THEORY OF INTEREST CLASSICAL THEORY Meaning of Interest

- Slides: 11

THEORY OF INTEREST ( CLASSICAL THEORY)

Meaning of Interest rate: �What is interest rate? �It is the rate of return on capital. In other words, interest is the price paid for borrowed funds. It is cost to the borrower and return to the lender. � Two types of interest rate – nominal and real. �Nominal interest rate – the rate at which funds can be borrowed from the market. �Real interest rate – It is the nominal rate of interest corrected for inflation. Or �Real interest rate = Nominal interest rate – inflation rate.

Three school of thoughts for theory of interest: � 1. Classical (Economists like, J. B. Clark, F. H. Knight, Fisher, Bohm-Bawerk, N. Senior, and others): According to this school interest rate (r ) is determined by Saving (S) and Investment (I). � 2. Neo-classical (Economists such as Wicksell, Ohlin, Haberler, Robertson, Viner, and others): It is also known as Loanable Funds Theory of interest. According to this school monetary and non-monetary both forces plays role in the determination of interest rate. Contd…

Continued… � 3. Keynes’ Theory of the rate of interest: This theory is also known as Liquidity Preference Theory. According to Keynes the liquidity preference and the supply of money determine the rate of interest.

Details of the Classical Theory of Interest Assumptions: 1. Generally there is full employment situation. 2. Households are the net savers and Producers are the net borrowers. 3. No government intervention.

Definitions of interest rate �According to Fisher: An interest rate is the price a borrower pays for the use of money they borrow from a lender. �Nasau Senior: The interest is compensation for the sacrifice of abstaining from consumption. Interest arises because of the abstinence involved in the act of saving. �Marshall: interest is the price for postponing consumption.

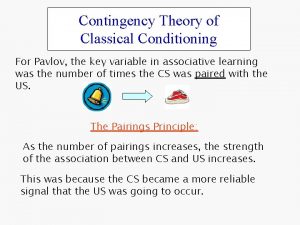

Determination of the Rate of Interest: Classical Approach �According to the Classical theory, rate of interest is determined by the supply of savings and demand for it to invest. � Higher the rate of interest, higher the savings by the households. More savings means increasing rate of sacrifice, so to compensate it higher interest rate as reward. A simple saving equation is below: S = f ( r ), where S is saving and r is interest rate. Contd…

Continued… �Lower the rate of interest, higher the demand for investment by the producers. As investment increases the M. E. C decreases, therefore investment demand rises when interest rate falls. The equation for investment is: I = f ( r ), where I is investment. �The rate of interest is determined by the equality of S and I equations.

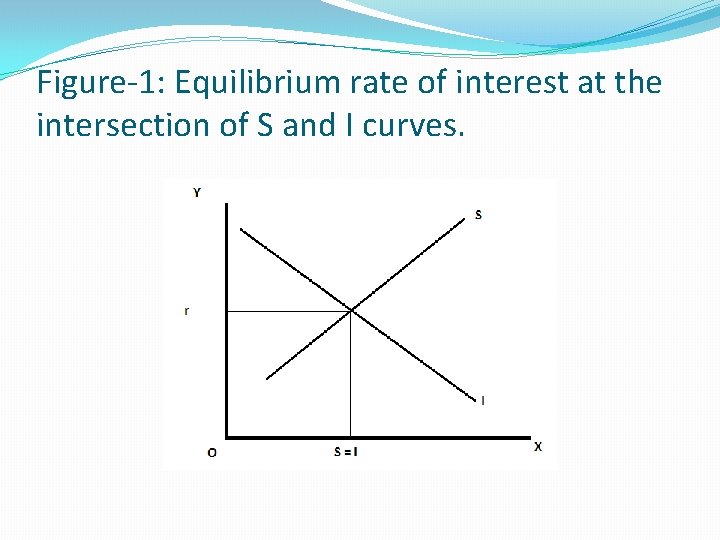

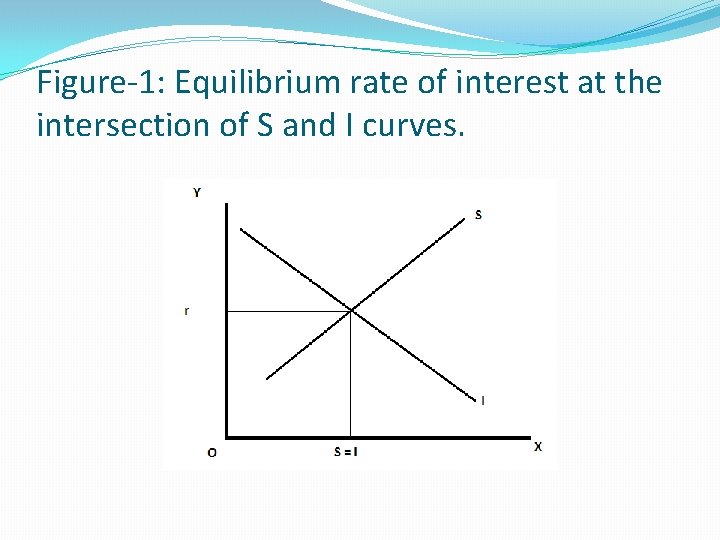

Figure-1: Equilibrium rate of interest at the intersection of S and I curves.

Explanation of Figure-1 �X-axis represents S&I, whereas Y-axis represent r. Supply of saving curve and demand for investment curve are represented by S and I respectively. Equilibrium rate of interest is at the intersection of above two curves. At equilibrium the S=I and r* is the interest rate.

Limitations of the Classical Theory: � 1) Full employment situation is impractical. � 2)Income effect on saving has been ignored. � 3) The effect on consumption due to higher saving is not considered. � 4) The Classical theory is indeterminate.

Neoclassical organization theory

Neoclassical organization theory Classical theory vs keynesian theory

Classical theory vs keynesian theory Classical theory vs keynesian theory

Classical theory vs keynesian theory What is real interest rate and nominal interest rate

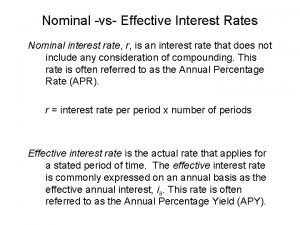

What is real interest rate and nominal interest rate Effective interest rate

Effective interest rate 0 965

0 965 Myth examples

Myth examples Classical scientific management

Classical scientific management Classical modernization theory

Classical modernization theory Negative contingency

Negative contingency Posdco

Posdco Timeline of management theories

Timeline of management theories