Technology Private Equity Funds Jonathan H Holley Jasper

- Slides: 11

Technology Private Equity Funds Jonathan H. Holley Jasper Asset Management

The Challenge in Defining Technology in PE Funds § Often associated with Information Technology and Web 1. 0 • • Google and Yahoo! Microsoft Oracle Sun Microsystems § Recently focused on Alternative and Clean Energy Technology, “Viral” Internet Communities and Digital Convergence • • • Non-corn ethanol processing technologies Bio-diesel Hybrid engine technologies Social networking business models Voice over Internet Protocol (Vo. IP) networks and digital media transmission (incl. High Definition) § Starting to embrace Technology Solution Bundles • • Page 2 Intelligent Building solutions Wireless telecom and Radio Frequency Identification Devices (RFID). Mostly for integrated supply chain tracking. Unmanned security technologies Web 2. 0 Services

Differentiating Venture from Mezzanine/Late Stage Technology § Technology Venture Capital Funds: • • • Funds invest in the development of ideas and new applications, usually in a trend sector with an uncertain commercial environment Average portfolio company investment is US$1. 0 -2. 0 million Technology VC funds tend to average US$50 million in size - - not mega-funds Average Internal Rate of Return is 12%. Top quartile funds average 22%. Failure rate of portfolio investments average 35% of invested capital § Mezzanine/Late Stage Technology Funds: • • • Funds invest in developed products or services requiring enhanced working capital, new management and commercialization funding Usually has secured intellectual property rights protection Average IRR is 14%. Top quartile funds average 27%. Failure rate is 15 -20%. § Technology Funds utilized in lieu of In-House Research & Development • • • Page 3 Venture arms of major enterprise software and telecommunication companies Sponsorship of university “incubators” with equity participation Range from Venture through Late-Stage with common goal of ensuring commercial focus and speed to market

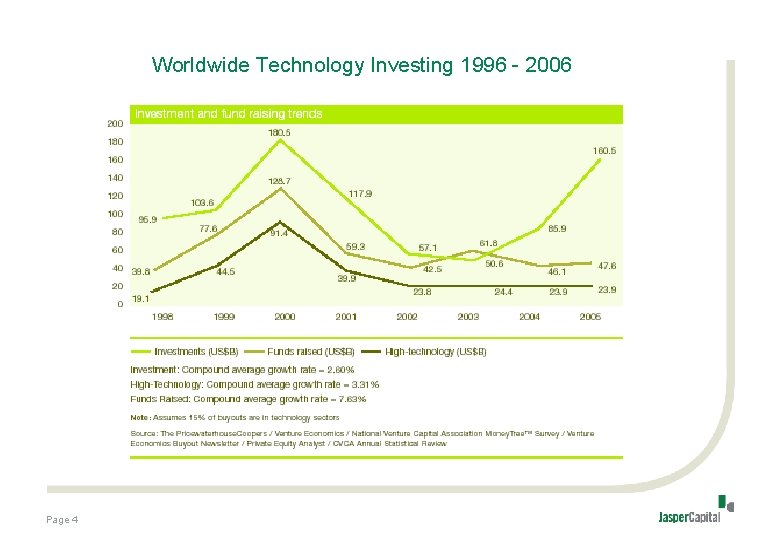

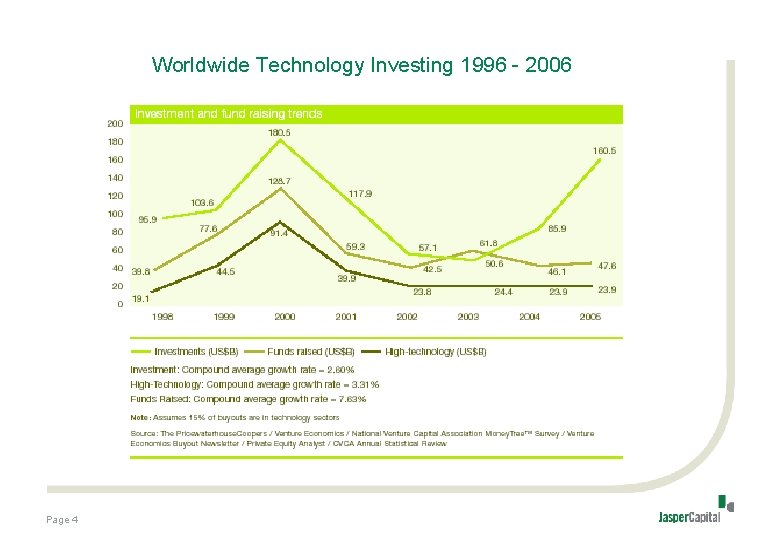

Worldwide Technology Investing 1996 - 2006 Page 4

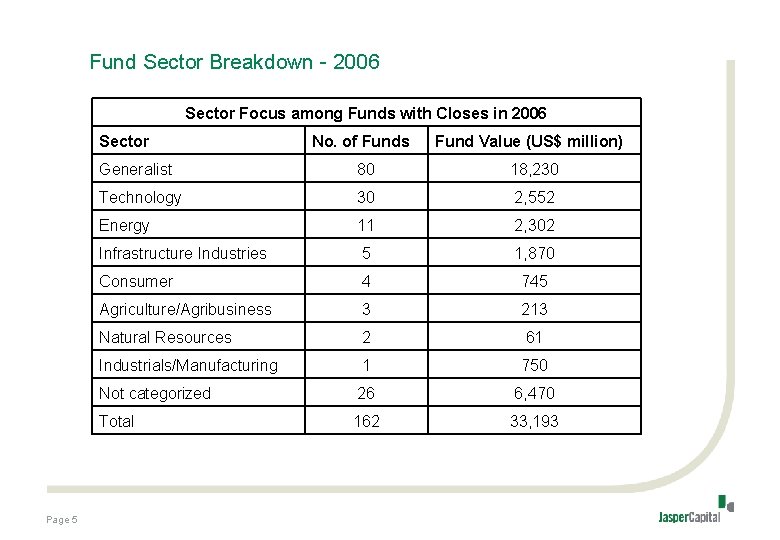

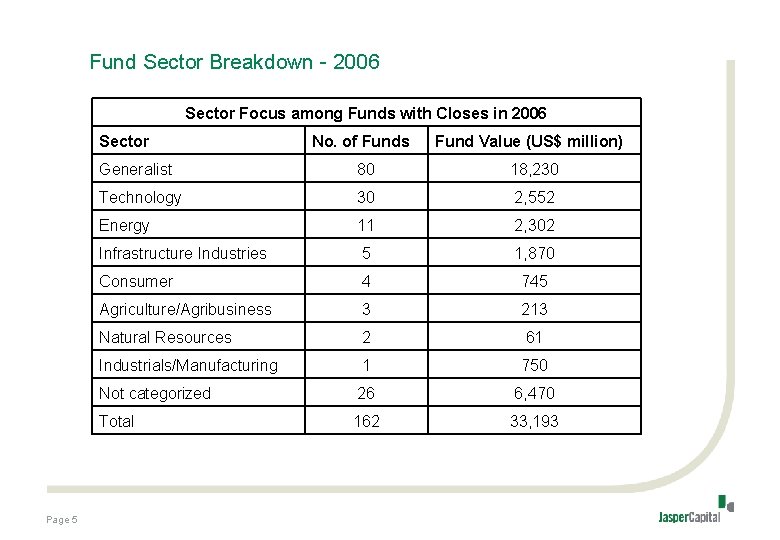

Fund Sector Breakdown - 2006 Sector Focus among Funds with Closes in 2006 Sector Page 5 No. of Funds Fund Value (US$ million) Generalist 80 18, 230 Technology 30 2, 552 Energy 11 2, 302 Infrastructure Industries 5 1, 870 Consumer 4 745 Agriculture/Agribusiness 3 213 Natural Resources 2 61 Industrials/Manufacturing 1 750 Not categorized 26 6, 470 Total 162 33, 193

Technology PE Funds are currently focused on Clean Technology • Global venture capital investment in clean technology companies surged to $1. 1 billion in the first six months of 2007 alone • Propelled by activity in the US, 2007 venture capital investment in clean technology companies are now on track to increase by more than 35% compared to 2006 • 71 clean tech deals were closed in the first six months of 2007 in the US and Europe raising over $893 million - - about 5% more year-onyear from 2006 • Globally, the valuations of clean technology companies are substantial. For example, in the US, median valuations reached $30 million in the first half of this year – up from $15. 8 million in 2001. Page 6

Recent Technology Investing in Europe § Information technology had the most significant upturn of any industry in the first quarter of 2007. § In total, € 550. 2 million was invested in 133 technology deals, representing € 30. 1 million more in capital and 11 more deals from the first quarter of a year ago. § The software and information services segments showed the most activity for the sector. Software deals increased by 20% over the same period a year ago to 73, and investment increased 11% to € 222. 5 million. § More dramatically, deal flow in the information services segment increased 131% to 30 deals, and capital increased more than twofold to € 114. 7 million. § In addition, the number of IPOs for information services companies doubled over the past year and this is likely a factor in investors' preference for the segment this quarter. Page 7

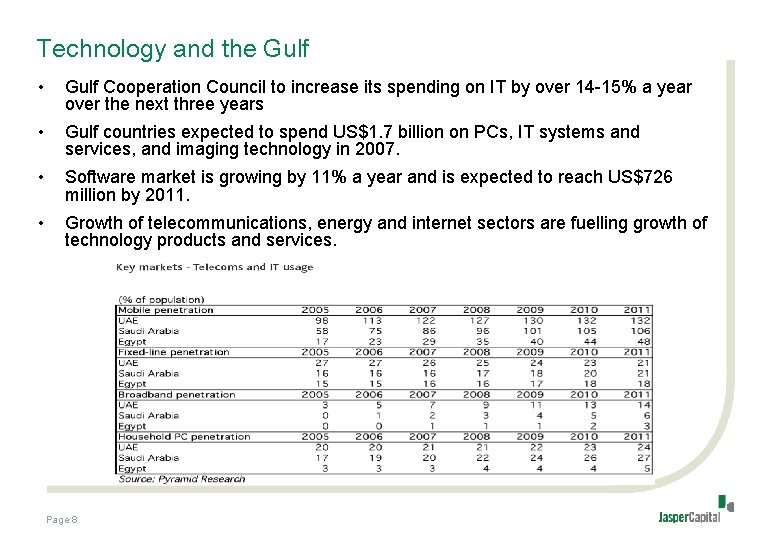

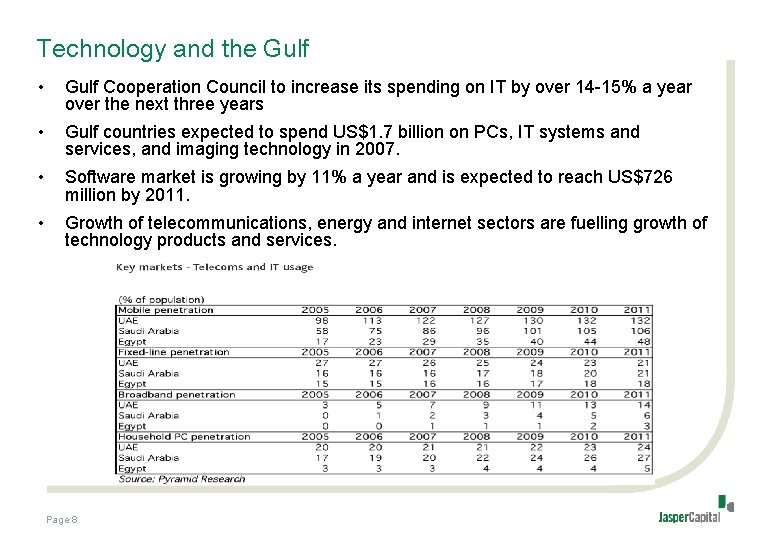

Technology and the Gulf • Gulf Cooperation Council to increase its spending on IT by over 14 -15% a year over the next three years • Gulf countries expected to spend US$1. 7 billion on PCs, IT systems and services, and imaging technology in 2007. • Software market is growing by 11% a year and is expected to reach US$726 million by 2011. • Growth of telecommunications, energy and internet sectors are fuelling growth of technology products and services. Page 8

Sharia’a-Compliant Investment in Technology Funds § Conservative view often is Tech Venture Capital Funds are tantamount to gambling due to very high valuations and high failure rates - - rarely invest § Will support Sharia’a compliant Mezz/Late Stage Funds with a focus on product commercialization, usually in the energy, automation/controls, intelligent building and manufacturing technology sectors - - although fund participation is very low due to the prevalent use of leverage in funds to enhance returns § Jasper opinion is Sharia’a compliant technology funds will emerge once MENA financial exchanges develop more fully, and then will dominate regional Gulf technology investing Page 9

Observations of Technology Sector in the Gulf § The GCC is considered to buy 95% of the technology it needs from overseas - - effectively no domestic tech industry § Country-sponsored technology initiatives are underway in most GCC countries to reverse the investment trend from US/EU/Asia to GCC - limited success due to real estate and energy focus of investors § Cooperative technology initiatives between the GCC and Asian countries has rapidly expanded due to cooling of US IPO markets and high cost of regulatory compliance. Recent Mubadala (UAE) technology agreements with South Korea are noteworthy. § The GCC technology sector will continue to struggle without a coordinated education initiative in the region. Technology is fuelled by younger, innovative generations. § Will need to develop an acceptance of technology venturing and its associated failure rates Page 10

Jasper Capital group companies Jasper Asset Management Limited Jasper Capital Turkey Limited Jasper Consult DMCC Jasper Consult Limited Jasper Corporate Finance Limited Jasper Private India Limited London Abu Dhabi Dubai Bury House 33 Bury Street St James’s SW 1 Y 6 AX London United Kingdom Tel: +44 (0) 20 7839 8766 Fax: +44 (0) 20 7839 1810 Jasper Consult Limited 2102, Level P 1 Al Lu. Lu Tower B Khalifa Street PO Box 45168, Abu Dhabi United Arab Emirates Tel: +971 (0) 2 627 1834 Fax: +971 (0) 2 627 1834 Jasper Consult DMCC 1007, Level 10 Grosvenor House Commercial Tower Sheikh Zayed Road PO Box 58549, Dubai United Arab Emirates Tel: +971 (0) 4 329 8799 Fax: +971 (0) 4 329 8797 Istanbul New Delhi Jasper Capital Turkey Limited Ebulullah Caddesí, Meydan Sokao Mermerler Sítesí Blok D 3, Akatlar 34335 Istanbul, Turkey T +90 (0) 212 352 6010 F +90 (0) 212 352 1888 Jasper Private India Limited 101 -C Super Mart – II, DLF – IV Gurgaon 122 022, Gurgaon New Delhi, India Tel: +91 124 404 0498/99 Fax: +91 124 404 4295 www. jaspercapital. co. uk info@jaspercapital. co. uk Page 11