TIF Basics and Project Planning A RealLife Example

TIF Basics and Project Planning – A Real-Life Example Presented to WGFOA Winter Conference Christine Cramer December 2, 2010

Tax Incremental Financing • Provides a means for the City to stimulate beneficial development and redevelopment • One of the best financing tools for economic development projects

Principles of TIF • Taxes generated through increased property values within the TIF district pay for needed improvements • The City provides public improvements and incentives to attract development—the overlying tax districts that benefit should share in costs

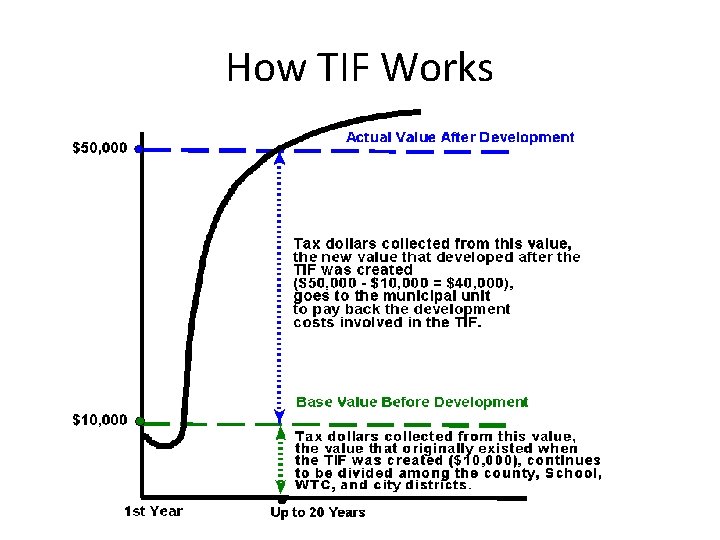

How TIF Works

27 th Street Corridor Proposed TID No. 3 Presented to the City of Greenfield July 14, 2009

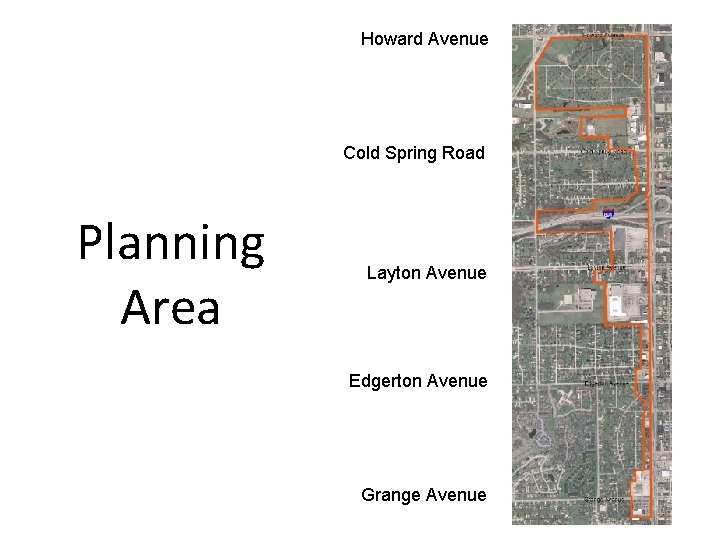

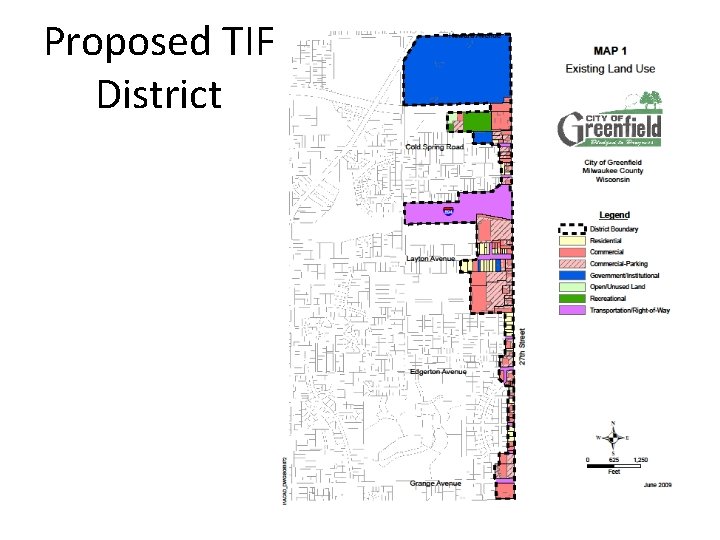

Howard Avenue Cold Spring Road Planning Area Layton Avenue Edgerton Avenue Grange Avenue

Need for Redevelopment of the 27 th St. Corridor • Improve existing buildings and promote redevelopment of underused or obsolete sites • Transportation System Changes – Reconfiguration of 27 th St. /I-894 interchange – Need for traffic improvements in the area of the 27 th St. and Layton Ave. • Competition from Other Commercial Corridors – 27 th Street in Franklin/Oak Creek – Highway 100 – Bluemound Road

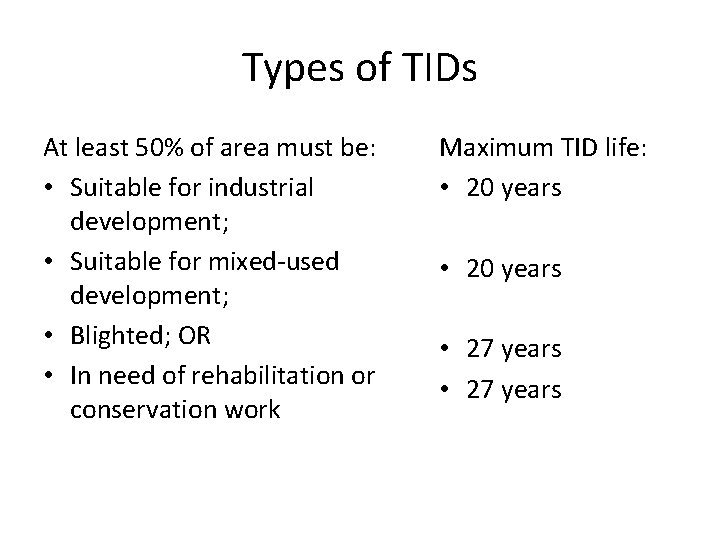

Types of TIDs At least 50% of area must be: • Suitable for industrial development; • Suitable for mixed-used development; • Blighted; OR • In need of rehabilitation or conservation work Maximum TID life: • 20 years • 27 years

Rehabilitation and Conservation Work Wis. Stat. § 66. 1337(2 m)—rehabilitation or conservation work includes: “carrying out a program of voluntary or compulsory repair and rehabilitation of buildings or other improvements; acquisition of real property and demolition, removal or rehabilitation of buildings or improvements on the property where necessary to eliminate unhealthful, unsanitary or unsafe conditions, lessen density, reduce traffic hazards, eliminate obsolete or other uses detrimental to the public welfare, to otherwise remove or prevent the spread of blight or deterioration, or to provide land needed for public facilities; installation, construction or reconstruction of streets, utilities, parks, playgrounds, and other improvements necessary for carrying out the objectives of the urban renewal project; or the disposition for uses in accordance with the objectives of the urban renewal project, of any property acquired in the area of the project. An urban renewal project includes activities for the elimination and for the prevention of the development or spread of slums or blighted, deteriorated or deteriorating areas. ”

Existing Buildings

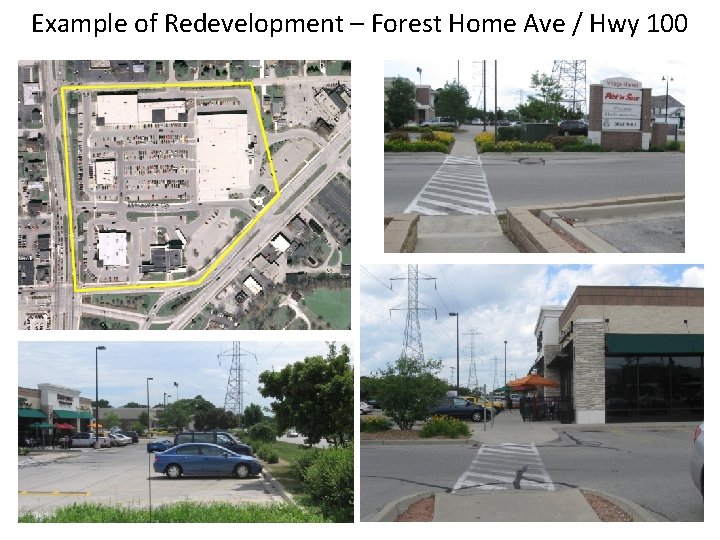

Example of Redevelopment – Forest Home Ave / Hwy 100

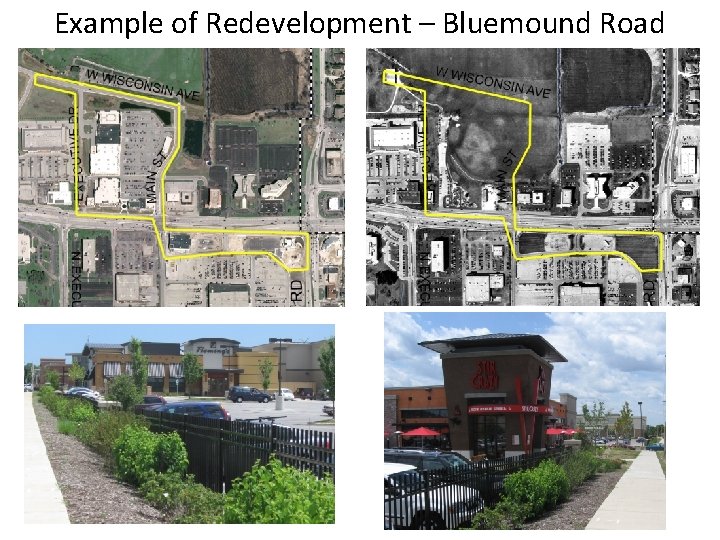

Example of Redevelopment – Bluemound Road

Example of Redevelopment – Bluemound Road

Goals of the TIF District • • • Improved appearance of the corridor/gateway Increased property values New housing New employment More office and retail space Better mix of land uses

Proposed TIF District • Public infrastructure improvements – Street, storm water and utility improvements / right-of-way acquisition • Creation of a complete “ 28 th Street” for better access and improved traffic flow • Access to property north of 27 th St. /Cold Spring Road intersection – Streetscape improvements • Along 27 th St. and Layton Ave. • Gateway features at entrance to Greenfield from Layton Ave. • Redevelopment and rehabilitation assistance to property owners and developers • Public assistance will be necessary in order to attract the high-quality redevelopment desired by the City

Proposed TIF District

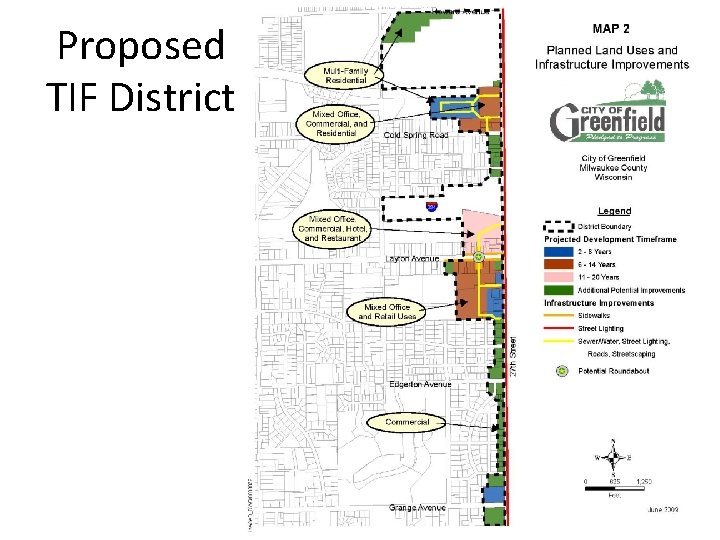

Proposed TIF District

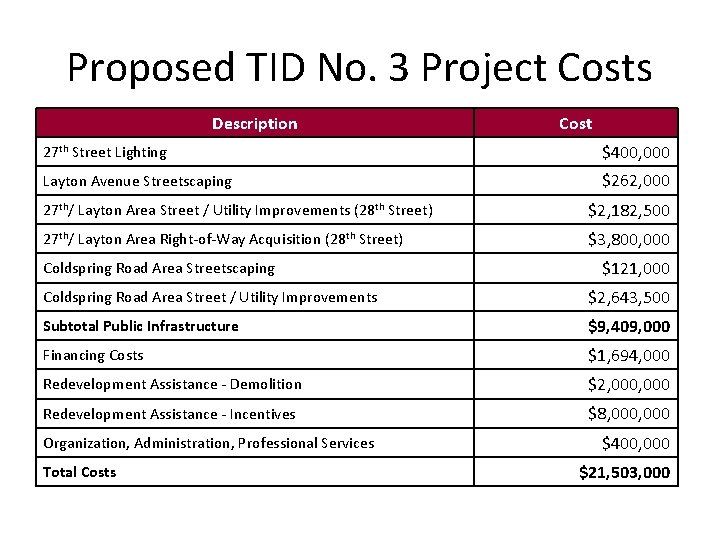

Proposed TID No. 3 Project Costs Description Cost 27 th Street Lighting $400, 000 Layton Avenue Streetscaping $262, 000 27 th/ Layton Area Street / Utility Improvements (28 th Street) $2, 182, 500 27 th/ Layton Area Right-of-Way Acquisition (28 th Street) $3, 800, 000 Coldspring Road Area Streetscaping $121, 000 Coldspring Road Area Street / Utility Improvements $2, 643, 500 Subtotal Public Infrastructure $9, 409, 000 Financing Costs $1, 694, 000 Redevelopment Assistance - Demolition $2, 000 Redevelopment Assistance - Incentives $8, 000 Organization, Administration, Professional Services Total Costs $400, 000 $21, 503, 000

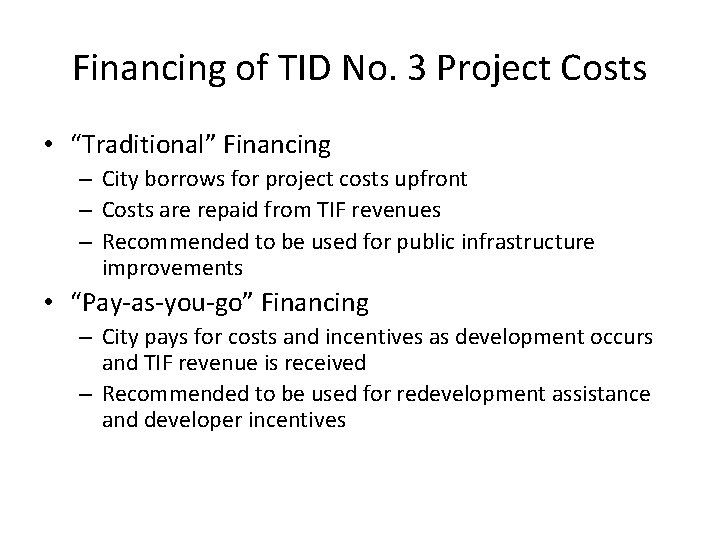

Financing of TID No. 3 Project Costs • “Traditional” Financing – City borrows for project costs upfront – Costs are repaid from TIF revenues – Recommended to be used for public infrastructure improvements • “Pay-as-you-go” Financing – City pays for costs and incentives as development occurs and TIF revenue is received – Recommended to be used for redevelopment assistance and developer incentives

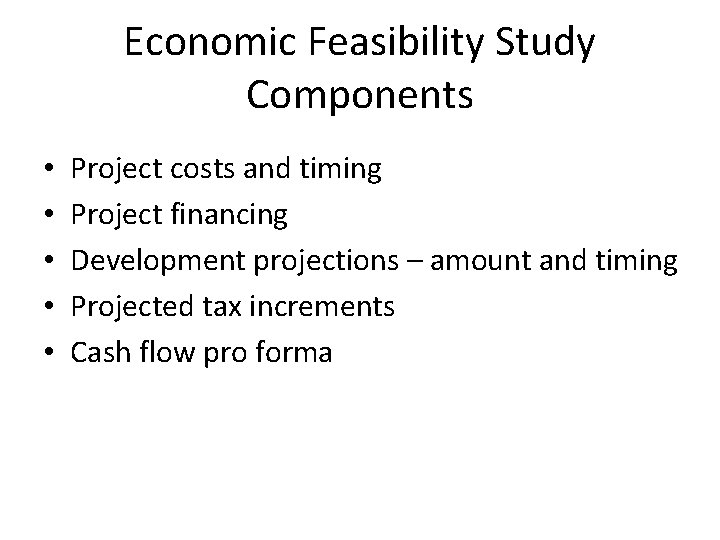

Economic Feasibility Study Components • • • Project costs and timing Project financing Development projections – amount and timing Projected tax increments Cash flow pro forma

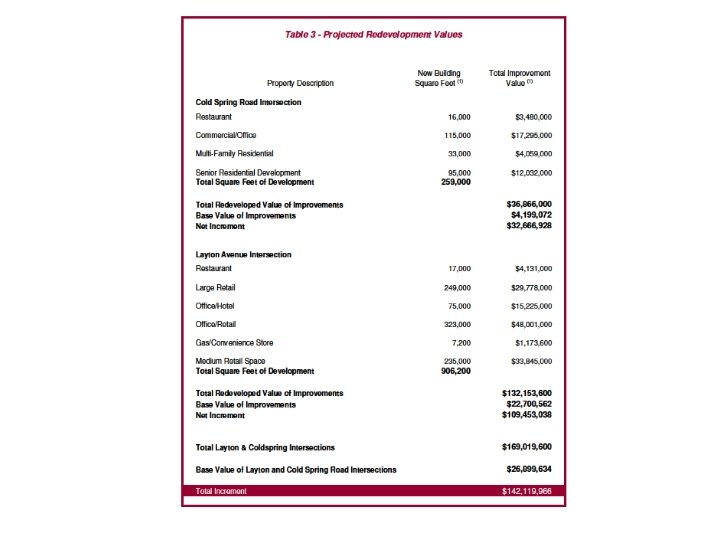

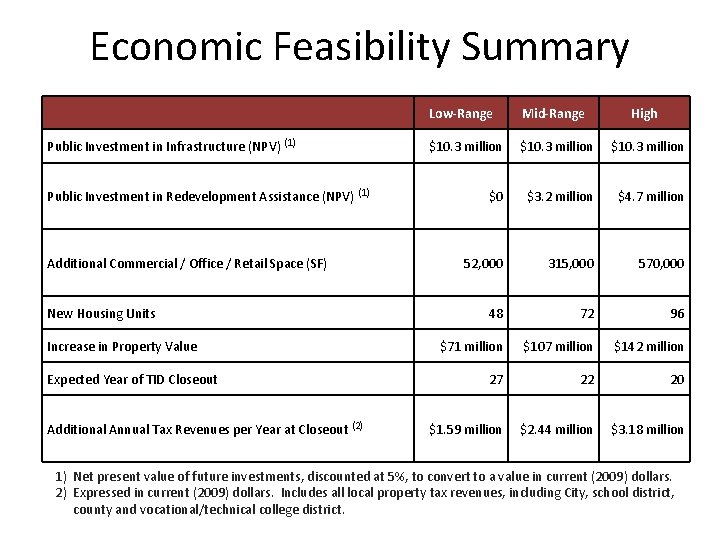

Economic Feasibility Summary Public Investment in Infrastructure (NPV) (1) Public Investment in Redevelopment Assistance (NPV) (1) Additional Commercial / Office / Retail Space (SF) New Housing Units Increase in Property Value Expected Year of TID Closeout Additional Annual Tax Revenues per Year at Closeout (2) Low-Range Mid-Range High $10. 3 million $0 $3. 2 million $4. 7 million 52, 000 315, 000 570, 000 48 72 96 $71 million $107 million $142 million 27 22 20 $1. 59 million $2. 44 million $3. 18 million 1) Net present value of future investments, discounted at 5%, to convert to a value in current (2009) dollars. 2) Expressed in current (2009) dollars. Includes all local property tax revenues, including City, school district, county and vocational/technical college district.

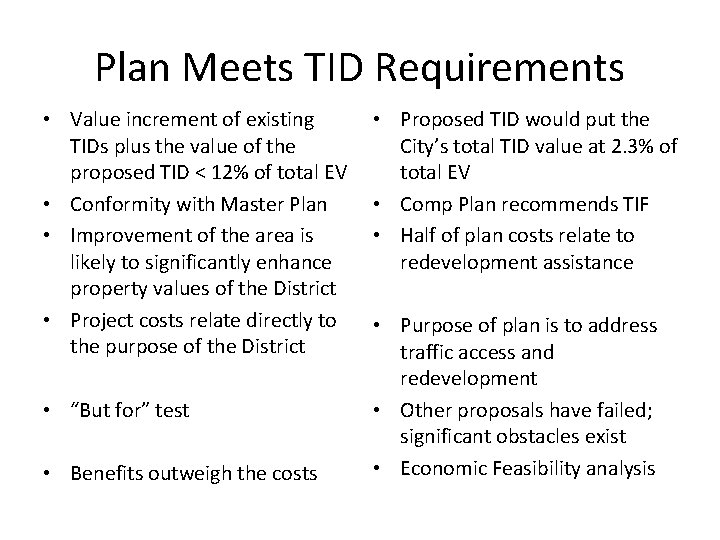

Plan Meets TID Requirements • Value increment of existing TIDs plus the value of the proposed TID < 12% of total EV • Conformity with Master Plan • Improvement of the area is likely to significantly enhance property values of the District • Project costs relate directly to the purpose of the District • “But for” test • Benefits outweigh the costs • Proposed TID would put the City’s total TID value at 2. 3% of total EV • Comp Plan recommends TIF • Half of plan costs relate to redevelopment assistance • Purpose of plan is to address traffic access and redevelopment • Other proposals have failed; significant obstacles exist • Economic Feasibility analysis

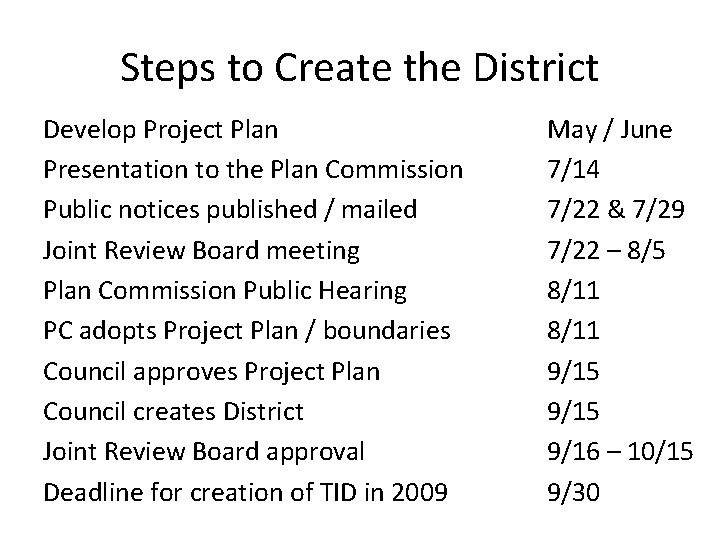

Steps to Create the District Develop Project Plan Presentation to the Plan Commission Public notices published / mailed Joint Review Board meeting Plan Commission Public Hearing PC adopts Project Plan / boundaries Council approves Project Plan Council creates District Joint Review Board approval Deadline for creation of TID in 2009 May / June 7/14 7/22 & 7/29 7/22 – 8/5 8/11 9/15 9/16 – 10/15 9/30

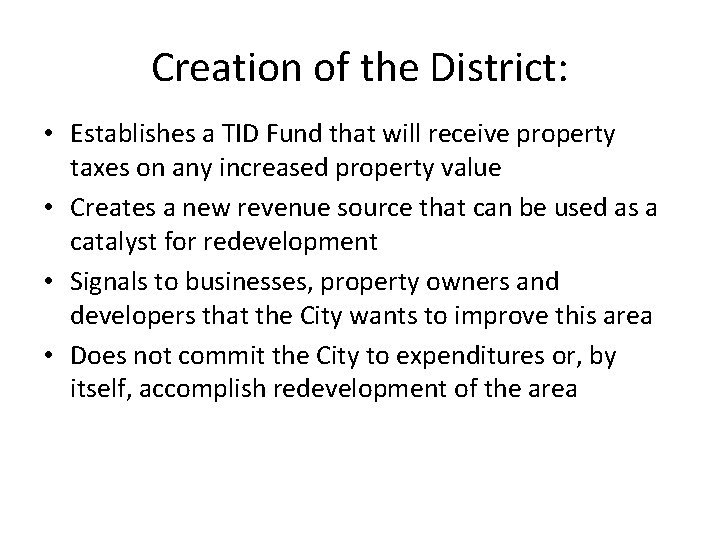

Creation of the District: • Establishes a TID Fund that will receive property taxes on any increased property value • Creates a new revenue source that can be used as a catalyst for redevelopment • Signals to businesses, property owners and developers that the City wants to improve this area • Does not commit the City to expenditures or, by itself, accomplish redevelopment of the area

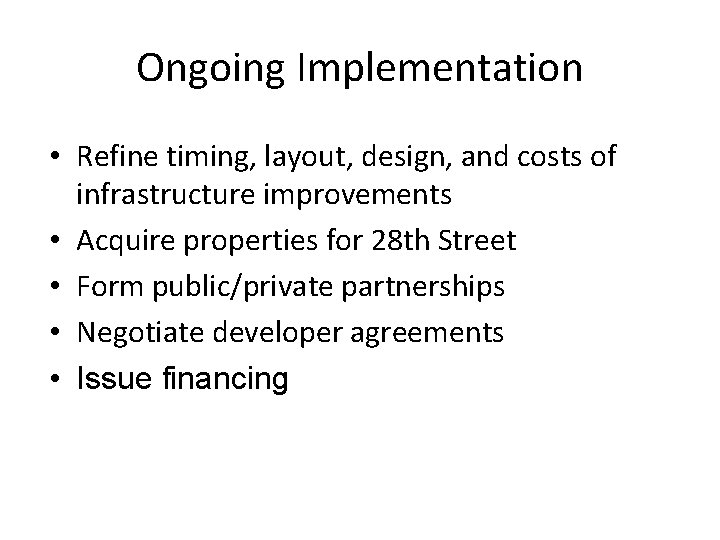

Ongoing Implementation • Refine timing, layout, design, and costs of infrastructure improvements • Acquire properties for 28 th Street • Form public/private partnerships • Negotiate developer agreements • Issue financing

Minimizing the City’s Risk • Carefully monitor TIF performance every year • Don’t assume that if you build it they will come – base City investment on ‘real’ projects • Limit public investment to the minimum needed to move a desired project forward • Limit City-financed costs—use pay-as-you-go as much as possible • Strong developer guarantees • Use TIF to leverage more private investment

Best Practices in Implementation • Build community partnerships – Coordinate efforts with the City of Milwaukee to promote the corridor • Establish developer need, not want • Align TIF use with community goals – Adopt detailed TIF policy guidelines • Monitor and report performance • Use TIF to compete on a global scale Source: “Tax Increment Financing in Southeastern Wisconsin, ” Public Policy Forum, Research Brief Volume 96, Number 2, February 2008.

Current Trends and Issues • Loss of property value in some districts – Economic conditions – Change in DOR valuation methods – Ag use • Other factors reducing TIF revenues – Levy limits and lower tax rates

Options for Struggling TIDs • • Extension of maximum District life Distressed designation Donor TIDs Boundary amendments

Questions? For additional information: Christine Cramer ccramer@ruekert-mielke. com (262) 542 - 5733

- Slides: 31