THINKING STRATEGICALLY Strengths Opportunities and Threats to the

![Contrast 2021 with 2001 Millennials (+Y): 6 to 23 years [most were not customers] Contrast 2021 with 2001 Millennials (+Y): 6 to 23 years [most were not customers]](https://slidetodoc.com/presentation_image_h2/6bb1e62ed46b970b4c120a6a6a444af3/image-13.jpg)

- Slides: 20

THINKING STRATEGICALLY: Strengths, Opportunities and Threats to the Mutual Model MAXIMIZING MUTUALITY PENNSYLVANIA ASSOCIATION OF COMMUNITY BANKERS June 2, 2021

Jim Clarke, Ph. D. Clarke Consulting, Villanova, Pennsylvania JJClarke 2@aol. com Dr. James Clarke, Ph. D. has served on the faculty of the ABA’s Stonier National School of Banking, New England School of Banking, and the Southwest Graduate School of Banking. He also serves as a faculty member for state banking schools. Jim conducts seminars on ALM annually for national associations such as Risk Management Association [RMA] and Financial Managers Society (FMS) as well as state bankers’ associations, including PACB. Jim facilitates strategic planning for community banks throughout the country. Many of Jim’s clients have been mutual associations providing him with an in depth understanding of the mutual model. Dr. Clarke is a frequent convention and meeting speaker. In 2019 -21 Jim spoke at the Connecticut, and Pennsylvania Community Bankers conventions, Massachusetts, Ohio, Pennsylvania, Texas and Maine Directors Conferences, and PACB and Massachusetts Mutuality Conferences. Jim has a B. A. in Economics from La. Salle College and a Ph. D. in Economics from the University of Notre Dame. He is a former faculty member in the Finance Department at Villanova University. He has served on the board of five community banks (including three mutual associations) and an investment company. 2

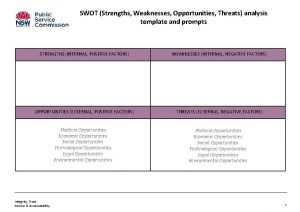

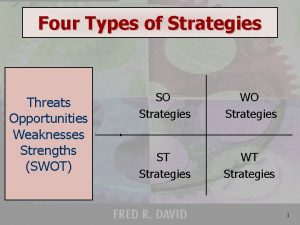

Outline • Understanding the mutual business model. • Assessing your opportunities in the current environment. • Assessing the threats to the mutual model. • The Board’s role in the planning process, be bold, but realistic. • Preserving the Mutual Model 3

Pennsylvania Banking Environment Large Money Center Banks Wells Fargo, Bank of America, and Chase which is new to the state, but growing in Philadelphia market. Wells Fargo and Bank of America have significant market share in Eastern Pennsylvania. Regionals Citizens, PNC, M&T, Santander, TD, Key, and Truist. These banks have significant market share throughout Pennsylvania. State Regionals FNB, Fulton, Northwest, S&T and WSFS. These are primarily in state banks that have offices throughout much of the state of Pennsylvania. 4

Pennsylvania Community Bank Environment • Stock Commercial Bank These institutions are prominent within the state of Pennsylvania. These banks make up the majority of the banks in the state and rank in size from $5 billion down to less than $100 million. • Mutual Savings Banks and Savings & Loan Associations Based on my count approximately 35 institutions broken down as follows: > $1 billion – Five institutions led by Dollar Bank at $9 billion (currently the largest mutual in the country). $100 million to $1 billion 21 institutions Less than $100 million 9 institutions. Pennsylvania has the 3 rd largest number of mutual charters in U. S. . We have legacy in mutuality and mutual banks continue to be a viable member of Pennsylvania community banks. 5

The Mutual Model - Origins Charters: q Savings Bank State chartered – Origins are in providing savings accounts to the working class. Most savings banks used savings deposit to make residential mortgage loans. Many of Pennsylvania savings banks started out as Federal Savings and Loan Associations and converted to the state charter. Savings banks are prominent in the Northeast. q Saving and Loan Associations (Building and Loan Associations) – The S&L industry was created to make residential mortgage loans. S&Ls are more prominent in the Midwest and other parts of the country, but we have a significant number in Pennsylvania. Both charters were built around mutuality. 6

The Mutual Model – Ownership Structure As the name implies, ownership is about a mutual arrangement, an agreement among the organizers. These institutions were created by concerned citizens in local communities. I have served on the Board of both state savings banks and federal thrifts. Who owns a state mutual savings banks? God, the clouds, who knows? When mutual banks convert to stock institutions where do the process from the sale go? To depositors? Federal thrifts are a little different in that depositors have some voting rights. But from a practical perspective we are organizations without stockholders (unless you are a Mutual Holding Company that issued public shares). This arrangement has significant implications. 7

Strengths arising from Mutual Model (Unique to a Mutual) 1. Independence – Many banks promote their independence, but mutuality guarantees independence. 2. No stockholders – no dividend payments Net income becomes retained earnings and moves to the capital account. 3. Community endeavors in lieu of dividend payments. We are better able to provide financial support to community related projects. ________________________________ We all have other strengths, but the above relate directly to the mutual model. 8

Weaknesses or Concerns Capital – For many of us the only source of capital is retained earnings. Therefore, growth depends on earning, and our sustainable growth rate. If you have a mutual holding company, you have other options, including subordinated debt which can help to neutralize this weakness. Focus on Profitability – No one owns the bank therefore there is no external pressure to maximize profits. ROA for mutual banks is on average lower than stock banks. But we discussed this among the strengths – Contributions to the community reduces ROA. A fair comparison mutual vs. stock earnings would be ROA – dividends. Profitability As a mutual how fast to we run? 9

Strategic Opportunities for Mutual Banks Market Disruption – This is happening due to M&A, and it is going to continue. Susquehanna is gone, Royal Bank is gone, Nat Penn is gone and recently Bryn Mawr Trust is gone. Disruption creates opportunities to attract new customers and attract talent. We need to act strategically, but quickly. Who is next? Let’s speculate! q Out of state recent example: Peoples United headquartered in Bridgeport, Ct. was a mutual until 1994. In the last 25 years built a great franchise across Connecticut, into New York Metro, and then across Massachusetts, including Boston, and Maine, and Rhode Island. M&T, a Buffalo, N. Y. bank decided they want to move North, they recent purchase PUB giving them a fabulous franchise in New England. q Take this to Pennsylvania. TD has built an incredible franchise from Maine to Florida. To expand that franchise, they need to move west, maybe starting in Pennsylvania. Who do you buy that will get you across Pennsylvania, western New York and parts of Ohio? Disruption is going to continue – remember BB&T. 10

Strategic Opportunities for Mutual Banks Mutual Combinations – New England has experienced more of this activity than we have in Pennsylvania. We have an excellent example of this model in eastern Pennsylvania – Penn Community Bank. It is helping mutual banks gain scale which is good, it is getting more and more difficult for banks under $200 million to remain viable (mutual or stock) giving the growth of compliance costs and technology. There are downsides, in some cases, a loss of identity. In ability to achieve the benefits under MHC without collapsing charters. How do you make it work? First, find a partner you can trust and where there is compatibility. Second have honest conversations regarding branding and charter consolidation. 11

Opportunities Changing Demographics 1. Age – Slide 12 contrasts age distribution over the last twenty years. The question many banks are addressing is: How do we attract the Gen Z group? Many of us are doing a good job attracting millennials – especially older millennials (35 to 43). Let talk about age issue as Pennsylvania is the 2 nd on 3 rd oldest state with respect to average of the population. 2. Ethnic – Growth in the Latino population is a trend many banks are missing. We have a number of market areas in central and eastern Pennsylvania with growing Latino populations – Reading, the Lehigh Valley, York, Lancaster to name a few. 3. Gender – I would suspect 50% of our customer base are women. Also, likely more than 50% of our employees are women. So, we have good gender diversity at the customer level and the employee level, but what about the BOARD room. NASDAQ is putting pressure on stock banks to move on more diversity in the board room. As mutual associations we need to address this issue sooner rather than later – I would hate see regulators push us on this issue. We should be able to do this on our own. 12

![Contrast 2021 with 2001 Millennials Y 6 to 23 years most were not customers Contrast 2021 with 2001 Millennials (+Y): 6 to 23 years [most were not customers]](https://slidetodoc.com/presentation_image_h2/6bb1e62ed46b970b4c120a6a6a444af3/image-13.jpg)

Contrast 2021 with 2001 Millennials (+Y): 6 to 23 years [most were not customers] Gen X: 24 to 36 years Baby Boomers: 37 to 55 years [key bank demographic group] Senior: 56+ [our best legacy customers] 2021 Z Gen: born after 1996 – 24 and younger; becoming an important bank customer Millennials (+Y): 25 to 43 years [rapidly becoming our customers] Gen X: 44 to 56 years Baby Boomers: 57 to 75 years [Rapidly retiring] Senior: 76+ [our legacy customer are declining] This is having a significant impact on community banking. We need to grow retail checking and it is important to focus on MILLENIALS and Gen Z? 13

Threats to Mutual Banks Economies of Scale: Asset size has become more and more important over the last twenty years, partly driven by technology costs and compliance. Large banks have an advantage, but there are many smaller banks doing fine. The key is to be focused, do not try to be everything to everybody because at $300 million you can’t be everything to everybody. Best examples are in the Northeast banks under $300 million with relatively narrow business models and with limited franchises. We are seeing M&A among stock banks due to the scale issue. Stockholders are forcing the issue – BMT simply couldn’t survive at $3. 7 billion and satisfy Walls Street which is sad. This a threat to all banks, but we have an advantage as a $300 million mutual – we don’t need the earnings level to satisfy Wall Street. 14

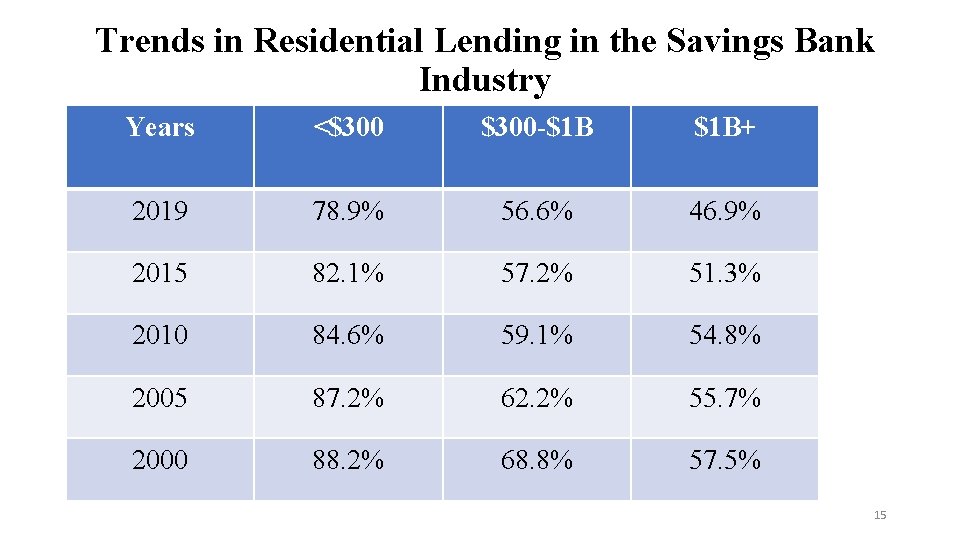

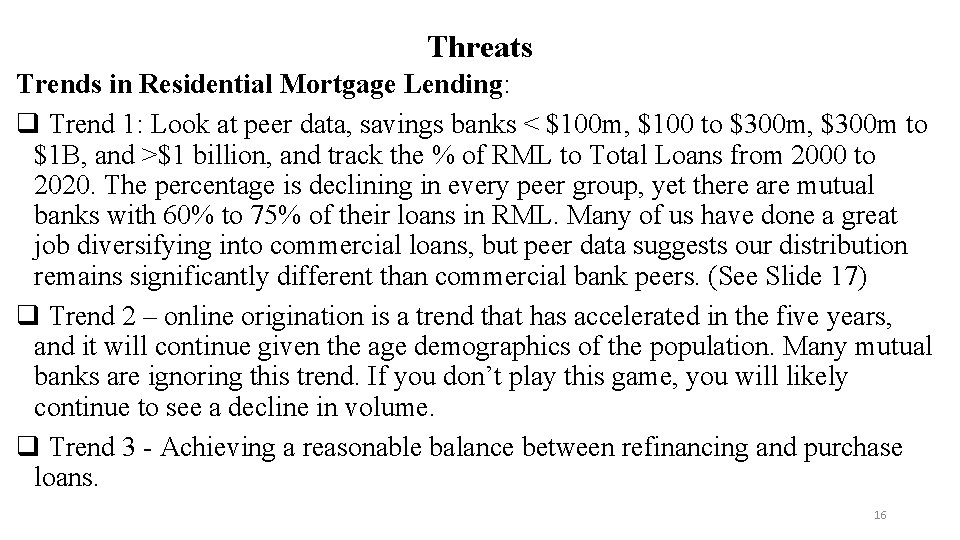

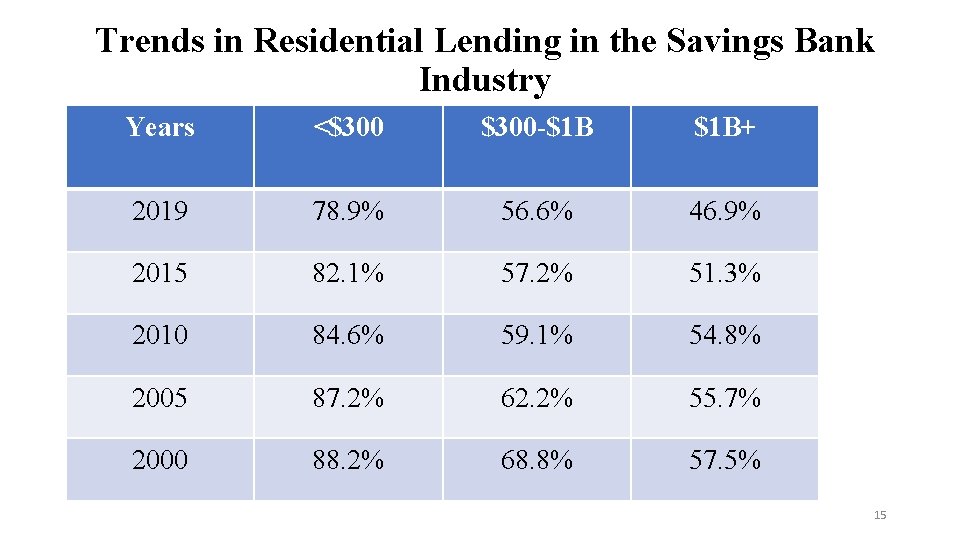

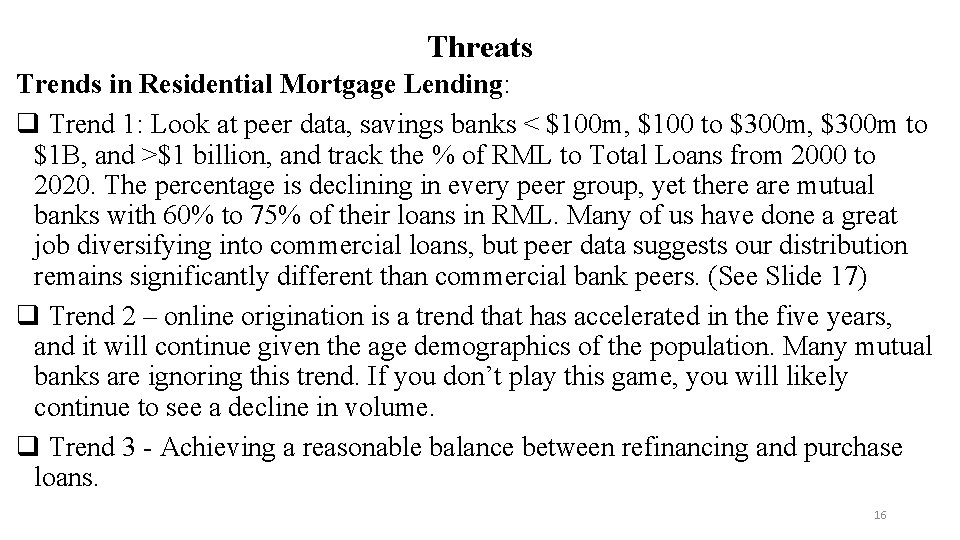

Trends in Residential Lending in the Savings Bank Industry Years <$300 -$1 B $1 B+ 2019 78. 9% 56. 6% 46. 9% 2015 82. 1% 57. 2% 51. 3% 2010 84. 6% 59. 1% 54. 8% 2005 87. 2% 62. 2% 55. 7% 2000 88. 2% 68. 8% 57. 5% 15

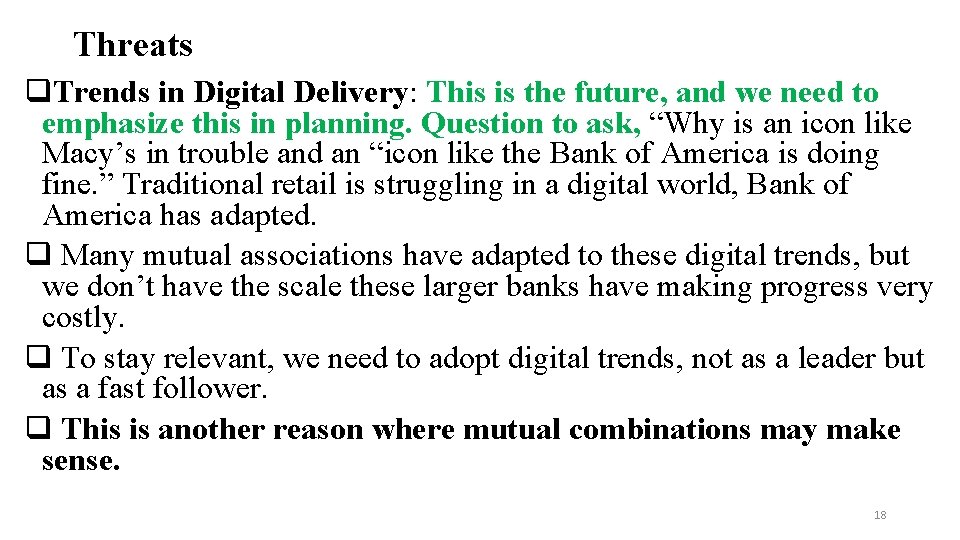

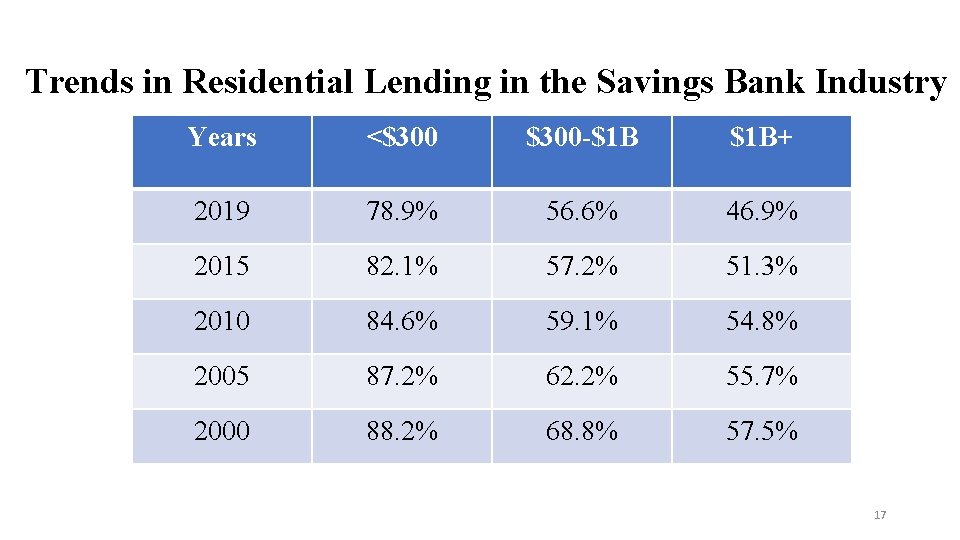

Threats Trends in Residential Mortgage Lending: q Trend 1: Look at peer data, savings banks < $100 m, $100 to $300 m, $300 m to $1 B, and >$1 billion, and track the % of RML to Total Loans from 2000 to 2020. The percentage is declining in every peer group, yet there are mutual banks with 60% to 75% of their loans in RML. Many of us have done a great job diversifying into commercial loans, but peer data suggests our distribution remains significantly different than commercial bank peers. (See Slide 17) q Trend 2 – online origination is a trend that has accelerated in the five years, and it will continue given the age demographics of the population. Many mutual banks are ignoring this trend. If you don’t play this game, you will likely continue to see a decline in volume. q Trend 3 - Achieving a reasonable balance between refinancing and purchase loans. 16

Trends in Residential Lending in the Savings Bank Industry Years <$300 -$1 B $1 B+ 2019 78. 9% 56. 6% 46. 9% 2015 82. 1% 57. 2% 51. 3% 2010 84. 6% 59. 1% 54. 8% 2005 87. 2% 62. 2% 55. 7% 2000 88. 2% 68. 8% 57. 5% 17

Threats q. Trends in Digital Delivery: This is the future, and we need to emphasize this in planning. Question to ask, “Why is an icon like Macy’s in trouble and an “icon like the Bank of America is doing fine. ” Traditional retail is struggling in a digital world, Bank of America has adapted. q Many mutual associations have adapted to these digital trends, but we don’t have the scale these larger banks have making progress very costly. q To stay relevant, we need to adopt digital trends, not as a leader but as a fast follower. q This is another reason where mutual combinations may make sense. 18

Focus on Priorities or Critical Issues We have discussed a number of issues and maybe it is time to make some decisions about the future. Don’t start playing trivia pursuit. What are the big important things we need to do over the next five years? Let me give you my bucket list! q We need to figure out how to attract Gen Z and Millennials to diversify our customer base. Old only gets older – change the mix and lower the average – that is the goal. q We need to diversify our loan portfolio which generally means more commercial loans, but not all real estate collateral – we need to learn how to do more C&I. A community bank should serve all constituents in their community, including small businesses needing non-real estate loans. q We need to continue to change the retail office model to reflect the changes in branch traffic and the movement to digital. 19

Preserving the Mutual Ownership Model • Starts with the Board appointments – recruit community focused individuals. You can demonstrate how MUTUALITY can made a difference. • CEO is the key to maintaining your independency as a MUTUAL. Therefore, the Board needs to carefully consider the selection of the new CEO. My first choice would always be an insider. But to do this you need to develop talent inhouse. This again become a scale issue. • Look for contributions to your community that combine philanthropic endeavors and marketing. In other words, let’s self promote a little better, so the community understands mutuality. • Focus on legacy, and to perpetuation of this legacy Also strive to build a successful business model which perpetuates legacy. • To maximize mutuality, you need a BOARD and SENIOR MANAGERS that are committed to the mutual concept. We have over 200 years of history. 20

Strengths opportunities threats weaknesses

Strengths opportunities threats weaknesses Strengths opportunities threats weaknesses

Strengths opportunities threats weaknesses For weakness

For weakness Factbranch

Factbranch Swot analysis of a teacher

Swot analysis of a teacher Swot analysis for english teachers

Swot analysis for english teachers List of opportunities and threats

List of opportunities and threats Swot analysis examples for students

Swot analysis examples for students Managing strategically

Managing strategically Use appropriate tools strategically

Use appropriate tools strategically Measurement in staffing

Measurement in staffing Strategically-oriented cycle of hrd activities

Strategically-oriented cycle of hrd activities Positive thinking vs negative thinking examples

Positive thinking vs negative thinking examples Thinking about your own thinking

Thinking about your own thinking Analytic vs holistic thinking example

Analytic vs holistic thinking example Perbedaan critical thinking dan creative thinking

Perbedaan critical thinking dan creative thinking Thinking about you thinking about me

Thinking about you thinking about me Wireless security threats and vulnerabilities

Wireless security threats and vulnerabilities Cyber security threats and countermeasures

Cyber security threats and countermeasures Malicious attacks threats and vulnerabilities

Malicious attacks threats and vulnerabilities Media information opportunities

Media information opportunities