THE INSTITUTE OF CHARTERED ACCOUNTANTS OF SRI LANKA

- Slides: 18

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF SRI LANKA POSTGRADUATE DIPLOMA IN BUSINESS AND FINANCE 2014/2015 Principles of Financial and Cost Accounting Thilanka Warnakulasooriya B. Com Special (Col), ACA, MBA Fin ( Col)

IAS 16/ LKAS 16 Property, Plant & Equipment

�Objective: �The objective of LKAS 16 is to prescribe the accounting treatment for property, plant, and equipment. The principal issues are: - the timing of recognition of asset; - the determination of their carrying amounts; and - the depreciation charges to be recognized.

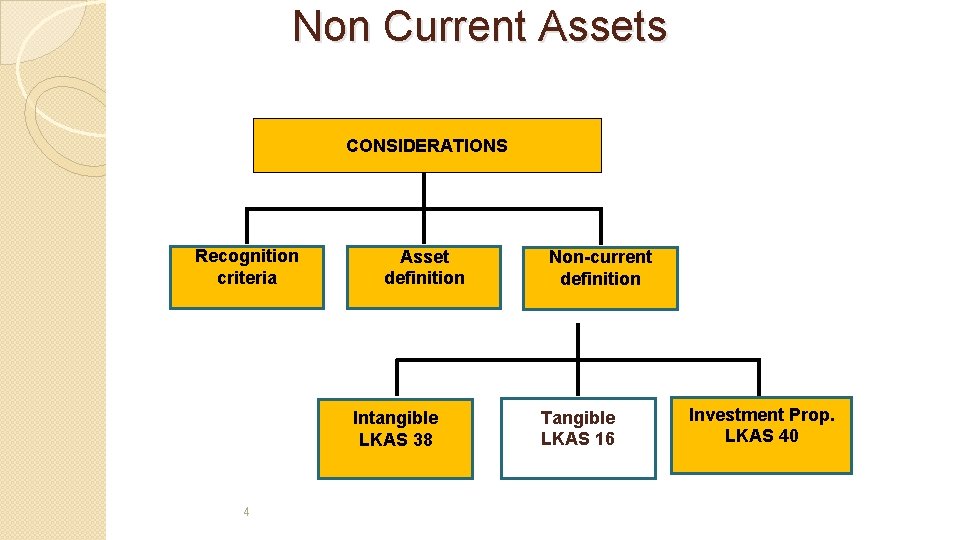

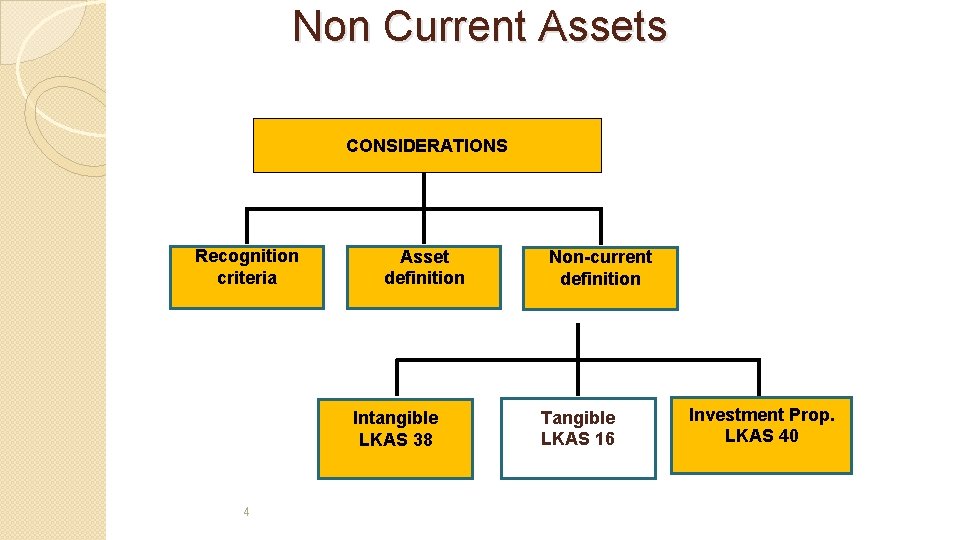

Non Current Assets CONSIDERATIONS Recognition criteria Asset definition Intangible LKAS 38 4 Non-current definition Tangible LKAS 16 Investment Prop. LKAS 40

Definition Property, plant and equipment (PPE) are tangible items that are Held for use in the production or supply of goods or services, for rental to others, or for administration purposes; and Are expected to be used during more than one period. Cost. The amount paid or fair value of other consideration given to acquire or construct an asset.

§ Depreciation - Systematic allocation of the depreciable amount of an asset over its useful life. § Carrying amount: Carrying amount is the amount which an asset is included in the Statement of financial Position after deducting any accumulated depreciation § Residual Value: is the net amount which the enterprise expects to obtain for an asset and the end of its useful life after deducting the expected costs of disposal

Useful life: �The period of time over which an asset is expected to be used by the enterprise or �The no of production or similar units expected to be obtained from the asset by the enterprise �Following are relevant for determining the life time of asset. �Expected usage of asset �Expected Physical wear & tare �Technical obsolescence �Legal Limits Land usually has an indefinite useful life and consequently land is not usually depreciated.

RECOGNITION OF AN ASSET An item of property, plant, and equipment should be recognized as an asset �if and only if it is probable that future economic benefits associated with the asset will flow to the entity �and the cost of the item can be measured reliably

Initial Recognition - Cost Purchase price : including import duties, nonrefundable purchase taxes, less trade discounts and rebates Costs directly attributable to bringing the asset to the location and condition necessary for it to be used in a manner intended by the entity

�Examples - of Directly Attributable Costs: Cost of employee benefits. Cost of site preparation. Initial delivery and handling cost. Installation and assembly cost. Cost of testing after deducting the net proceeds from selling any items produced. Professional fees.

Examples of costs that are not directly attributable costs and therefore must be expensed in the income statement include �Costs of opening a new facility (often referred to as preoperative expenses) �Costs of introducing a new product or service �Advertising and promotional costs �Costs of conducting business in a new location or with a new class of customer �Training costs �Administration and other general overheads �Costs incurred while an asset, capable of being used as intended, is yet to be brought into use, is left idle, or is operating at below full capacity �Initial operating losses �Costs of relocating or reorganizing part or all of an entitys operations -

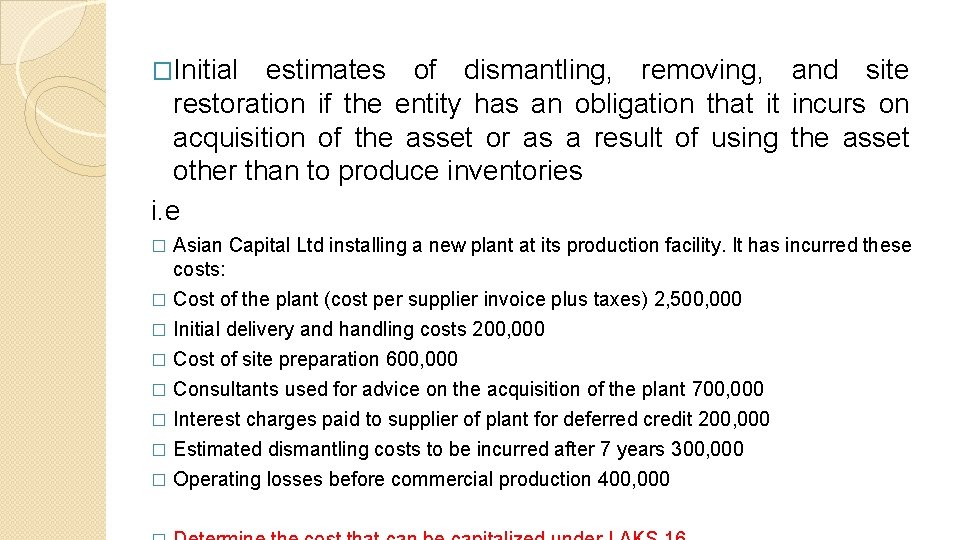

�Initial estimates of dismantling, removing, and site restoration if the entity has an obligation that it incurs on acquisition of the asset or as a result of using the asset other than to produce inventories i. e Asian Capital Ltd installing a new plant at its production facility. It has incurred these costs: � Cost of the plant (cost per supplier invoice plus taxes) 2, 500, 000 � Initial delivery and handling costs 200, 000 � Cost of site preparation 600, 000 � Consultants used for advice on the acquisition of the plant 700, 000 � Interest charges paid to supplier of plant for deferred credit 200, 000 � Estimated dismantling costs to be incurred after 7 years 300, 000 � Operating losses before commercial production 400, 000 �

Measurement of cost – Repairs and Maintenance Routine repairs and maintenance and servicing costs should normally be recognised in the Statement of comprehensive income when the costs are incurred. However, when the subsequent expenditure enhances the value of the asset to the extent that additional economic benefits will flow to the entity, that additional expenditure should be recognised as part of the assets costs.

DEPRECIATION Methods: Straight line Units of production Diminishing balance (Reducing balance) Approach: Depreciation charge for each period is recognized directly in Statement of comprehensive Income Methods should be reviewed annually Charges start when asset ready for use and stop when asset derecognized

Straight line method �Straight line method depreciates cost evenly through out the useful life of the asset. Straight line depreciation is calculated as follows: �Depreciation per annum = (Cost - Residual Value) / Useful Life �Accounting for Depreciation ◦ Depreciation Expense( Dr Account) ◦ Accumulated Deprecation Cr

i. e: Cost of the Asset 110, 000 Residual Value 10, 000 Expected Life time period : 10 years Determine the annual depreciation amount

Subsequent measurement � An entity may choose between: ◦ Cost model (i. e. cost less accumulated depreciation and accumulated impairment losses, if any) ◦ Revaluation model (i. e. fair value at the date of revaluation less subsequent accumulated depreciation/impairment losses) � 17 However, the same policy must be applied to each entire class of property, plant and equipment.

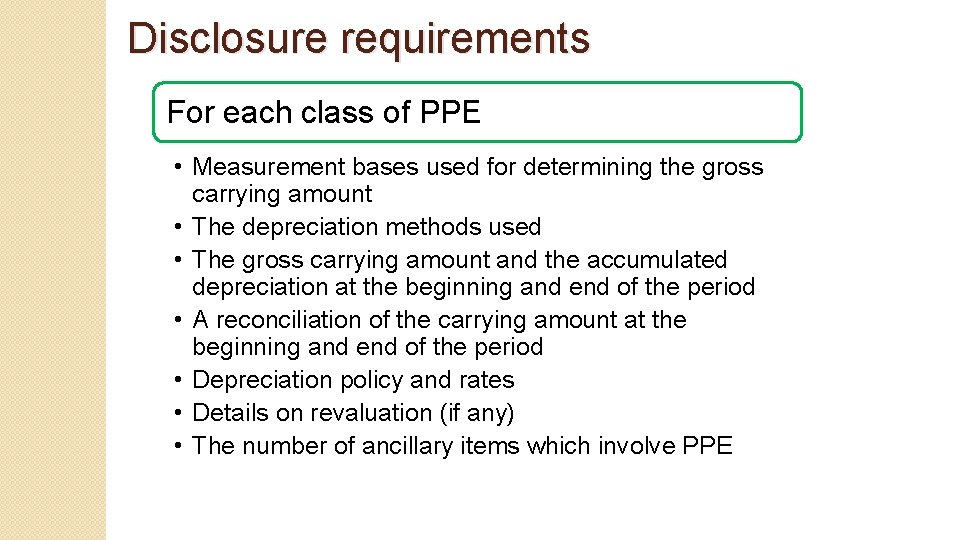

Disclosure requirements For each class of PPE • Measurement bases used for determining the gross carrying amount • The depreciation methods used • The gross carrying amount and the accumulated depreciation at the beginning and end of the period • A reconciliation of the carrying amount at the beginning and end of the period • Depreciation policy and rates • Details on revaluation (if any) • The number of ancillary items which involve PPE

Sri rama sri rama sri manoharama

Sri rama sri rama sri manoharama Sri lanka institute of information technology colors

Sri lanka institute of information technology colors Sri lanka institute of information technology affiliations

Sri lanka institute of information technology affiliations Accrue chartered accountants

Accrue chartered accountants Chartered accountants academy

Chartered accountants academy Climate data sri lanka

Climate data sri lanka Administrative structure of health service in sri lanka

Administrative structure of health service in sri lanka Cba sri lanka

Cba sri lanka Agriculture insurance in sri lanka

Agriculture insurance in sri lanka Handicap international sri lanka

Handicap international sri lanka Seismometer in sri lanka

Seismometer in sri lanka Shotokan karate sri lanka

Shotokan karate sri lanka Mohanscience lk

Mohanscience lk Payment and settlement system in sri lanka

Payment and settlement system in sri lanka Sri lanka folk tales

Sri lanka folk tales Apartment ownership law sri lanka

Apartment ownership law sri lanka Ecommerce website in sri lanka

Ecommerce website in sri lanka Rashmin lokubandara

Rashmin lokubandara How to calculate vat in sri lanka

How to calculate vat in sri lanka