Tamil Nadu Development Imperatives and Reforms Finance Department

- Slides: 46

Tamil Nadu : Development Imperatives and Reforms Finance Department Government of Tamil Nadu 1

MACRO-ECONOMIC PROFILE SECTORAL COMPOSITION OF THE STATE DOMESTIC PRODUCT 1970 -71 2000 -2001 (Source: DOES) 2

MACRO-ECONOMIC PROFILE EMPLOYMENT BY MAJOR SECTORS (PERCENT) 1987 - 1988 1999 -2000 (Source: DOES) 3

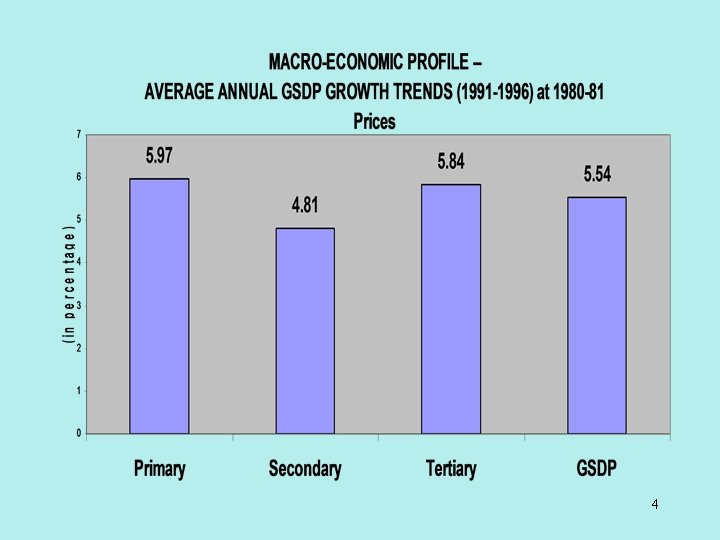

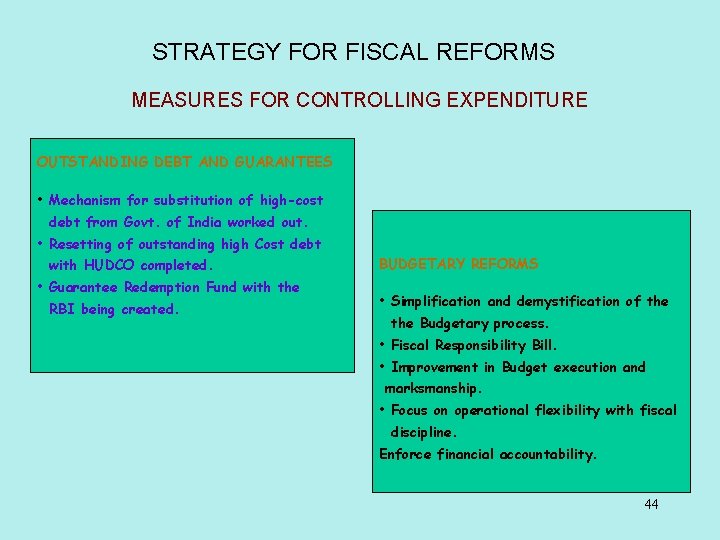

4

5

6

7

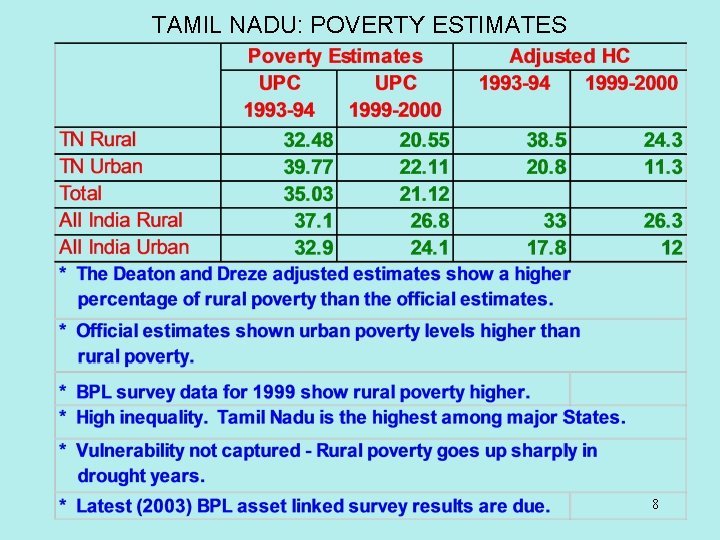

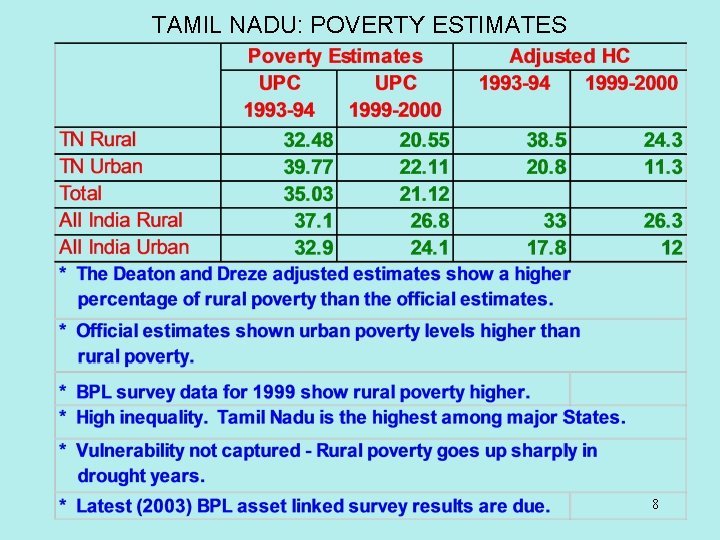

TAMIL NADU: POVERTY ESTIMATES 8

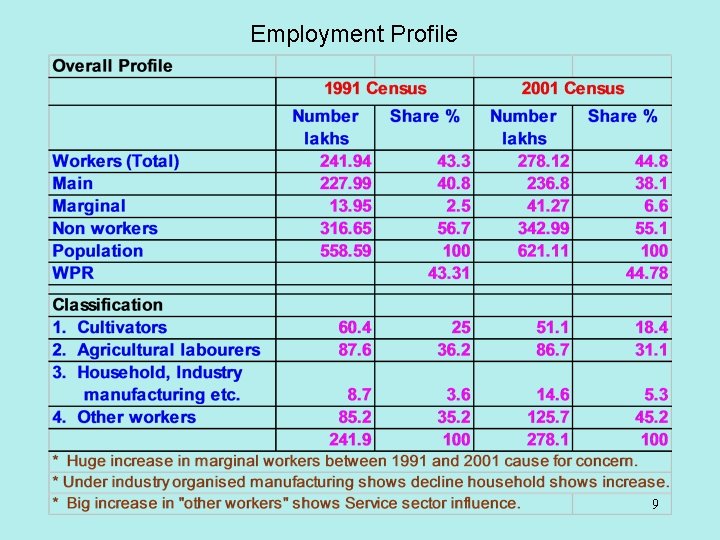

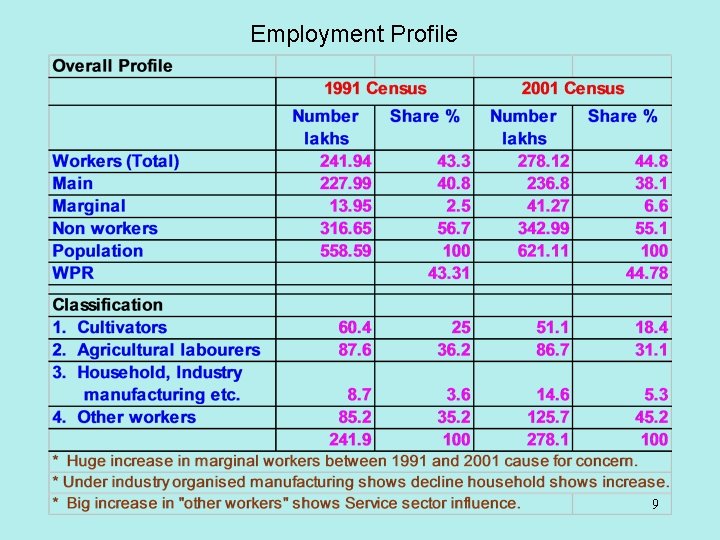

Employment Profile 9

MACRO-ECONOMIC PROFILE • An analysis of the sectoral composition of GSDP and sector-wise employment patterns reveals the following: – The State economy has undergone a transition from being primarily agrarian in nature to one led by rapid growth in services. – Despite the sharp decline in the contribution of the primary sector to the overall GSDP, as it well may, the employment in this sector remains over 50%. – Nearly 62% percent of the total population is estimated to be dependent on the primary sector. – The fact that the bulk of the population depends on the primary sector with its declining share straightaway points to substantial poverty. 10

MACRO-ECONOMIC PROFILE The broad conclusions are: • Tamil Nadu’s economy has changed from being mainly agrarian to one led by growth in the services sector. • The employment in the primary sector is high at over 50%. • The percent of the total population dependent on the primary sector is as high as 62%. • This high dependency of the population on the primary sector points to substantial rural poverty. • All estimates of poverty [Planning Commission, Deaton etc. ] confirm high level of rural poverty. Highest among Southern States as per official estimates • Unemployment in Tamil Nadu is the third highest in the country. India average is 7. 32%. Tamil Nadu is at 12. 05%. • Income inequality is highest in Tamil Nadu. High rural poverty and high unemployment rates reveal this picture. 11

MACRO-ECONOMIC PROFILE CORE AREAS OF CONCERN – Plateauing of the performance of the primary sector. Low growth – 0. 86% in later years 1998 -2001, in the recent past, is a cause for serious worry. – This is attributed to technology stagnation, inadequate diversification, adverse impact on production and productivity due to recurrent drought, lack of new irrigation. – Manufacturing sector not doing well. Liberalization meant downsizing, correction and new jobs in new activities. Where are the new jobs? – Absence of adequate employment opportunities amongst the educated sections of the population. Employment Exchange statistics reveal that an estimated 5 million educated youth are on roll seeking employment. – Continuing poverty and high vulnerability. – Public sector downsizing adding to woes! – Stagnation in the other vital indices pertaining to human development. 12 CBR has stopped falling. IMR is not falling rapidly enough.

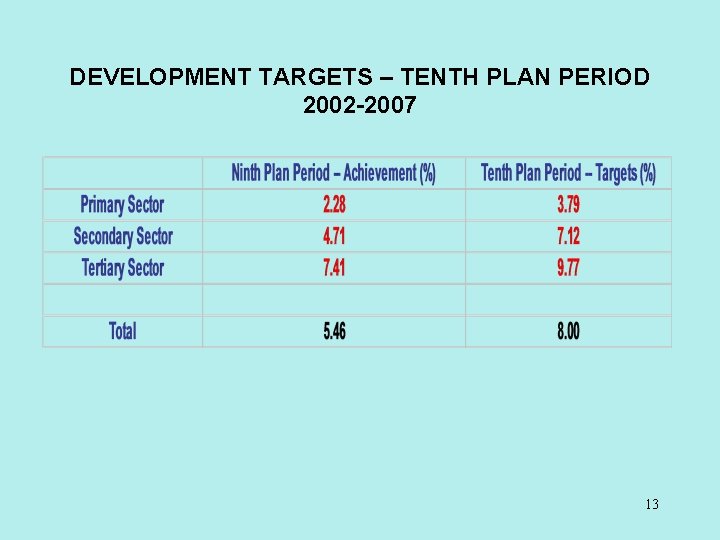

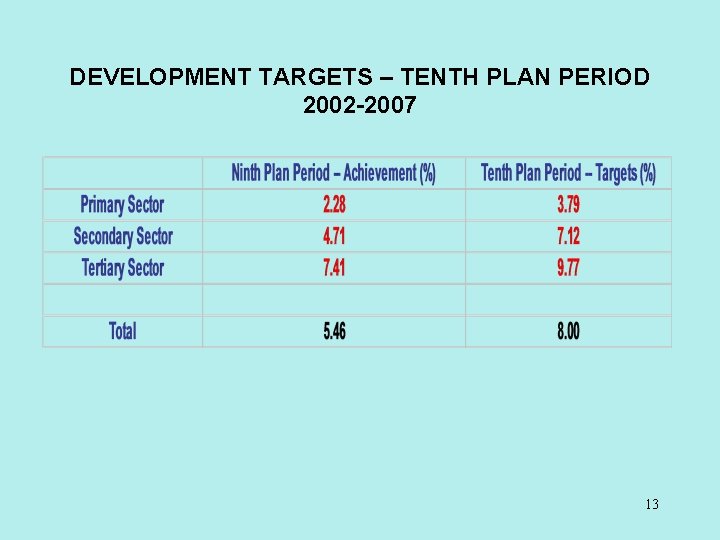

DEVELOPMENT TARGETS – TENTH PLAN PERIOD 2002 -2007 13

TENTH PLAN (2002 -2007) -- SECTORAL OUTLAYS 14

DEVELOPMENT STRATEGY OF THE GOVERNMENT OF TAMIL NADU 1. Double per capita income by 2010. 2. Attack poverty – Bring it down to less than 5%. 3. Provide employment. – Bring unemployment status to 5% by 2010. 4. Revive the primary sector. 5. Impart a new growth momentum to the manufacturing sector. 6. Facilitate the tertiary sector. 7. Human Development. 8. Fiscal consolidation. 9. Governance reforms to facilitate development. 15

STRATEGY FOR POVERTY ALLEVIATION AND REVIVING THE PRIMARY SECTOR Ø Address the problem of wastelands. Estimates indicate 2 million hectares of cultivable lands are lying waste either as current fallows or permanent fallows. Ø Adopt an agri-clinical approach to evaluate each farmer and his land see how knowledge and inputs can be provided to revive cultivation of wastelands. Ø Address major problem of low irrigation addition. This involves multiple interventions which are as follows: § Encourage rainwater harvesting to replenish ground water and surface water sources. § Remodel and upgrade surface water sources such as irrigation tanks and village ponds with a basin wide approach. 16

STRATEGY FOR POVERTY ALLEVIATION AND REVIVING THE PRIMARY SECTOR § Take up precision farming with low water use § Change over to higher value added crops to facilitate better farm incomes. § Promote irrigation through conventional farm pump sets for large farmers and solar photovoltaic pump sets for small and marginal farmers. § Push for Peninsular River Water grid – Tamil Nadu stands to gain substantially – World Bank to help in Peninsular River Water grid completion in X Plan period. 17

STRATEGY FOR POVERTY ALLEVIATION AND REVIVING THE PRIMARY SECTOR • Examine each and every one of 1. 5 million existing farm pump sets and mount extension programme to improve farm incomes to counter income shock. • Develop new technology packages for farm sector. • Rejuvenate farm extension systems with a convergence approach. • Involve women in farming. • Develop better market intelligence and communications to farmers. • Promote capital investment in agriculture. Revamp the cooperative credit system for better outcomes. 18

STRATEGY FOR POVERTY ALLEVIATION AND REVIVING THE PRIMARY SECTOR • Promote rural industrialisation – New Anna Marumalarchi Thittam and other non-farm activities in rural areas. • Promote rural self-employment. • Facilitate Self Help Groups to help themselves. • Encourage subsidiary occupations such as animal husbandry, fisheries. • Promote Fisheries Mission activities. • Promote Homestead farming in dry land areas with strong animal husbandry component. 19

IMPARTING A NEW MOMENTUM TO THE SECONDARY SECTOR • Focus on manufacturing. • Tamil Nadu has to emerge as an export-led economy. special economic zones. • Recognize contribution of SSI’s. Facilitate their revival and enhance their contribution. • Undertake second generation reforms in the secondary sector. These include the following: v v v v v Focus on Reduction of transaction time and costs at Ports & Customs. Interest rate corrections. Global integration. Labour reforms and labour productivity. Simplification of procedures and deregulation. Provision of quality infrastructure. Quality Energy Supply. Technological modernization & upgradation. Reforms in State level taxation 20

IMPARTING A NEW MOMENTUM TO THE SECONDARY SECTOR • Our strategy for industrial revival includes: – Focussing on areas with comparative advantage and productive strengths such as textiles, leather, automobiles and ancillary industries, heavy engineering etc. – Focus on bio-technology, information technology enabled services, off shoring. – Radically improving the physical infrastructure. – Upgrading quality of human capital and skill formation. – Streamlining administrative processes and regulations so that they do not constrain growth and proliferation of businesses in the State. 21

IMPARTING A NEW MOMENTUM TO THE SECONDARY SECTOR • Focus on Quality infrastructure • The State Government has announced the constitution of an Infrastructure Development Fund (Rs. 200 crores). • New legislation on infrastructure development through public-private participation on the anvil. 22

IMPARTING A NEW MOMENTUM TO THE TERTIARY SECTOR • This sector has done well in the recent past. • Facilitate accelerated growth. • Focus on ICT, ITES, BPO off shoring opportunities. • Promote Tourism growth as a key driver. • Focus on urban development as growth driver. 23

INITIATIVES FOR HUMAN DEVELOPMENT • The Budget for 2003 -2004 spells outs the concept of a comprehensive social safety net for the needy and poor with an outlay of Rs. 4232 crores. • The effort will be to improve the social safety net in real terms. • Implement the Hon’ble Chief Minister's 18 -point programme for Women and Child Welfare. • Mal-Nutrition Free Tamil Nadu entails whole life-cycle approach to the concept of nutrition security. • Entrepreneurial Development Programme for Women. • Provide all support including Medicare for vulnerable groups namely the aged, severely disabled etc. 24

FINANCIAL MANAGEMENT IN TAMIL NADU • Tamil Nadu has always had a tradition of prudent management of its Public Finances. • Our vital fiscal parameters were easily among the best in the country. Revenue deficit as percent of revenue receipts was less than 3% and the Fiscal deficit was 1. 6% of GSDP in 1995 -96. • This fiscal advantage and strong economic fundamentals of the State were hailed countrywide. • Tamil Nadu in 1995 -1996 availed the largest development assistance from the World Bank and other multilateral financial institutions. • Achieving the development agenda set out by the State Government was always realisable. 25

PUBLIC FINANCES IN TAMIL NADU • The downslide in the public finances of the State Government was rather sudden. • It was triggered by the implementation of the Sixth State Pay Commission’s recommendations in 1998 with effect from 1. 1. 96. The State Government is still trying to cope with its impact. • The implementation of the recommendations of the Eleventh Finance Commission from the fiscal 2000 -2001 dealt a body blow to the State’s finances. • Resort to borrowings to handle the huge recurring revenue deficit has led to an increased interest burden. 26

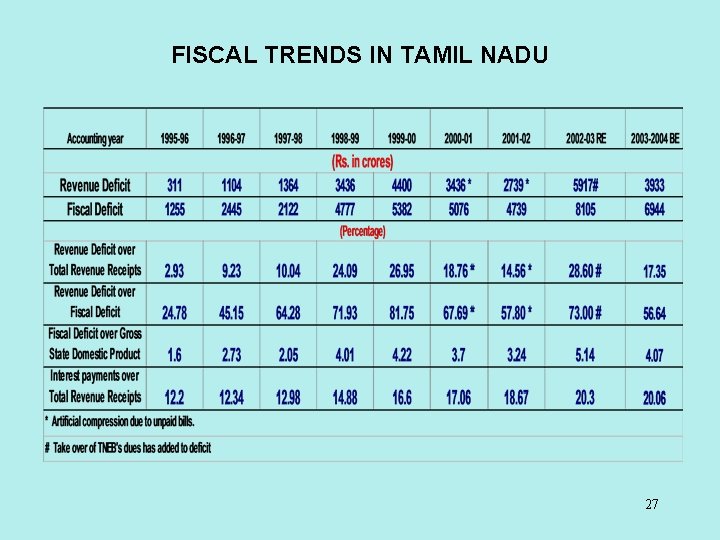

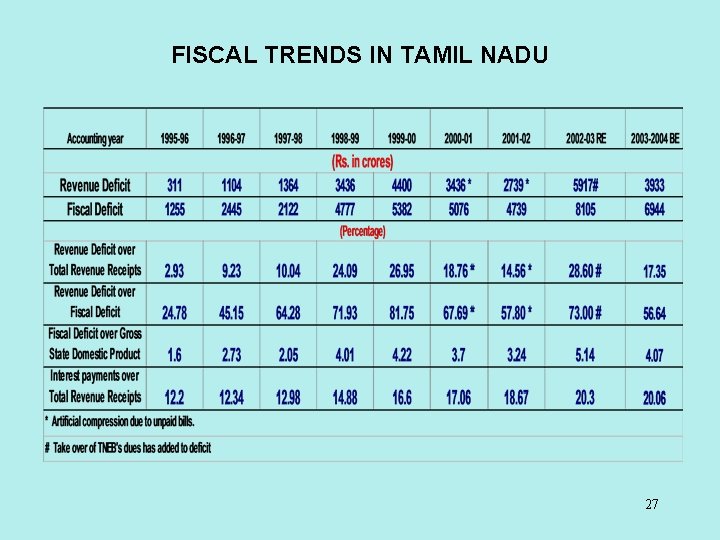

FISCAL TRENDS IN TAMIL NADU 27

THE ISSUE OF PENDING LIABILITIES • States basically have a hard budget • The ways & means control and overdraft regulations of the Reserve Bank will not permit any substantial carryover. • Carrying over bills is counter productive – within a short period can lead to a fiscal breakdown. • Fiscal 2000 -2001 end witnessed carryover of about Rs. 700 crores. Fiscal 2001 -2002 end involved carryover of about Rs. 1900 crores. This included about Rs. 800 crores of local body grants. The payment of this has been dropped as a one time aberration caused by State’s fiscal problems. • Good news: Fiscal 2002 -2003 end involves virtually no carryover. All bills as at end of March 2003 have been settled. • Data on bills carried over is monitored closely. • Better still is to see whethere any Treasury controls over and above normal controls. • Bills carried over is not a substantive monitorable indicator. 28

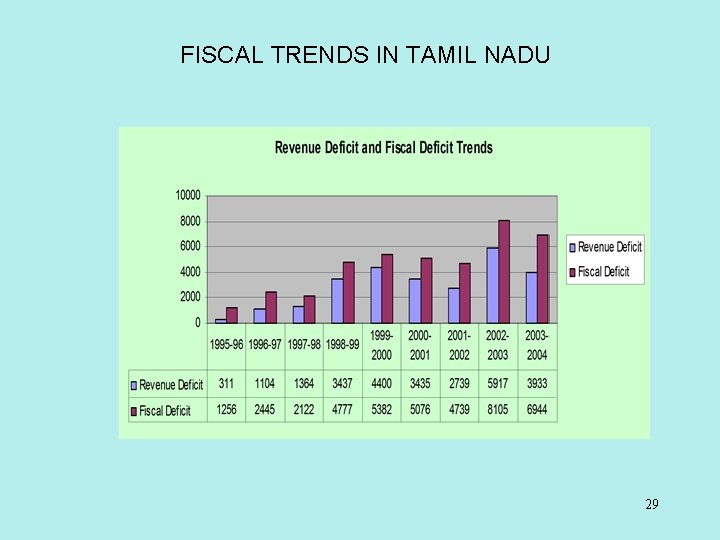

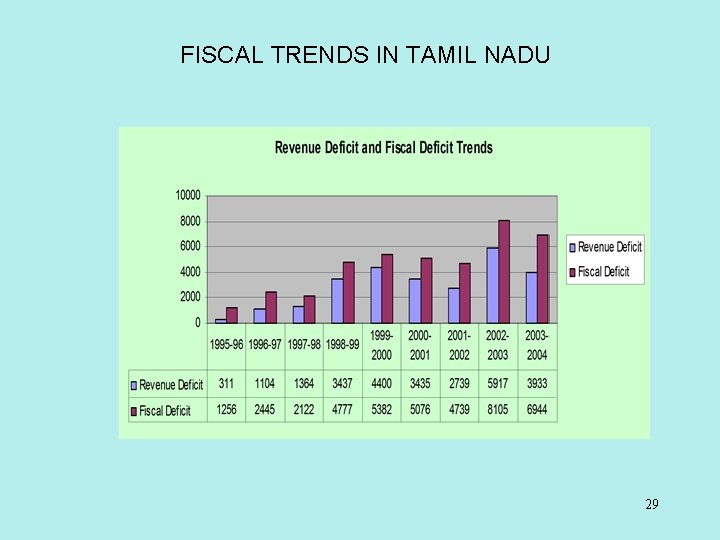

FISCAL TRENDS IN TAMIL NADU 29

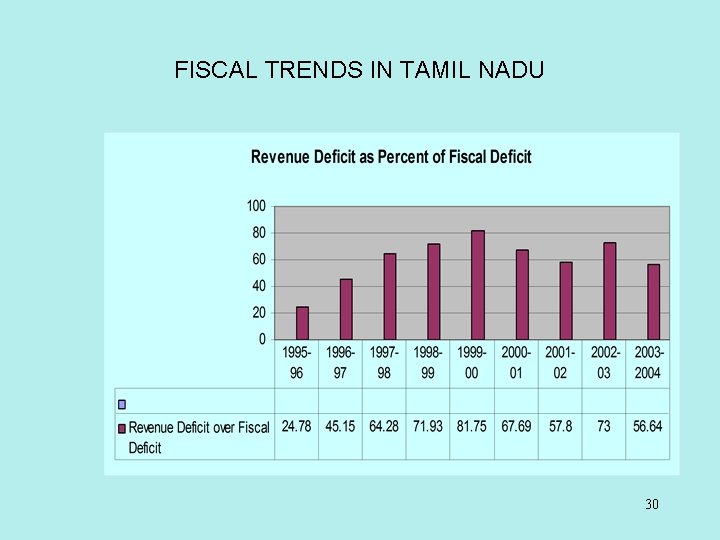

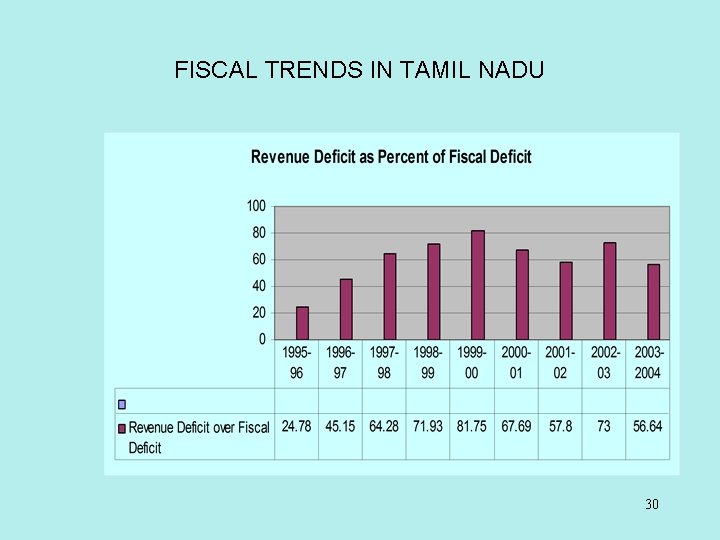

FISCAL TRENDS IN TAMIL NADU 30

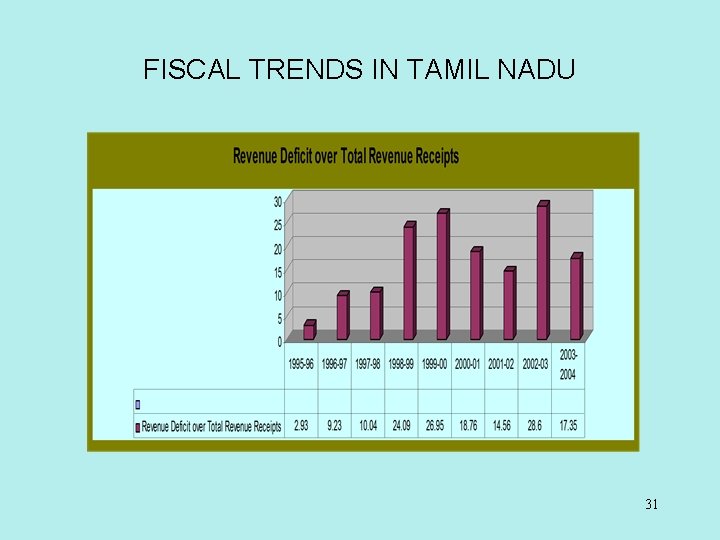

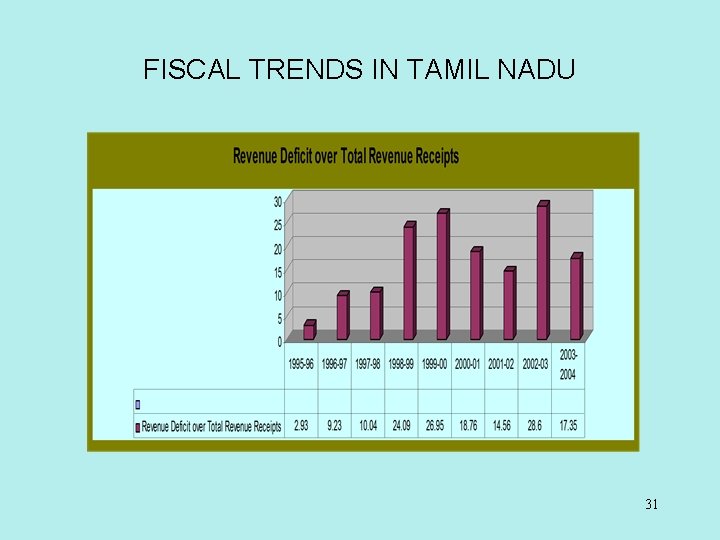

FISCAL TRENDS IN TAMIL NADU 31

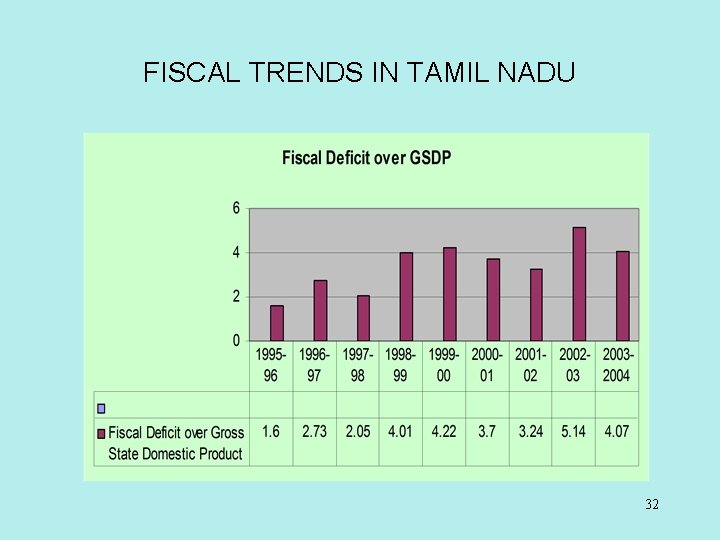

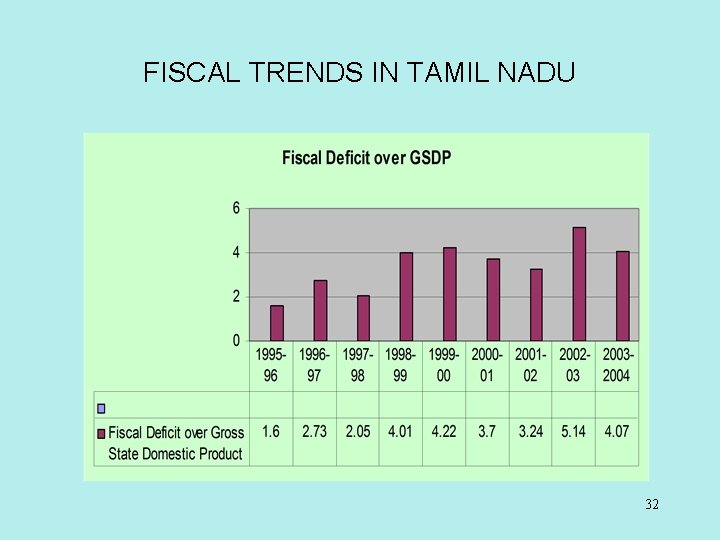

FISCAL TRENDS IN TAMIL NADU 32

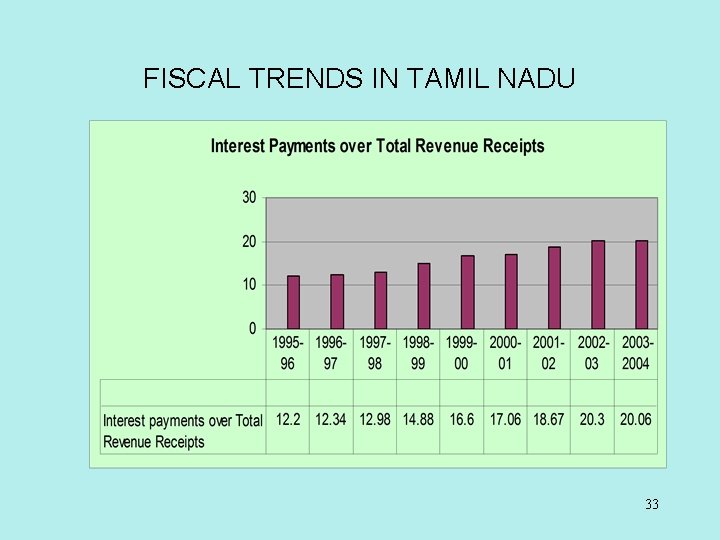

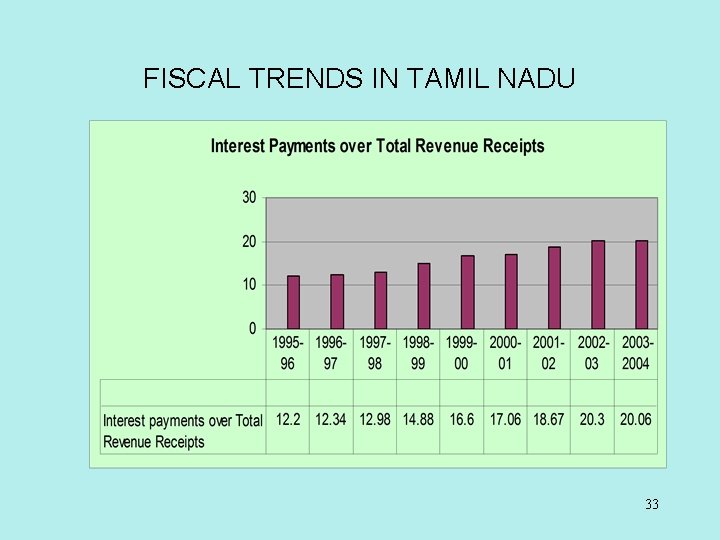

FISCAL TRENDS IN TAMIL NADU 33

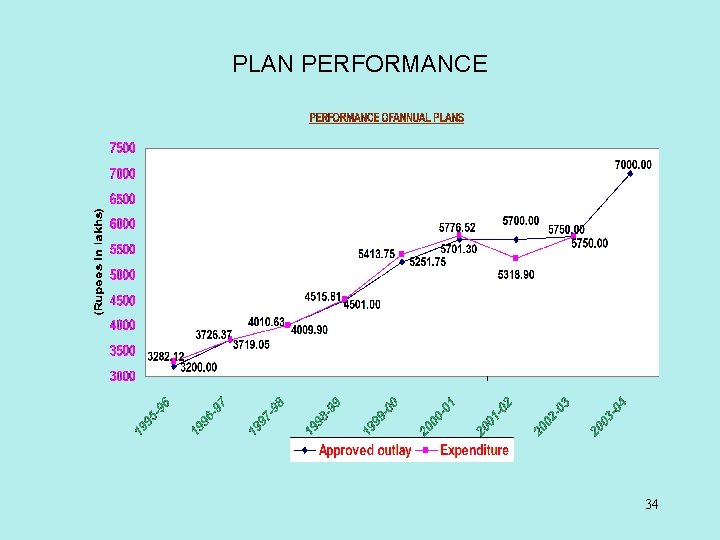

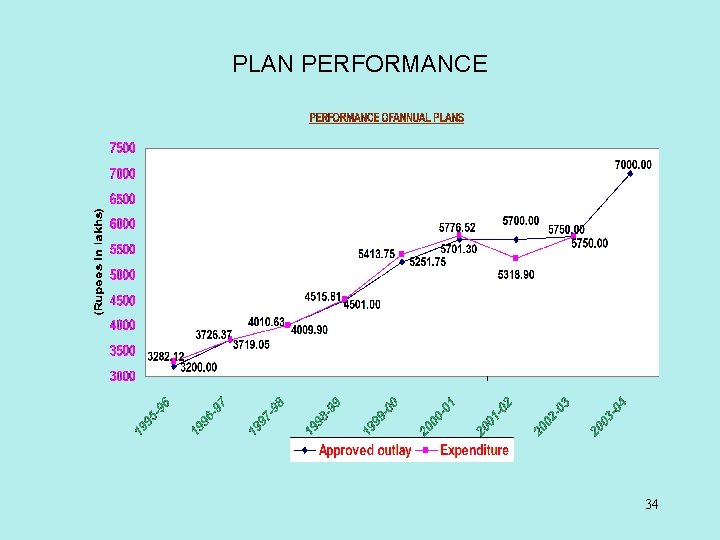

PLAN PERFORMANCE 34

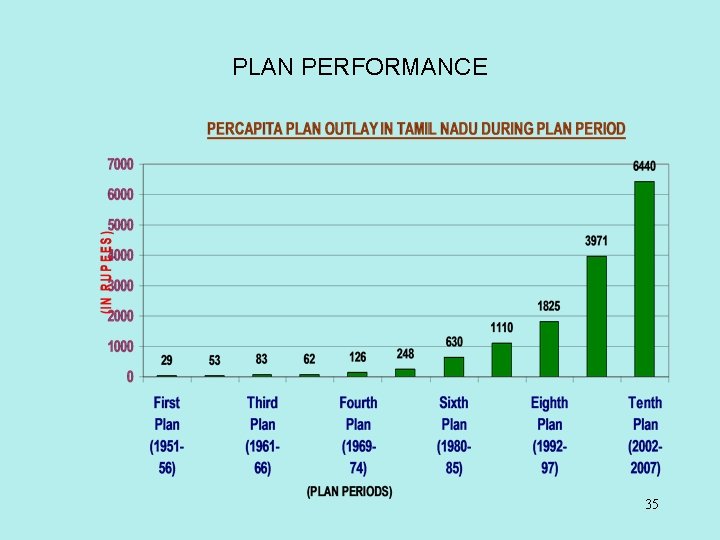

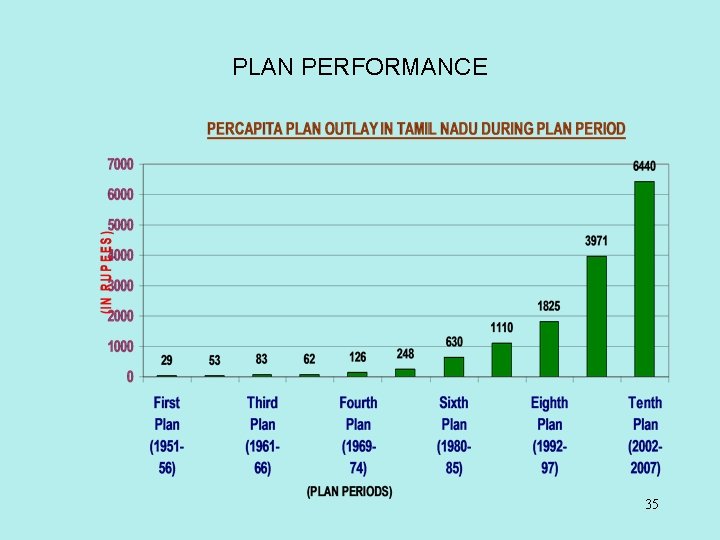

PLAN PERFORMANCE 35

MANIFESTATIONS OF THE FISCAL CRISIS • The manifestations are: – Tamil Nadu’s planned development outlay has stagnated. – Investment on physical infrastructure has stagnated. – Huge liquidity crunch upto end of 2002 -2003. – Pressure to cut back on social sector outlays. – Asset maintenance languishing. – Growth trajectory not encouraging. 36

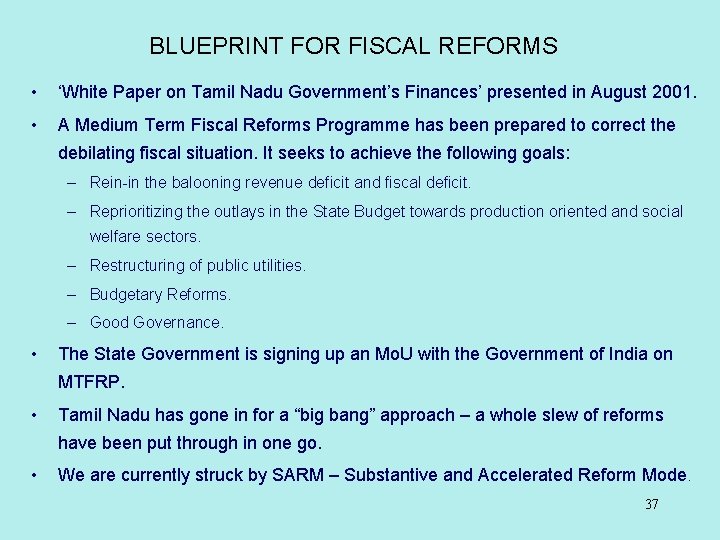

BLUEPRINT FOR FISCAL REFORMS • ‘White Paper on Tamil Nadu Government’s Finances’ presented in August 2001. • A Medium Term Fiscal Reforms Programme has been prepared to correct the debilating fiscal situation. It seeks to achieve the following goals: – Rein-in the balooning revenue deficit and fiscal deficit. – Reprioritizing the outlays in the State Budget towards production oriented and social welfare sectors. – Restructuring of public utilities. – Budgetary Reforms. – Good Governance. • The State Government is signing up an Mo. U with the Government of India on MTFRP. • Tamil Nadu has gone in for a “big bang” approach – a whole slew of reforms have been put through in one go. • We are currently struck by SARM – Substantive and Accelerated Reform Mode. 37

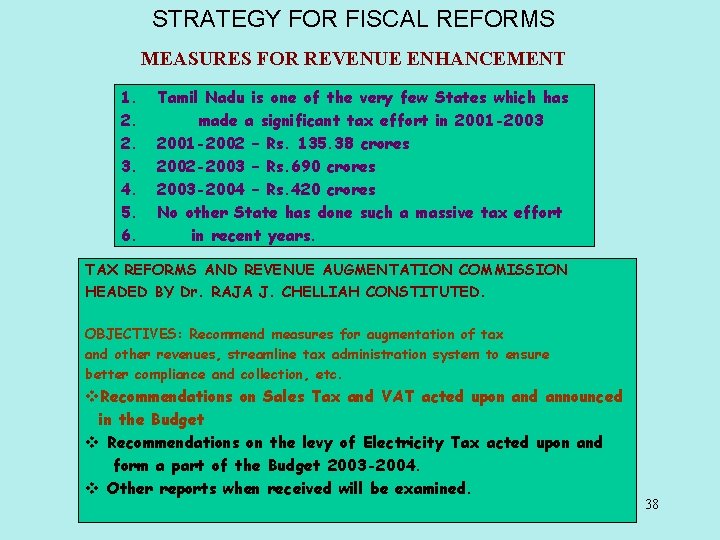

STRATEGY FOR FISCAL REFORMS MEASURES FOR REVENUE ENHANCEMENT 1. 2. 2. 3. 4. 5. 6. Tamil Nadu is one of the very few States which has made a significant tax effort in 2001 -2003 2001 -2002 – Rs. 135. 38 crores 2002 -2003 – Rs. 690 crores 2003 -2004 – Rs. 420 crores No other State has done such a massive tax effort in recent years. TAX REFORMS AND REVENUE AUGMENTATION COMMISSION HEADED BY Dr. RAJA J. CHELLIAH CONSTITUTED. OBJECTIVES: Recommend measures for augmentation of tax and other revenues, streamline tax administration system to ensure better compliance and collection, etc. v. Recommendations on Sales Tax and VAT acted upon and announced in the Budget v Recommendations on the levy of Electricity Tax acted upon and form a part of the Budget 2003 -2004. v Other reports when received will be examined. 38

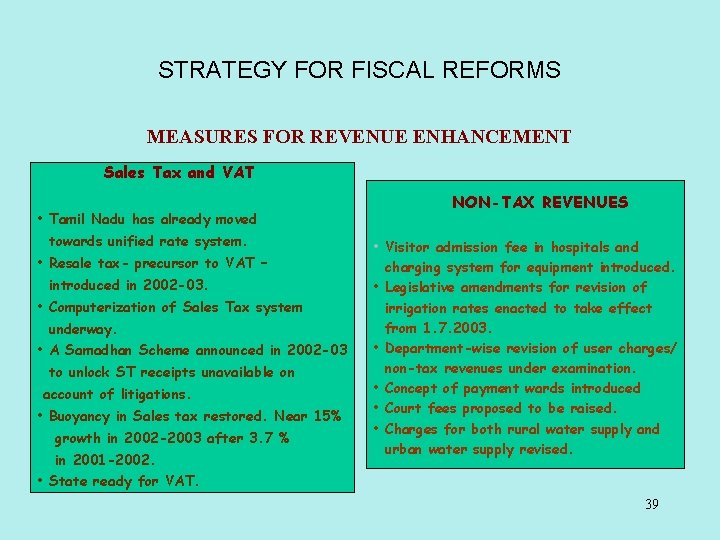

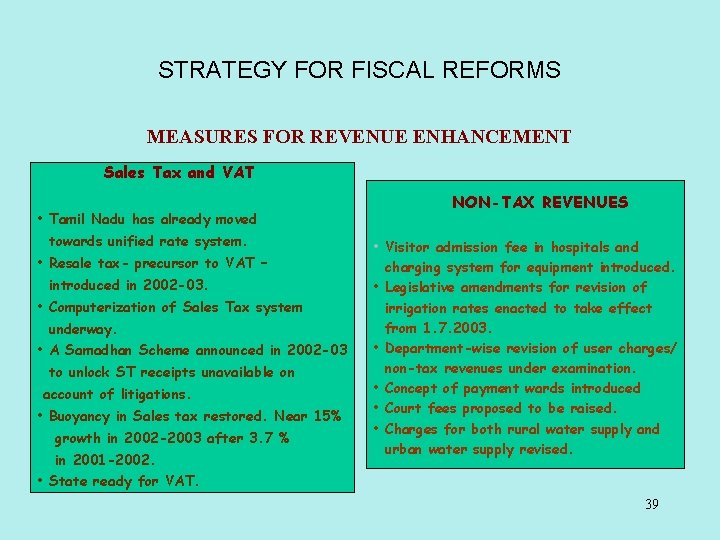

STRATEGY FOR FISCAL REFORMS MEASURES FOR REVENUE ENHANCEMENT Sales Tax and VAT • Tamil Nadu has already moved towards unified rate system. • Resale tax- precursor to VAT – introduced in 2002 -03. • Computerization of Sales Tax system underway. • A Samadhan Scheme announced in 2002 -03 to unlock ST receipts unavailable on account of litigations. • Buoyancy in Sales tax restored. Near 15% growth in 2002 -2003 after 3. 7 % in 2001 -2002. NON-TAX REVENUES • Visitor admission fee in hospitals and charging system for equipment introduced. • Legislative amendments for revision of irrigation rates enacted to take effect from 1. 7. 2003. • Department-wise revision of user charges/ non-tax revenues under examination. • Concept of payment wards introduced • Court fees proposed to be raised. • Charges for both rural water supply and urban water supply revised. • State ready for VAT. 39

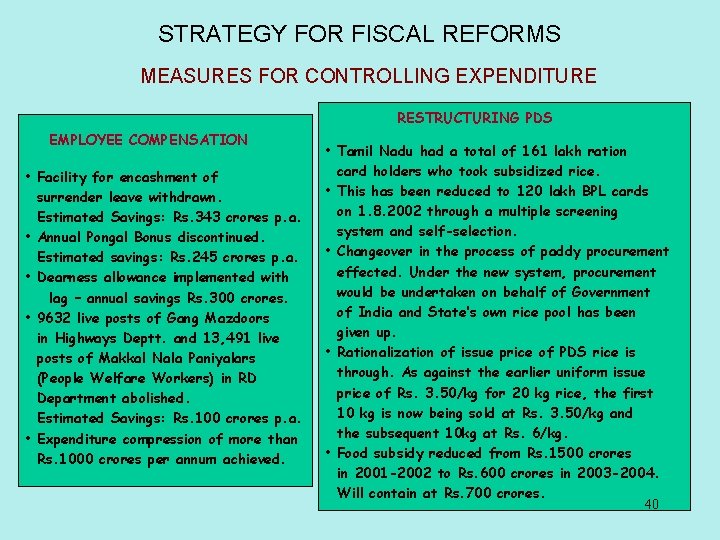

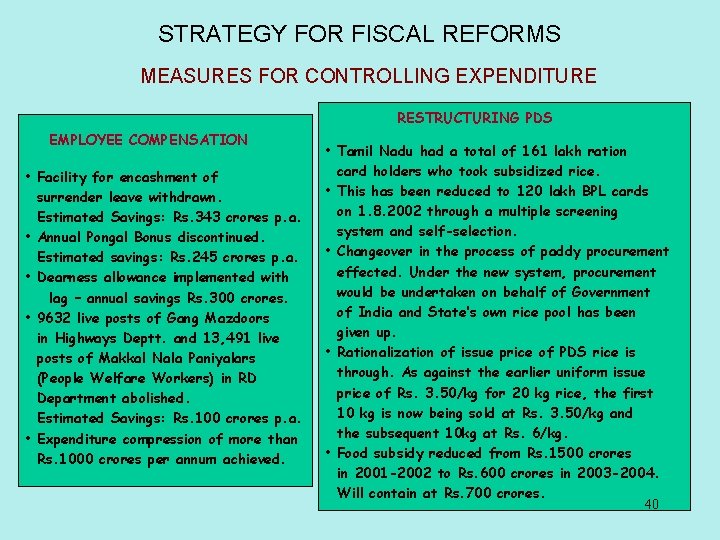

STRATEGY FOR FISCAL REFORMS MEASURES FOR CONTROLLING EXPENDITURE RESTRUCTURING PDS EMPLOYEE COMPENSATION • Facility for encashment of surrender leave withdrawn. Estimated Savings: Rs. 343 crores p. a. • Annual Pongal Bonus discontinued. Estimated savings: Rs. 245 crores p. a. • Dearness allowance implemented with lag – annual savings Rs. 300 crores. • 9632 live posts of Gang Mazdoors in Highways Deptt. and 13, 491 live posts of Makkal Nala Paniyalars (People Welfare Workers) in RD Department abolished. Estimated Savings: Rs. 100 crores p. a. • Expenditure compression of more than Rs. 1000 crores per annum achieved. • Tamil Nadu had a total of 161 lakh ration card holders who took subsidized rice. • This has been reduced to 120 lakh BPL cards on 1. 8. 2002 through a multiple screening system and self-selection. • Changeover in the process of paddy procurement effected. Under the new system, procurement would be undertaken on behalf of Government of India and State’s own rice pool has been given up. • Rationalization of issue price of PDS rice is through. As against the earlier uniform issue price of Rs. 3. 50/kg for 20 kg rice, the first 10 kg is now being sold at Rs. 3. 50/kg and the subsequent 10 kg at Rs. 6/kg. • Food subsidy reduced from Rs. 1500 crores in 2001 -2002 to Rs. 600 crores in 2003 -2004. Will contain at Rs. 700 crores. 40

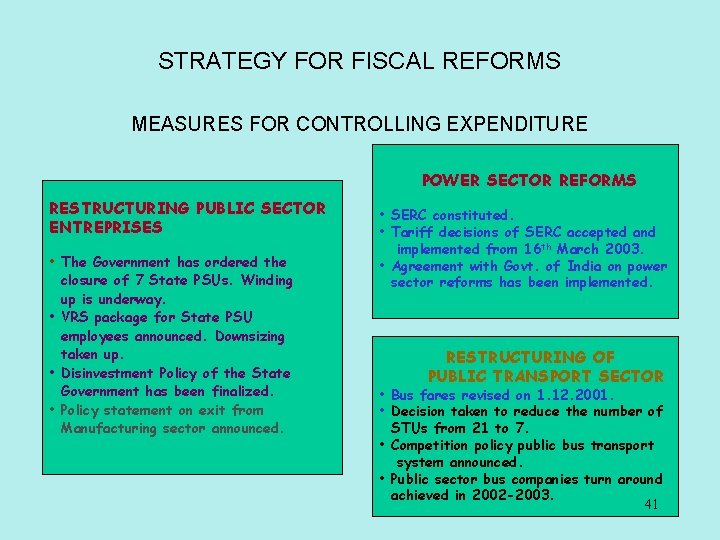

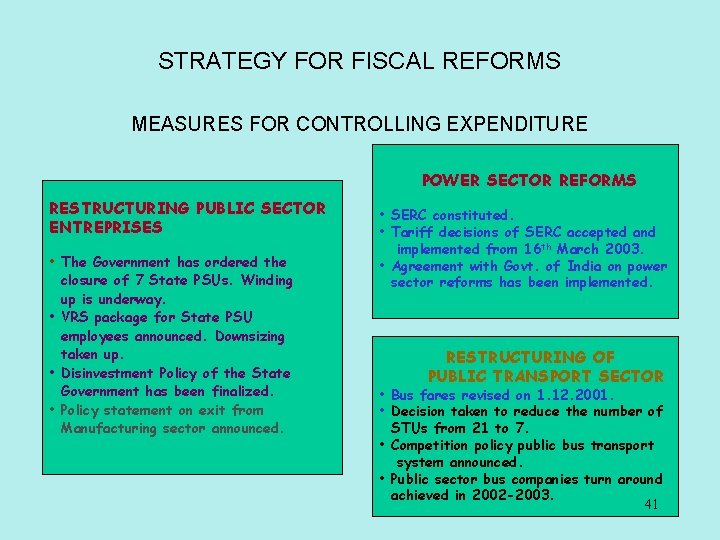

STRATEGY FOR FISCAL REFORMS MEASURES FOR CONTROLLING EXPENDITURE POWER SECTOR REFORMS RESTRUCTURING PUBLIC SECTOR ENTREPRISES • The Government has ordered the closure of 7 State PSUs. Winding up is underway. • VRS package for State PSU employees announced. Downsizing taken up. • Disinvestment Policy of the State Government has been finalized. • Policy statement on exit from Manufacturing sector announced. • SERC constituted. • Tariff decisions of SERC accepted and implemented from 16 th March 2003. • Agreement with Govt. of India on power sector reforms has been implemented. RESTRUCTURING OF PUBLIC TRANSPORT SECTOR • Bus fares revised on 1. 12. 2001. • Decision taken to reduce the number of STUs from 21 to 7. • Competition policy public bus transport system announced. • Public sector bus companies turn around achieved in 2002 -2003. 41

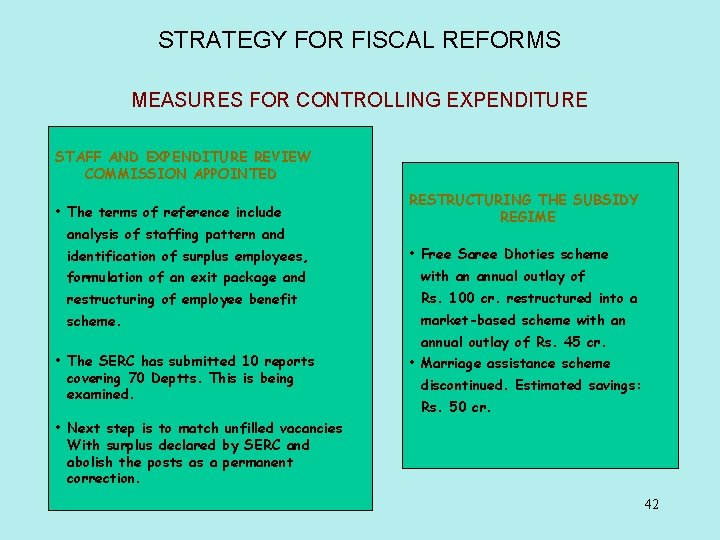

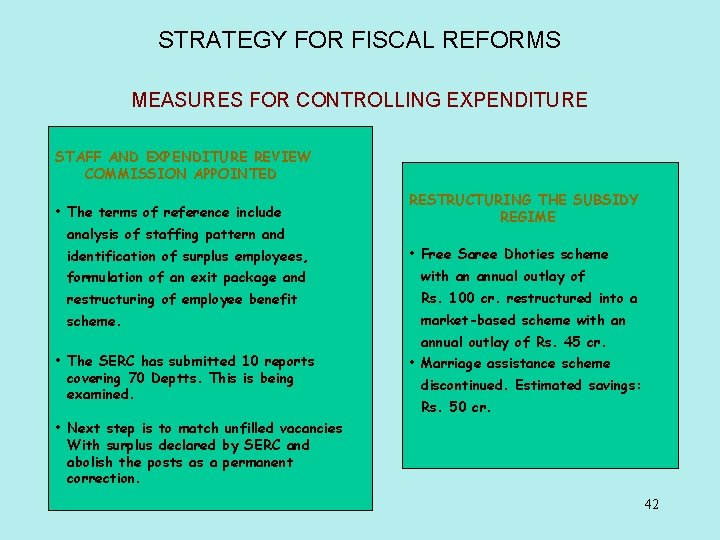

STRATEGY FOR FISCAL REFORMS MEASURES FOR CONTROLLING EXPENDITURE STAFF AND EXPENDITURE REVIEW COMMISSION APPOINTED • The terms of reference include analysis of staffing pattern and identification of surplus employees, RESTRUCTURING THE SUBSIDY REGIME • Free Saree Dhoties scheme formulation of an exit package and with an annual outlay of restructuring of employee benefit Rs. 100 cr. restructured into a scheme. market-based scheme with an • The SERC has submitted 10 reports covering 70 Deptts. This is being examined. annual outlay of Rs. 45 cr. • Marriage assistance scheme discontinued. Estimated savings: Rs. 50 cr. • Next step is to match unfilled vacancies With surplus declared by SERC and abolish the posts as a permanent correction. 42

STRATEGY FOR FISCAL REFORMS Pension Reforms 1. Contributory Pension scheme for new employees from 1. 4. 2003. 2. Pension entitlements reduced. 3. Commutation entitlement and commutation table revised. 4. Payment of part of gratuity and encashment of leave in Small Savings. 5. No other State has undertaken such major Pension scheme changes. 43

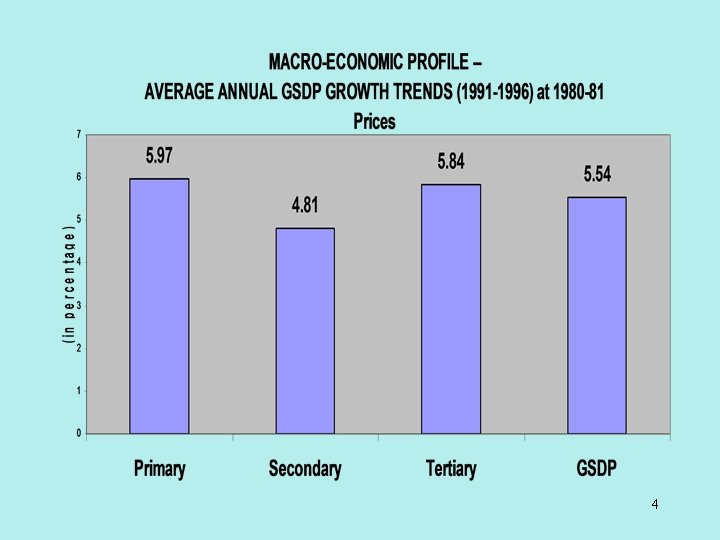

STRATEGY FOR FISCAL REFORMS MEASURES FOR CONTROLLING EXPENDITURE OUTSTANDING DEBT AND GUARANTEES • Mechanism for substitution of high-cost debt from Govt. of India worked out. • Resetting of outstanding high Cost debt with HUDCO completed. • Guarantee Redemption Fund with the RBI being created. BUDGETARY REFORMS • Simplification and demystification of the Budgetary process. • Fiscal Responsibility Bill. • Improvement in Budget execution and marksmanship. • Focus on operational flexibility with fiscal discipline. Enforce financial accountability. 44

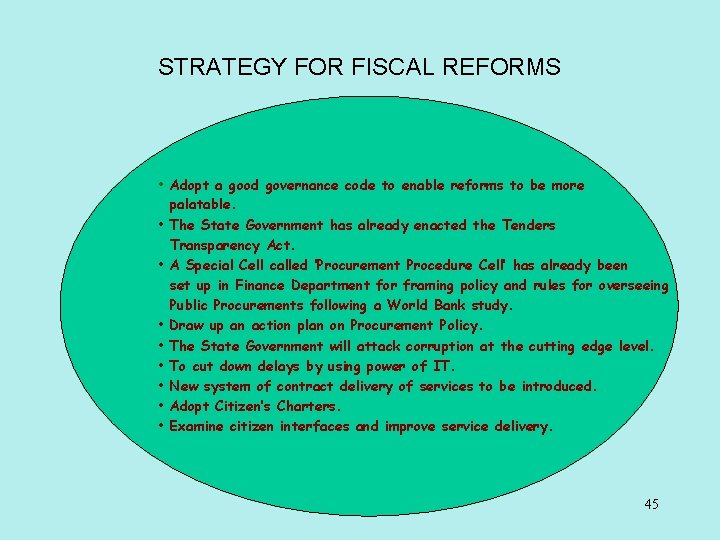

STRATEGY FOR FISCAL REFORMS • Adopt a good governance code to enable reforms to be more palatable. • The State Government has already enacted the Tenders Transparency Act. • A Special Cell called ‘Procurement Procedure Cell’ has already been set up in Finance Department for framing policy and rules for overseeing Public Procurements following a World Bank study. • Draw up an action plan on Procurement Policy. • The State Government will attack corruption at the cutting edge level. • To cut down delays by using power of IT. • New system of contract delivery of services to be introduced. • Adopt Citizen’s Charters. • Examine citizen interfaces and improve service delivery. 45

Thank You 46

Public works department meaning in tamil

Public works department meaning in tamil Aaseevagam tamil

Aaseevagam tamil Go 354 tamil nadu

Go 354 tamil nadu Noon meal forms 2019-20

Noon meal forms 2019-20 Tamilnadu nursing council

Tamilnadu nursing council Mgnrega social audit tamil nadu

Mgnrega social audit tamil nadu Urban horticulture

Urban horticulture Chief minister special cell meaning in tamil

Chief minister special cell meaning in tamil P umanath ias

P umanath ias Nhm tamilnadu

Nhm tamilnadu Sangam age meaning

Sangam age meaning Falmore house gleneely

Falmore house gleneely Department of finance and administration

Department of finance and administration Ms department of finance and administration

Ms department of finance and administration Reforms revolutions and war answer key

Reforms revolutions and war answer key Wars revolutions and reforms

Wars revolutions and reforms Function of finance department

Function of finance department Koshwahini up

Koshwahini up Finance department functions

Finance department functions Finance dept structure

Finance dept structure State of alabama department of finance

State of alabama department of finance Meeting minutes

Meeting minutes Department of local government finance

Department of local government finance The four c's of healthcare finance

The four c's of healthcare finance Jackson state university finance department

Jackson state university finance department City of houston finance department

City of houston finance department Indirect speech: imperatives

Indirect speech: imperatives Hypothetical imperative

Hypothetical imperative Kant imperatives hypothetical and categorical

Kant imperatives hypothetical and categorical Categorical imperative ethics

Categorical imperative ethics Kant imperatives hypothetical and categorical

Kant imperatives hypothetical and categorical Tanzimat reforms definition

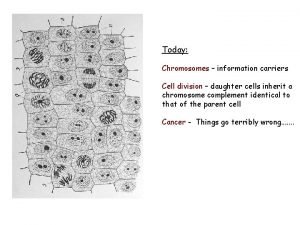

Tanzimat reforms definition Nuclear membrane reforms

Nuclear membrane reforms A peaceful crusade or campaign for reforms by means of pen

A peaceful crusade or campaign for reforms by means of pen How successful were the liberal reforms essay

How successful were the liberal reforms essay Tanzimat reforms definition

Tanzimat reforms definition The modern colossus of railroads political cartoon meaning

The modern colossus of railroads political cartoon meaning Education sector reforms in pakistan

Education sector reforms in pakistan National curriculum framework

National curriculum framework Administrative reforms of cornwallis

Administrative reforms of cornwallis Julius caesar reforms

Julius caesar reforms Late qing reforms

Late qing reforms Reforms in the antebellum period

Reforms in the antebellum period Antebellum reform apush

Antebellum reform apush Mohan lal grero

Mohan lal grero Npqml project example

Npqml project example Napoleons reign

Napoleons reign