The Mad Hedge Fund Trader Crash With John

- Slides: 87

The Mad Hedge Fund Trader “Crash!” With John Thomas from San Francisco, CA January 7, 2015 www. madhedgefundtrader. com

MHFT Global Strategy Luncheons Buy tickets at www. madhedgefundtrader. com Honolulu, Hawaii April 3, 2015

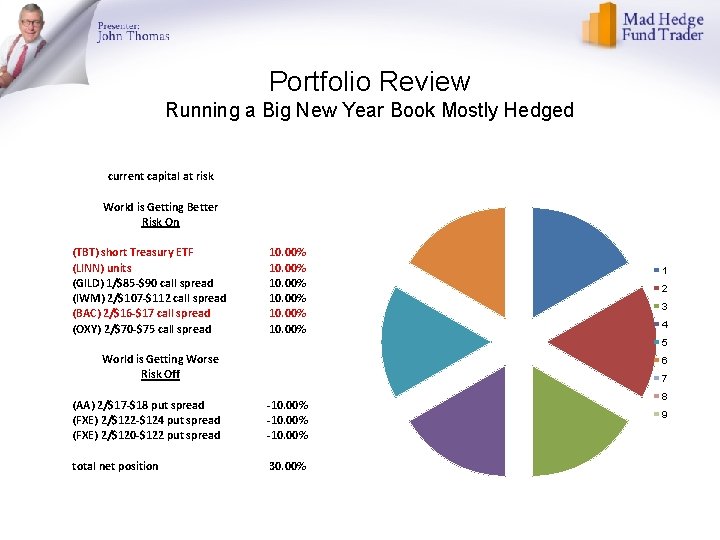

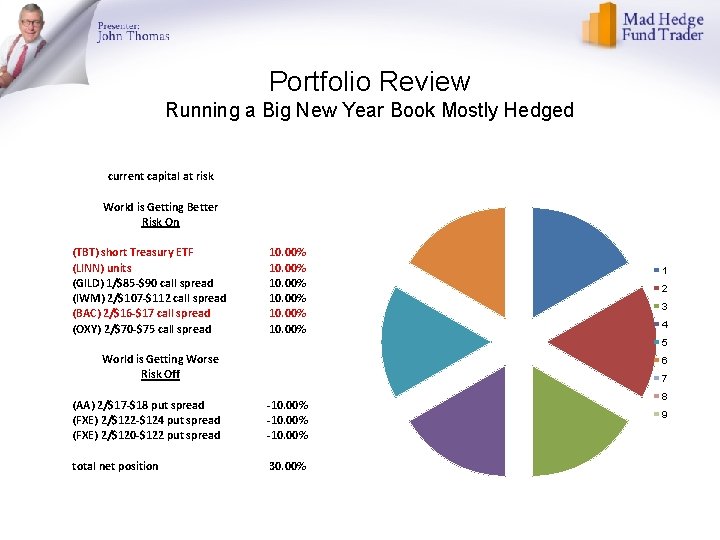

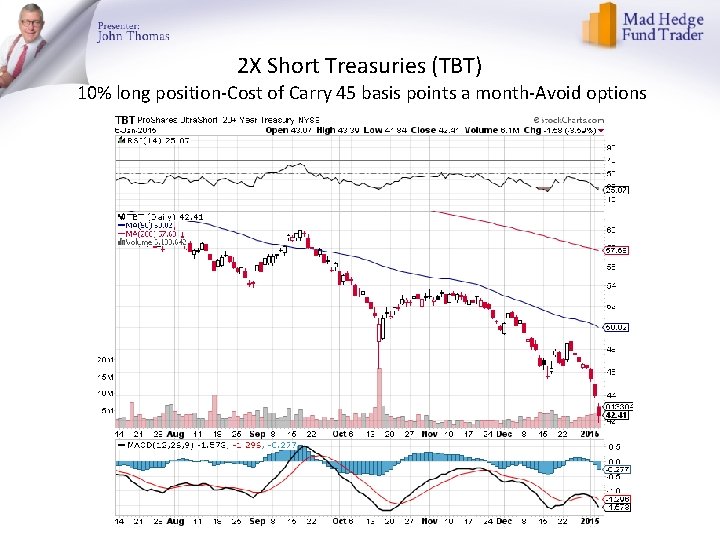

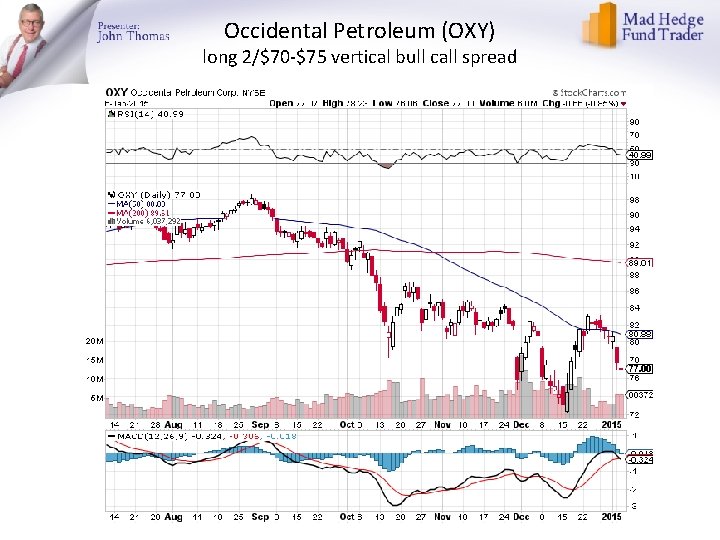

Portfolio Review Running a Big New Year Book Mostly Hedged current capital at risk World is Getting Better Risk On (TBT) short Treasury ETF (LINN) units (GILD) 1/$85 -$90 call spread (IWM) 2/$107 -$112 call spread (BAC) 2/$16 -$17 call spread (OXY) 2/$70 -$75 call spread 10. 00% 1 2 3 4 5 World is Getting Worse Risk Off 6 7 (AA) 2/$17 -$18 put spread (FXE) 2/$122 -$124 put spread (FXE) 2/$120 -$122 put spread -10. 00% total net position 30. 00% 8 9

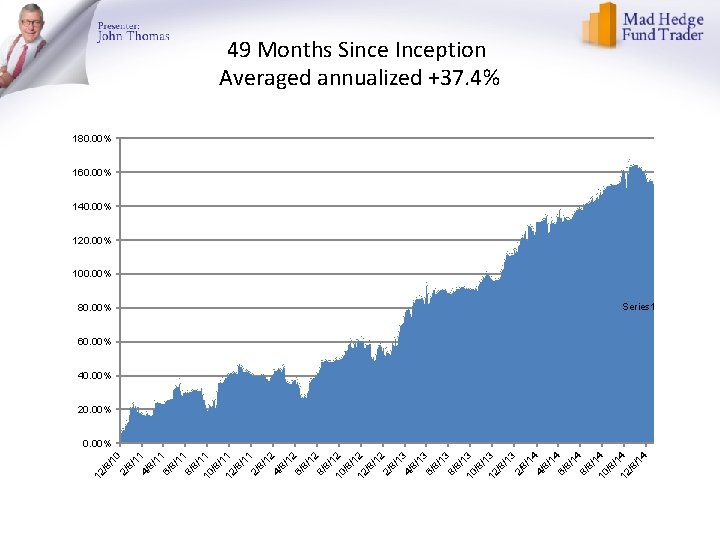

Trade Alert Performance Four Year Anniversary! *January Final +3. 05%, *February Final +6. 41%, *March Final -2. 52% *April Final +3. 32% *May Final +4. 61% *June Final +4. 24% *January MTD - +1. 60% *July Final +4. 18% *August Final 5. 86% *September Final 5. 01% *October Final 6. 69% * November -1. 26% *December final -9. 64%-Ouch!! 2014 FINAL +30. 31%, versus 7% for the Dow *First 212 weeks of Trading +152. 8%!

Paid Subscriber Trailing 12 Month Return +30. 3% 50. 0% 40. 0% 30. 0% 20. 0% Series 1 10. 0% 12/31/13 1/31/14 2/28/14 3/28/14 -10. 0% 4/28/14 5/28/14 6/28/14 7/28/14 8/28/14 9/28/14 10/28/14 11/28/14 12/28/14

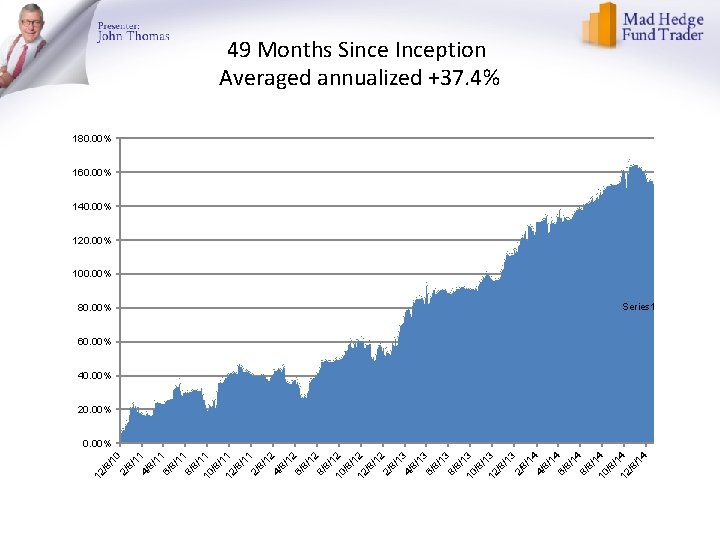

/1 0 8/ 1 10 1 /8 /1 12 1 /8 /1 1 2/ 8/ 12 4/ 8/ 12 6/ 8/ 12 8/ 8/ 1 10 2 /8 /1 12 2 /8 /1 2 2/ 8/ 13 4/ 8/ 13 6/ 8/ 13 8/ 8/ 1 10 3 /8 /1 12 3 /8 /1 3 2/ 8/ 14 4/ 8/ 14 6/ 8/ 14 8/ 8/ 1 10 4 /8 /1 12 4 /8 /1 4 8/ 8/ 11 6/ 8/ 11 4/ 8/ 11 2/ 12 /8 49 Months Since Inception Averaged annualized +37. 4% 180. 00% 160. 00% 140. 00% 120. 00% 100. 00% 80. 00% Series 1 60. 00% 40. 00% 20. 00%

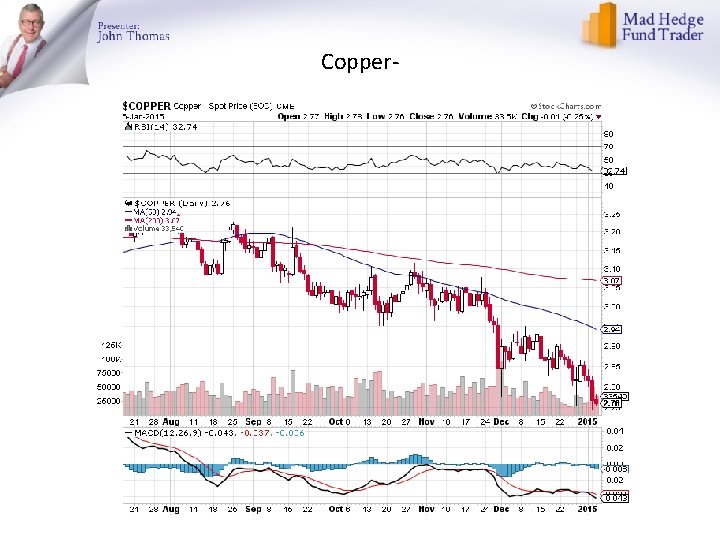

Strategy Outlook-The Oil Black Swan *Super weak oil cancels the Christmas rally, prompts global “RISK OFF” and profit taking, but the end is near *Oil fell so fast that it is creating global systemic risks and uncertainty *Heightened disinflation fears spills over to other commodities, and a monster bond market rally *Newly aggressive Euro QE brings a new leg down in the (FXE) *Gold starting to put in a convincing bottom *Grains in winter hibernation

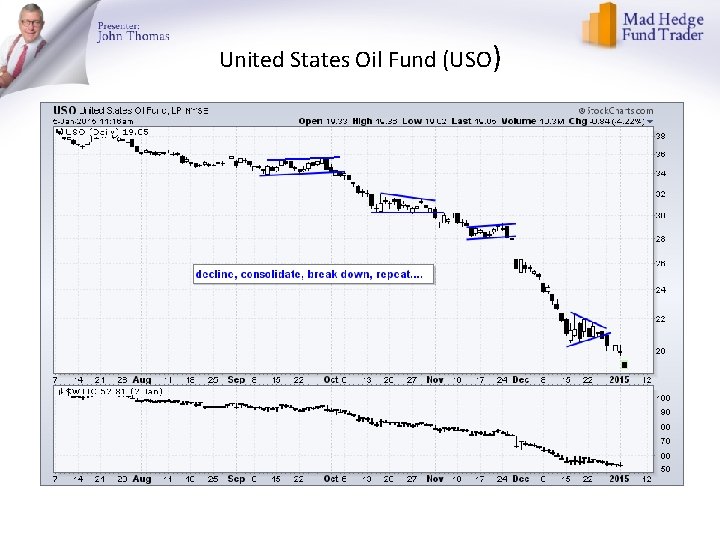

The Jim Parker View The Mad Day Trader-On sale for a $1, 500 upgrade Technical Set Up of the week-Chase Buy dollars (UUP), bonds (TLT) on next two point break Gold (GLD) and miners (GDX) Stocks (SPY), but only low beta names Sell Short Euro’s (FXE), (EUO) Avoid Oil (USO), too volatile to trade the Winners!

The Global Economy-It’s All About Oil and Interest Rates *Ultra low gasoline prices and interest rates paving the way for another leg up in the global economy. *But we have to survive the collapse of the oil industry first, 12% of the stock market *New Greek political crisis brings 0. 50% yield on ten year German bunds *Russian economic collapse happening so fast that it is creating global systemic risks *GM December sales rocket by 19. 3%, underlining health of US economy. *China ramps up QE, eases bank loan/deposit ratio, PMI slips fro, 50. 3 to 50. 1 on soft real estate *Japan 0. 70% inflation rate prompts new $29 billion stimulus program, more to come

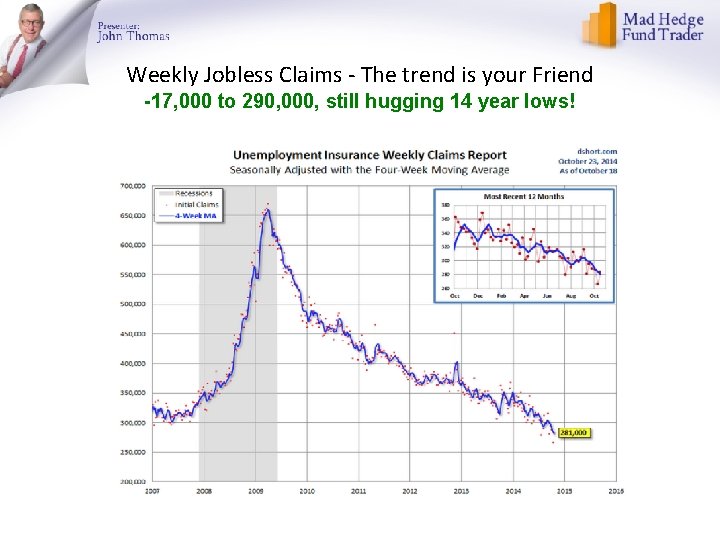

Weekly Jobless Claims - The trend is your Friend -17, 000 to 290, 000, still hugging 14 year lows!

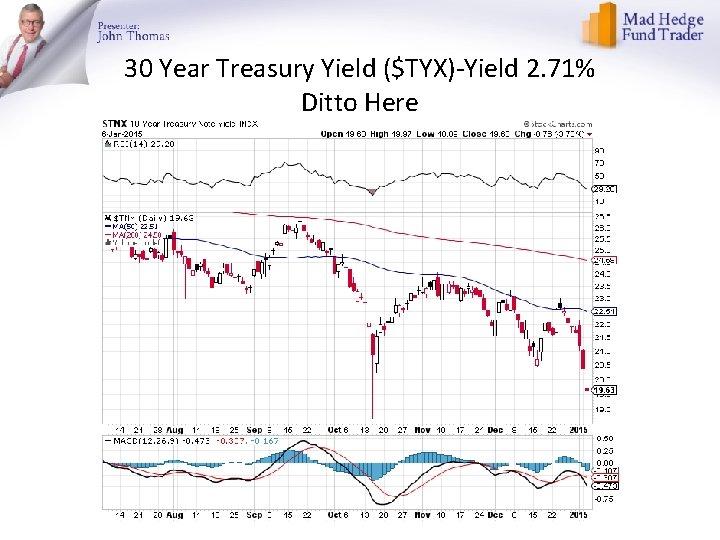

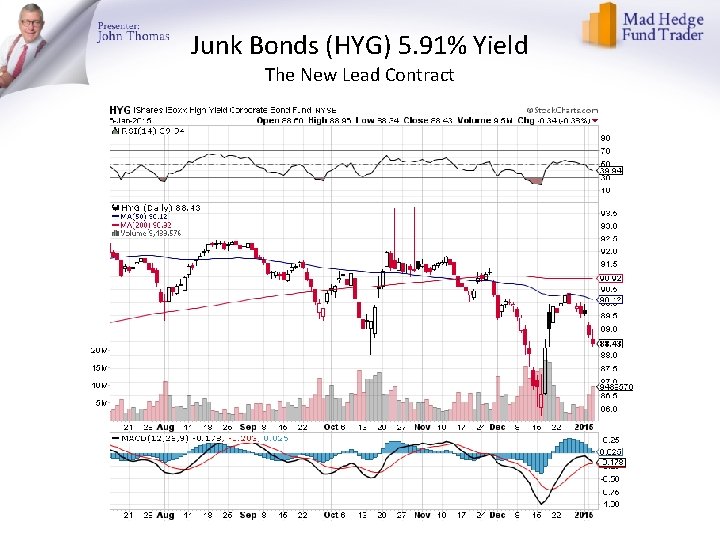

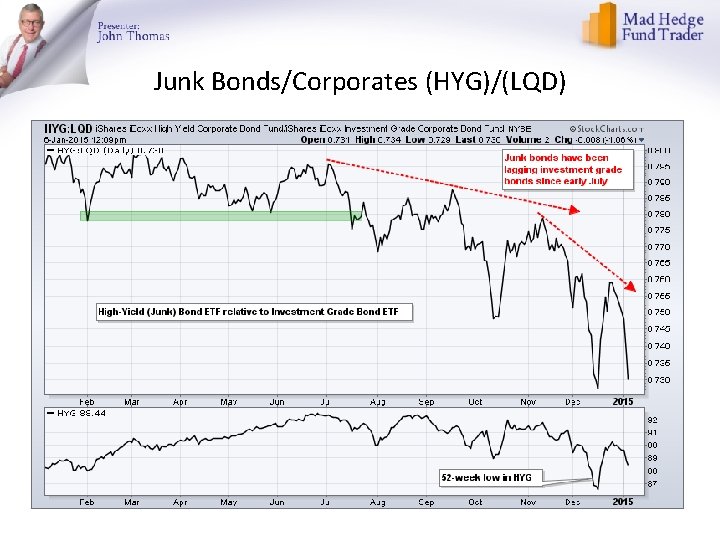

Bonds-New Highs *German ten year bunds at 0. 45% are dragging down yields globally *Quantitative easing is over in the US, but is reborn in Japan and the US * (TBT) hits new all time low at $42 handle *Sell off in junk bonds accelerates as energy issues weigh down index, is 18% of the junk universe *Fed not to raise interest rates until 2016, reinforced by oil and bond yield crashes *Deflation is here to stay *Momentum may favor bonds for a few more months

Ten Year Treasuries (TLT) 2. 00% The Trend is Your Enemy

Ten Year Treasuries ($TNX) 2. 00%

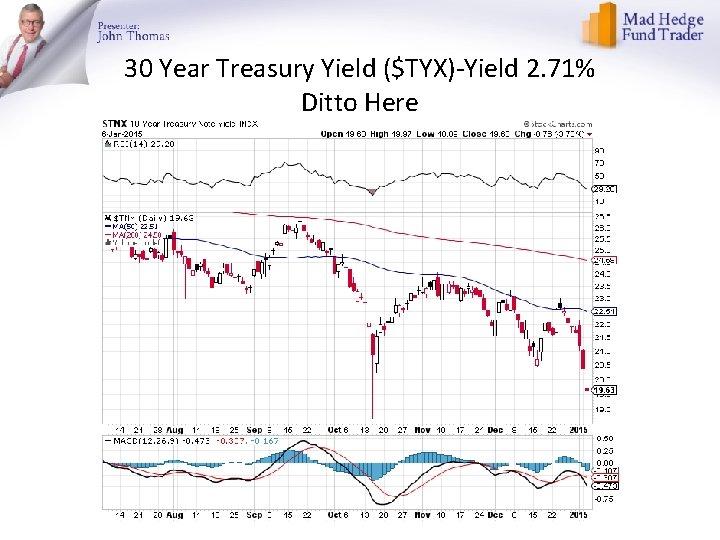

30 Year Treasury Yield ($TYX)-Yield 2. 71% Ditto Here

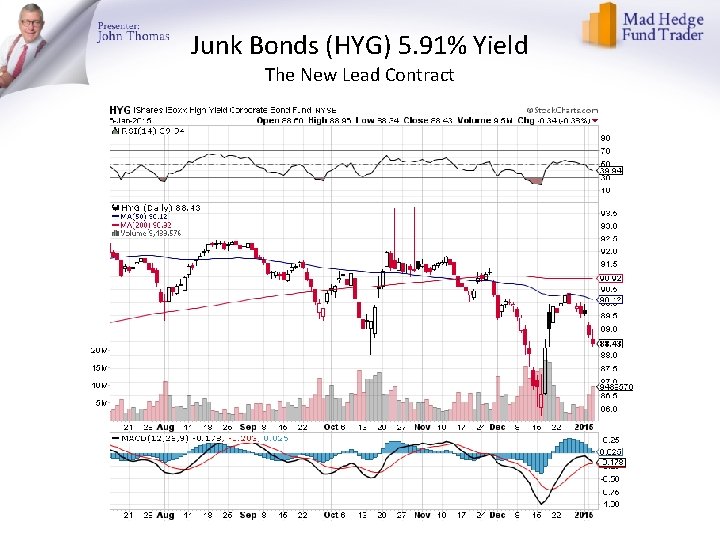

Junk Bonds (HYG) 5. 91% Yield The New Lead Contract

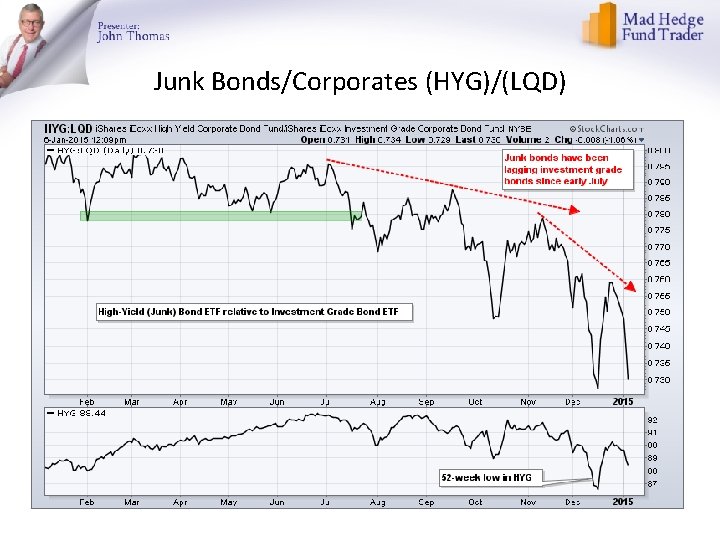

Junk Bonds/Corporates (HYG)/(LQD)

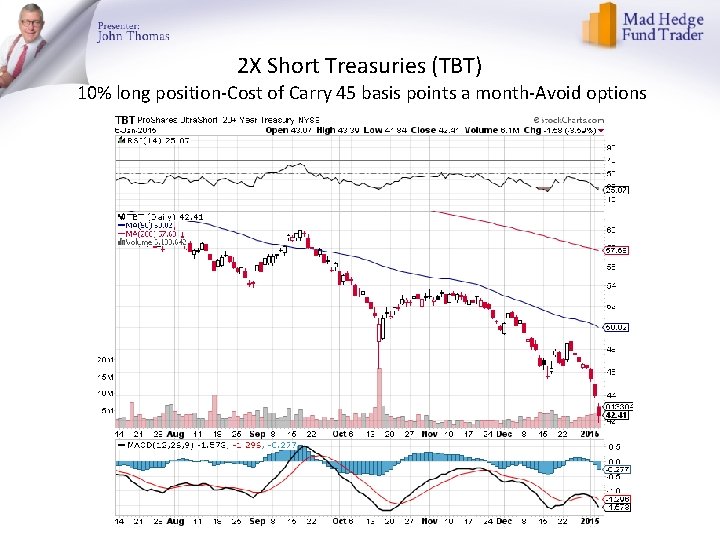

2 X Short Treasuries (TBT) 10% long position-Cost of Carry 45 basis points a month-Avoid options

German 10 Year Bunds vs. Commodities Deflation in All its Glory, 50 basis point yields

2 X Short Treasuries (TBT) New All Time Low-Thank Goodness for Small Positions!

Investment Grade Corporate Bonds (LQD) 3. 30% Yield

Emerging Market Debt (ELD) 5. 20% Yield

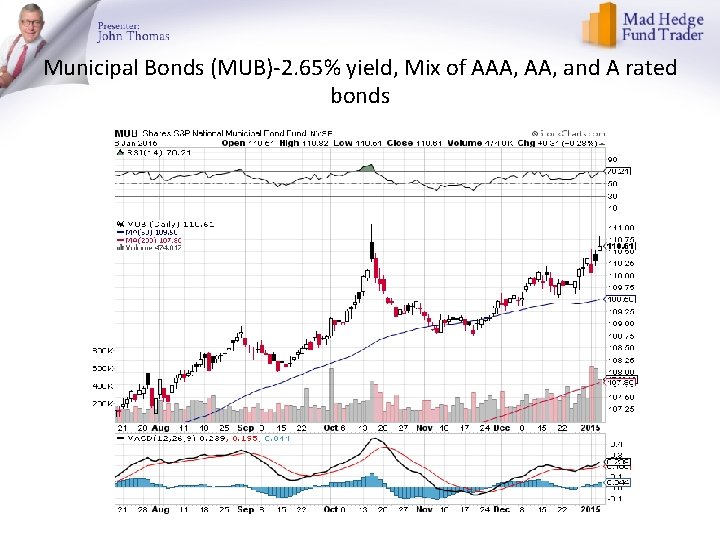

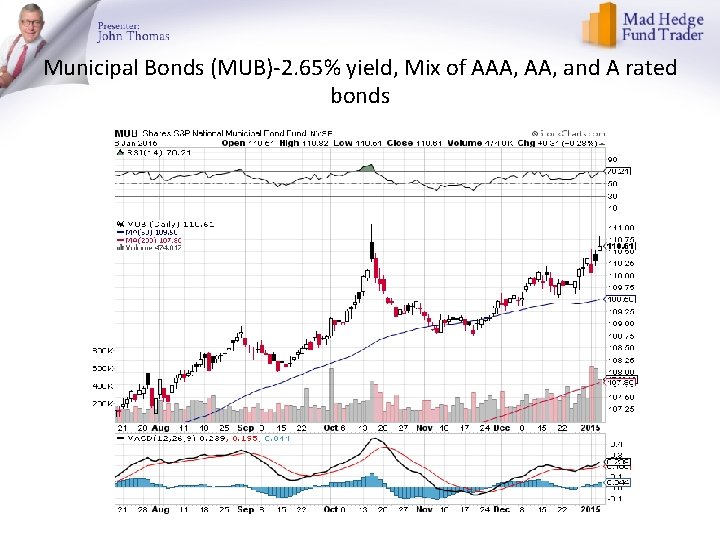

Municipal Bonds (MUB)-2. 65% yield, Mix of AAA, and A rated bonds

MLP’s (LINE) 20. 74% Yield-Capitulation Sell Off long a 10% Position, rescued by cold weather, yielding 15% after a 47% dividend cut

Stocks-Another 5%er *This is another 5% correction, not a new bear market *This is creating a great entry point for 2015 for the best non oil sectors, like financials, technology, health care, and solar *Economic data is modestly weakening, giving fright of a potential slowdown *Oil company earnings forecasts are going to zero, while everything else is getting ramped up from 10% to 12% *Long term investors now bottom fishing energy names, buying large, safe names with big balance sheets

S&P 500 -Targeting 1, 900?

Dow Average-Targeting 16, 800?

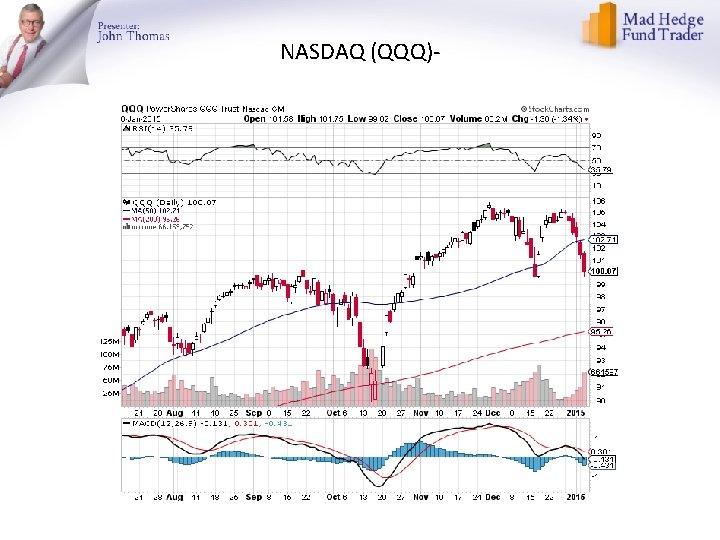

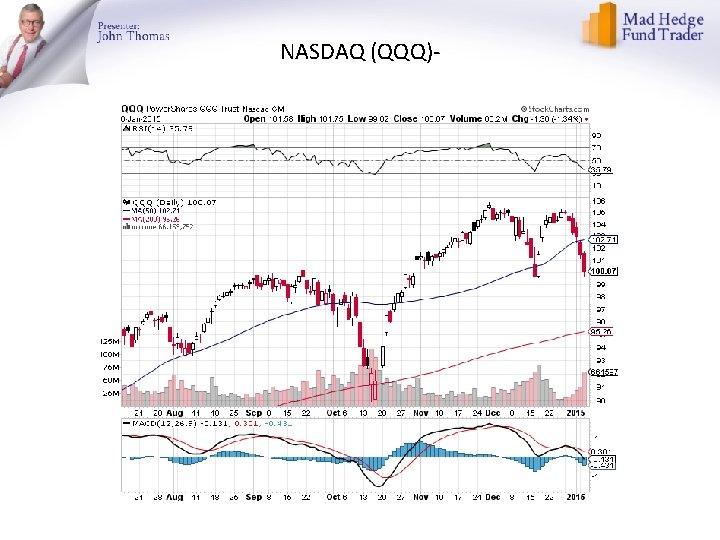

NASDAQ (QQQ)-

Europe Hedged Equity (HEDJ)-Demolished by Russia

(VIX)-Setting up a Triple top

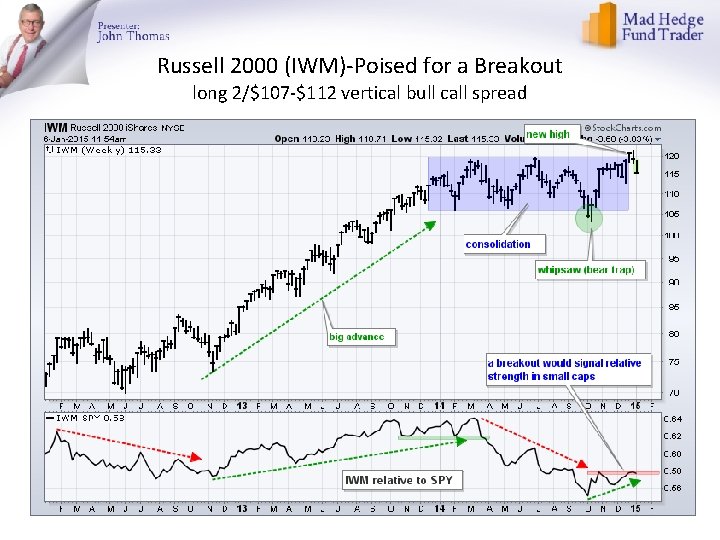

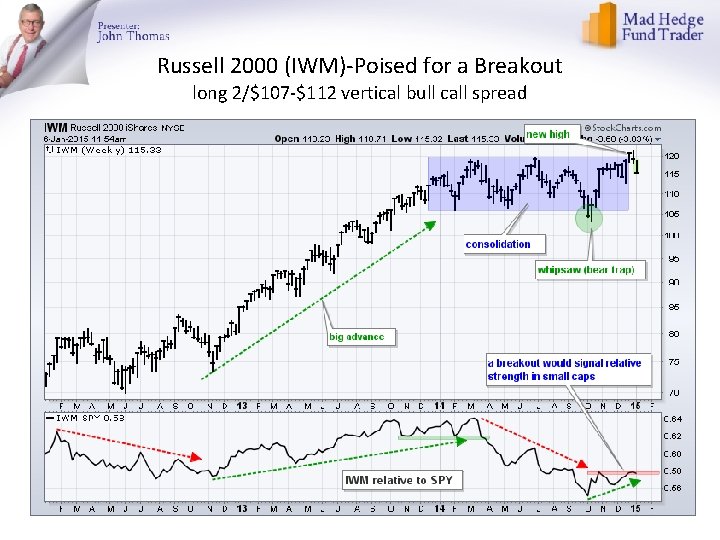

Russell 2000 (IWM)-Poised for a Breakout long 2/$107 -$112 vertical bull call spread

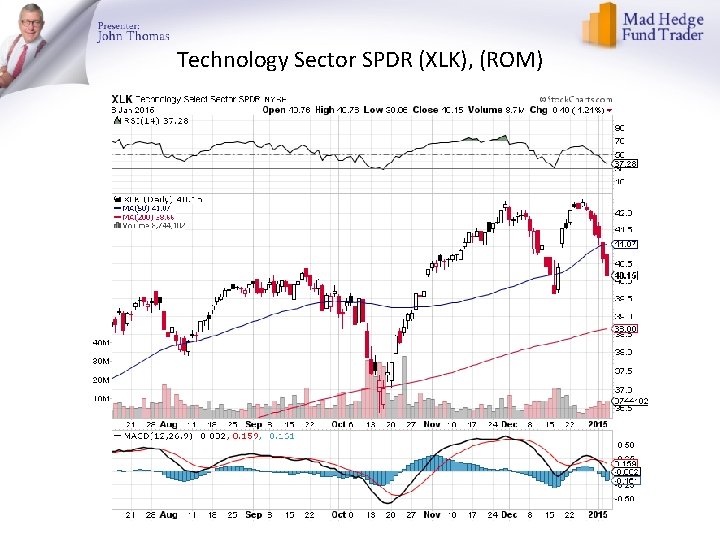

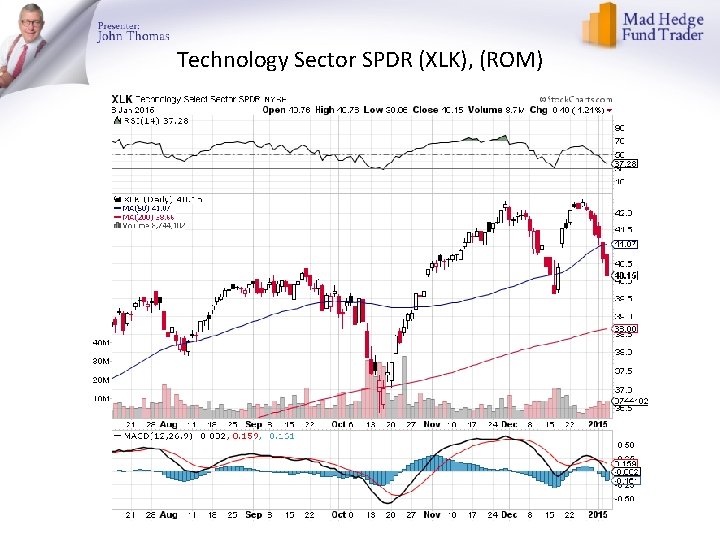

Technology Sector SPDR (XLK), (ROM)

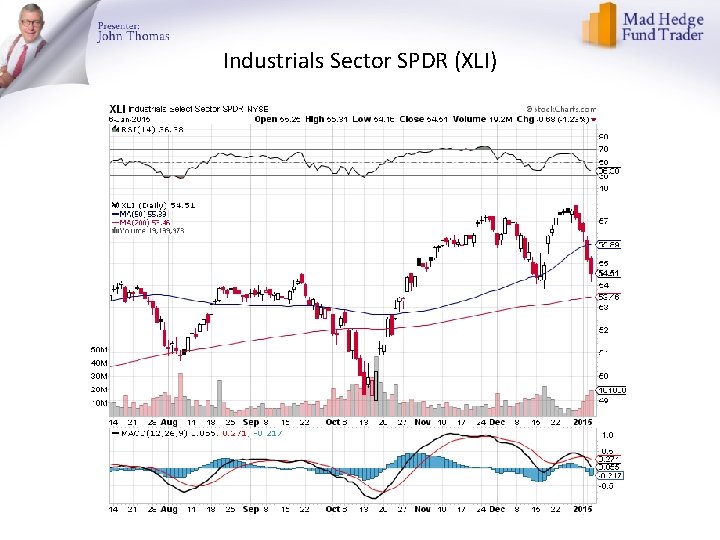

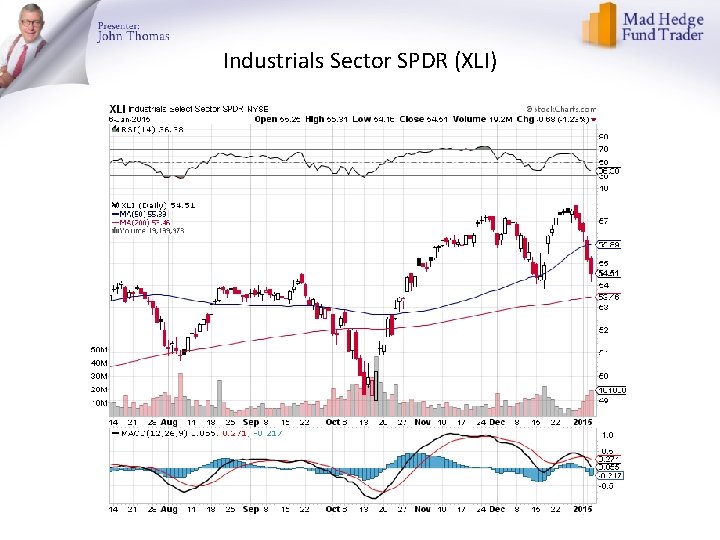

Industrials Sector SPDR (XLI)

Health Care Sector SPDR (XLV), (RXL)

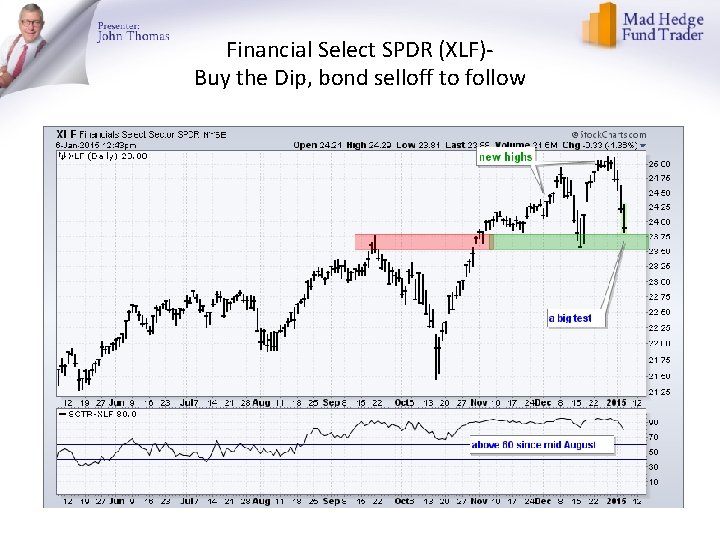

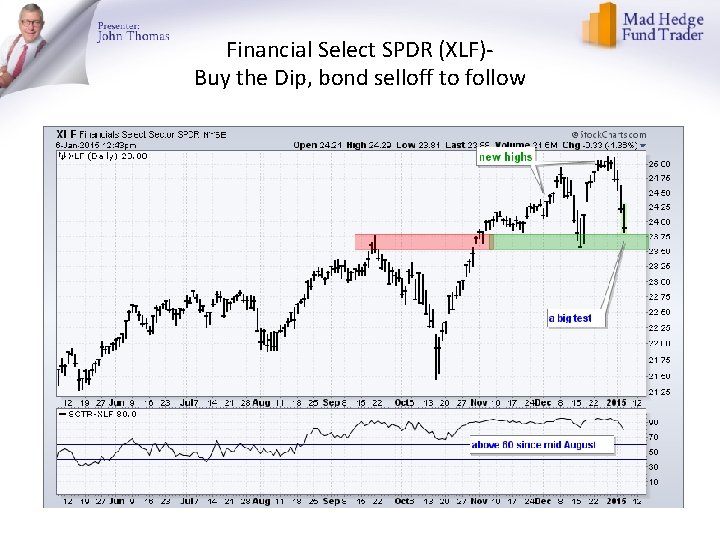

Financial Select SPDR (XLF)Buy the Dip, bond selloff to follow

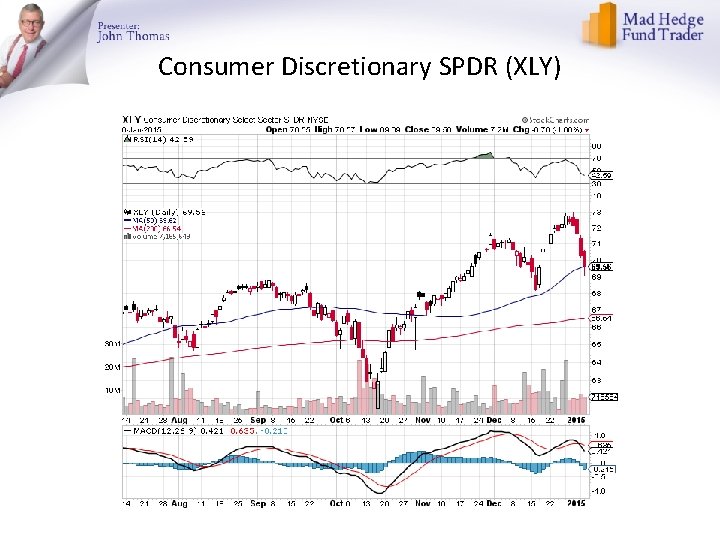

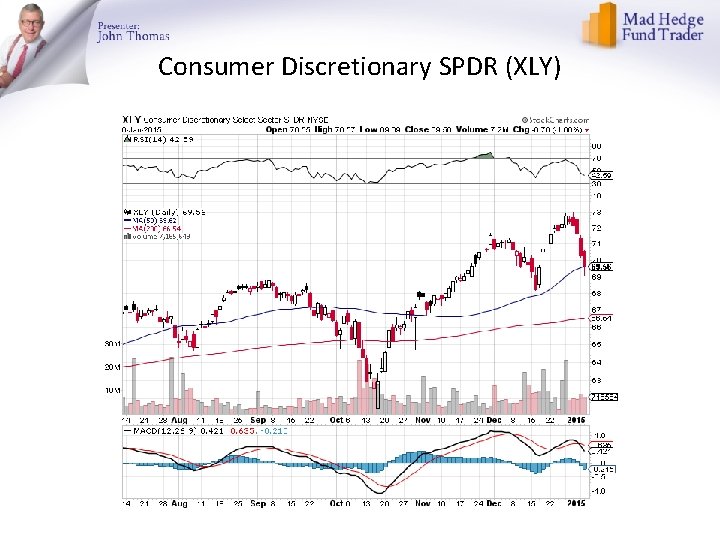

Consumer Discretionary SPDR (XLY)

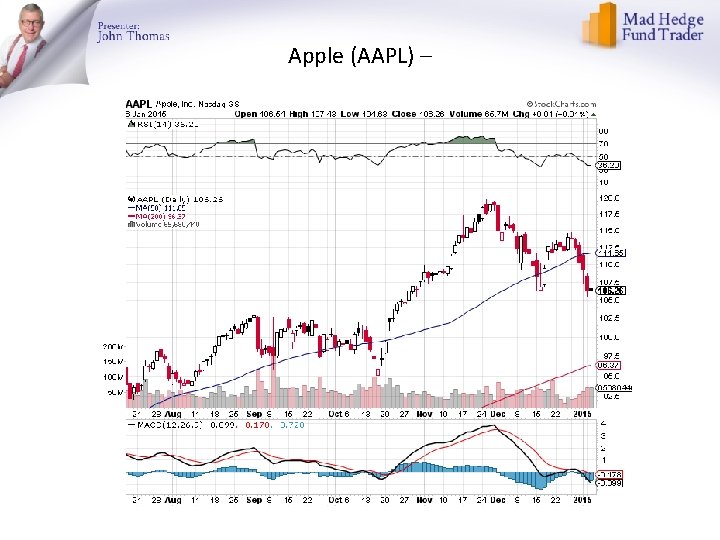

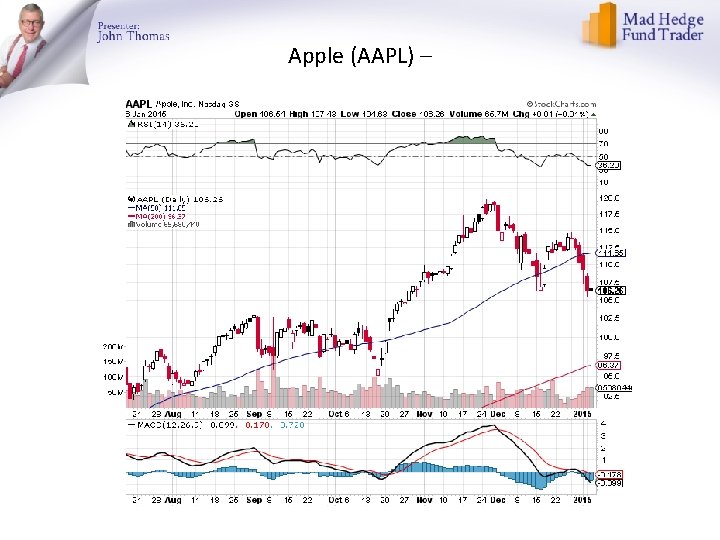

Apple (AAPL) –

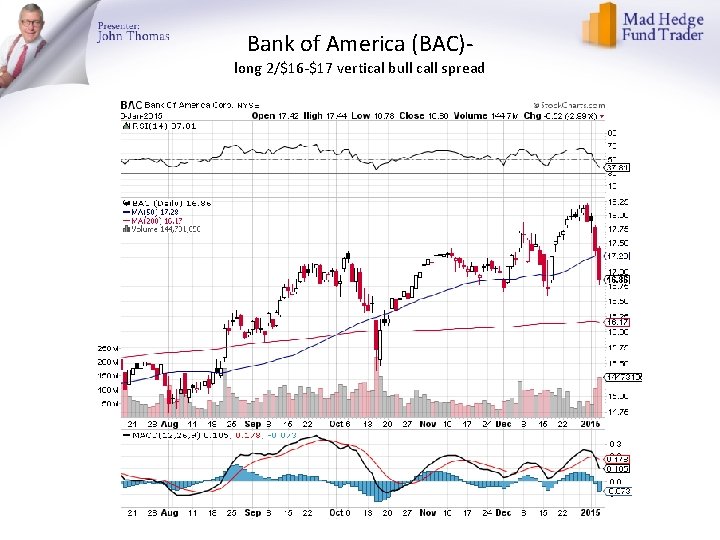

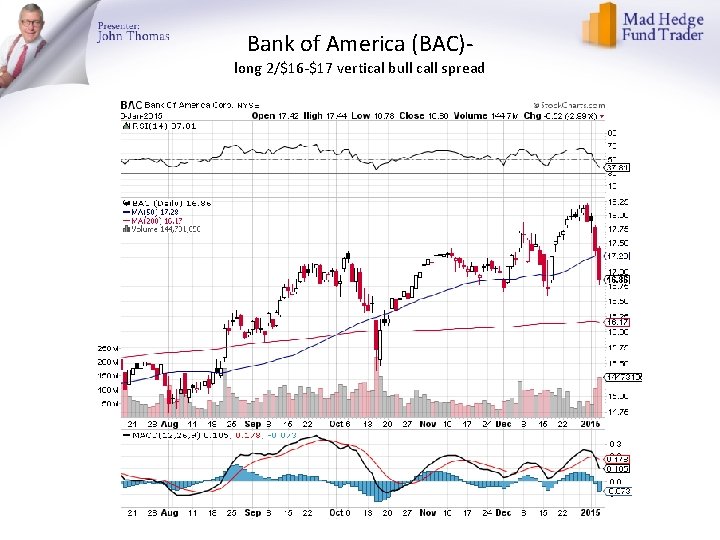

Bank of America (BAC)- long 2/$16 -$17 vertical bull call spread

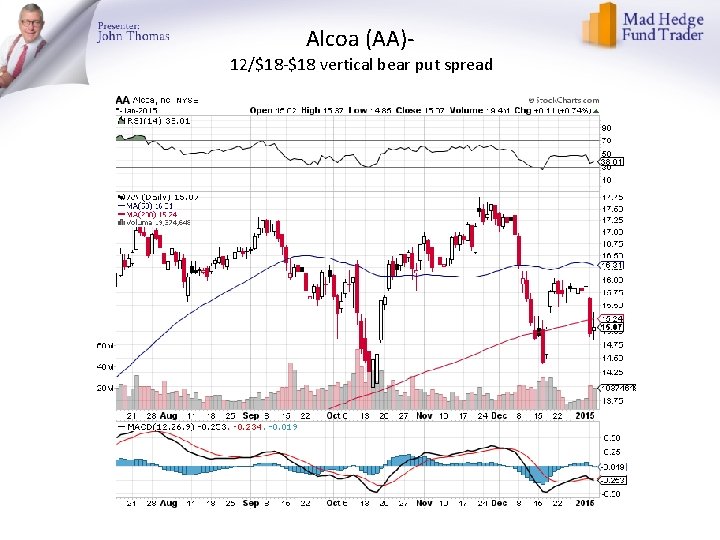

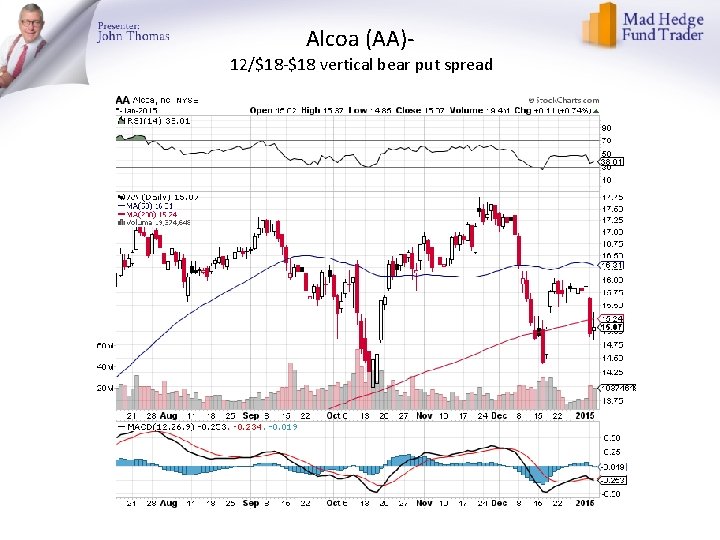

Alcoa (AA)- 12/$18 -$18 vertical bear put spread

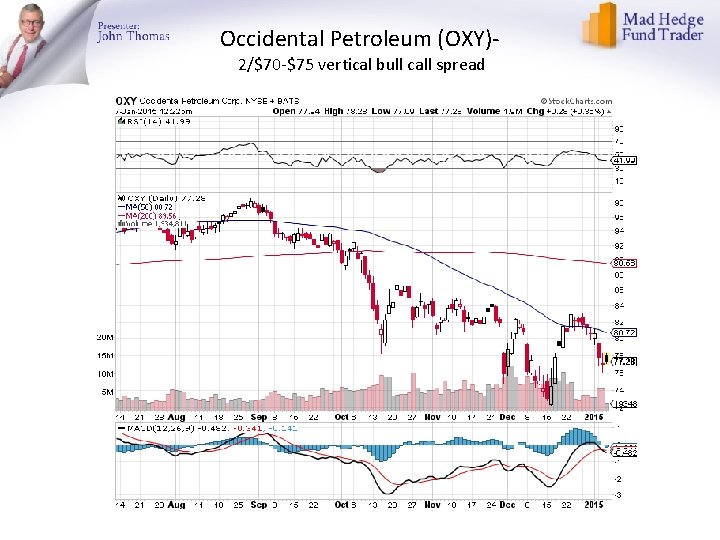

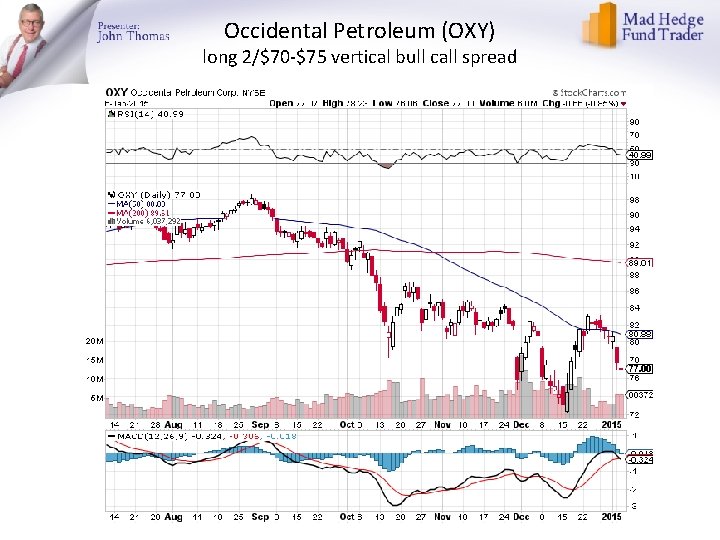

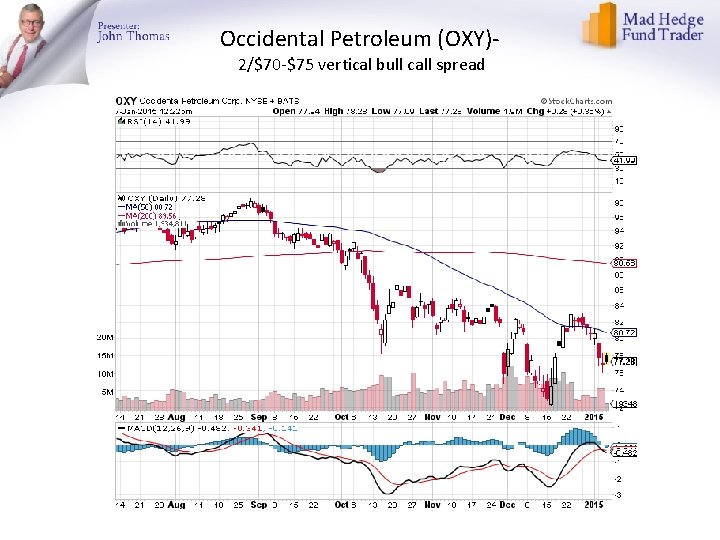

Occidental Petroleum (OXY)2/$70 -$75 vertical bull call spread

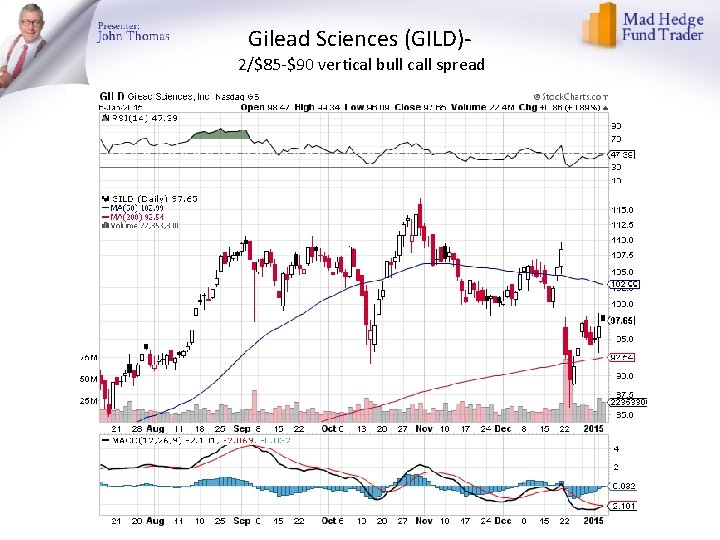

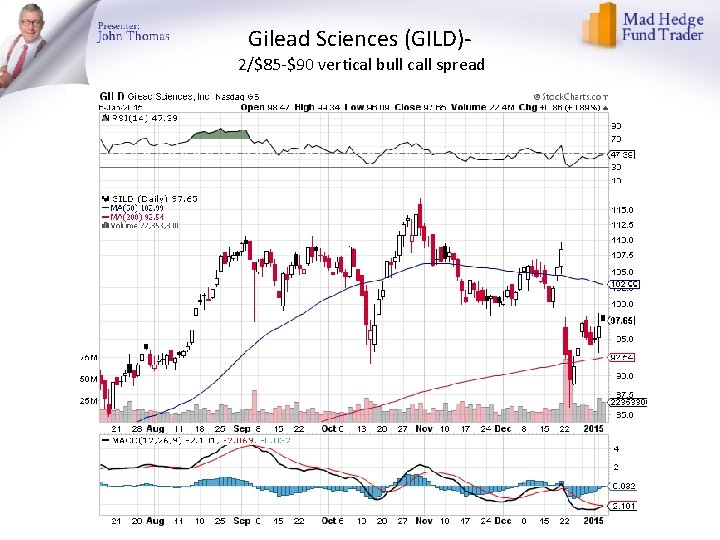

Gilead Sciences (GILD)- 2/$85 -$90 vertical bull call spread

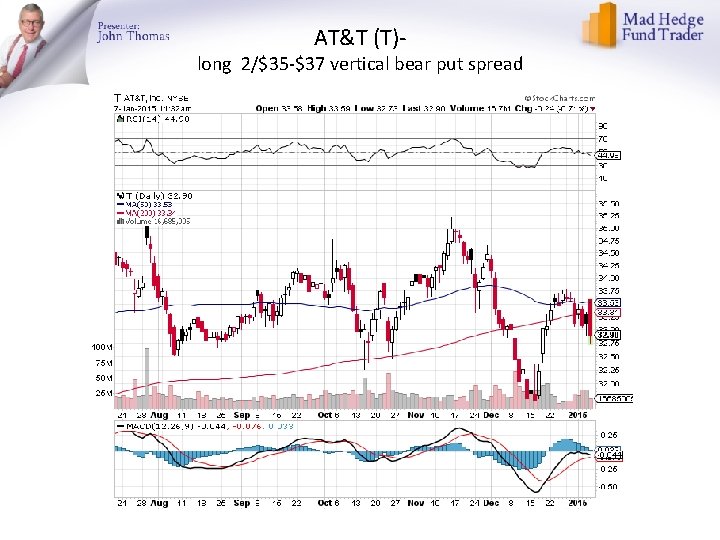

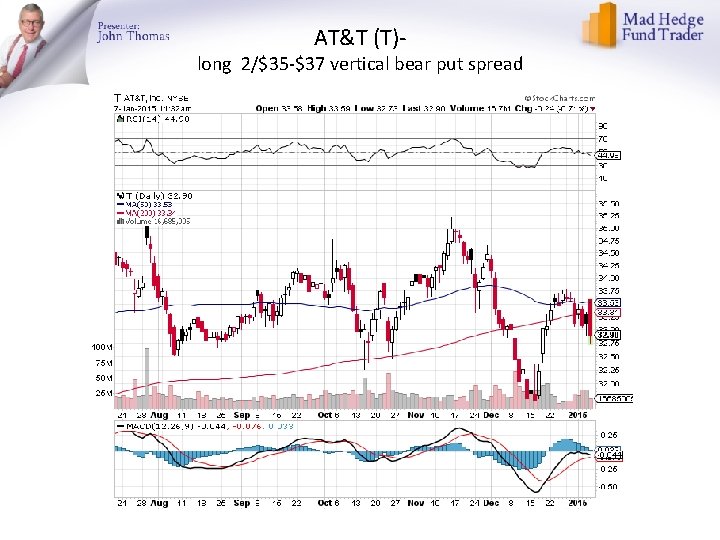

AT&T (T)- long 2/$35 -$37 vertical bear put spread

China (FXI)-

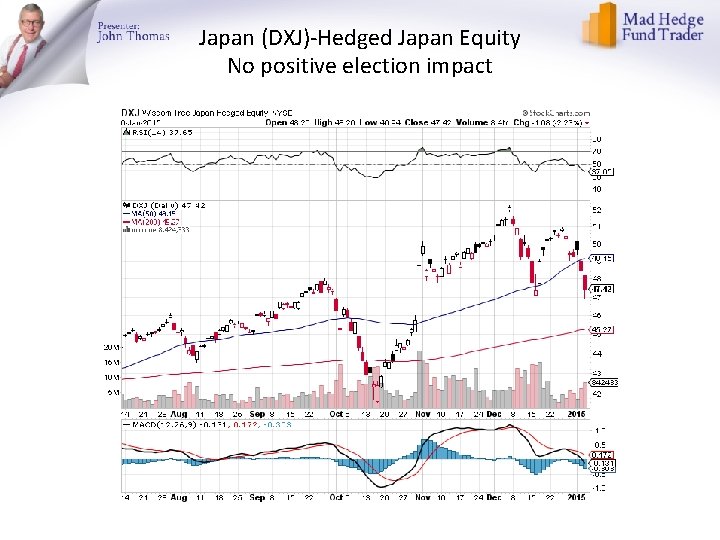

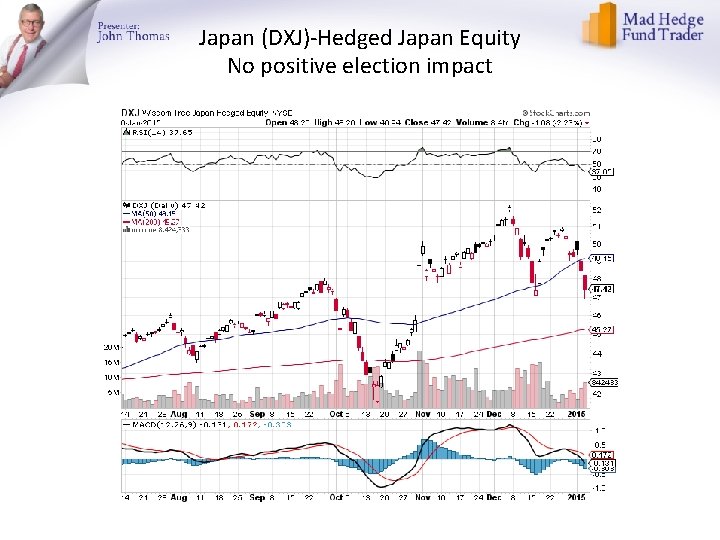

Japan (DXJ)-Hedged Japan Equity No positive election impact

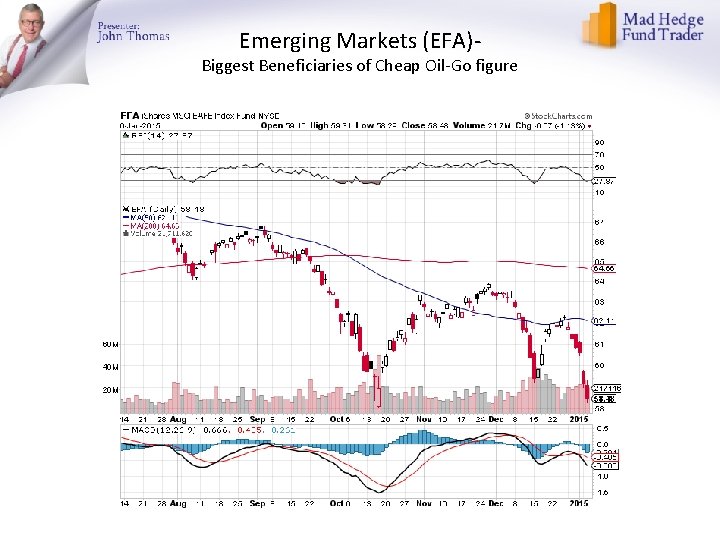

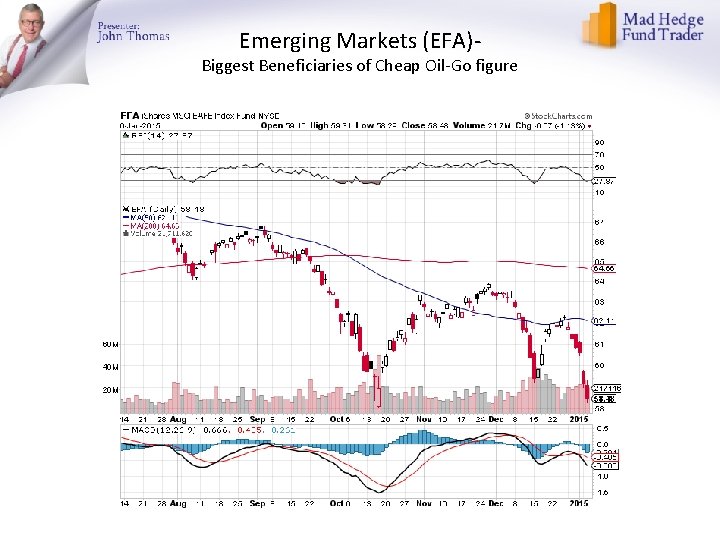

Emerging Markets (EFA)- Biggest Beneficiaries of Cheap Oil-Go figure

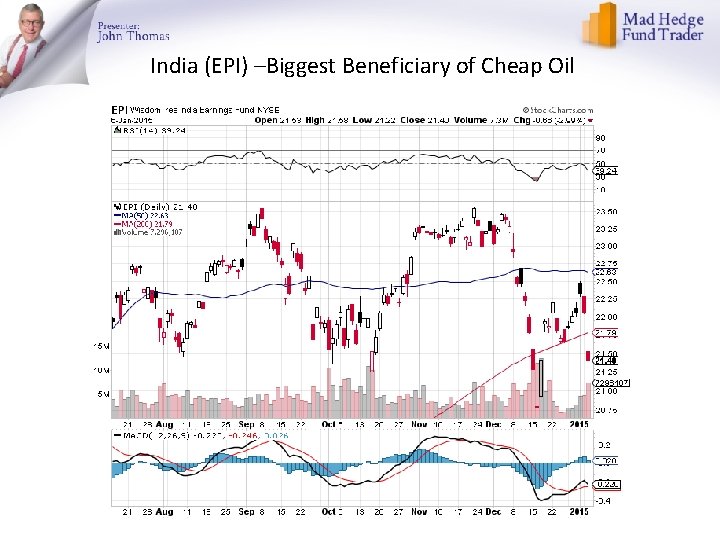

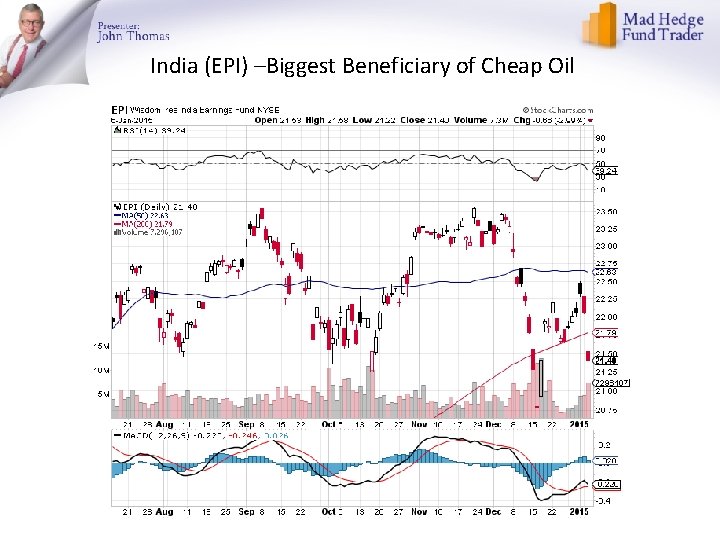

India (EPI) –Biggest Beneficiary of Cheap Oil

Russia (RSX)

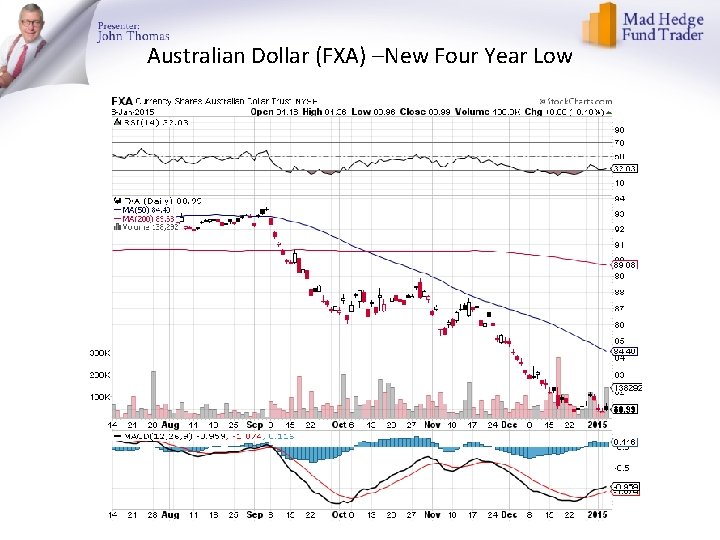

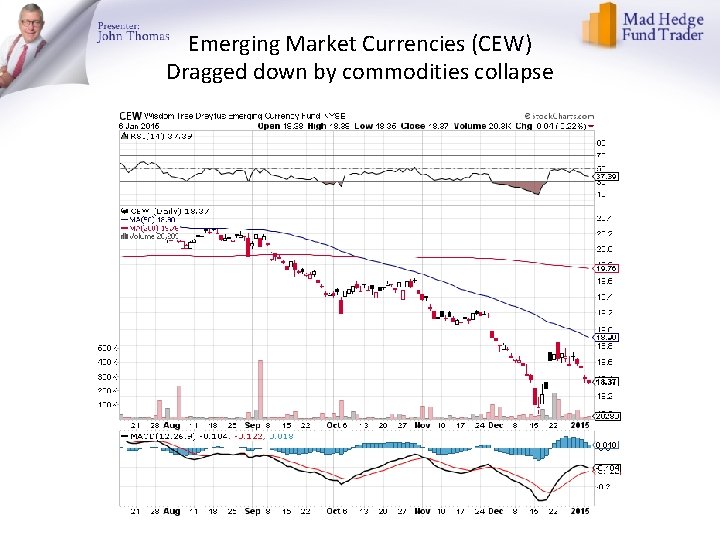

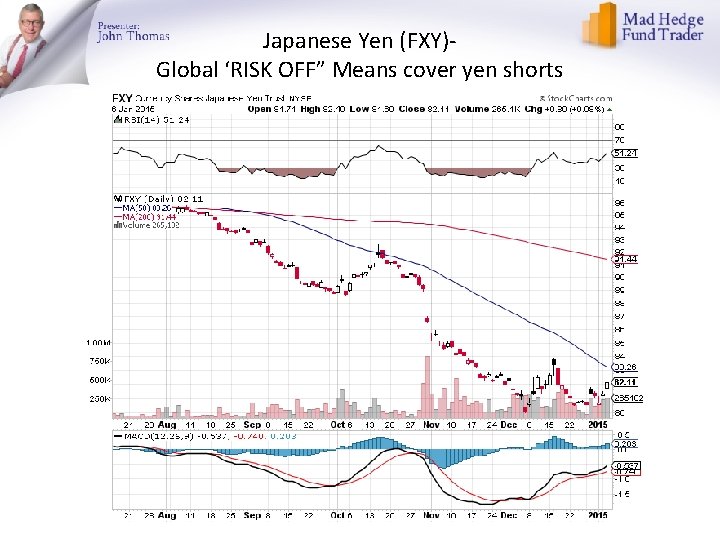

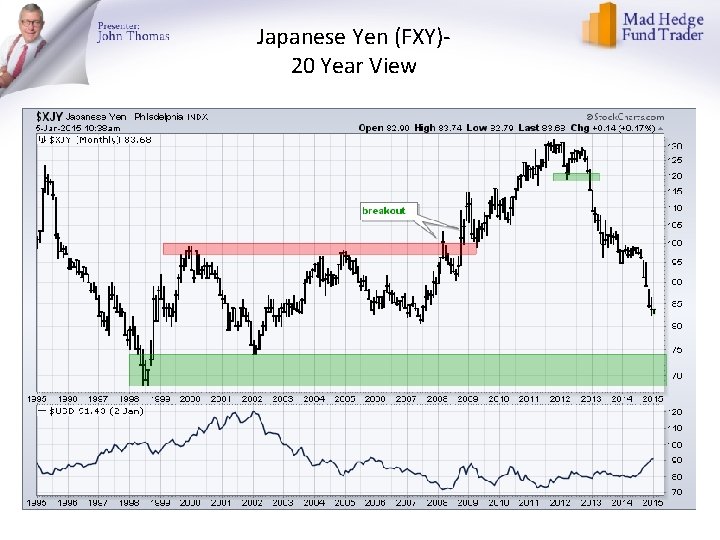

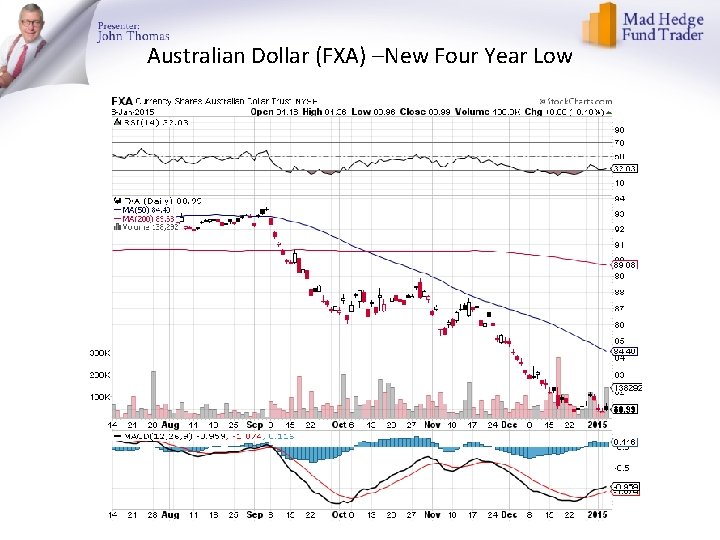

Foreign Currencies- ”RISK OFF” Means Take Profits on All Shorts *Mario Draghi says “there is a risk that we do not fulfill our mandate of price stability”, crashes Euro to new three year lows *Potential Greek withdrawal accelerating the downturn *Euro is dragging British pound down as well *Abe Japanese election win very yen negative long term *Aussie hits new four year low on collapsing commodities and weaker growth, iron ore meltdown *Emerging currencies in free fall

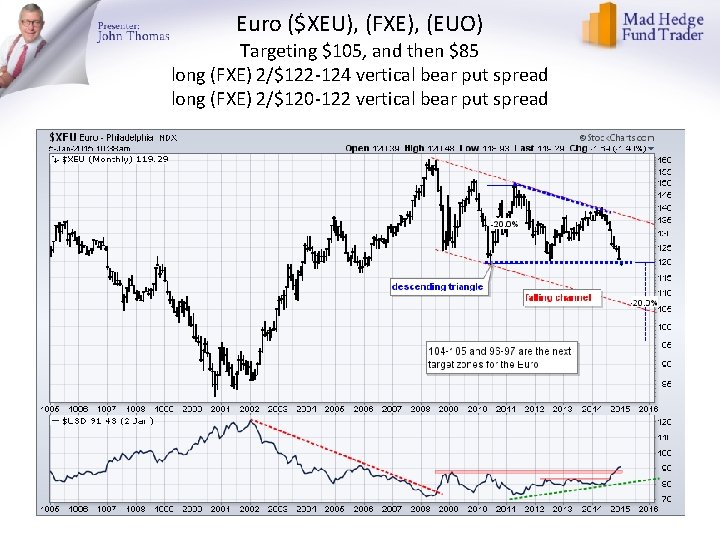

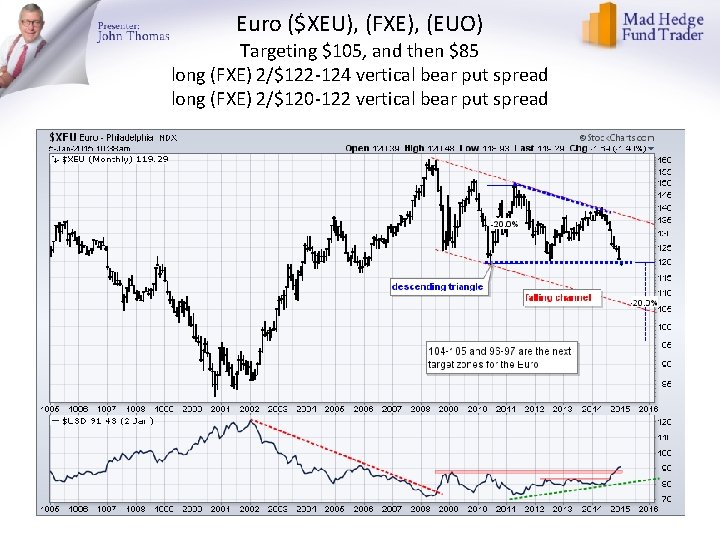

Euro ($XEU), (FXE), (EUO) Targeting $105, and then $85 long (FXE) 2/$122 -124 vertical bear put spread long (FXE) 2/$120 -122 vertical bear put spread

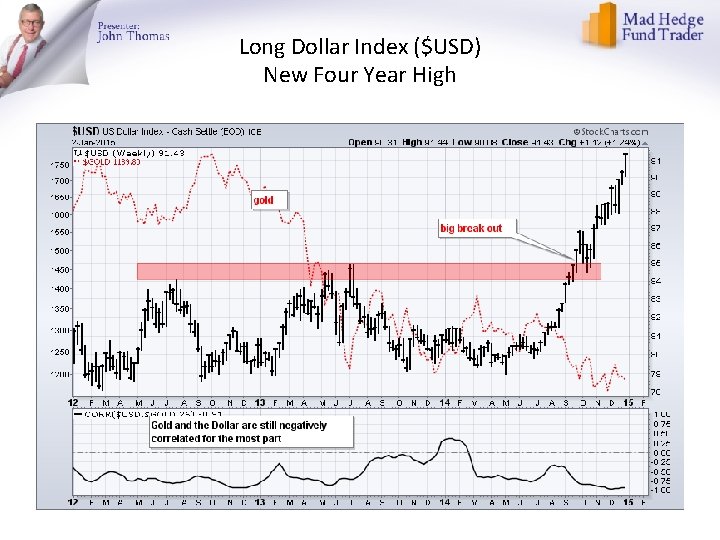

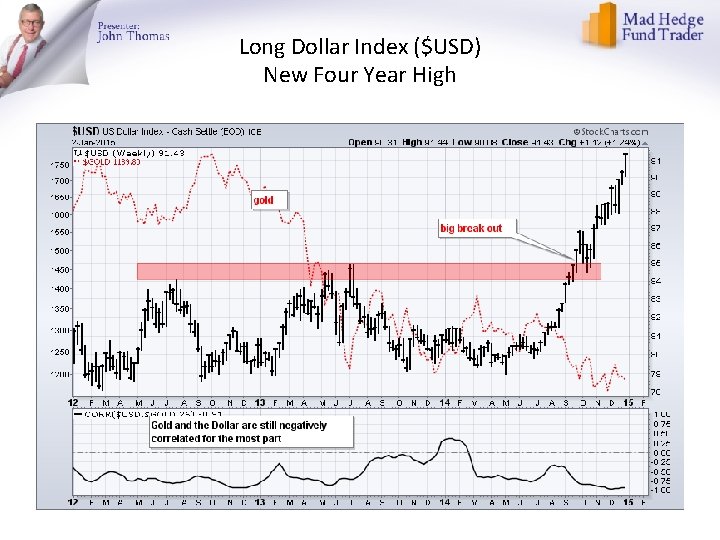

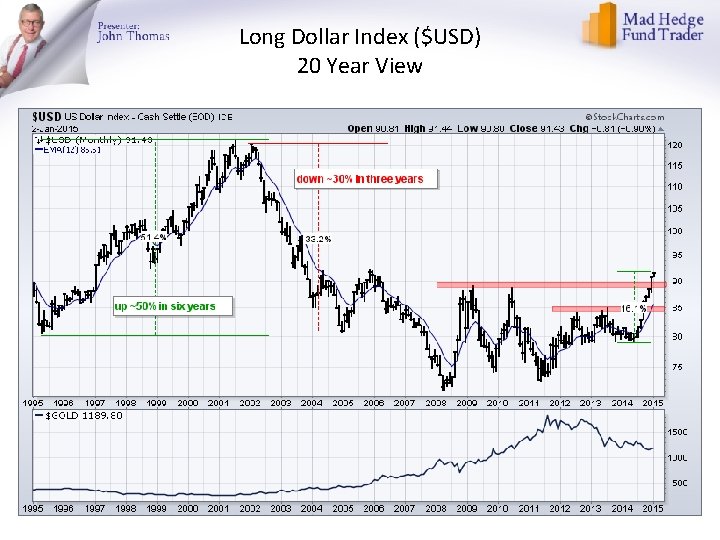

Long Dollar Index ($USD) New Four Year High

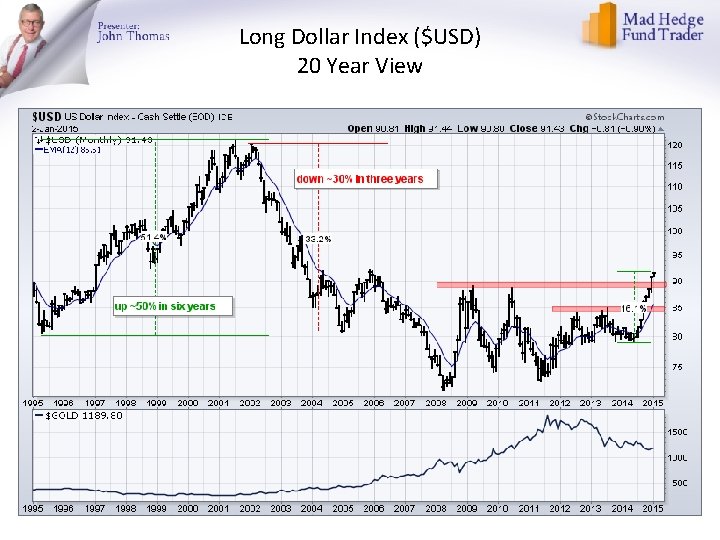

Long Dollar Index ($USD) 20 Year View

British Pound (FXB)-

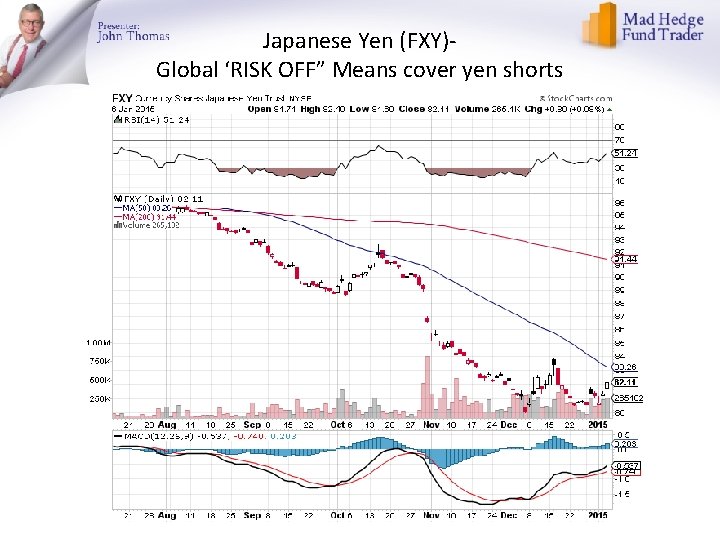

Japanese Yen (FXY)Global ‘RISK OFF” Means cover yen shorts

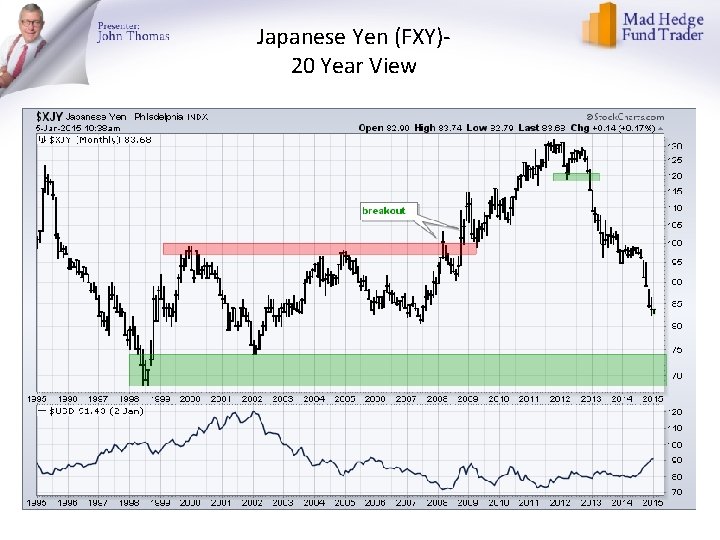

Japanese Yen (FXY)20 Year View

Short Japanese Yen ETF (YCS)

Australian Dollar (FXA) –New Four Year Low

Chinese Yuan- (CYB)

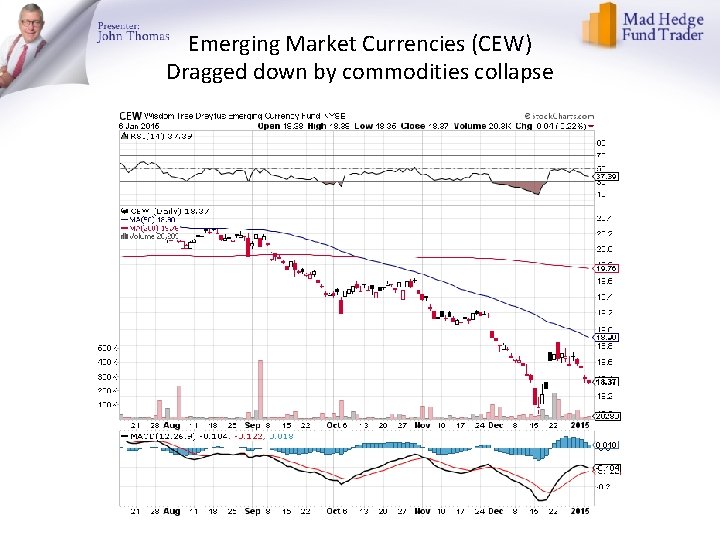

Emerging Market Currencies (CEW) Dragged down by commodities collapse

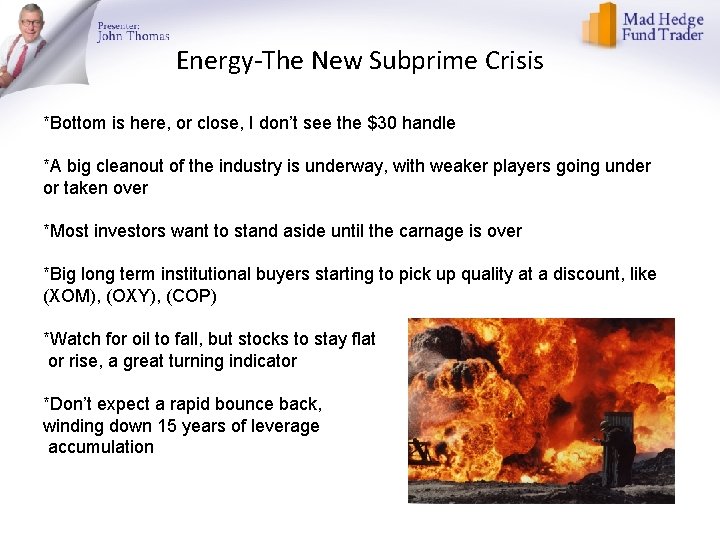

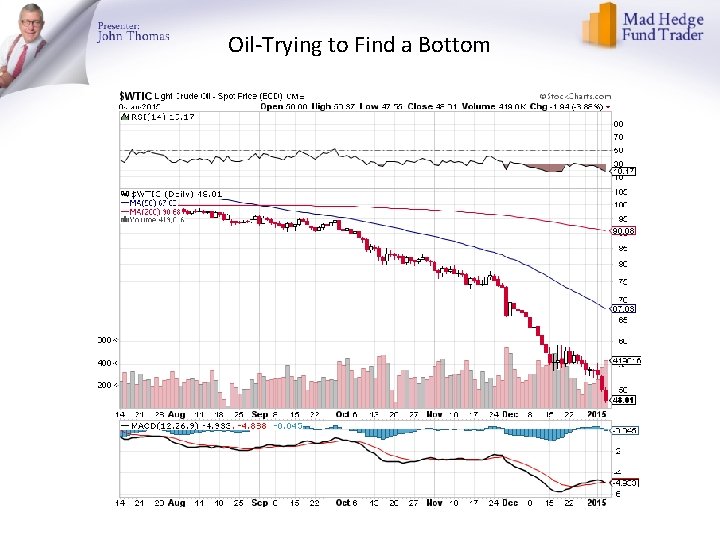

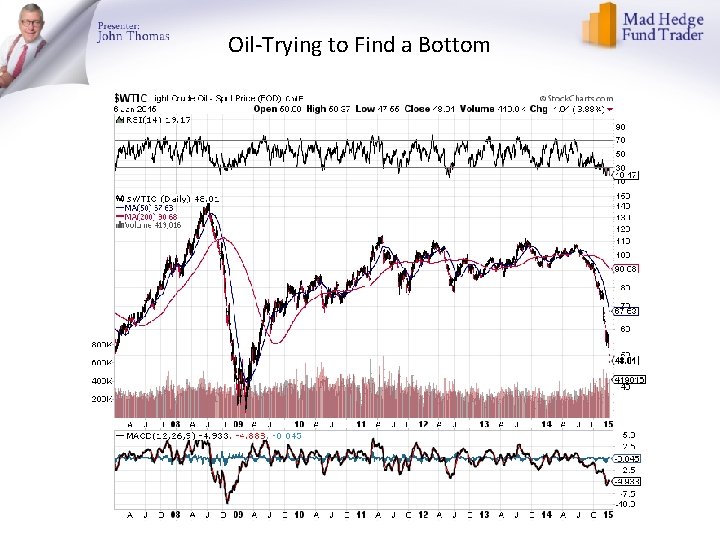

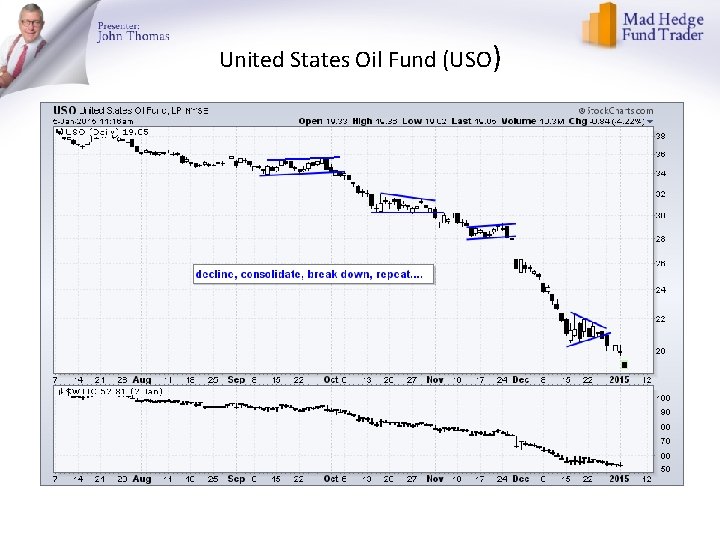

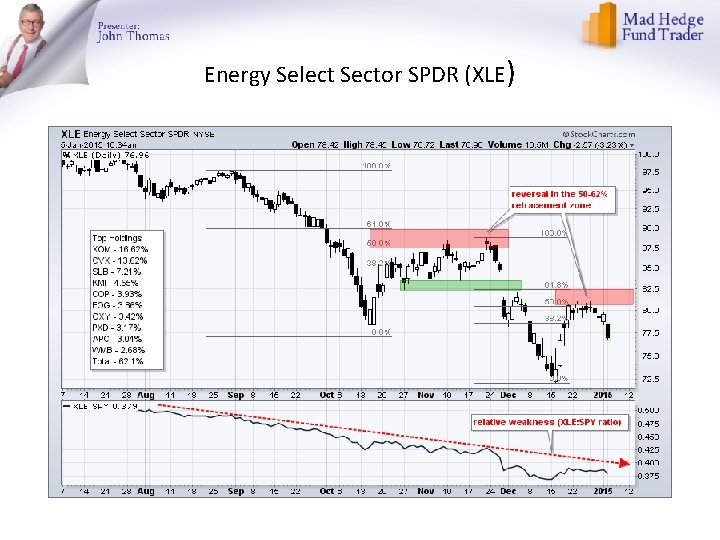

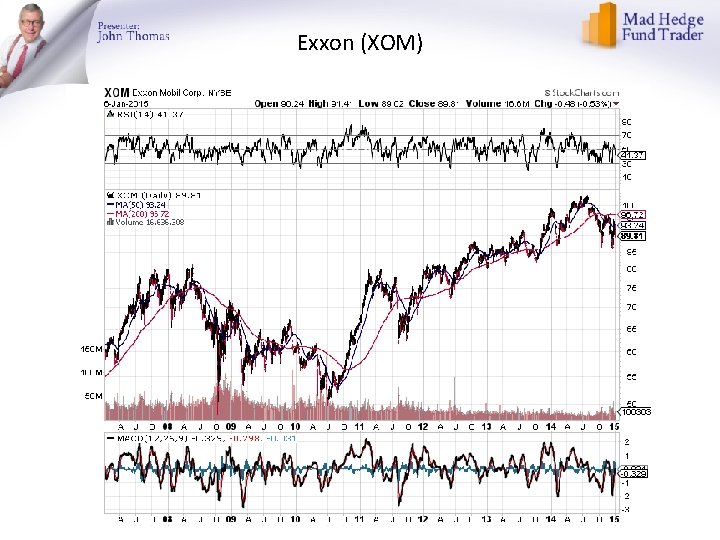

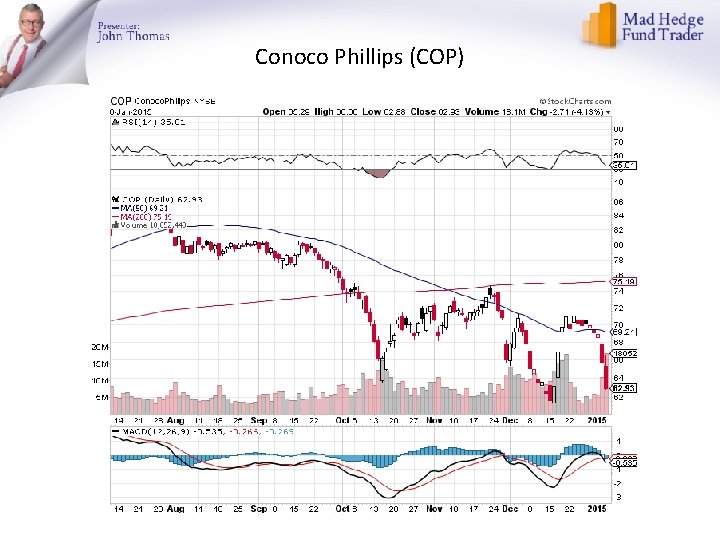

Energy-The New Subprime Crisis *Bottom is here, or close, I don’t see the $30 handle *A big cleanout of the industry is underway, with weaker players going under or taken over *Most investors want to stand aside until the carnage is over *Big long term institutional buyers starting to pick up quality at a discount, like (XOM), (OXY), (COP) *Watch for oil to fall, but stocks to stay flat or rise, a great turning indicator *Don’t expect a rapid bounce back, winding down 15 years of leverage accumulation

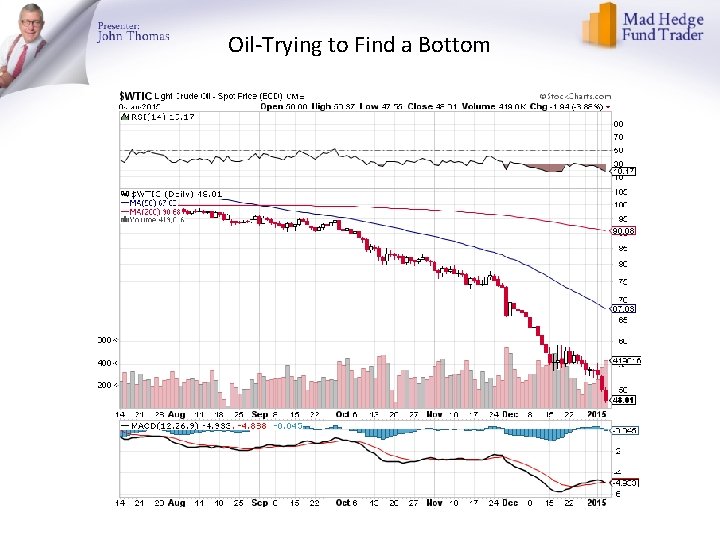

Oil-Trying to Find a Bottom

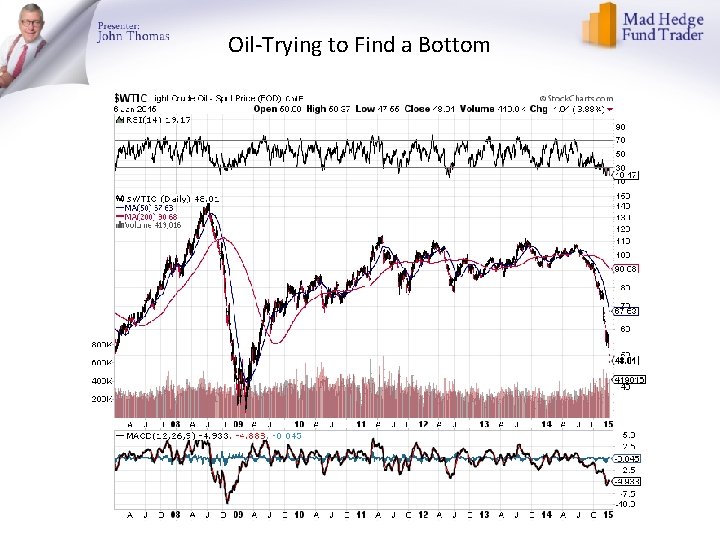

Oil-Trying to Find a Bottom

United States Oil Fund (USO)

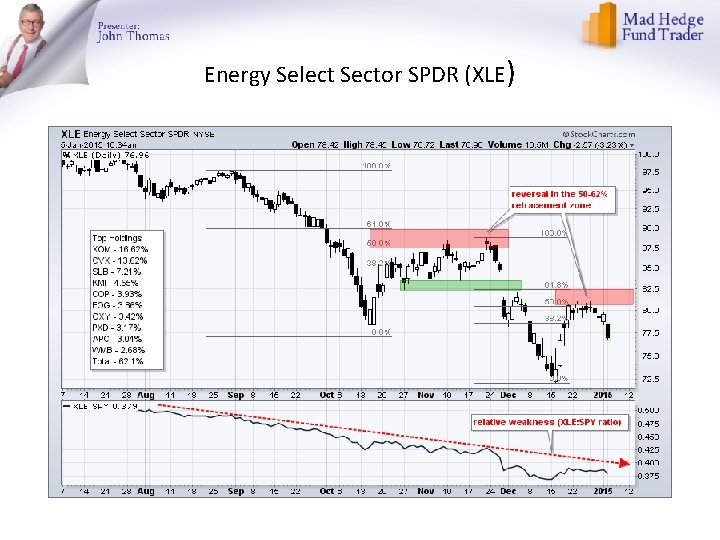

Energy Select Sector SPDR (XLE)

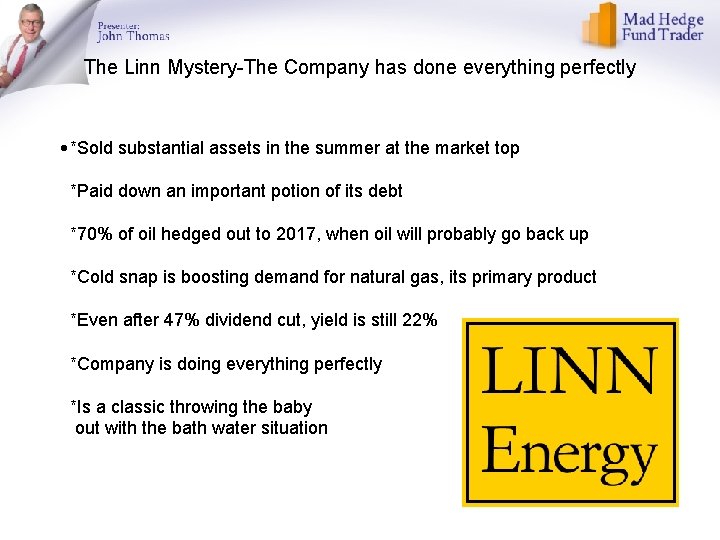

MLP’s (LINE) 20. 74% Yield-Capitulation Sell Off long a 10% Position, rescued by cold weather, yielding 15% after a 47% dividend cut

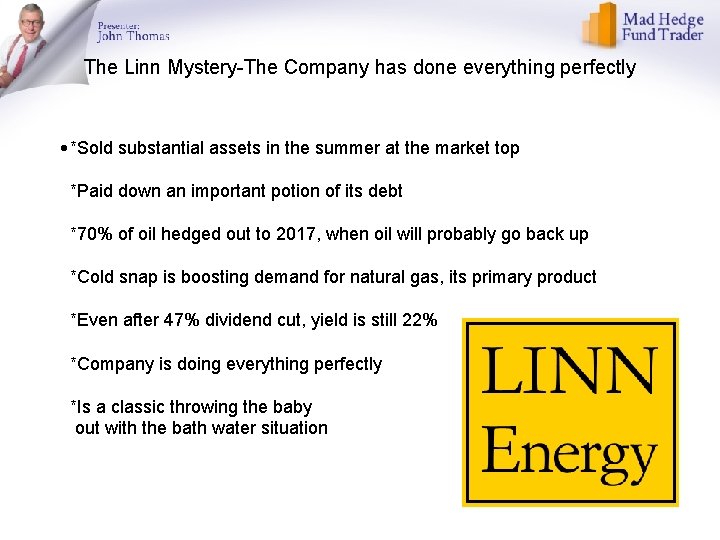

The Linn Mystery-The Company has done everything perfectly • *Sold substantial assets in the summer at the market top *Paid down an important potion of its debt *70% of oil hedged out to 2017, when oil will probably go back up *Cold snap is boosting demand for natural gas, its primary product *Even after 47% dividend cut, yield is still 22% *Company is doing everything perfectly *Is a classic throwing the baby out with the bath water situation

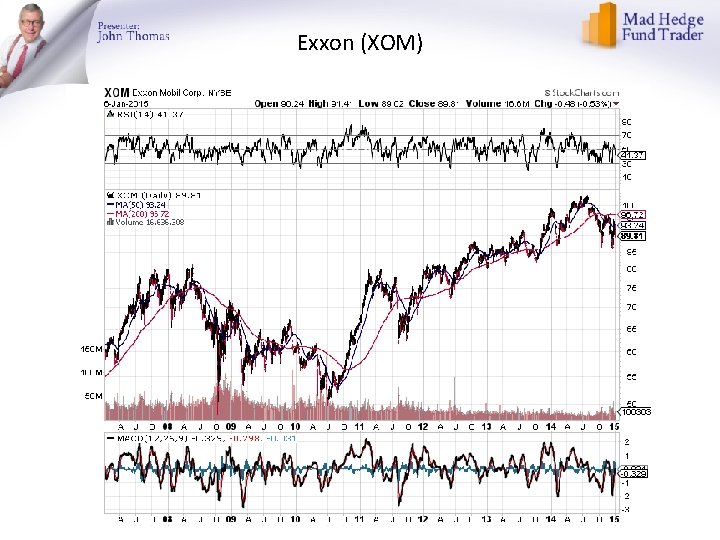

Exxon (XOM)

Occidental Petroleum (OXY) long 2/$70 -$75 vertical bull call spread

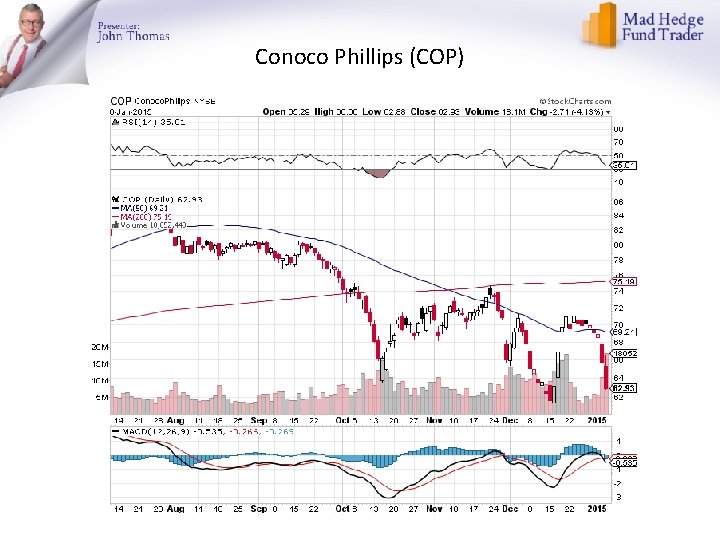

Conoco Phillips (COP)

Natural Gas (UNG)-

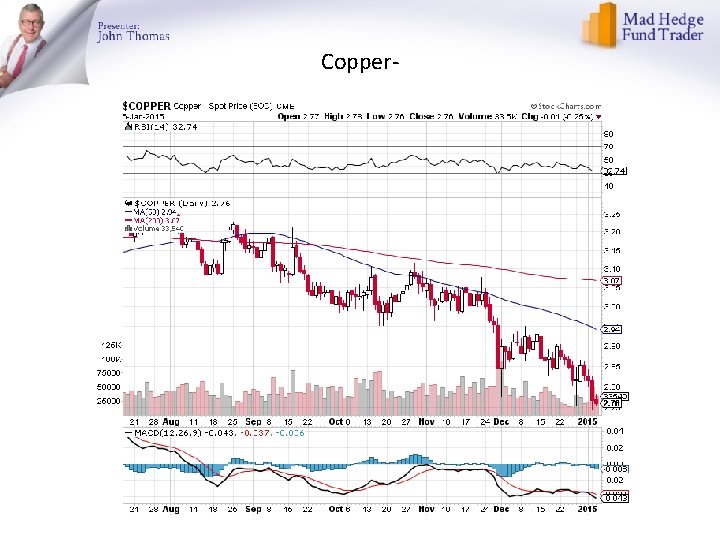

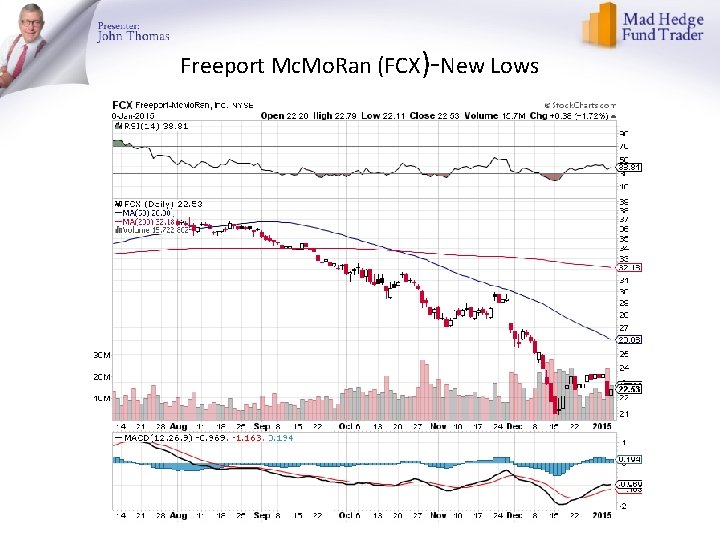

Copper-

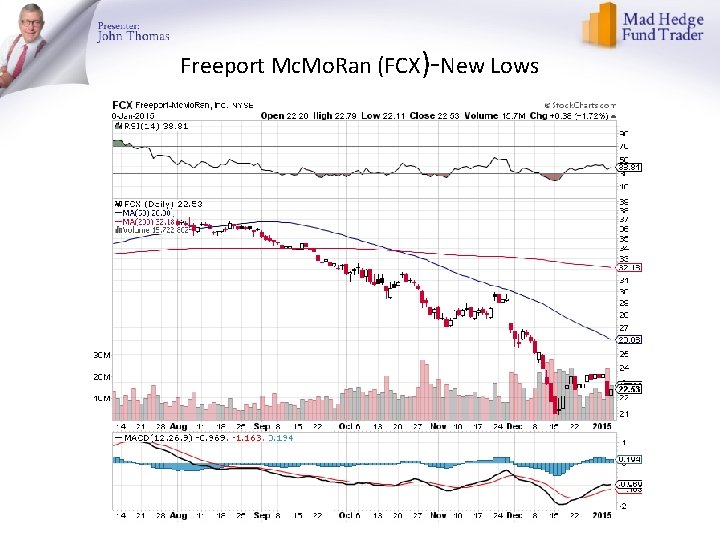

Freeport Mc. Mo. Ran (FCX)-New Lows

Precious Metals-A Bear Market Rally *Flight to safety finally finds gold *Charts starting to put in a convincing, multi month bottom, setting up a trading rally *Still targeting $1, 000 on next market recovery *Gold is pulling up silver as well *Best potential is in the Miners (GDX) and Barrack Gold (ABX)

Gold-A More Convincing Bottom

Barrack Gold (ABX)-New Lows

Market Vectors Gold Miners ETF- (GDX) No Friends

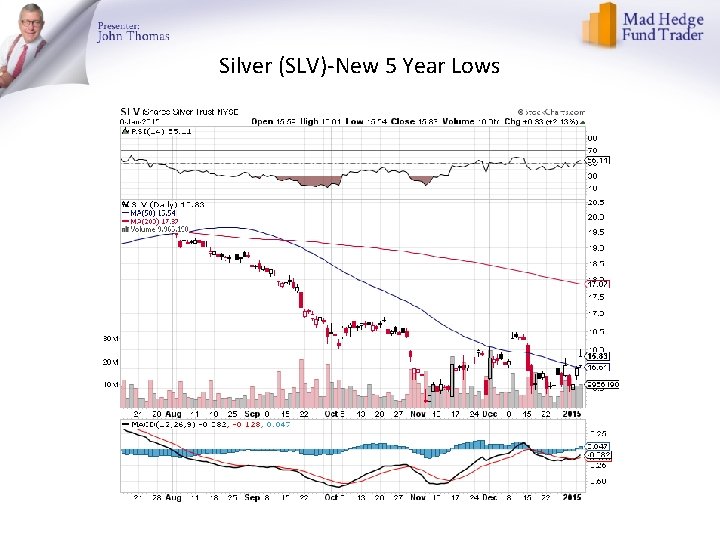

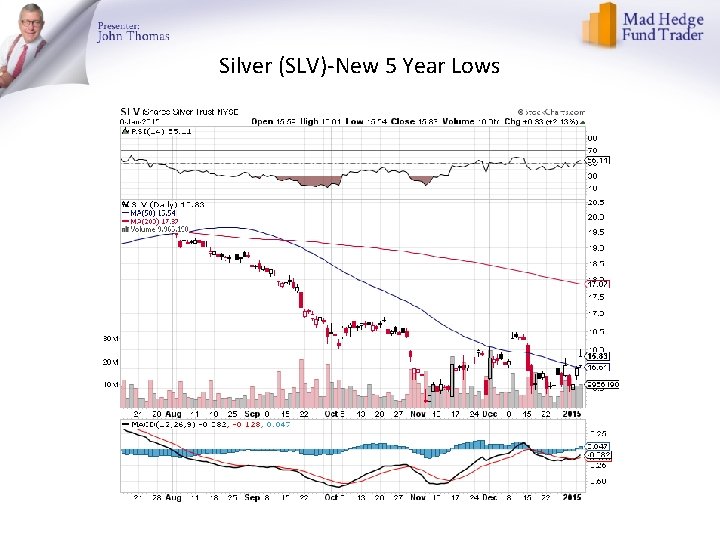

Silver (SLV)-New 5 Year Lows

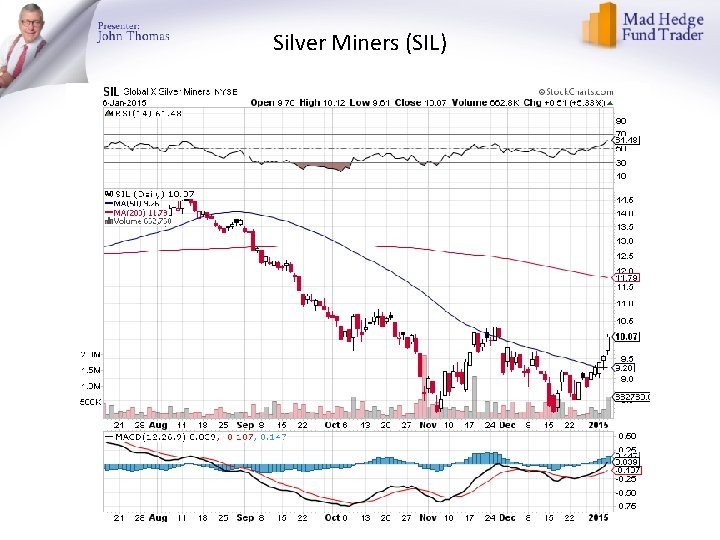

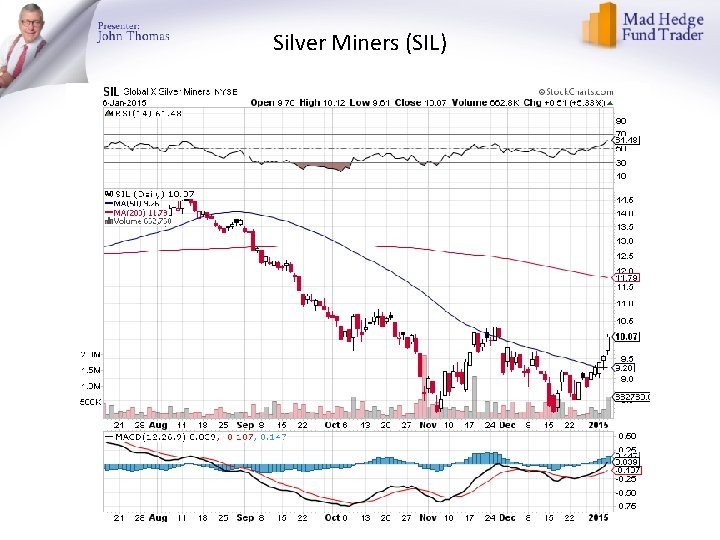

Silver Miners (SIL)

Agriculture *Transportation crisis is providing support under market • *Collapse of Russian Ruble gives the huge price advantage in international markets *Strong dollar hurting US sellers, will get worse *Volatility has gone out of the market, look elsewhere for better trades *Focus on 2015, but it will be another record crop without extreme weather

(CORN) –

(SOYB)-Not Much of a Rally

Ag Commodities ETF (DBA)

Real Estate-Looking Soft, But Better Next Year *October S&P Case Shiller shows 4. 5% YOY price gains in 20 cities *November pending home sales up 0. 8%, despite mortgage rates going out at year’s lows *Rising rents starting to push buyers into the market at the low end *High prices, lack of credit freezing out buyers, shrinking volumes *Ultra low mortgage rates could bring a jump in new construction by 14% in 2015, giving another leg up for the economy *Rising wages could finally give real estate the spur it needs.

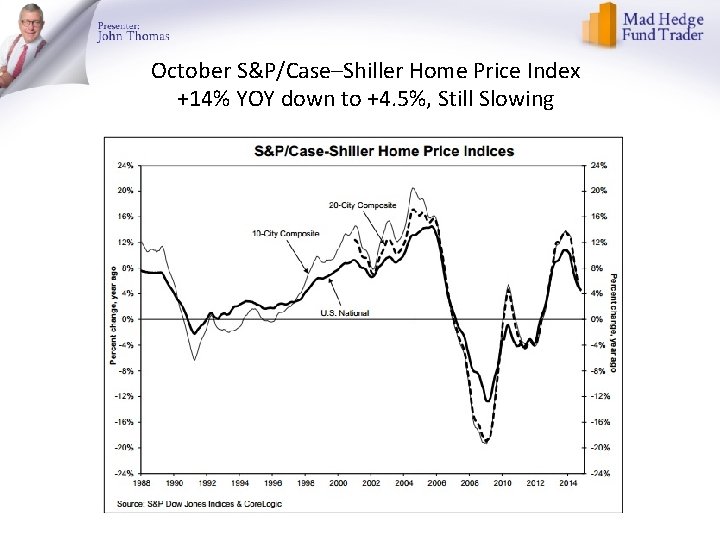

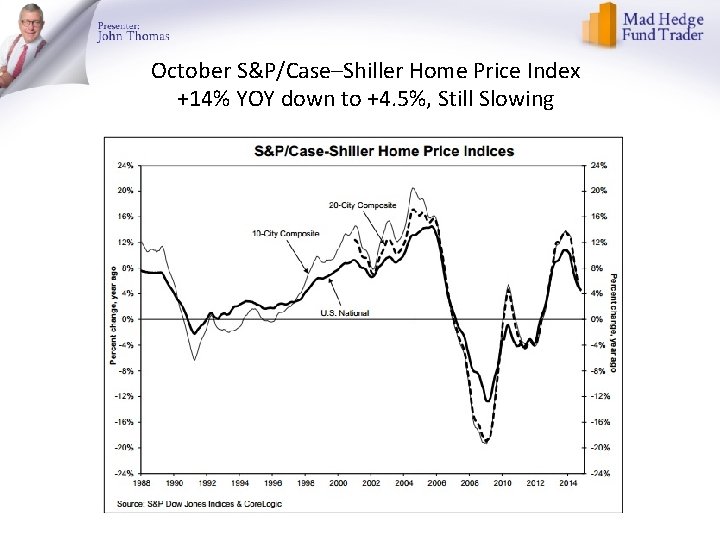

October S&P/Case–Shiller Home Price Index +14% YOY down to +4. 5%, Still Slowing

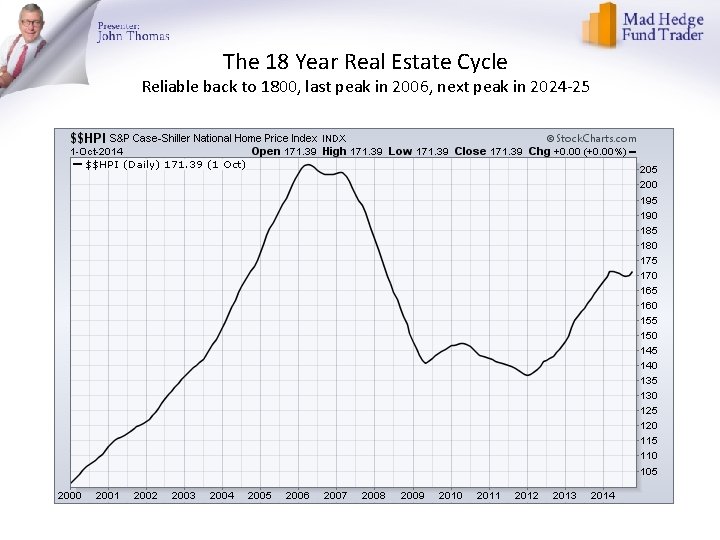

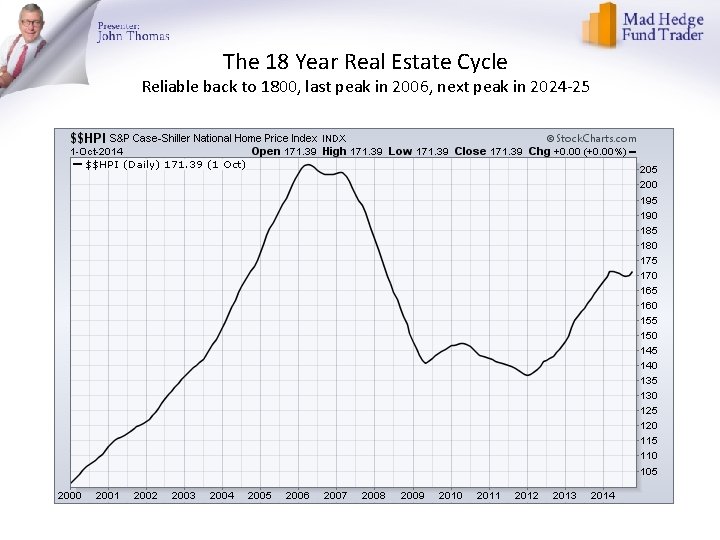

The 18 Year Real Estate Cycle Reliable back to 1800, last peak in 2006, next peak in 2024 -25

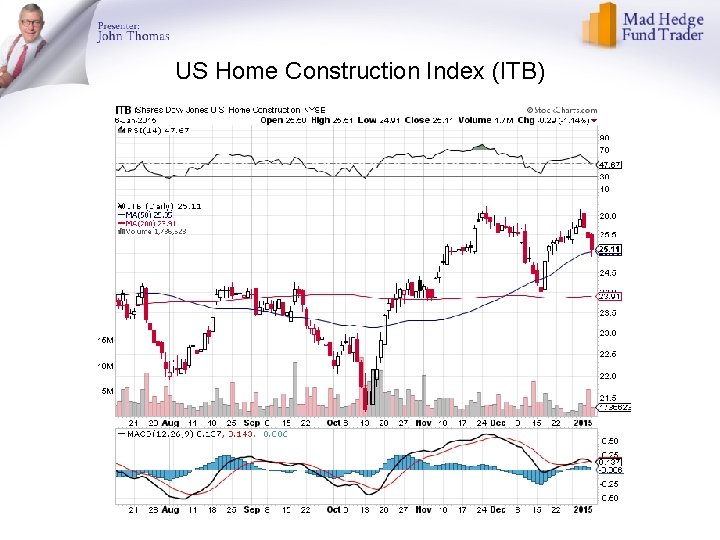

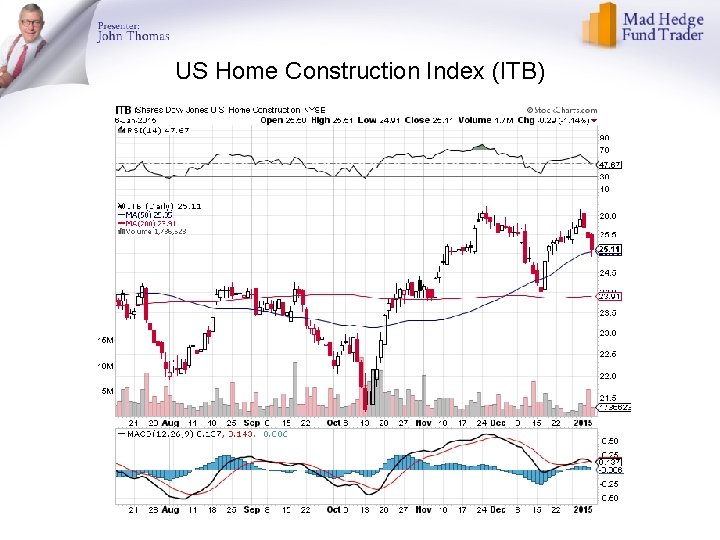

Is the Next Leg of the Real Estate Market About to Begin? (ITB)/(SPX)

US Home Construction Index (ITB)

Trade Sheet So What Do We Do About All This? *Stocks- buy the dips, with Financials, technology and health care leading, we’re running to new highs *Bonds- stand aside, its gone crazy *Commodities-stand aside until global economy recovers *Currencies- sell every Euro rally forever, and the yen too *Precious Metals –there may be a short term trade here *Volatility-is peaking, get ready to sell *The Ags –stand aside until next season *Real estate- stand aside, the dead cat bounce is done

To buy strategy luncheon tickets Please go to: www. madhedgefundtrader. com Next Strategy Webinar 12: 00 Wednesday, January 21, 2015 Live from San Francisco, CA Good Luck and Good Trading!