Swaps Chapter 7 Options Futures and Other Derivatives

- Slides: 53

Swaps Chapter 7 Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 1

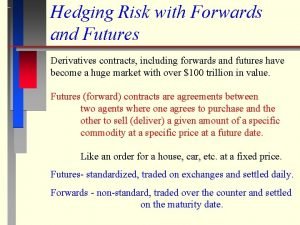

Nature of Swaps l l l A swap is an agreement to exchange cash flows at specified future times according to certain specified rules The agreement specifies the dates when the cash flows are to be paid Calculation of the cash flows involves the future value of interest rates, exchange rates, or other market variables. Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 2

An Example of a “Plain Vanilla” Interest Rate Swap l l l An agreement by Microsoft to receive 6 -month LIBOR & pay a fixed rate of 5% per annum every 6 months for 3 years on a notional principal of $100 million The swap is initiated on March 5, 2004 Microsoft is the fixed-rate payer, while Intel is the floating-rate payer Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 3

An Example of a “Plain Vanilla” Interest Rate Swap 5. 0% Intel Microsoft LIBOR Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 4

An Example of a “Plain Vanilla” Interest Rate Swap l l l The first exchange of payments would take place on September 5. Microsoft would pay Intel $2. 5 million. This is the interest on the $100 million principal for 6 months at 5%. Intel would pay Microsoft interest at the 6 month LIBOR (prevailing 6 months prior to September 6, that is, March 5). Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 5

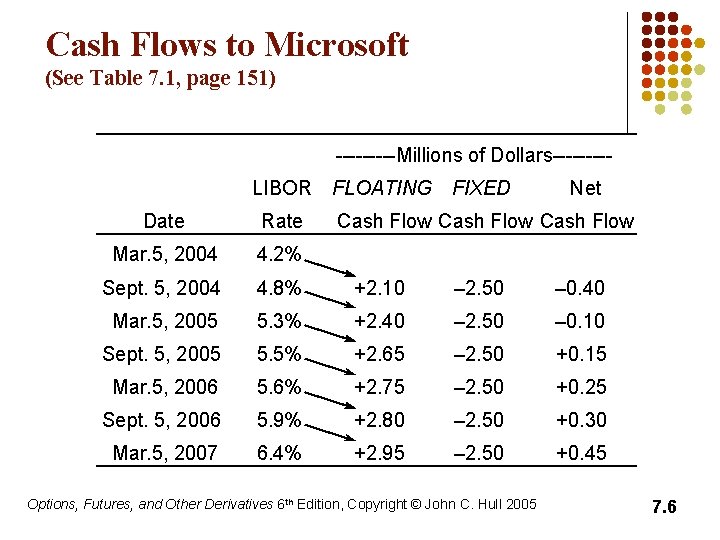

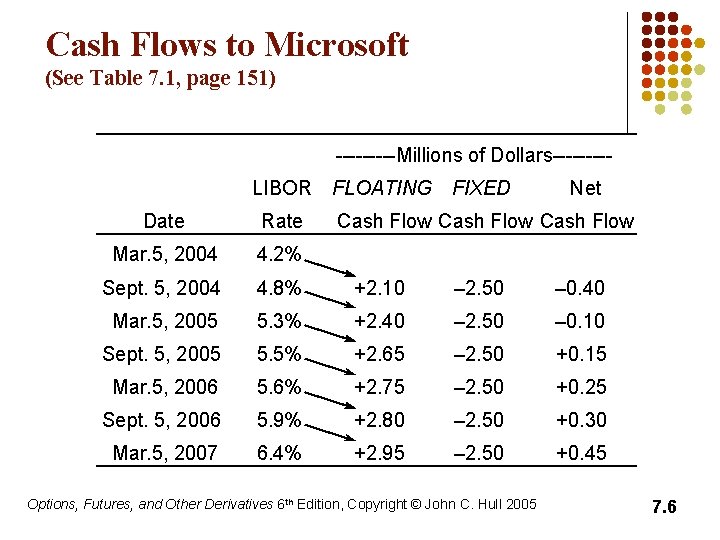

Cash Flows to Microsoft (See Table 7. 1, page 151) -----Millions of Dollars----LIBOR FLOATING FIXED Net Date Rate Cash Flow Mar. 5, 2004 4. 2% Sept. 5, 2004 4. 8% +2. 10 – 2. 50 – 0. 40 Mar. 5, 2005 5. 3% +2. 40 – 2. 50 – 0. 10 Sept. 5, 2005 5. 5% +2. 65 – 2. 50 +0. 15 Mar. 5, 2006 5. 6% +2. 75 – 2. 50 +0. 25 Sept. 5, 2006 5. 9% +2. 80 – 2. 50 +0. 30 Mar. 5, 2007 6. 4% +2. 95 – 2. 50 +0. 45 Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 6

Fixed-to-Floating-rate bond l l l A swap can be regarded as the exchange of a fixed-rate bond for a floating-rate bond Microsoft, is long a floating-rate bond and short a fixed rate bond Intel is short a floating-rate bond and long a fixed rate bond. Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 7

Typical Uses of Interest Rate Swaps l Converting a liability from l fixed rate to floating rate l floating rate to fixed rate Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 8

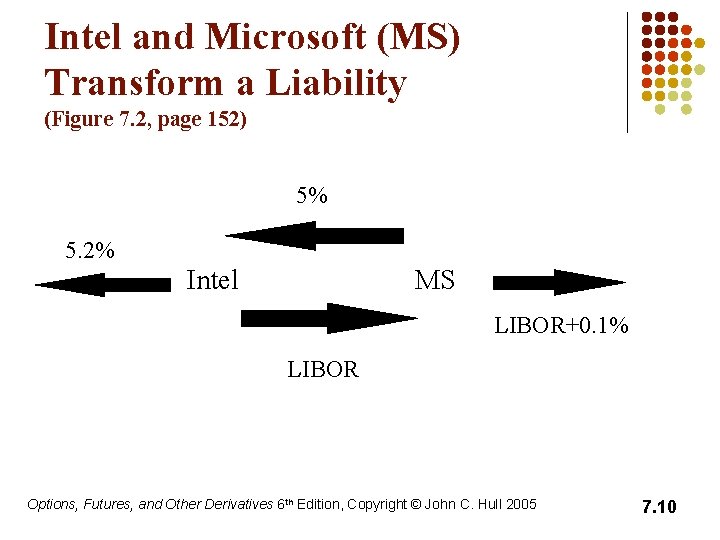

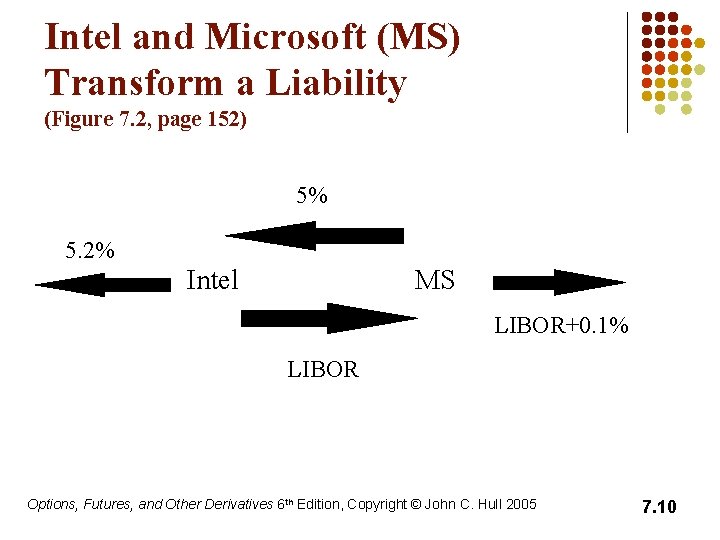

Typical Uses of Interest Rate Swaps l l Suppose Microsoft has arranged to borrow $100 million at LIBOR + 10 bps. 1. It pays LIBOR plus 0. 1% to outside lenders 2. It receives LIBOR under the terms of the swap 3. It pays 5% under the terms of the swap Average interest payment is 5. 1% Suppose Intel has a 3 -year $100 million loan outstanding on which it pays 5. 2%. 1. It pays 5. 2% to outside lenders 2. It pays LIBOR under the terms of the swap 3. It receives 5% under the terms of the swap Average interest payment is LIBOR plus 0. 2% Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 9

Intel and Microsoft (MS) Transform a Liability (Figure 7. 2, page 152) 5% 5. 2% Intel MS LIBOR+0. 1% LIBOR Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 10

Typical Uses of Interest Rate Swaps l Converting an asset from l fixed rate to floating rate l floating rate to fixed rate Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 11

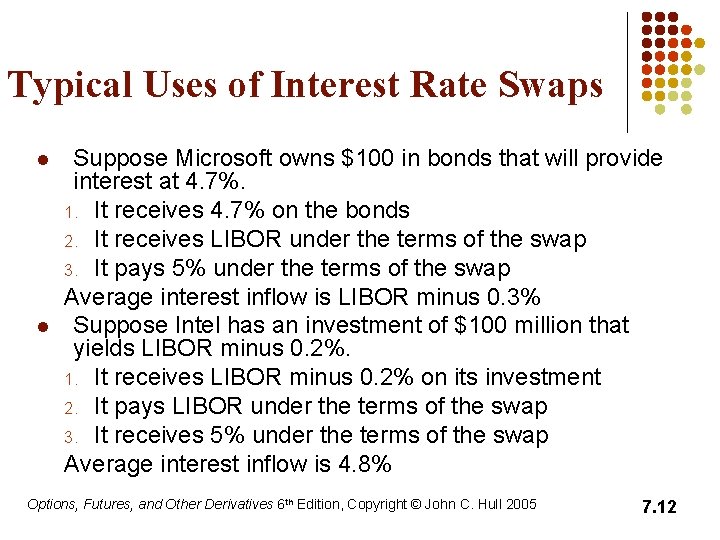

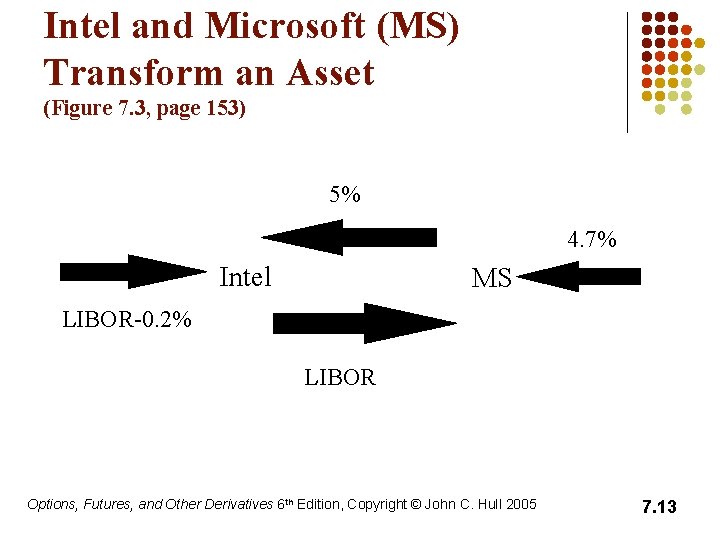

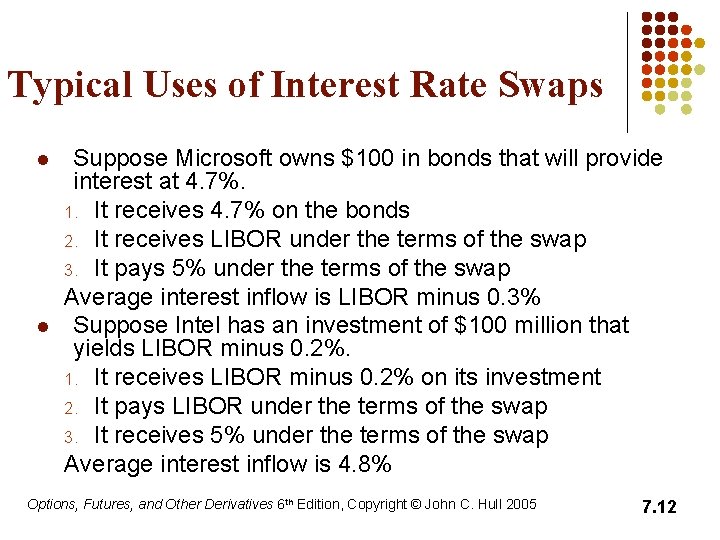

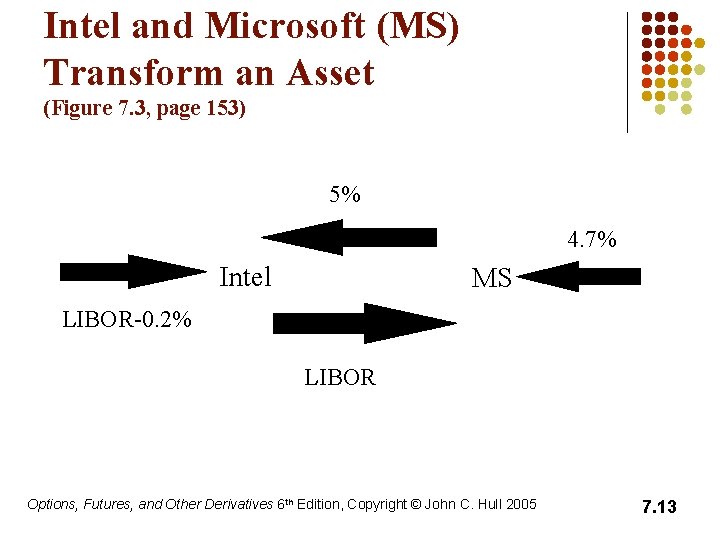

Typical Uses of Interest Rate Swaps l l Suppose Microsoft owns $100 in bonds that will provide interest at 4. 7%. 1. It receives 4. 7% on the bonds 2. It receives LIBOR under the terms of the swap 3. It pays 5% under the terms of the swap Average interest inflow is LIBOR minus 0. 3% Suppose Intel has an investment of $100 million that yields LIBOR minus 0. 2%. 1. It receives LIBOR minus 0. 2% on its investment 2. It pays LIBOR under the terms of the swap 3. It receives 5% under the terms of the swap Average interest inflow is 4. 8% Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 12

Intel and Microsoft (MS) Transform an Asset (Figure 7. 3, page 153) 5% 4. 7% Intel MS LIBOR-0. 2% LIBOR Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 13

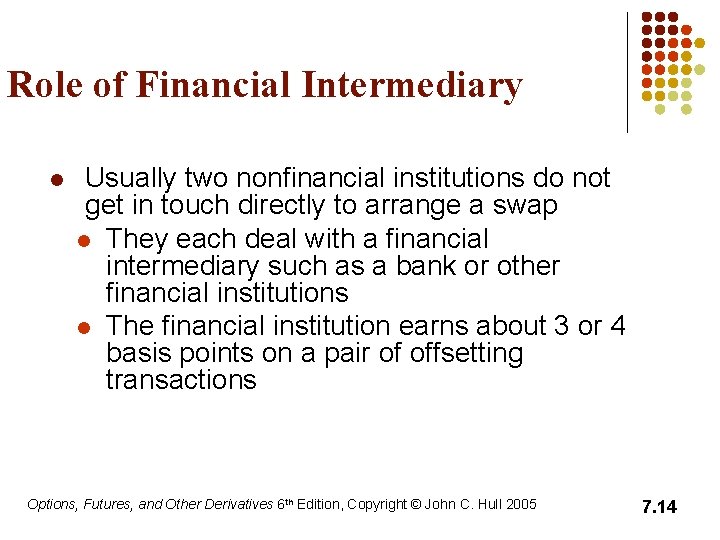

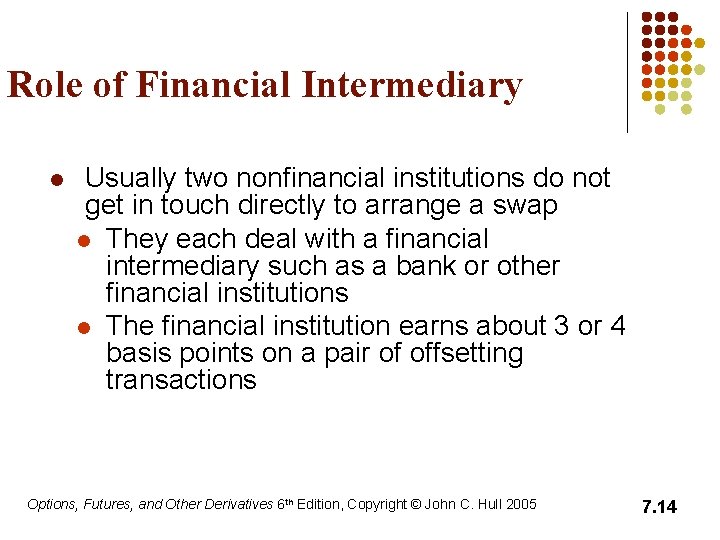

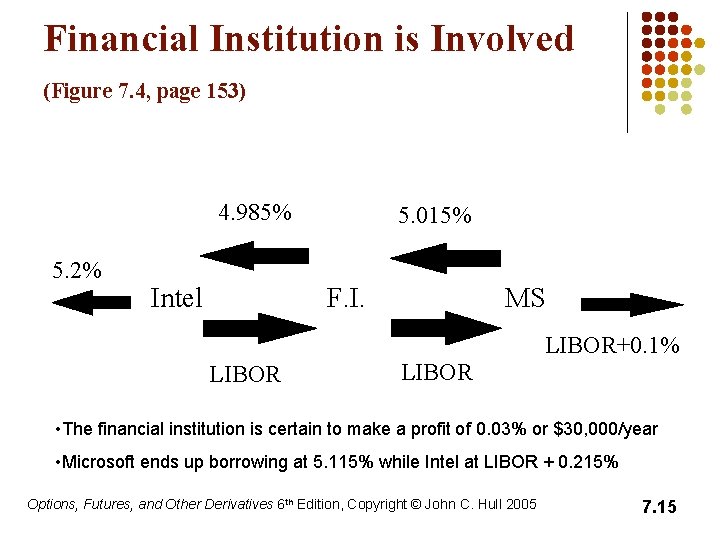

Role of Financial Intermediary l Usually two nonfinancial institutions do not get in touch directly to arrange a swap l They each deal with a financial intermediary such as a bank or other financial institutions l The financial institution earns about 3 or 4 basis points on a pair of offsetting transactions Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 14

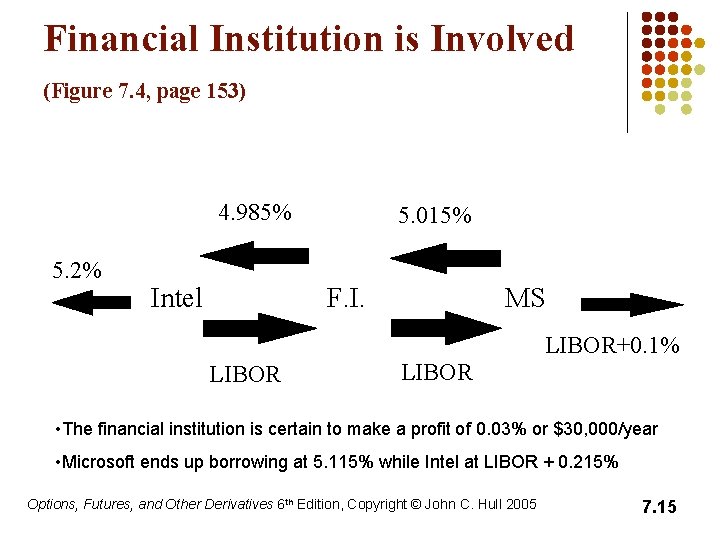

Financial Institution is Involved (Figure 7. 4, page 153) 4. 985% 5. 2% Intel 5. 015% F. I. MS LIBOR+0. 1% LIBOR • The financial institution is certain to make a profit of 0. 03% or $30, 000/year • Microsoft ends up borrowing at 5. 115% while Intel at LIBOR + 0. 215% Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 15

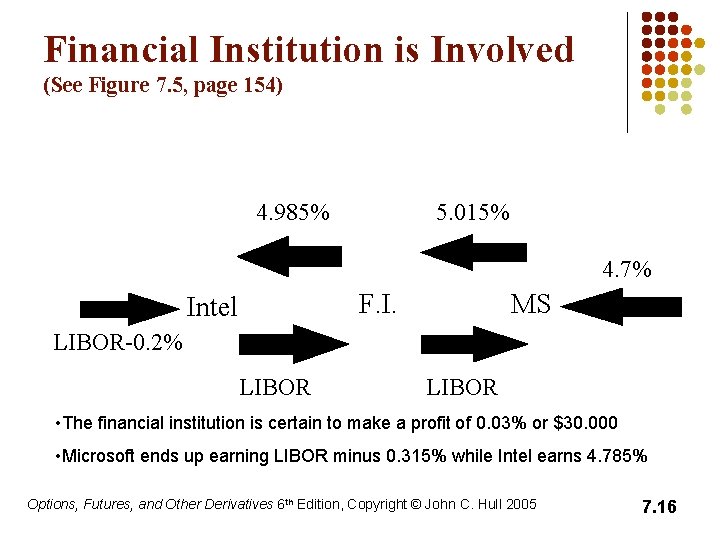

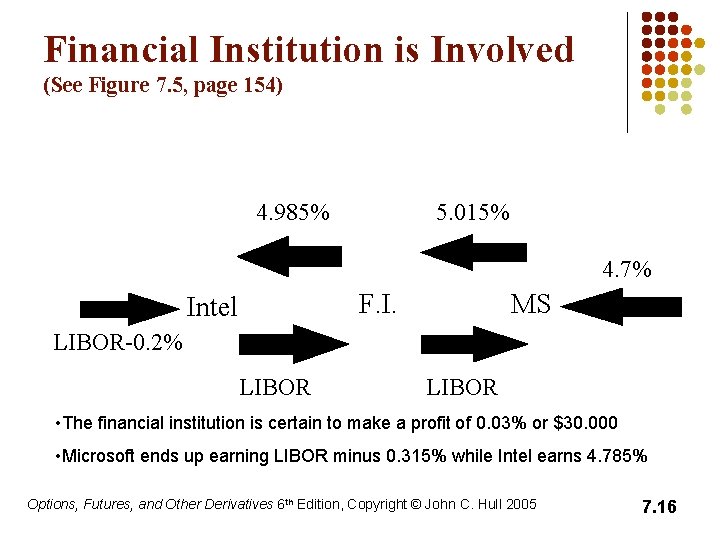

Financial Institution is Involved (See Figure 7. 5, page 154) 4. 985% 5. 015% 4. 7% F. I. Intel MS LIBOR-0. 2% LIBOR • The financial institution is certain to make a profit of 0. 03% or $30. 000 • Microsoft ends up earning LIBOR minus 0. 315% while Intel earns 4. 785% Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 16

Market Makers It is unlikely that two companies will contact a financial institution at the same time and want the opposite positions in exactly the same swap l Many large financial institutions act as market makers l They are prepared to enter into a swap without having an offsetting swap with another counterparty l Therefore market makers must quantify and hedge the risks they are taking. Bonds, forward rate agreements and interest rate futures are used Options, Futures, and Other Derivatives 6 Edition, Copyright © John C. Hull 2005 7. 17 l th

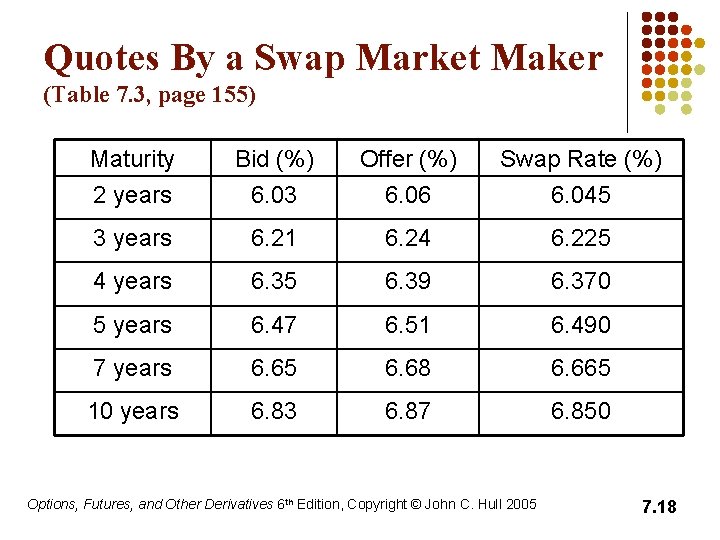

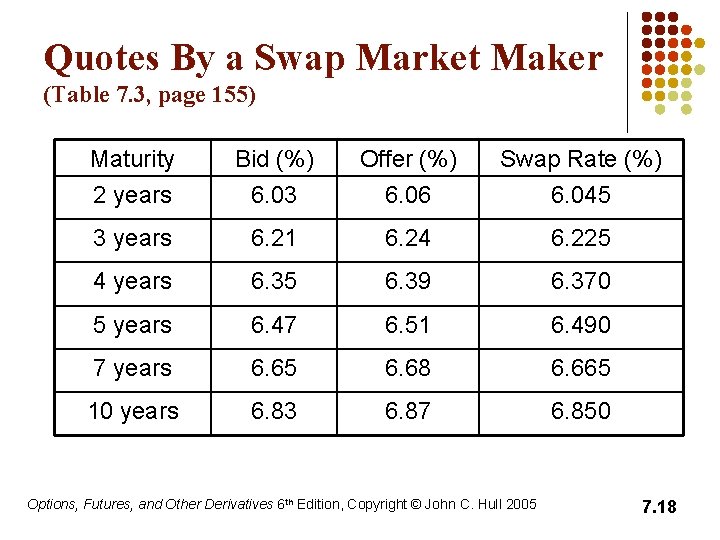

Quotes By a Swap Market Maker (Table 7. 3, page 155) Maturity Bid (%) Offer (%) Swap Rate (%) 2 years 6. 03 6. 06 6. 045 3 years 6. 21 6. 24 6. 225 4 years 6. 35 6. 39 6. 370 5 years 6. 47 6. 51 6. 490 7 years 6. 65 6. 68 6. 665 10 years 6. 83 6. 87 6. 850 Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 18

Swap value l l Consider a new swap where the fixed rate equals the current swap rate. The value of this swap should be zero The swap can be characterized as the difference between a fixed-rate bond a forward rate bond. Define Bfix: Value of fixed-rate bond underlying the swap Bfl: Value of floating-rate bond underlying the swap Since the value of swap is zero it follows that Bfix = Bfl Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 19

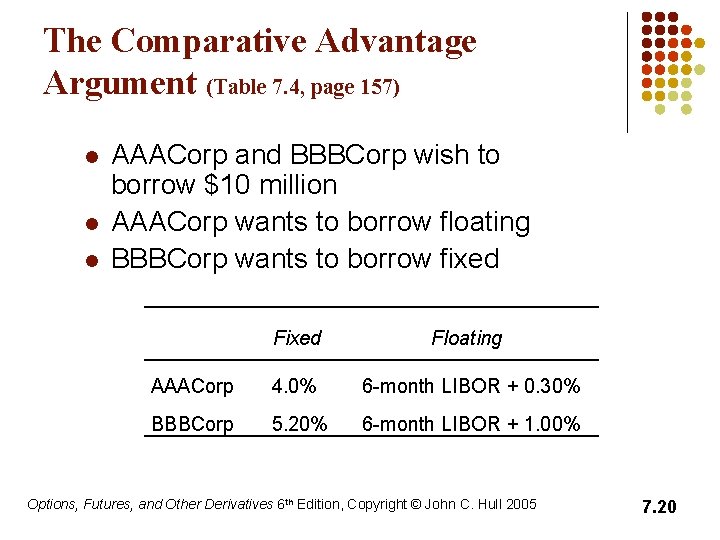

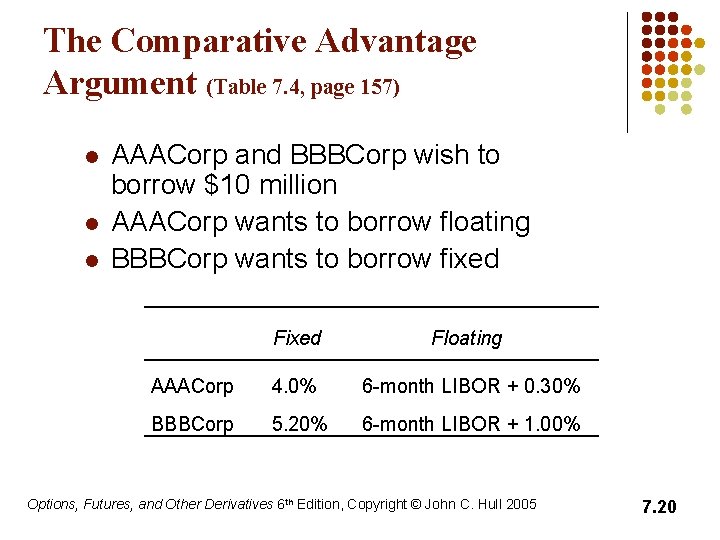

The Comparative Advantage Argument (Table 7. 4, page 157) l l l AAACorp and BBBCorp wish to borrow $10 million AAACorp wants to borrow floating BBBCorp wants to borrow fixed Floating AAACorp 4. 0% 6 -month LIBOR + 0. 30% BBBCorp 5. 20% 6 -month LIBOR + 1. 00% Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 20

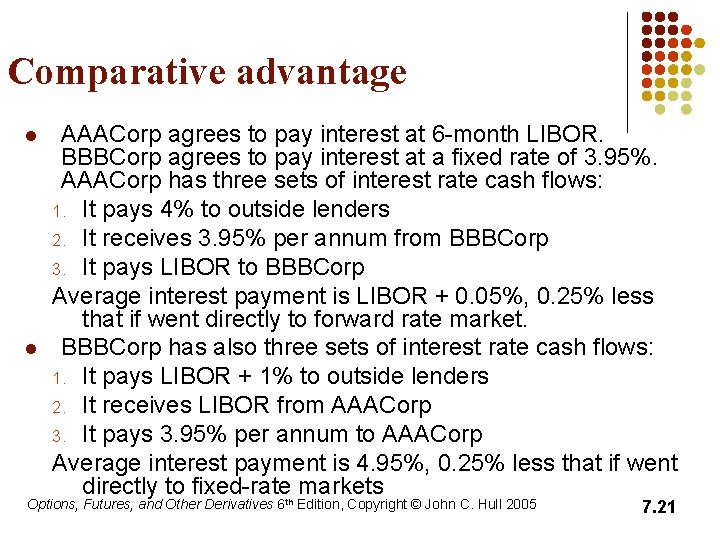

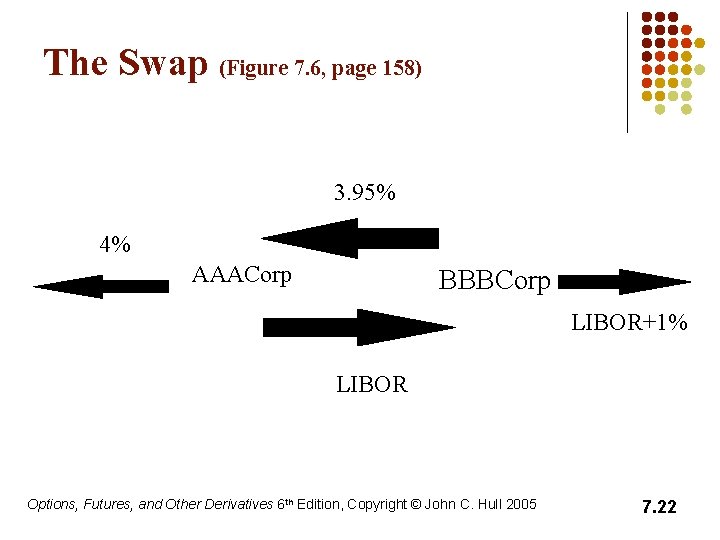

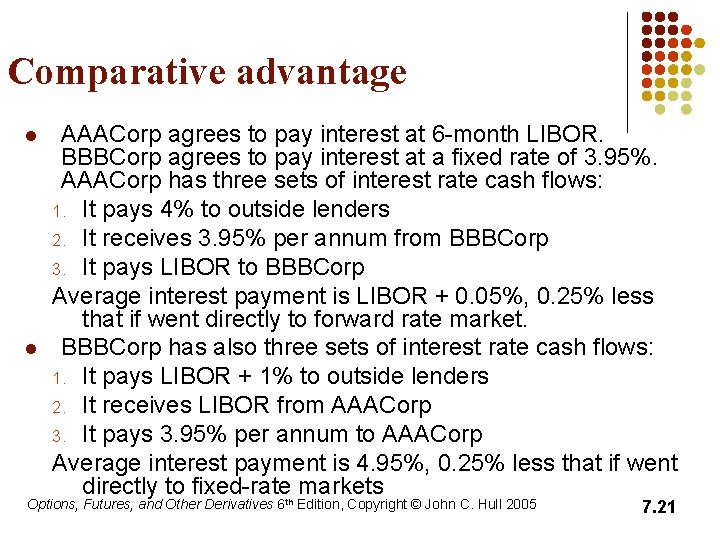

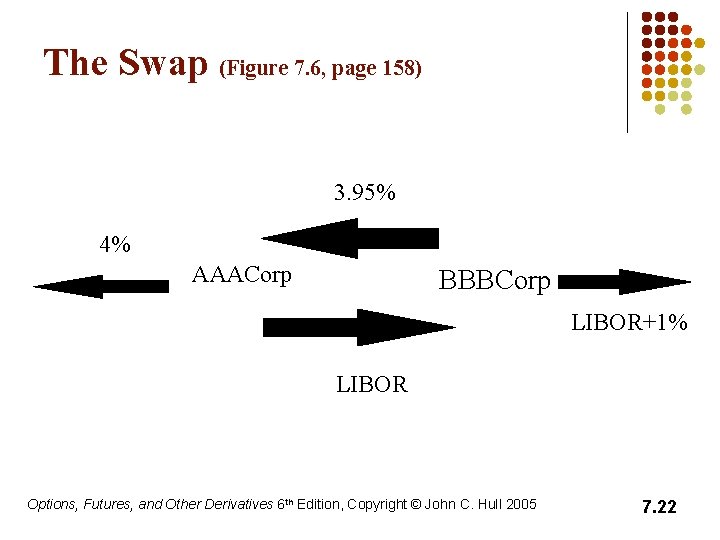

Comparative advantage l l AAACorp agrees to pay interest at 6 -month LIBOR. BBBCorp agrees to pay interest at a fixed rate of 3. 95%. AAACorp has three sets of interest rate cash flows: 1. It pays 4% to outside lenders 2. It receives 3. 95% per annum from BBBCorp 3. It pays LIBOR to BBBCorp Average interest payment is LIBOR + 0. 05%, 0. 25% less that if went directly to forward rate market. BBBCorp has also three sets of interest rate cash flows: 1. It pays LIBOR + 1% to outside lenders 2. It receives LIBOR from AAACorp 3. It pays 3. 95% per annum to AAACorp Average interest payment is 4. 95%, 0. 25% less that if went directly to fixed-rate markets Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 21

The Swap (Figure 7. 6, page 158) 3. 95% 4% AAACorp BBBCorp LIBOR+1% LIBOR Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 22

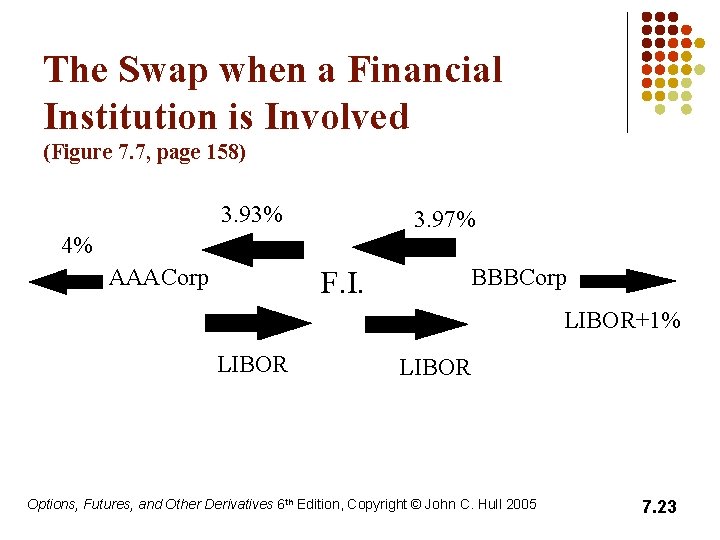

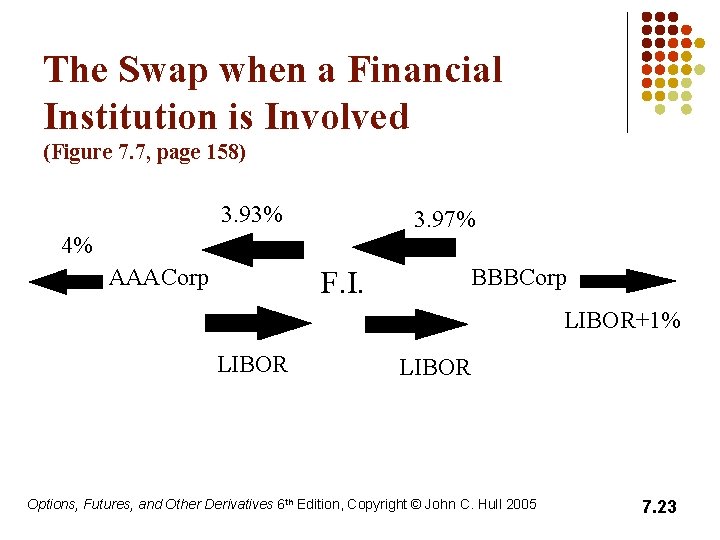

The Swap when a Financial Institution is Involved (Figure 7. 7, page 158) 3. 93% 3. 97% 4% AAACorp BBBCorp F. I. LIBOR+1% LIBOR Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 23

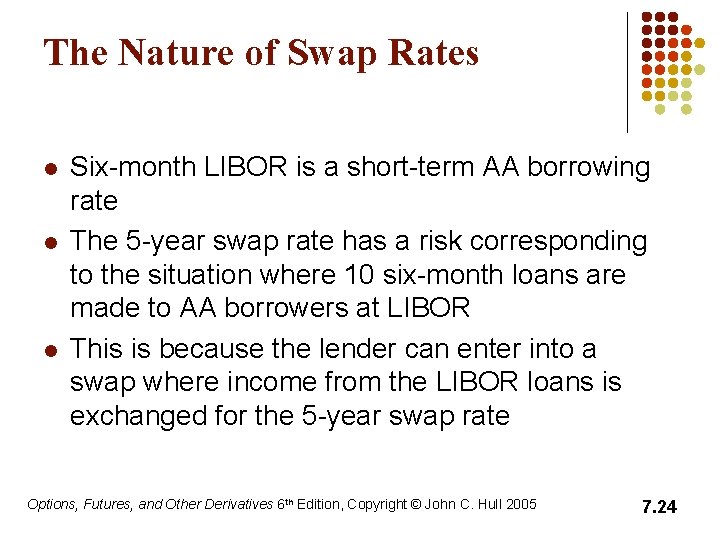

The Nature of Swap Rates l l l Six-month LIBOR is a short-term AA borrowing rate The 5 -year swap rate has a risk corresponding to the situation where 10 six-month loans are made to AA borrowers at LIBOR This is because the lender can enter into a swap where income from the LIBOR loans is exchanged for the 5 -year swap rate Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 24

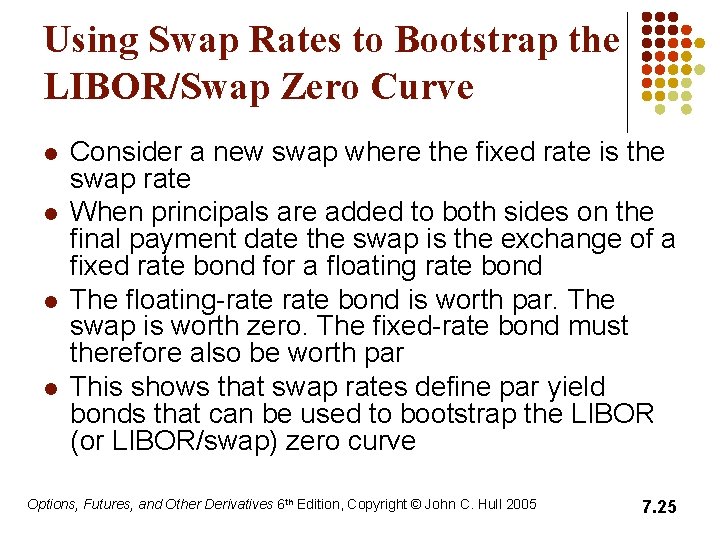

Using Swap Rates to Bootstrap the LIBOR/Swap Zero Curve l l Consider a new swap where the fixed rate is the swap rate When principals are added to both sides on the final payment date the swap is the exchange of a fixed rate bond for a floating rate bond The floating-rate bond is worth par. The swap is worth zero. The fixed-rate bond must therefore also be worth par This shows that swap rates define par yield bonds that can be used to bootstrap the LIBOR (or LIBOR/swap) zero curve Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 25

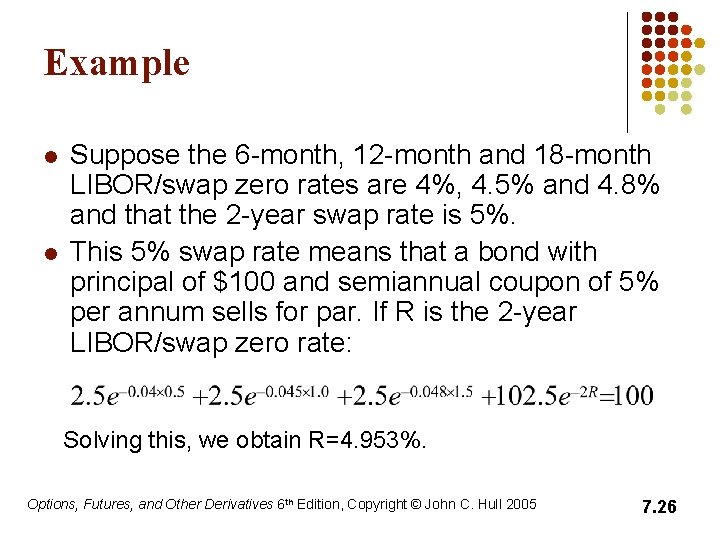

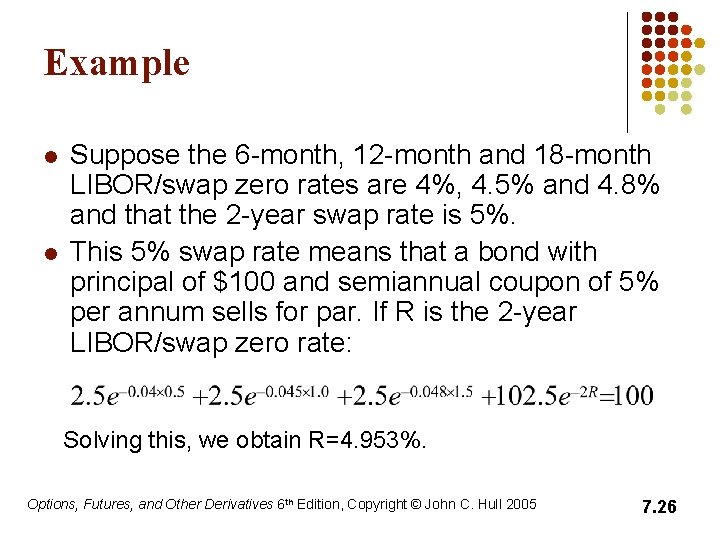

Example l l Suppose the 6 -month, 12 -month and 18 -month LIBOR/swap zero rates are 4%, 4. 5% and 4. 8% and that the 2 -year swap rate is 5%. This 5% swap rate means that a bond with principal of $100 and semiannual coupon of 5% per annum sells for par. If R is the 2 -year LIBOR/swap zero rate: Solving this, we obtain R=4. 953%. Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 26

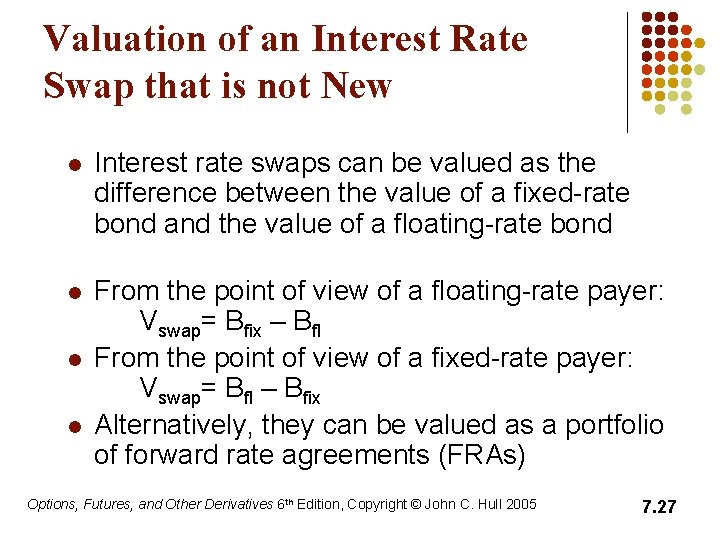

Valuation of an Interest Rate Swap that is not New l Interest rate swaps can be valued as the difference between the value of a fixed-rate bond and the value of a floating-rate bond l From the point of view of a floating-rate payer: Vswap= Bfix – Bfl From the point of view of a fixed-rate payer: Vswap= Bfl – Bfix Alternatively, they can be valued as a portfolio of forward rate agreements (FRAs) l l Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 27

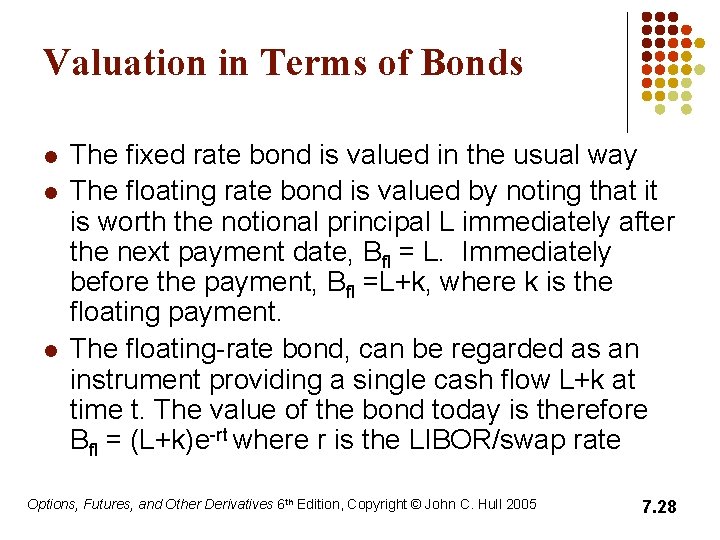

Valuation in Terms of Bonds l l l The fixed rate bond is valued in the usual way The floating rate bond is valued by noting that it is worth the notional principal L immediately after the next payment date, Bfl = L. Immediately before the payment, Bfl =L+k, where k is the floating payment. The floating-rate bond, can be regarded as an instrument providing a single cash flow L+k at time t. The value of the bond today is therefore Bfl = (L+k)e-rt where r is the LIBOR/swap rate Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 28

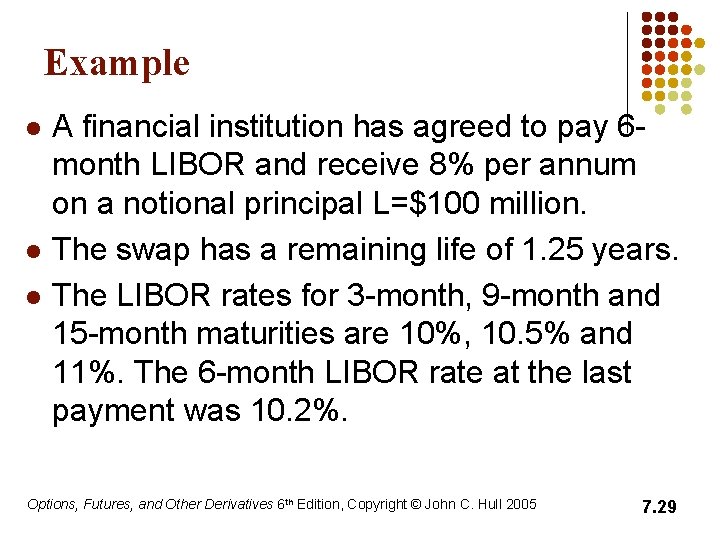

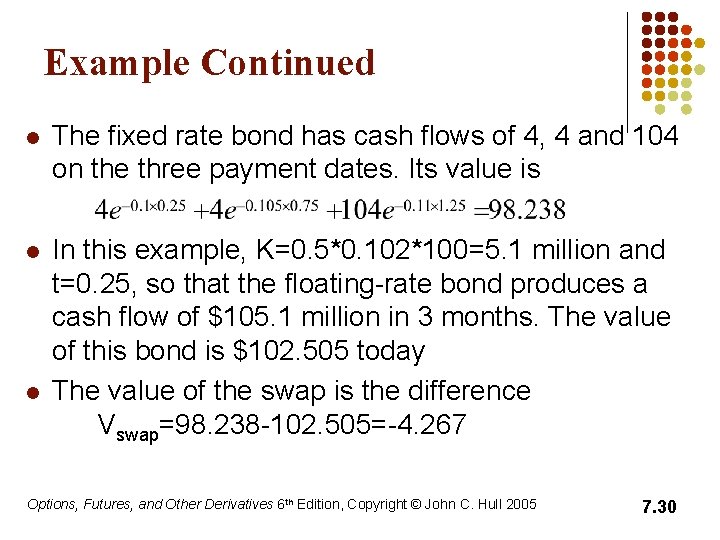

Example l l l A financial institution has agreed to pay 6 month LIBOR and receive 8% per annum on a notional principal L=$100 million. The swap has a remaining life of 1. 25 years. The LIBOR rates for 3 -month, 9 -month and 15 -month maturities are 10%, 10. 5% and 11%. The 6 -month LIBOR rate at the last payment was 10. 2%. Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 29

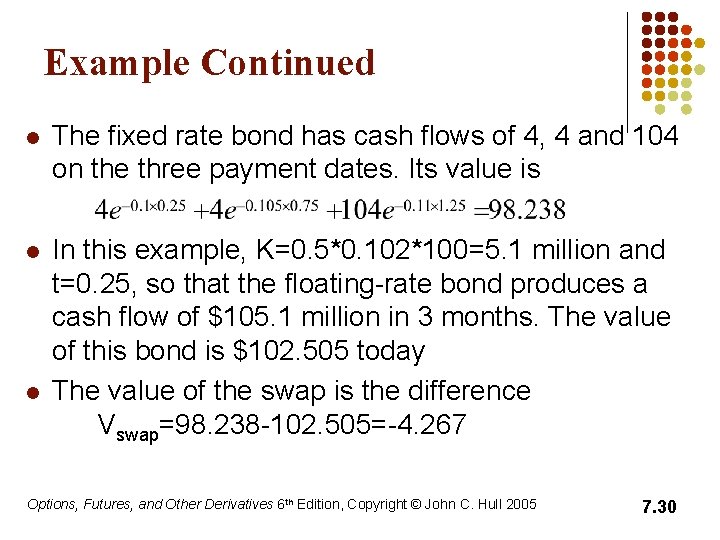

Example Continued l The fixed rate bond has cash flows of 4, 4 and 104 on the three payment dates. Its value is l In this example, Κ=0. 5*0. 102*100=5. 1 million and t=0. 25, so that the floating-rate bond produces a cash flow of $105. 1 million in 3 months. The value of this bond is $102. 505 today The value of the swap is the difference Vswap=98. 238 -102. 505=-4. 267 l Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 30

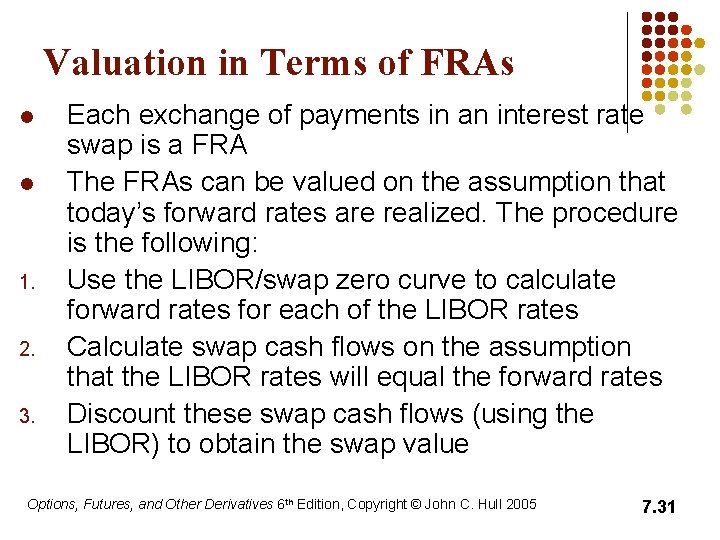

Valuation in Terms of FRAs l l 1. 2. 3. Each exchange of payments in an interest rate swap is a FRA The FRAs can be valued on the assumption that today’s forward rates are realized. The procedure is the following: Use the LIBOR/swap zero curve to calculate forward rates for each of the LIBOR rates Calculate swap cash flows on the assumption that the LIBOR rates will equal the forward rates Discount these swap cash flows (using the LIBOR) to obtain the swap value Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 31

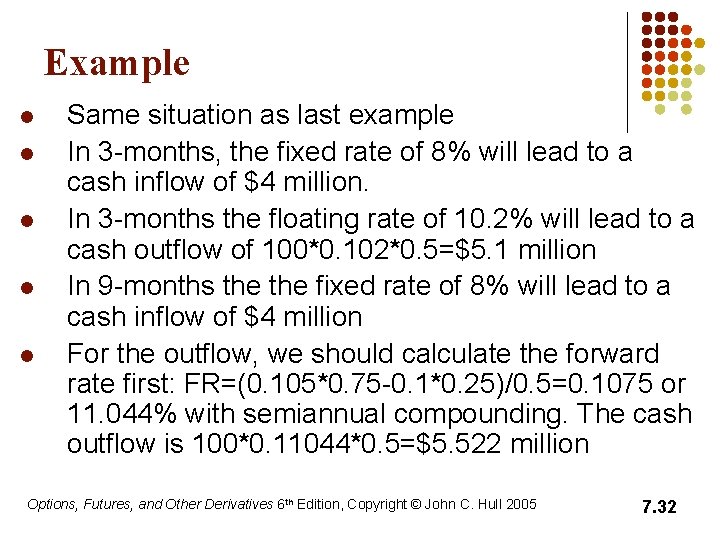

Example l l l Same situation as last example In 3 -months, the fixed rate of 8% will lead to a cash inflow of $4 million. In 3 -months the floating rate of 10. 2% will lead to a cash outflow of 100*0. 102*0. 5=$5. 1 million In 9 -months the fixed rate of 8% will lead to a cash inflow of $4 million For the outflow, we should calculate the forward rate first: FR=(0. 105*0. 75 -0. 1*0. 25)/0. 5=0. 1075 or 11. 044% with semiannual compounding. The cash outflow is 100*0. 11044*0. 5=$5. 522 million Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 32

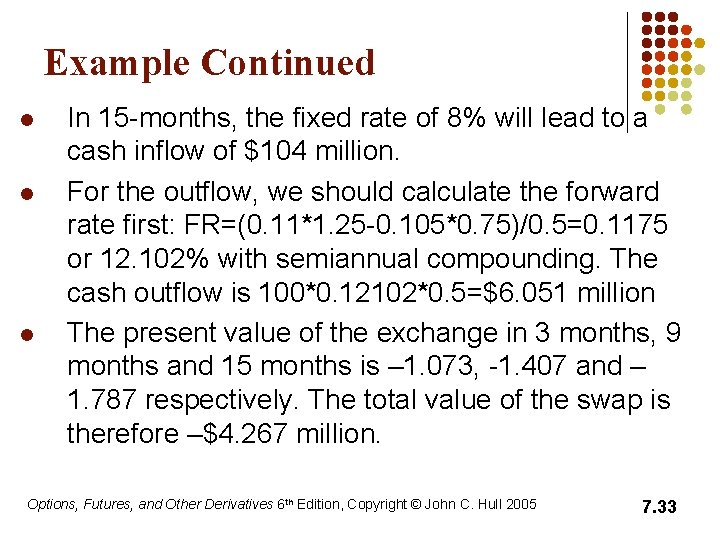

Example Continued l l l In 15 -months, the fixed rate of 8% will lead to a cash inflow of $104 million. For the outflow, we should calculate the forward rate first: FR=(0. 11*1. 25 -0. 105*0. 75)/0. 5=0. 1175 or 12. 102% with semiannual compounding. The cash outflow is 100*0. 12102*0. 5=$6. 051 million The present value of the exchange in 3 months, 9 months and 15 months is – 1. 073, -1. 407 and – 1. 787 respectively. The total value of the swap is therefore –$4. 267 million. Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 33

Currency swap l l l Involves exchanging principal and interest payments in one currency for principal and interest in another In an interest rate swap the principal is not exchanged In a currency swap the principal is usually exchanged at the beginning and the end of the swap’s life Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 34

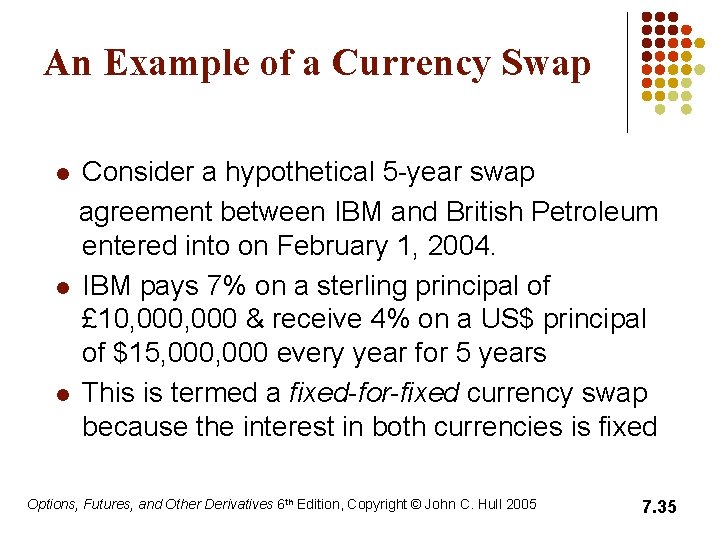

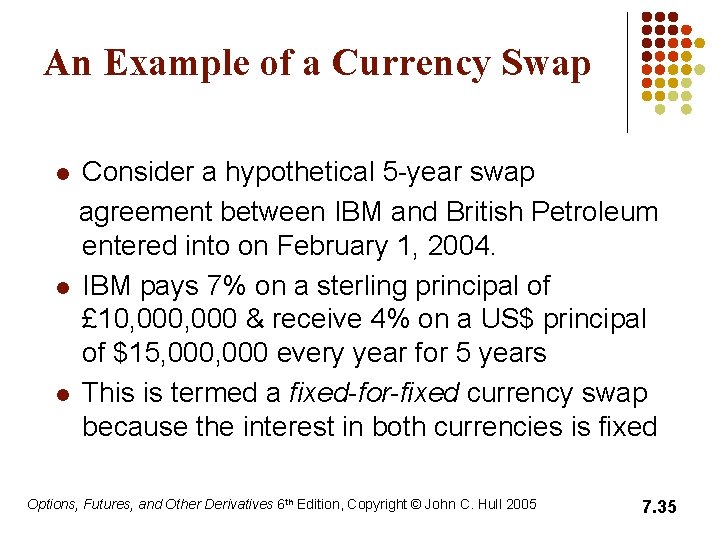

An Example of a Currency Swap Consider a hypothetical 5 -year swap agreement between IBM and British Petroleum entered into on February 1, 2004. l IBM pays 7% on a sterling principal of £ 10, 000 & receive 4% on a US$ principal of $15, 000 every year for 5 years l This is termed a fixed-for-fixed currency swap because the interest in both currencies is fixed l Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 35

An Example of a Currency Swap l l l At the outset of the swap, IBM pays $15 million and receives £ 10 million Each year during the life of the swap, IBM receives $0. 60 million (=4% of $15 million) and pays £ 0. 70 million (=7% of £ 10 million) At the end of the life of the swap, it pays a principal of £ 10 million and receives a principal of $15 million. Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 36

The Cash Flows (Table 7. 7, page 166) Year 2004 2005 2006 2007 2008 2009 Dollars Pounds $ £ ------millions-----– 15. 00 +10. 00 +0. 60 – 0. 70 +15. 60 − 10. 70 Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 37

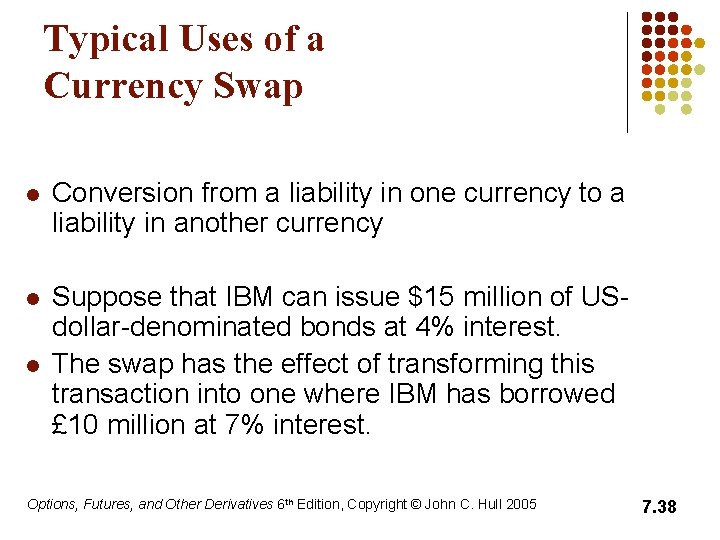

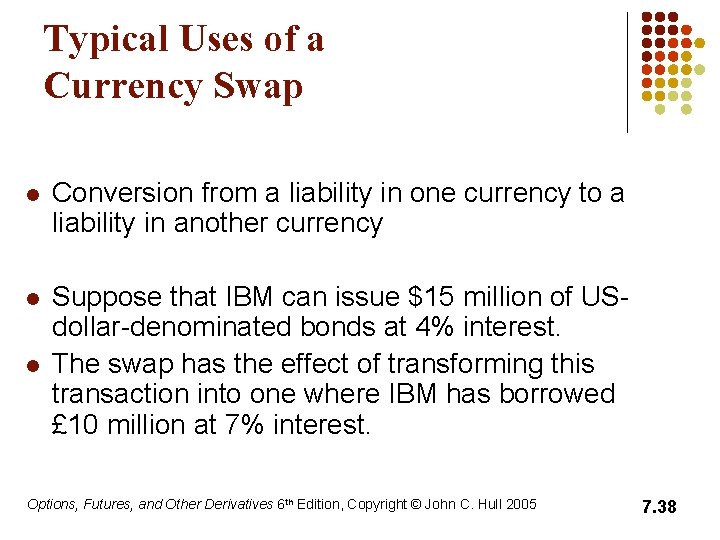

Typical Uses of a Currency Swap l Conversion from a liability in one currency to a liability in another currency l Suppose that IBM can issue $15 million of USdollar-denominated bonds at 4% interest. The swap has the effect of transforming this transaction into one where IBM has borrowed £ 10 million at 7% interest. l Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 38

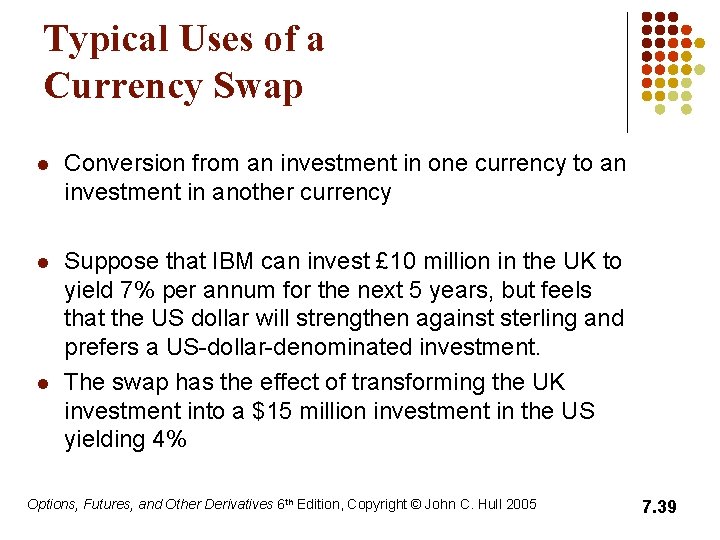

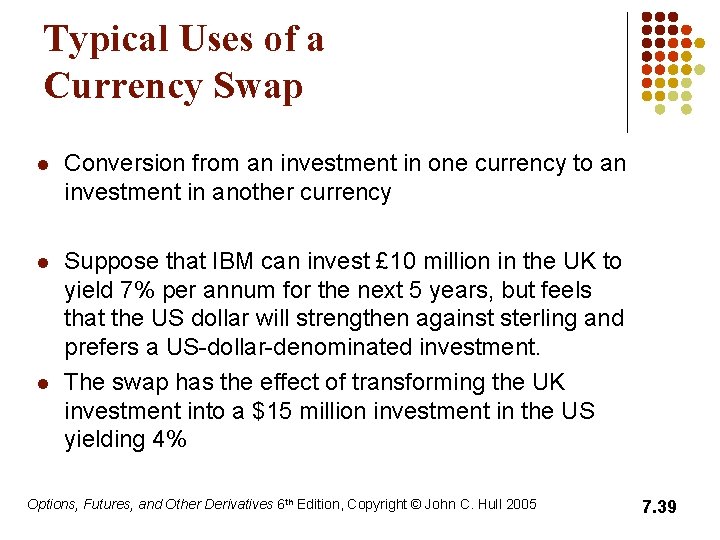

Typical Uses of a Currency Swap l Conversion from an investment in one currency to an investment in another currency l Suppose that IBM can invest £ 10 million in the UK to yield 7% per annum for the next 5 years, but feels that the US dollar will strengthen against sterling and prefers a US-dollar-denominated investment. The swap has the effect of transforming the UK investment into a $15 million investment in the US yielding 4% l Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 39

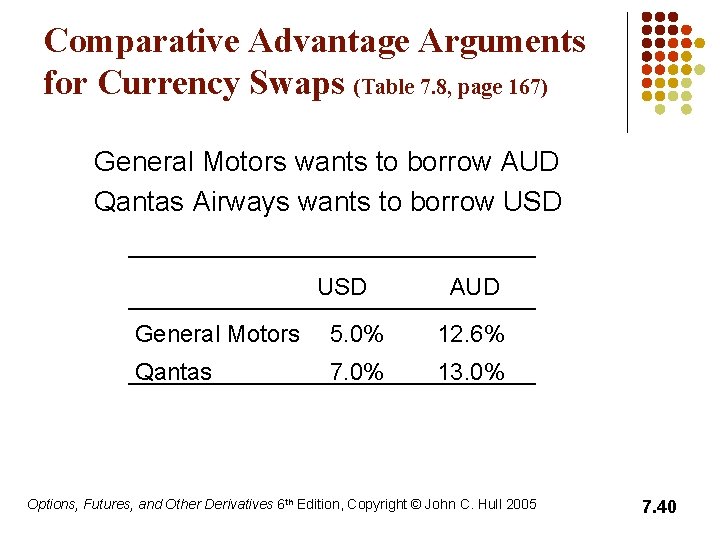

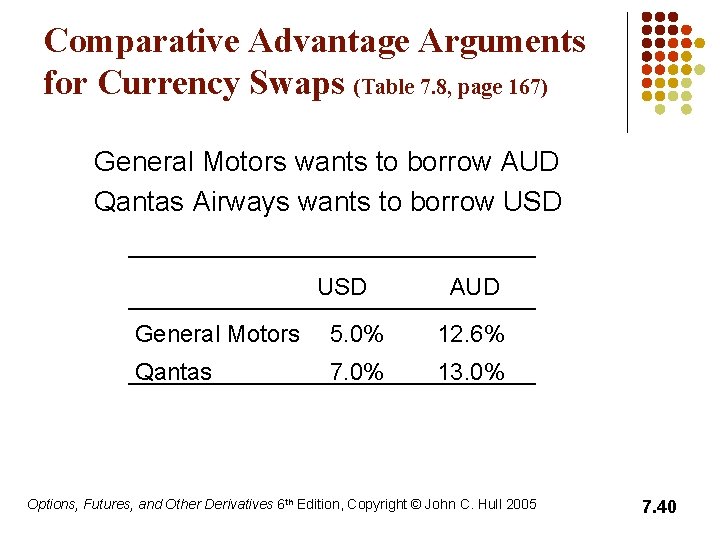

Comparative Advantage Arguments for Currency Swaps (Table 7. 8, page 167) General Motors wants to borrow AUD Qantas Airways wants to borrow USD AUD General Motors 5. 0% 12. 6% Qantas 7. 0% 13. 0% Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 40

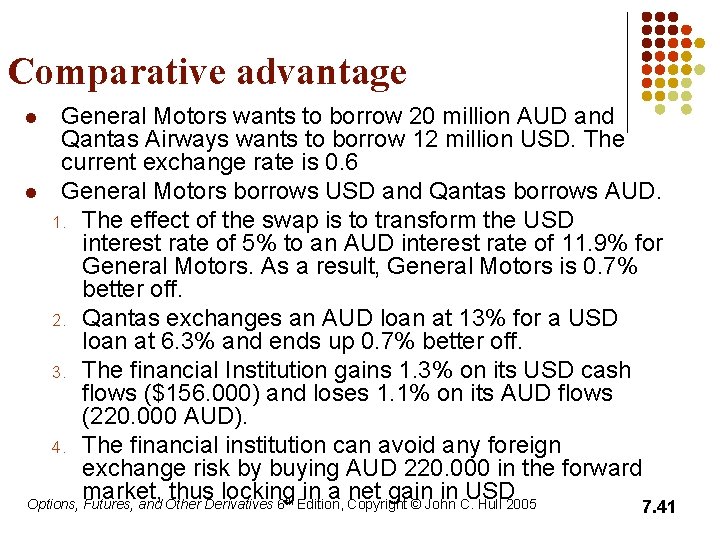

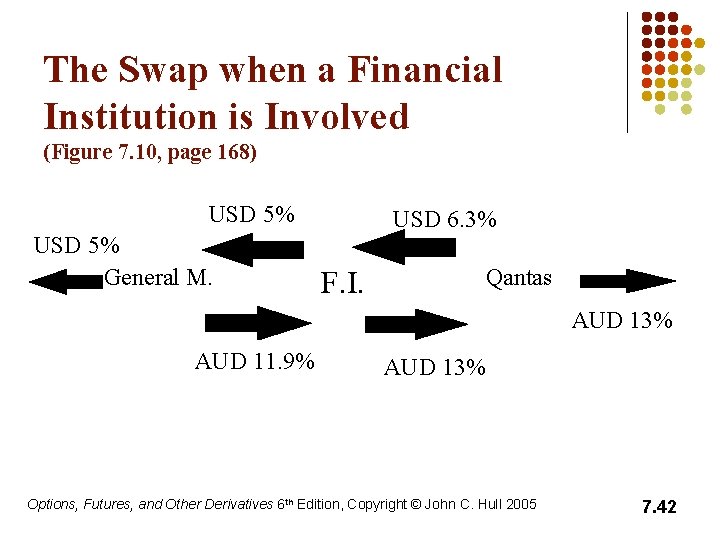

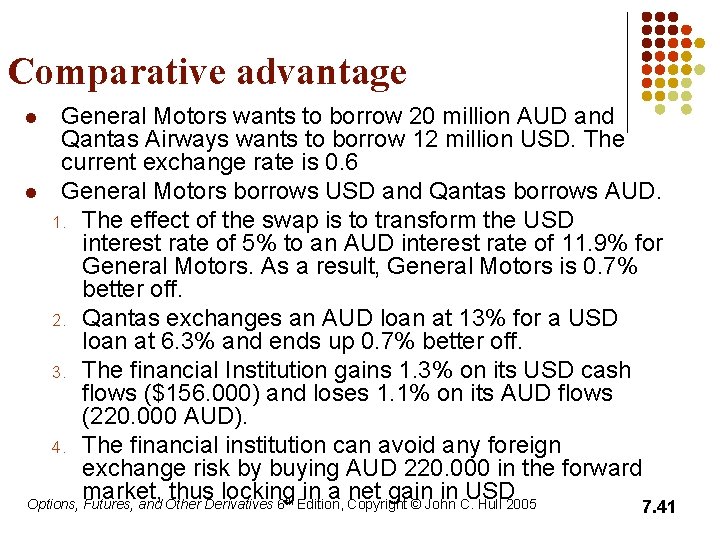

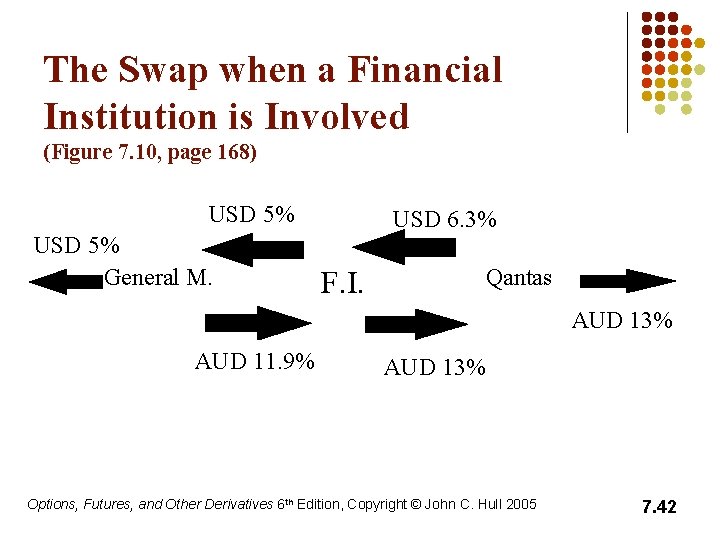

Comparative advantage General Motors wants to borrow 20 million AUD and Qantas Airways wants to borrow 12 million USD. The current exchange rate is 0. 6 l General Motors borrows USD and Qantas borrows AUD. 1. The effect of the swap is to transform the USD interest rate of 5% to an AUD interest rate of 11. 9% for General Motors. As a result, General Motors is 0. 7% better off. 2. Qantas exchanges an AUD loan at 13% for a USD loan at 6. 3% and ends up 0. 7% better off. 3. The financial Institution gains 1. 3% on its USD cash flows ($156. 000) and loses 1. 1% on its AUD flows (220. 000 AUD). 4. The financial institution can avoid any foreign exchange risk by buying AUD 220. 000 in the forward market, thus locking in a net gain in USD Options, Futures, and Other Derivatives 6 Edition, Copyright © John C. Hull 2005 l th 7. 41

The Swap when a Financial Institution is Involved (Figure 7. 10, page 168) USD 5% General M. USD 6. 3% F. I. Qantas AUD 13% AUD 11. 9% AUD 13% Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 42

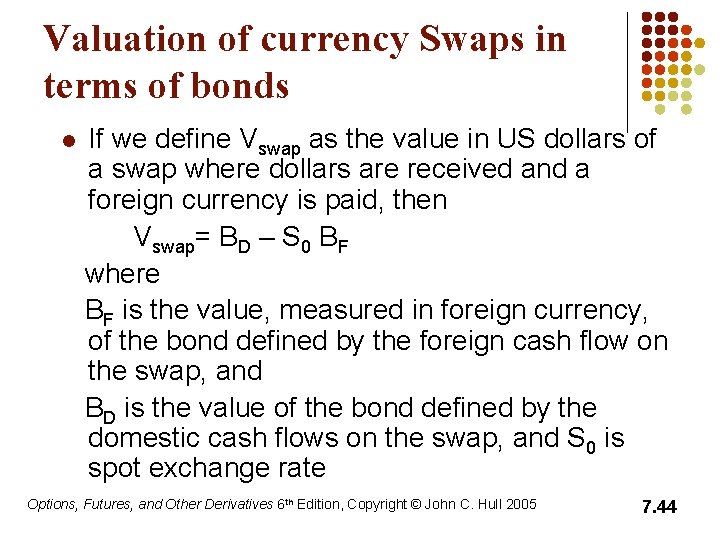

Valuation of Currency Swaps Like interest rate swaps, currency swaps can be valued either as the difference between 2 bonds or as a portfolio of forward foreign exchange contracts Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 43

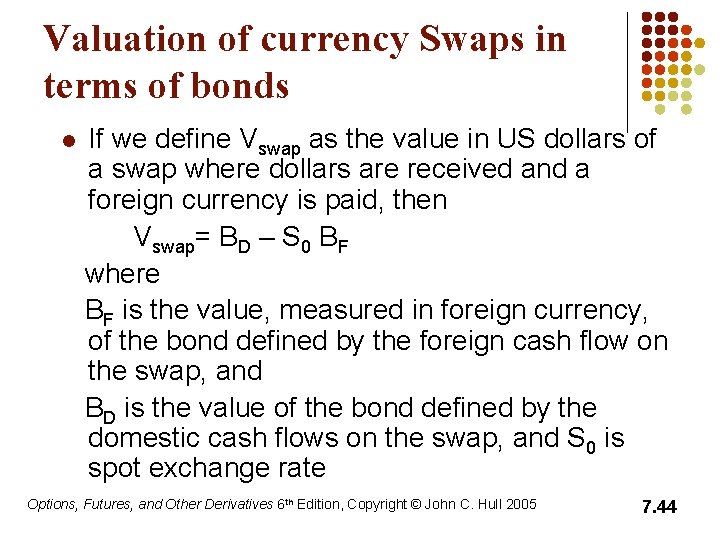

Valuation of currency Swaps in terms of bonds l If we define Vswap as the value in US dollars of a swap where dollars are received and a foreign currency is paid, then Vswap= BD – S 0 BF where BF is the value, measured in foreign currency, of the bond defined by the foreign cash flow on the swap, and BD is the value of the bond defined by the domestic cash flows on the swap, and S 0 is spot exchange rate Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 44

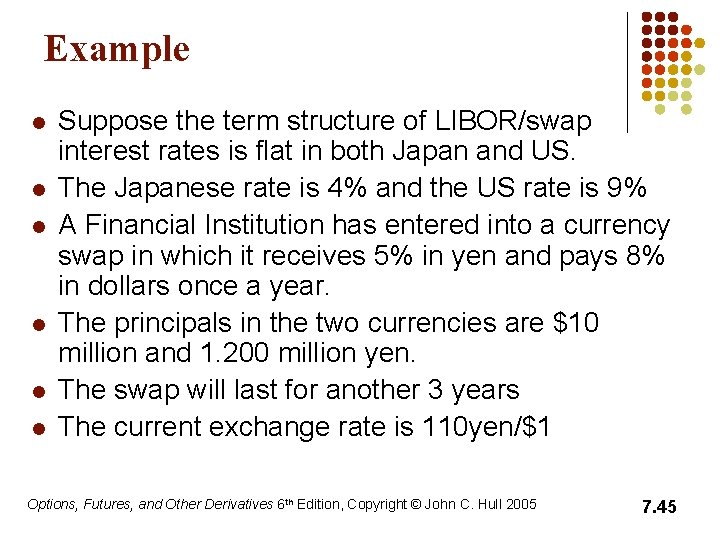

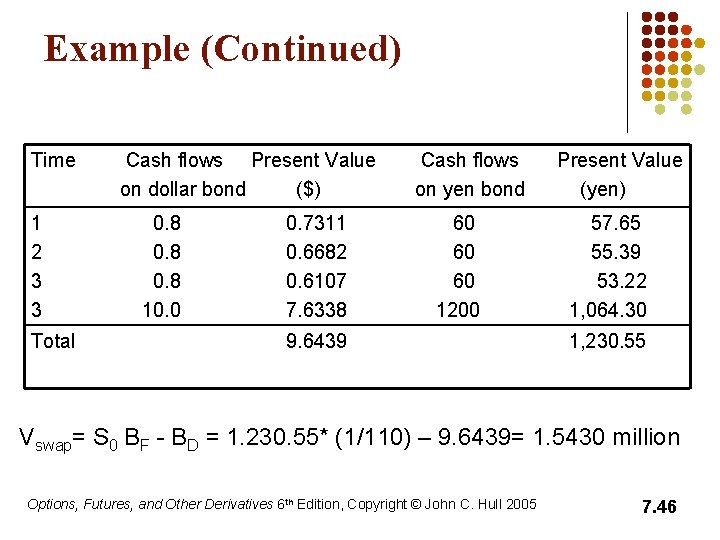

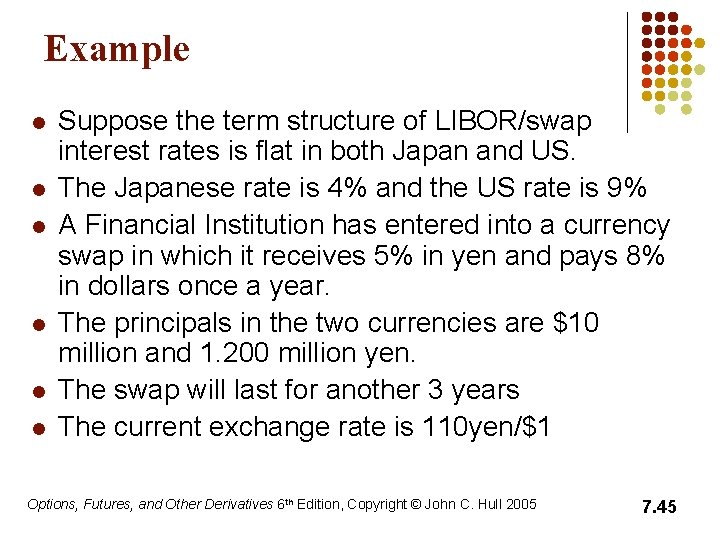

Example l l l Suppose the term structure of LIBOR/swap interest rates is flat in both Japan and US. The Japanese rate is 4% and the US rate is 9% A Financial Institution has entered into a currency swap in which it receives 5% in yen and pays 8% in dollars once a year. The principals in the two currencies are $10 million and 1. 200 million yen. The swap will last for another 3 years The current exchange rate is 110 yen/$1 Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 45

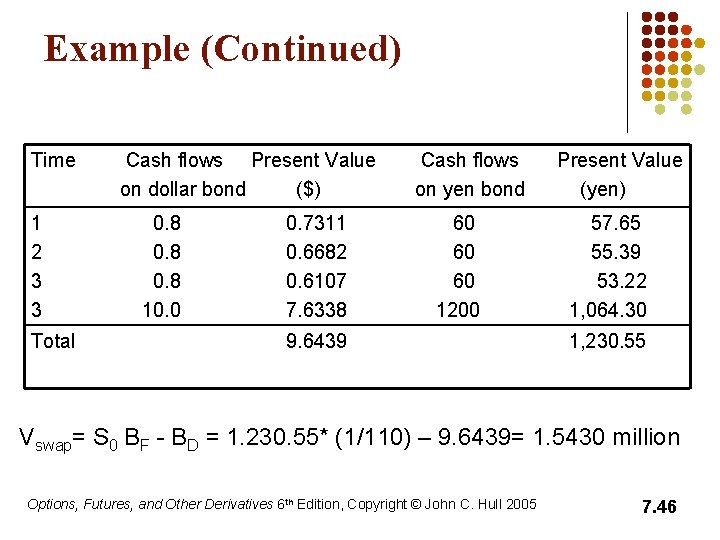

Example (Continued) Time 1 2 3 3 Total Cash flows Present Value on dollar bond ($) 0. 8 10. 0 0. 7311 0. 6682 0. 6107 7. 6338 Cash flows on yen bond 60 60 60 1200 9. 6439 Present Value (yen) 57. 65 55. 39 53. 22 1, 064. 30 1, 230. 55 Vswap= S 0 BF - BD = 1. 230. 55* (1/110) – 9. 6439= 1. 5430 million Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 46

Swaps & Forwards l l l A swap can be regarded as a convenient way of packaging forward contracts The “plain vanilla” interest rate swap in the example (slide 7. 6) consisted of 6 FRAs The “fixed for fixed” currency swap in the example (slide 7. 36) consisted of a cash transaction & 5 forward contracts Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 47

Example l l l Suppose the term structure of LIBOR/swap interest rates is flat in both Japan and US. The Japanese rate is 4% and the US rate is 9% A Financial Institution is entered into a currency swap in which it receives 5% in yen and pays 8% in dollars once a year. The principals in the two currencies are $10 million and 1. 200 million yen. The swap will last for another 3 years The current exchange rate is 110 yen/$1 Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 48

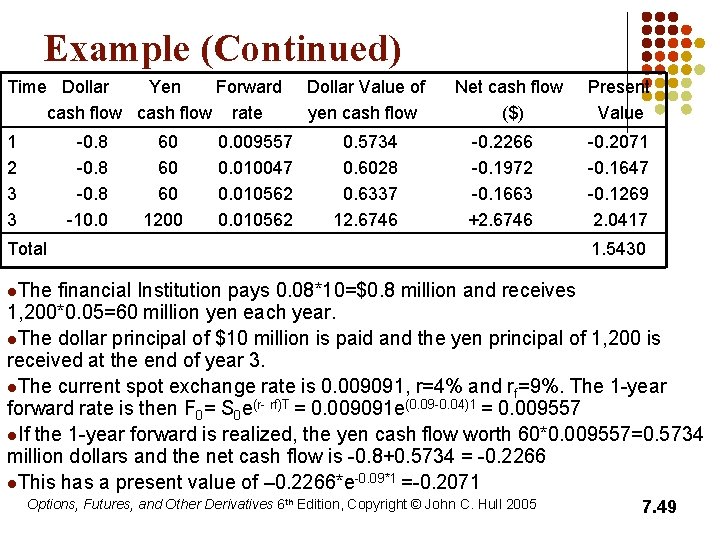

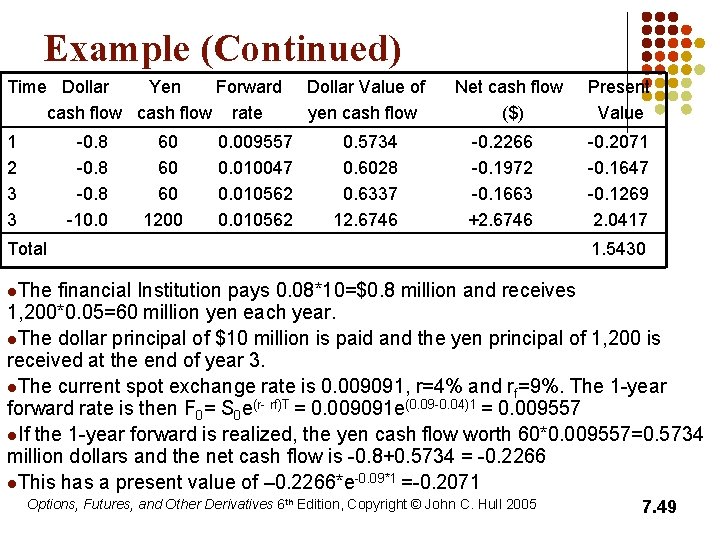

Example (Continued) Time Dollar Yen Forward cash flow rate 1 2 3 3 -0. 8 -10. 0 60 60 60 1200 0. 009557 0. 010047 0. 010562 Dollar Value of yen cash flow 0. 5734 0. 6028 0. 6337 12. 6746 Net cash flow ($) -0. 2266 -0. 1972 -0. 1663 +2. 6746 Total Present Value -0. 2071 -0. 1647 -0. 1269 2. 0417 1. 5430 l. The financial Institution pays 0. 08*10=$0. 8 million and receives 1, 200*0. 05=60 million yen each year. l. The dollar principal of $10 million is paid and the yen principal of 1, 200 is received at the end of year 3. l. The current spot exchange rate is 0. 009091, r=4% and rf=9%. The 1 -year forward rate is then F 0= S 0 e(r- rf)T = 0. 009091 e(0. 09 -0. 04)1 = 0. 009557 l. If the 1 -year forward is realized, the yen cash flow worth 60*0. 009557=0. 5734 million dollars and the net cash flow is -0. 8+0. 5734 = -0. 2266 l. This has a present value of – 0. 2266*e-0. 09*1 =-0. 2071 Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 49

Swaps & Forwards (continued) l l The value of the swap is the sum of the values of the forward contracts underlying the swap Swaps are normally “at the money” initially l This means that it costs nothing to enter into a swap l It does not mean that each forward contract underlying a swap is “at the money” initially Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 50

Swaptions l l A swaption or swap option gives the holder the right to enter into an interest rate swap in the future Two kinds The right to pay a specified fixed rate and receive LIBOR l The right to receive a specified fixed rate and pay LIBOR Swaptions provide companies with a guarantee that the rate of interest that they will pay on a loan at some future time will not exceed some level With swaptions, the company is able to benefit from favorable interest rate movements, while acquiring protection from unfavorable rate movements l Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 51

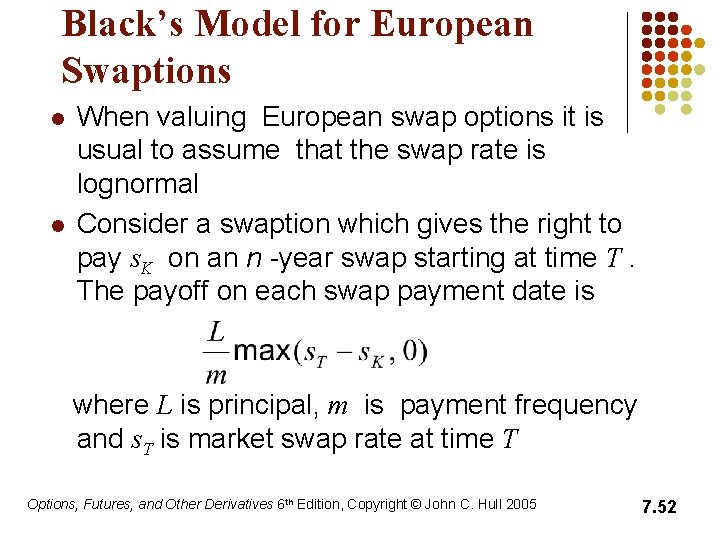

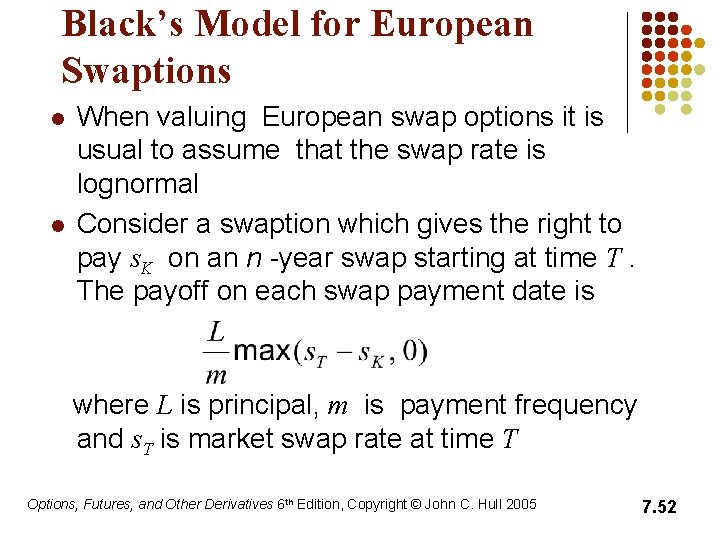

Black’s Model for European Swaptions l l When valuing European swap options it is usual to assume that the swap rate is lognormal Consider a swaption which gives the right to pay s. K on an n -year swap starting at time T. The payoff on each swap payment date is where L is principal, m is payment frequency and s. T is market swap rate at time T Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 52

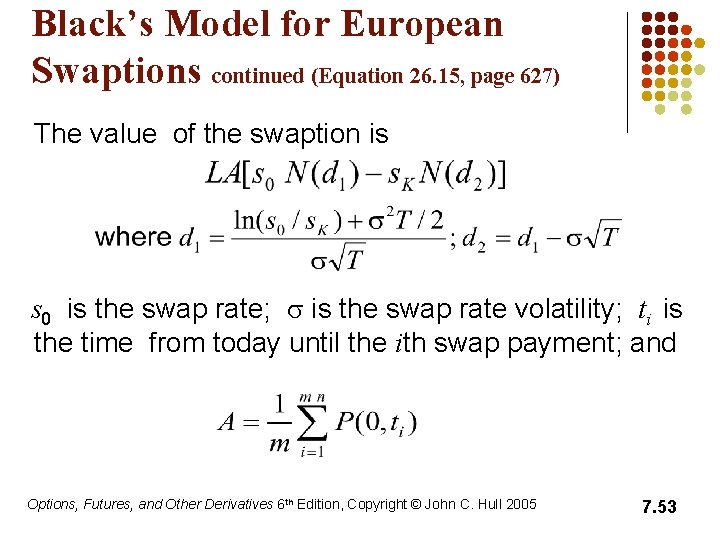

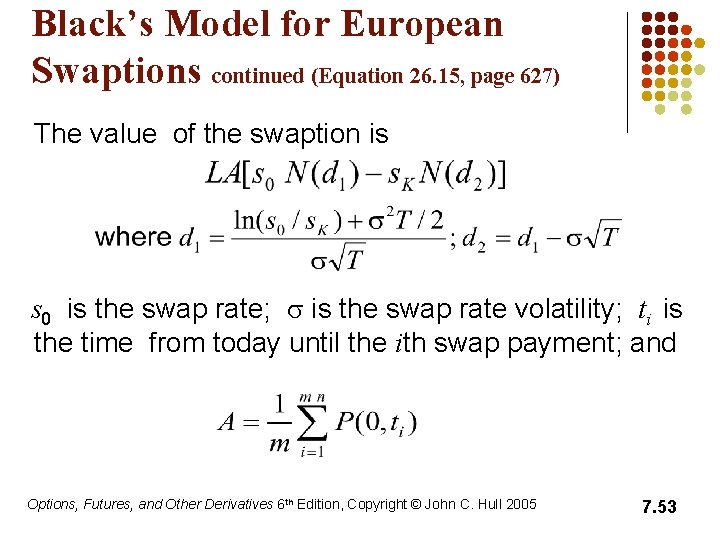

Black’s Model for European Swaptions continued (Equation 26. 15, page 627) The value of the swaption is s 0 is the swap rate; s is the swap rate volatility; ti is the time from today until the ith swap payment; and Options, Futures, and Other Derivatives 6 th Edition, Copyright © John C. Hull 2005 7. 53

Options futures and other derivatives

Options futures and other derivatives Advantages and disadvantages of derivatives

Advantages and disadvantages of derivatives Options futures and risk management

Options futures and risk management Introduction to futures and options

Introduction to futures and options Options futures and risk management

Options futures and risk management Currency futures

Currency futures Tailing the hedge

Tailing the hedge Put call parity

Put call parity Short position meaning

Short position meaning Credit default swap ppt

Credit default swap ppt Credit default swap

Credit default swap Swaps

Swaps Banker swaps rat race for bus lane

Banker swaps rat race for bus lane Mercados de forwards y swaps

Mercados de forwards y swaps Tipos de swaps

Tipos de swaps Advantages of interest rate swaps

Advantages of interest rate swaps Unwinding swaps

Unwinding swaps Swaps

Swaps Considering interestrate swaps, the swap rate is

Considering interestrate swaps, the swap rate is Tailing hedge

Tailing hedge Chapter 4 applications of derivatives

Chapter 4 applications of derivatives Chapter 4 applications of derivatives

Chapter 4 applications of derivatives Other initiated self repair example

Other initiated self repair example Product and quotient rules and higher order derivatives

Product and quotient rules and higher order derivatives Futures and forwards

Futures and forwards Chapter 3 food service career options worksheet answers

Chapter 3 food service career options worksheet answers Tomato sauce derivatives

Tomato sauce derivatives Cleft and pouch

Cleft and pouch Basis risk arises due to

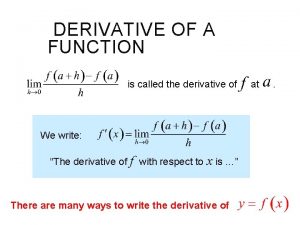

Basis risk arises due to Derivative of ln 3x

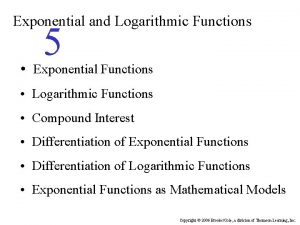

Derivative of ln 3x Exponential differentiation

Exponential differentiation Exponential rule derivative

Exponential rule derivative Carboxylic acids and their derivatives

Carboxylic acids and their derivatives Acidity of carboxylic acid derivatives

Acidity of carboxylic acid derivatives Naming carboxylic acids

Naming carboxylic acids Fischer esterification

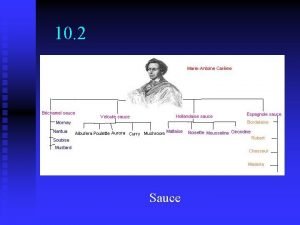

Fischer esterification Mother sauces definition

Mother sauces definition Financial engineering derivatives and risk management

Financial engineering derivatives and risk management Limits and derivatives class 11

Limits and derivatives class 11 Limits and derivatives

Limits and derivatives Derivatives and the shape of a graph

Derivatives and the shape of a graph Is no2 para or meta directing

Is no2 para or meta directing Limits and derivatives

Limits and derivatives Sejarah mother sauce

Sejarah mother sauce Cotx derivative

Cotx derivative Financial engineering derivatives and risk management

Financial engineering derivatives and risk management Financial engineering derivatives and risk management

Financial engineering derivatives and risk management Pt member of jakarta

Pt member of jakarta Forward contract definition

Forward contract definition Cheapest to deliver futures

Cheapest to deliver futures Euro-btp options

Euro-btp options Future contracts

Future contracts Add-on yield

Add-on yield Currency futures

Currency futures