The Statement of Cash Flows Revisited Chapter 21

- Slides: 42

The Statement of Cash Flows Revisited Chapter 21 Power. Point Authors: Susan Coomer Galbreath, Ph. D. , CPA Charles W. Caldwell, D. B. A. , CMA Jon A. Booker, Ph. D. , CPA, CIA Cynthia J. Rooney, Ph. D. , CPA Copyright © 2013 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

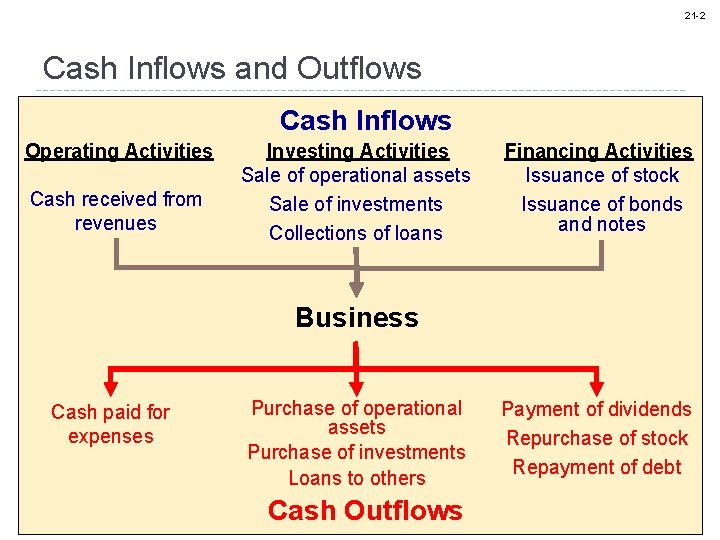

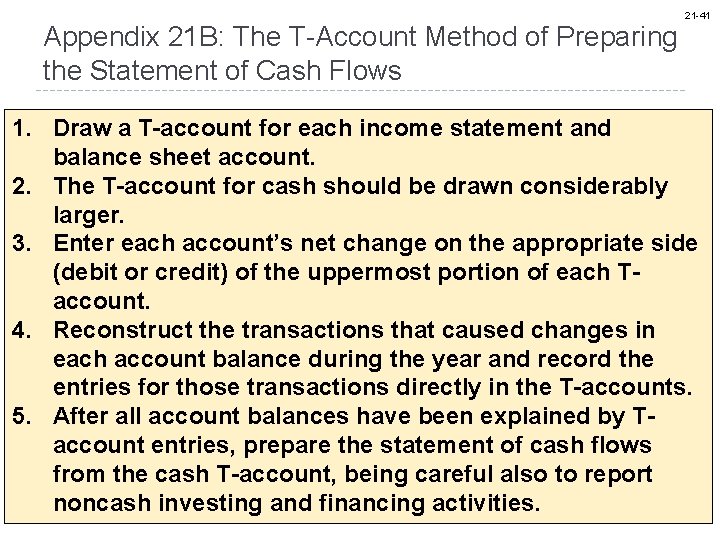

21 -2 Cash Inflows and Outflows Cash Inflows Operating Activities Cash received from revenues Investing Activities Sale of operational assets Sale of investments Collections of loans Financing Activities Issuance of stock Issuance of bonds and notes Business Cash paid for expenses Purchase of operational assets Purchase of investments Loans to others Cash Outflows Payment of dividends Repurchase of stock Repayment of debt

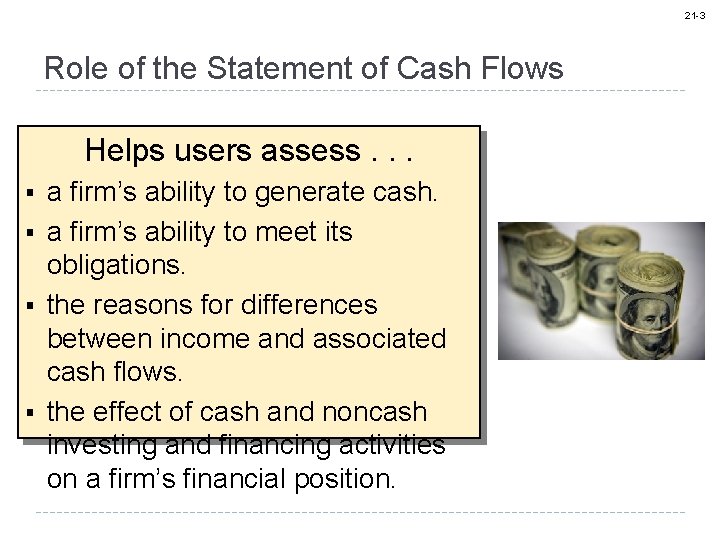

21 -3 Role of the Statement of Cash Flows Helps users assess. . . § § a firm’s ability to generate cash. a firm’s ability to meet its obligations. the reasons for differences between income and associated cash flows. the effect of cash and noncash investing and financing activities on a firm’s financial position.

21 -4 Role of the Statement of Cash Flows Lists all cash inflows and all cash outflows by category: operating, investing, and financing Explains the change in cash during the period Required by GAAP Cash is King! Especially during an economic downturn.

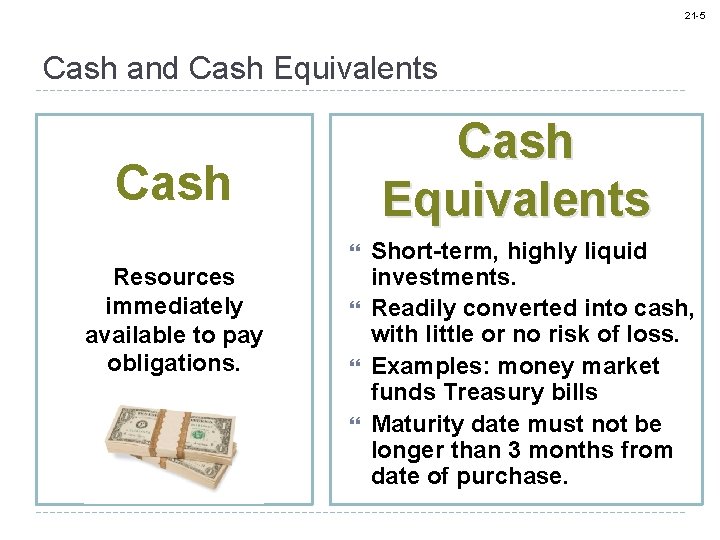

21 -5 Cash and Cash Equivalents Cash Resources immediately available to pay obligations. Short-term, highly liquid investments. Readily converted into cash, with little or no risk of loss. Examples: money market funds Treasury bills Maturity date must not be longer than 3 months from date of purchase.

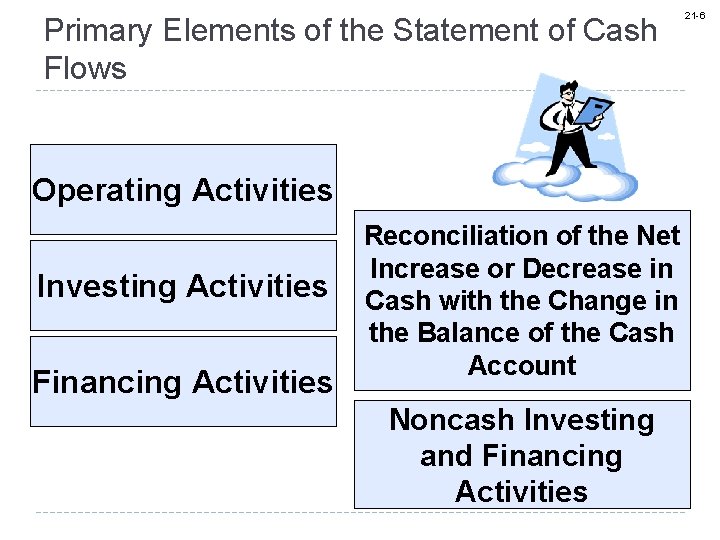

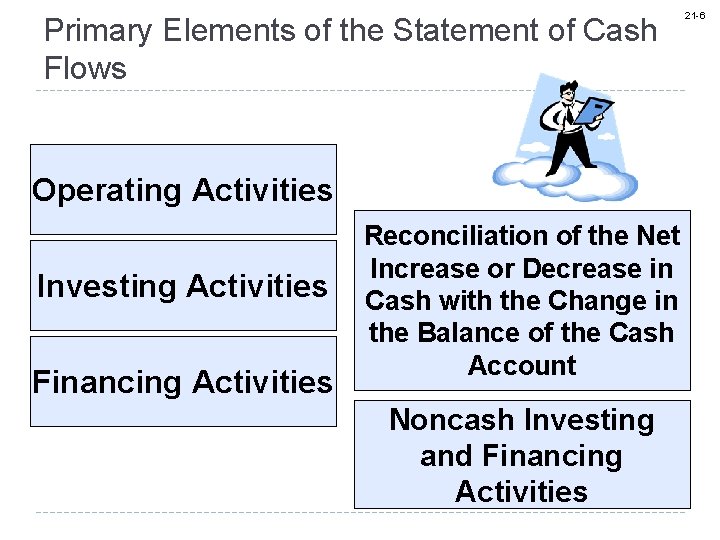

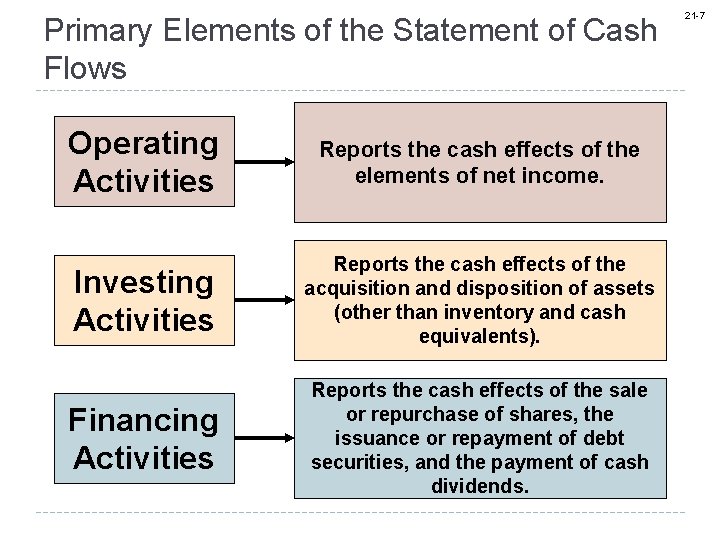

Primary Elements of the Statement of Cash Flows Operating Activities Investing Activities Financing Activities Reconciliation of the Net Increase or Decrease in Cash with the Change in the Balance of the Cash Account Noncash Investing and Financing Activities 21 -6

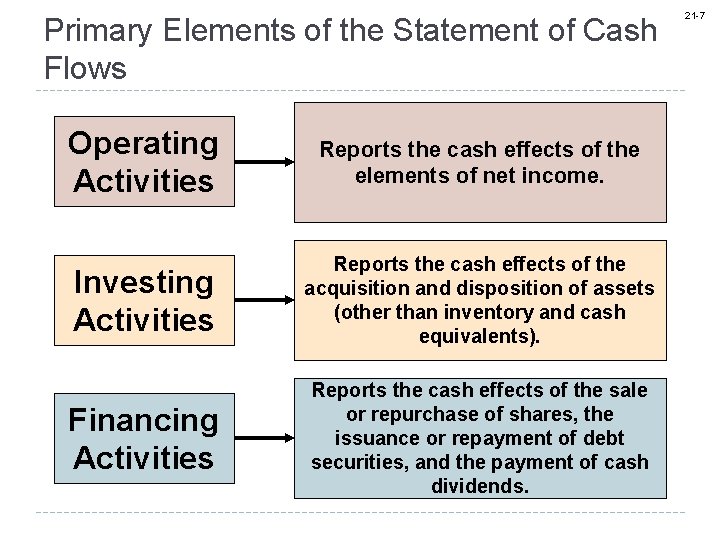

Primary Elements of the Statement of Cash Flows Operating Activities Reports the cash effects of the elements of net income. Investing Activities Reports the cash effects of the acquisition and disposition of assets (other than inventory and cash equivalents). Financing Activities Reports the cash effects of the sale or repurchase of shares, the issuance or repayment of debt securities, and the payment of cash dividends. 21 -7

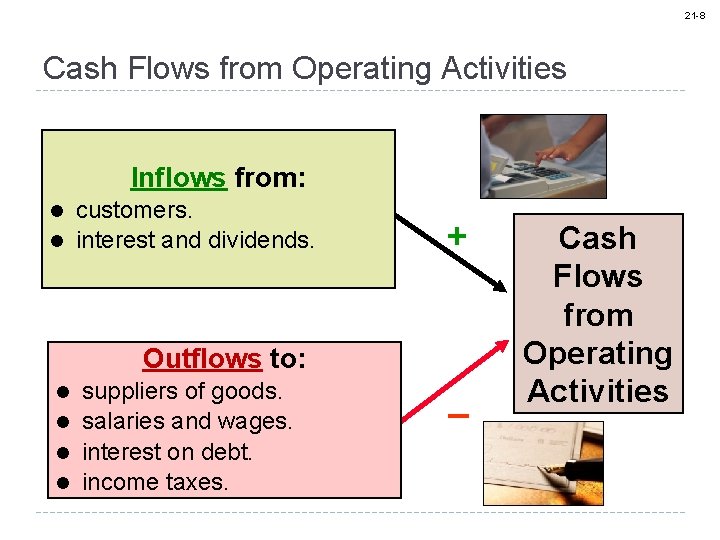

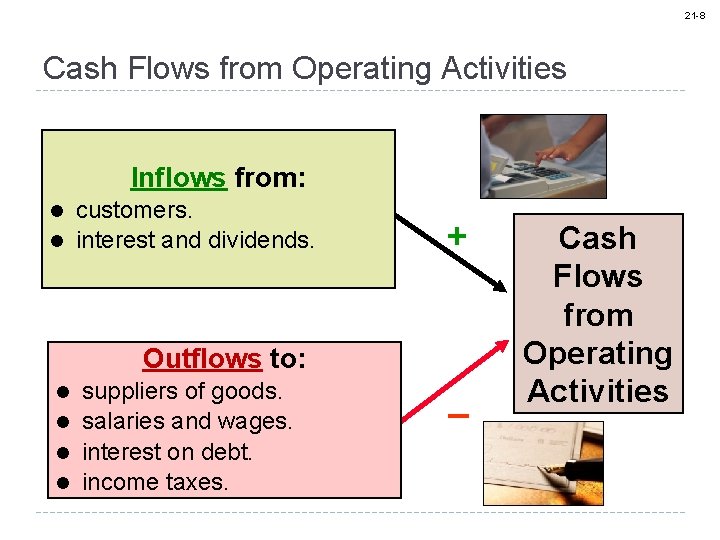

21 -8 Cash Flows from Operating Activities Inflows from: customers. l interest and dividends. l + Outflows to: suppliers of goods. l salaries and wages. l interest on debt. l income taxes. l _ Cash Flows from Operating Activities

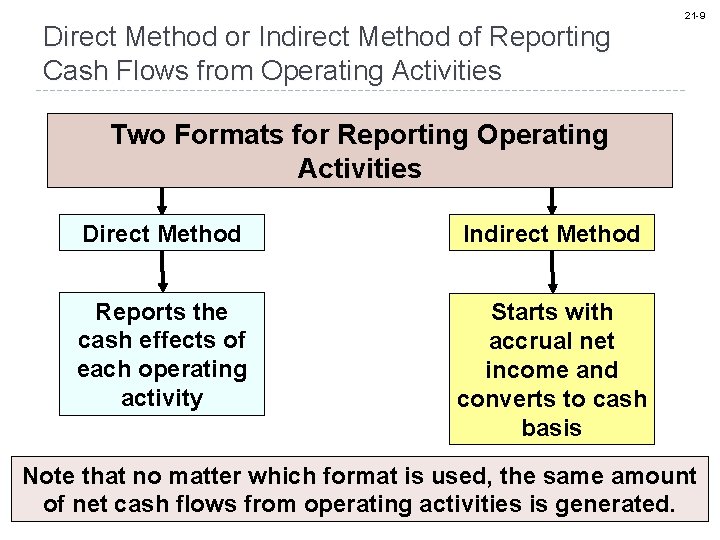

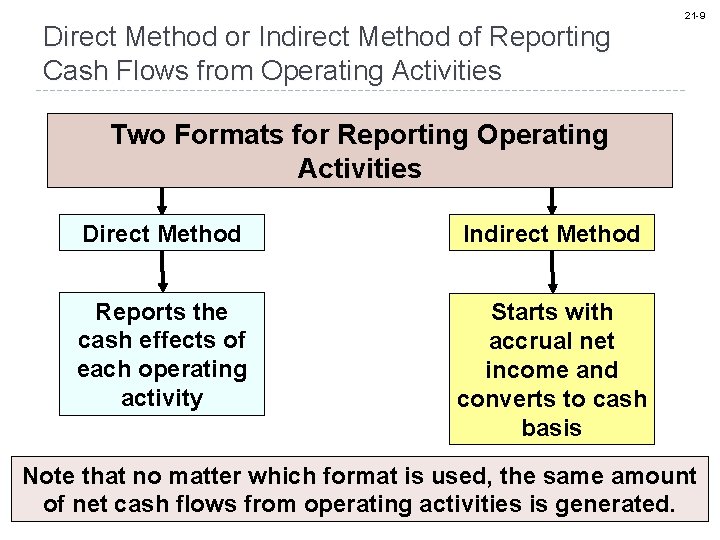

Direct Method or Indirect Method of Reporting Cash Flows from Operating Activities 21 -9 Two Formats for Reporting Operating Activities Direct Method Indirect Method Reports the cash effects of each operating activity Starts with accrual net income and converts to cash basis Note that no matter which format is used, the same amount of net cash flows from operating activities is generated.

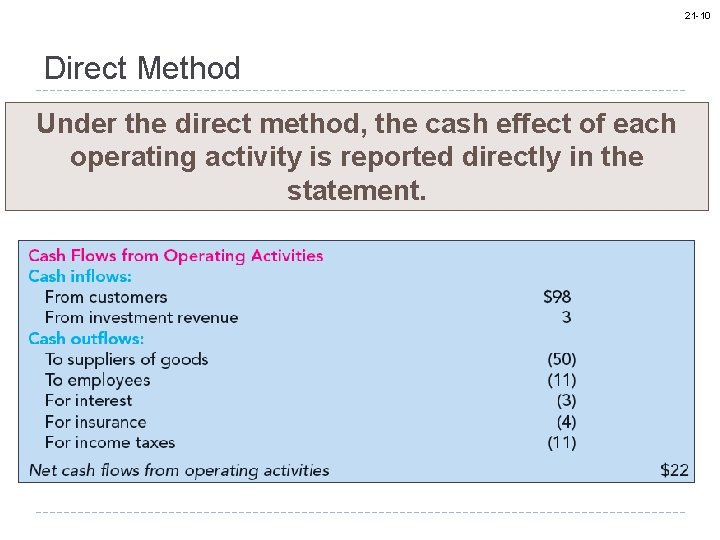

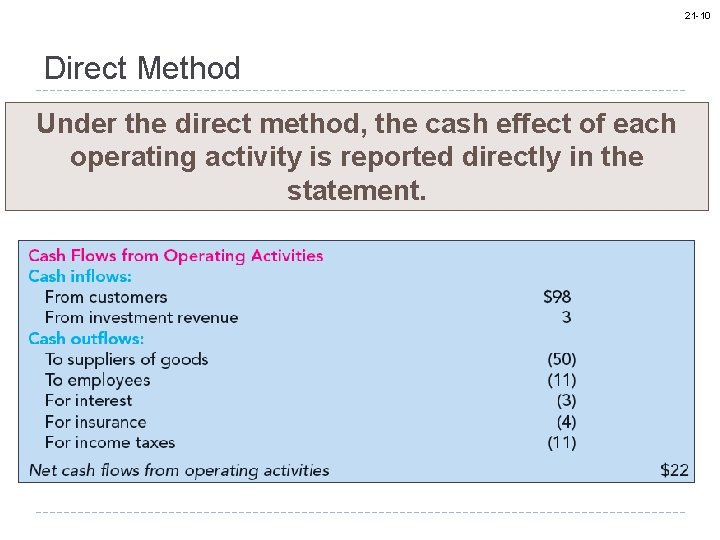

21 -10 Direct Method Under the direct method, the cash effect of each operating activity is reported directly in the statement.

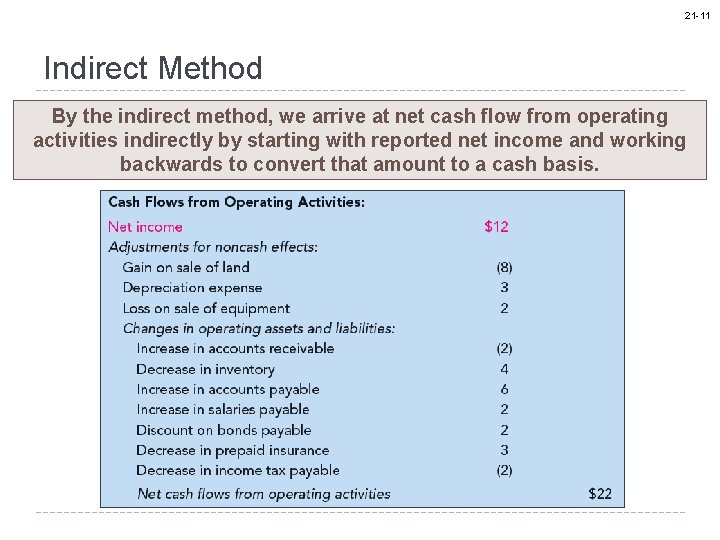

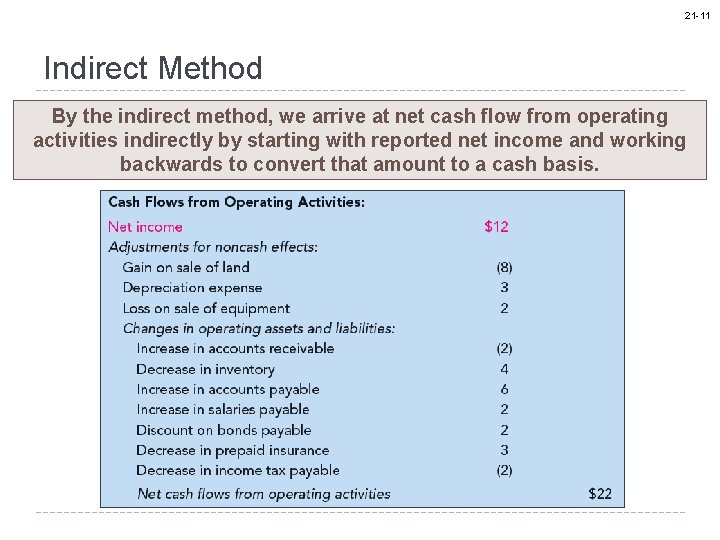

21 -11 Indirect Method By the indirect method, we arrive at net cash flow from operating activities indirectly by starting with reported net income and working backwards to convert that amount to a cash basis.

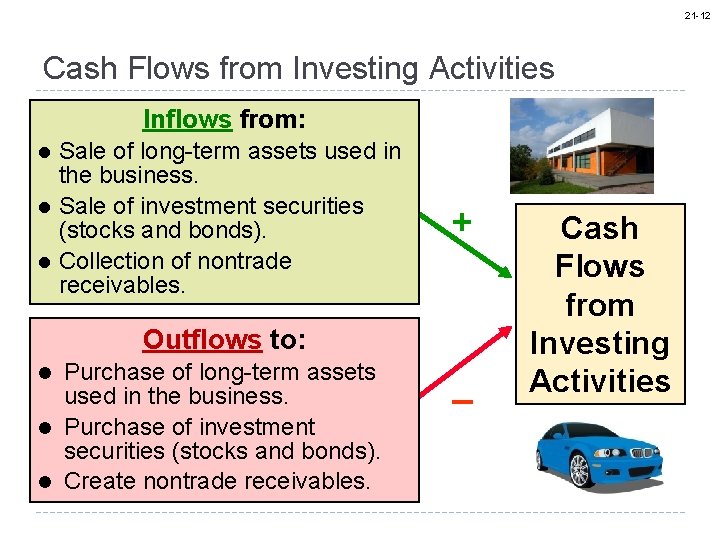

21 -12 Cash Flows from Investing Activities Inflows from: l l l Sale of long-term assets used in the business. Sale of investment securities (stocks and bonds). Collection of nontrade receivables. + Outflows to: Purchase of long-term assets used in the business. l Purchase of investment securities (stocks and bonds). l Create nontrade receivables. l _ Cash Flows from Investing Activities

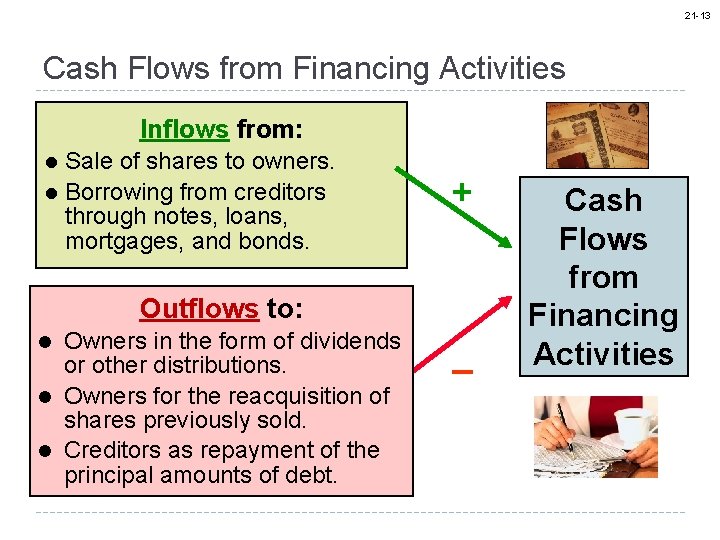

21 -13 Cash Flows from Financing Activities Inflows from: l l Sale of shares to owners. Borrowing from creditors through notes, loans, mortgages, and bonds. + Outflows to: Owners in the form of dividends or other distributions. l Owners for the reacquisition of shares previously sold. l Creditors as repayment of the principal amounts of debt. l _ Cash Flows from Financing Activities

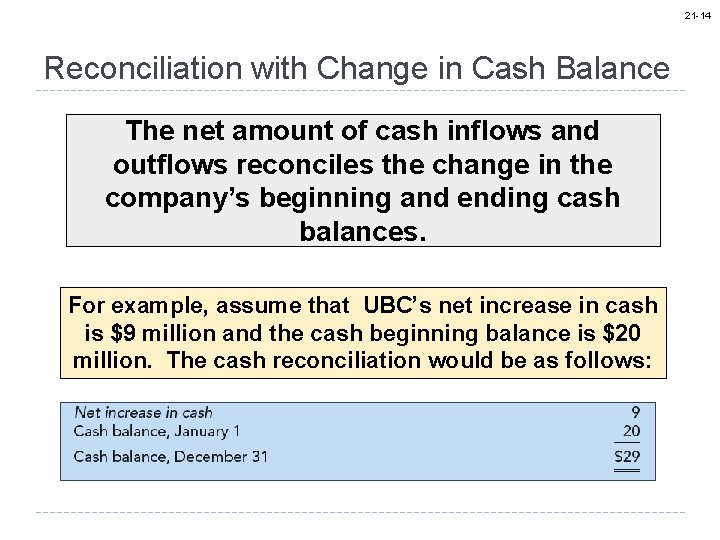

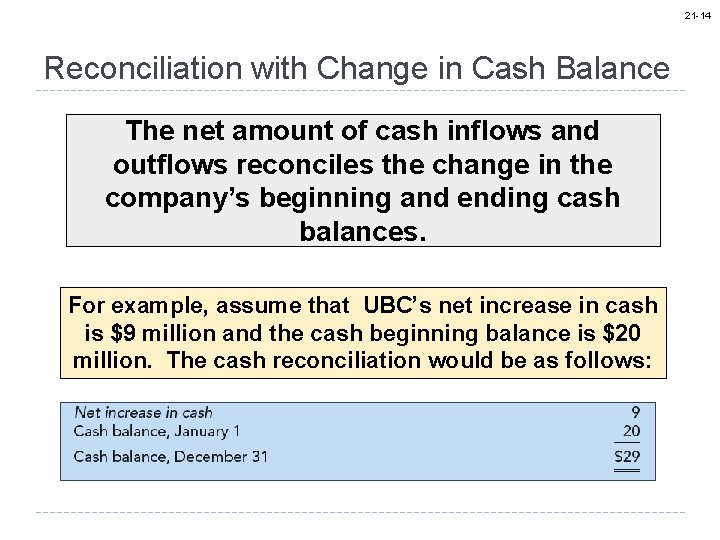

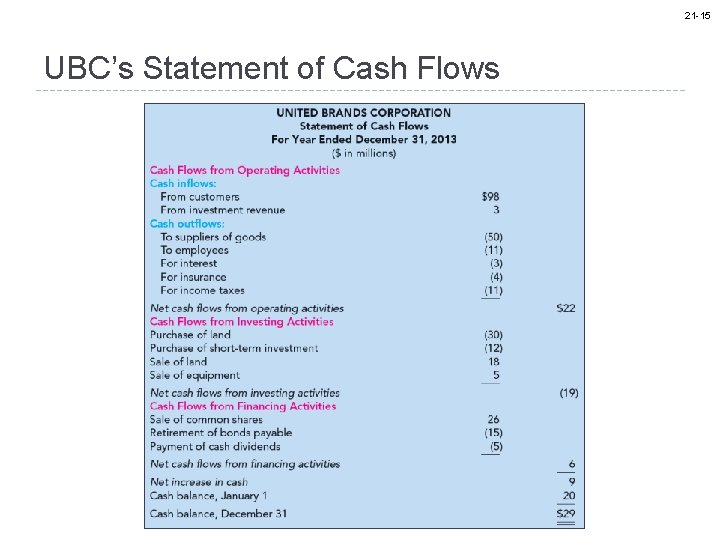

21 -14 Reconciliation with Change in Cash Balance The net amount of cash inflows and outflows reconciles the change in the company’s beginning and ending cash balances. For example, assume that UBC’s net increase in cash is $9 million and the cash beginning balance is $20 million. The cash reconciliation would be as follows:

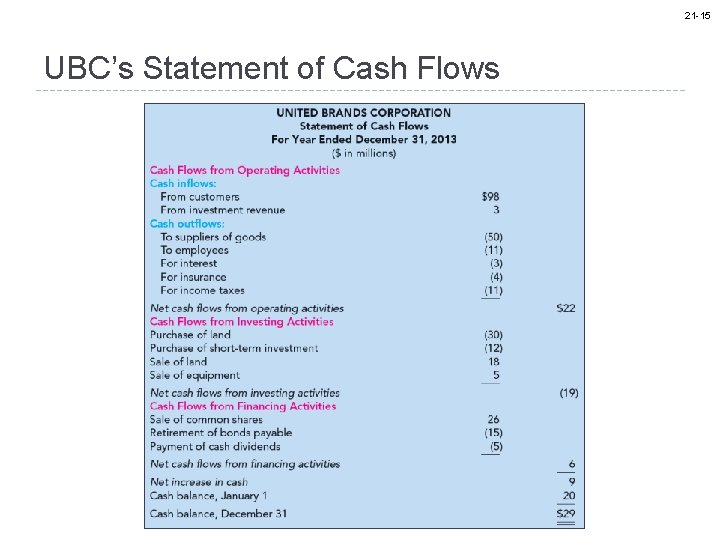

21 -15 UBC’s Statement of Cash Flows

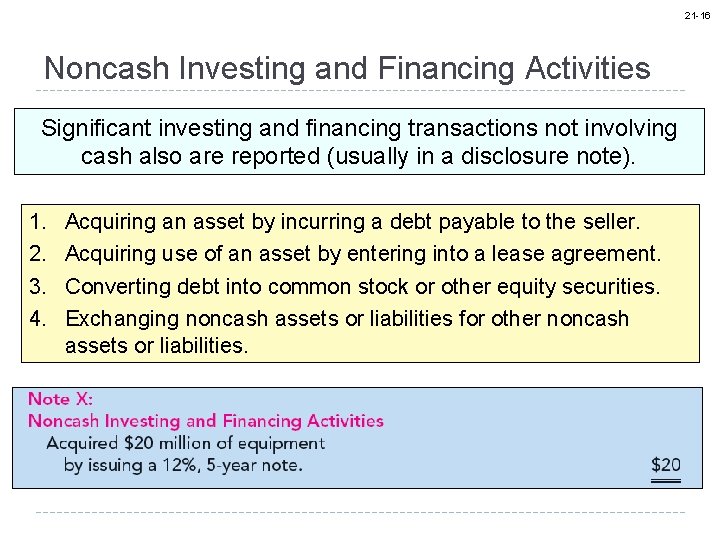

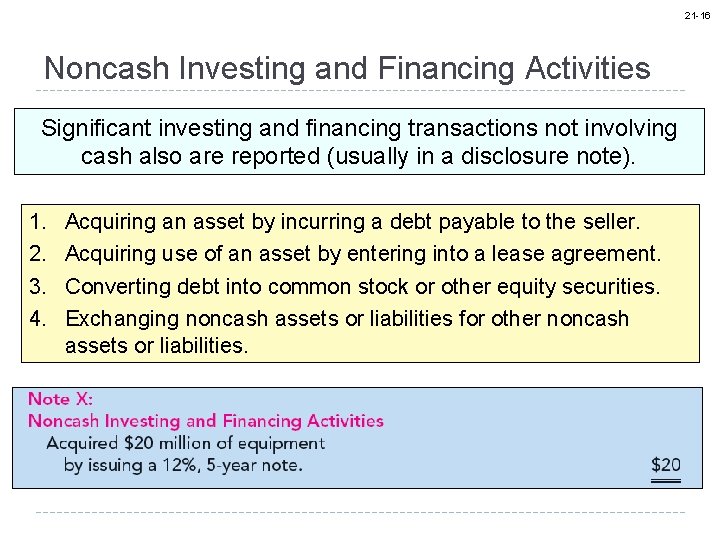

21 -16 Noncash Investing and Financing Activities Significant investing and financing transactions not involving cash also are reported (usually in a disclosure note). 1. 2. 3. 4. Acquiring an asset by incurring a debt payable to the seller. Acquiring use of an asset by entering into a lease agreement. Converting debt into common stock or other equity securities. Exchanging noncash assets or liabilities for other noncash assets or liabilities.

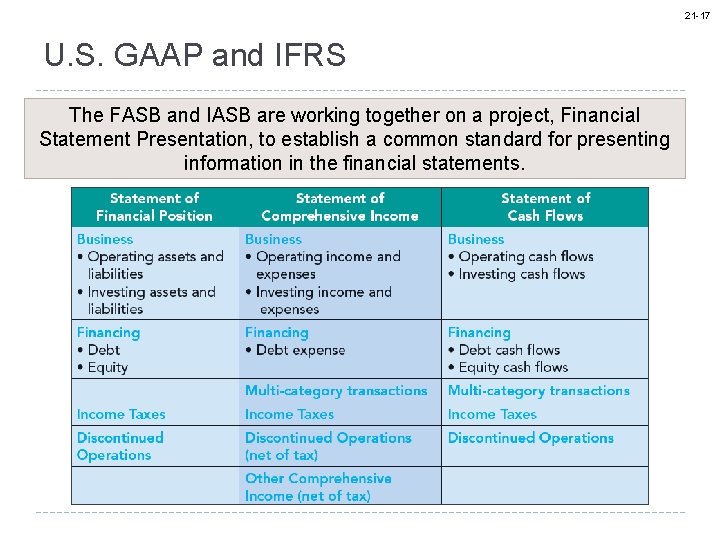

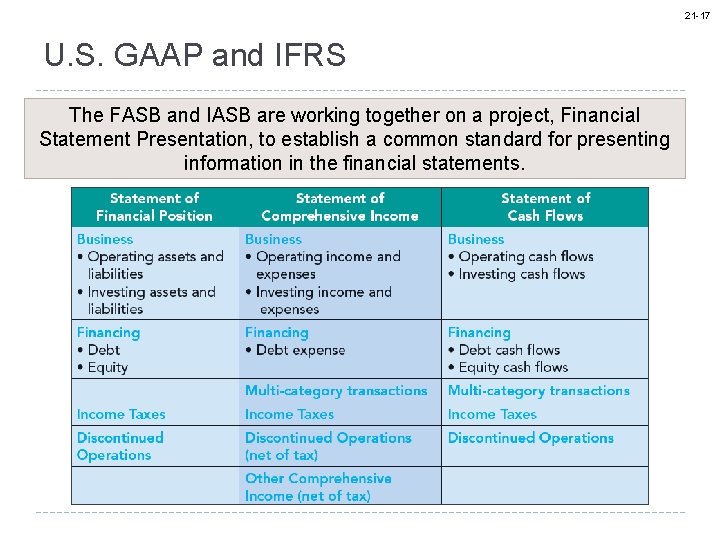

21 -17 U. S. GAAP and IFRS The FASB and IASB are working together on a project, Financial Statement Presentation, to establish a common standard for presenting information in the financial statements.

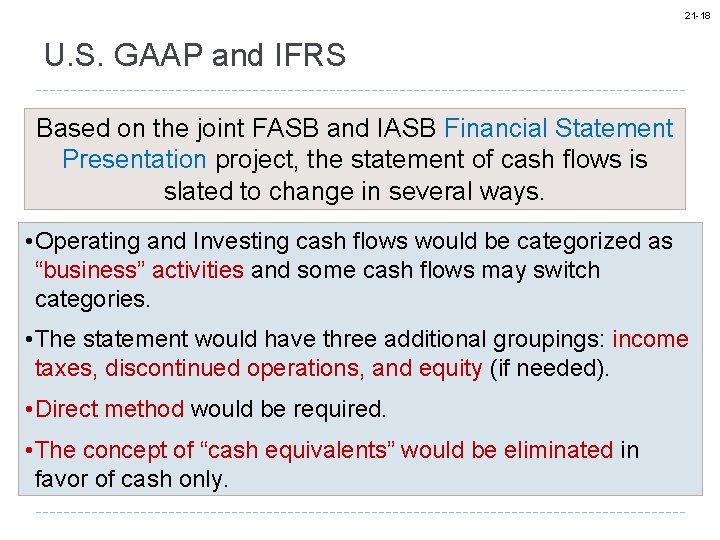

21 -18 U. S. GAAP and IFRS Based on the joint FASB and IASB Financial Statement Presentation project, the statement of cash flows is slated to change in several ways. • Operating and Investing cash flows would be categorized as “business” activities and some cash flows may switch categories. • The statement would have three additional groupings: income taxes, discontinued operations, and equity (if needed). • Direct method would be required. • The concept of “cash equivalents” would be eliminated in favor of cash only.

Preparation of the Statement of Cash Flows Reconstructing the events and transactions that occurred during the period helps identify the operating, investing, and financing activities to be reported. A spreadsheet can be used to ensure that no reportable activities are inadvertently overlooked. 21 -19

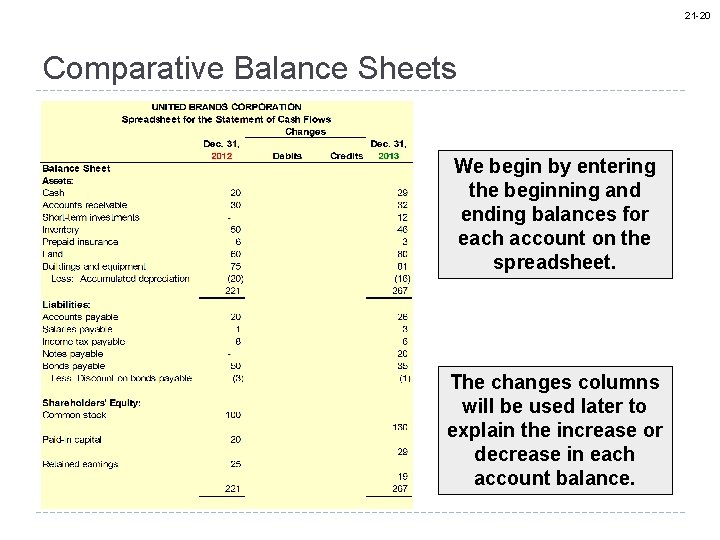

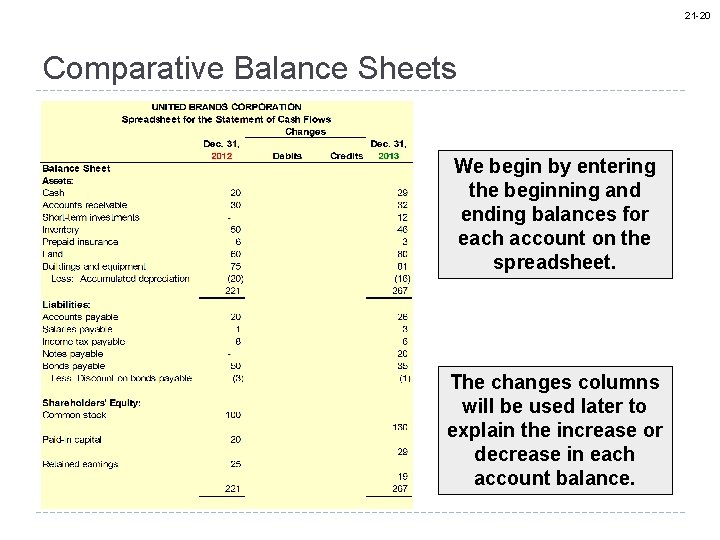

21 -20 Comparative Balance Sheets We begin by entering the beginning and ending balances for each account on the spreadsheet. The changes columns will be used later to explain the increase or decrease in each account balance.

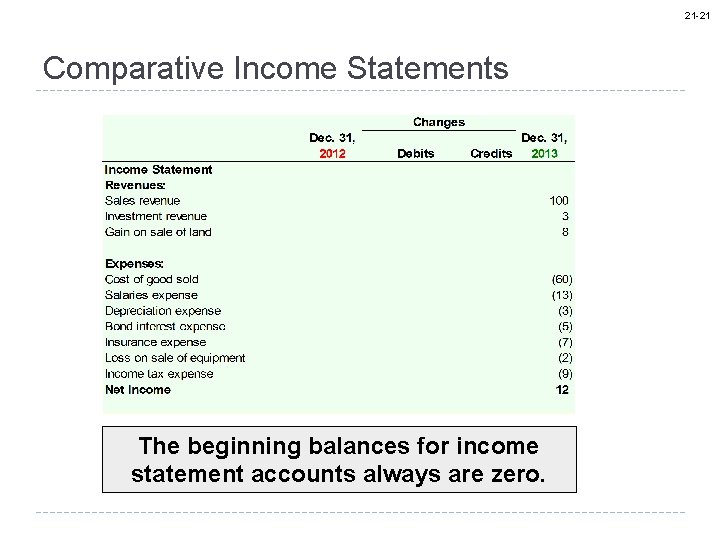

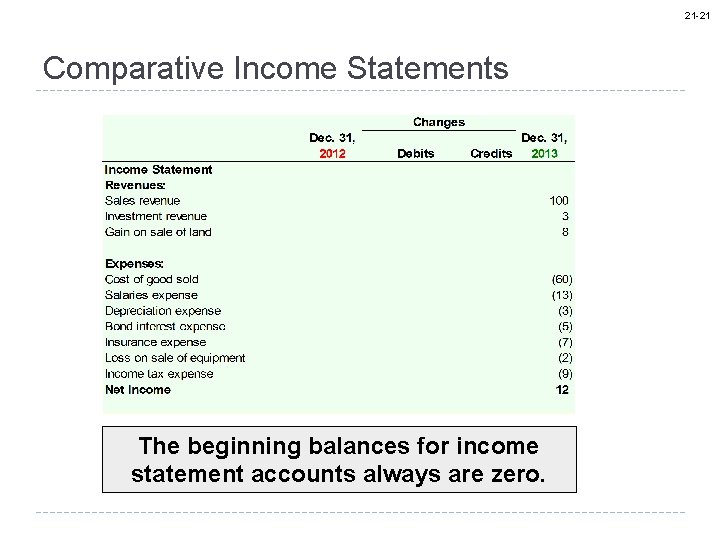

21 -21 Comparative Income Statements The beginning balances for income statement accounts always are zero.

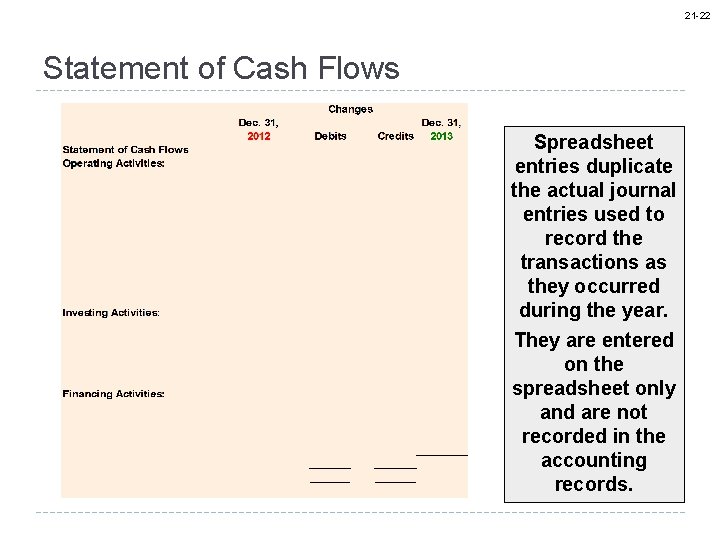

21 -22 Statement of Cash Flows Spreadsheet entries duplicate the actual journal entries used to record the transactions as they occurred during the year. They are entered on the spreadsheet only and are not recorded in the accounting records.

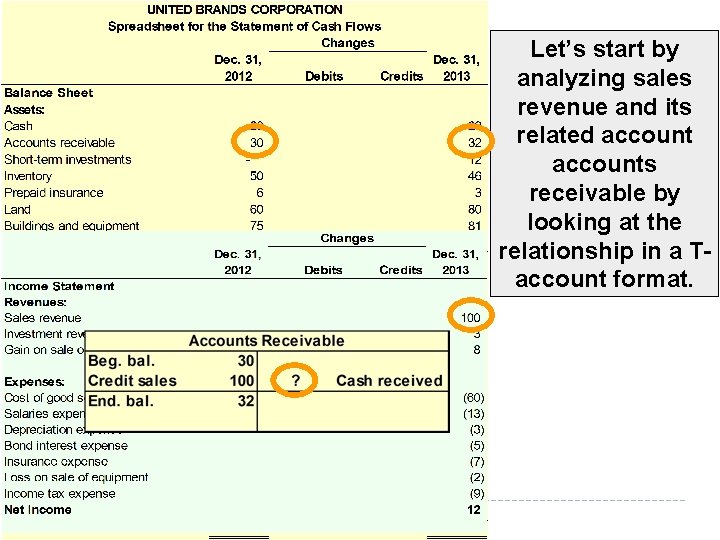

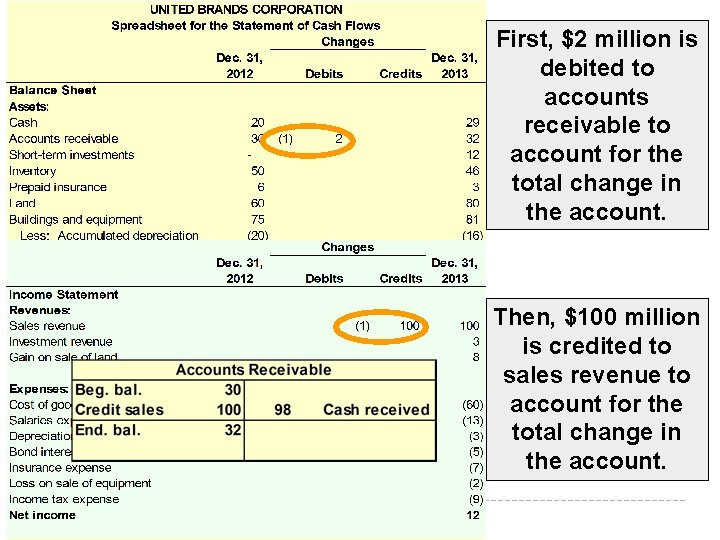

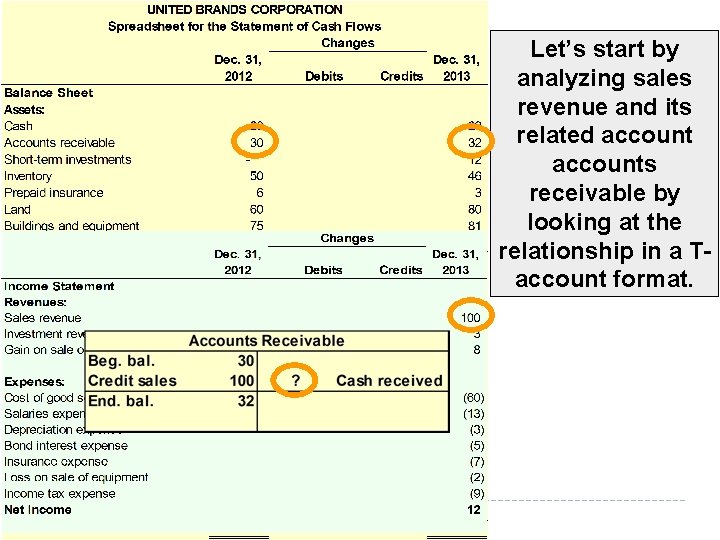

Let’s start by analyzing sales revenue and its related accounts receivable by looking at the relationship in a Taccount format.

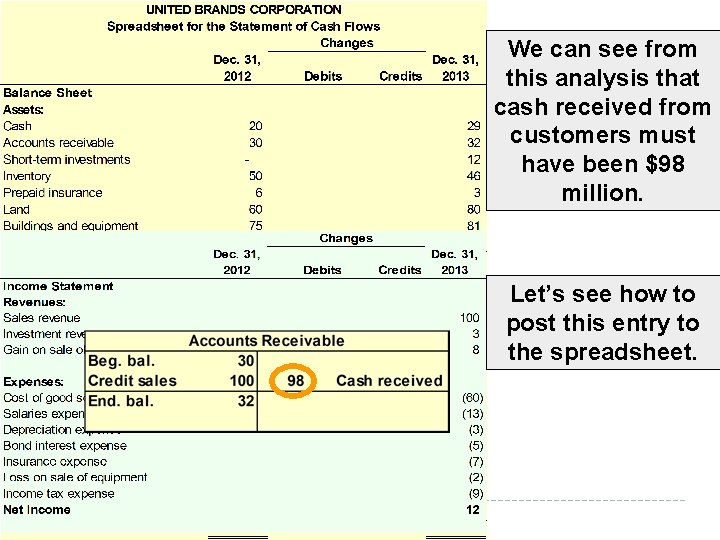

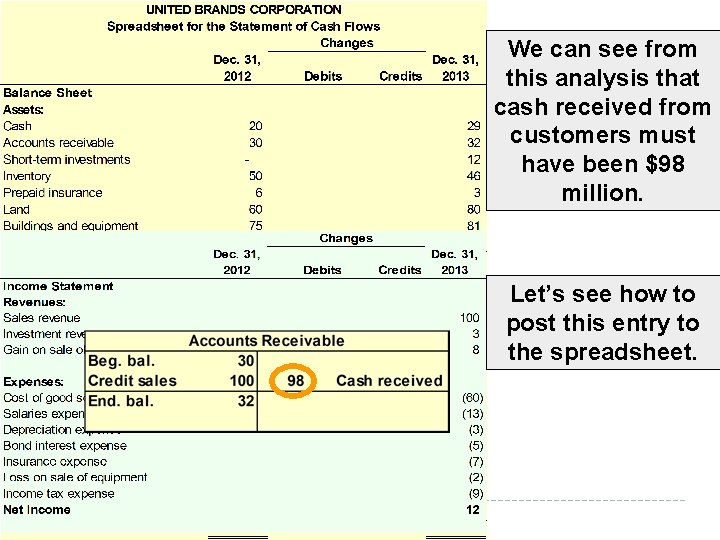

We can see from this analysis that cash received from customers must have been $98 million. Let’s see how to post this entry to the spreadsheet.

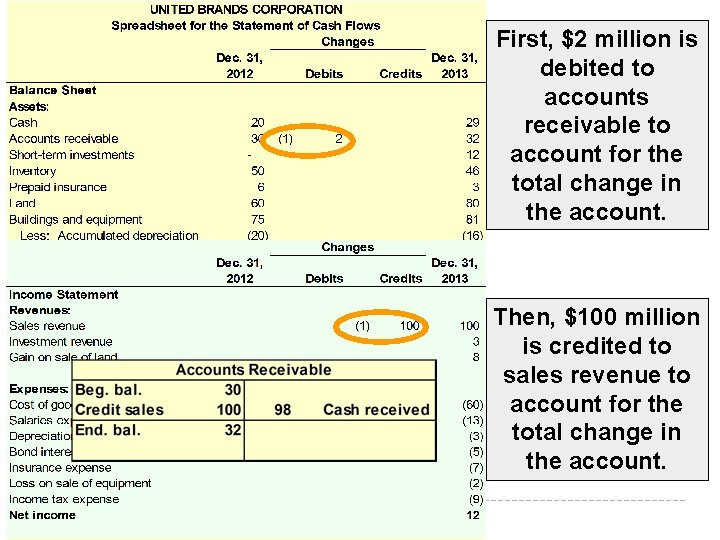

First, $2 million is debited to accounts receivable to account for the total change in the account. Then, $100 million is credited to sales revenue to account for the total change in the account.

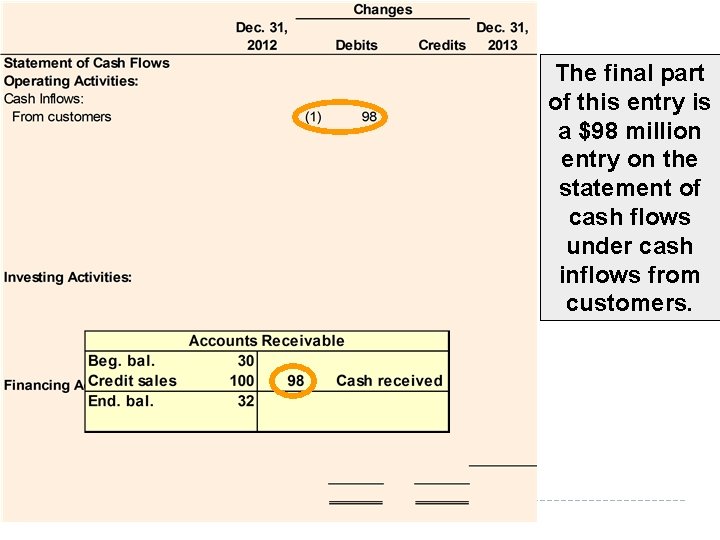

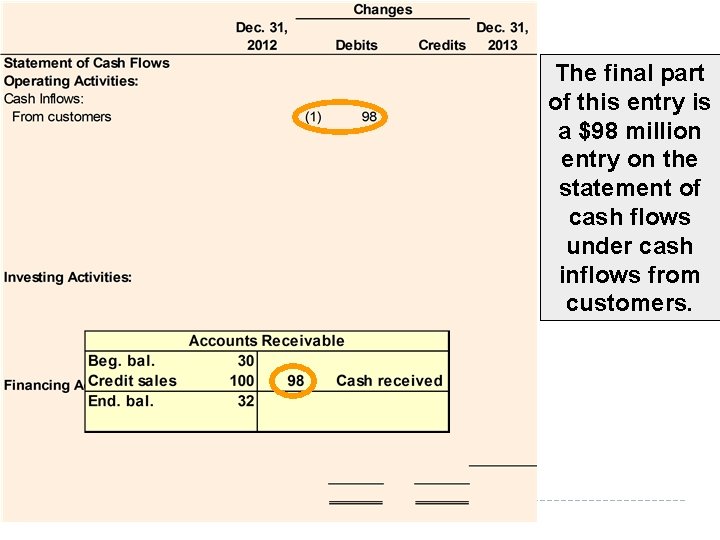

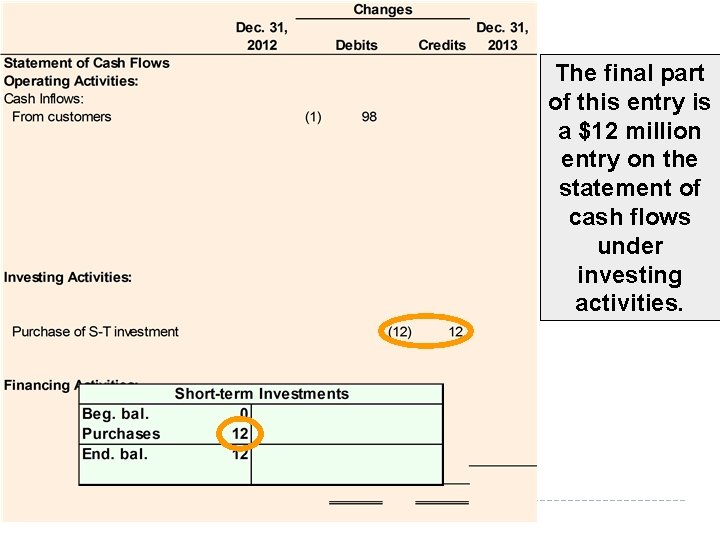

The final part of this entry is a $98 million entry on the statement of cash flows under cash inflows from customers.

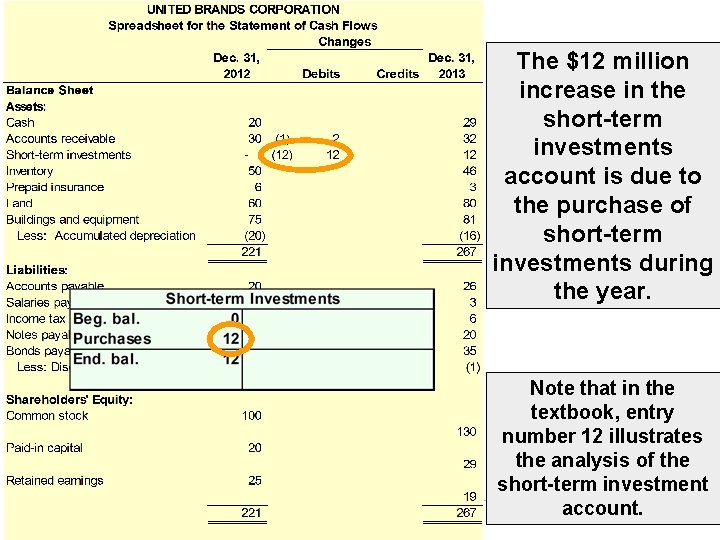

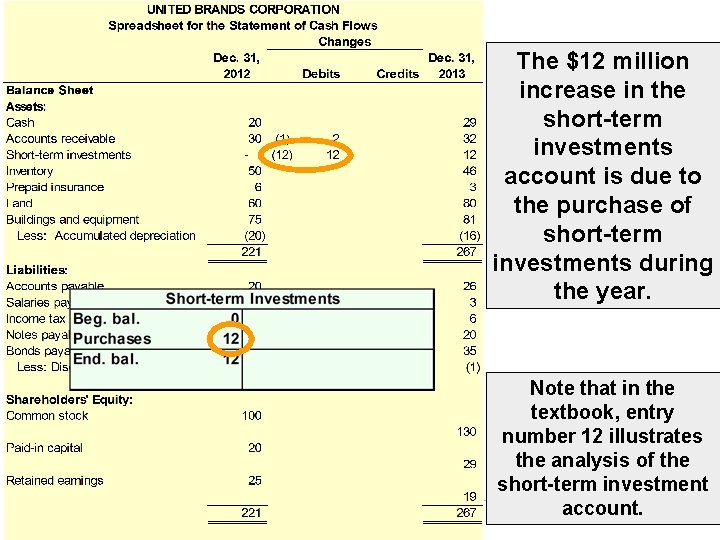

The $12 million increase in the short-term investments account is due to the purchase of short-term investments during the year. Note that in the textbook, entry number 12 illustrates the analysis of the short-term investment account.

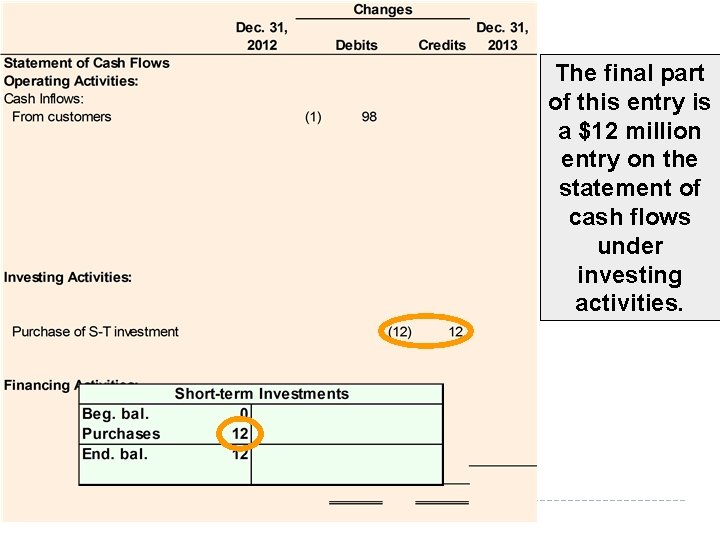

The final part of this entry is a $12 million entry on the statement of cash flows under investing activities.

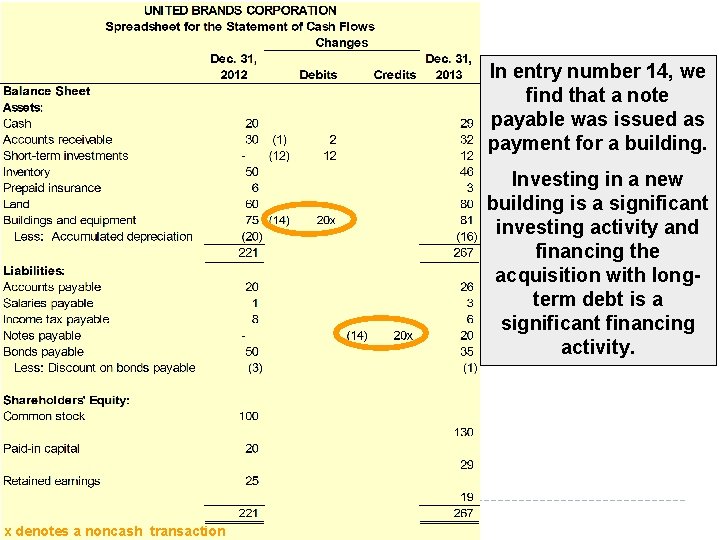

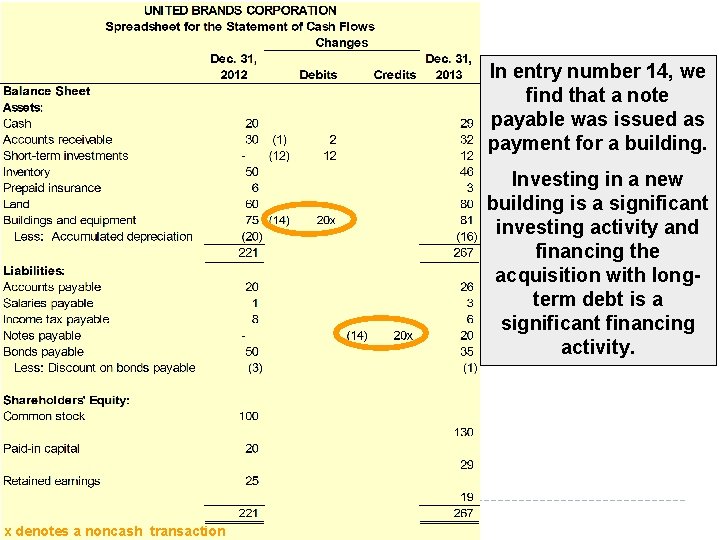

In entry number 14, we find that a note payable was issued as payment for a building. Investing in a new building is a significant investing activity and financing the acquisition with longterm debt is a significant financing activity. x denotes a noncash transaction

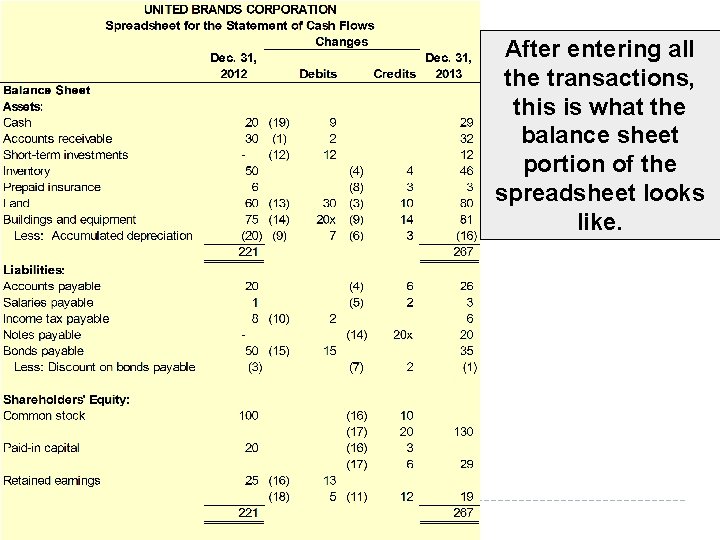

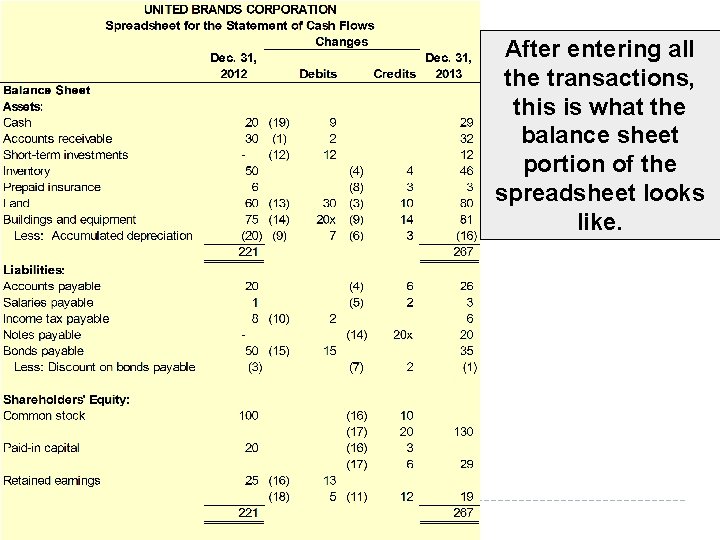

After entering all the transactions, this is what the balance sheet portion of the spreadsheet looks like.

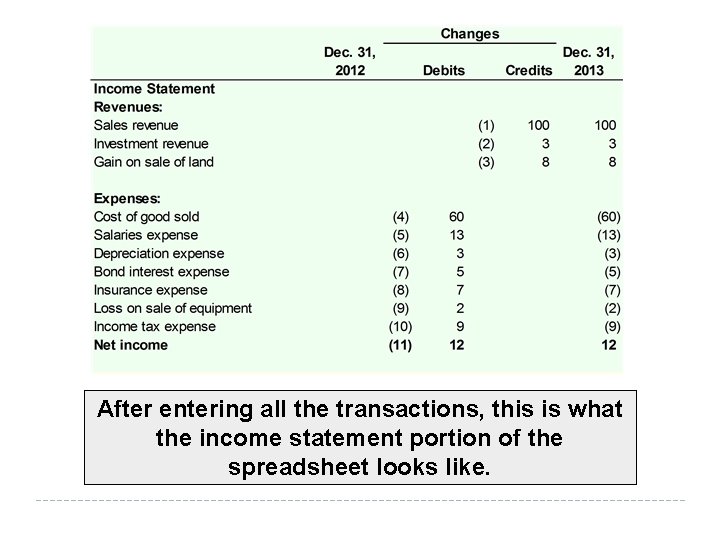

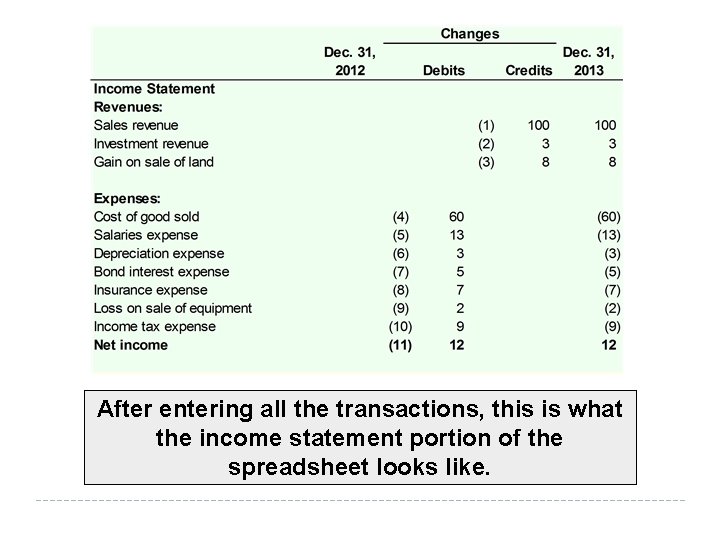

After entering all the transactions, this is what the income statement portion of the spreadsheet looks like.

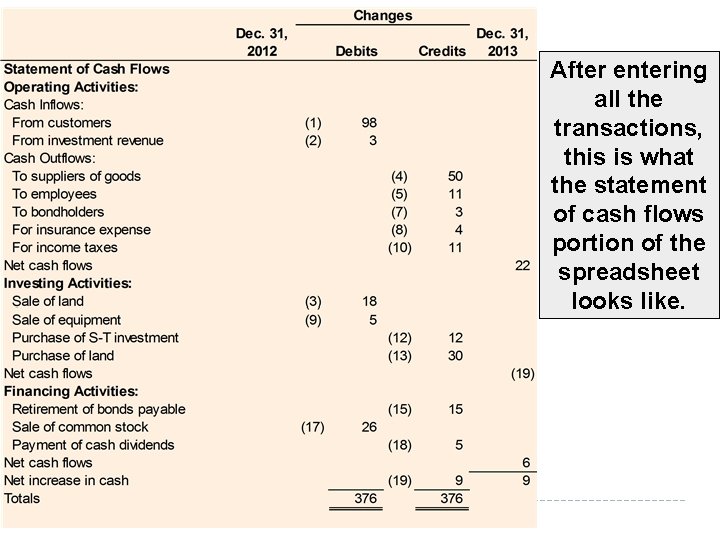

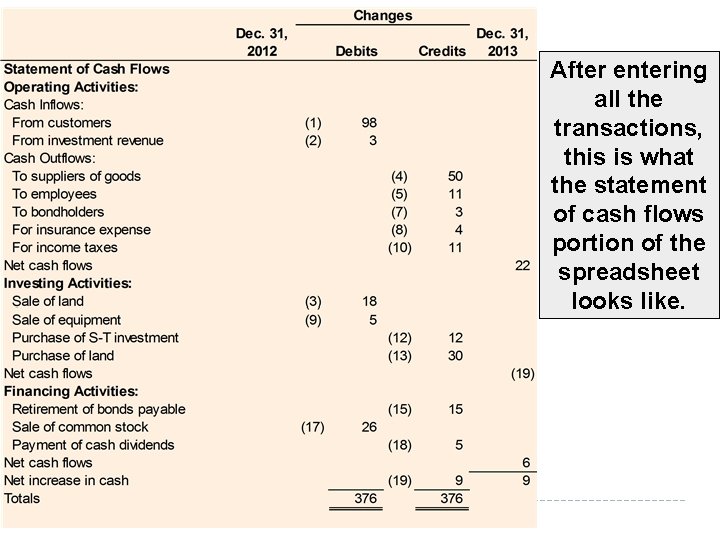

After entering all the transactions, this is what the statement of cash flows portion of the spreadsheet looks like.

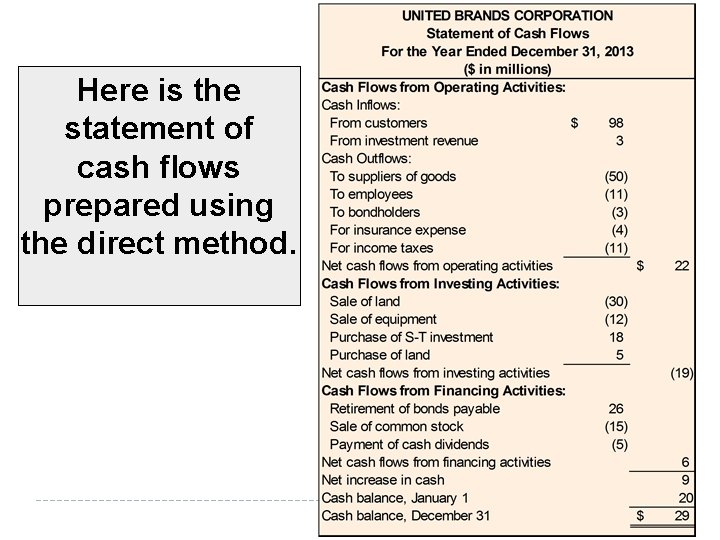

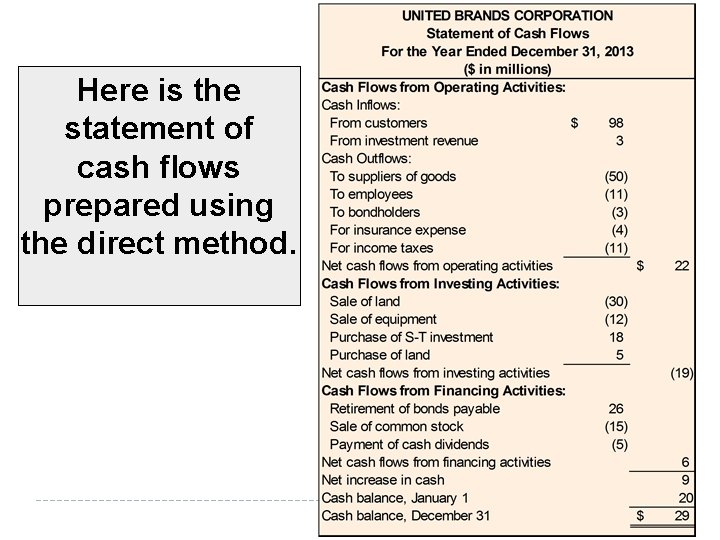

Here is the statement of cash flows prepared using the direct method.

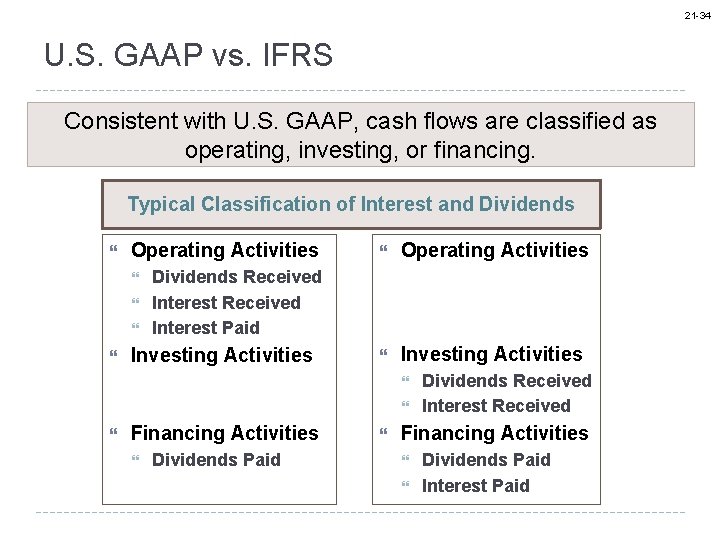

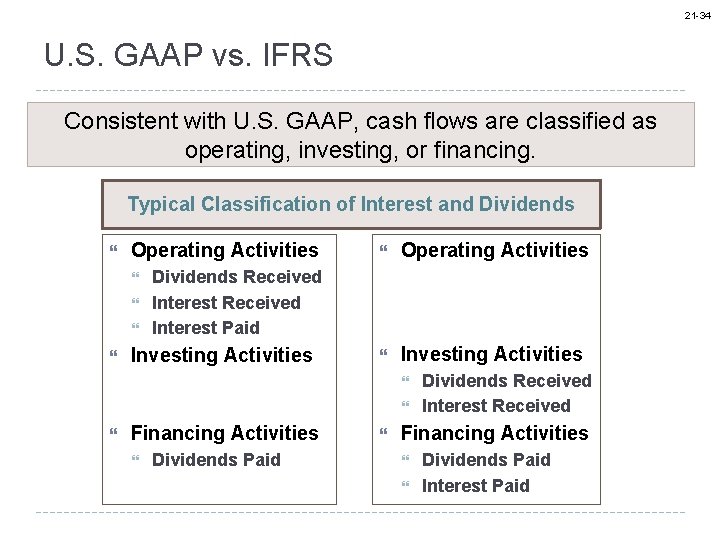

21 -34 U. S. GAAP vs. IFRS Consistent with U. S. GAAP, cash flows are classified as operating, investing, or financing. Typical Classification of Interest and Dividends Operating Activities Investing Activities Dividends Received Interest Paid Investing Activities Financing Activities Dividends Paid Dividends Received Interest Received Financing Activities Dividends Paid Interest Paid

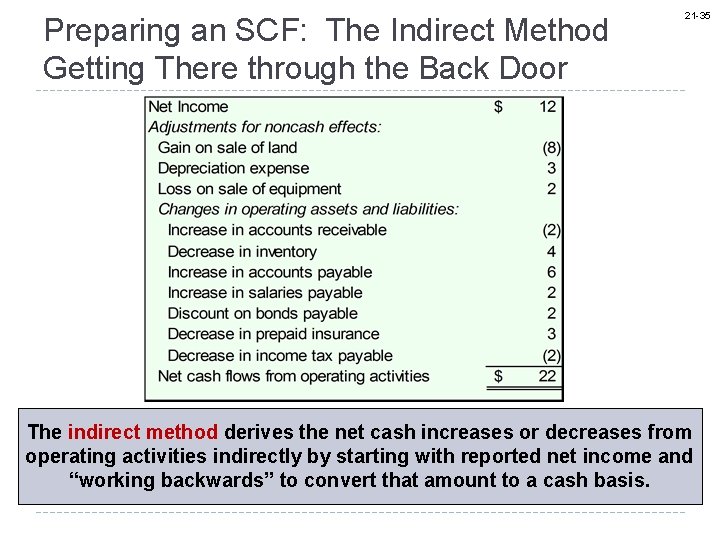

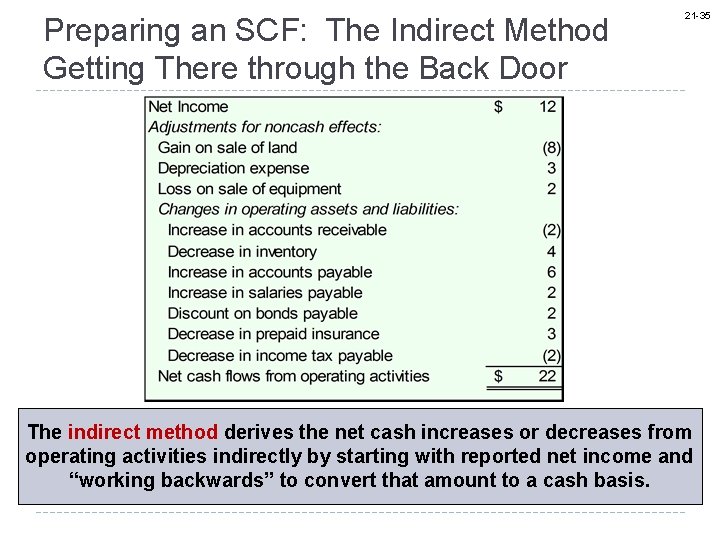

Preparing an SCF: The Indirect Method Getting There through the Back Door 21 -35 The indirect method derives the net cash increases or decreases from operating activities indirectly by starting with reported net income and “working backwards” to convert that amount to a cash basis.

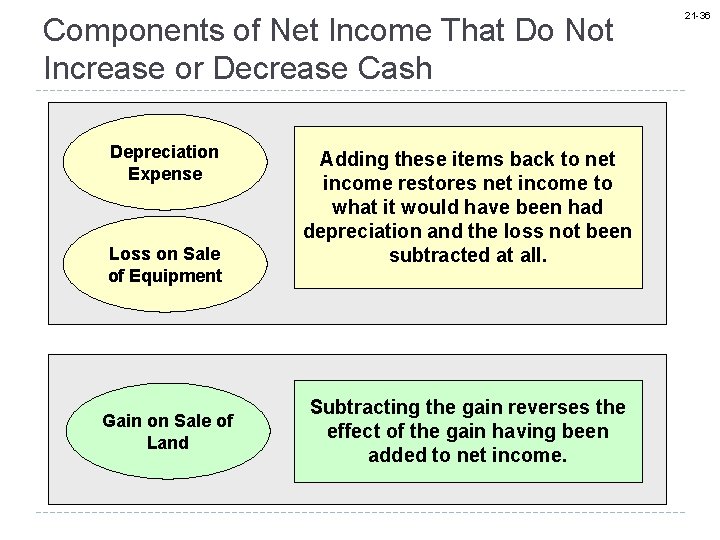

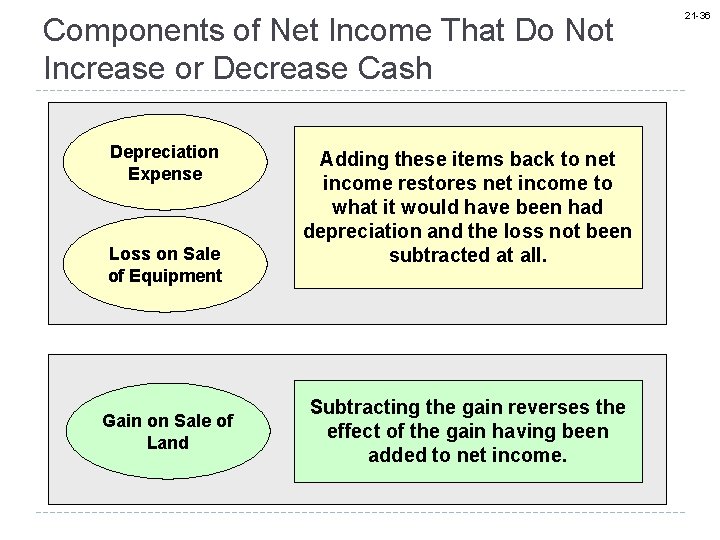

Components of Net Income That Do Not Increase or Decrease Cash Depreciation Expense Loss on Sale of Equipment Gain on Sale of Land Adding these items back to net income restores net income to what it would have been had depreciation and the loss not been subtracted at all. Subtracting the gain reverses the effect of the gain having been added to net income. 21 -36

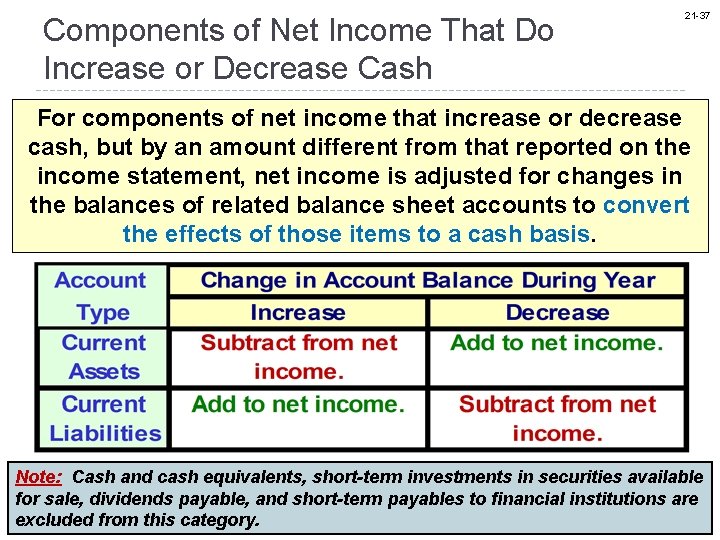

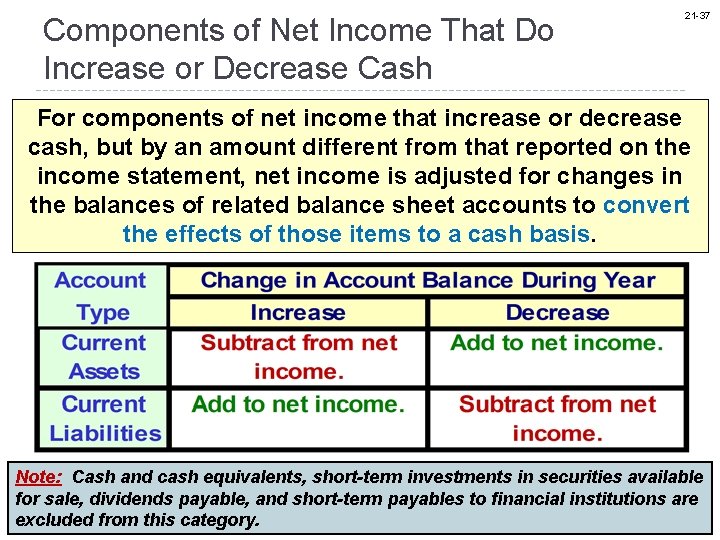

Components of Net Income That Do Increase or Decrease Cash 21 -37 For components of net income that increase or decrease cash, but by an amount different from that reported on the income statement, net income is adjusted for changes in the balances of related balance sheet accounts to convert the effects of those items to a cash basis. Note: Cash and cash equivalents, short-term investments in securities available for sale, dividends payable, and short-term payables to financial institutions are excluded from this category.

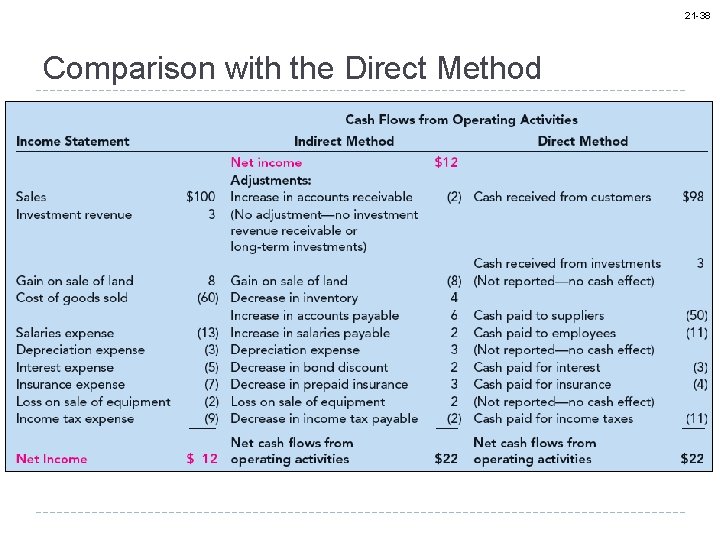

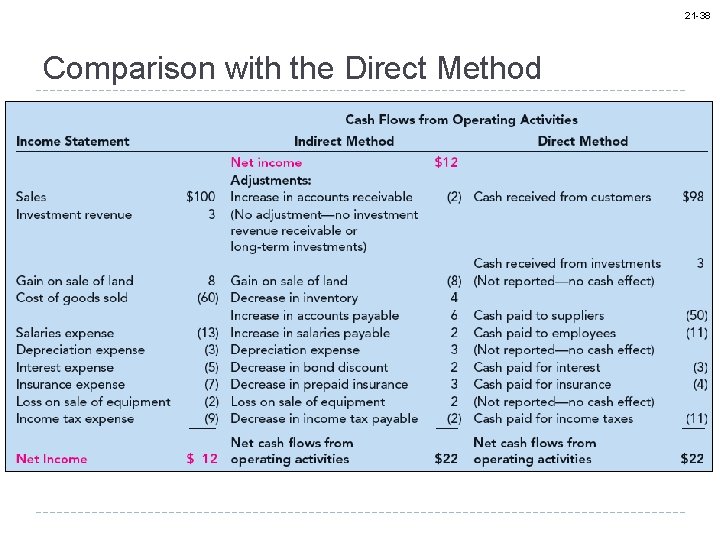

21 -38 Comparison with the Direct Method

Appendix 21 A: Spreadsheet for the Indirect Method A spreadsheet is equally useful in preparing a statement of cash flows whether we use the direct or the indirect method of determining cash flows from operating activities. 21 -39

Appendix 21 B: The T-Account Method of Preparing the Statement of Cash Flows The T-Account method serves the same purpose as a spreadsheet in assisting in the preparation of a statement of cash flows. 21 -40

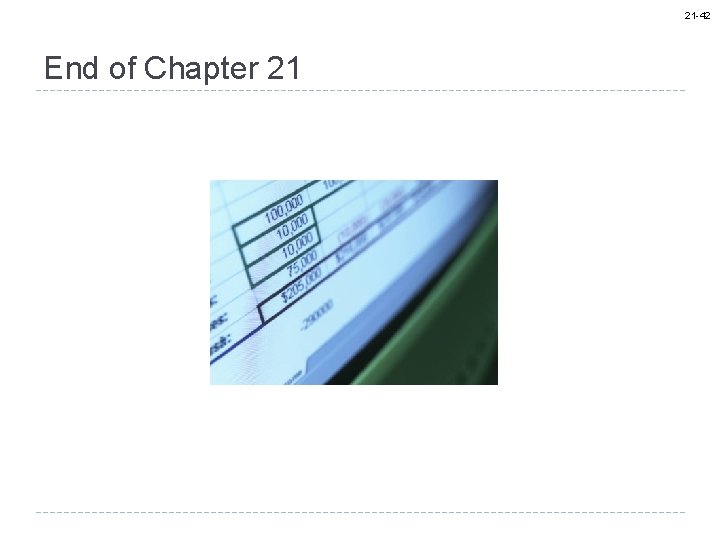

Appendix 21 B: The T-Account Method of Preparing the Statement of Cash Flows 21 -41 1. Draw a T-account for each income statement and balance sheet account. 2. The T-account for cash should be drawn considerably larger. 3. Enter each account’s net change on the appropriate side (debit or credit) of the uppermost portion of each Taccount. 4. Reconstruct the transactions that caused changes in each account balance during the year and record the entries for those transactions directly in the T-accounts. 5. After all account balances have been explained by Taccount entries, prepare the statement of cash flows from the cash T-account, being careful also to report noncash investing and financing activities.

21 -42 End of Chapter 21