Taxation Corporate Tax Chapter 5 Corporate Tax Step

- Slides: 7

Taxation Corporate Tax Chapter 5

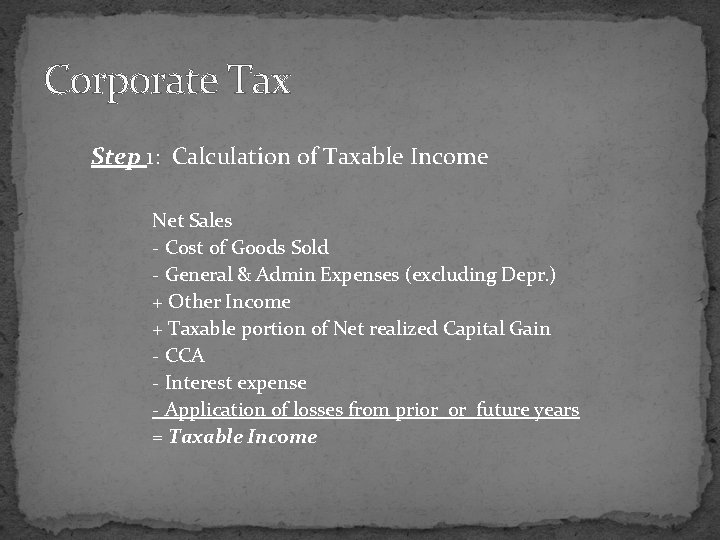

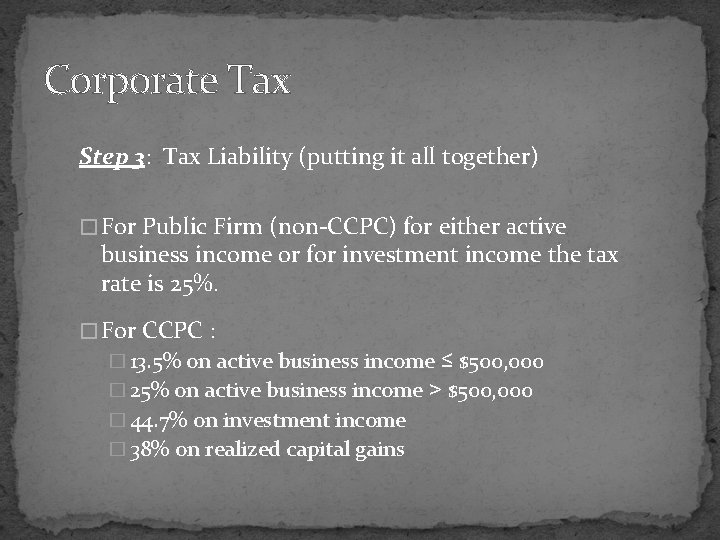

Corporate Tax Step 1: Calculation of Taxable Income Net Sales - Cost of Goods Sold - General & Admin Expenses (excluding Depr. ) + Other Income + Taxable portion of Net realized Capital Gain - CCA - Interest expense - Application of losses from prior or future years = Taxable Income

Notes: 1) There is a high degree of commonality between Taxable Income and Net Income, but the two are distinct. 2) CCA is depreciation for tax purposes, mandated by the government and differs from financial statement depreciation 3) Taxable portion of Net realized Capital Gain = 50% (Sales Price less expenses minus Purchase Price less expenses)

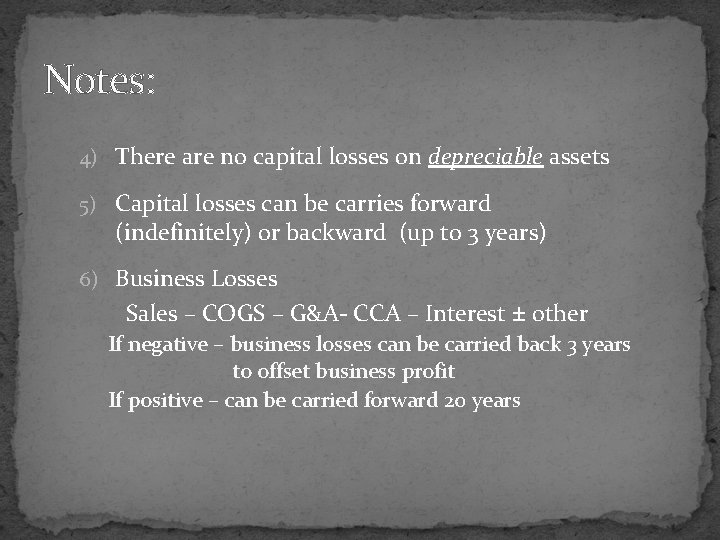

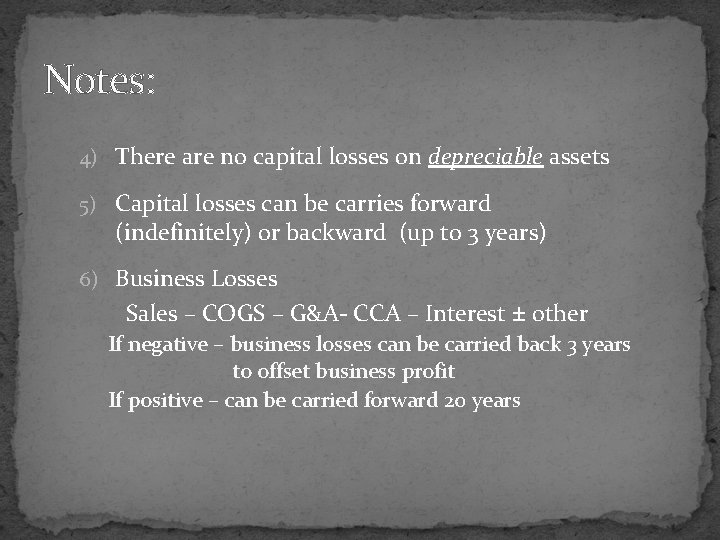

Notes: 4) There are no capital losses on depreciable assets 5) Capital losses can be carries forward (indefinitely) or backward (up to 3 years) 6) Business Losses Sales – COGS – G&A- CCA – Interest ± other If negative – business losses can be carried back 3 years to offset business profit If positive – can be carried forward 20 years

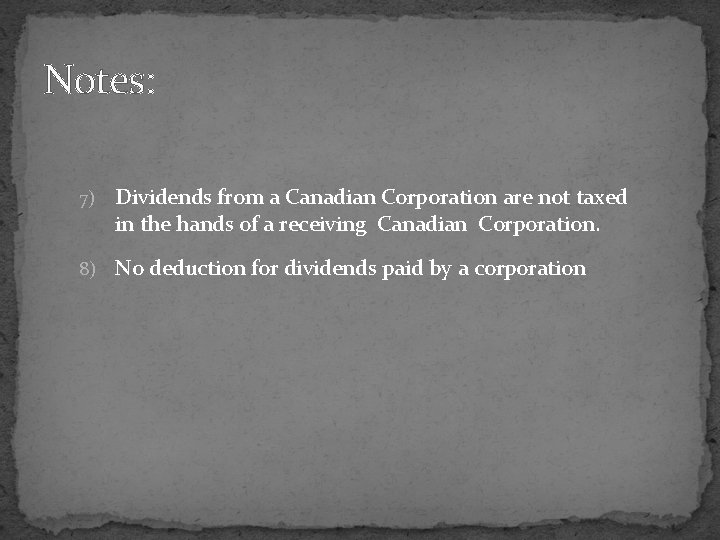

Notes: 7) Dividends from a Canadian Corporation are not taxed in the hands of a receiving Canadian Corporation. 8) No deduction for dividends paid by a corporation

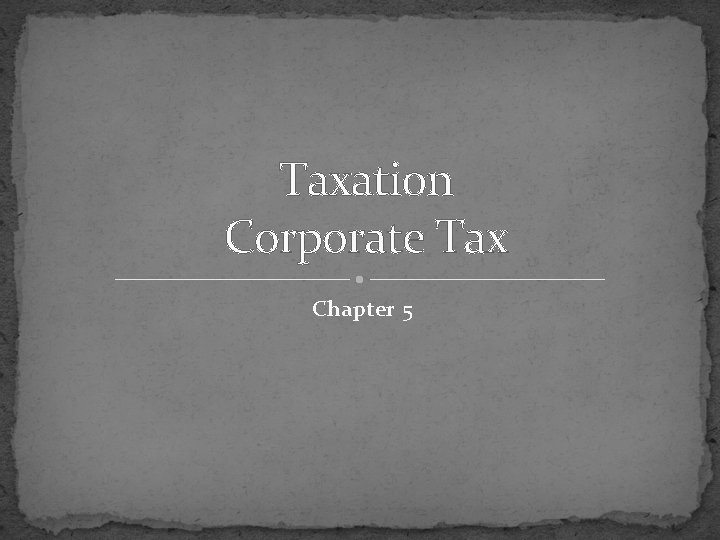

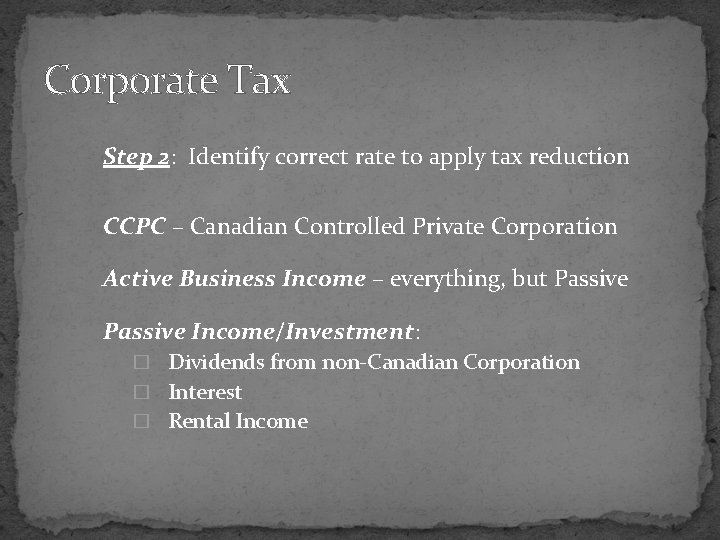

Corporate Tax Step 2: Identify correct rate to apply tax reduction CCPC – Canadian Controlled Private Corporation Active Business Income – everything, but Passive Income/Investment: � Dividends from non-Canadian Corporation � Interest � Rental Income

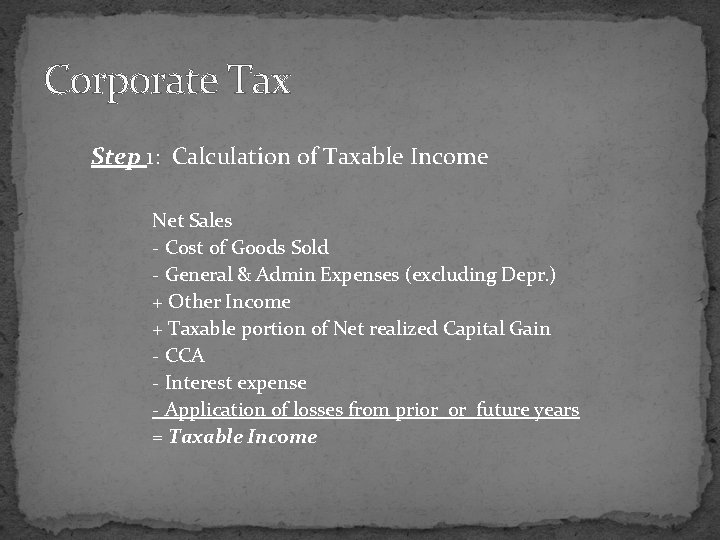

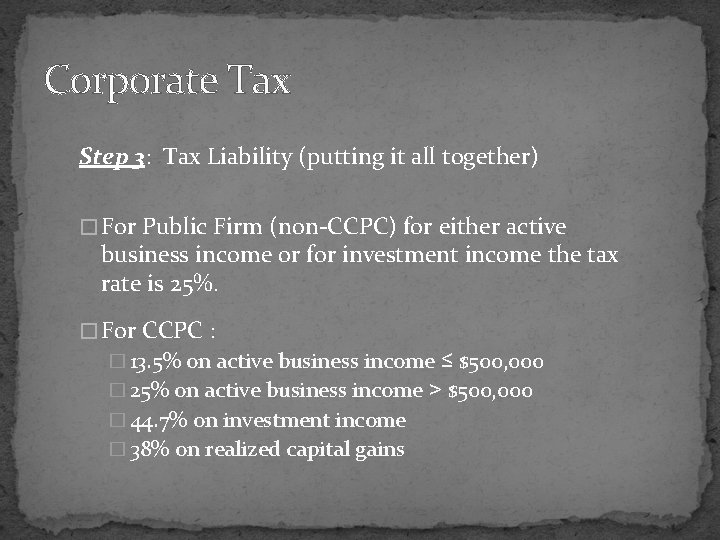

Corporate Tax Step 3: Tax Liability (putting it all together) � For Public Firm (non-CCPC) for either active business income or for investment income the tax rate is 25%. � For CCPC : � 13. 5% on active business income ≤ $500, 000 � 25% on active business income > $500, 000 � 44. 7% on investment income � 38% on realized capital gains