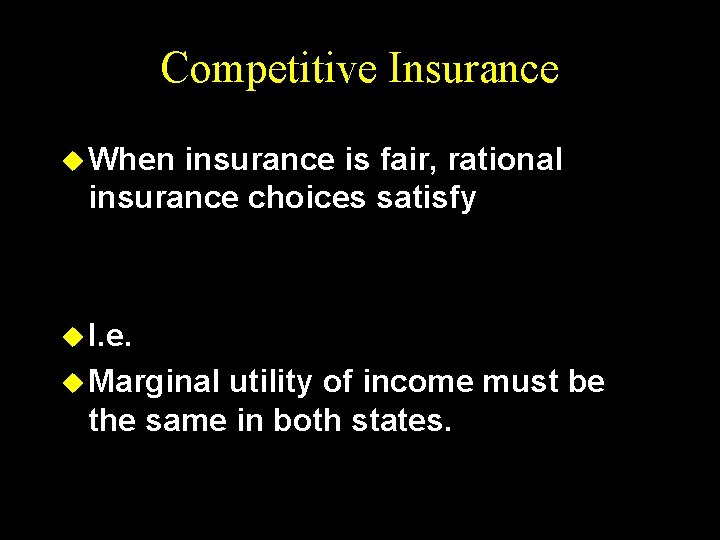

Competitive Insurance u When insurance is fair, rational insurance choices satisfy

Competitive Insurance u When insurance is fair, rational insurance choices satisfy u I. e.

Competitive Insurance u When insurance is fair, rational insurance choices satisfy u I. e. u Marginal utility of income must be the same in both states.

Competitive Insurance u How much fair insurance does a riskaverse consumer buy?

Competitive Insurance u How much fair insurance does a riskaverse consumer buy? u Risk-aversion MU(c) as c .

Competitive Insurance u How much fair insurance does a riskaverse consumer buy? u Risk-aversion u Hence MU(c) as c .

Competitive Insurance u How much fair insurance does a riskaverse consumer buy? u Risk-aversion MU(c) as c . u Hence u I. e. full-insurance.

“Unfair” Insurance u Suppose insurers make positive expected economic profit. u I. e. K - a. K - (1 - a)0 = ( - a)K > 0.

“Unfair” Insurance u Suppose insurers make positive expected economic profit. u I. e. K - a. K - (1 - a)0 = ( - a)K > 0. u Then > a

“Unfair” Insurance u Rational choice requires

“Unfair” Insurance u Rational u Since choice requires

“Unfair” Insurance u Rational choice requires u Since u Hence for a risk-averter.

“Unfair” Insurance u Rational choice requires u Since u Hence for a risk-averter. u I. e. a risk-averter buys less than full “unfair” insurance.

Uncertainty is Pervasive u What are rational responses to uncertainty? – buying insurance (health, life, auto) – a portfolio of contingent consumption goods.

Uncertainty is Pervasive u What are rational responses to uncertainty? – buying insurance (health, life, auto) – a portfolio of contingent consumption goods.

Uncertainty is Pervasive u What are rational responses to uncertainty? – buying insurance (health, life, auto) ? – a portfolio of contingent consumption goods.

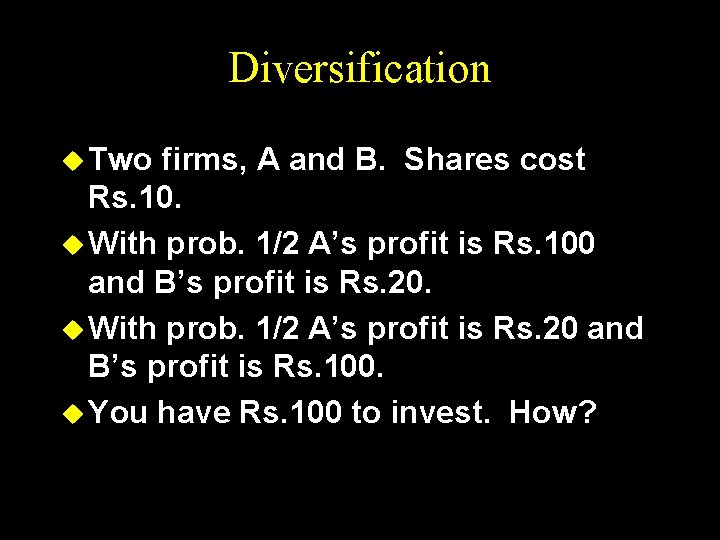

Diversification u Two firms, A and B. Shares cost Rs. 10. u With prob. 1/2 A’s profit is Rs. 100 and B’s profit is Rs. 20. u With prob. 1/2 A’s profit is Rs. 20 and B’s profit is Rs. 100. u You have Rs. 100 to invest. How?

Diversification u Buy only firm A’s stock? u Rs. 100/10 = 10 shares. u You earn Rs. 1000 with prob. 1/2 and Rs. 200 with prob. 1/2. u Expected earning: Rs. 500 + Rs. 100 = Rs. 600

Diversification u Buy only firm B’s stock? u Rs. 100/10 = 10 shares. u You earn Rs. 1000 with prob. 1/2 and Rs. 200 with prob. 1/2. u Expected earning: Rs. 500 + Rs. 100 = Rs. 600

Diversification u Buy 5 shares in each firm? u You earn Rs. 600 for sure. u Diversification has maintained expected earning and lowered risk.

Diversification u Buy 5 shares in each firm? u You earn Rs. 600 for sure. u Diversification has maintained expected earning and lowered risk. u Typically, diversification lowers expected earnings in exchange for lowered risk.

Risk Spreading/Mutual Insurance u 100 risk-neutral persons each independently risk a Rs. 10, 000 loss. u Loss probability = 0. 01. u Initial wealth is Rs. 40, 000. u No insurance: expected wealth is

Risk Spreading/Mutual Insurance u Mutual insurance: Expected loss is u Each of the 100 persons pays Rs. 1 into a mutual insurance fund. u Mutual insurance: expected wealth is u Risk-spreading benefits everyone.