The Eesti Pank Expreience in the ERMII Mrten

- Slides: 12

The Eesti Pank Expreience in the ERM-II Märten Ross Eesti Pank October 3 rd, 2005, Sofia

Background • Fixed exchange rate arrangement for ‘who knows how many years’ – Public expectations, transmission mechanism – Inflation well-checked – Perception of ‘already a currency union’ • ERM-II entry close to EU entry: any economic imlplications interconnected • Some global factors more important than ERM-II decision

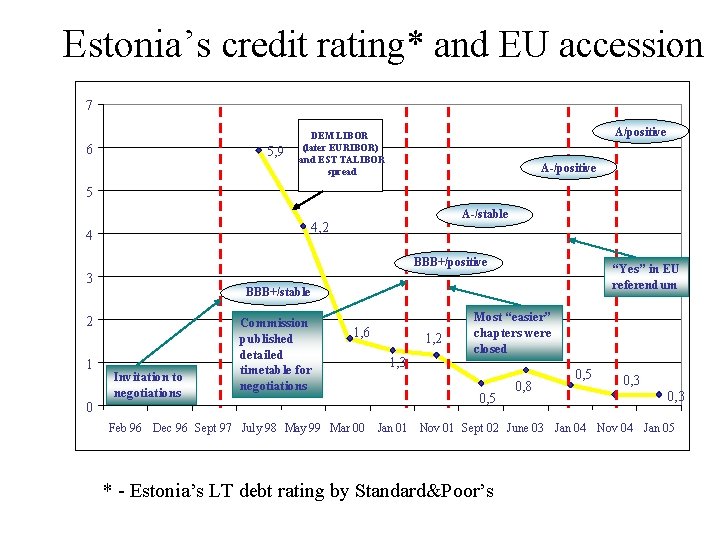

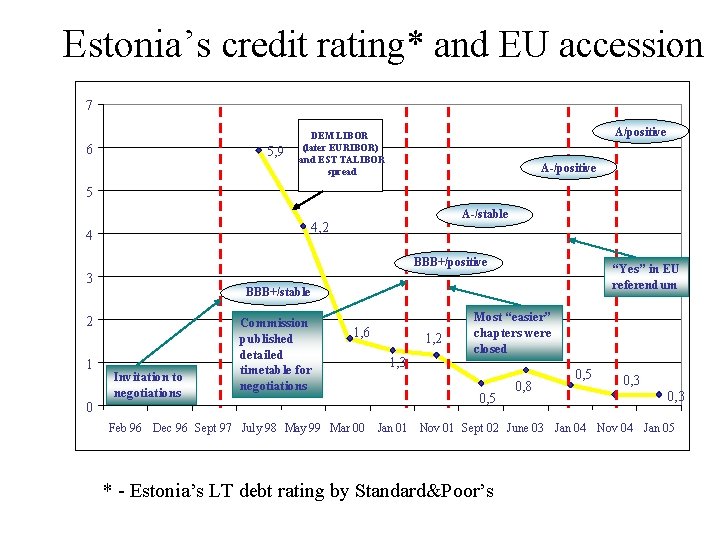

Estonia’s credit rating* and EU accession 7 12 6 5, 9 10 A/positive DEM LIBOR (later EURIBOR) and EST TALIBOR spread A-/positive 5 8 A-/stable 4, 2 4 6 BBB+/positive “Yes” in EU referendum 3 4 2 2 1 0 Invitation to negotiations BBB+/stable Commission published detailed timetable for negotiations 1, 6 Feb 96 Dec 96 Sept 97 July 98 May 99 Mar 00 1, 2 1, 3 Most “easier” chapters were closed 0, 5 0, 8 0, 5 0, 3 Jan 01 Nov 01 Sept 02 June 03 Jan 04 Nov 04 Jan 05 * - Estonia’s LT debt rating by Standard&Poor’s

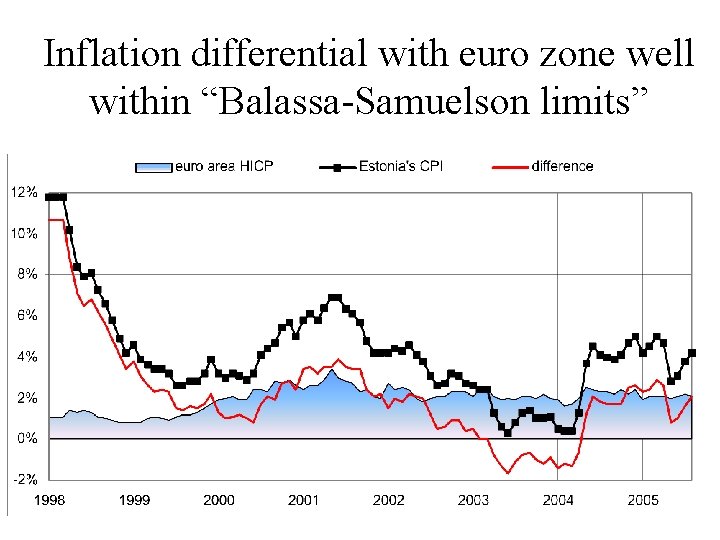

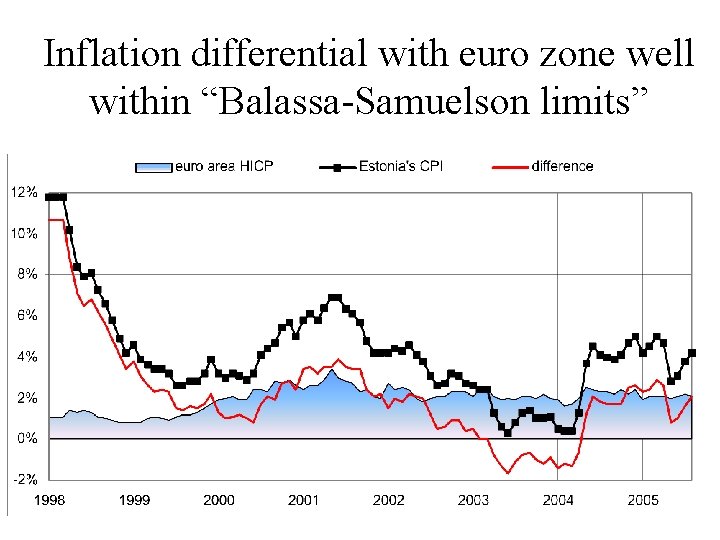

Inflation differential with euro zone well within “Balassa-Samuelson limits”

About the entry • Pre-entry discussions very serious (‘good peer pressure’, but little knowledge of currency board) • Some dispute about its rationale • Complications in communication – How to communicate XR policy without XR? – is it a waiting room? • Entry itself was non-event for public – Estonian press reps in Brussels even did notice it! And rightly so.

About the life within the ERM II • So far no pressures whatsoever • Has not done at least any harm: PR of XR policies has become even easier • More squeezing from partners (‘good peer pressure – now for double’) • Minor additional technical responsibilities • Participation often taken de facto as a ‘waiting room’

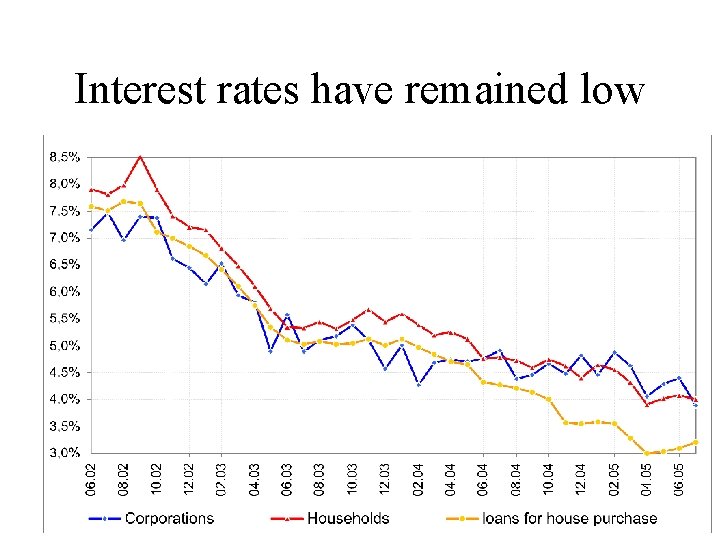

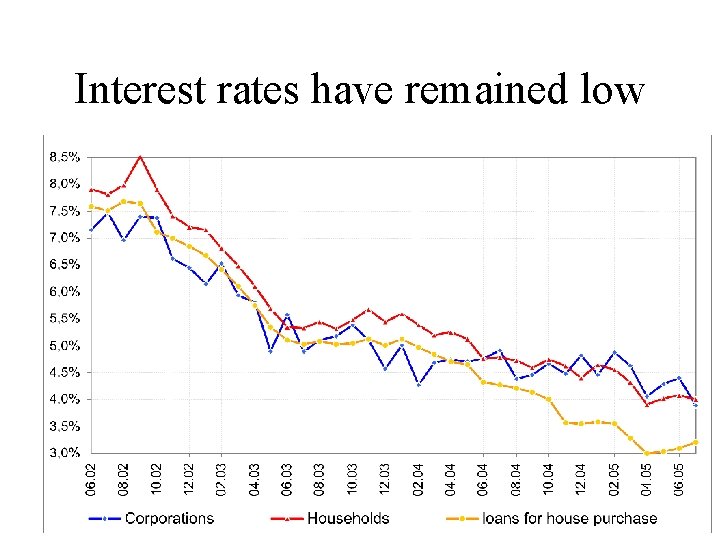

Interest rates have remained low

About the economic implications • EU (ERM-II? ) has been even bigger boost for growth, investment and productivity than expected • EU entry had technical implications for inflation – reasons difficult to communicate! • ERM II per se has not probably caused major capital flows • If ERM II entry is credibility enhancing and connected to euro entry expectations, then it adds to the demand pressure – it’s unavoidable and not necessarily bad

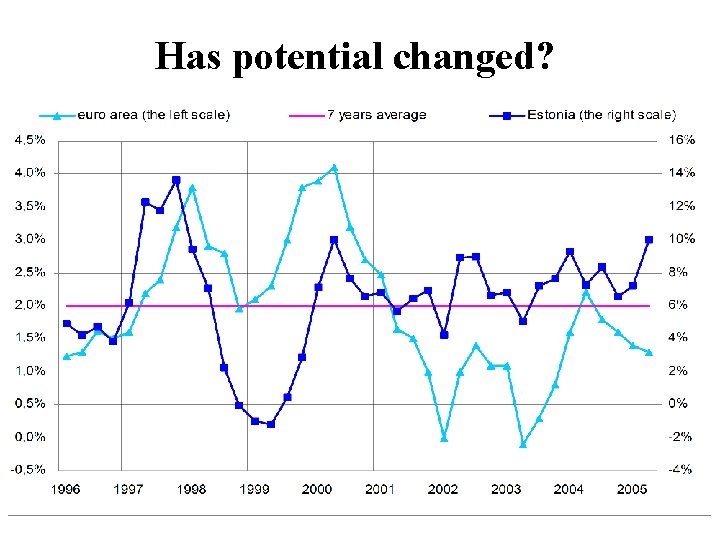

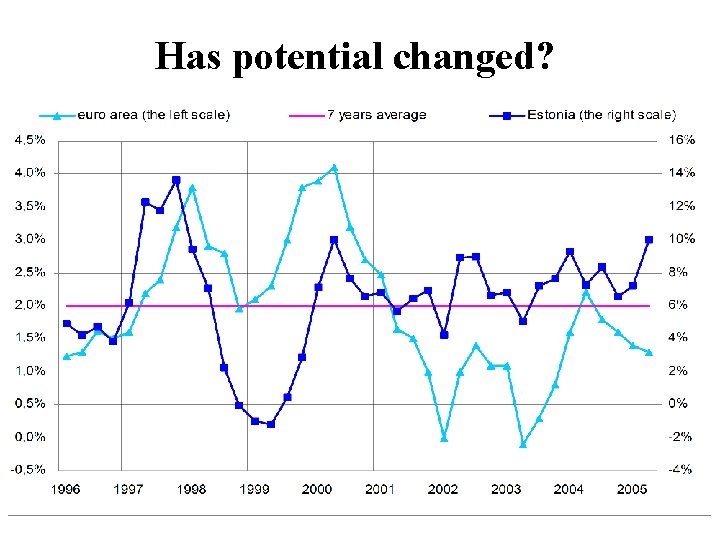

Has potential changed?

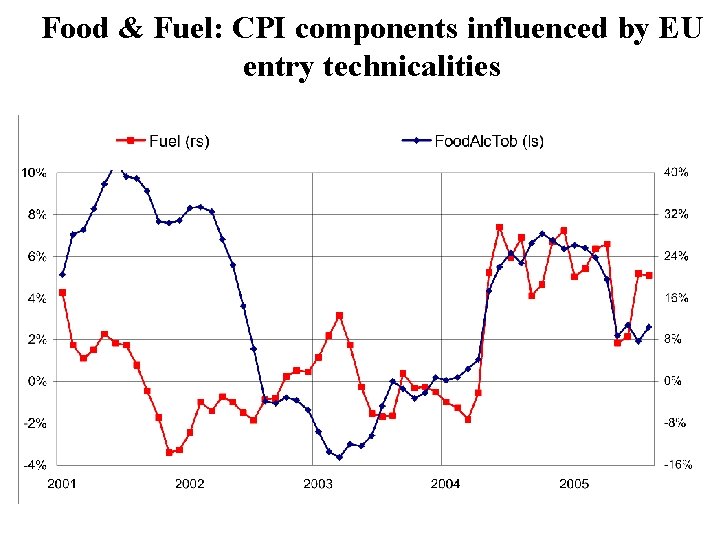

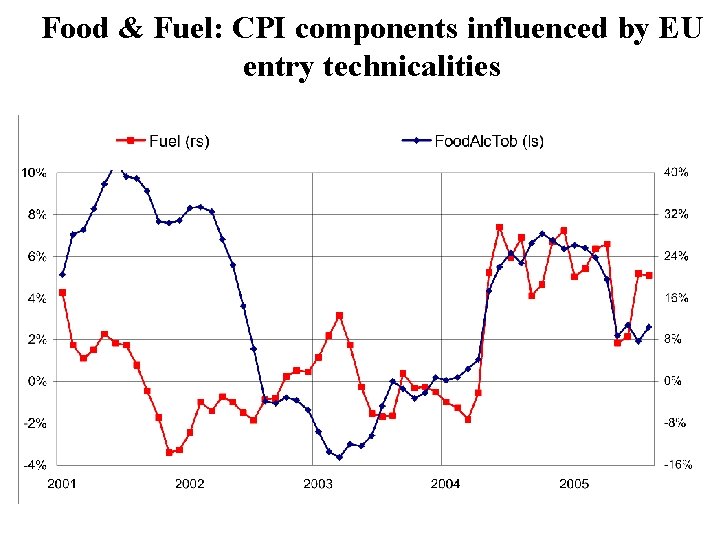

Food & Fuel: CPI components influenced by EU entry technicalities

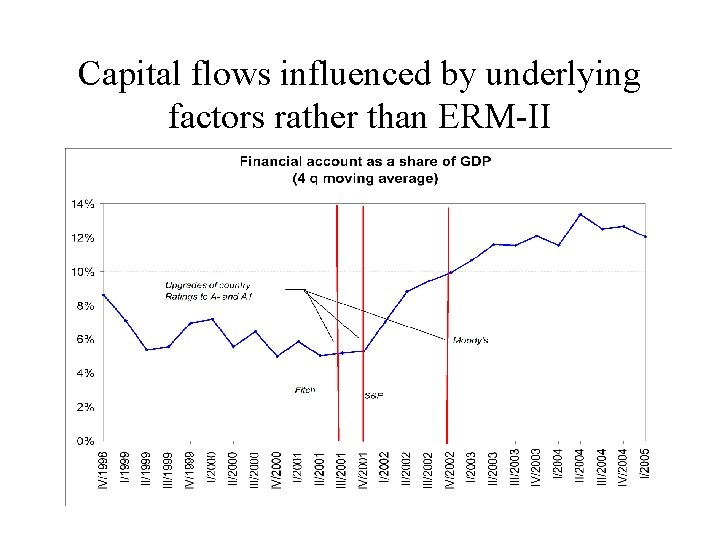

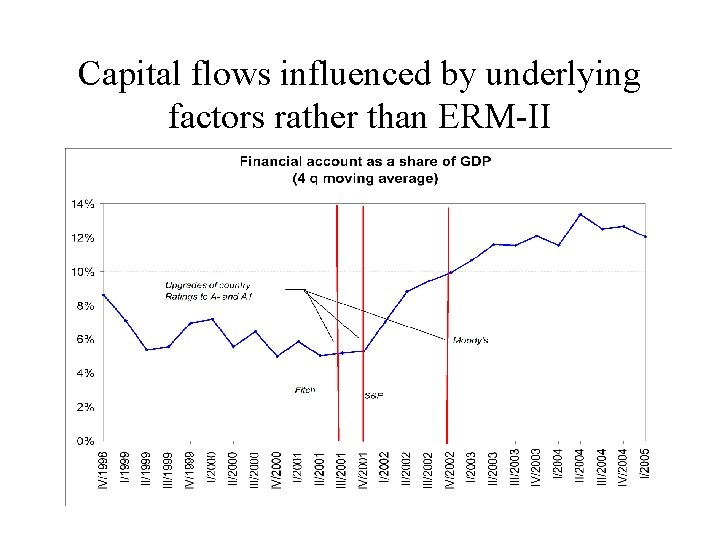

Capital flows influenced by underlying factors rather than ERM-II

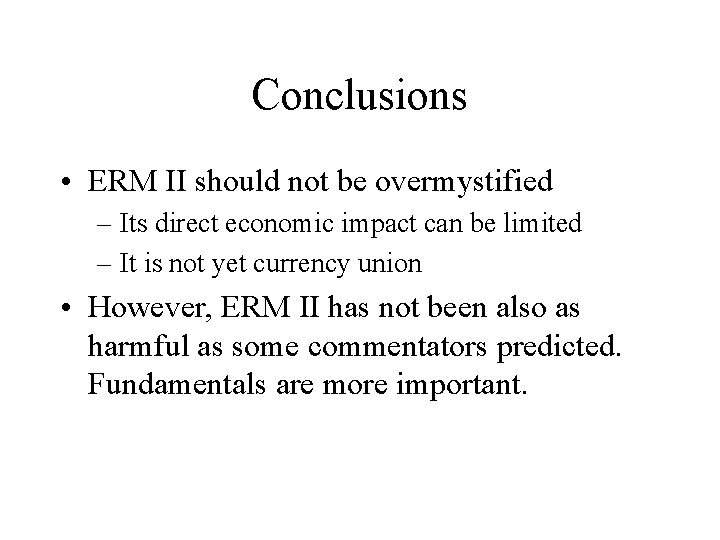

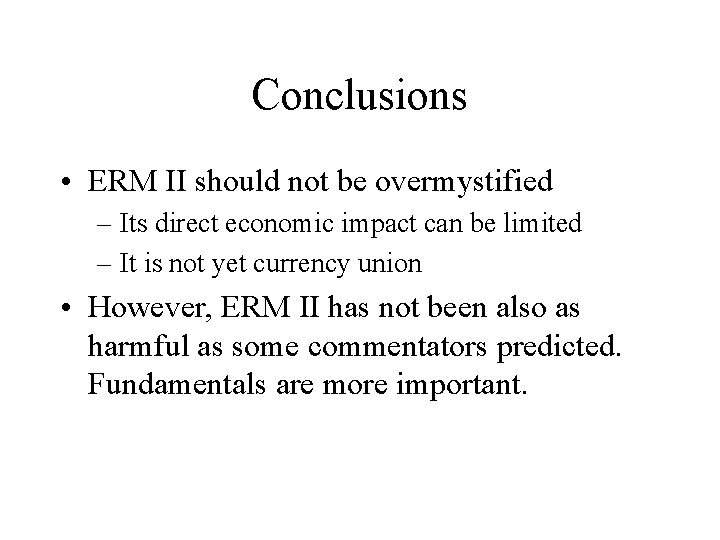

Conclusions • ERM II should not be overmystified – Its direct economic impact can be limited – It is not yet currency union • However, ERM II has not been also as harmful as some commentators predicted. Fundamentals are more important.