Tally tutorials Introduction to VAT Value Added Tax

- Slides: 24

Tally tutorials Introduction to VAT

Value Added Tax (VAT • Sales tax is levied on sale of movable goods • Most of the Indian states have replaced sales tax with VAT from 1 Apr 2005 • VAT is tax which is charged on the increse in value of goods and services at each stage of production and circulation

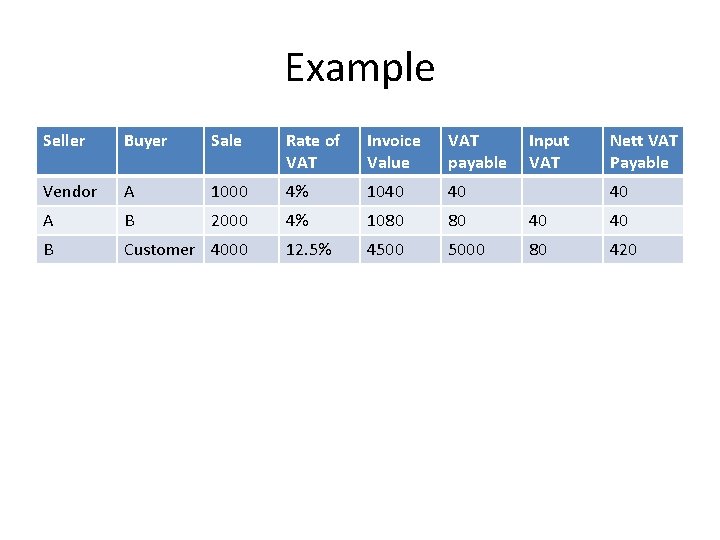

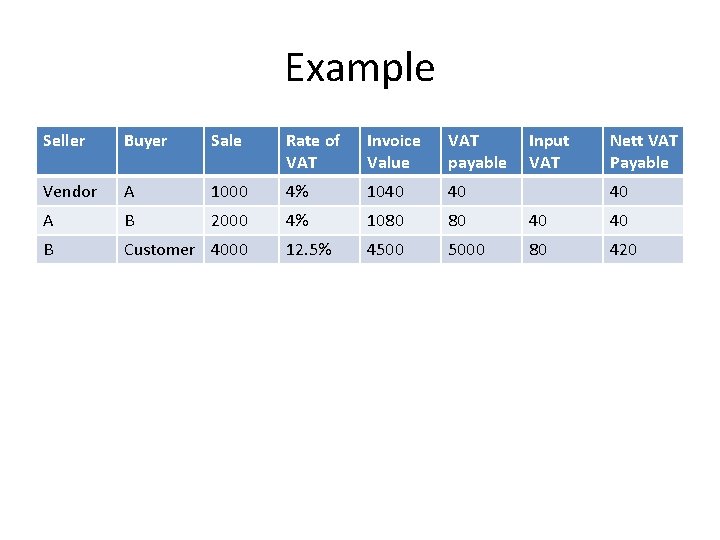

Example Seller Buyer Sale Rate of VAT Invoice Value VAT payable Input VAT Nett VAT Payable Vendor A 1000 4% 1040 40 A B 2000 4% 1080 80 40 40 B Customer 4000 12. 5% 4500 5000 80 420 40

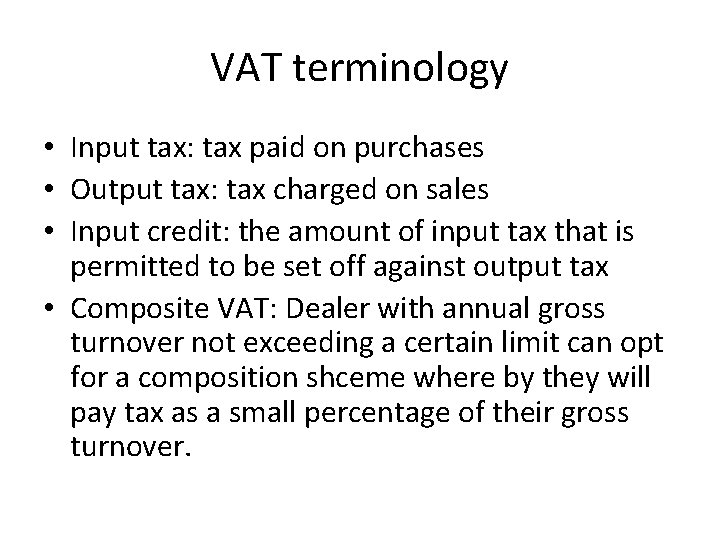

VAT terminology • Input tax: tax paid on purchases • Output tax: tax charged on sales • Input credit: the amount of input tax that is permitted to be set off against output tax • Composite VAT: Dealer with annual gross turnover not exceeding a certain limit can opt for a composition shceme where by they will pay tax as a small percentage of their gross turnover.

VAT Rates in Kerala • I: Exempted good (0%)- essential commodities • II: 1% Goods- precious stones • III: 4% goods- industrial goods and capital goods • IV: 12. 5% goods- all others

Enabling VAT in Tally • At gate way F 11 Features > statutory & taxation> set yes at enable VAT and set yes at set/alter VAT details and enter details • Enter VAT applicable date

VAT Classification • • Input VAT@1% Input VAT@4% Input VAT@12. 5% Output VAT@1% Output VAT@4% Output VAT@12. 5% Purchase exempt

Ledger creation for VAT • Purchase exempt, puchase@1%, purchase@4% etc • Sales exempt, sales@1%, sales@12%, etc • VAT ledger under duties and taxes • Input VAT 1%, input VAT 4%, output VAT 1%, our put VAT 4% etc

VAT vouchers • VAT configuration: press F 12 and Set No at use common ledger A/c for item allocation and set Yes at allow selection of VAT/Tax classes during entry • Purchase voucher(as invoice) • Select required VAT Class(purchase@4%) and select the input VAT ledger. And give other details as usual

• Sales voucher(as invoice) • Select VAT class(sales@4%) and select output VAT ledger and enter other details as usual.

Payment of VAT • To view VAT computation Report • Gateway>Display>Statutory Reports>VAT reports>VAT computations • Create ledger named VAT payable and pass the following journal entry • Output. VAT a/c Dr • To Input VAT a/c • To VAT payable a/c • Then make payment of VAT

VAT Return • Gateway>Display>Statutory Reports>VAT reports>VAT Return

CST • Central Sales Tax are applicable on Interstate sale of goods • Generally it is 2% • Activating CST in Tally • In F 11 features at statutory & taxation enter interstate registration number • At F 12 configure > invoice order entry option menu> set yes at activiate E 1, E 2 transaction.

CST ledger creation • Create CST party ledger under sundry creditors • Create CST on sales ledger(CST@2%) under duties and taxes • Create CST on purchase ledger (CST 2% (purchase))

CST Vouchers • In Sales voucher select interstate sales from VAT/Tax class • Select CST tax ledger • Select the form to issue and • Select the form to receive • Enter other details as usual

CST Repots • Gateway>display>statutory reports>CST reports>form Receivable/Form payable •

CST Details in VAT computation • VAT computation report provide the assessable value and the tax amount of the sales and purchase transactions entere using defferent VAT/Tax classifications. • Display>statutory reports>VAT coputations • To view CST details click F 12 configure and set yes at show all VAT classifications

CST Sales register • Display>statutory reports>CST register>CST sales • CST purchase register • Display>statutory reports>CST register>CST purchase

Service Tax • • Tax on services Except few all services are taxable The rate of service tax is 10% + 3% Ed-Cess To enable service tax in tally press F 11 features and set yes at enable service tax and set yes and set/alter service tax details and enter the required information

Recording purchase of serivices • Create purchase ledger and set yes in the field “is service tax applicable? ” • Create supplier ledger and set yes in the field “is service provider/receover? ” (Before that in F 12 Configure set yes at allow advanced entries in master and at use addresses for ledger acconts) • Create service tax ledgers(service tax 12%) • Enter purchase in purchase vouchers

Input credit summary report • Display>statutory reports>service tax reports>Input credity • Same procedure to be followed to record sale of services. Ie create sales ledger, customer ledger, service tax ledger.

Service tax payables • Display>statutory reports>service tax reports>sevice tax payables • Printing TRS Challan • Display>statutory reports>service tax reports>input credity form/ST 3 Report/ST 3 A report

Central excise • • Tax on porduction. It is an indirect tax Different rates for different products Three types of Excises in india. Basic excise duty, additional duty of excise and special excise duty

• Thank you… • abbasvattoli@yahoo. com