The Illinois Secure Choice Savings Program Courtney Eccles

- Slides: 14

The Illinois Secure Choice Savings Program Courtney Eccles, Program Manager Illinois State Treasurer’s Office 01

Creation of Secure Choice • The Illinois Secure Choice Savings Program Act (Secure Choice) created as a response to the retirement crisis in Illinois • Access to an employment-based plan for workers • Lightest touch on employers (facilitate auto-enrollment, no contributions, no management, no fiduciary duties) • Secure Choice will impact approximately 1. 2 million workers throughout Illinois • Program design and implementation are underway 02

Secure Choice Act • Signed into law in January of 2015 • State-run retirement savings program for private sector workers in Illinois • Secure Choice applies to businesses: 1. With 25 or more employees, 2. That have been operating in Illinois for at least two years, and 3. Don’t offer a qualified savings program 03

Participation and Accounts • Employees at qualifying businesses will be automatically enrolled into Secure Choice • Default deduction of 3 percent into a default target date Roth IRA • Employees can change contribution level, select a different fund option, or opt-out entirely • Accounts will be pooled together and privately managed, and will be portable 04

Employer Role • Employers will: • Facilitate enrollment (and set up the payroll deductions) • Hand out Program packets (which will be provided in advance) • Employers will NOT: • Have any administrative or managerial obligations • Make any contributions • Pay any fees or costs associated with the program 05

Administrative Features • Managed by a seven person Board (day to day management by private sector vendor) • Treasurer’s Office provides administrative and staff support • Program must become self-sustaining • Any start-up costs appropriated by the state must be paid back • Total fees capped at 75 basis points • Program must not be subject to ERISA 06

Benefits for Workers • Access to a retirement savings vehicle at work (contribute through payroll deduction) • No high minimum initial contribution requirements • Caps on fees and additional protections through state program • Default options make participation easy • Employees have the option to increase/decrease contribution amounts, select different fund options, opt -out entirely • Full-time and part-time workers will be eligible 07

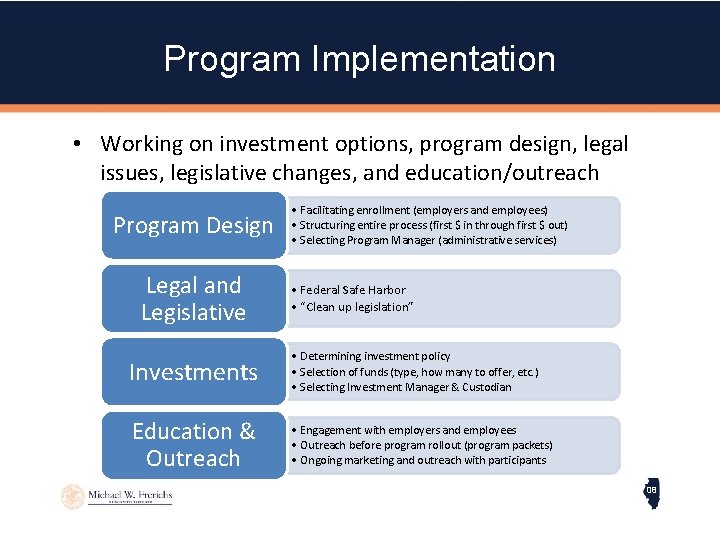

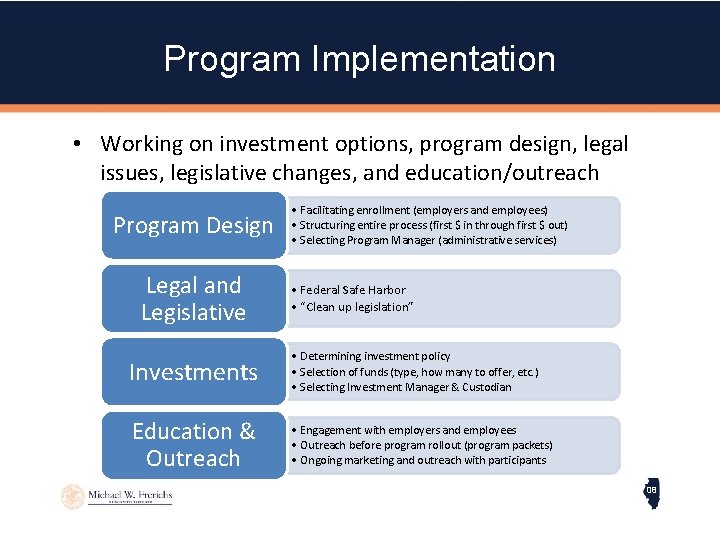

Program Implementation • Working on investment options, program design, legal issues, legislative changes, and education/outreach Program Design Legal and Legislative • Facilitating enrollment (employers and employees) • Structuring entire process (first $ in through first $ out) • Selecting Program Manager (administrative services) • Federal Safe Harbor • “Clean up legislation” Investments • Determining investment policy • Selection of funds (type, how many to offer, etc. ) • Selecting Investment Manager & Custodian Education & Outreach • Engagement with employers and employees • Outreach before program rollout (program packets) • Ongoing marketing and outreach with participants 08

Implementation Continued • Focus on minimizing role of the employer and making enrollment as easy as possible for employees • Working with state agencies – gather information, communicate with employers • Meeting with stakeholders and industry regularly (record keepers, payroll providers, advocates, financial service organizations) • Partnering with the other states engaged in implementation (CA, OR, and CT primarily) 09

Program Rollout • Enrollment of participants expected to begin in 2018 • Phased rollout beginning with a pilot program • All employers will be made aware of the program but many may not begin participating until 2019 (in later phases) • Research on participant demographics, financial feasibility, and program design is underway • Final program design elements will be determined by early 2017 • Program Manager RFP and selection will take place in spring/summer of 2017 10

Role of Advocates/Stakeholders Engagement by advocates is crucial to the creation and passage of legislation, and the ultimate success of state programs. 11

Research and Legislation • Some states already have laws on the books, but many do not • Conduct state specific research • Work with legislative champions, State Treasurer, State Comptroller • Build diverse base of support – education on the issue will be key (public and policymakers) • Growing momentum for state programs – expect significant activity over next few years 12

Assisting with Implementation • Engage with the process – many state programs operated by Boards with open/public meetings • Provide research/resources (most programs have limited/no budget for start up) • Participate in state rulemaking process • Serve as resources to Board and staff (expertise in consumer protections, asset building, focus on LMI workers) • Outreach and education to employees/employers • Focus groups, messaging, key considerations for lower-income workers • Continue to be public voice of support for programs 13

More Information • Treasurer’s Website includes a page for Secure Choice (www. illinoisretirement. gov) • • Email address for questions Board materials (agendas, minutes, approved documents) One page introductory fact sheet More information will be added in the coming months • Contact Courtney Eccles: ceccles@illinoistreasurer. gov 14