THE ACCOUNTING CYCLE Closing Entries 1 Adjusting and

- Slides: 32

THE ACCOUNTING CYCLE: Closing Entries 1

Adjusting and Closing Entries If a work sheet has been prepared, the data for these entries are in the Adjustments columns. 2

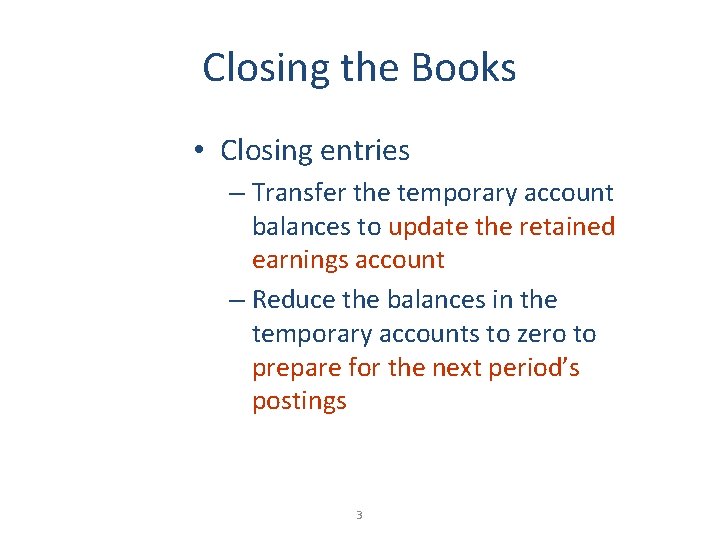

Closing the Books • Closing entries – Transfer the temporary account balances to update the retained earnings account – Reduce the balances in the temporary accounts to zero to prepare for the next period’s postings 3

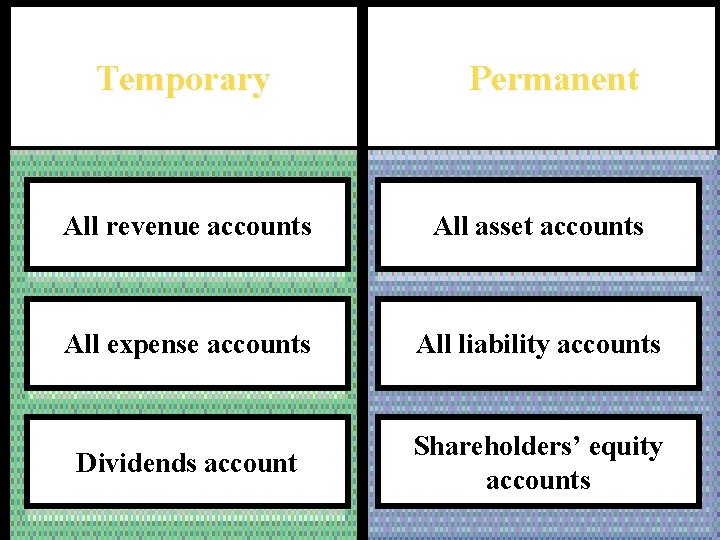

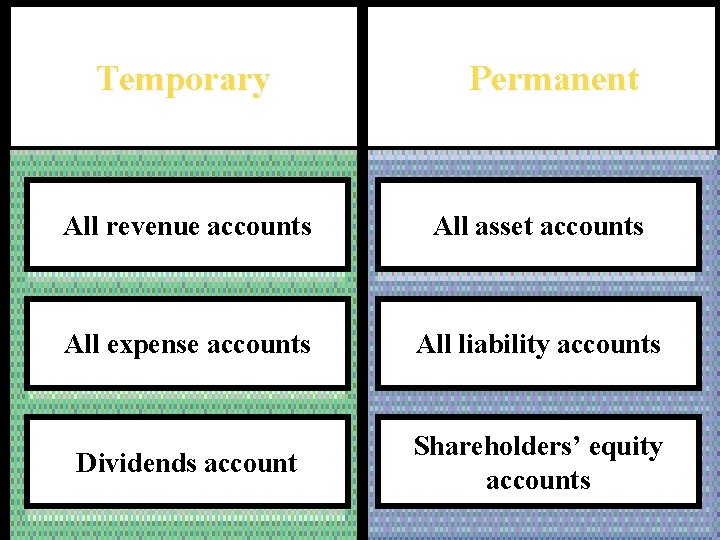

Temporary Permanent All revenue accounts All asset accounts All expense accounts All liability accounts Dividends account Shareholders’ equity accounts 4

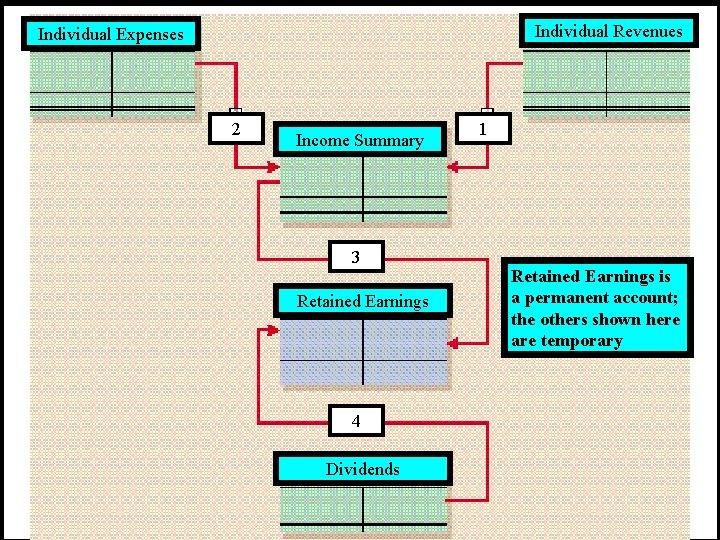

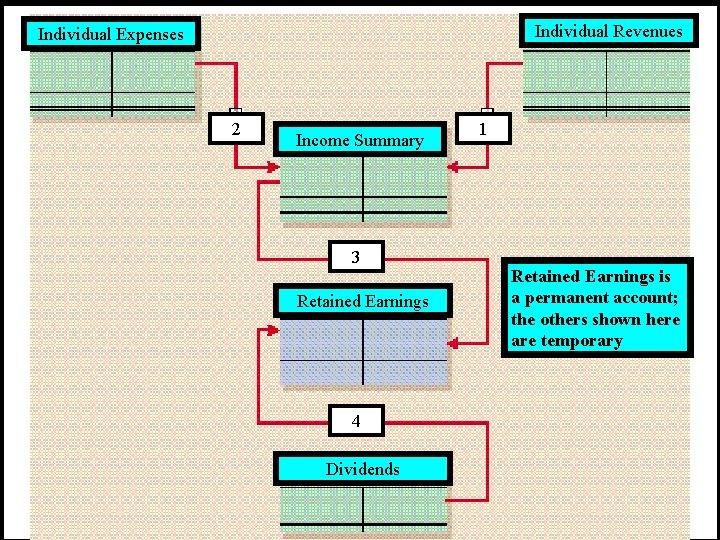

Individual Revenues Individual Expenses 2 Income Summary 3 Retained Earnings 4 Dividends 5 1 Retained Earnings is a permanent account; the others shown here are temporary

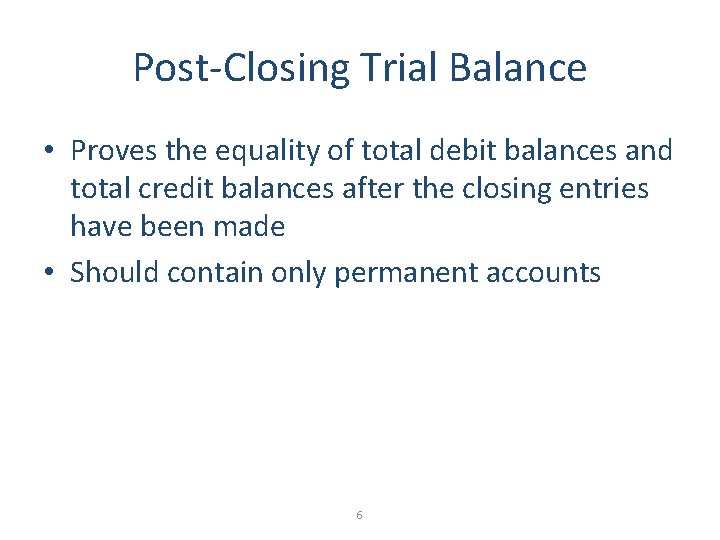

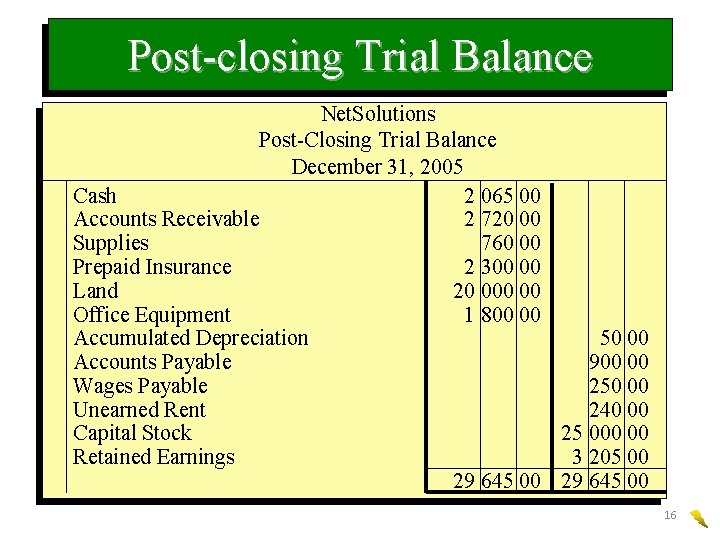

Post-Closing Trial Balance • Proves the equality of total debit balances and total credit balances after the closing entries have been made • Should contain only permanent accounts 6

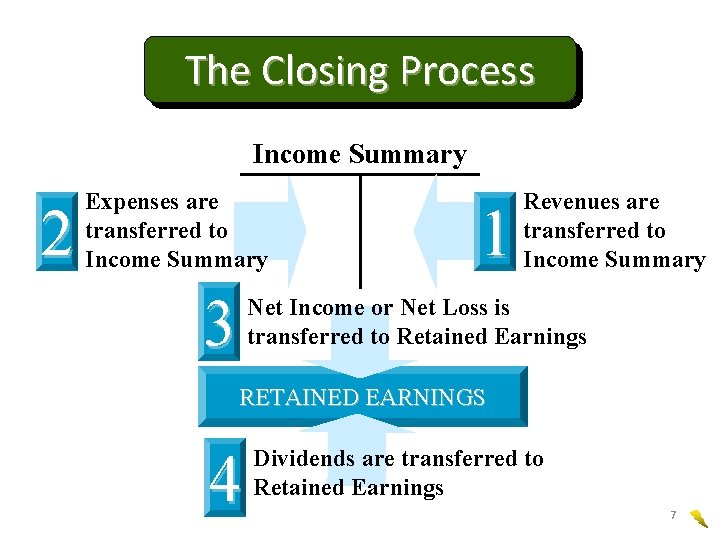

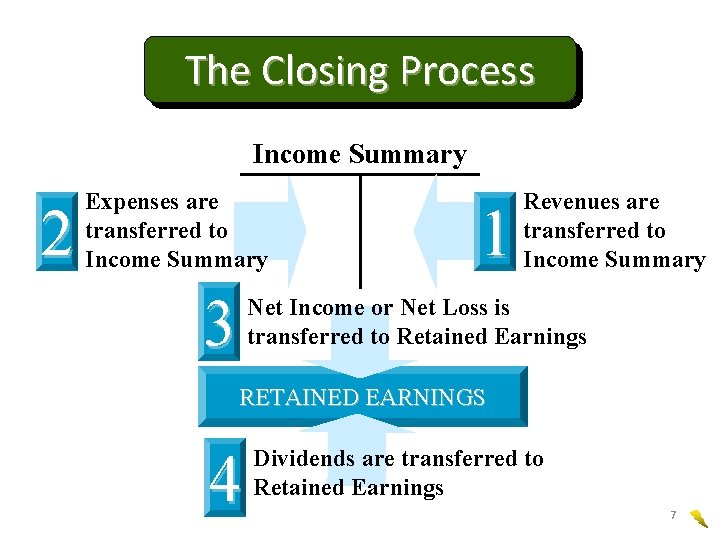

The Closing Process Income Summary 2 Expenses are transferred to Income Summary 3 1 Revenues are transferred to Income Summary Net Income or Net Loss is transferred to Retained Earnings RETAINED EARNINGS 4 Dividends are transferred to Retained Earnings 7

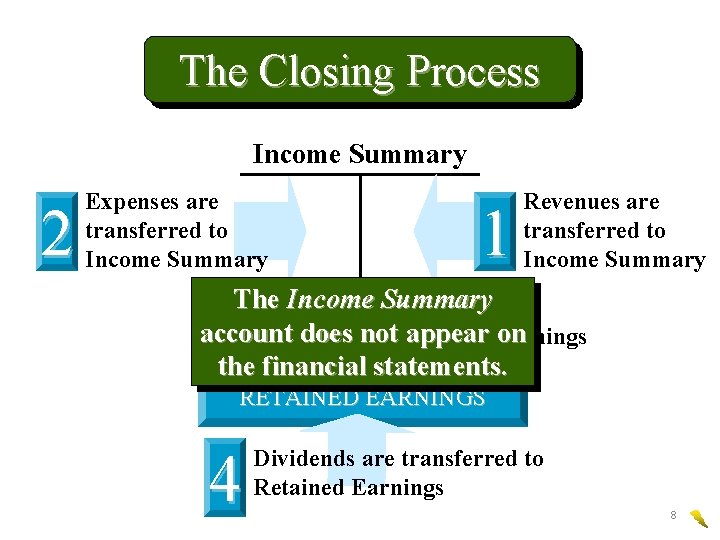

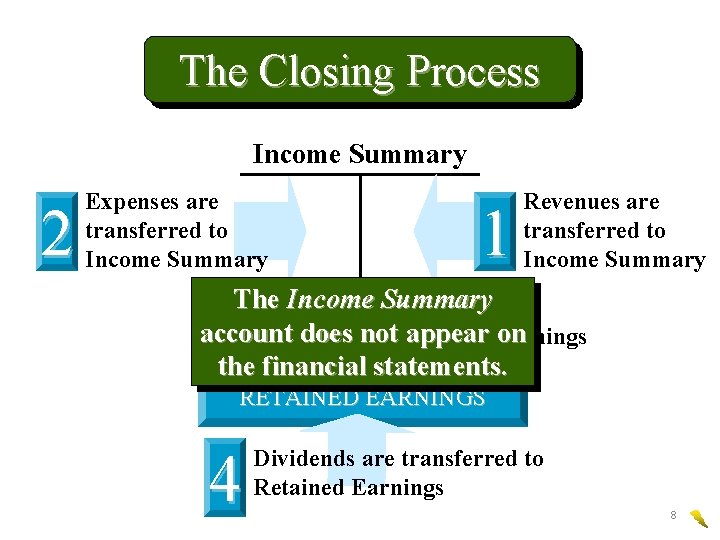

The Closing Process Income Summary 2 Expenses are transferred to Income Summary 1 Revenues are transferred to Income Summary The Summary Net Income or Net Loss is account does not appear Earnings on transferred to Retained the financial statements. 3 RETAINED EARNINGS 4 Dividends are transferred to Retained Earnings 8

The Closing Process Fees Earned Wages Expense Bal. Income Summary 4, 525 Rent Expense Bal. Rent Revenue 1, 600 Bal. Depreciation Expense Bal. 50 Utilities Expense Bal. Retained Earnings 985 Bal. 25, 000 Supplies Expense Bal. 2, 040 Insurance Expense Bal. 100 Miscellaneous Expense Bal. 455 Bal. 16, 840 Dividends Bal. 4, 000 120 Note: The balances shown are adjusted balances before closing. The following sequence demonstrates the closing process. 9

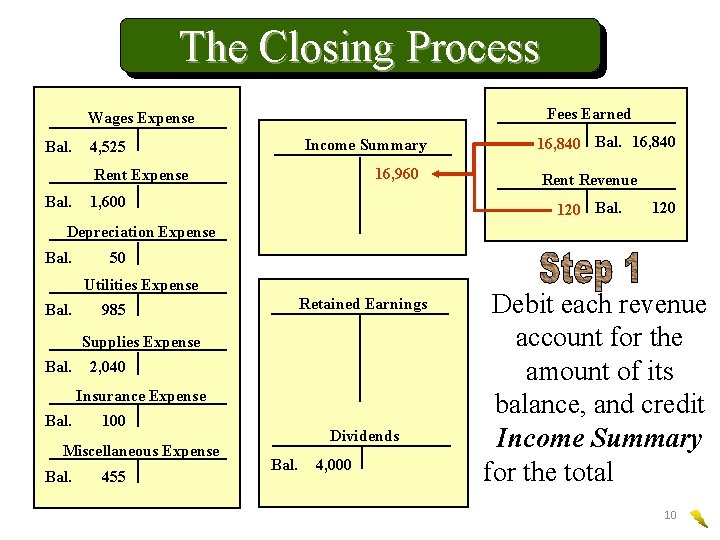

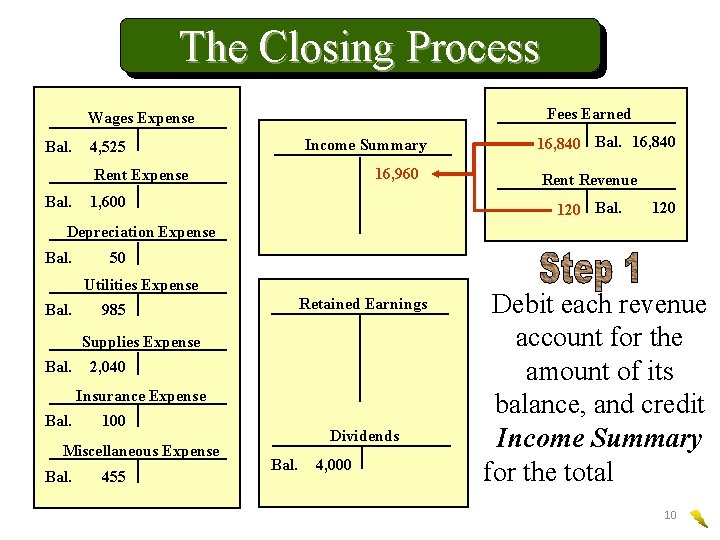

The Closing Process Fees Earned Wages Expense Bal. Income Summary 4, 525 16, 960 Rent Expense Bal. 1, 600 16, 840 Bal. 16, 840 Rent Revenue 120 Bal. 120 Depreciation Expense Bal. 50 Utilities Expense Bal. Retained Earnings 985 Supplies Expense Bal. 2, 040 Insurance Expense Bal. 100 Miscellaneous Expense Bal. 455 Dividends Bal. 4, 000 Debit each revenue account for the amount of its balance, and credit Income Summary for the total revenue. 10

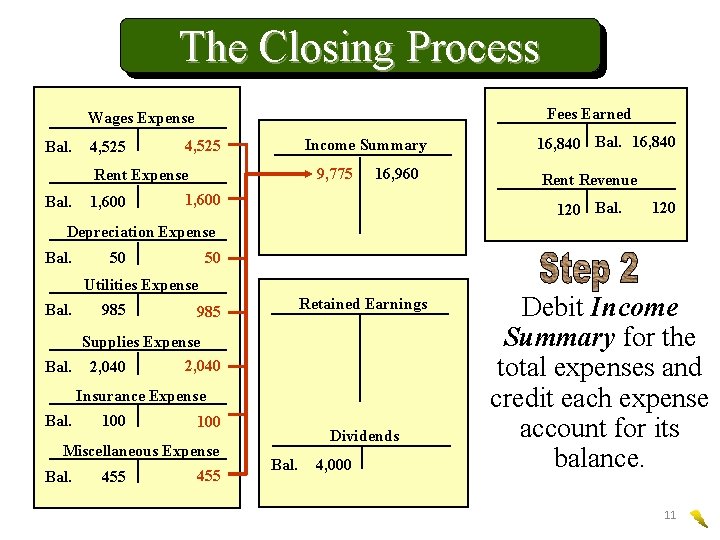

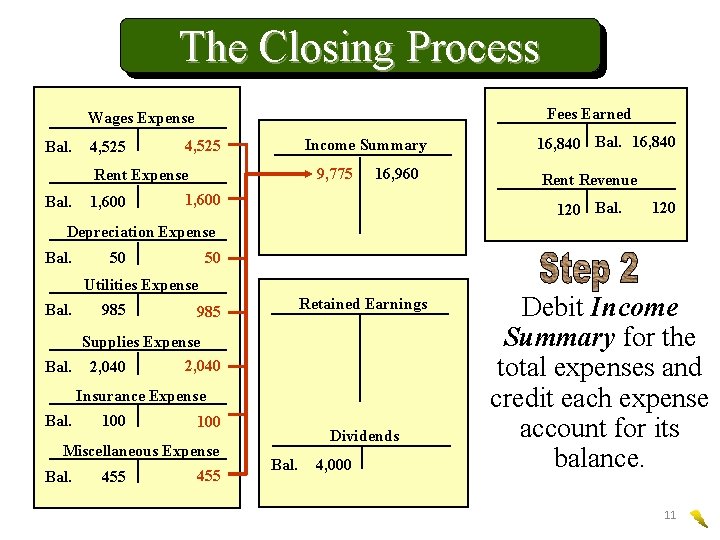

The Closing Process Fees Earned Wages Expense Bal. 4, 525 Income Summary 4, 525 9, 775 Rent Expense Bal. 1, 600 16, 960 1, 600 16, 840 Bal. 16, 840 Rent Revenue 120 Bal. 120 Depreciation Expense Bal. 50 50 Utilities Expense Bal. 985 Retained Earnings 985 Supplies Expense 2, 040 Bal. 2, 040 Insurance Expense Bal. 100 Miscellaneous Expense Bal. 455 Dividends Bal. 4, 000 Debit Income Summary for the total expenses and credit each expense account for its balance. 11

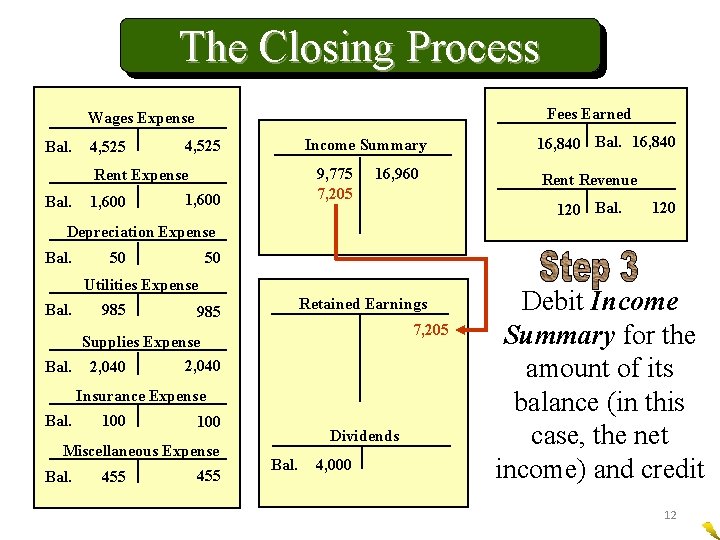

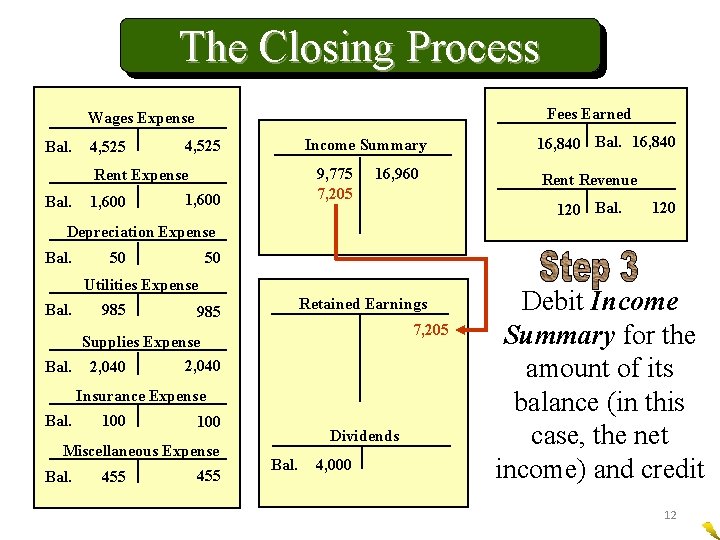

The Closing Process Fees Earned Wages Expense Bal. 4, 525 Income Summary 4, 525 9, 775 7, 205 Rent Expense Bal. 1, 600 16, 960 16, 840 Bal. 16, 840 Rent Revenue 120 Bal. 120 Depreciation Expense Bal. 50 50 Utilities Expense Bal. 985 Retained Earnings 985 7, 205 Supplies Expense 2, 040 Bal. 2, 040 Insurance Expense Bal. 100 Miscellaneous Expense Bal. 455 Dividends Bal. 4, 000 Debit Income Summary for the amount of its balance (in this case, the net income) and credit Retained Earnings. 12

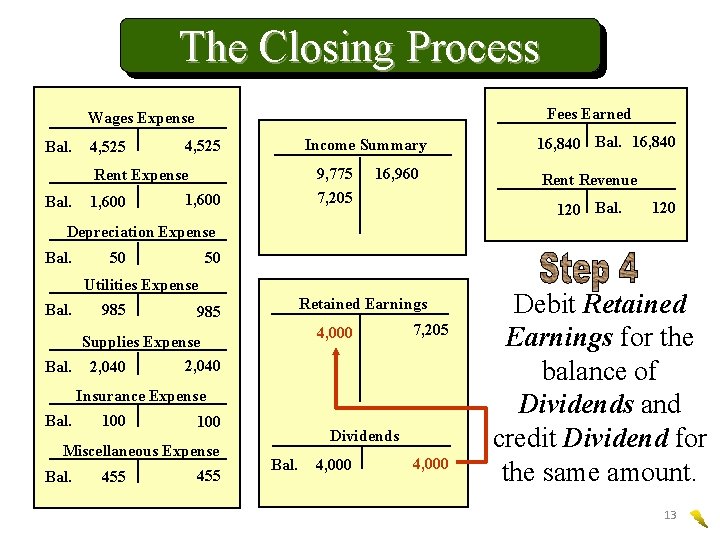

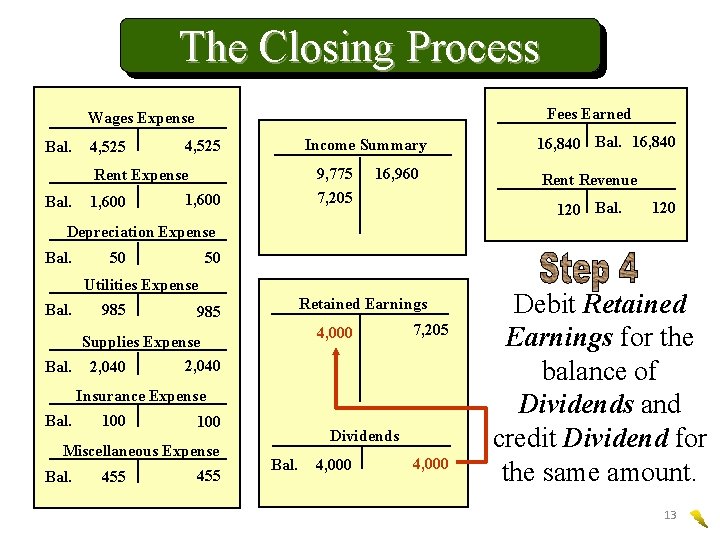

The Closing Process Fees Earned Wages Expense Bal. 4, 525 Income Summary 4, 525 9, 775 7, 205 Rent Expense Bal. 1, 600 16, 960 16, 840 Bal. 16, 840 Rent Revenue 120 Bal. 120 Depreciation Expense Bal. 50 50 Utilities Expense Bal. 985 Retained Earnings 985 4, 000 Supplies Expense 2, 040 Bal. 2, 040 7, 205 Insurance Expense Bal. 100 Miscellaneous Expense Bal. 455 Dividends Bal. 4, 000 Debit Retained Earnings for the balance of Dividends and credit Dividend for the same amount. 13

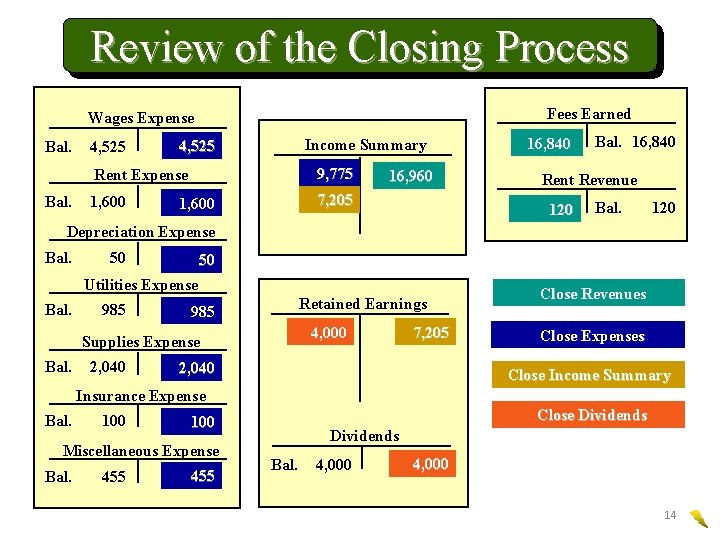

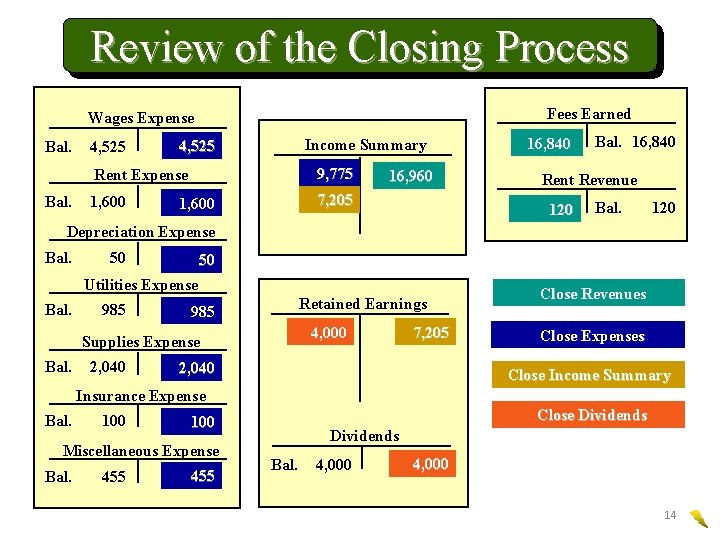

Review of the Closing Process Fees Earned Wages Expense Bal. 4, 525 Income Summary 4, 525 9, 775 7, 205 Rent Expense Bal. 1, 600 16, 960 16, 480 Bal. 16, 840 Rent Revenue 120 Bal. 120 Depreciation Expense Bal. 50 50 50 Utilities Expense Bal. 985 Retained Earnings 985 4, 000 Supplies Expense 2, 040 Bal. 2, 040 7, 205 Close Revenues Close Expenses Close Income Summary Insurance Expense Bal. 100 Miscellaneous Expense Bal. 455 Close Dividends 100 455 445 Dividends Bal. 4, 000 14

After the closing entries are posted, all of the temporary accounts have zero balances. 15

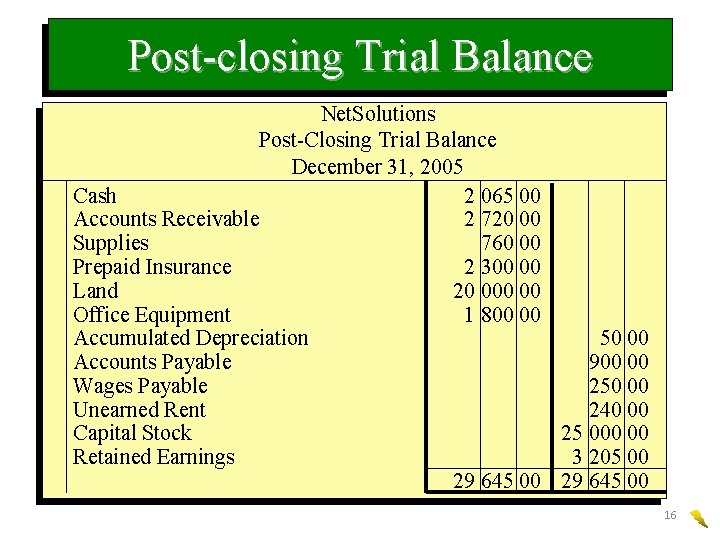

Post-closing Trial Balance Net. Solutions Post-Closing Trial Balance December 31, 2005 Cash 2 065 00 Accounts Receivable 2 720 00 Supplies 760 00 Prepaid Insurance 2 300 00 Land 20 00 Office Equipment 1 800 00 Accumulated Depreciation 50 00 Accounts Payable 900 00 Wages Payable 250 00 Unearned Rent 240 00 Capital Stock 25 000 00 Retained Earnings 3 205 00 29 645 00 16

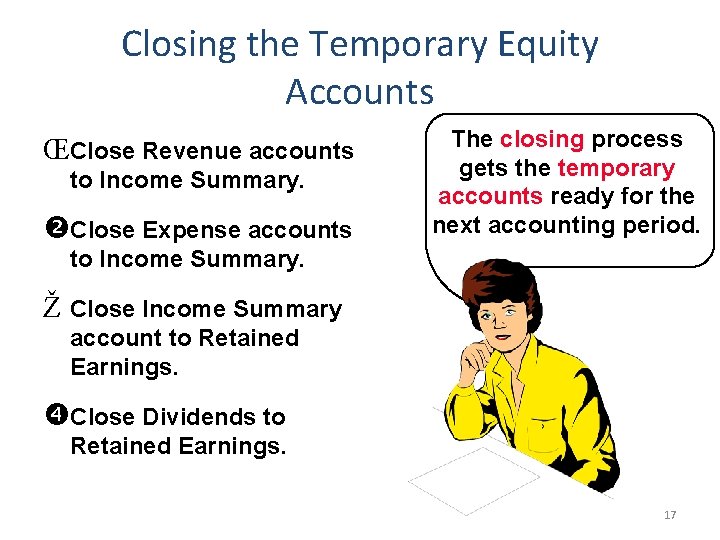

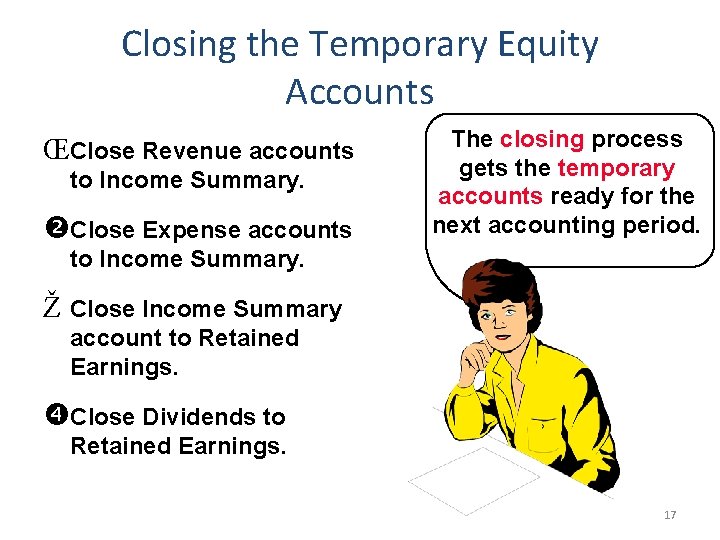

Closing the Temporary Equity Accounts ŒClose Revenue accounts to Income Summary. Close Expense accounts The closing process gets the temporary accounts ready for the next accounting period. to Income Summary. Ž Close Income Summary account to Retained Earnings. Close Dividends to Retained Earnings. 17

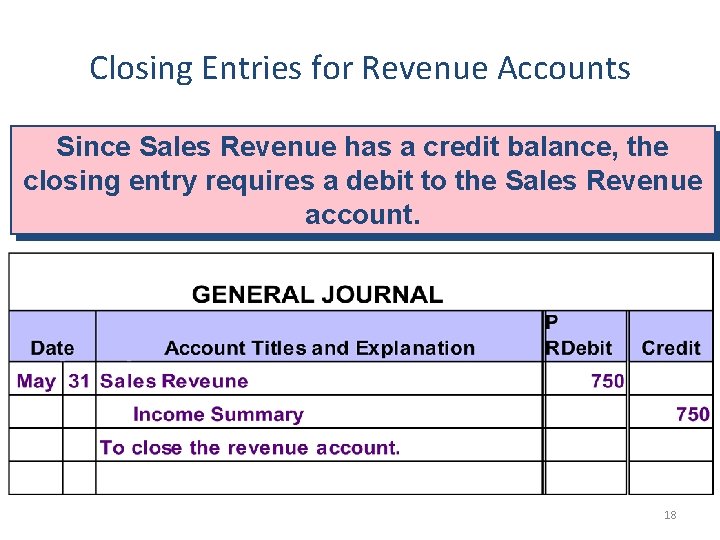

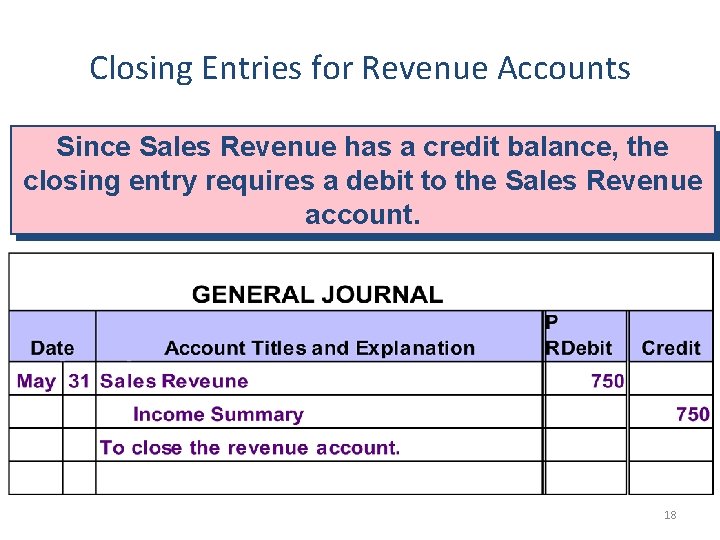

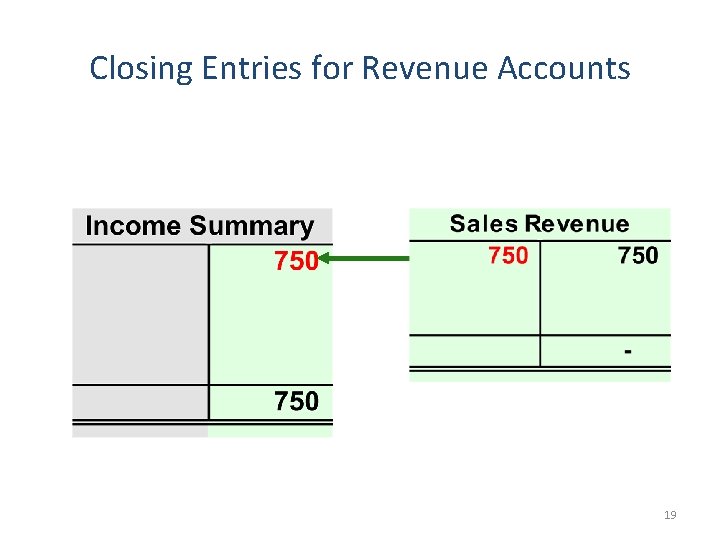

Closing Entries for Revenue Accounts Since Sales Revenue has a credit balance, the closing entry requires a debit to the Sales Revenue account. 18

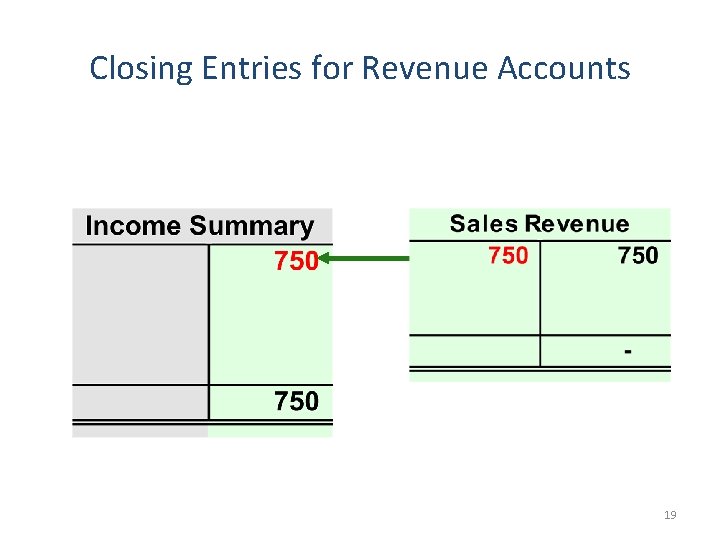

Closing Entries for Revenue Accounts 19

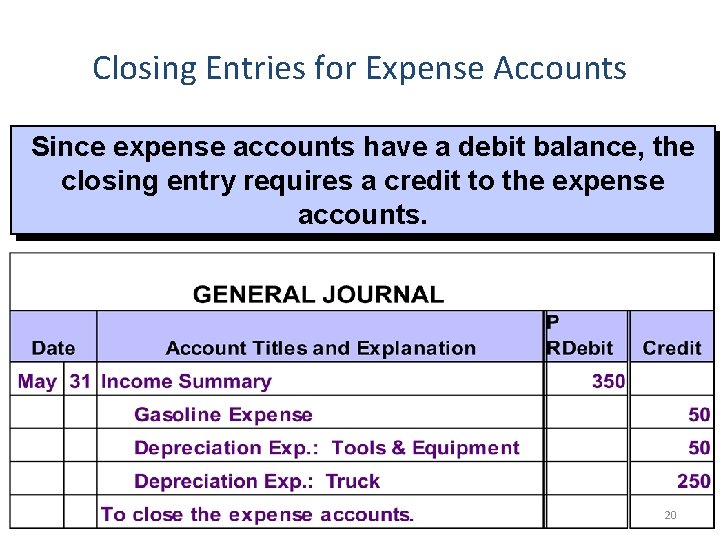

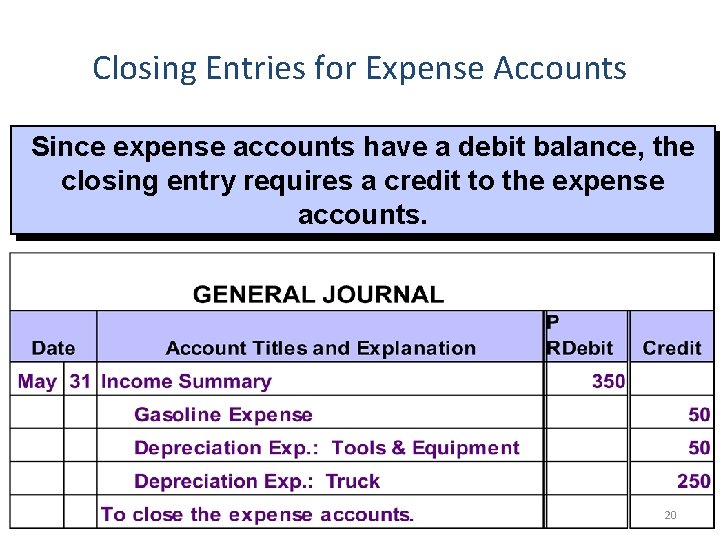

Closing Entries for Expense Accounts Since expense accounts have a debit balance, the closing entry requires a credit to the expense accounts. 20

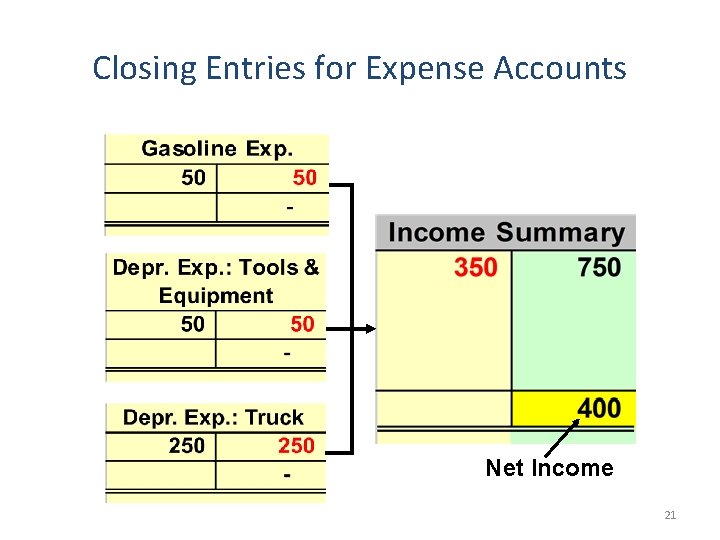

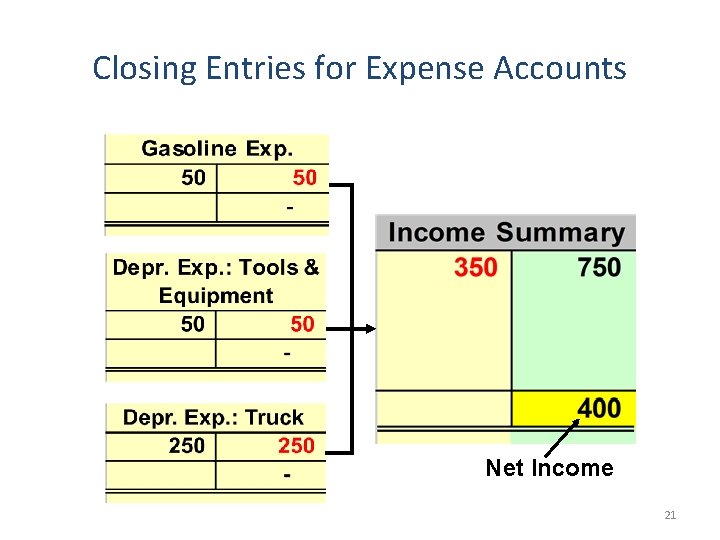

Closing Entries for Expense Accounts Net Income 21

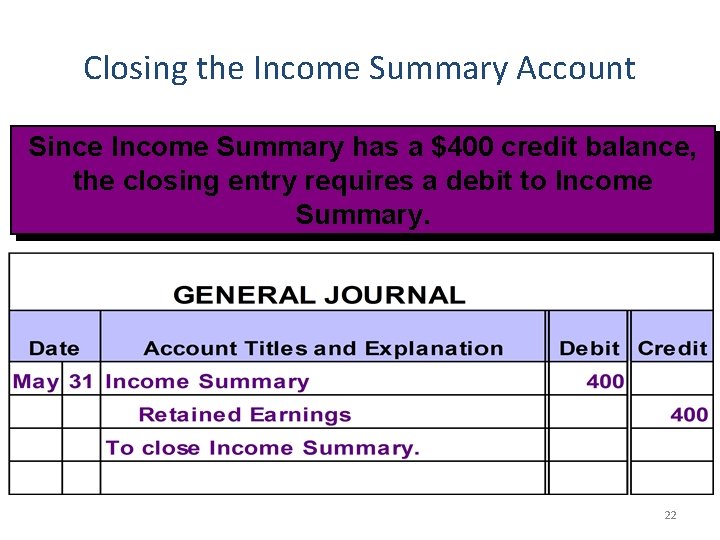

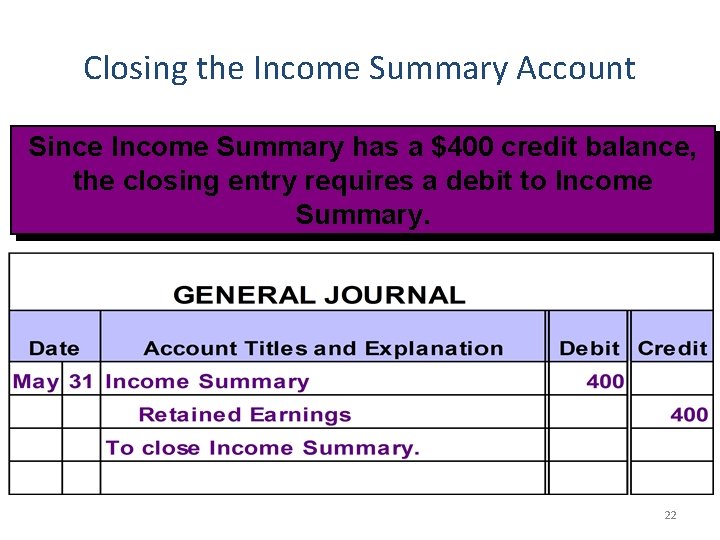

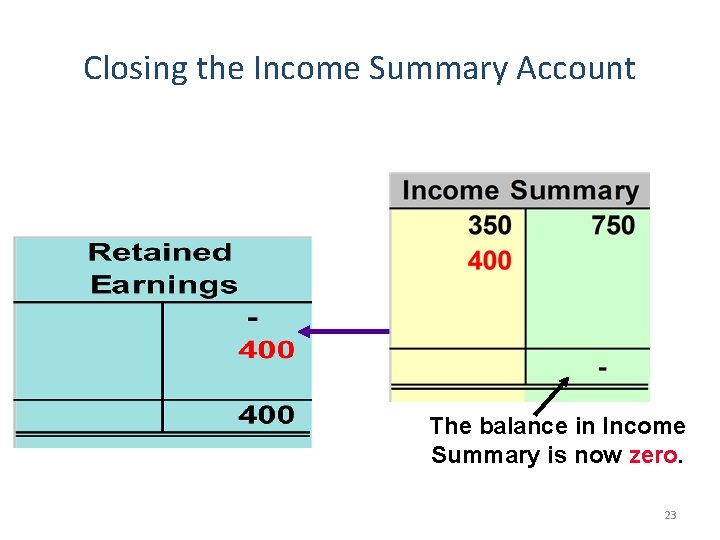

Closing the Income Summary Account Since Income Summary has a $400 credit balance, the closing entry requires a debit to Income Summary. 22

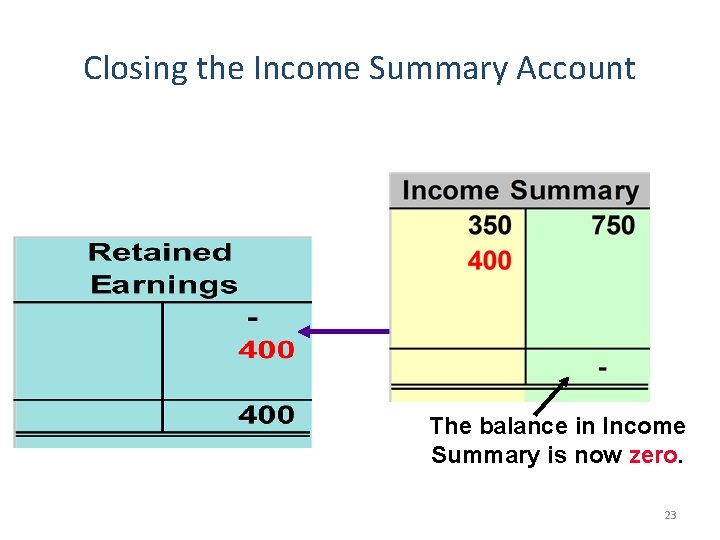

Closing the Income Summary Account The balance in Income Summary is now zero. 23

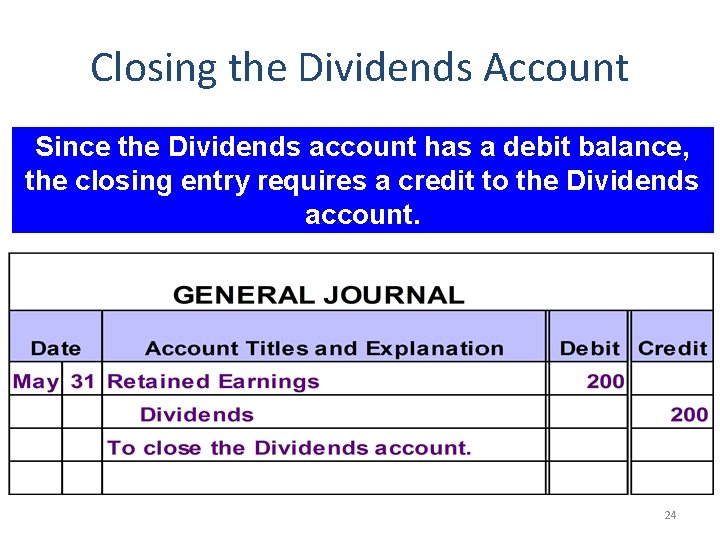

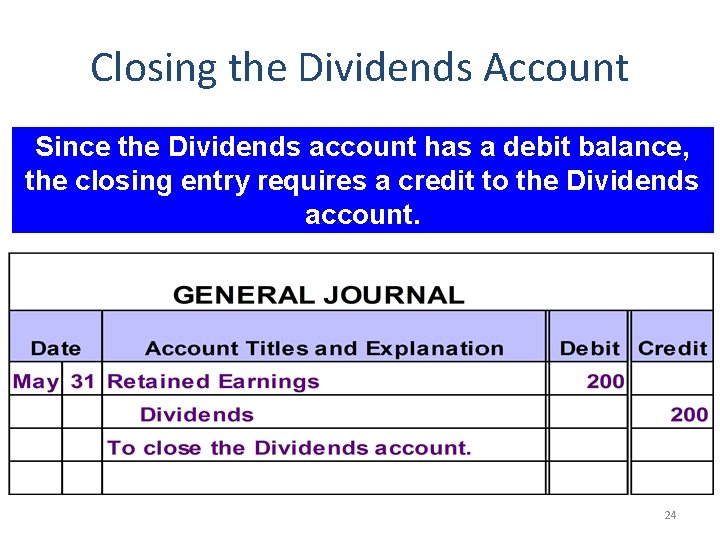

Closing the Dividends Account Since the Dividends account has a debit balance, the closing entry requires a credit to the Dividends account. 24

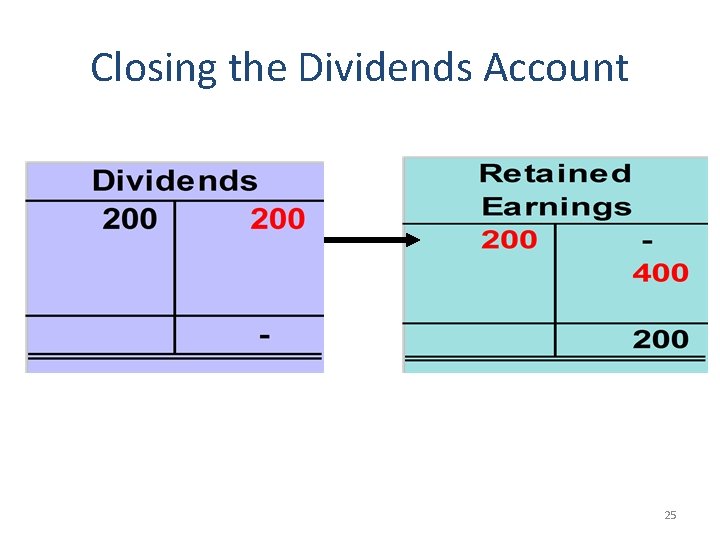

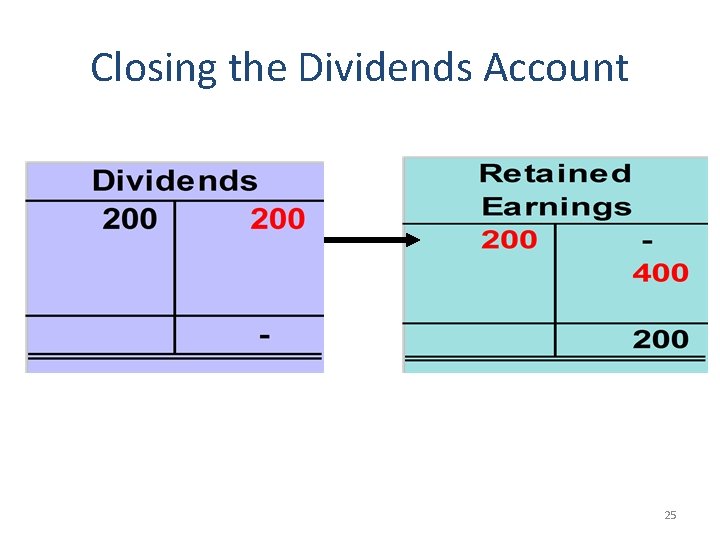

Closing the Dividends Account 25

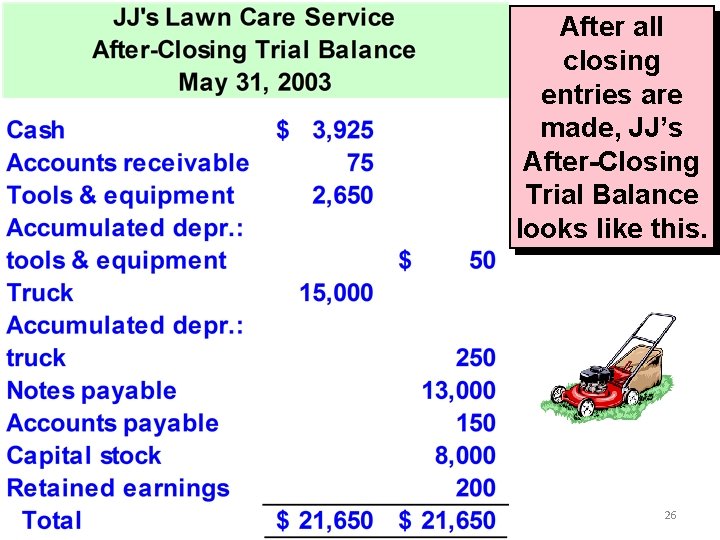

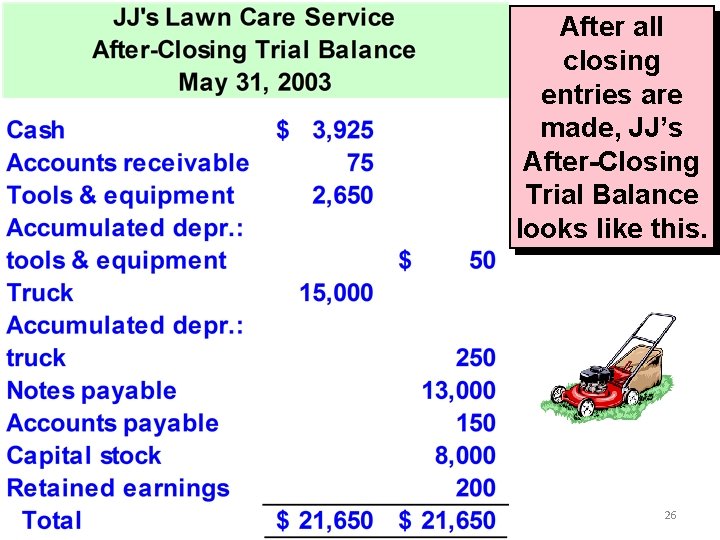

After all closing entries are made, JJ’s After-Closing Trial Balance looks like this. 26

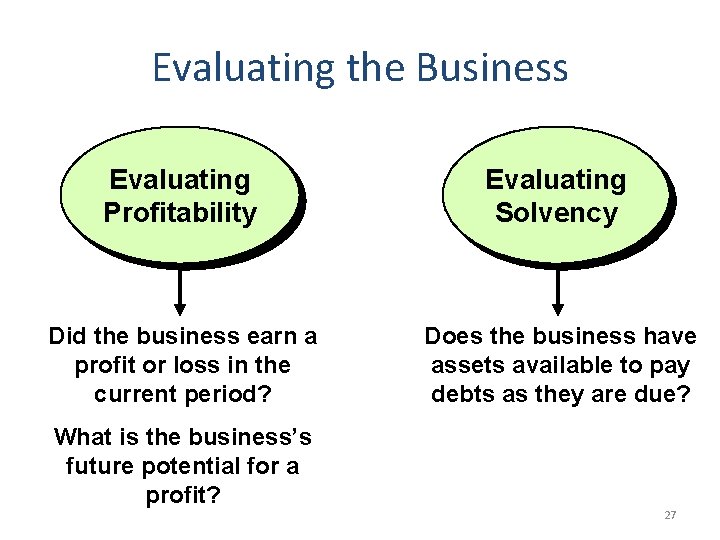

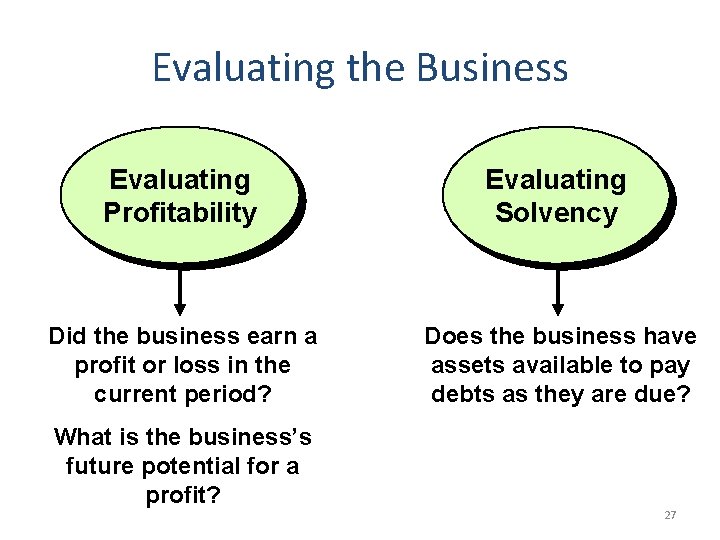

Evaluating the Business Evaluating Profitability Evaluating Solvency Did the business earn a profit or loss in the current period? Does the business have assets available to pay debts as they are due? What is the business’s future potential for a profit? 27

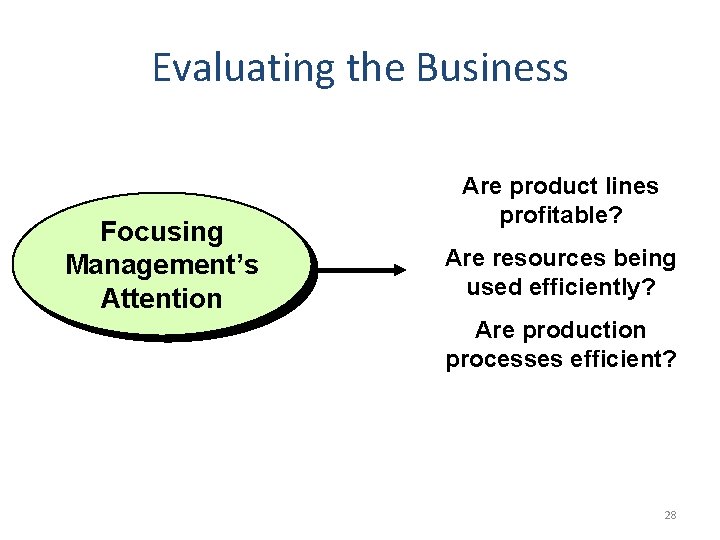

Evaluating the Business Focusing Management’s Attention Are product lines profitable? Are resources being used efficiently? Are production processes efficient? 28

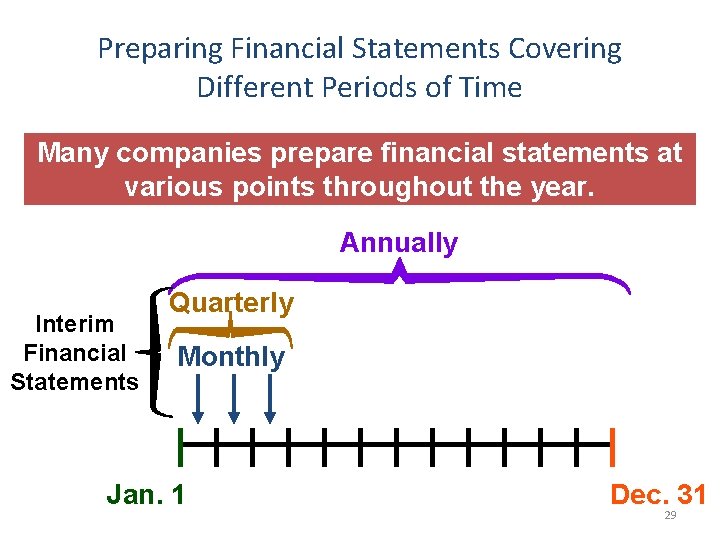

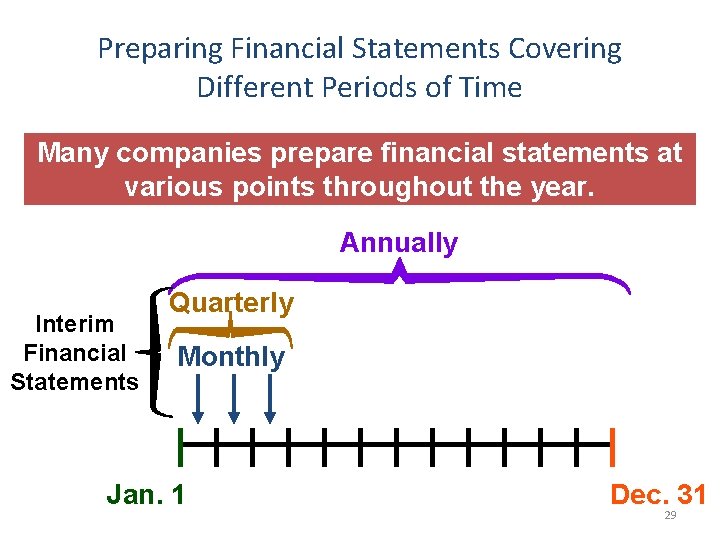

Preparing Financial Statements Covering Different Periods of Time Many companies prepare financial statements at various points throughout the year. Annually Interim Financial Statements Quarterly Monthly Jan. 1 Dec. 31 29

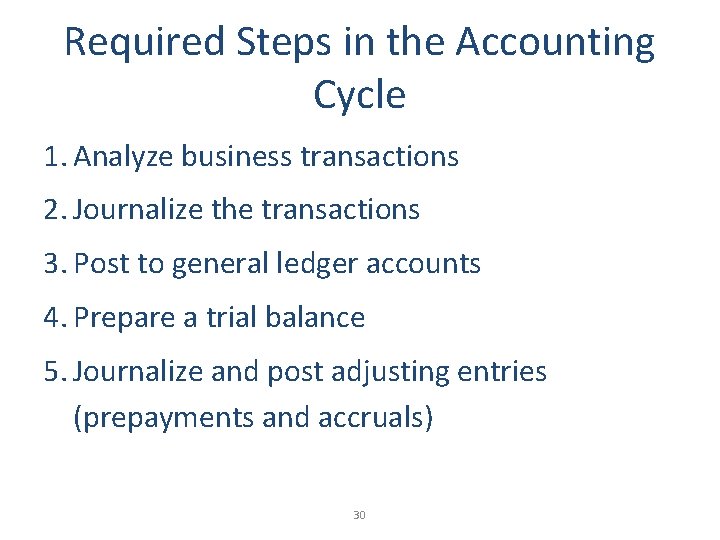

Required Steps in the Accounting Cycle 1. Analyze business transactions 2. Journalize the transactions 3. Post to general ledger accounts 4. Prepare a trial balance 5. Journalize and post adjusting entries (prepayments and accruals) 30

Required Steps in the Accounting Cycle 6. Prepare an adjusted trial balance 7. Prepare financial statements 8. Journalize and post closing entries 9. Prepare a post-closing trial balance 31

End of Chapter 5 32