The Actuarys Evolving Role in Enterprise Risk Management

- Slides: 20

The Actuary’s Evolving Role in Enterprise Risk Management A Case Study 2001 Casualty Loss Reserve Seminar Barry A. Franklin, FCAS, MAAA Managing Director Aon Risk Consultants

“Risk” per the CAS Statement of Principles on Property & Casualty Ratemaking • Random variation from expected cost. – Reflected in cost of capital assumption. – Influences the underwriting profit provision. • Systematic variation of estimated costs from expected costs. – Reflected in the contingency provision.

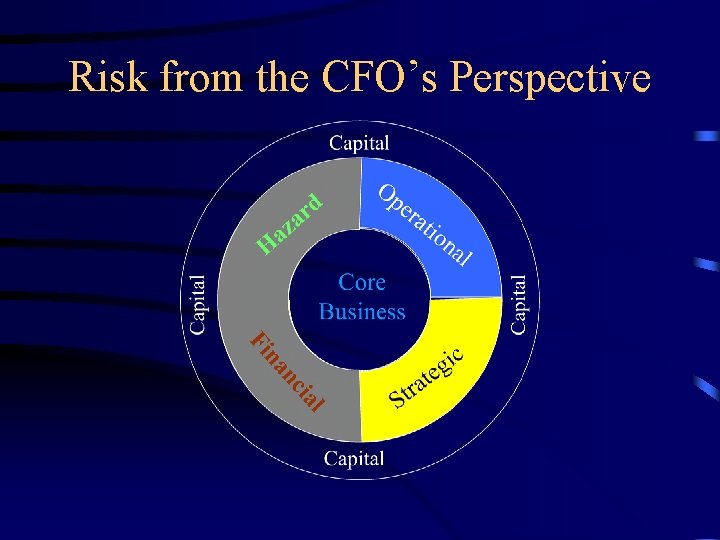

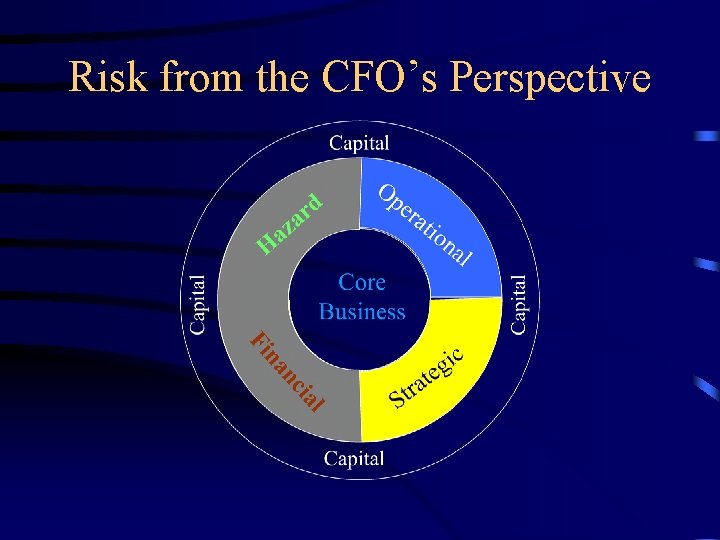

Risk from the CFO’s Perspective

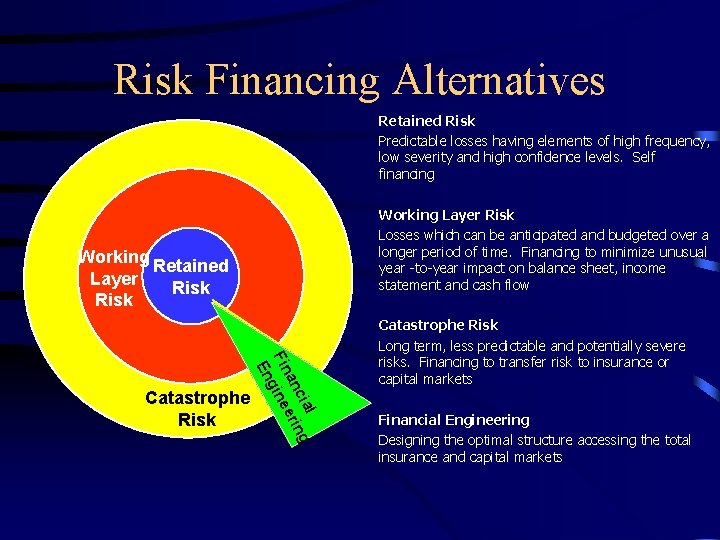

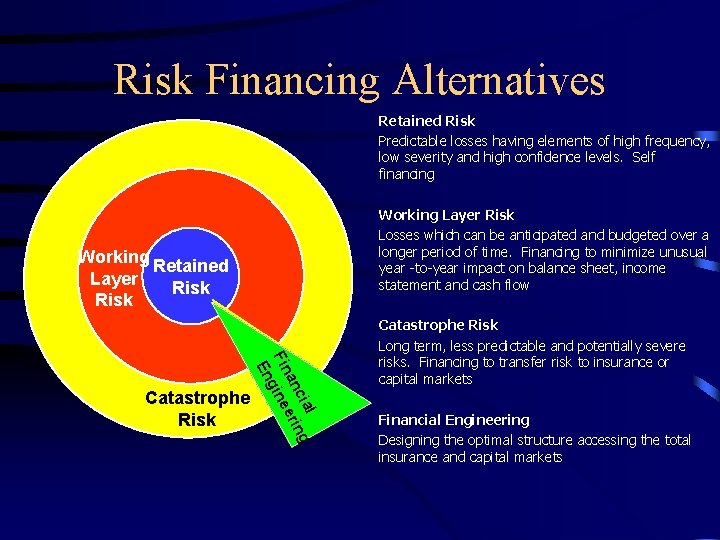

Risk Financing Alternatives Retained Risk Predictable losses having elements of high frequency, low severity and high confidence levels. Self financing Working Layer Risk Losses which can be anticipated and budgeted over a longer period of time. Financing to minimize unusual year -to-year impact on balance sheet, income statement and cash flow Working Retained Layer Risk l g cia an erin Fin gine En Catastrophe Risk Long term, less predictable and potentially severe risks. Financing to transfer risk to insurance or capital markets Financial Engineering Designing the optimal structure accessing the total insurance and capital markets

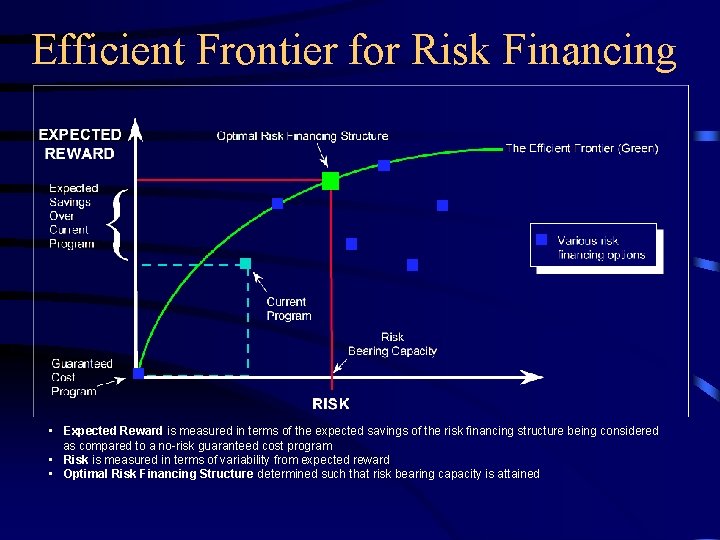

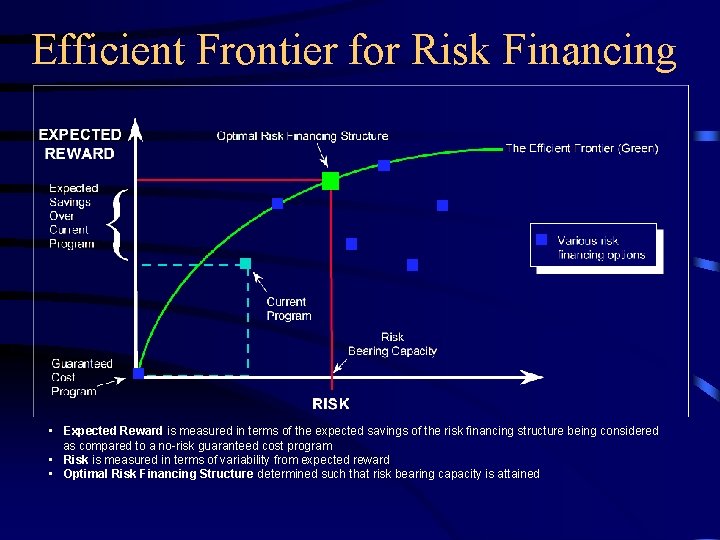

Efficient Frontier for Risk Financing • Expected Reward is measured in terms of the expected savings of the risk financing structure being considered as compared to a no-risk guaranteed cost program • Risk is measured in terms of variability from expected reward • Optimal Risk Financing Structure determined such that risk bearing capacity is attained

Case Study - ABC Corporation • Based on composite and re-scaled individual company data, industry information, recent press releases and some pure “guestimates” • Quantify risks individually and in the aggregate • Measure earnings impact of events not currently covered • Determine theoretical risk capital for selected level of earnings “protection”

ABC Corporation -Assumptions • • • Market Cap = $4. 28 Billion Net Income = $545 Million (ttm) EPS = $4. 72 (ttm); Share Price = $38. 12 Effective Tax Rate = 35% Exposures can be transferred at pretax nominal cost (expenses offset PV factor)

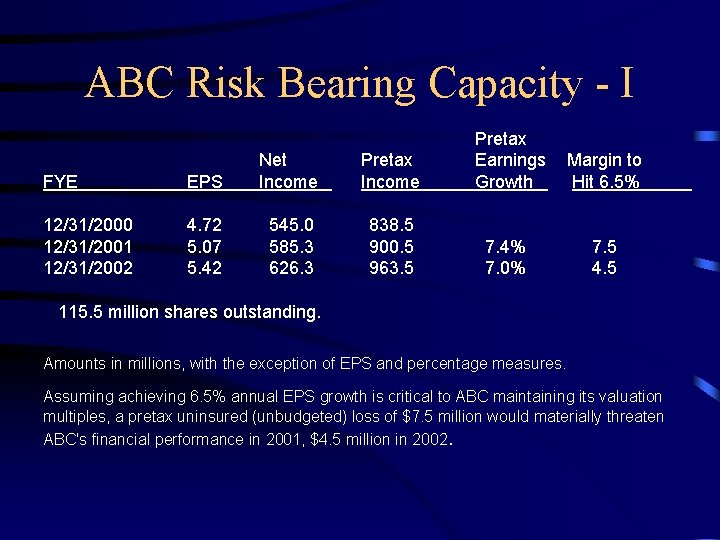

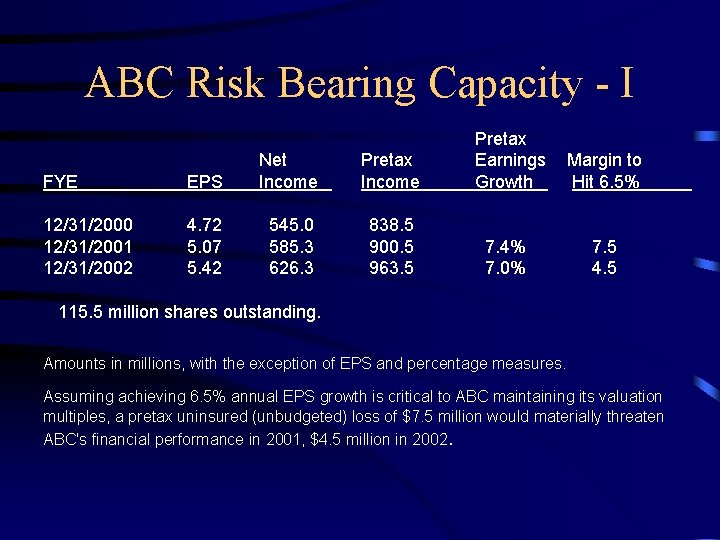

ABC Risk Bearing Capacity - I FYE EPS Net Income 12/31/2000 12/31/2001 12/31/2002 4. 72 5. 07 5. 42 545. 0 585. 3 626. 3 Pretax Income Pretax Earnings Growth 838. 5 900. 5 963. 5 7. 4% 7. 0% Margin to Hit 6. 5% 7. 5 4. 5 115. 5 million shares outstanding. Amounts in millions, with the exception of EPS and percentage measures. Assuming achieving 6. 5% annual EPS growth is critical to ABC maintaining its valuation multiples, a pretax uninsured (unbudgeted) loss of $7. 5 million would materially threaten ABC's financial performance in 2001, $4. 5 million in 2002.

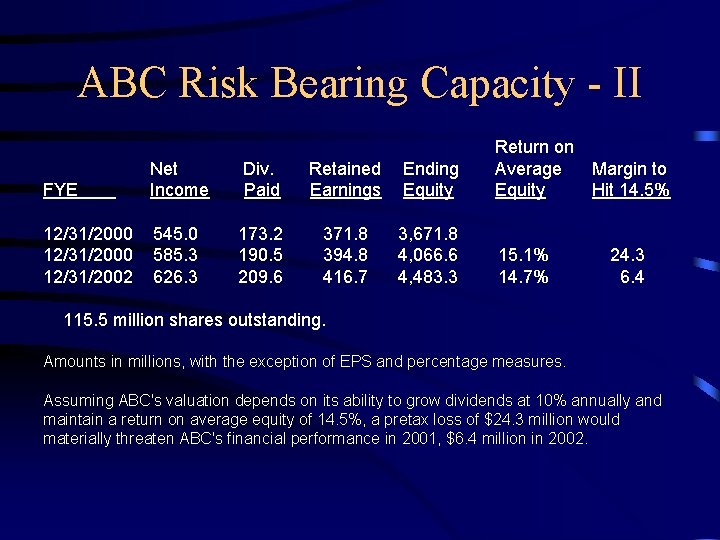

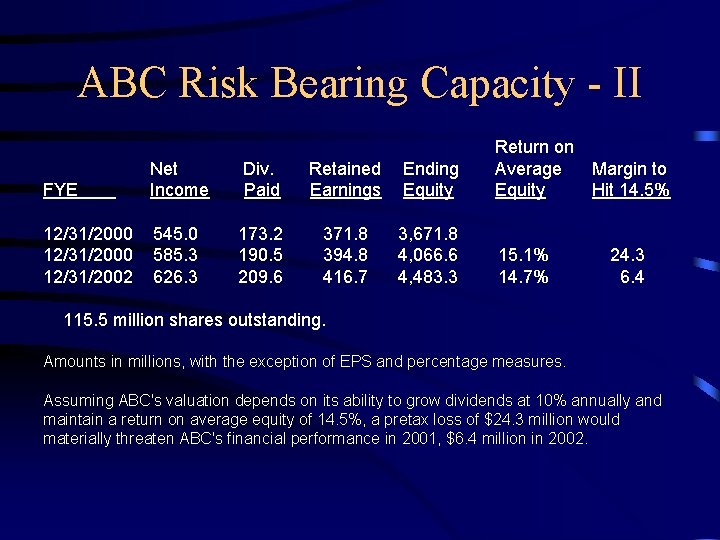

ABC Risk Bearing Capacity - II FYE Net Income Div. Paid Retained Earnings Ending Equity Return on Average Margin to Equity Hit 14. 5% 12/31/2000 12/31/2002 545. 0 585. 3 626. 3 173. 2 190. 5 209. 6 371. 8 394. 8 416. 7 3, 671. 8 4, 066. 6 4, 483. 3 15. 1% 14. 7% 24. 3 6. 4 115. 5 million shares outstanding. Amounts in millions, with the exception of EPS and percentage measures. Assuming ABC's valuation depends on its ability to grow dividends at 10% annually and maintain a return on average equity of 14. 5%, a pretax loss of $24. 3 million would materially threaten ABC's financial performance in 2001, $6. 4 million in 2002.

ABC Corporation Risks - I • Hazard/Legal Risks – – – Property Business Interruption Automobile Liability General Liability Products Liability Employment Practices – – Crime D&O Foreign E&O

ABC Corporation Risks - II • Financial Risks – Credit – Fiduciary • Strategic Risks – Product Selection – R&D Investments • Operational Risks – – – Warranty Product Recall Political Intellectual Property Strike

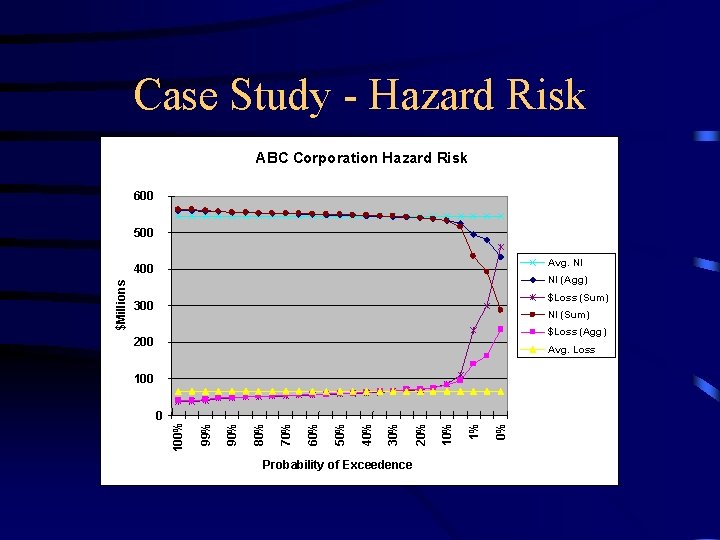

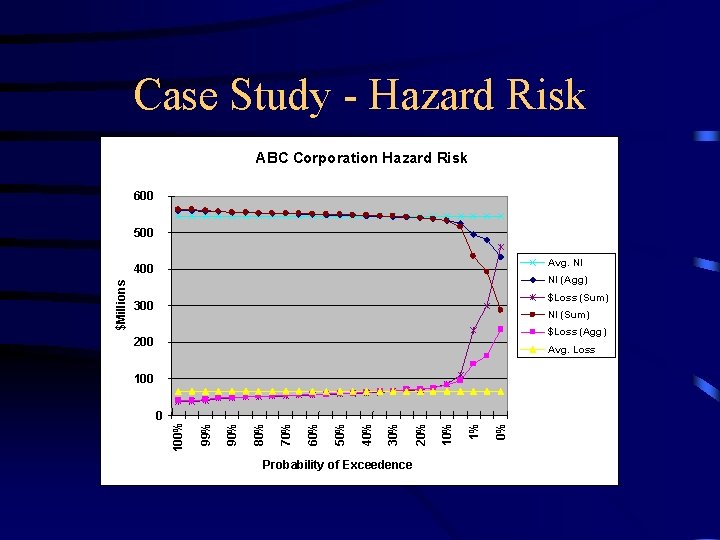

Case Study - Hazard Risk ABC Corporation Hazard Risk 600 500 Avg. NI NI (Agg) $Loss (Sum) 300 NI (Sum) $Loss (Agg) 200 Avg. Loss Probability of Exceedence 0% 1% 10% 20% 30% 40% 50% 60% 70% 80% 90% 0 99% 100% $Millions 400

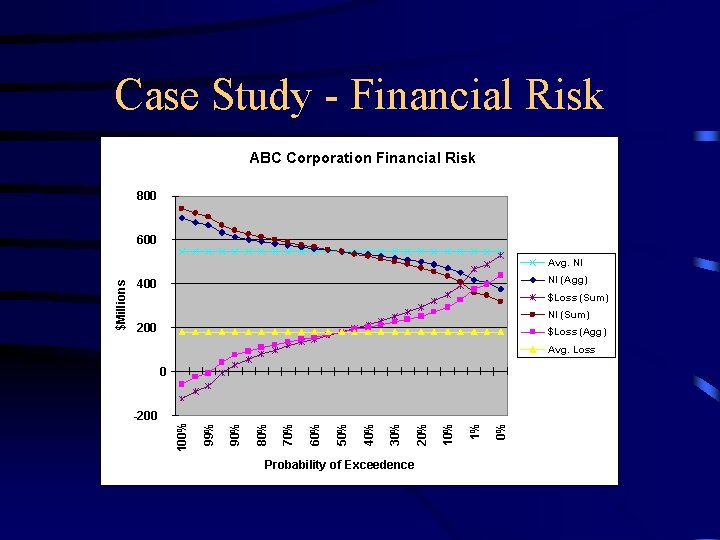

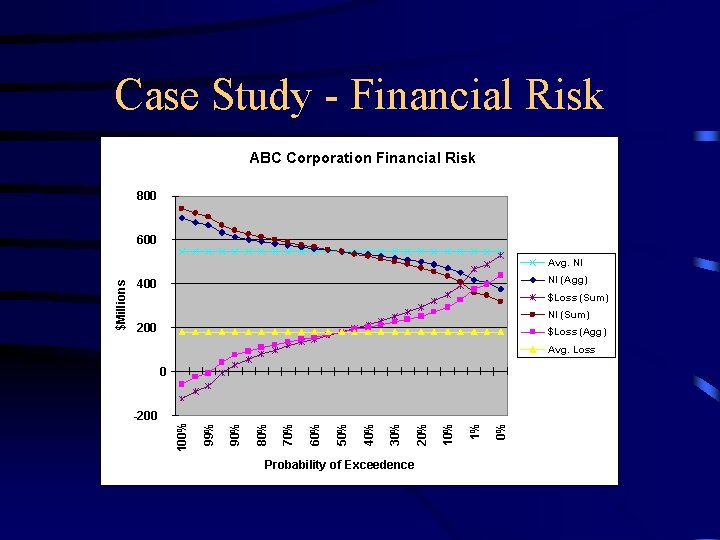

Case Study - Financial Risk ABC Corporation Financial Risk 800 600 NI (Agg) 400 $Loss (Sum) NI (Sum) 200 $Loss (Agg) Avg. Loss Probability of Exceedence 0% 1% 10% 20% 30% 40% 50% 60% 70% 80% 90% -200 99% 0 100% $Millions Avg. NI

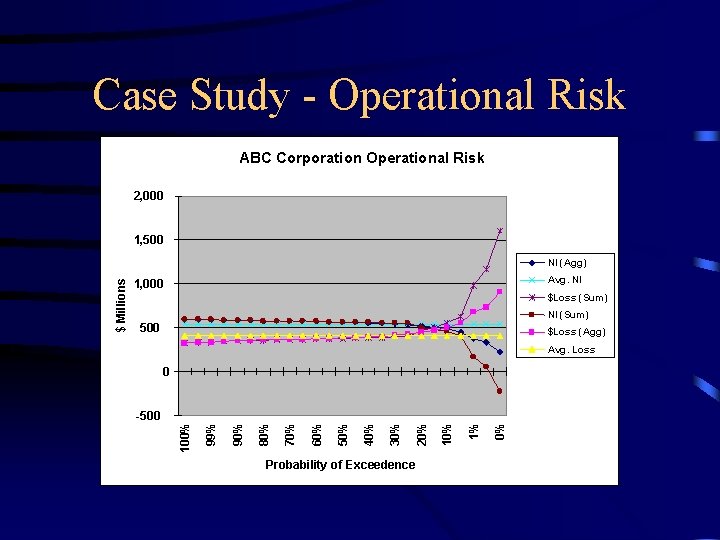

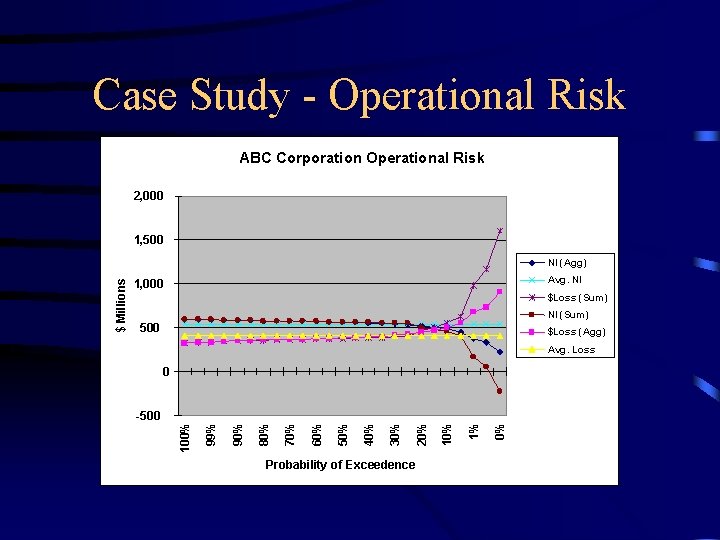

Case Study - Operational Risk ABC Corporation Operational Risk 2, 000 1, 500 Avg. NI 1, 000 $Loss (Sum) NI (Sum) 500 $Loss (Agg) Avg. Loss Probability of Exceedence 0% 1% 10% 20% 30% 40% 50% 60% 70% 80% 90% -500 99% 0 100% $ Millions NI (Agg)

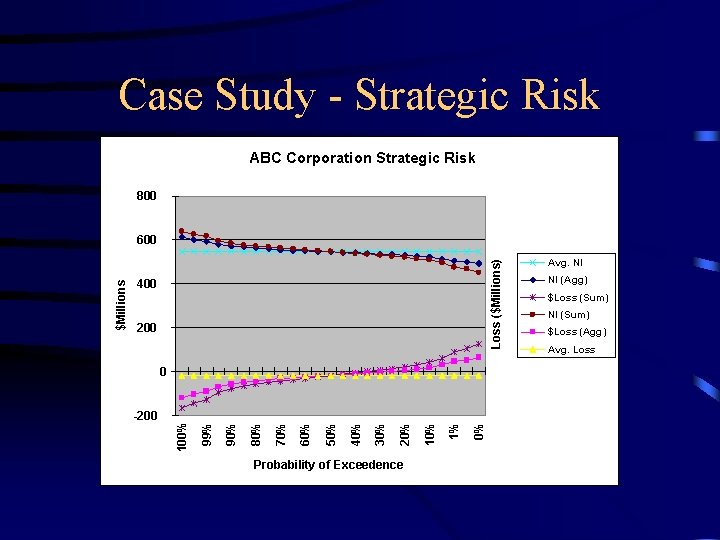

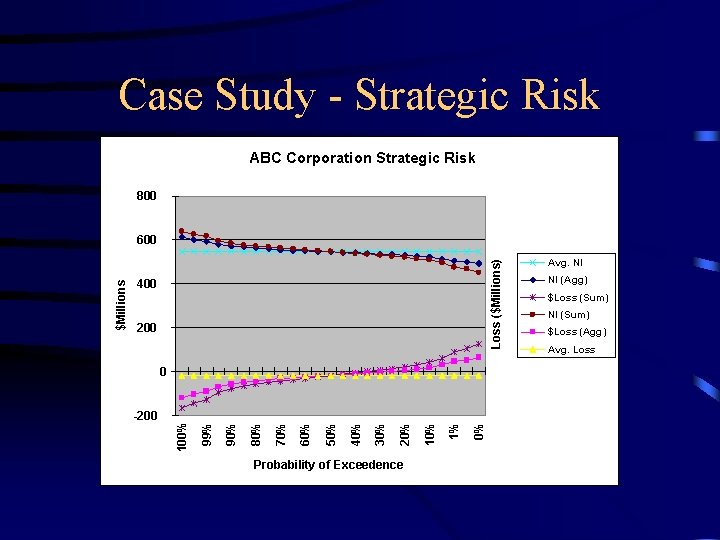

Case Study - Strategic Risk ABC Corporation Strategic Risk 800 Loss ($Millions) 400 200 Probability of Exceedence 0% 1% 10% 20% 30% 40% 50% 60% 70% 80% 90% -200 99% 0 100% $Millions 600 Avg. NI NI (Agg) $Loss (Sum) NI (Sum) $Loss (Agg) Avg. Loss

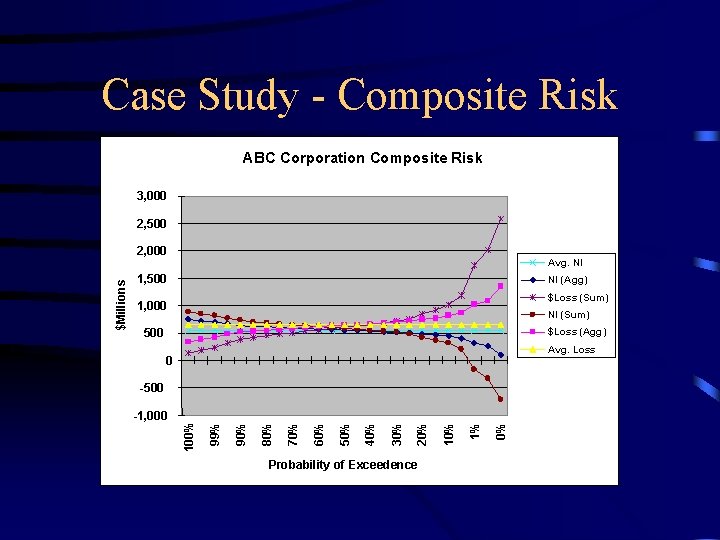

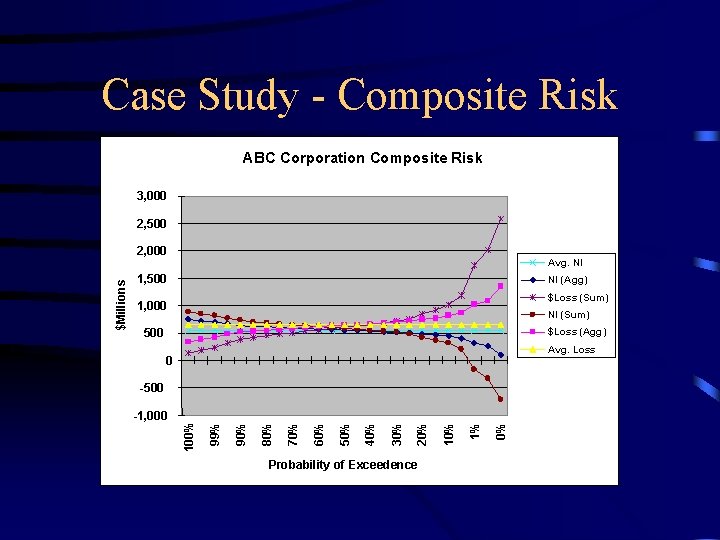

Case Study - Composite Risk ABC Corporation Composite Risk 3, 000 2, 500 Avg. NI 1, 500 NI (Agg) $Loss (Sum) 1, 000 NI (Sum) $Loss (Agg) 500 Avg. Loss 0 Probability of Exceedence 0% 1% 10% 20% 30% 40% 50% 60% 70% 80% 90% -1, 000 99% -500 100% $Millions 2, 000

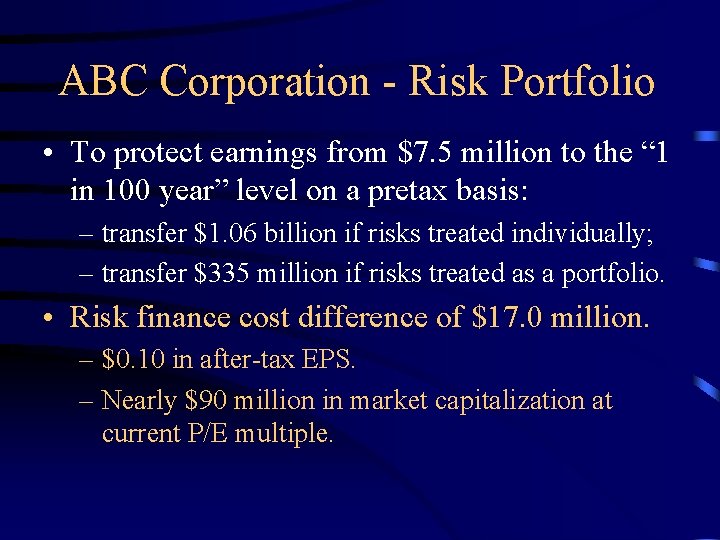

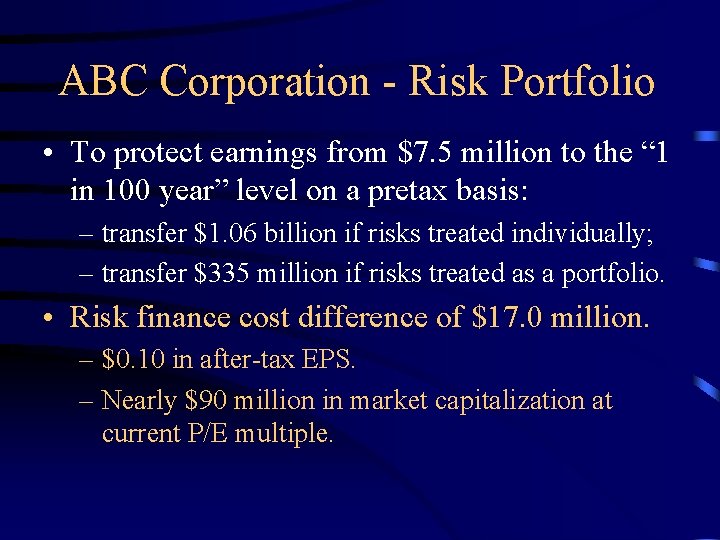

ABC Corporation - Risk Portfolio • To protect earnings from $7. 5 million to the “ 1 in 100 year” level on a pretax basis: – transfer $1. 06 billion if risks treated individually; – transfer $335 million if risks treated as a portfolio. • Risk finance cost difference of $17. 0 million. – $0. 10 in after-tax EPS. – Nearly $90 million in market capitalization at current P/E multiple.

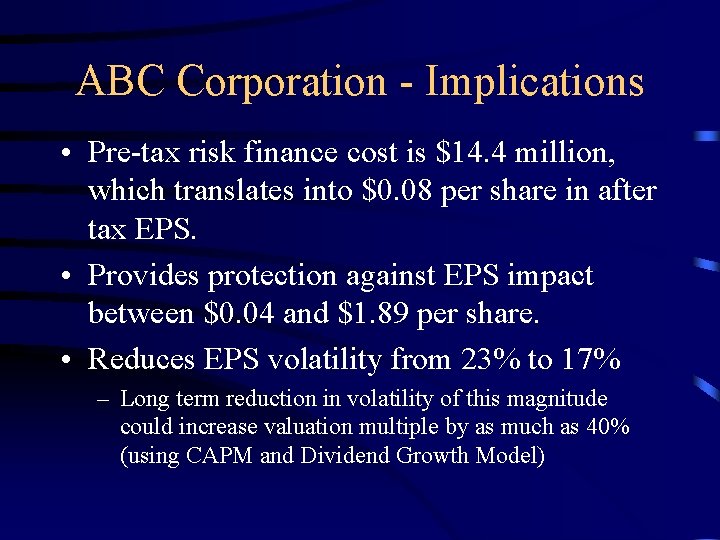

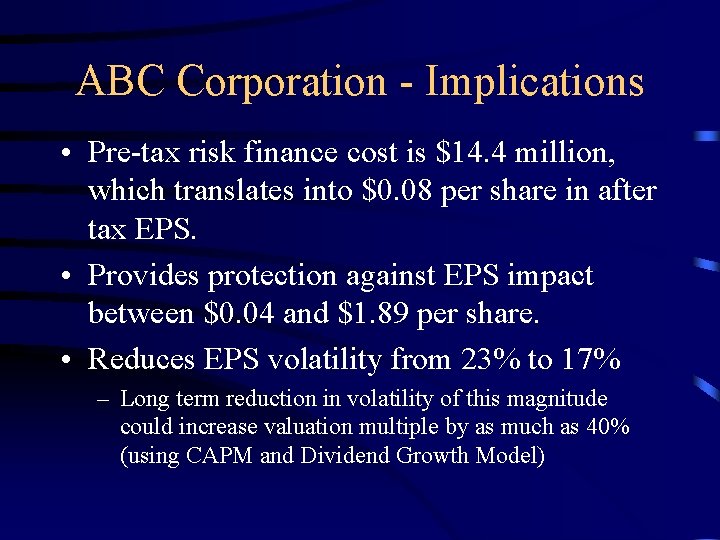

ABC Corporation - Implications • Pre-tax risk finance cost is $14. 4 million, which translates into $0. 08 per share in after tax EPS. • Provides protection against EPS impact between $0. 04 and $1. 89 per share. • Reduces EPS volatility from 23% to 17% – Long term reduction in volatility of this magnitude could increase valuation multiple by as much as 40% (using CAPM and Dividend Growth Model)

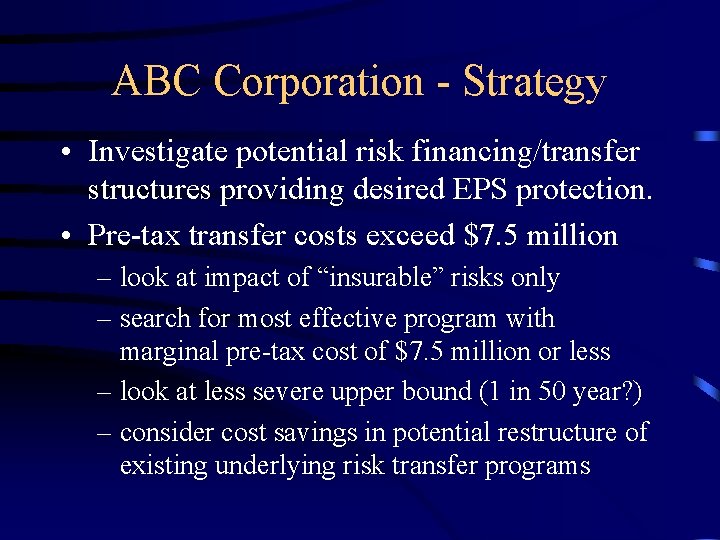

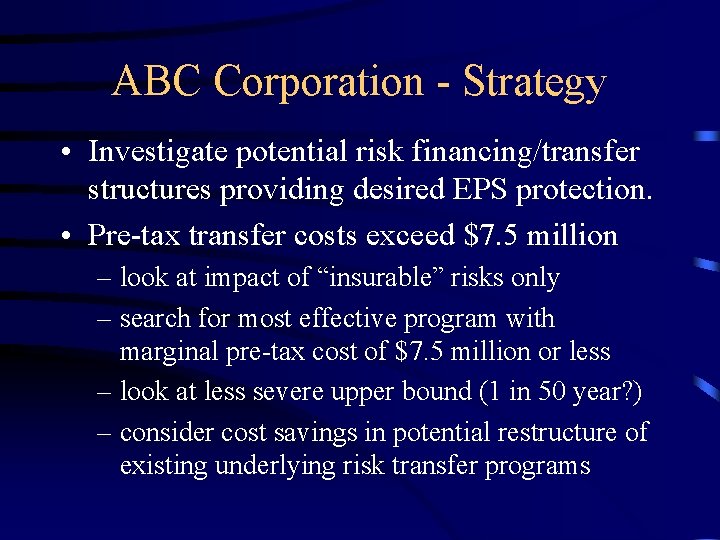

ABC Corporation - Strategy • Investigate potential risk financing/transfer structures providing desired EPS protection. • Pre-tax transfer costs exceed $7. 5 million – look at impact of “insurable” risks only – search for most effective program with marginal pre-tax cost of $7. 5 million or less – look at less severe upper bound (1 in 50 year? ) – consider cost savings in potential restructure of existing underlying risk transfer programs

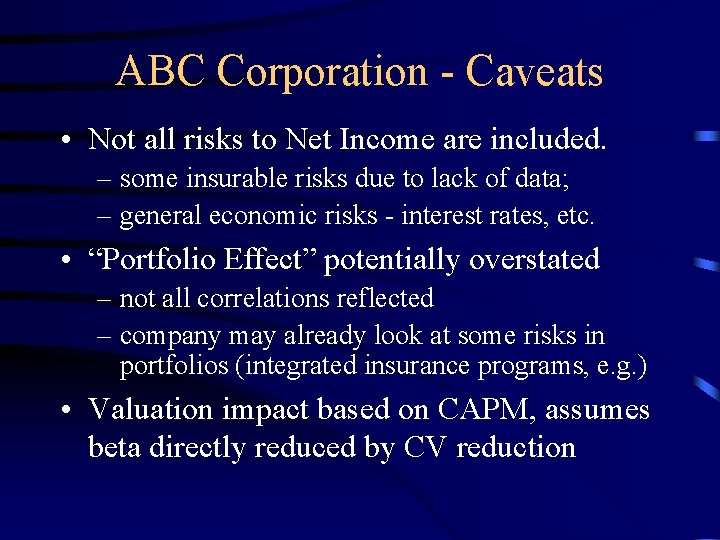

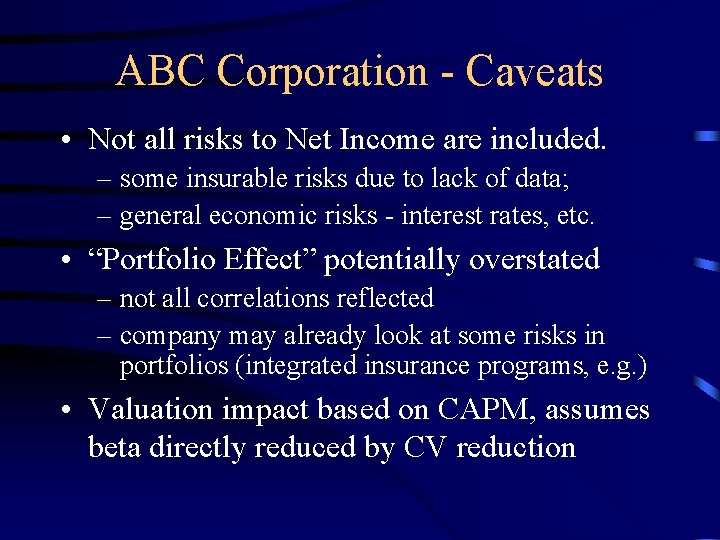

ABC Corporation - Caveats • Not all risks to Net Income are included. – some insurable risks due to lack of data; – general economic risks - interest rates, etc. • “Portfolio Effect” potentially overstated – not all correlations reflected – company may already look at some risks in portfolios (integrated insurance programs, e. g. ) • Valuation impact based on CAPM, assumes beta directly reduced by CV reduction