The Revenue Cycle Sales to Cash Collections Chapter

- Slides: 40

The Revenue Cycle: Sales to Cash Collections Chapter 12 Copyright © 2015 Pearson Education, Inc. 12 -1

Learning Objectives • Describe the basic business activities and related information processing operations performed in the revenue cycle. • Discuss the key decisions that need to be made in the revenue cycle, and identify the information needed to make those decisions. • Identify major threats in the revenue cycle, and evaluate the adequacy of various control procedures for dealing with those threats. Copyright © 2015 Pearson Education, Inc. 12 -2

INTRODUCTION • The revenue cycle is a recurring set of business activities and related information processing operations associated with: ▫ Providing goods and services to customers ▫ Collecting their cash payments • The primary external exchange of information is with customers. Copyright © 2015 Pearson Education, Inc.

Basic Revenue Cycle Activities • • 1. Sales order entry 2. Shipping 3. Billing 4. Cash Collections Copyright © 2015 Pearson Education, Inc. 12 -4

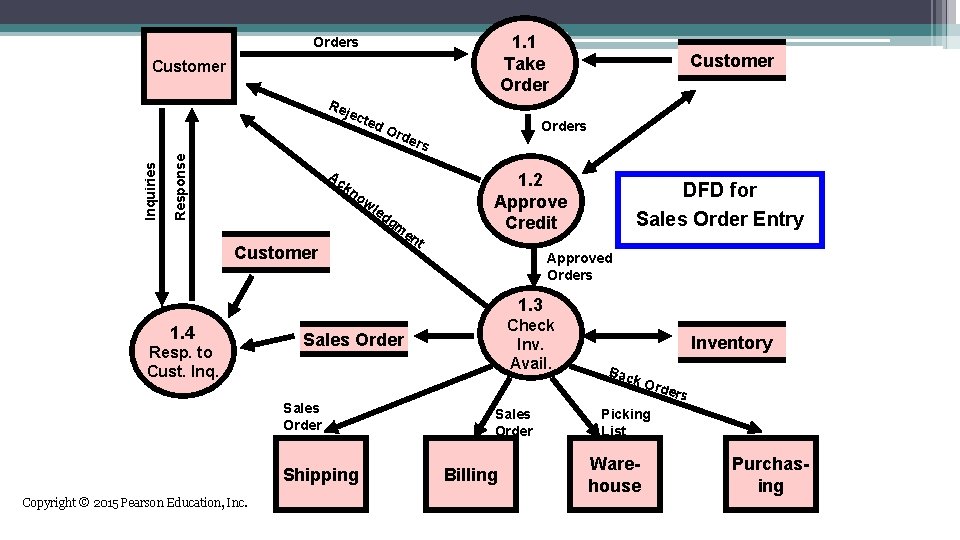

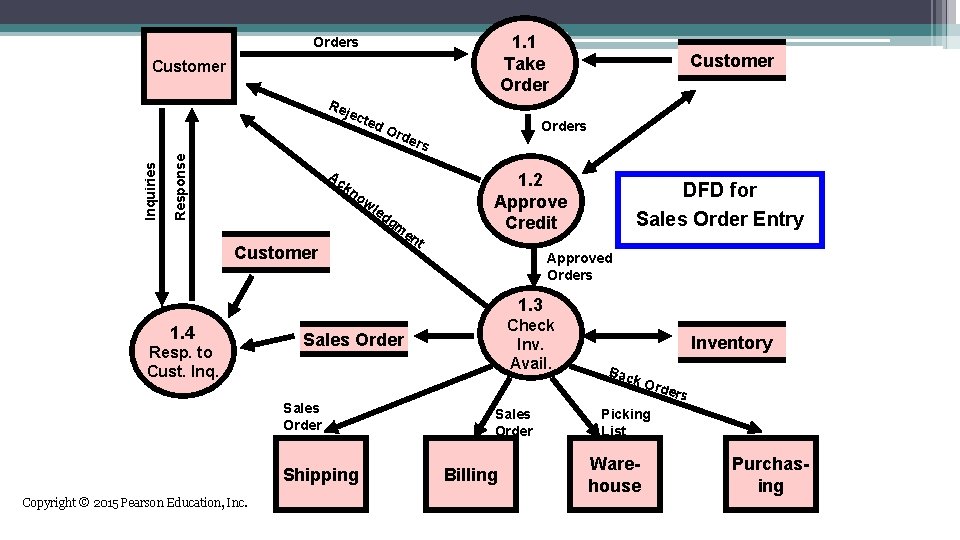

1. Sales Order Entry Processing Steps • Performed by Sales Department (reports to VP of Marketing) • • 1. 1 Take the customer order 1. 2 Approve customer credit 1. 3 Check inventory availability 1. 4 Respond to customer inquiries Copyright © 2015 Pearson Education, Inc. 12 -5

1. 1 Take Orders Customer Re jec ted Customer Orders Ord e Response Inquiries rs Ac 1. 2 Approve Credit kn o wl ed Customer gm en DFD for Sales Order Entry t Approved Orders 1. 3 1. 4 Resp. to Cust. Inq. Sales Order Shipping Copyright © 2015 Pearson Education, Inc. Check Inv. Avail. Sales Order Billing Inventory Bac k Ord ers Picking List Warehouse Purchasing

1. 1 Take the customer order • Source document: sales order • The sales order (paper or electronic) indicates: ▫ ▫ ▫ Item numbers ordered Quantities Prices Salesperson Etc. Copyright © 2015 Pearson Education, Inc.

1. 1 Take the customer order • How IT can improve efficiency and effectiveness: ▫ Have customers enter data themselves (OCR, webpages, etc. ) ▫ Orders entered online can be routed directly to the warehouse for picking and shipping. ▫ Sales history can be used to customize solicitations. ▫ Choiceboards can be used to customize orders. ▫ Electronic data interchange (EDI) can be used to link a company directly with its customers to receive orders or even manage the customer’s inventory. ▫ Email and instant messaging are used to notify sales staff of price changes and promotions. Copyright © 2015 Pearson Education, Inc.

1. 2 Approve customer credit • Credit sales should be approved before the order is processed any further. • There are two types of credit authorization: ▫ General authorization ▫ Specific authorization • How can IT improve the credit check process? ▫ Automatic checking of credit limits and balances ▫ Emails or IMs to the credit manager for accounts needing specific authorization Copyright © 2015 Pearson Education, Inc.

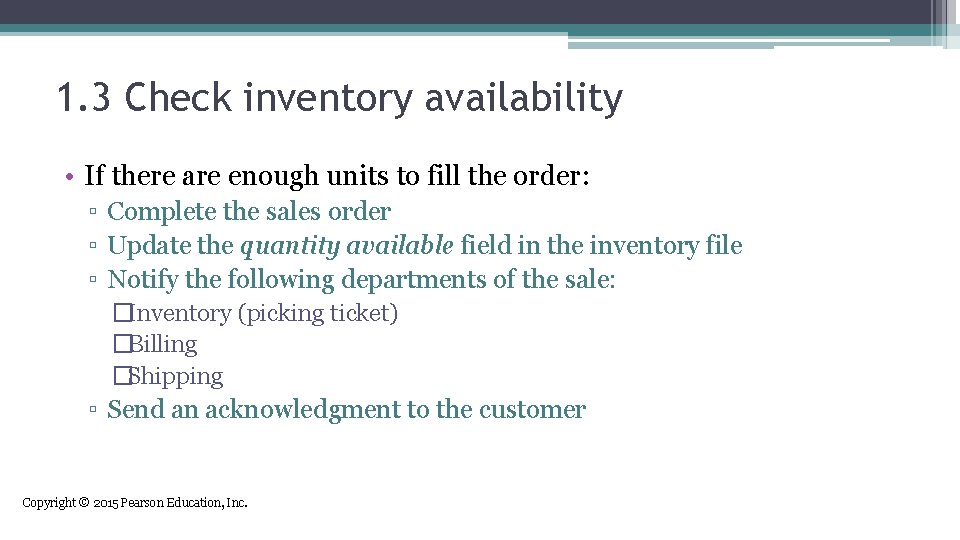

1. 3 Check inventory availability • When the order has been received and the customer’s credit approved, the next step is to ensure there is sufficient inventory to fill the order and advise the customer of the delivery date. • The sales order clerk can usually reference a screen displaying: ▫ Quantity on hand ▫ Quantity already committed to others ▫ Quantity on order Copyright © 2015 Pearson Education, Inc.

1. 3 Check inventory availability • If there are enough units to fill the order: ▫ Complete the sales order ▫ Update the quantity available field in the inventory file ▫ Notify the following departments of the sale: �Inventory (picking ticket) �Billing �Shipping ▫ Send an acknowledgment to the customer Copyright © 2015 Pearson Education, Inc.

1. 3 Check inventory availability • If there’s not enough to fill the order, initiate a back order. ▫ For manufacturing companies, notify the production department that more should be manufactured. ▫ For retail companies, notify purchasing that more should be purchased. Copyright © 2015 Pearson Education, Inc.

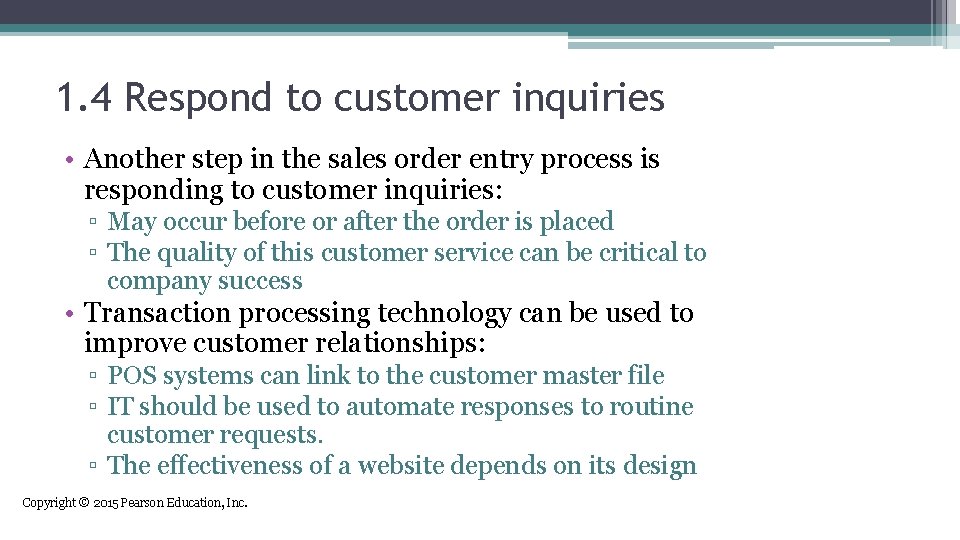

1. 4 Respond to customer inquiries • Another step in the sales order entry process is responding to customer inquiries: ▫ May occur before or after the order is placed ▫ The quality of this customer service can be critical to company success • Transaction processing technology can be used to improve customer relationships: ▫ POS systems can link to the customer master file ▫ IT should be used to automate responses to routine customer requests. ▫ The effectiveness of a website depends on its design Copyright © 2015 Pearson Education, Inc.

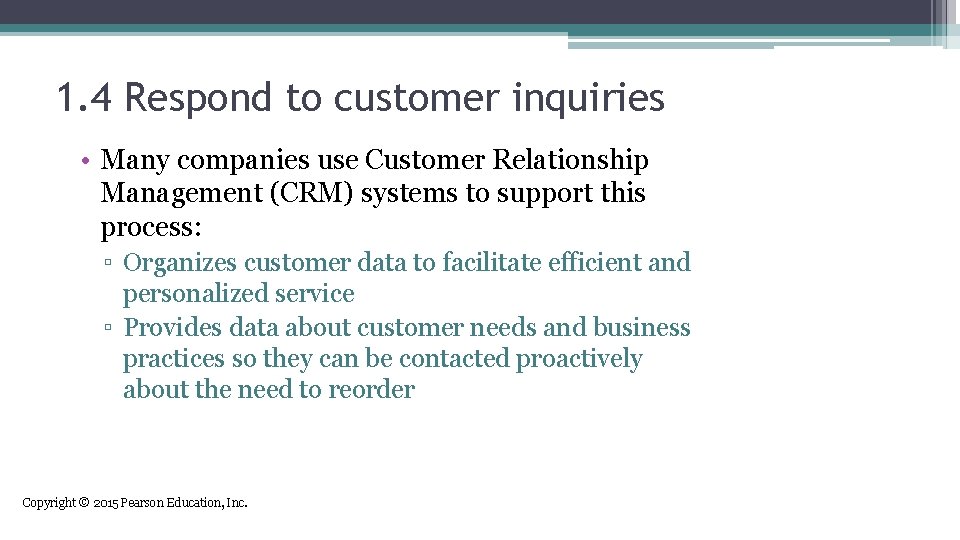

1. 4 Respond to customer inquiries • Many companies use Customer Relationship Management (CRM) systems to support this process: ▫ Organizes customer data to facilitate efficient and personalized service ▫ Provides data about customer needs and business practices so they can be contacted proactively about the need to reorder Copyright © 2015 Pearson Education, Inc.

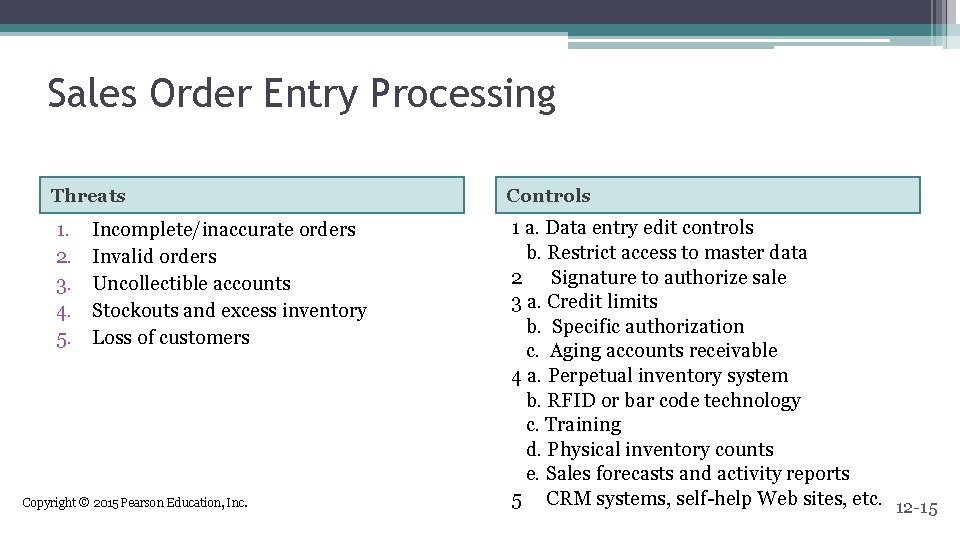

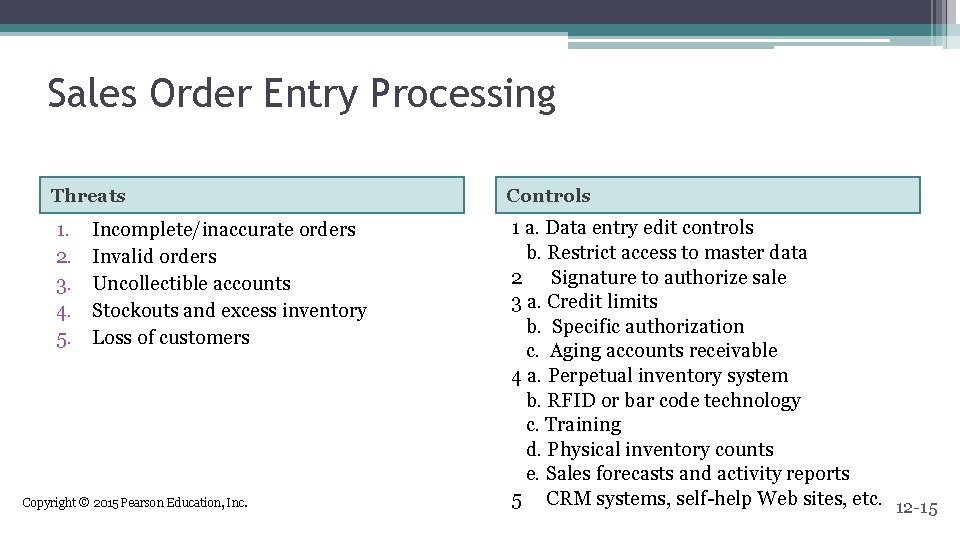

Sales Order Entry Processing Threats Controls 1. 2. 3. 4. 5. 1 a. Data entry edit controls b. Restrict access to master data 2 Signature to authorize sale 3 a. Credit limits b. Specific authorization c. Aging accounts receivable 4 a. Perpetual inventory system b. RFID or bar code technology c. Training d. Physical inventory counts e. Sales forecasts and activity reports 5 CRM systems, self-help Web sites, etc. 12 -15 Incomplete/inaccurate orders Invalid orders Uncollectible accounts Stockouts and excess inventory Loss of customers Copyright © 2015 Pearson Education, Inc.

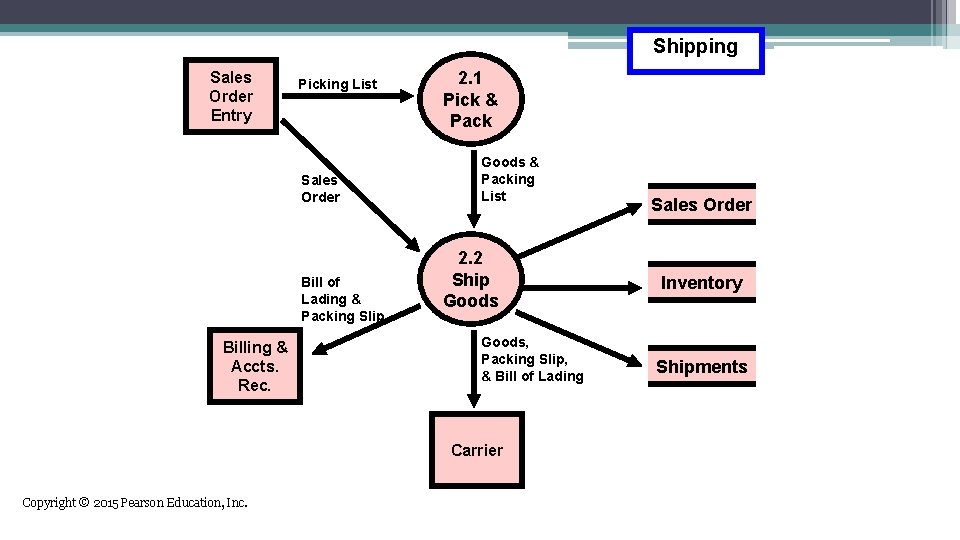

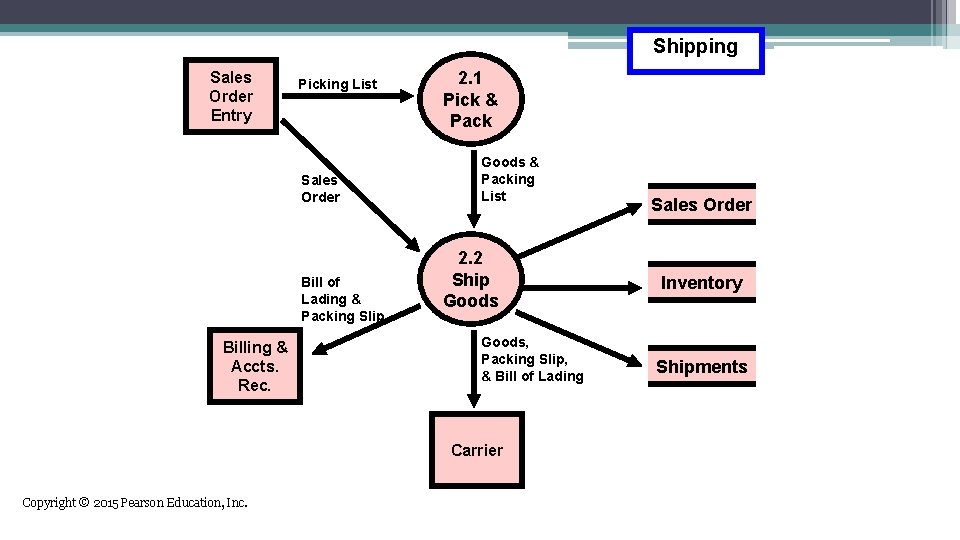

2. SHIPPING • The second basic activity in the revenue cycle is filling customer orders and shipping the desired merchandise. • The process consists of two steps ▫ Picking and packing the order ▫ Shipping the order • The warehouse department typically picks the order • The shipping departments packs and ships the order • Both functions include custody of inventory and ultimately report to the VP of Manufacturing. Copyright © 2015 Pearson Education, Inc.

Shipping Sales Order Entry Picking List Sales Order Bill of Lading & Packing Slip Billing & Accts. Rec. 2. 1 Pick & Pack Goods & Packing List 2. 2 Ship Goods, Packing Slip, & Bill of Lading Carrier Copyright © 2015 Pearson Education, Inc. Sales Order Inventory Shipments

2. 1 Pick & pack the order • Source documents: picking ticket • A picking ticket is printed by sales order entry and triggers the pick-and-pack process • The picking ticket identifies: ▫ Which products to pick ▫ What quantity • Warehouse workers record the quantities picked on the picking ticket, which may be a paper or electronic document. • The picked inventory is then transferred to the shipping department. Copyright © 2015 Pearson Education, Inc.

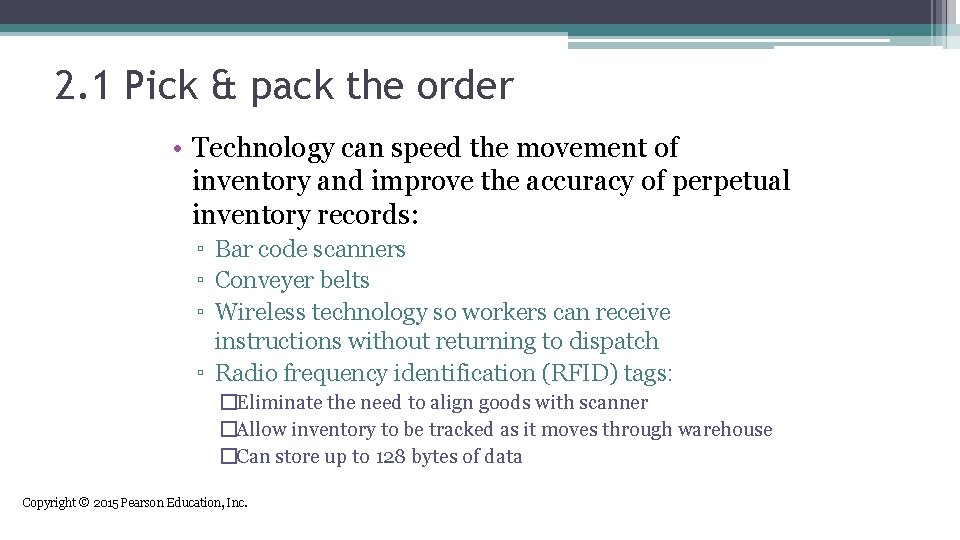

2. 1 Pick & pack the order • Technology can speed the movement of inventory and improve the accuracy of perpetual inventory records: ▫ Bar code scanners ▫ Conveyer belts ▫ Wireless technology so workers can receive instructions without returning to dispatch ▫ Radio frequency identification (RFID) tags: �Eliminate the need to align goods with scanner �Allow inventory to be tracked as it moves through warehouse �Can store up to 128 bytes of data Copyright © 2015 Pearson Education, Inc.

2. 2 Ship goods • The shipping department compares the following quantities: ▫ Physical count of inventory ▫ Quantities indicated on picking ticket ▫ Quantities on sales order • Discrepancies can arise if: ▫ Items weren’t stored in the location indicated ▫ Perpetual inventory records were inaccurate • If there are discrepancies, a back order is initiated. Copyright © 2015 Pearson Education, Inc.

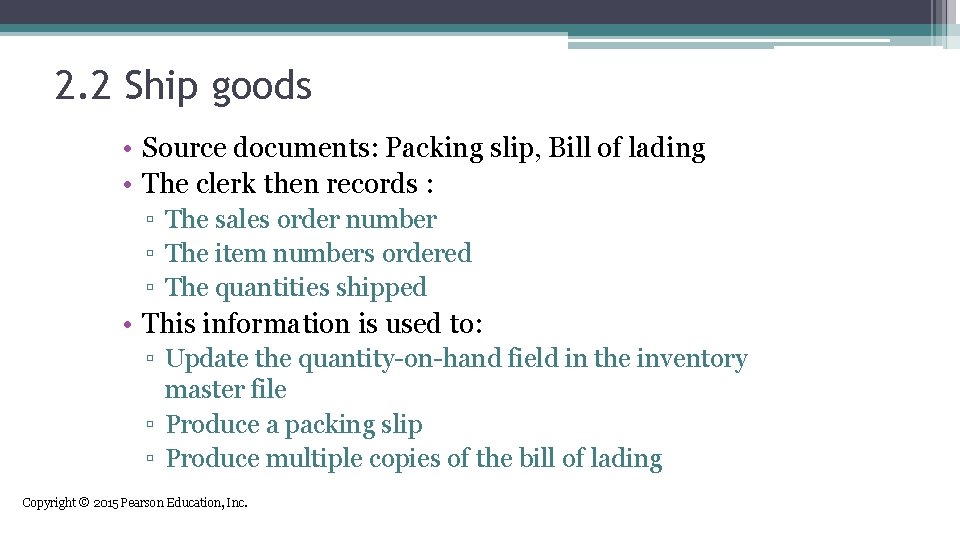

2. 2 Ship goods • Source documents: Packing slip, Bill of lading • The clerk then records : ▫ The sales order number ▫ The item numbers ordered ▫ The quantities shipped • This information is used to: ▫ Update the quantity-on-hand field in the inventory master file ▫ Produce a packing slip ▫ Produce multiple copies of the bill of lading Copyright © 2015 Pearson Education, Inc.

2. 2 Ship goods • The shipment is accompanied by: ▫ The packing slip ▫ A copy of the bill of lading ▫ The freight bill �(Sometimes bill of lading doubles as freight bill) • What happens to other copies of the bill of lading? ▫ One is kept in shipping to track and confirm delivery ▫ One is sent to billing to trigger an invoice ▫ One is retained by the freight carrier Copyright © 2015 Pearson Education, Inc.

Shipping Process Threats Controls 1. Picking wrong item or quantity to ship 2. Theft 3. Shipping errors (delay or failure to ship, wrong quantities, wrong items, wrong addresses, etc. ) 1 a. Bar code technology &RFID b. Reconcile picking list to sales order 2 a. Restrict physical access to inventory b. Document inventory transfers c. RFID and bar code technology d. Physical counts of inventory 3 a. Reconcile shipping documents to sales orders, picking lists, and packing slips b. Use RFID system to identify delays c. Data entry via bar-codes & RFID d. Data entry edit controls e. Configuration of ERP system 12 -23 Copyright © 2015 Pearson Education, Inc.

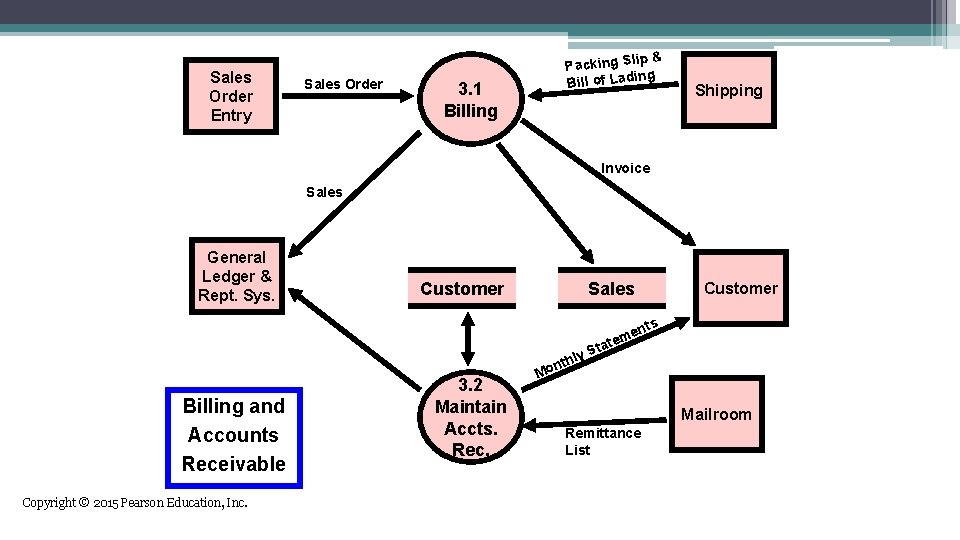

3. BILLING • The third revenue cycle activity is billing customers. • This activity involves two tasks: ▫ Invoicing/billing ▫ Updating accounts receivable Copyright © 2015 Pearson Education, Inc.

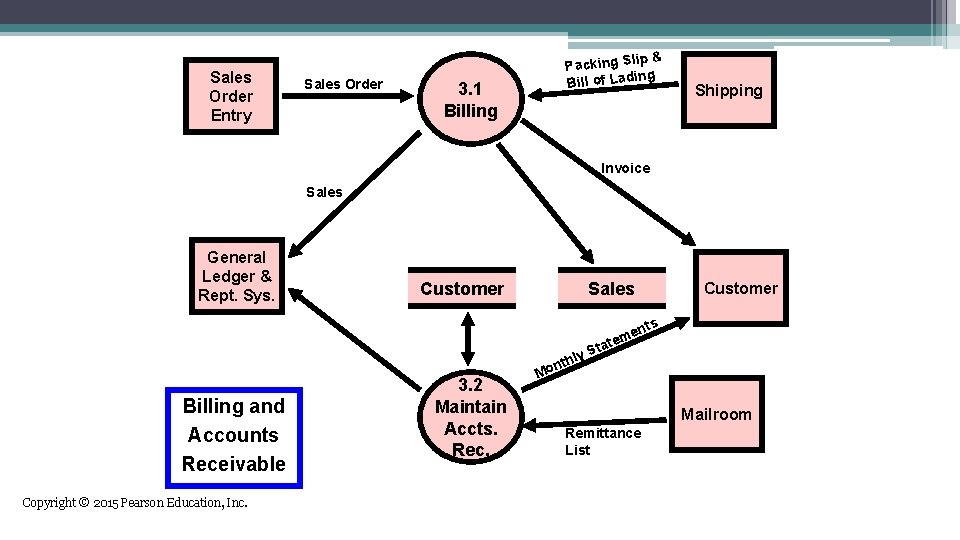

Sales Order Entry Sales Order 3. 1 Billing p& Packing Sli ing Bill of Lad Shipping Invoice Sales General Ledger & Rept. Sys. Customer Sales ly Billing and Accounts Receivable Copyright © 2015 Pearson Education, Inc. 3. 2 Maintain Accts. Rec. nth Mo Customer s ent m te Sta Mailroom Remittance List

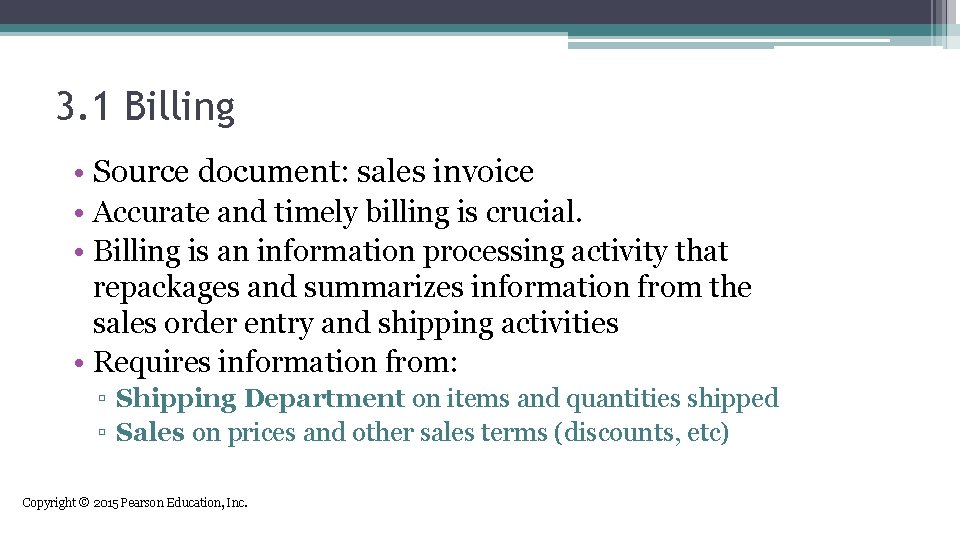

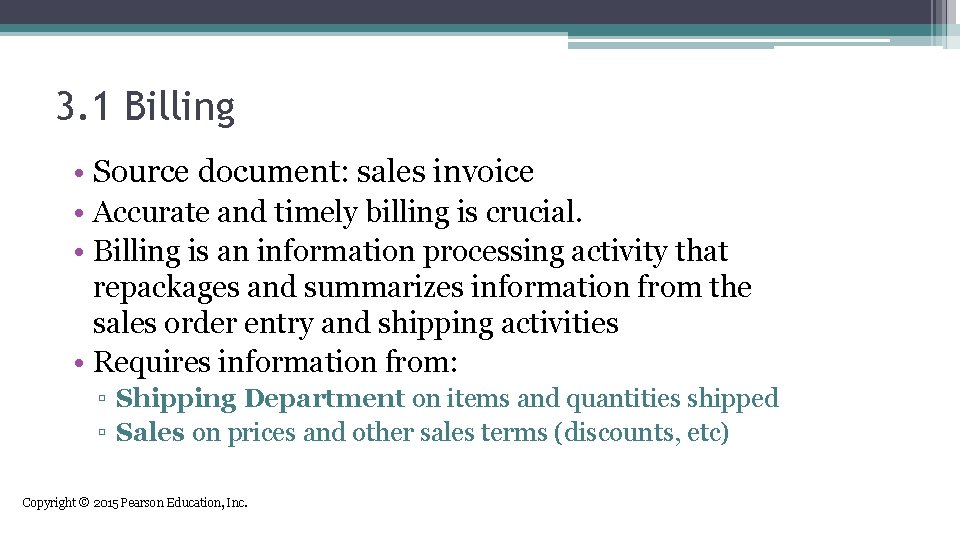

3. 1 Billing • Source document: sales invoice • Accurate and timely billing is crucial. • Billing is an information processing activity that repackages and summarizes information from the sales order entry and shipping activities • Requires information from: ▫ Shipping Department on items and quantities shipped ▫ Sales on prices and other sales terms (discounts, etc) Copyright © 2015 Pearson Education, Inc.

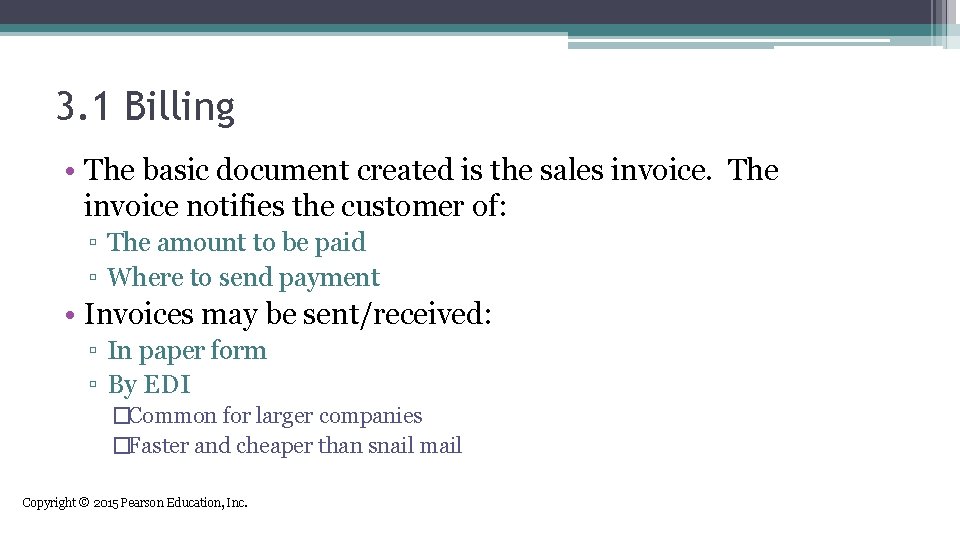

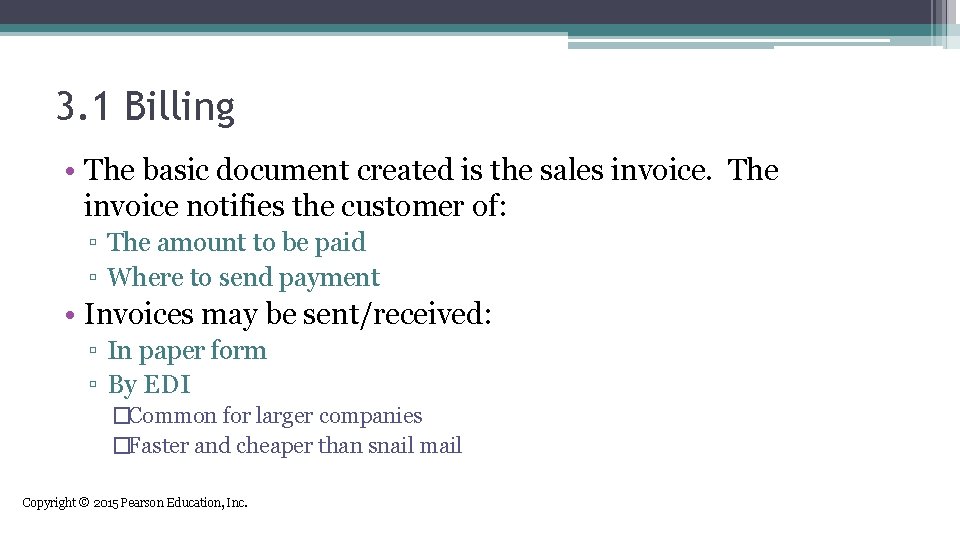

3. 1 Billing • The basic document created is the sales invoice. The invoice notifies the customer of: ▫ The amount to be paid ▫ Where to send payment • Invoices may be sent/received: ▫ In paper form ▫ By EDI �Common for larger companies �Faster and cheaper than snail mail Copyright © 2015 Pearson Education, Inc.

3. 1 Billing • When buyer and seller have accurate online systems: ▫ Invoicing process may be skipped �Seller sends an email when goods are shipped �Buyer sends acknowledgment when goods are received �Buyer automatically remits payments within a specified number of days after receiving the goods ▫ Can produce substantial cost savings Copyright © 2015 Pearson Education, Inc.

3. 2 Update accounts receivable • Source document: credit memo and monthly statements • The accounts receivable function reports to the controller • This function performs two basic tasks ▫ Debits customer accounts for the amount the customer is invoiced ▫ Credits customer accounts for the amount of customer payments • Two basic ways to maintain accounts receivable: ▫ Open-invoice method ▫ Balance forward method Copyright © 2015 Pearson Education, Inc.

3. 2 Update accounts receivable • OPEN-INVOICE METHOD: ▫ Customers pay according to each invoice ▫ Two copies of the invoice are typically sent to the customer �Customer is asked to return one copy with payment �This copy is a turnaround document called a remittance advice ▫ Advantages of open-invoice method �Conducive to offering early-payment discounts �Results in more uniform flow of cash collections ▫ Disadvantages of open-invoice method �More complex to maintain Copyright © 2015 Pearson Education, Inc.

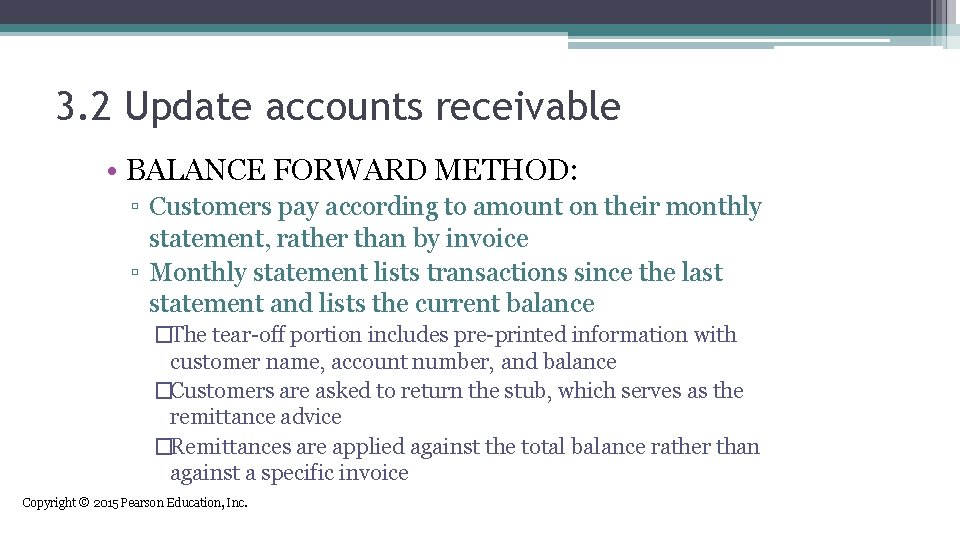

3. 2 Update accounts receivable • BALANCE FORWARD METHOD: ▫ Customers pay according to amount on their monthly statement, rather than by invoice ▫ Monthly statement lists transactions since the last statement and lists the current balance �The tear-off portion includes pre-printed information with customer name, account number, and balance �Customers are asked to return the stub, which serves as the remittance advice �Remittances are applied against the total balance rather than against a specific invoice Copyright © 2015 Pearson Education, Inc.

3. 2 Update accounts receivable • Cycle billing is commonly used with the balanceforward method ▫ Monthly statements are prepared for subsets of customers at different times. �EXAMPLE: Bill customers according to the following schedule: � 1 st week of month—Last names beginning with A-F � 2 nd week of month—Last names beginning with G-M � 3 rd week of month—Last names beginning with N-S � 4 th week of month—Last names beginning with T-Z Copyright © 2015 Pearson Education, Inc.

3. 2 Update accounts receivable • Image processing can improve the efficiency and effectiveness of managing customer accounts. ▫ Digital images of customer remittances and accounts are stored electronically • Advantages: ▫ Fast, easy retrieval ▫ Copy of document can be instantly transmitted to customer or others ▫ Multiple people can view document at once ▫ Drastically reduces document storage space Copyright © 2015 Pearson Education, Inc.

3. 2 Update accounts receivable • EXCEPTION PROCEDURES: ACCOUNT ADJUSTMENTS AND WRITE-OFFS: ▫ Adjustments to customer accounts may need to be made for: �Returns �Allowances for damaged goods �Write-offs as uncollectible ▫ These adjustments are handled by the credit manager Copyright © 2015 Pearson Education, Inc.

3. 2 Update accounts receivable • If there’s a return, the credit manager: ▫ Receives confirmation from the receiving dock that the goods were actually returned to inventory ▫ Then issues a credit memo which authorizes the crediting of the customer’s account • If goods are slightly damaged, the customer may agree to keep them for a price reduction ▫ Credit manager issues a credit memo to reflect that reduction Copyright © 2015 Pearson Education, Inc.

3. 2 Update accounts receivable • Distribution of credit memos: ▫ One copy to accounts receivable to adjust the customer account ▫ One copy to the customer • If repeated attempts to collect payment fail, the credit manager may issue a credit memo to write off an account: ▫ A copy will not be sent to the customer Copyright © 2015 Pearson Education, Inc.

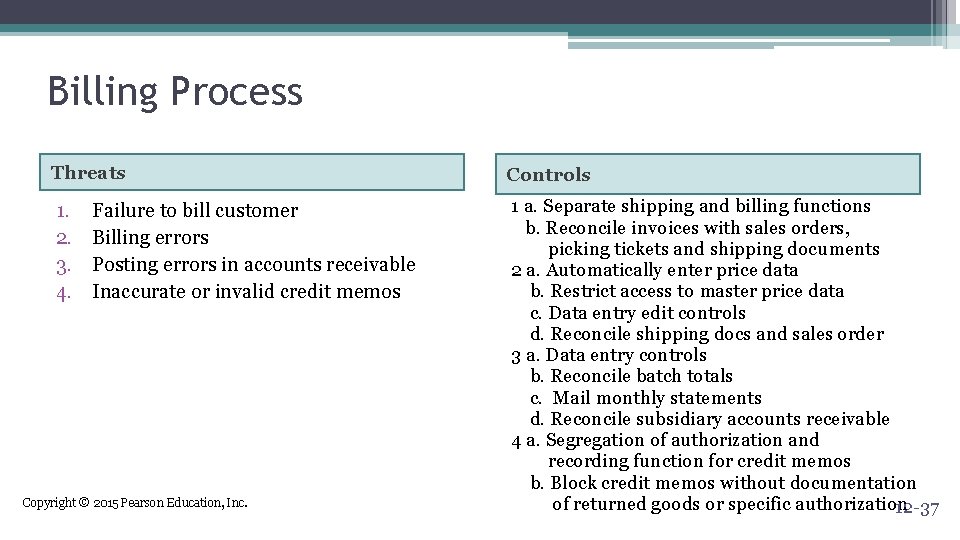

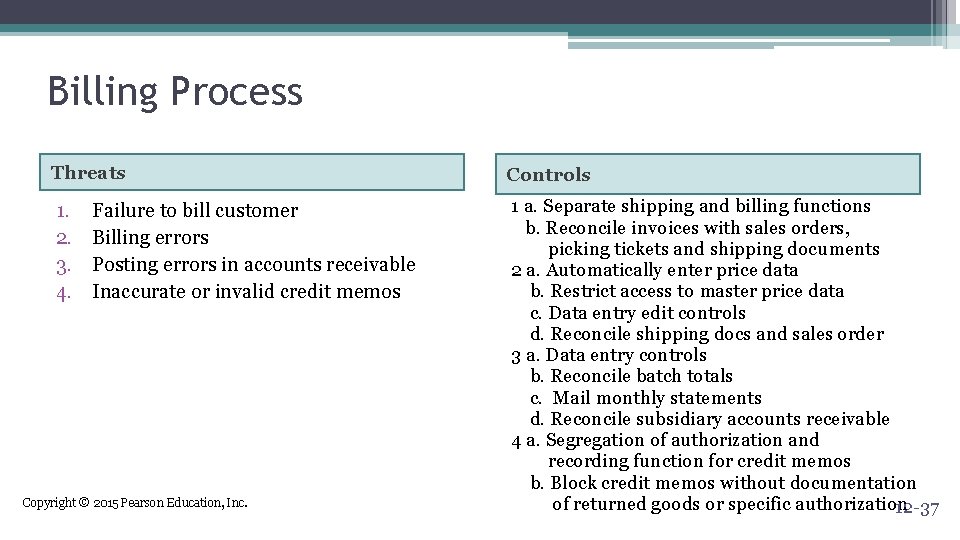

Billing Process Threats Controls 1. 2. 3. 4. 1 a. Separate shipping and billing functions b. Reconcile invoices with sales orders, picking tickets and shipping documents 2 a. Automatically enter price data b. Restrict access to master price data c. Data entry edit controls d. Reconcile shipping docs and sales order 3 a. Data entry controls b. Reconcile batch totals c. Mail monthly statements d. Reconcile subsidiary accounts receivable 4 a. Segregation of authorization and recording function for credit memos b. Block credit memos without documentation of returned goods or specific authorization 12 -37 Failure to bill customer Billing errors Posting errors in accounts receivable Inaccurate or invalid credit memos Copyright © 2015 Pearson Education, Inc.

4. CASH COLLECTIONS • The final activity in the revenue cycle is collecting cash from customers • The cashier, who reports to the treasurer, handles customer remittances and deposits them in the bank • Because cash and checks are highly vulnerable, controls should be in place to discourage theft ▫ Accounts receivable personnel should not have access to cash (including checks) Copyright © 2015 Pearson Education, Inc.

4. CASH COLLECTIONS • Possible approaches to collecting cash: ▫ ▫ ▫ Turnaround documents forwarded to accounts receivable Lockbox arrangements Electronic lockboxes Electronic funds transfer (EFT) Financial electronic data interchange (FEDI) Accept credit cards or procurement cards from customers Copyright © 2015 Pearson Education, Inc.

Cash Collection Process Threats Control 1. Theft of cash 2. Cashflow problems 1 a. Separation of cash handling function from accounts receivable and credit functions and bank reconciliation b. Use of EFT, FEDI, and lockboxes c. Use a UPIC to receive EFT and FEDI payments d. Upon opening mail, create list of payments e. Prompt, restrictive endorsement of customer checks f. Having two people open all mail likely to contain customer payments g. Use of cash registers h. Daily deposit of all cash receipts 2 a. Lockbox arrangements, EFT, or credit cards b. Discounts for prompt payment by customers c. Cash flow budgets Copyright © 2015 Pearson Education, Inc. 12 -40

Revenue cycle sales to cash collections

Revenue cycle sales to cash collections Customers typically pay according to each invoice with the

Customers typically pay according to each invoice with the Cash to cash cycle time

Cash to cash cycle time Cash to cash cycle time

Cash to cash cycle time Average revenue vs marginal revenue

Average revenue vs marginal revenue Chapter 9 auditing the revenue cycle solutions

Chapter 9 auditing the revenue cycle solutions Revenue and receipt cycle flowchart

Revenue and receipt cycle flowchart What are the big three of cash management

What are the big three of cash management Revenue dominated cash flow

Revenue dominated cash flow Learning objectives of profit and loss

Learning objectives of profit and loss Margin of safety formula units

Margin of safety formula units Breakeven volume

Breakeven volume Sales revenue maximisation theory

Sales revenue maximisation theory The process of classifying and reviewing past due accounts

The process of classifying and reviewing past due accounts Cash in cash out example

Cash in cash out example Budgeted income statement

Budgeted income statement Paid cash to replenish the petty cash fund

Paid cash to replenish the petty cash fund Chapter 5 cash control systems answer key

Chapter 5 cash control systems answer key Received cash from sales.

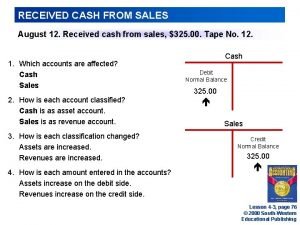

Received cash from sales. Sales and cash receipts journal

Sales and cash receipts journal Glencoe accounting chapter 14

Glencoe accounting chapter 14 Analyzing sales and cash receipts

Analyzing sales and cash receipts Analyzing sales and cash receipts

Analyzing sales and cash receipts Recorded cash and credit card sales

Recorded cash and credit card sales Cash received journal

Cash received journal Product sales structure

Product sales structure Discuss the nuances of sales letters.

Discuss the nuances of sales letters. Sales force composite

Sales force composite Incremental method of sales force example

Incremental method of sales force example Establishing sales territories

Establishing sales territories Revenue cycle activities

Revenue cycle activities Rea diagram examples

Rea diagram examples Revenue cycle kpi

Revenue cycle kpi Application capability model

Application capability model Revenue and receipt cycle flowchart

Revenue and receipt cycle flowchart Dfd chapter 4

Dfd chapter 4 Rea diagrams

Rea diagrams Pearson education

Pearson education Revenue cycle analytics

Revenue cycle analytics Revenue transaction cycle

Revenue transaction cycle Auditing revenue cycle

Auditing revenue cycle