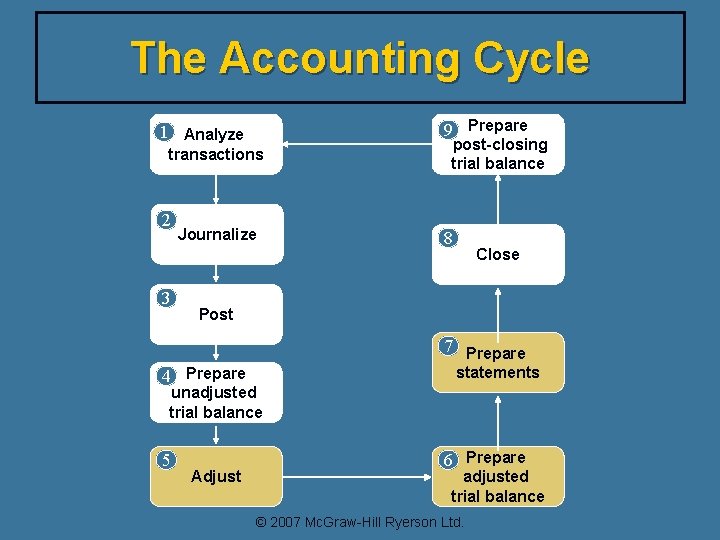

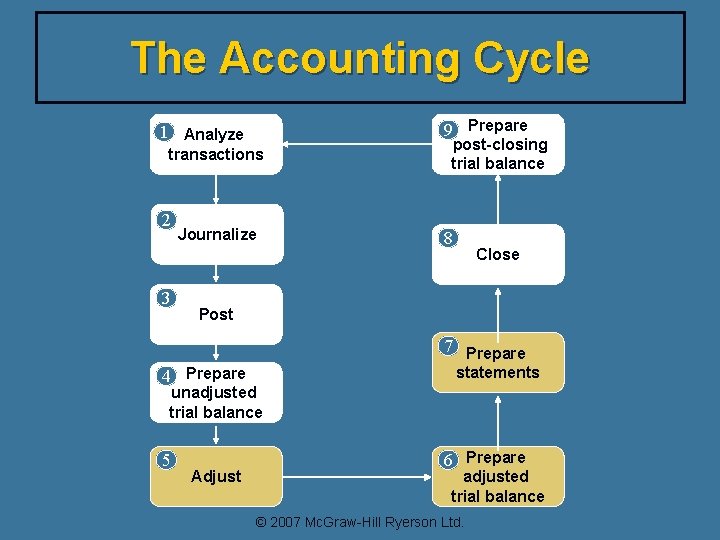

The Accounting Cycle 9 Prepare 1 Analyze transactions

- Slides: 46

The Accounting Cycle 9 Prepare 1 Analyze transactions 22 Journalize 3 post-closing trial balance 8 Close Post 7 Prepare 4 Prepare statements unadjusted trial balance 5 Adjust 6 Prepare adjusted trial balance © 2007 Mc. Graw-Hill Ryerson Ltd.

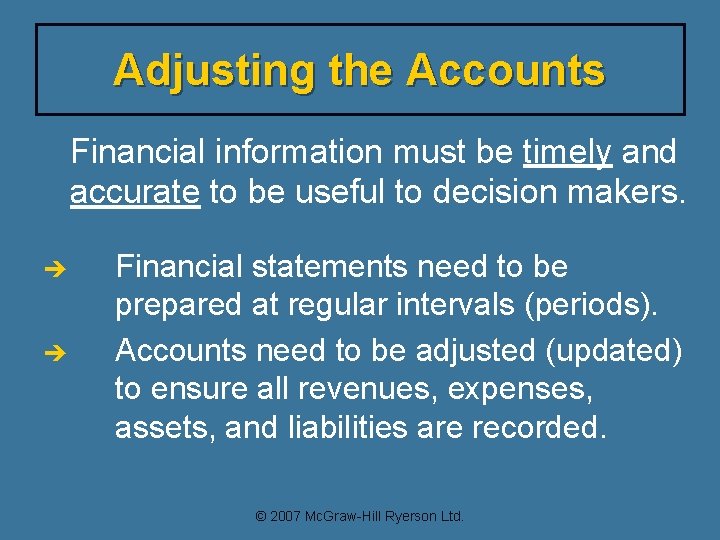

Adjusting the Accounts Financial information must be timely and accurate to be useful to decision makers. è è Financial statements need to be prepared at regular intervals (periods). Accounts need to be adjusted (updated) to ensure all revenues, expenses, assets, and liabilities are recorded. © 2007 Mc. Graw-Hill Ryerson Ltd.

GAAP and the Adjusting Process Adjustments are based on three generally accepted accounting principles: Ø Time period principle. Ø Revenue recognition principle. Ø Matching principle. © 2007 Mc. Graw-Hill Ryerson Ltd.

Accounting Principles Time Period Principle Assumes that the organization’s activities can be divided into specific time periods such as: Ø Months Ø Quarters Ø Years © 2007 Mc. Graw-Hill Ryerson Ltd.

Accounting Principles Revenue Recognition Principle Revenue is recorded at the time it is earned regardless of whether cash or another asset has been exchanged. Matching Principle Expenses are to be matched in the same accounting period as the revenues they helped to earn. © 2007 Mc. Graw-Hill Ryerson Ltd.

Cash vs. Accrual Basis Revenues and expenses are recognized when earned or incurred regardless of when cash is received or paid. Ø Consistent with GAAP. Ø Cash Basis Revenues and expenses are recognized when cash is received or paid. Ø Not consistent with GAAP. Ø © 2007 Mc. Graw-Hill Ryerson Ltd.

Adjustments Types: Ø Prepaid expenses Ø Amortization Ø Unearned revenues Ø Accrued expenses Ø Accrued revenues © 2007 Mc. Graw-Hill Ryerson Ltd.

Prepaid Expenses Costs paid in cash and recorded as assets before they are used are called prepaid expenses. Ø These costs expire with the passage of time or through use and consumption, e. g. , insurance, supplies. © 2007 Mc. Graw-Hill Ryerson Ltd.

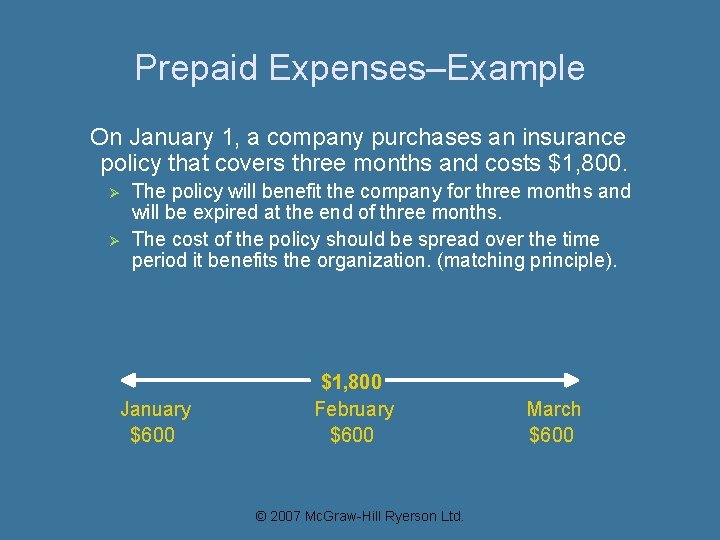

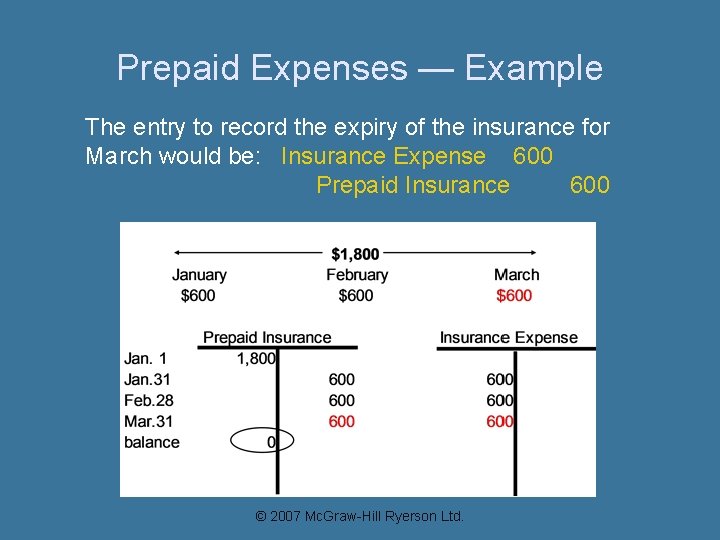

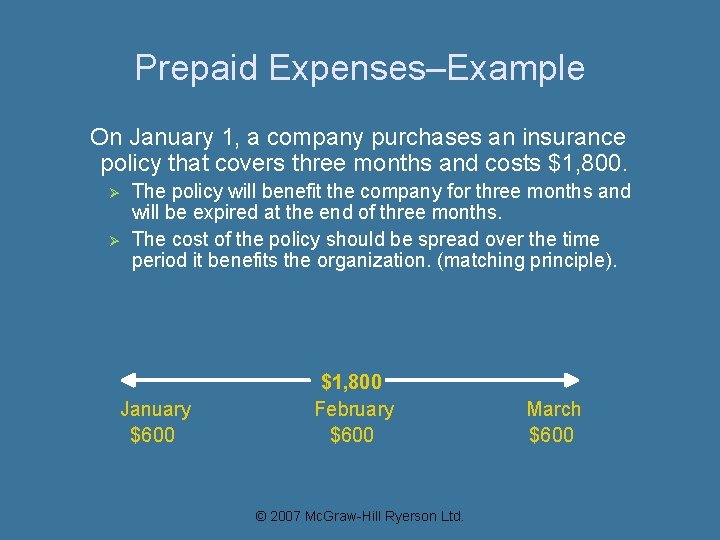

Prepaid Expenses–Example On January 1, a company purchases an insurance policy that covers three months and costs $1, 800. Ø Ø The policy will benefit the company for three months and will be expired at the end of three months. The cost of the policy should be spread over the time period it benefits the organization. (matching principle). January $600 $1, 800 February $600 © 2007 Mc. Graw-Hill Ryerson Ltd. March $600

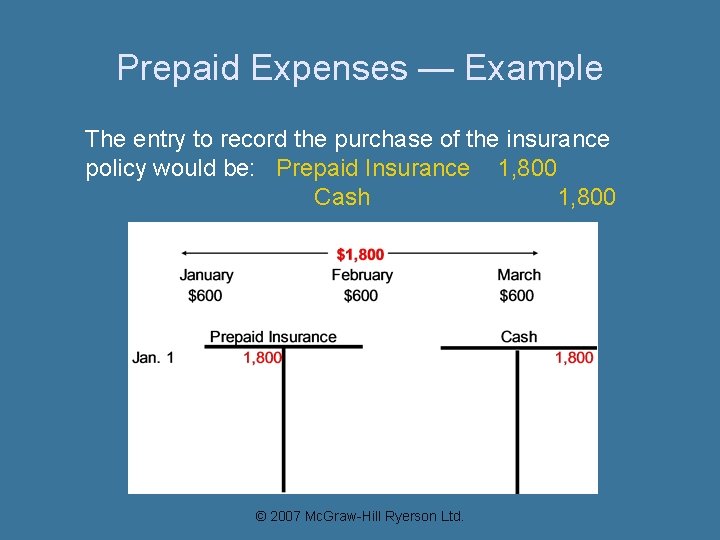

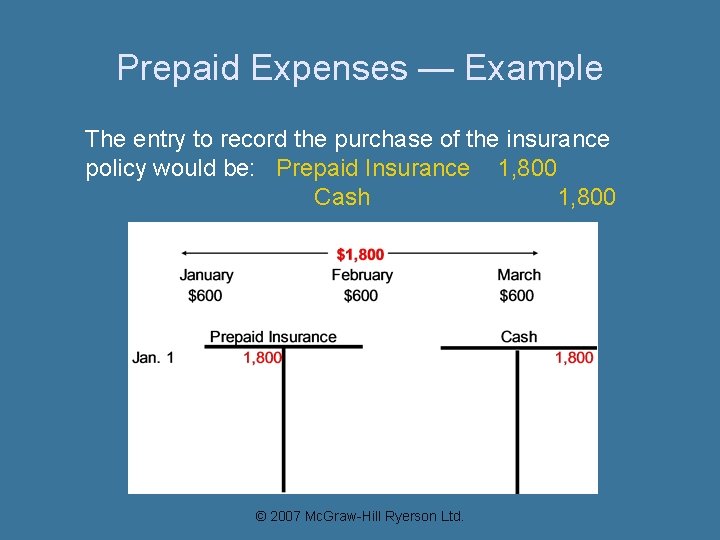

Prepaid Expenses — Example The entry to record the purchase of the insurance policy would be: Prepaid Insurance 1, 800 Cash 1, 800 $ 1 , 8 0 0 © 2007 Mc. Graw-Hill Ryerson Ltd.

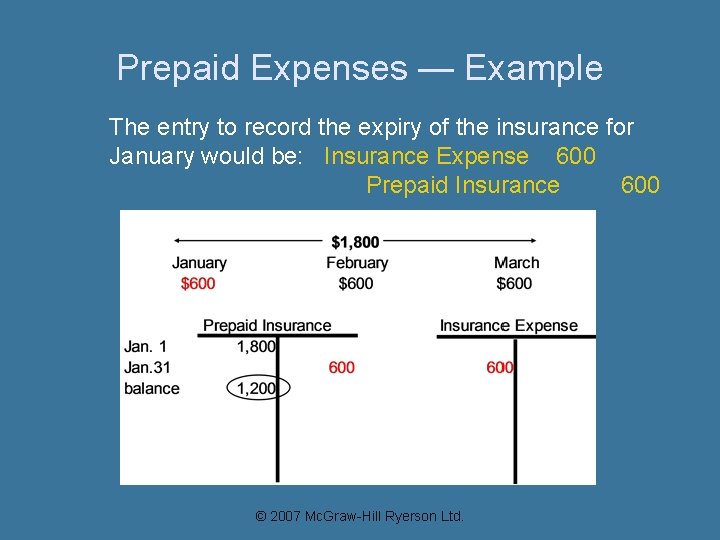

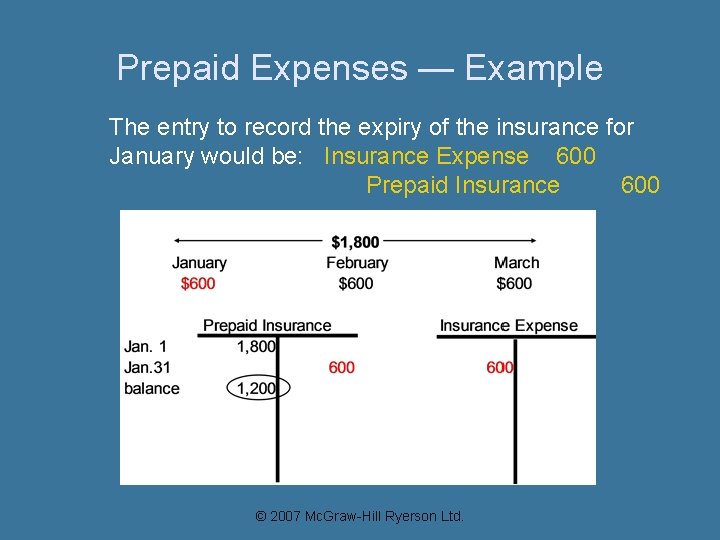

Prepaid Expenses — Example The entry to record the expiry of the insurance for January would be: Insurance Expense 600 Prepaid Insurance 600 $ 1 , 8 0 0 © 2007 Mc. Graw-Hill Ryerson Ltd.

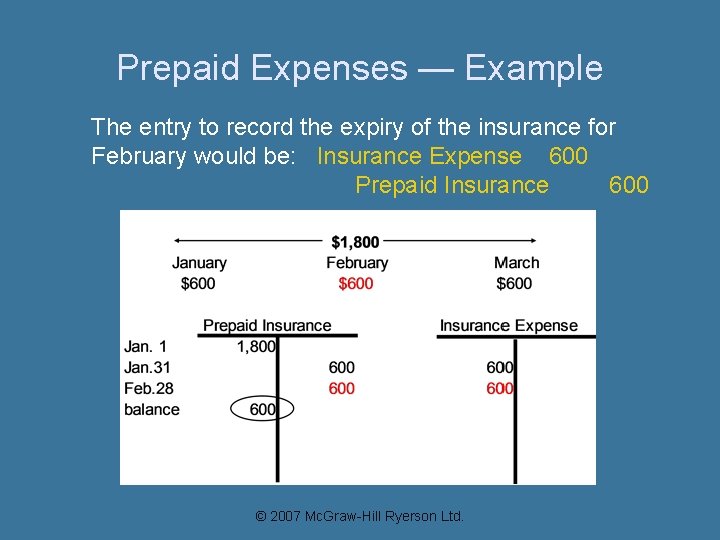

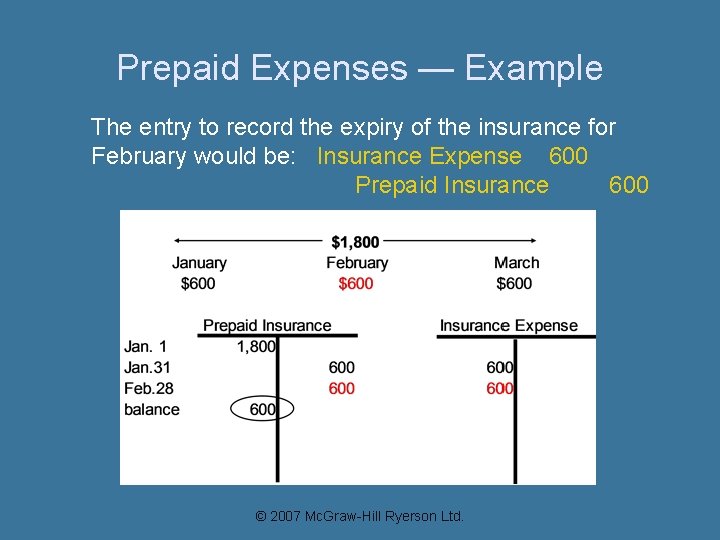

Prepaid Expenses — Example The entry to record the expiry of the insurance for February would be: Insurance Expense 600 Prepaid Insurance 600 $ 1 , 8 0 0 © 2007 Mc. Graw-Hill Ryerson Ltd.

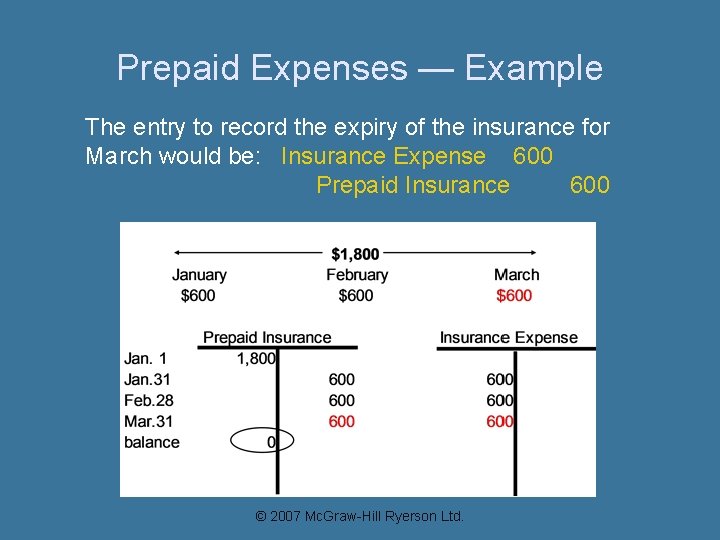

Prepaid Expenses — Example The entry to record the expiry of the insurance for March would be: Insurance Expense 600 Prepaid Insurance 600 $ 1 , 8 0 0 © 2007 Mc. Graw-Hill Ryerson Ltd.

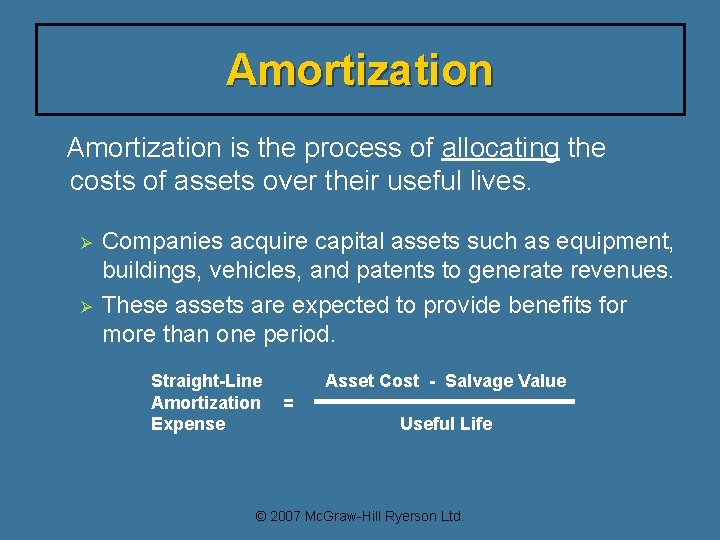

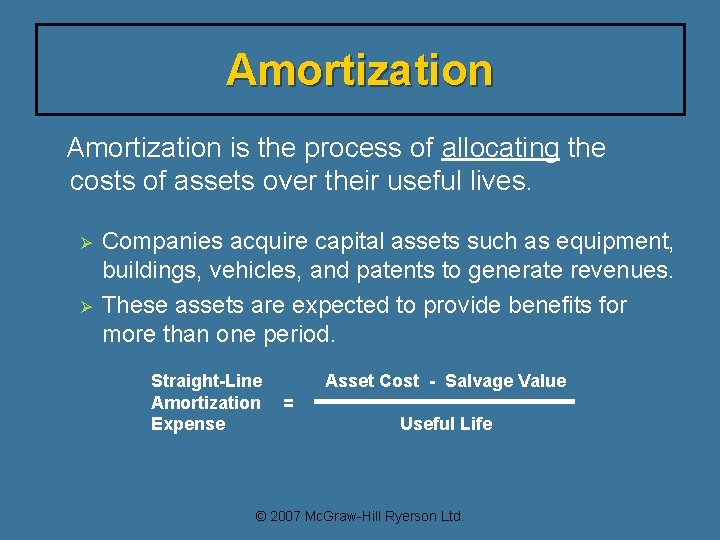

Amortization is the process of allocating the costs of assets over their useful lives. Ø Ø Companies acquire capital assets such as equipment, buildings, vehicles, and patents to generate revenues. These assets are expected to provide benefits for more than one period. Straight-Line Amortization Expense Asset Cost - Salvage Value = Useful Life © 2007 Mc. Graw-Hill Ryerson Ltd.

Unearned Revenues Cash received in advance of providing products and services. Ø The company has an obligation to provide goods or services. Ø Unearned revenues are liabilities. © 2007 Mc. Graw-Hill Ryerson Ltd.

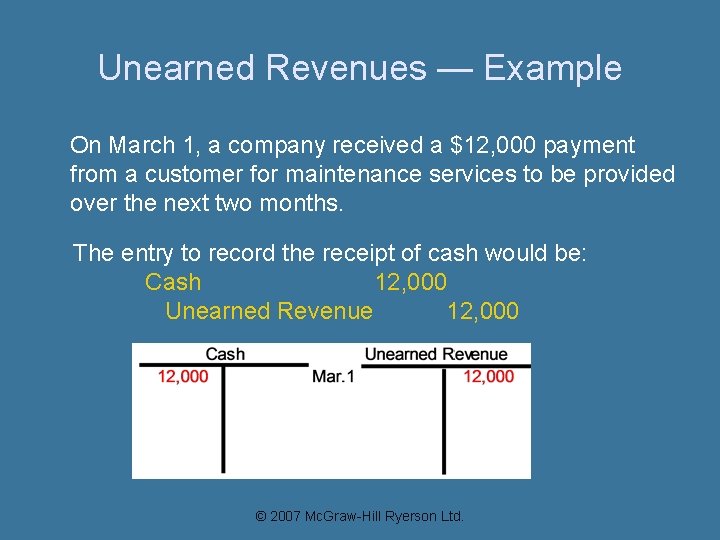

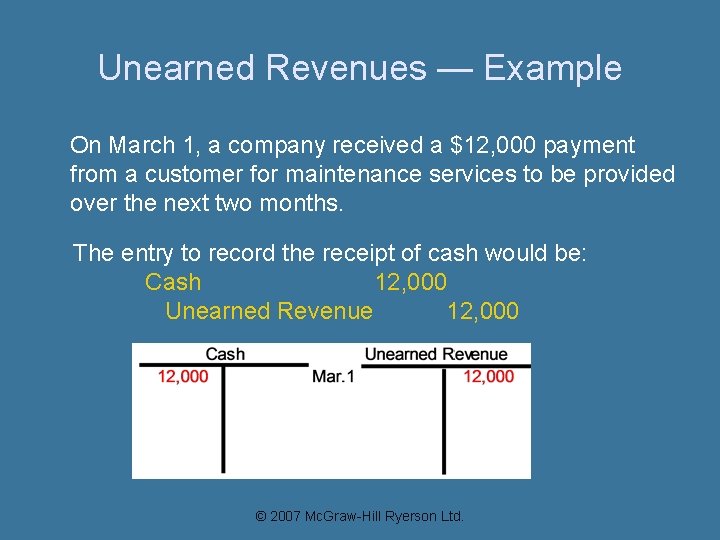

Unearned Revenues — Example On March 1, a company received a $12, 000 payment from a customer for maintenance services to be provided over the next two months. The entry to record the receipt of cash would be: Cash 12, 000 Unearned Revenue 12, 000 © 2007 Mc. Graw-Hill Ryerson Ltd.

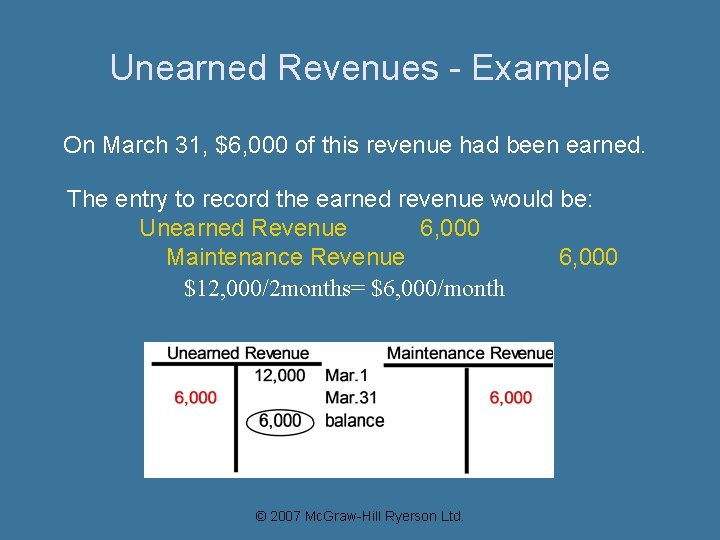

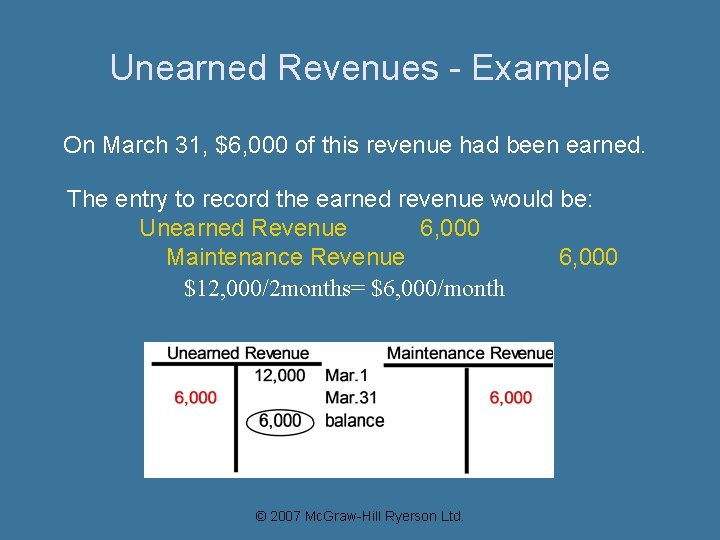

Unearned Revenues - Example On March 31, $6, 000 of this revenue had been earned. The entry to record the earned revenue would be: Unearned Revenue 6, 000 Maintenance Revenue 6, 000 $12, 000/2 months= $6, 000/month © 2007 Mc. Graw-Hill Ryerson Ltd.

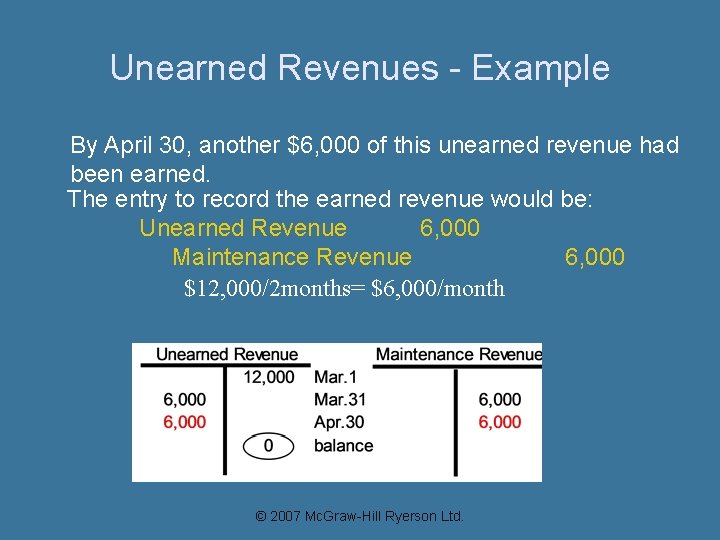

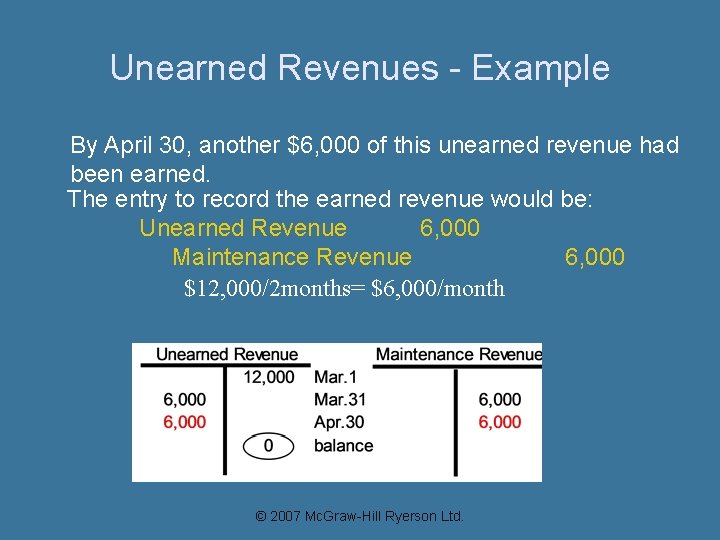

Unearned Revenues - Example By April 30, another $6, 000 of this unearned revenue had been earned. The entry to record the earned revenue would be: Unearned Revenue 6, 000 Maintenance Revenue 6, 000 $12, 000/2 months= $6, 000/month © 2007 Mc. Graw-Hill Ryerson Ltd.

Accrued Expenses Costs incurred in a period that are both unpaid and unrecorded. Ø Adjusting entries must be made to record the expense for the period and the related liability at the balance sheet date. Ø Examples: interest, wages, rent, taxes © 2007 Mc. Graw-Hill Ryerson Ltd.

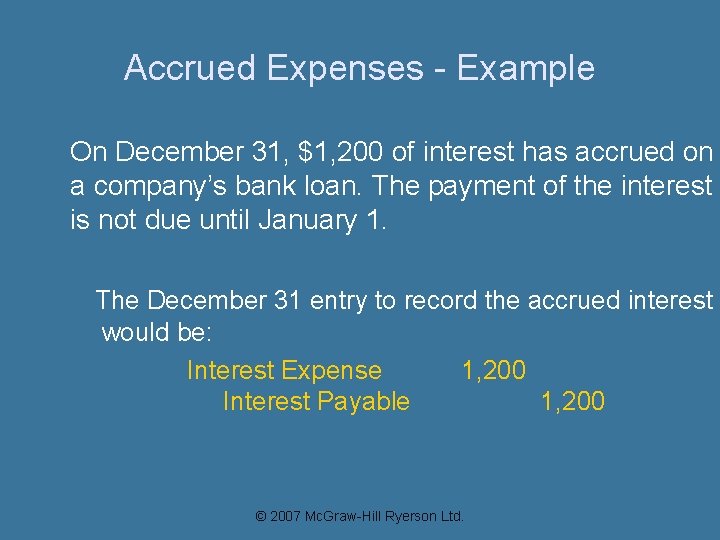

Accrued Expenses - Example On December 31, $1, 200 of interest has accrued on a company’s bank loan. The payment of the interest is not due until January 1. The December 31 entry to record the accrued interest would be: Interest Expense 1, 200 Interest Payable 1, 200 © 2007 Mc. Graw-Hill Ryerson Ltd.

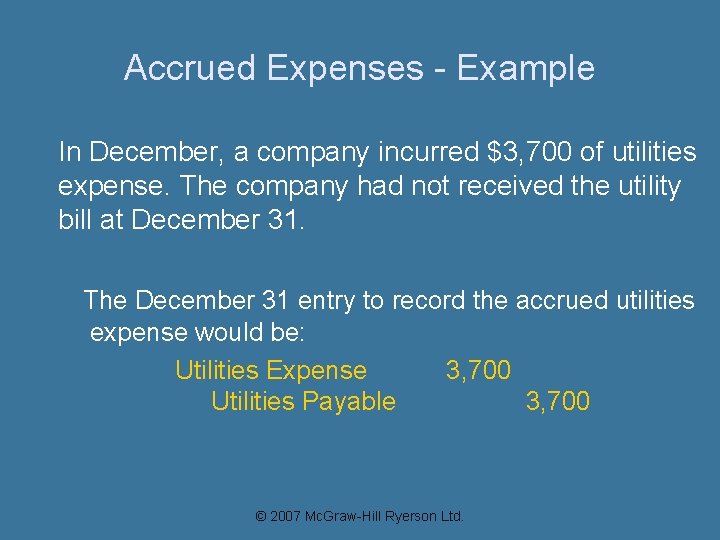

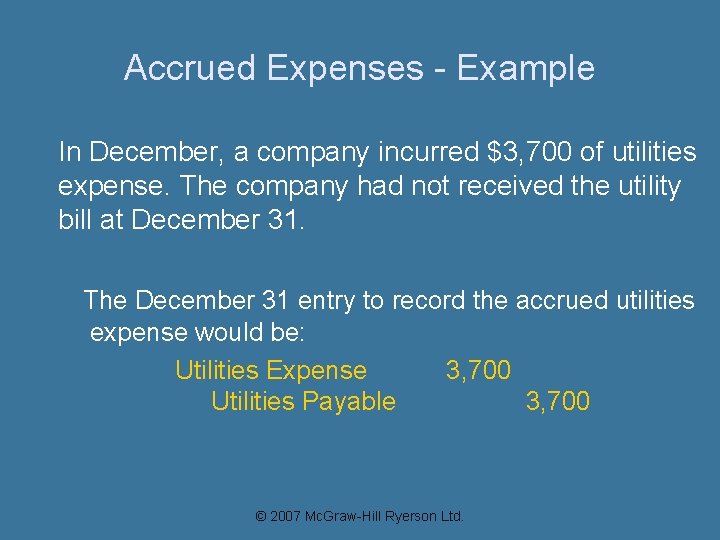

Accrued Expenses - Example In December, a company incurred $3, 700 of utilities expense. The company had not received the utility bill at December 31. The December 31 entry to record the accrued utilities expense would be: Utilities Expense 3, 700 Utilities Payable 3, 700 © 2007 Mc. Graw-Hill Ryerson Ltd.

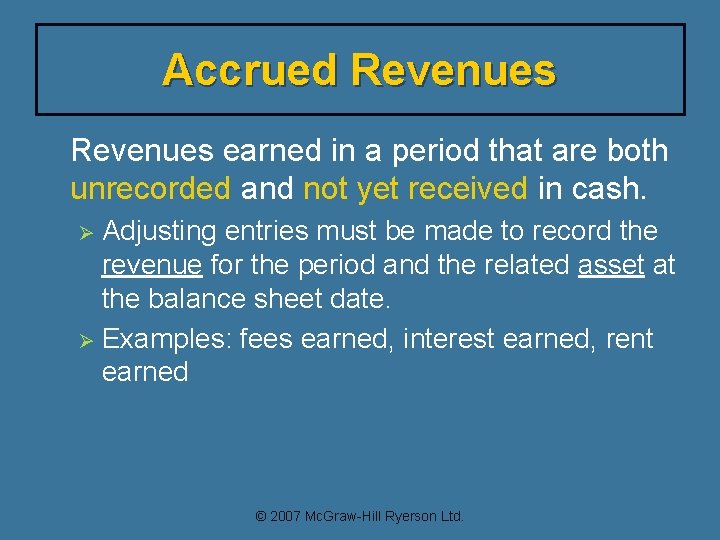

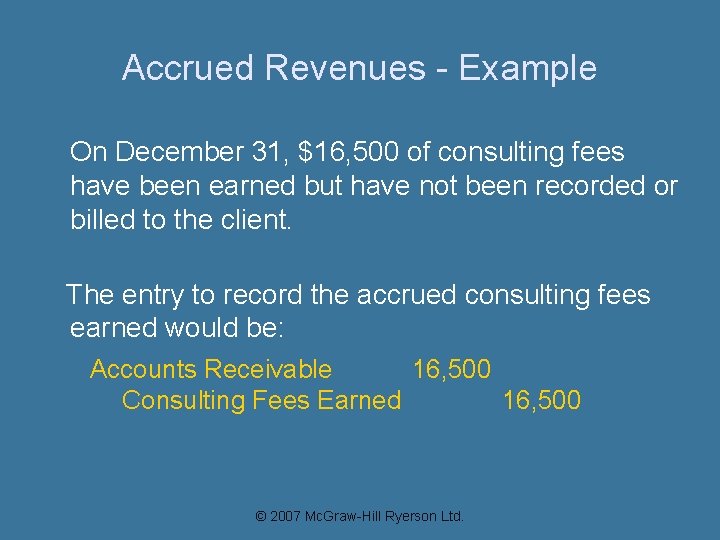

Accrued Revenues earned in a period that are both unrecorded and not yet received in cash. Adjusting entries must be made to record the revenue for the period and the related asset at the balance sheet date. Ø Examples: fees earned, interest earned, rent earned Ø © 2007 Mc. Graw-Hill Ryerson Ltd.

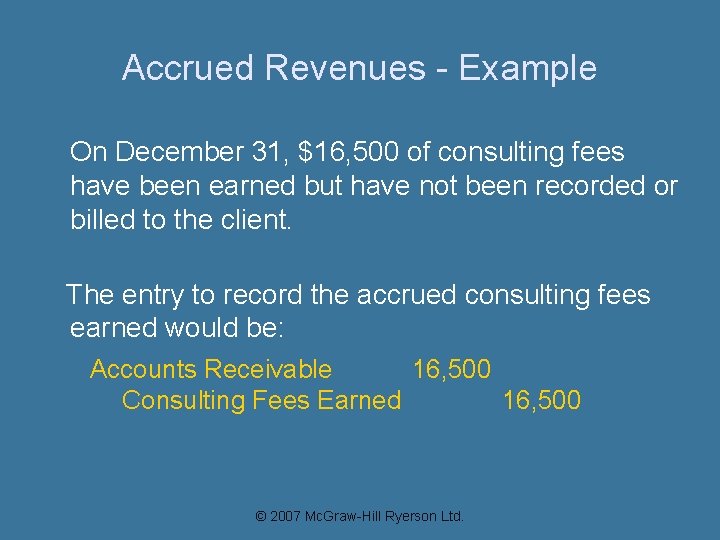

Accrued Revenues - Example On December 31, $16, 500 of consulting fees have been earned but have not been recorded or billed to the client. The entry to record the accrued consulting fees earned would be: Accounts Receivable 16, 500 Consulting Fees Earned 16, 500 © 2007 Mc. Graw-Hill Ryerson Ltd.

Adjustments & Financial Statements Adjustments are only made when financial statements are prepared. Ø Affect both the income statement and the balance sheet. Ø Do not affect cash. Ø © 2007 Mc. Graw-Hill Ryerson Ltd.

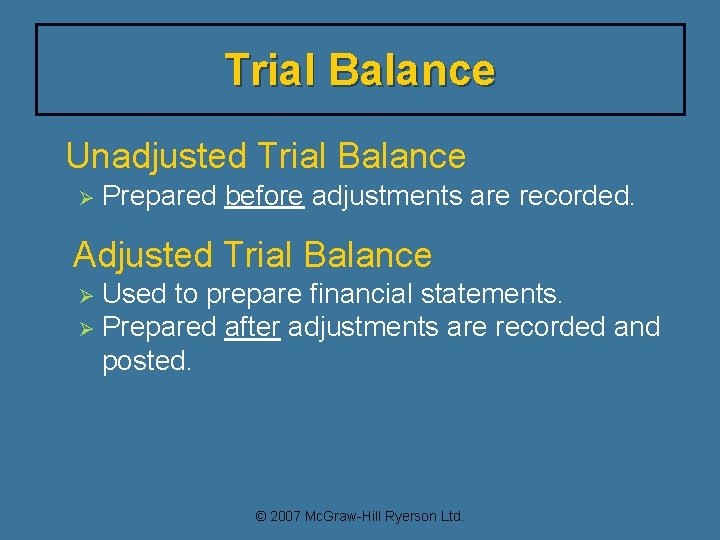

Trial Balance Unadjusted Trial Balance Ø Prepared before adjustments are recorded. Adjusted Trial Balance Used to prepare financial statements. Ø Prepared after adjustments are recorded and posted. Ø © 2007 Mc. Graw-Hill Ryerson Ltd.

Financial Statement Preparation Ø Ø Adjusting entries bring the accounts up-to-date. The adjusted trial balance is used to prepare the financial statements in the following order: Ø Ø Income Statement of Owner’s Equity Balance Sheet Cash Flow Statement © 2007 Mc. Graw-Hill Ryerson Ltd.

Review n n When and why are adjusting entries prepared? They are prepared when a company wishes to issue financial statements. Adjusting entries bring the account balances up-to-date. © 2007 Mc. Graw-Hill Ryerson Ltd.

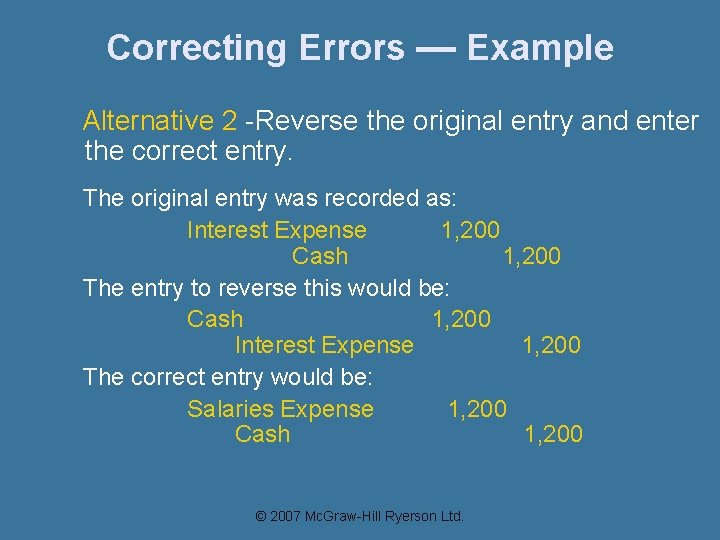

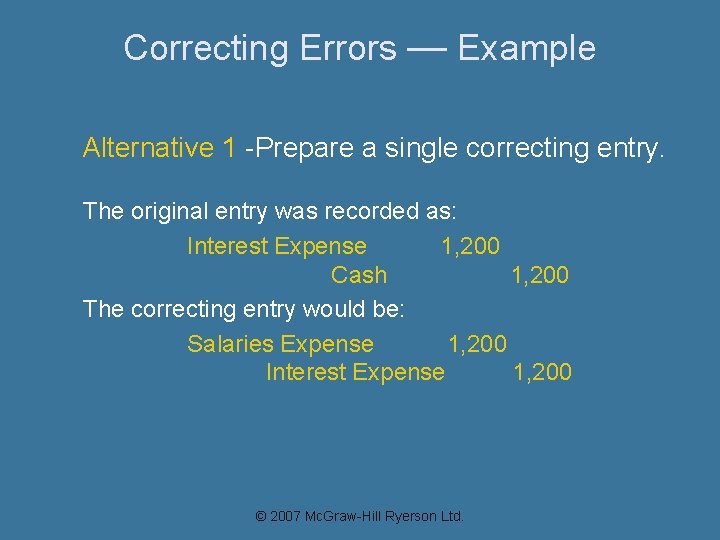

Correcting Errors — Example Alternative 1 -Prepare a single correcting entry. The original entry was recorded as: Interest Expense 1, 200 Cash 1, 200 The correcting entry would be: Salaries Expense 1, 200 Interest Expense 1, 200 © 2007 Mc. Graw-Hill Ryerson Ltd.

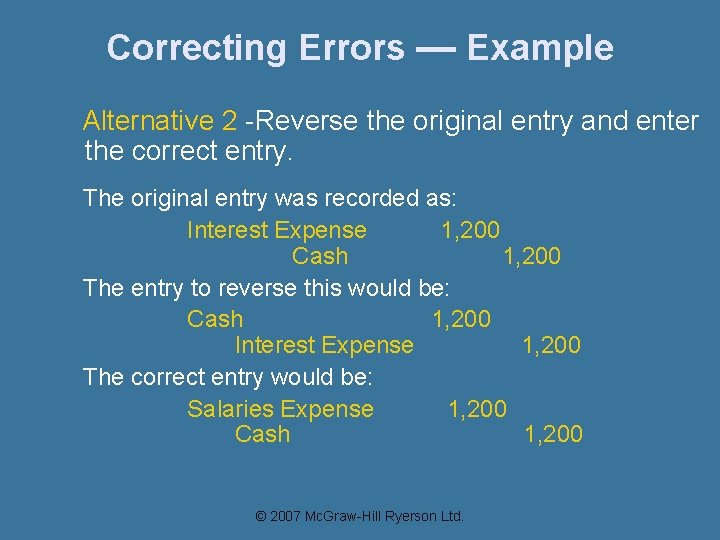

Correcting Errors — Example Alternative 2 -Reverse the original entry and enter the correct entry. The original entry was recorded as: Interest Expense 1, 200 Cash 1, 200 The entry to reverse this would be: Cash 1, 200 Interest Expense 1, 200 The correct entry would be: Salaries Expense 1, 200 Cash 1, 200 © 2007 Mc. Graw-Hill Ryerson Ltd.

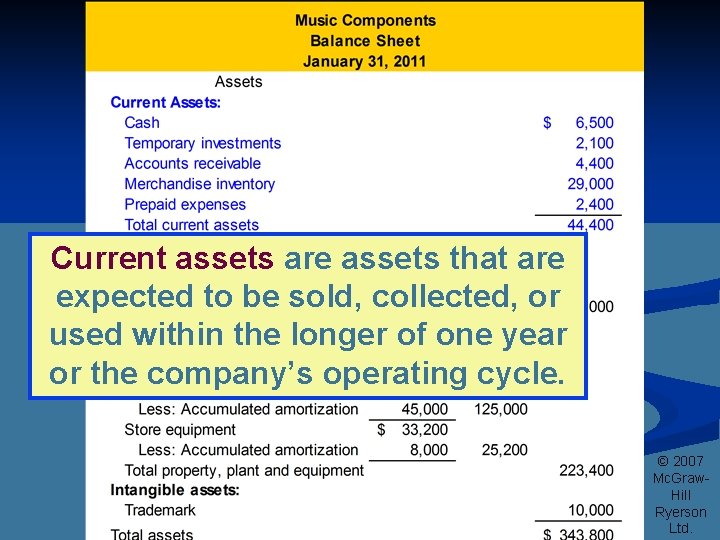

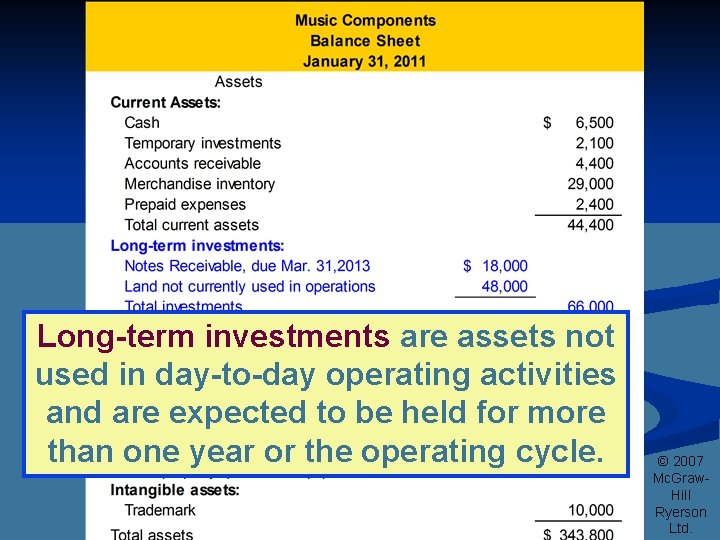

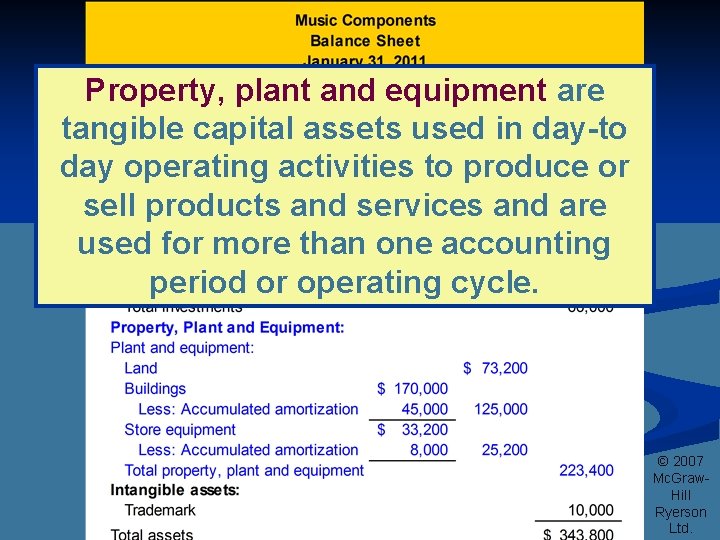

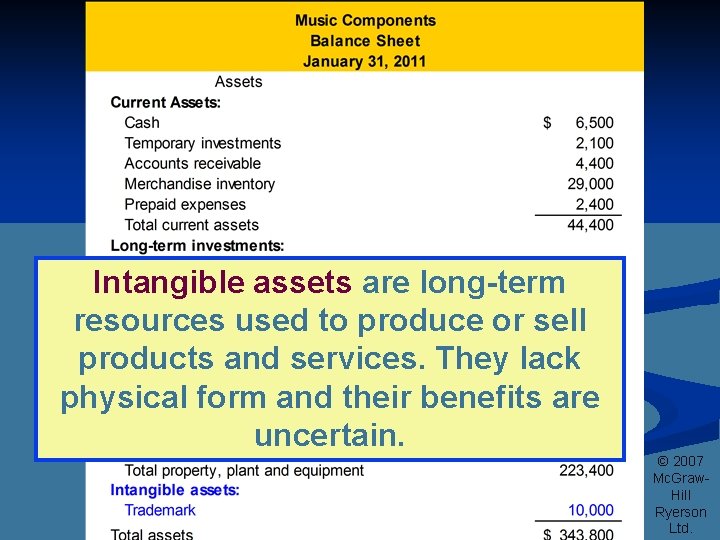

Classified Balance Sheet A balance sheet that presents the assets and liabilities in relevant subgroups. It provides users with more useful information for decision making. © 2007 Mc. Graw-Hill Ryerson Ltd.

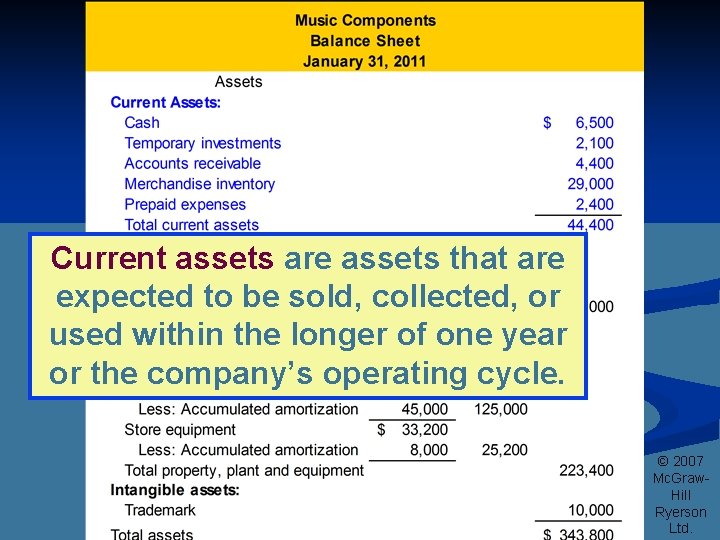

Current assets are assets that are expected to be sold, collected, or used within the longer of one year or the company’s operating cycle. © 2007 Mc. Graw. Hill Ryerson Ltd.

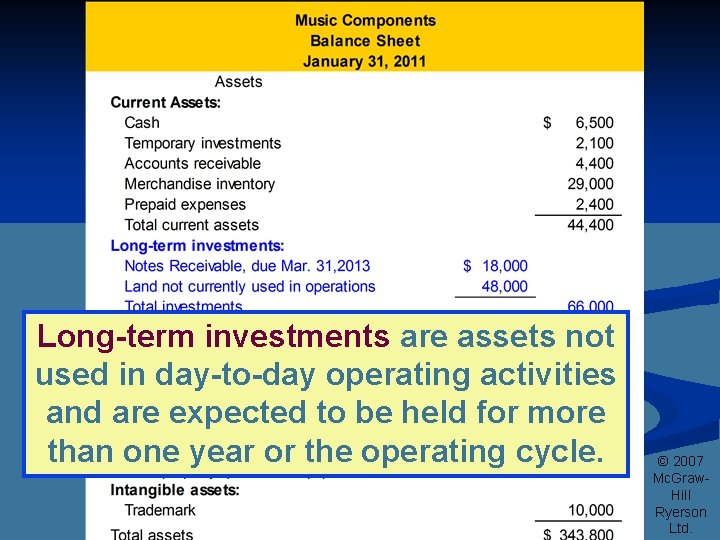

Long-term investments are assets not used in day-to-day operating activities and are expected to be held for more than one year or the operating cycle. © 2007 Mc. Graw. Hill Ryerson Ltd.

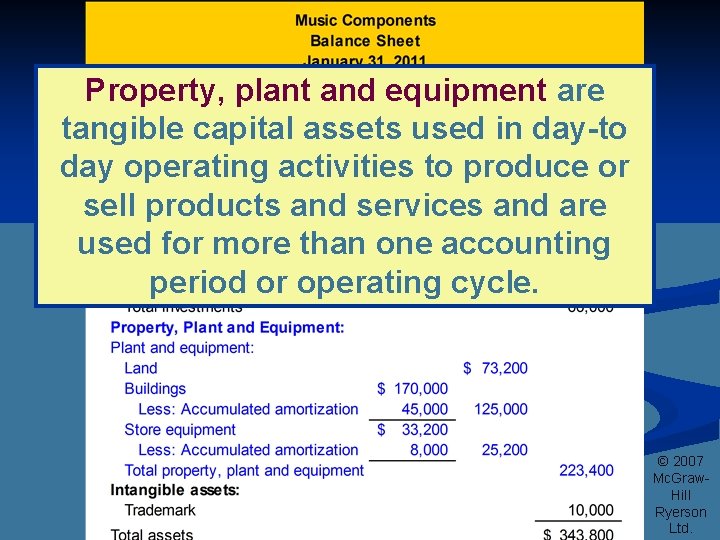

Property, plant and equipment are tangible capital assets used in day-to day operating activities to produce or sell products and services and are used for more than one accounting period or operating cycle. © 2007 Mc. Graw. Hill Ryerson Ltd.

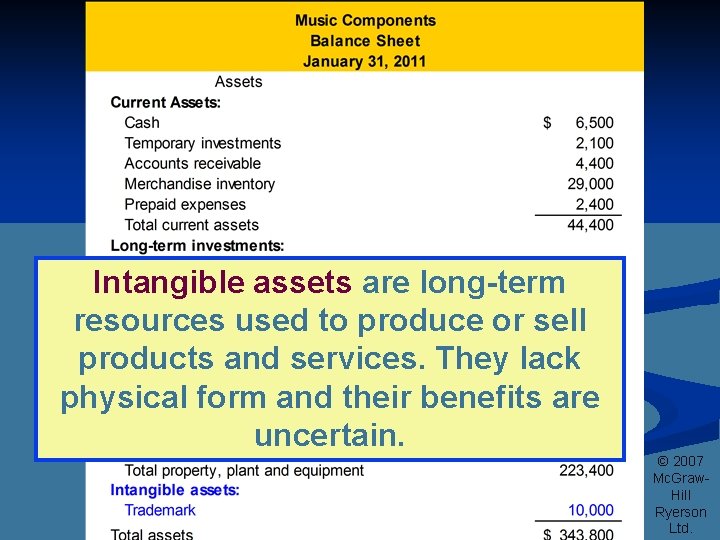

Intangible assets are long-term resources used to produce or sell products and services. They lack physical form and their benefits are uncertain. © 2007 Mc. Graw. Hill Ryerson Ltd.

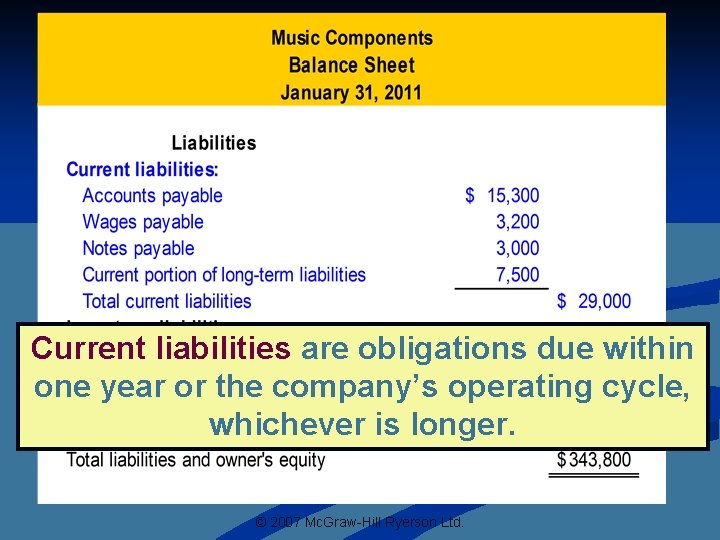

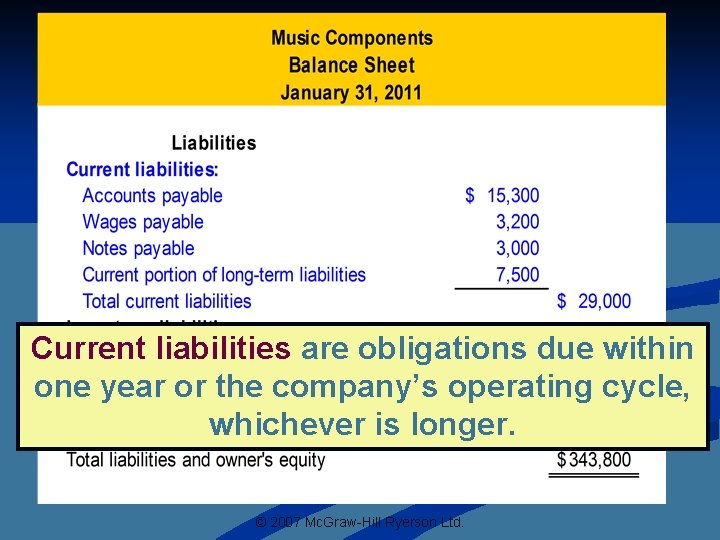

Current liabilities are obligations due within one year or the company’s operating cycle, whichever is longer. © 2007 Mc. Graw-Hill Ryerson Ltd.

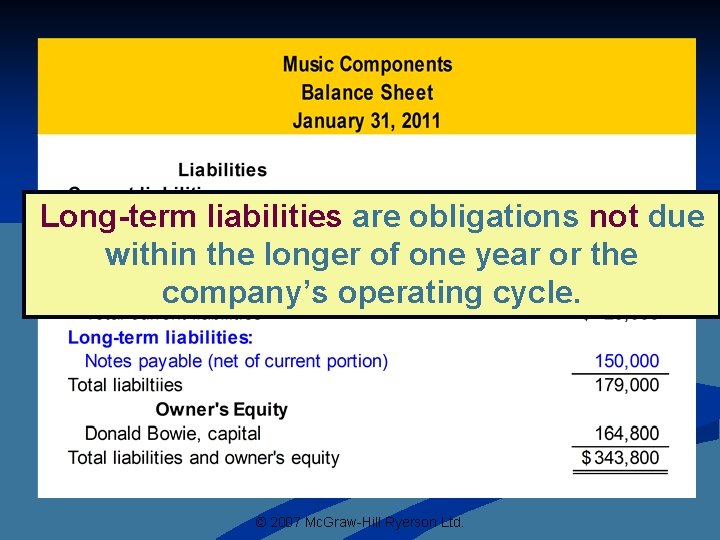

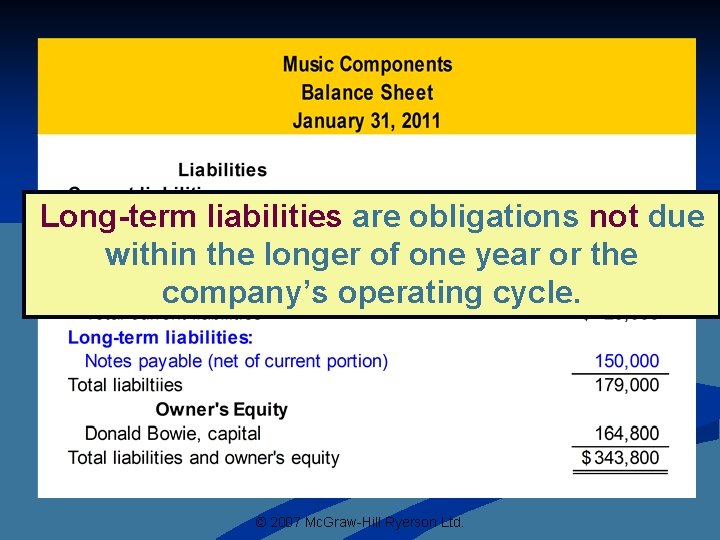

Long-term liabilities are obligations not due within the longer of one year or the company’s operating cycle. © 2007 Mc. Graw-Hill Ryerson Ltd.

Multi Step Income Statement n An income statement that contains one or more subtotals that highlight significant relationships. 4 -37 © 2005 Mc. Graw-Hill Ryerson Limited.

Single Step Income Statement n An income statement that groups all revenues together and then lists and deducts alls expenses together without drawing any intermediate sub totals. 4 -38 © 2005 Mc. Graw-Hill Ryerson Limited.

Gross Profit n The excess of sales revenue over the cost of the inventory that was sold 4 -39 © 2005 Mc. Graw-Hill Ryerson Limited.

Operating income n Gross profit less all operating expenses 4 -40 © 2005 Mc. Graw-Hill Ryerson Limited.

Gross Margin Percentage n n Gross Profit divided by sales Useful to retailer in choosing a pricing strategy and in judging results 4 -41 © 2005 Mc. Graw-Hill Ryerson Limited.

Return on Sales Ratio n n n Net income divided by sales Shows the relationship between net income to sales revenue. Followed closely by managers 4 -42 © 2005 Mc. Graw-Hill Ryerson Limited.

Return on Stockholder’s Equity n n Net income divided by invested capital Regarded as the ultimate measure of overall accomplishment. 4 -43 © 2005 Mc. Graw-Hill Ryerson Limited.

4 -44 © 2005 Mc. Graw-Hill Ryerson Limited.

IASB n n International Accounting Standards Board An organization charged with responsibility for developing a common set of accounting standards to be used hthe world. 4 -45 © 2005 Mc. Graw-Hill Ryerson Limited.

End of Chapter © 2007 Mc. Graw-Hill Ryerson Ltd.