The Value Proposition for International Standards in Valuation

- Slides: 10

The Value Proposition for International Standards in Valuation Latest Valuation Standards in the Global Market Ben Elder BA BSc FRICS ACIArb RICS Global Director of Valuation RICS-ERES Bucharest Oct 2012

What is the value proposition? • • Public benefit Market efficiency Externalities Pareto optimality

What is the value proposition? • • Public benefit Market efficiency Externalities Pareto optimality

Standardisation • • Division of labour Limits ‘time stealers’ Reduce risk Global Comparables

What do you see?

Hernando De Soto –The Mystery of Capital Hernando De Soto – The Mystery of Capital Creation– • “Capital is not created by money; it is created by people whose property systems help them to cooperate and think about how they can get assets they accumulate to deploy additional production”

Hernando De Soto – The Mystery of Capital Fungiability • “If standard descriptions of assets were not readily available, anyone who wanted to buy, rent or give credit against an asset would have to expend enormous resources comparing and evaluating it against other assets- which would also lack standard descriptions. ”

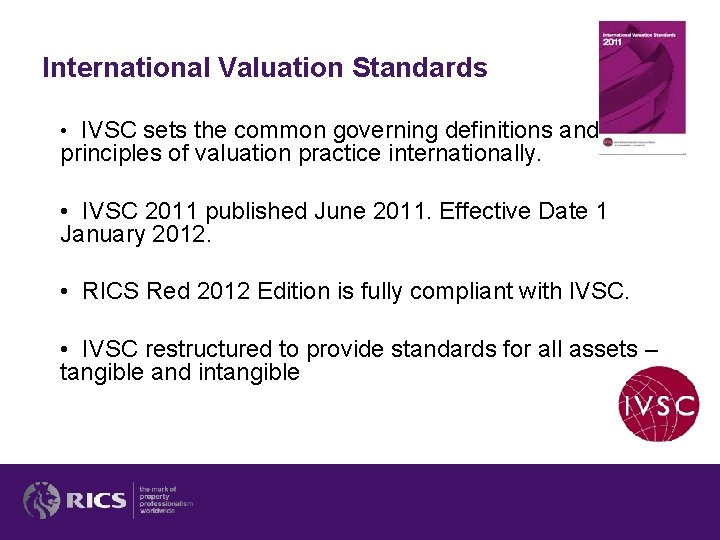

Red Book and the application of International Valuation Standards Council • IVS is an independent not-for-profit organisation with a remit to serve the public interest. • The Organisation’s objective is to build confidence and trust in the valuation process. • IVS comprise internationally accepted high level valuation standards which focus on the required principles and definitions in order to enable them to be applied as widely as possible.

International Valuation Standards • IVSC sets the common governing definitions and principles of valuation practice internationally. • IVSC 2011 published June 2011. Effective Date 1 January 2012. • RICS Red 2012 Edition is fully compliant with IVSC. • IVSC restructured to provide standards for all assets – tangible and intangible

Red Book Purpose “To provide an effective framework within the Rules of Conduct so that the users of valuation services can have confidence that the valuation of a RICS Member is consistent with IVSC internationally recognised standards”.