SVARs and DFMs for modeling electricity prices Matteo

- Slides: 16

SVARs and DFMs for modeling electricity prices Matteo Manera, University of Milan-Bicocca Massimiliano Serati, LIUC Manmade Project Ispra, 12 January 2009

Overview ü Standard models of electricity prices share two features: • • Statistical approach (not allowing for structural theoretical information) Univariate “partial” specifications ü General goal: overcome these drawbacks by theoretically inspired models allowing for a multivariate approach ü Specific goal: find (in a dynamic framework) the main determinants of price behaviour and connect price evolution to the occurrence of grid faults and disturbances. 2

Basic (S)VAR (1/2) ü Dataset: Nord. El ü Endogenous variables: • • • Cons = total consumption of electricity (demand side) Netimp = net imports (within Nord. Pool countries) (demand side) Icm = installed capacity (supply-structural side) Pldm = peak load demand (demand side) Iatcoutm = existing interconnections average transmission capacity, OUT (supply-structural side) • Iatcinm = existing interconnections average transmission capacity, IN (supply-structural side) • Prices = electricity spot price 3

Basic (S)VAR (2/2) ü All data monthly sampled; sample: 1999 M 1 – 2007 M 12 ü Specification allowing for three lags and no cointegration ü Specification tests and diagnostics: passed 4

Basic (S)VAR. IRFs (Cholesky identification scheme) Response to Cholesky One S. D. Innovation 2 S. E. Evidence is robust with respect to different variables ordering 5

Basic (S)VAR. Remarks ü Reactions of electricity price are significant and positive in presence of: • • a consumption shock (demand pressure) a net imports shock (aggregate Nord. Pool consumption-demand exceeds aggregate Nord. Pool production-supply) • a positive shock affecting the outwards interconnections transmission capacity (matching a higher foreign demand? ) • All effects disappear in the medium run ü Price does not seem to depend on peaks in the load demand. 6

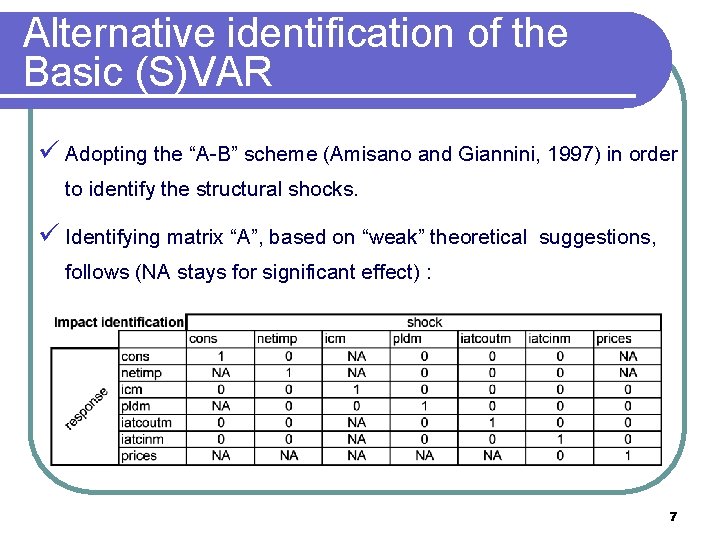

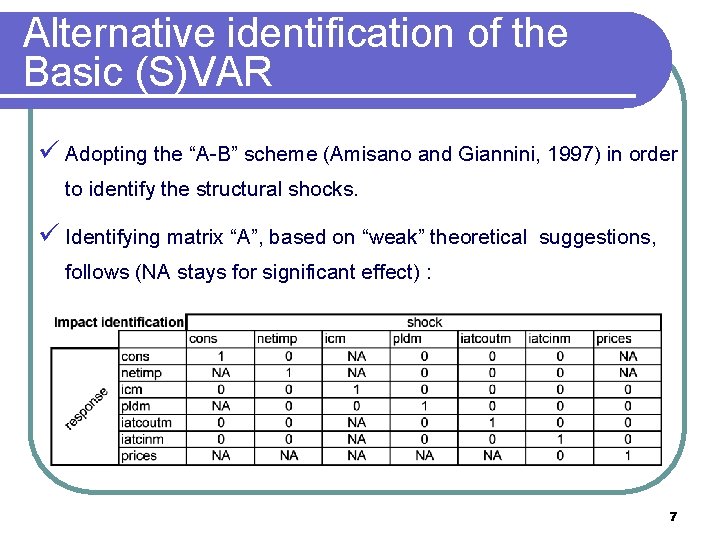

Alternative identification of the Basic (S)VAR ü Adopting the “A-B” scheme (Amisano and Giannini, 1997) in order to identify the structural shocks. ü Identifying matrix “A”, based on “weak” theoretical suggestions, follows (NA stays for significant effect) : 7

Basic (S)VAR. IRFs (A-B identification scheme) Response to Cholesky One S. D. Innovation 2 S. E. Evidence is robust with respect to different identification schemes: Cholesky vs A-B 8

An enlarged (S)VAR (1/2) ü Endogenous variables: • • • Cons = total consumption of electricity (demand side) Netimp = net imports (within Nord. Pool countries) (demand side) Icm = installed capacity (supply-structural side) Pldm = peak load demand (demand side) Iatcoutm = existing interconnections average transmission capacity, OUT (supply-structural side) • Iatcinm = existing interconnections average transmission capacity, IN (supply-structural side) • • Price = electricity spot price Disturbm_detr = number of disturbances (detrended) 9

An enlarged (S)VAR (2/2) ü All data monthly sampled; sample: 1999 M 1 – 2007 M 12 ü Specification allowing for three lags and no cointegration ü Specification tests and diagnostics: passed 10

(SVAR) including a disturbances series. IRFs Response to Cholesky One S. D. Innovation 2 S. E. 11

Enlarged (S)VAR. Remarks (1/3) ü (As before) Reactions of electricity price are significant and positive in presence of: • • a consumption shock (demand pressure) a net imports shock (whole Nord. Pool consumption-demand exceeds whole Nord. Pool production-supply) • a positive shock affecting the outwards Interconnections transmission capacity (matching a higher foreign demand? ) 12

Enlarged (S)VAR. Remarks (2/3) ü Negative reaction of price with respect to disturbances shocks. (Puzzling evidence, maybe due to both the montly frequency adopted and the improved efficiency in the grid management, joint with the historical positive trend of prices) ü Price does not seem to depend on peaks in the load demand. 13

Enlarged (S)VAR. Remarks (3/3) ü Reactions of disturbances are significant (both in short and long run) and positive in presence of: • a peak load demand shock (inducing congestion) ü Reactions of disturbances are significant (short run only) and negative in presence of: • • a net imports shock (excess demand is discharged outside the area) a shock affecting the outwards interconnections transmission capacity (quite obvious) ü Price does not influence disturbances 14

A Dynamic Factor Model (DFM) ü Work in progress… ü Data on single countries ü Higher (weakly) frequency (if possible) ü Aim: (a) exploit information of a larger dataset; (b) emphasize single-country effects; (c) evaluate gaps between supply and demand their effects on grid faults and prices. 15

A Dynamic Factor Model (DFM) ü Identification of three factors (sign restrictions) • • • Factor 1: local demand (positive effect on prices and faults) Factor 2: local supply (negative effect on prices and faults) Factor 3: “irregularities” in grid management (positive effect on prices) 16