The Future of Category Analytics Win with Shoppers

- Slides: 37

The Future of Category Analytics – Win with Shoppers

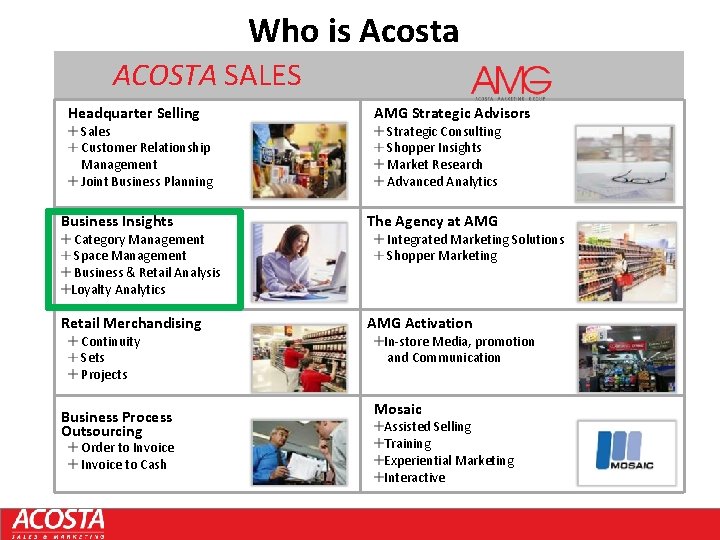

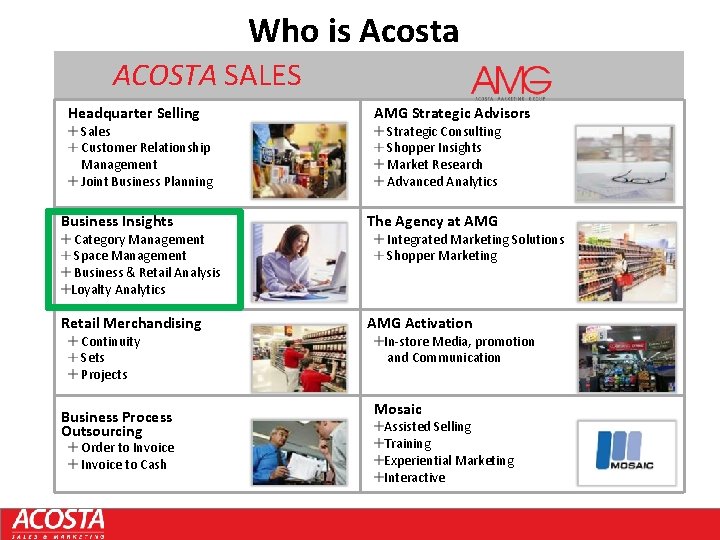

Who is Acosta ACOSTA SALES Headquarter Selling Sales Customer Relationship Management Joint Business Planning AMG Strategic Advisors Strategic Consulting Shopper Insights Market Research Advanced Analytics Business Insights The Agency at AMG Retail Merchandising AMG Activation Category Management Space Management Business & Retail Analysis Loyalty Analytics Continuity Sets Projects Business Process Outsourcing Order to Invoice to Cash Integrated Marketing Solutions Shopper Marketing In-store Media, promotion and Communication Mosaic Assisted Selling Training Experiential Marketing Interactive

Discussion Topics A quick look at the evolution of category analytics The need to focus on the shopper New skills and methods needed Bret Thurston • Sr. Manager Category Development – Hillshire Brands

The industry is evolving back to a local shopper focus 1980’s Future Past 2012+ Local Store Control National Strategies Shopper Based Offers Local Market Advertising One Plan for the Entire Chain Neighborhood/ Precision Marketing Limited Assortment as a Differentiator Assortment customization Private Brands as a Point of Difference Private Brands as a Margin Play Private Brands as a Point of Difference Small Neighborhood Stores Larger Super Stores Neighborhood Stores. Multi Formats Customer focus Efficiency focus “Shopper "focus - Everything Old is New Again(with a twist)

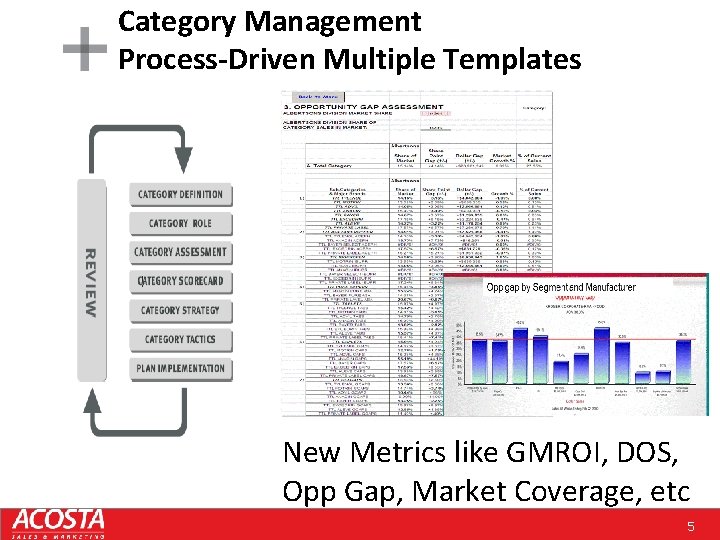

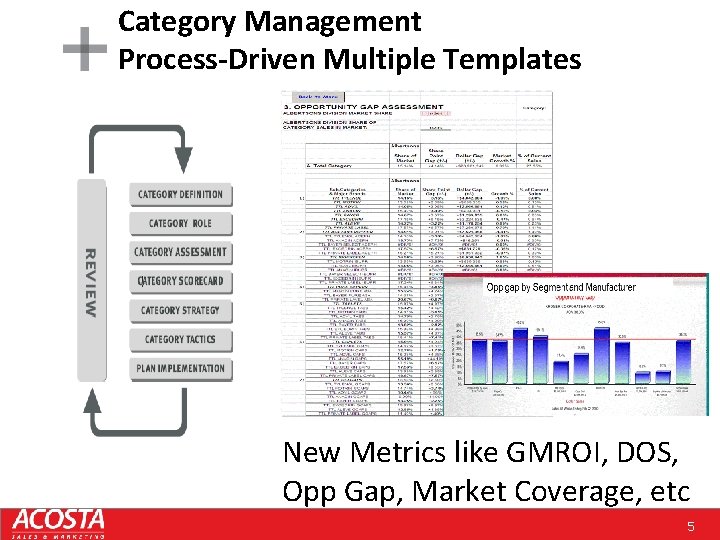

Category Management Process-Driven Multiple Templates New Metrics like GMROI, DOS, Opp Gap, Market Coverage, etc 5

Cut the store into Micro units versus looking at how Shoppers were buying across the store Refrigerated Juice Shelf Stable Juice

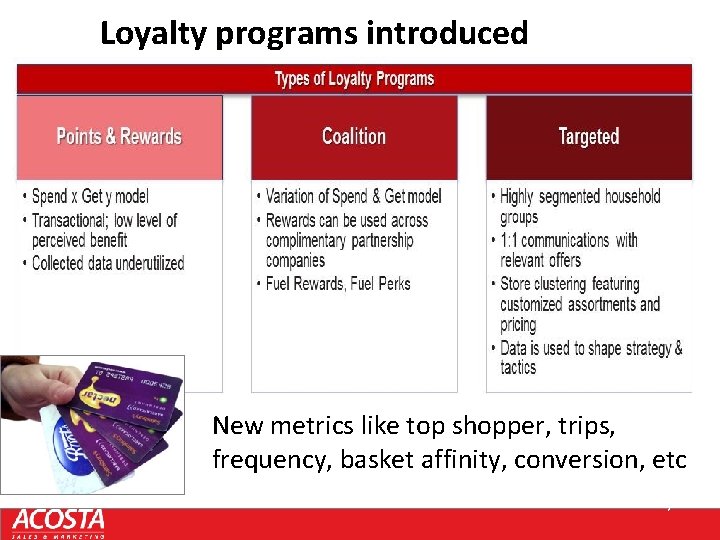

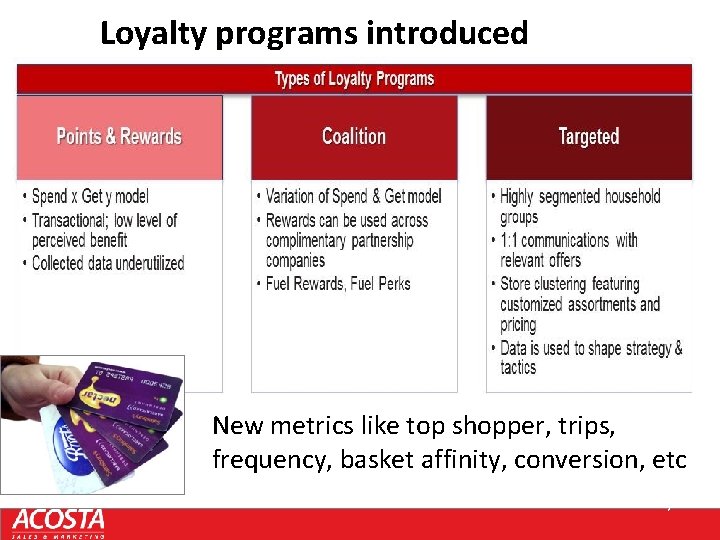

Loyalty programs introduced New metrics like top shopper, trips, frequency, basket affinity, conversion, etc 7

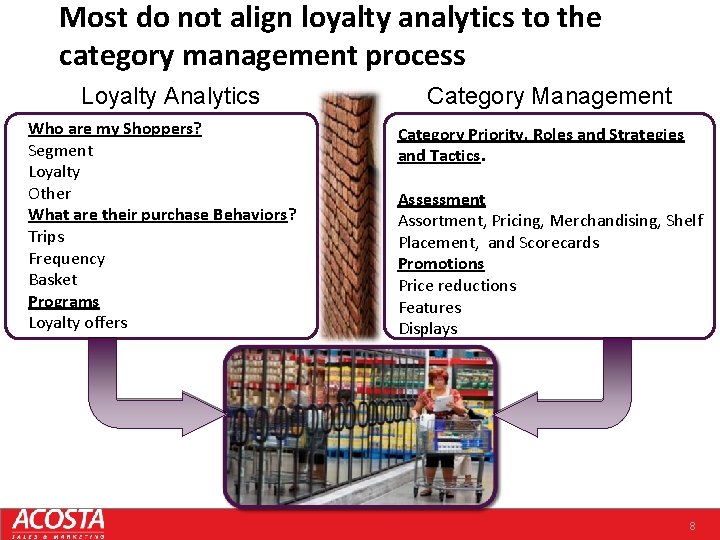

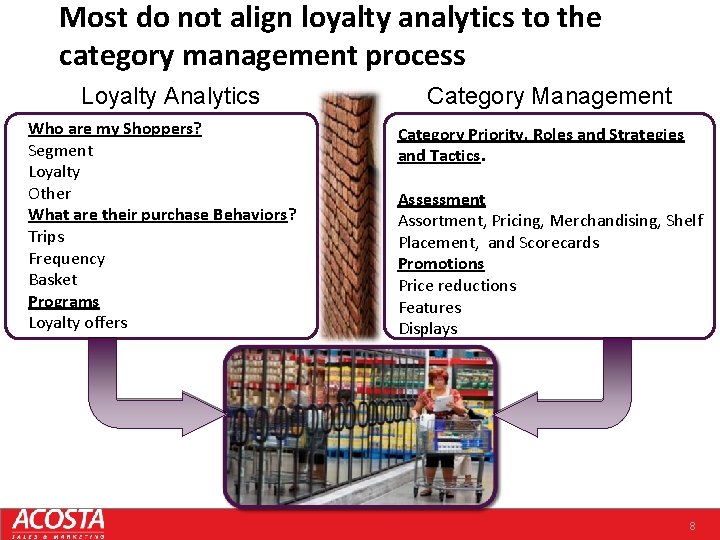

Most do not align loyalty analytics to the category management process Loyalty Analytics Who are my Shoppers? Segment Loyalty Other What are their purchase Behaviors? Trips Frequency Basket Programs Loyalty offers Category Management Category Priority, Roles and Strategies and Tactics. Assessment Assortment, Pricing, Merchandising, Shelf Placement, and Scorecards Promotions Price reductions Features Displays 8

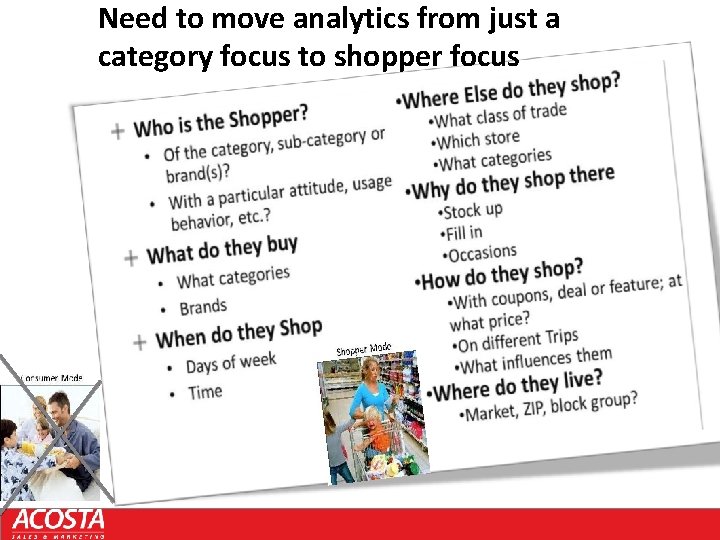

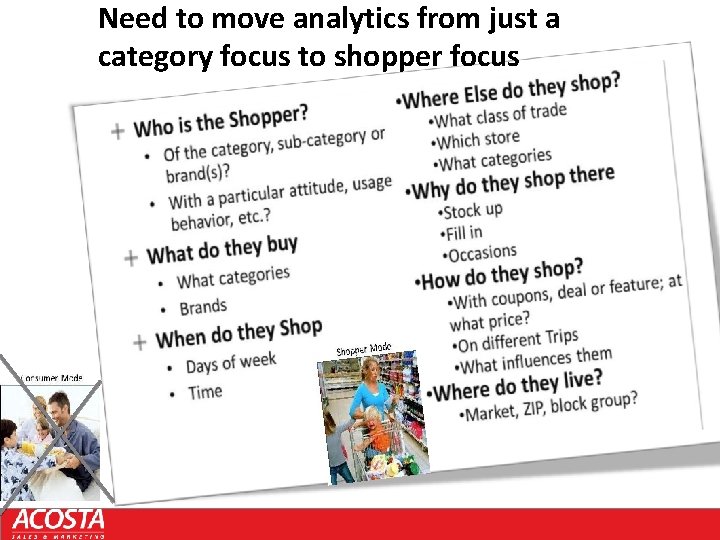

Need to move analytics from just a category focus to shopper focus

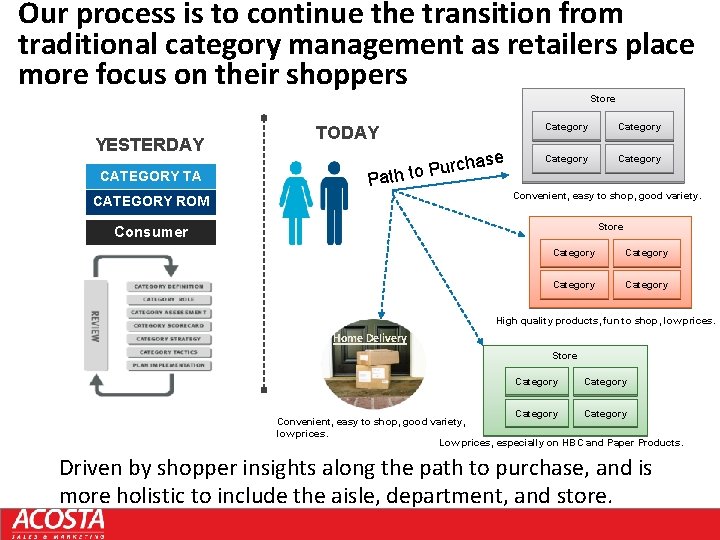

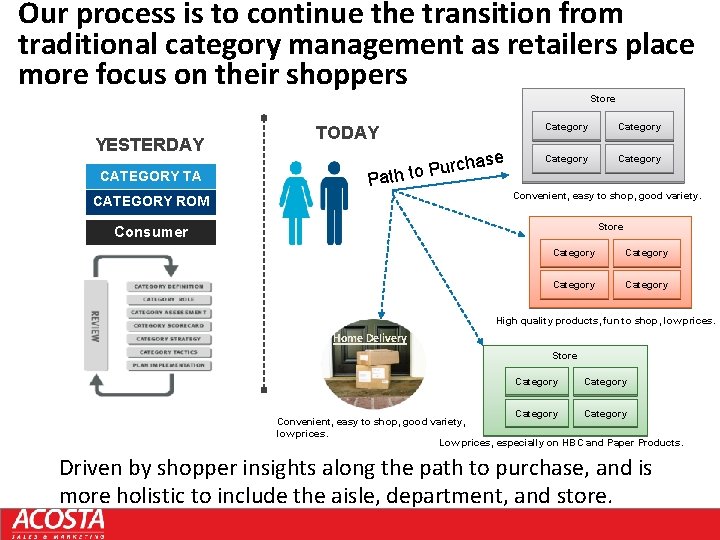

Our process is to continue the transition from traditional category management as retailers place more focus on their shoppers Store YESTERDAY CATEGORY TA TODAY rchase u P o t Path CATEGORY ROM Category Convenient, easy to shop, good variety. Store Consumer Category High quality products, fun to shop, low prices. Home Delivery Store Category Convenient, easy to shop, good variety, low prices. Low prices, especially on HBC and Paper Products. Driven by shopper insights along the path to purchase, and is more holistic to include the aisle, department, and store.

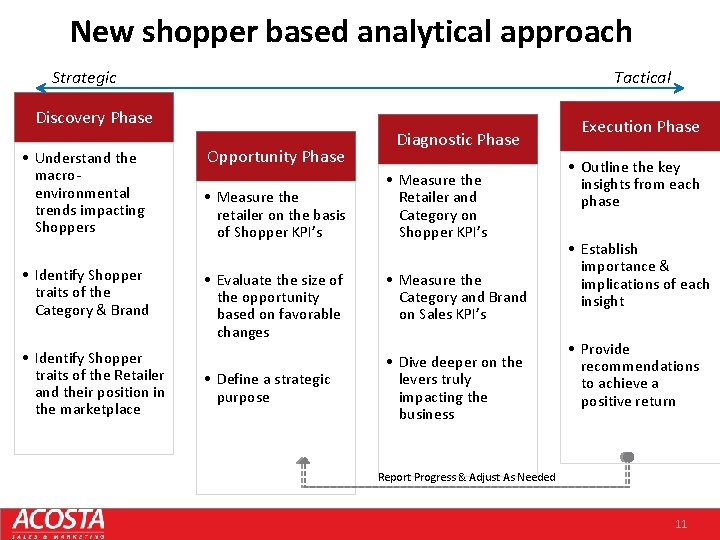

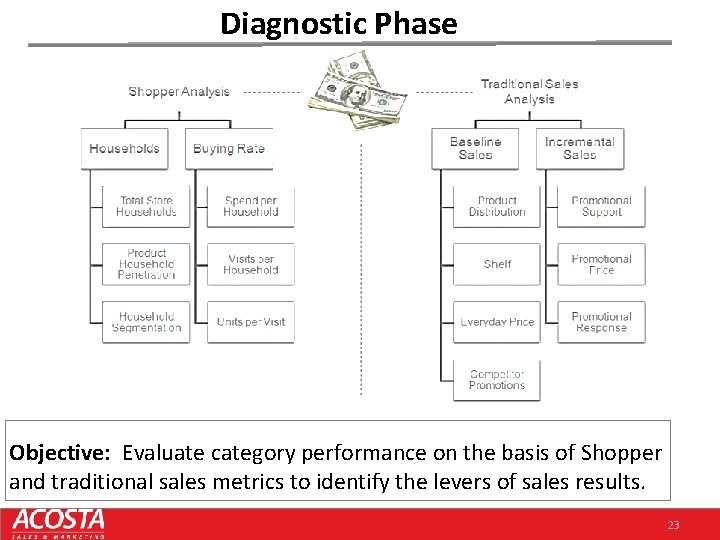

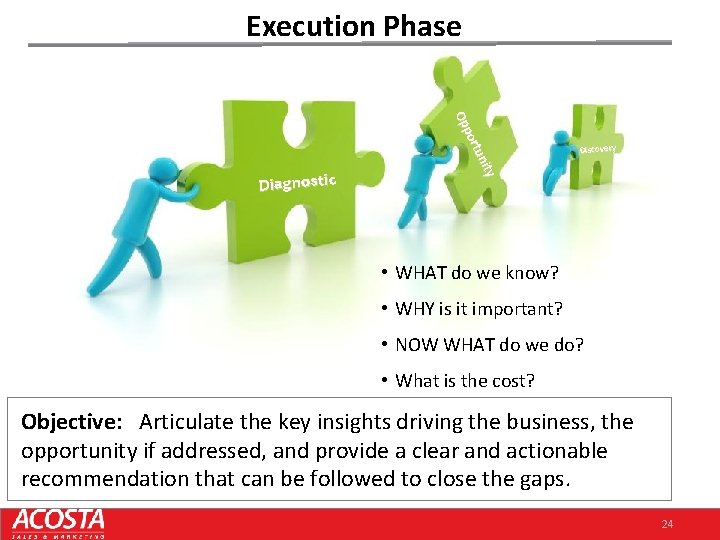

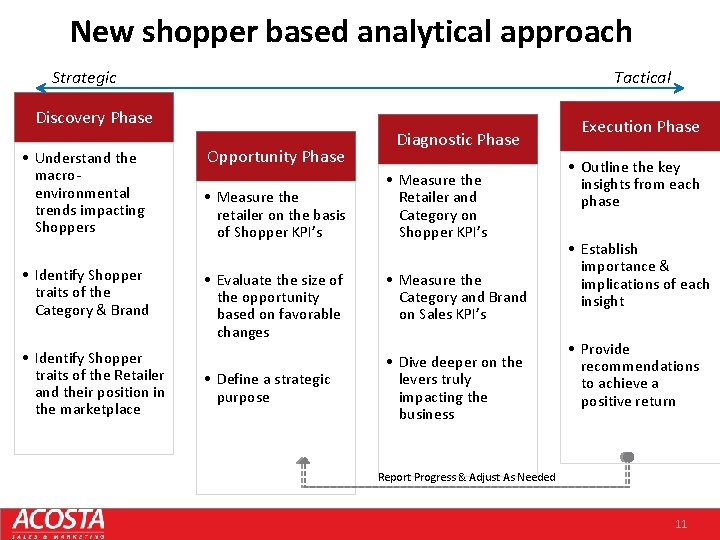

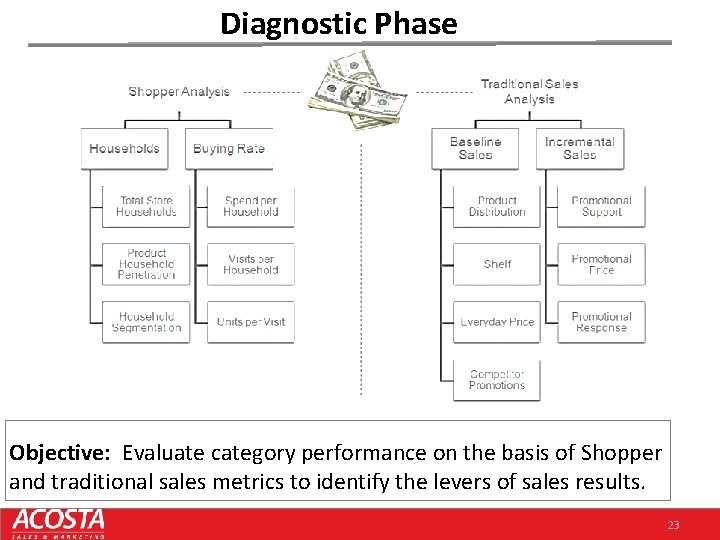

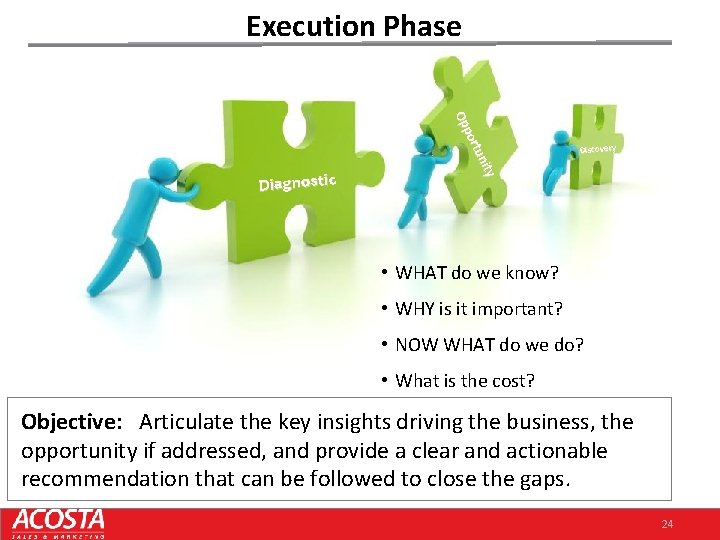

New shopper based analytical approach Strategic Tactical Discovery Phase • Understand the macroenvironmental trends impacting Shoppers • Identify Shopper traits of the Category & Brand • Identify Shopper traits of the Retailer and their position in the marketplace Opportunity Phase • Measure the retailer on the basis of Shopper KPI’s • Evaluate the size of the opportunity based on favorable changes • Define a strategic purpose Diagnostic Phase • Measure the Retailer and Category on Shopper KPI’s • Measure the Category and Brand on Sales KPI’s • Dive deeper on the levers truly impacting the business Execution Phase • Outline the key insights from each phase • Establish importance & implications of each insight • Provide recommendations to achieve a positive return Report Progress & Adjust As Needed 11

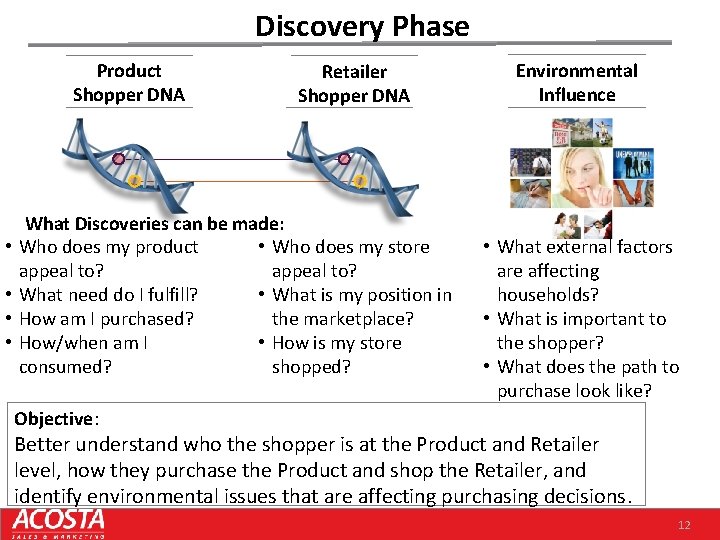

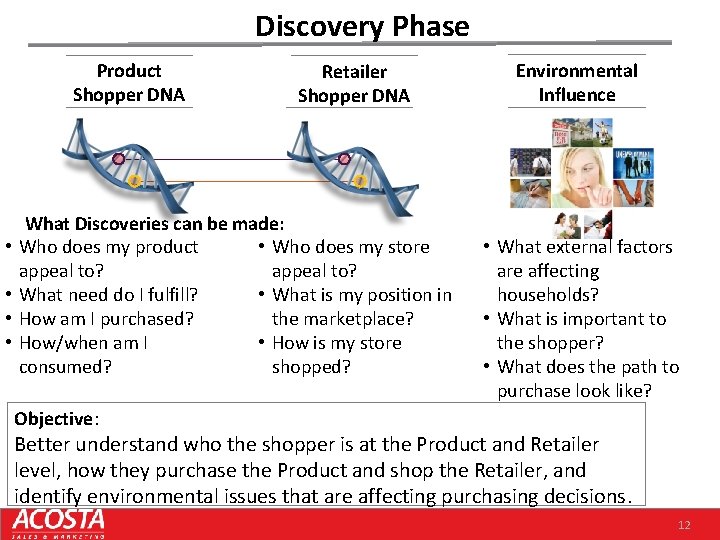

Discovery Phase Product Shopper DNA • • Retailer Shopper DNA What Discoveries can be made: Who does my product • Who does my store appeal to? What need do I fulfill? • What is my position in How am I purchased? the marketplace? How/when am I • How is my store consumed? shopped? Environmental Influence • What external factors are affecting households? • What is important to the shopper? • What does the path to purchase look like? Objective: Better understand who the shopper is at the Product and Retailer level, how they purchase the Product and shop the Retailer, and identify environmental issues that are affecting purchasing decisions. 12

Key Trends Impacting Our Industry 1. Shopper Landscape is Changing 2. Digital is Here and Growing Quickly 3. Retail Landscape is Changing 4. Marketing Spend is Shifting 5. Success is Driven by Innovative Growth Strategies 11/5/2020 Slide 13

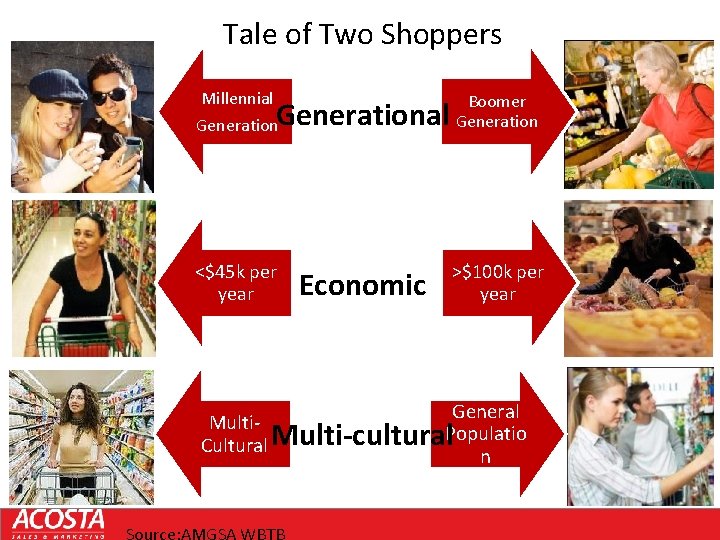

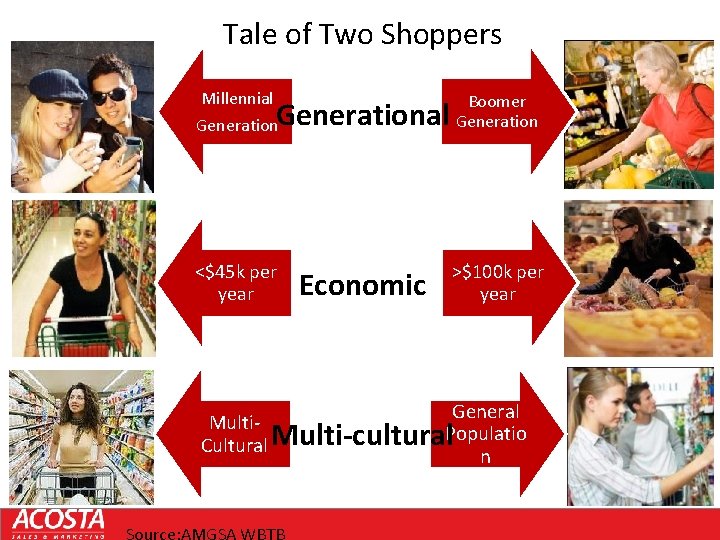

Tale of Two Shoppers Millennial Generation Boomer Generation <$45 k per year >$100 k per year Generational Economic General Multi. Populatio Cultural Multi-cultural n Source: AMGSA WBTB

ppers o h S “Older consumers tend to use the new technology to do old things. Younger consumers use the new technology Shoppers to do new things. ” -Antone Gonsalves, “Gen Y Taking Technology to New Level”

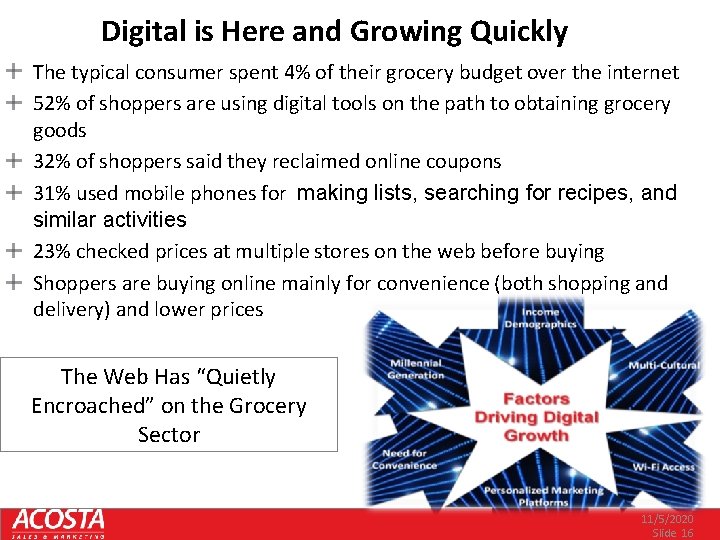

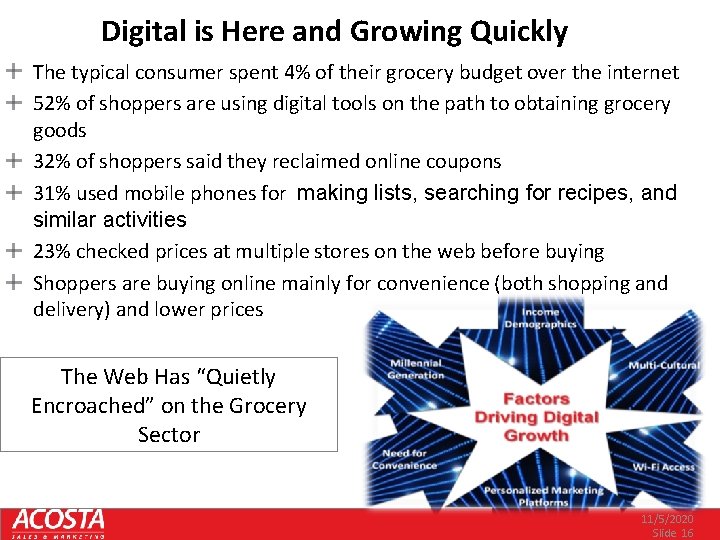

Digital is Here and Growing Quickly The typical consumer spent 4% of their grocery budget over the internet 52% of shoppers are using digital tools on the path to obtaining grocery goods 32% of shoppers said they reclaimed online coupons 31% used mobile phones for making lists, searching for recipes, and similar activities 23% checked prices at multiple stores on the web before buying Shoppers are buying online mainly for convenience (both shopping and delivery) and lower prices The Web Has “Quietly Encroached” on the Grocery Sector 11/5/2020 Slide 16

Many changes in how shoppers view the shopping landscape Dollar General (*Prototype) Grab & Go at CVS Walgreens Expands Fresh Target p. Fresh s Value Store Increased Food Offerings Online Replenishm ent Source: Kantar Retail , Nielsen s t a m r o f e l ltip u m / n a b r U

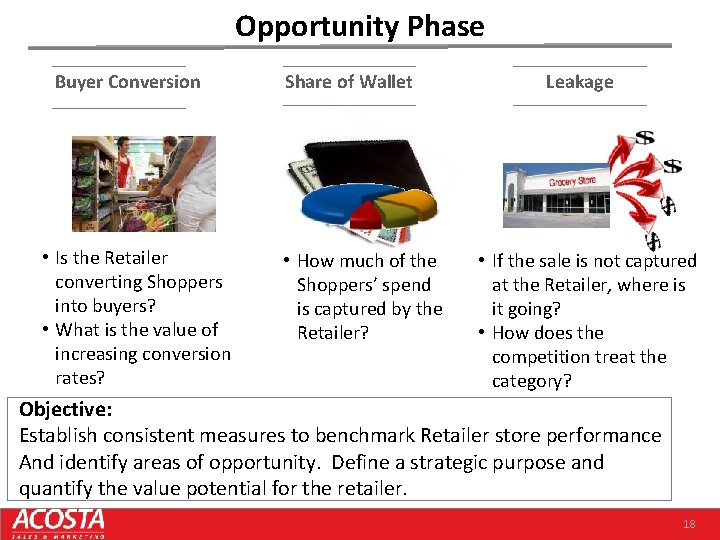

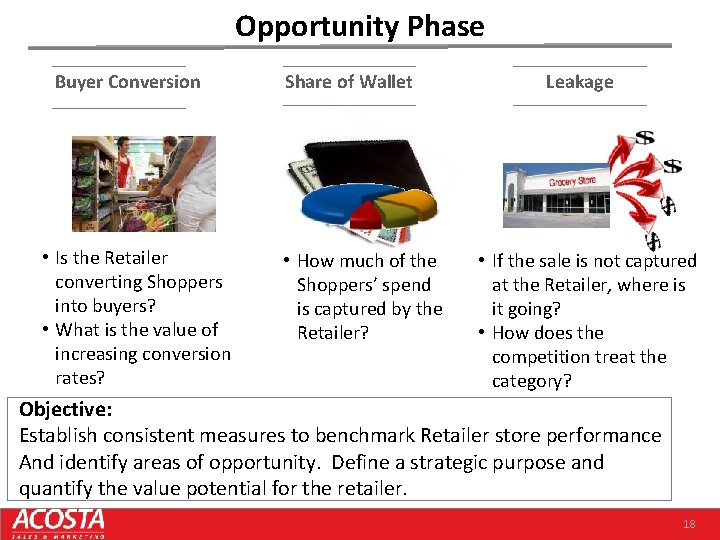

Opportunity Phase Buyer Conversion • Is the Retailer converting Shoppers into buyers? • What is the value of increasing conversion rates? Share of Wallet • How much of the Shoppers’ spend is captured by the Retailer? Leakage • If the sale is not captured at the Retailer, where is it going? • How does the competition treat the category? Objective: Establish consistent measures to benchmark Retailer store performance And identify areas of opportunity. Define a strategic purpose and quantify the value potential for the retailer. 18

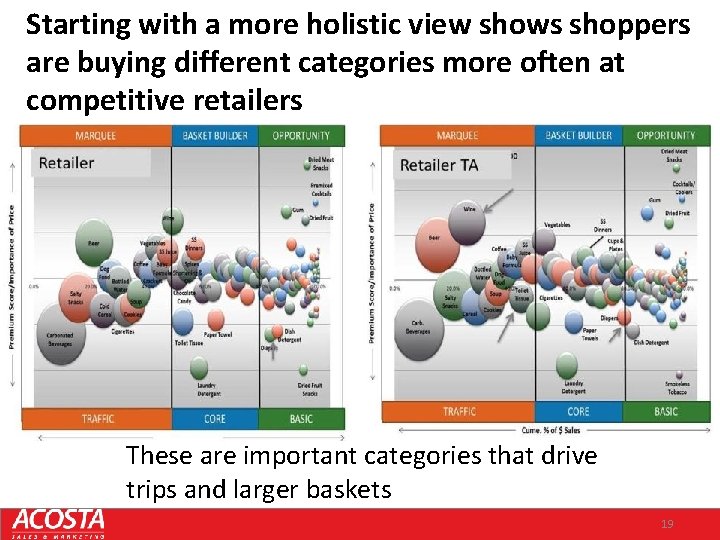

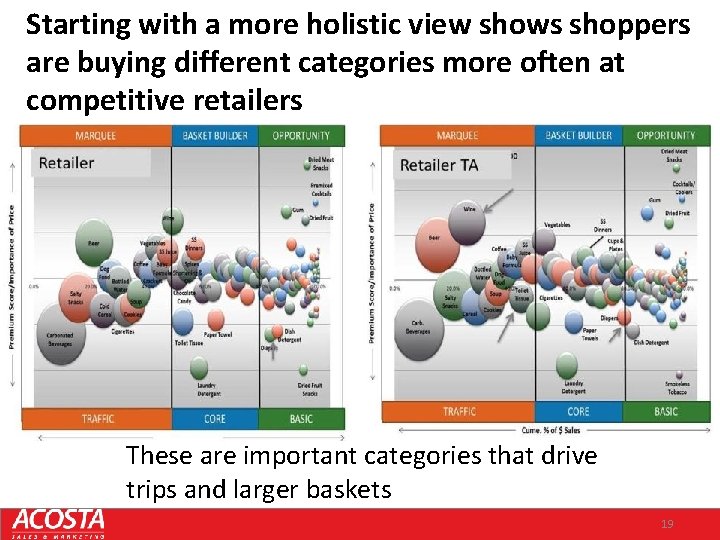

Starting with a more holistic view shows shoppers are buying different categories more often at competitive retailers These are important categories that drive trips and larger baskets 19

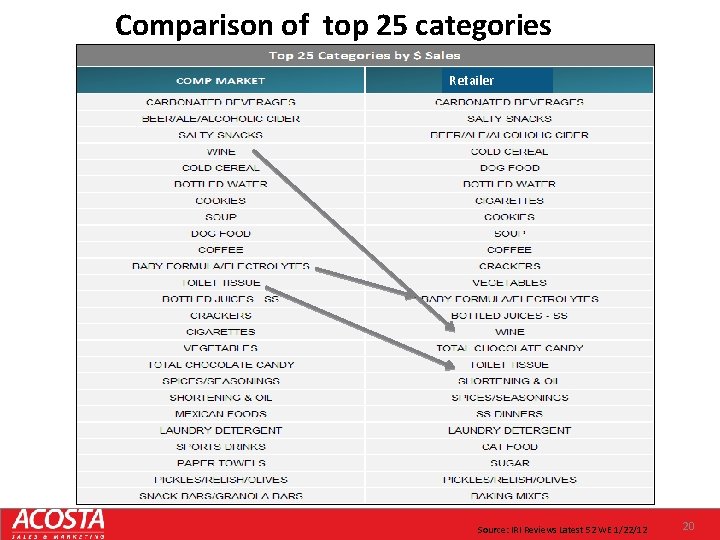

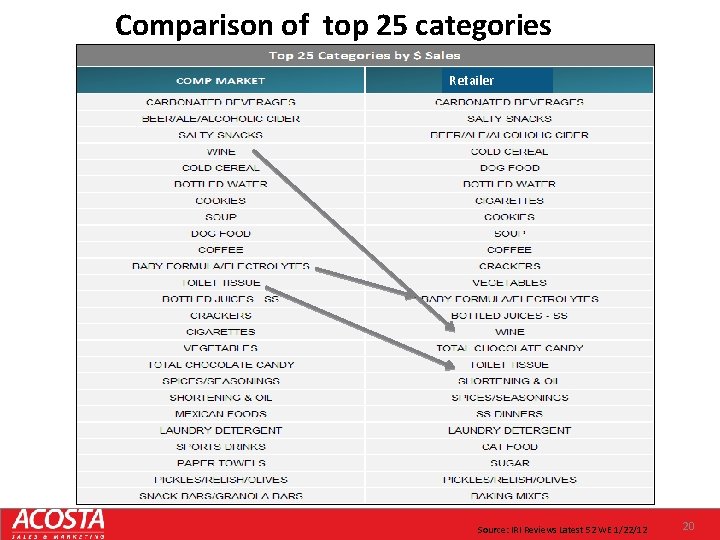

Comparison of top 25 categories Retailer Source: IRI Reviews Latest 52 WE 1/22/12 20

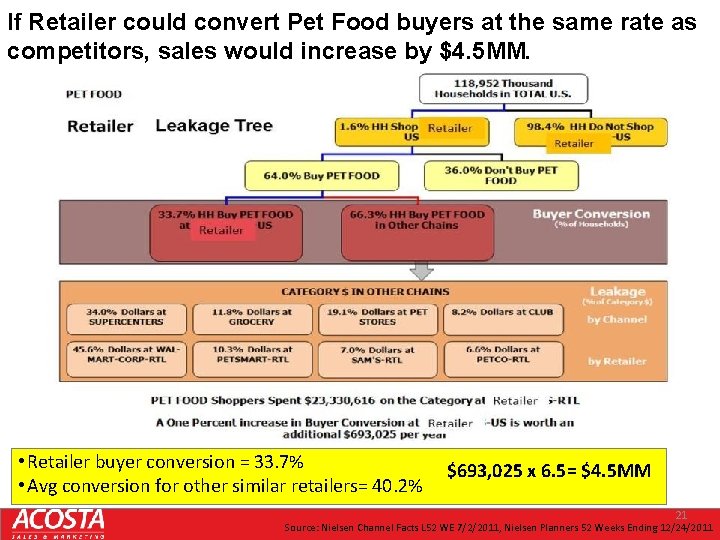

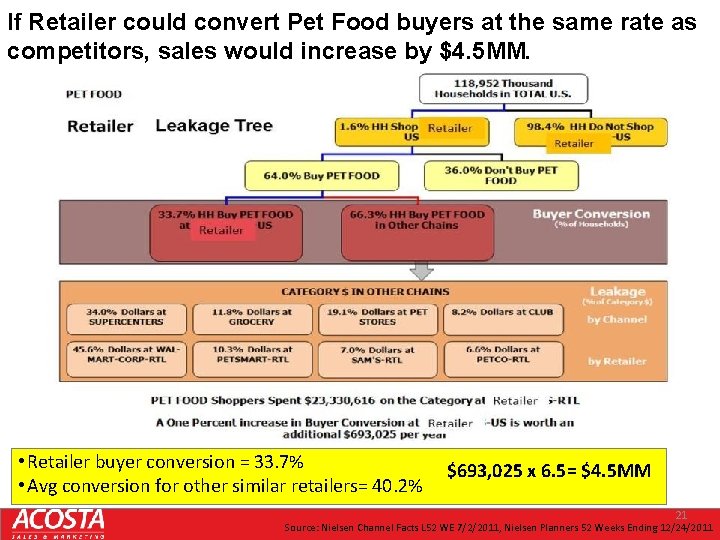

If Retailer could convert Pet Food buyers at the same rate as competitors, sales would increase by $4. 5 MM. • Retailer buyer conversion = 33. 7% • Avg conversion for other similar retailers= 40. 2% $693, 025 x 6. 5= $4. 5 MM 21 Source: Nielsen Channel Facts L 52 WE 7/2/2011, Nielsen Planners 52 Weeks Ending 12/24/2011

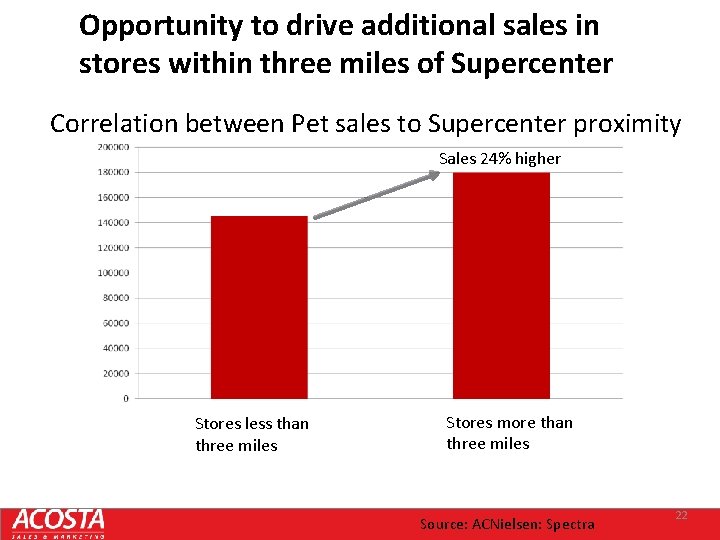

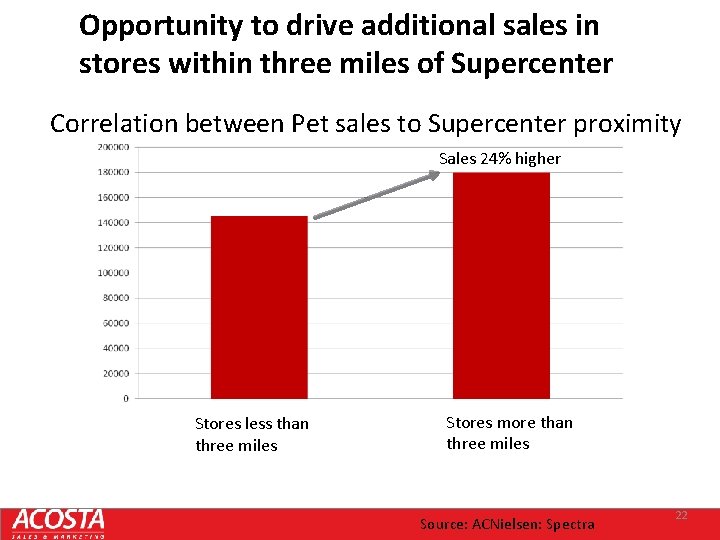

Opportunity to drive additional sales in stores within three miles of Supercenter Correlation between Pet sales to Supercenter proximity Sales 24% higher Stores less than three miles Stores more than three miles Source: ACNielsen: Spectra 22

Diagnostic Phase Objective: Evaluate category performance on the basis of Shopper and traditional sales metrics to identify the levers of sales results. 23

Execution Phase ity tun por Op Diagnostic Discovery • WHAT do we know? • WHY is it important? • NOW WHAT do we do? • What is the cost? Objective: Articulate the key insights driving the business, the opportunity if addressed, and provide a clear and actionable recommendation that can be followed to close the gaps. 24

Bret Thurston Category Leadership

Hillshire Brands Customer Development Focus Shopper Insights Category Leadership o Shopper Integration o Shopper Informed into Category o Pricing and Leadership Platform Promotion Expertise o Promotional Shopper Insights o KPI’s Against Shopper and Category Shopper Marketing Capability o Shopper ROI’s via o Change Management Shopper Marketing o Improved Development Communication o Link Insights to o Specific KPI Solutions improvement

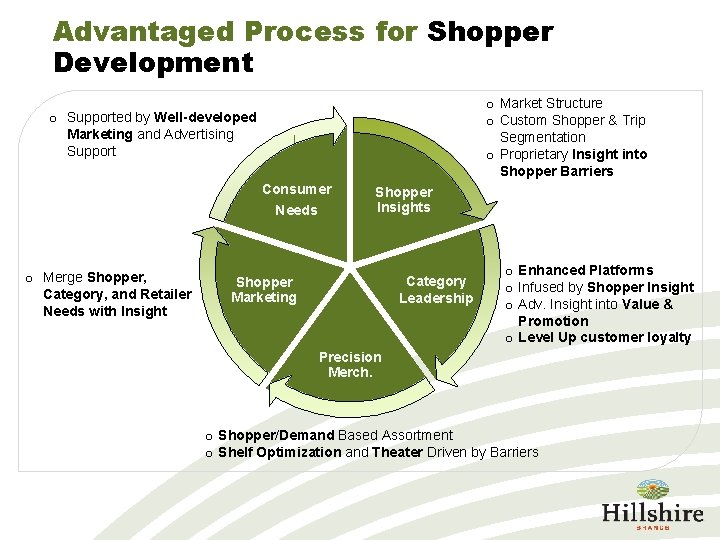

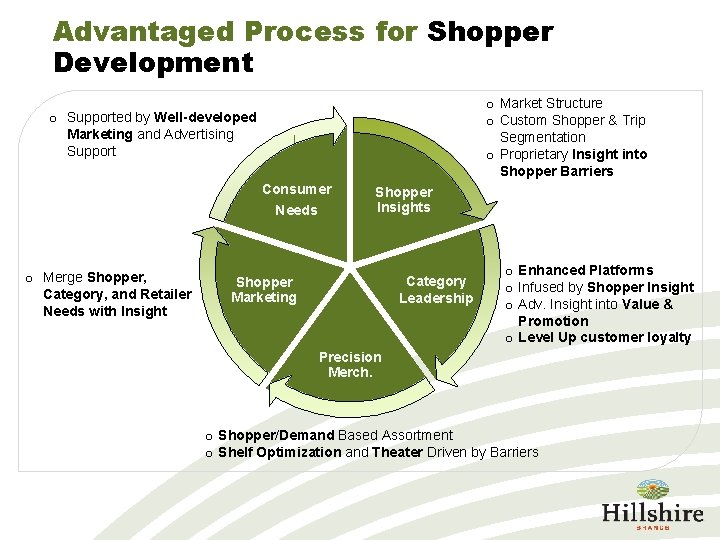

Advantaged Process for Shopper Development o Market Structure o Custom Shopper & Trip Segmentation o Proprietary Insight into Shopper Barriers o Supported by Well-developed Marketing and Advertising Support Consumer Needs o Merge Shopper, Category, and Retailer Needs with Insight Shopper Insights Category Leadership Shopper Marketing o Enhanced Platforms o Infused by Shopper Insight o Adv. Insight into Value & Promotion o Level Up customer loyalty Precision Merch. o Shopper/Demand Based Assortment o Shelf Optimization and Theater Driven by Barriers

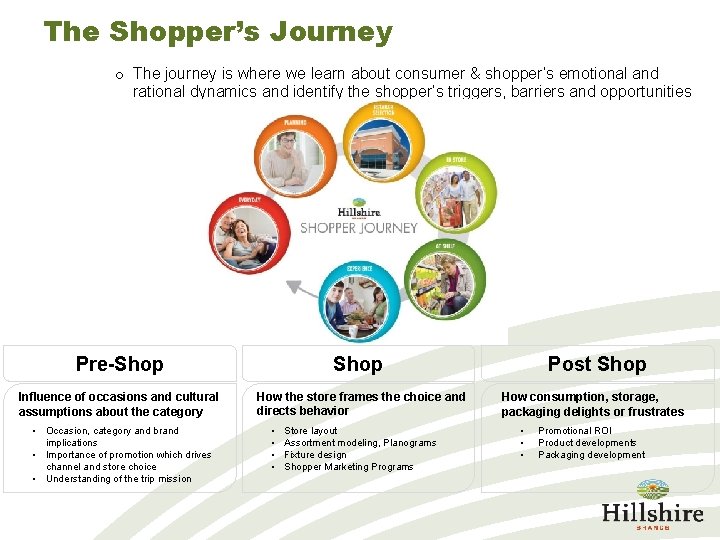

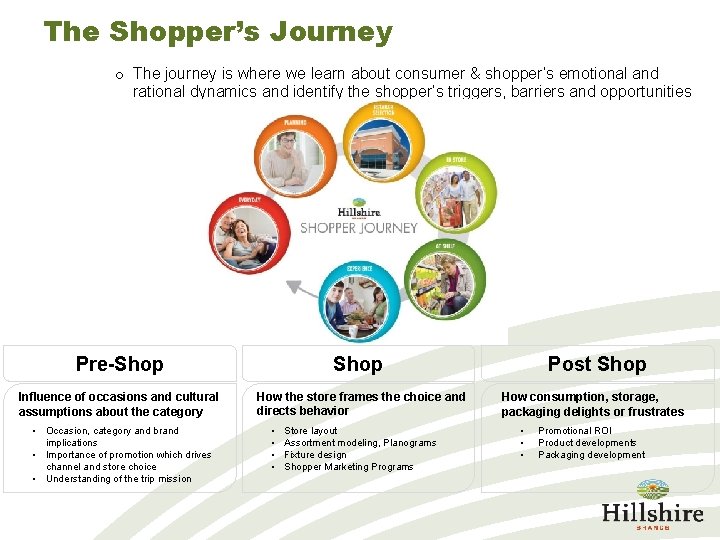

The Shopper’s Journey o The journey is where we learn about consumer & shopper’s emotional and rational dynamics and identify the shopper’s triggers, barriers and opportunities Pre-Shop Influence of occasions and cultural assumptions about the category How the store frames the choice and directs behavior • Occasion, category and brand implications • Importance of promotion which drives channel and store choice • Understanding of the trip mission • • Store layout Assortment modeling, Planograms Fixture design Shopper Marketing Programs Post Shop How consumption, storage, packaging delights or frustrates • • • Promotional ROI Product developments Packaging development

Hillshire Brands’ Commitment to Shopper Focused Category Leadership - Shopper Capabilities enable our strategies - Customer Focused engagement strategies enable our partnerships - Shopper Focused activation enables our success

Hillshire Brands Category Leadership Guiding Principles Strong Category Leadership platforms informed with shopper/category/customer insights Clear understanding of and alignment to the customers’ category planning cycles, operational requirements, and category goals Investment in customer-facing category teams charged with driving retail partnerships and customizing our category leadership platforms to create unique activation plans for customers Disciplined approach to measuring results in order to ensure success

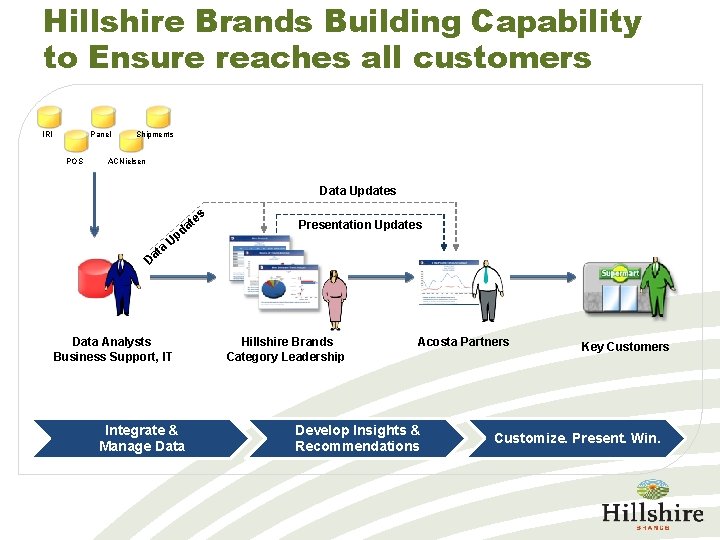

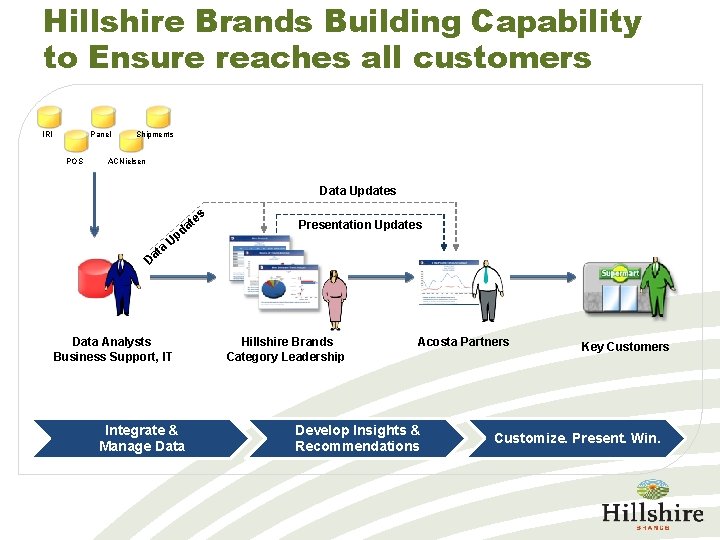

Hillshire Brands Building Capability to Ensure reaches all customers IRI Panel POS Shipments ACNielsen Data Updates es a t Da Up t da Data Analysts Business Support, IT Integrate & Manage Data Presentation Updates Hillshire Brands Category Leadership Acosta Partners Develop Insights & Recommendations Key Customers Customize. Present. Win.

Enable customization and ensure ROI - Align with the customer to a level we are able to support well - Fully engage in the areas where it makes sense to invest - Ensure that we have a point of view on each of the customer’s strategies and tactics - Become experts in areas that drive our business model forward with our customers

Closing thoughts

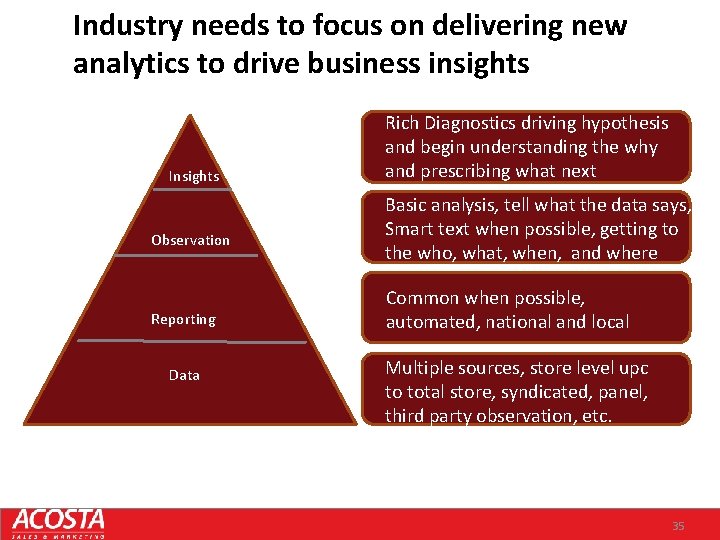

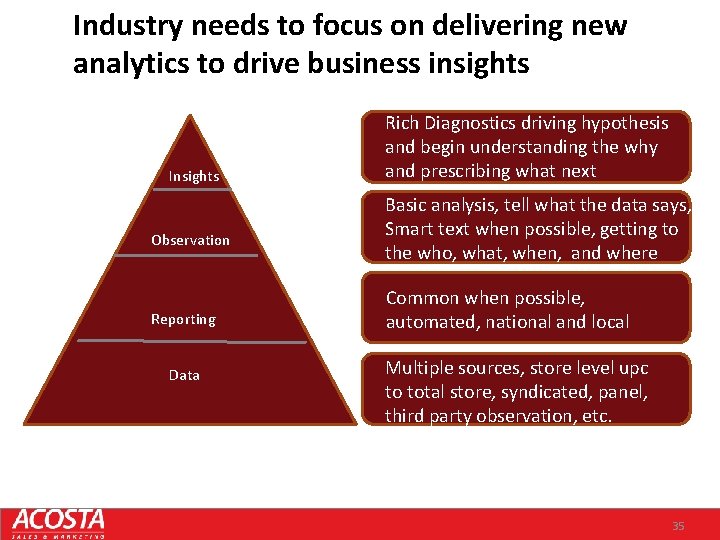

Industry needs to focus on delivering new analytics to drive business insights Insights Observation Reporting Data Rich Diagnostics driving hypothesis and begin understanding the why and prescribing what next Basic analysis, tell what the data says, Smart text when possible, getting to the who, what, when, and where Common when possible, automated, national and local Multiple sources, store level upc to total store, syndicated, panel, third party observation, etc. 35

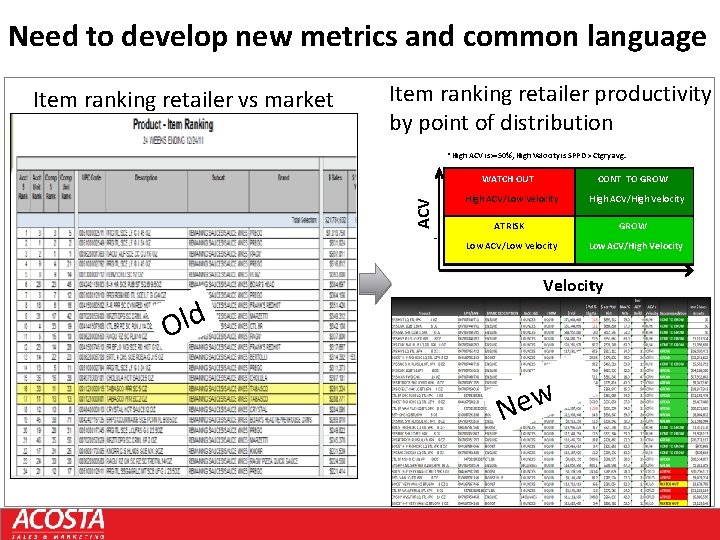

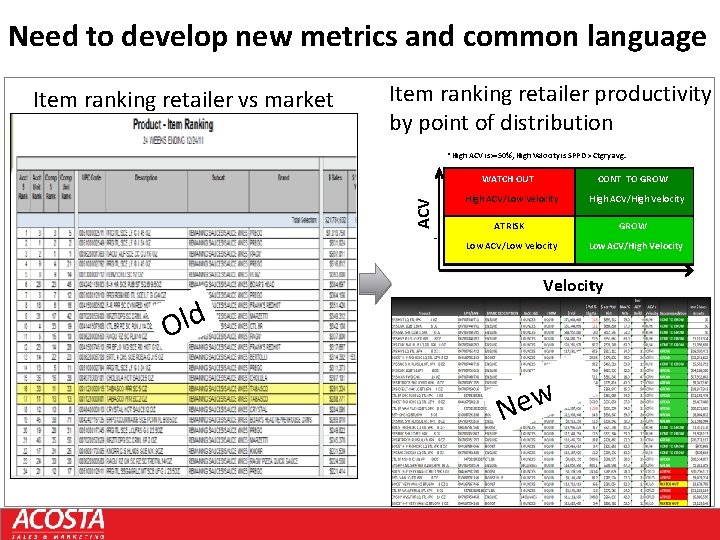

Need to develop new metrics and common language Item ranking retailer vs market Item ranking retailer productivity by point of distribution * High ACV is>=50%, High Velocity is SPPD > Ctgry avg. WATCH OUT CONT TO GROW ACV High ACV/Low Velocity High ACV/High Velocity AT RISK GROW Low ACV/Low Velocity Low. ACV/High Velocity ACV Old Velocity w e N

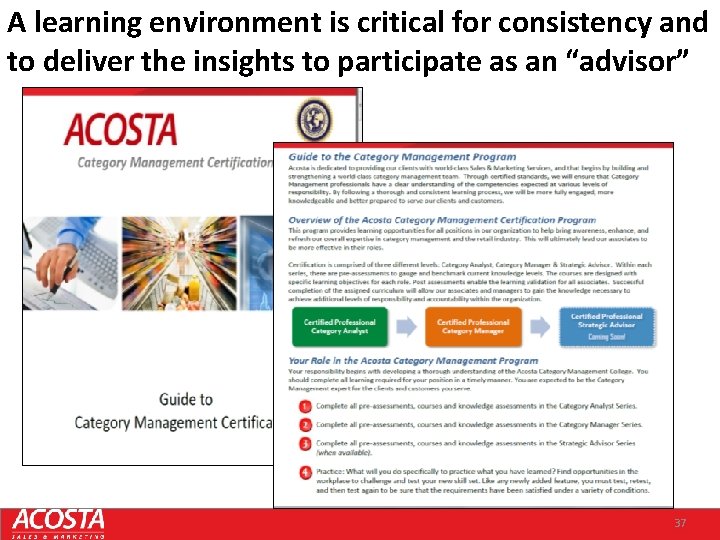

A learning environment is critical for consistency and to deliver the insights to participate as an “advisor” 37