Structuring Joseph V Rizzi Amsterdam Institute of Finance

- Slides: 25

Structuring Joseph V. Rizzi Amsterdam Institute of Finance October, 2014

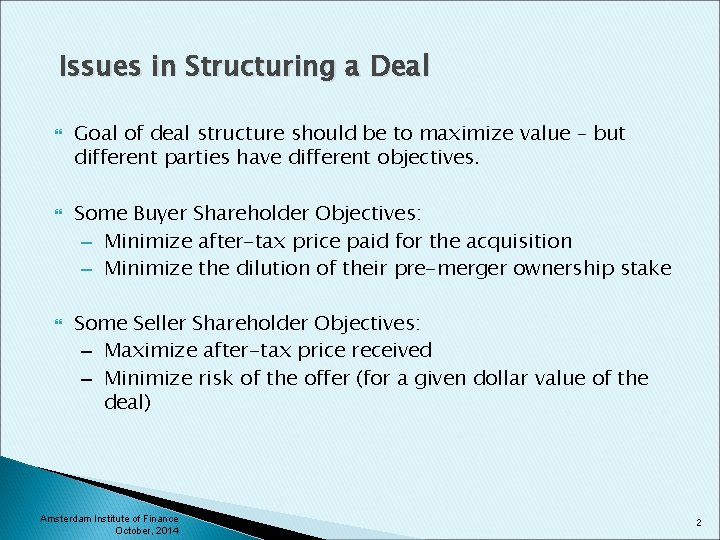

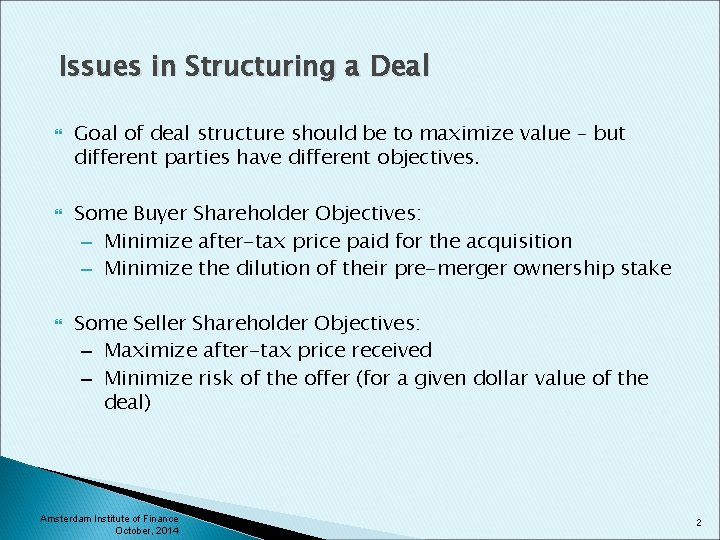

Issues in Structuring a Deal Goal of deal structure should be to maximize value – but different parties have different objectives. Some Buyer Shareholder Objectives: – Minimize after-tax price paid for the acquisition – Minimize the dilution of their pre-merger ownership stake Some Seller Shareholder Objectives: – Maximize after-tax price received – Minimize risk of the offer (for a given dollar value of the deal) Amsterdam Institute of Finance October, 2014 2

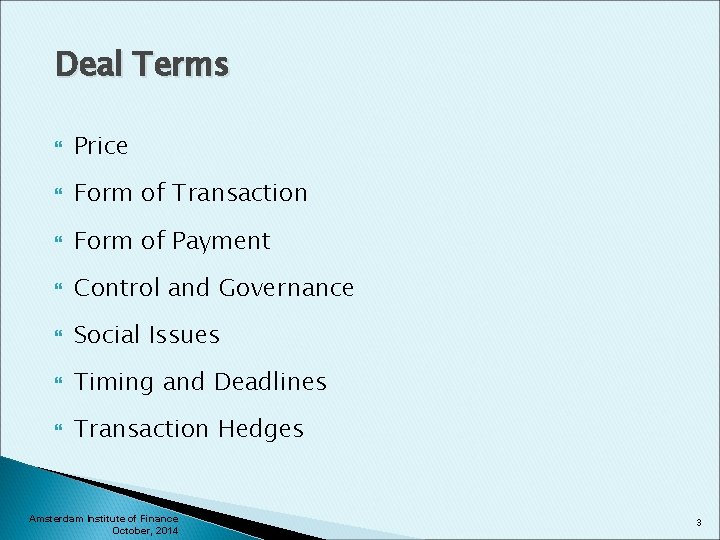

Deal Terms Price Form of Transaction Form of Payment Control and Governance Social Issues Timing and Deadlines Transaction Hedges Amsterdam Institute of Finance October, 2014 3

Transaction and Structuring Overview Creditors Rights Regulatory and Antitrust Contract Structuring Environment Business Plan Market Conditions Deal Accounting Transaction Characteristics Securities Financial Preferences Corporate Law Tax Competing Bidders Amsterdam Institute of Finance October, 2014 4

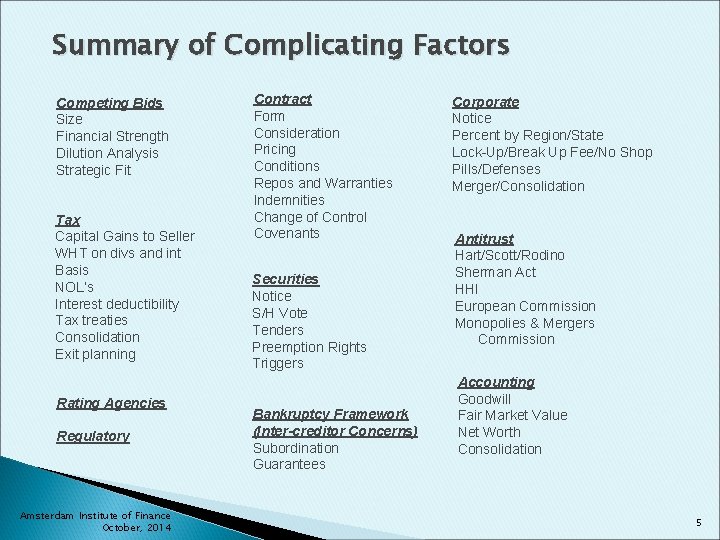

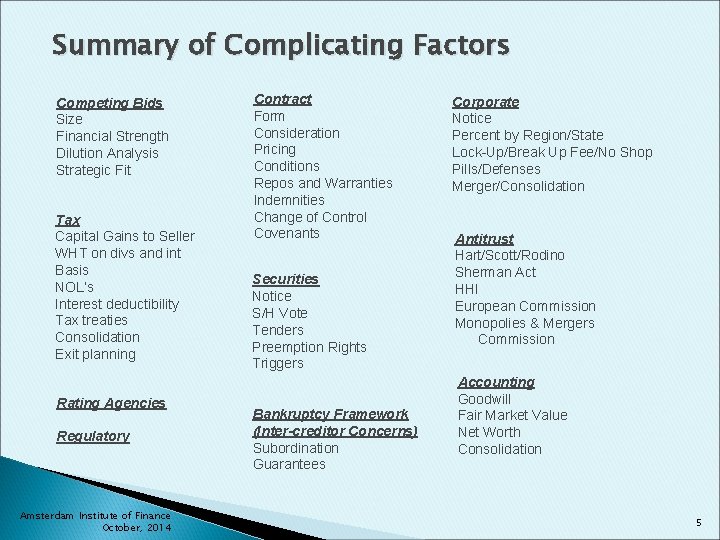

Summary of Complicating Factors Competing Bids Size Financial Strength Dilution Analysis Strategic Fit Tax Capital Gains to Seller WHT on divs and int Basis NOL’s Interest deductibility Tax treaties Consolidation Exit planning Rating Agencies Regulatory Amsterdam Institute of Finance October, 2014 Contract Form Consideration Pricing Conditions Repos and Warranties Indemnities Change of Control Covenants Securities Notice S/H Vote Tenders Preemption Rights Triggers Bankruptcy Framework (Inter-creditor Concerns) Subordination Guarantees Corporate Notice Percent by Region/State Lock-Up/Break Up Fee/No Shop Pills/Defenses Merger/Consolidation Antitrust Hart/Scott/Rodino Sherman Act HHI European Commission Monopolies & Mergers Commission Accounting Goodwill Fair Market Value Net Worth Consolidation 5

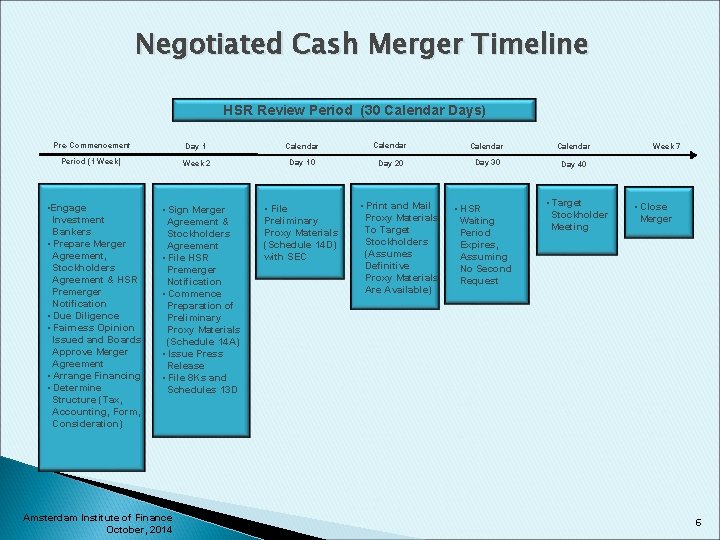

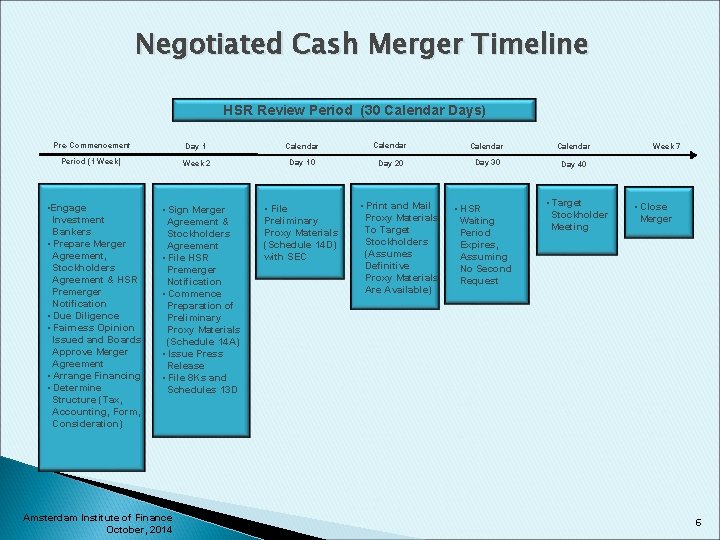

Negotiated Cash Merger Timeline HSR Review Period (30 Calendar Days) Pre-Commencement Day 1 Calendar Period (1 Week) Week 2 Day 10 Day 20 Day 30 Day 40 • Engage Investment Bankers • Prepare Merger Agreement, Stockholders Agreement & HSR Premerger Notification • Due Diligence • Fairness Opinion Issued and Boards Approve Merger Agreement • Arrange Financing • Determine Structure (Tax, Accounting, Form, Consideration) • Sign Merger Agreement & Stockholders Agreement • File HSR Premerger Notification • Commence Preparation of Preliminary Proxy Materials (Schedule 14 A) • Issue Press Release • File 8 Ks and Schedules 13 D Amsterdam Institute of Finance October, 2014 • File Preliminary Proxy Materials (Schedule 14 D) with SEC • Print and Mail Proxy Materials To Target Stockholders (Assumes Definitive Proxy Materials Are Available) • HSR Waiting Period Expires, Assuming No Second Request • Target Stockholder Meeting Week 7 • Close Merger 6

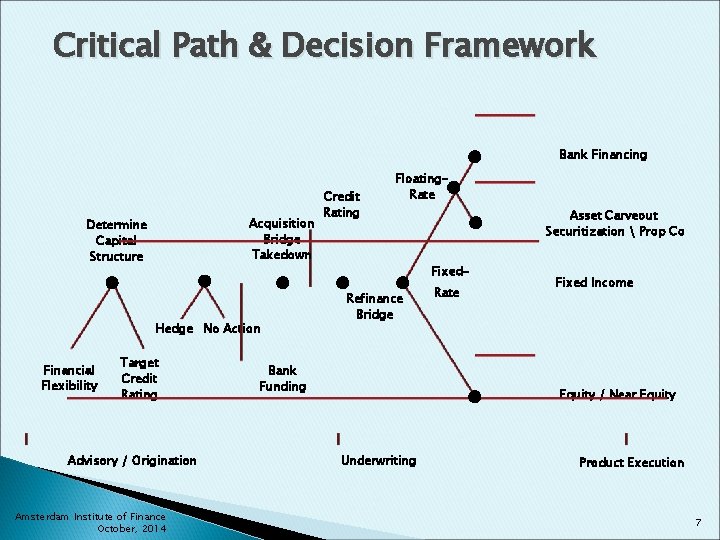

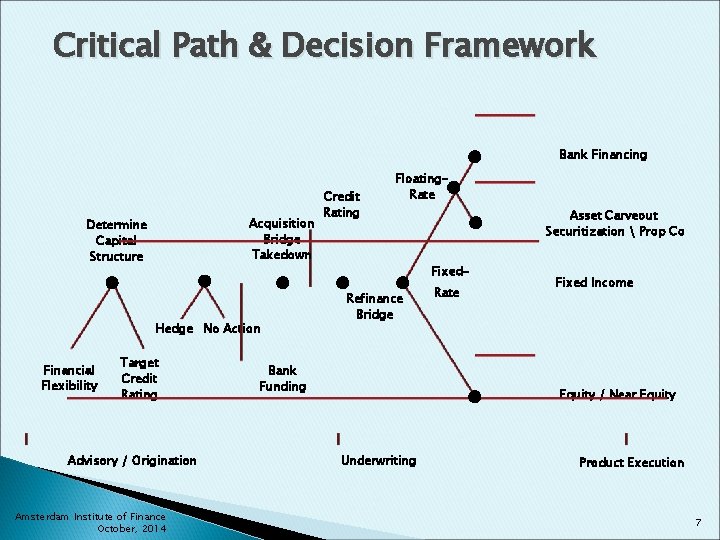

Critical Path & Decision Framework Bank Financing Acquisition Bridge Takedown Determine Capital Structure Hedge No Action Financial Flexibility Target Credit Rating Advisory / Origination Amsterdam Institute of Finance October, 2014 Credit Rating Floating. Rate Asset Carveout Securitization Prop Co Fixed- Refinance Bridge Bank Funding Rate Fixed Income Equity / Near Equity Underwriting Product Execution 7

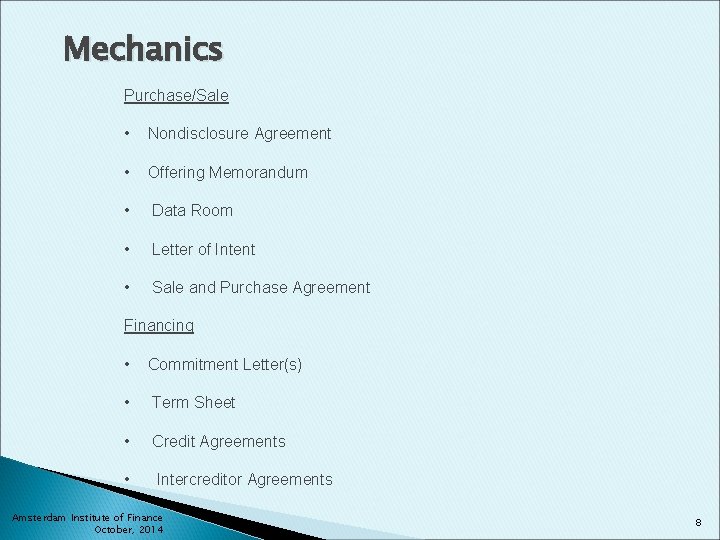

Mechanics Purchase/Sale • Nondisclosure Agreement • Offering Memorandum • Data Room • Letter of Intent • Sale and Purchase Agreement Financing • Commitment Letter(s) • Term Sheet • Credit Agreements • Intercreditor Agreements Amsterdam Institute of Finance October, 2014 8

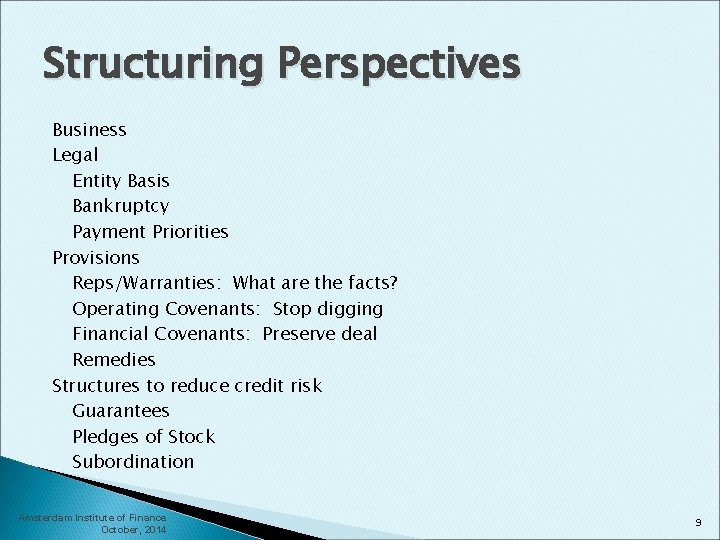

Structuring Perspectives Business Legal Entity Basis Bankruptcy Payment Priorities Provisions Reps/Warranties: What are the facts? Operating Covenants: Stop digging Financial Covenants: Preserve deal Remedies Structures to reduce credit risk Guarantees Pledges of Stock Subordination Amsterdam Institute of Finance October, 2014 9

Acquisition Agreement (Sale & Purchase Agreement) Parties Definitions Form: Merger, Tender, Asset Sale, … Consideration: Type, Payment, Mechanics, Calculation, … Reps/Warranties: Duration, Survival Target: MAC Buyer: Issue when stock used Ordinary Course Covenants: Target will operate as usual during signing/closing gap period Other Agreements: Filings, Meetings, … Closing Conditions: Regulatory, Shareholder Termination & Expenses: Drop Dead Fee, Drop Dead Date, Termination Fees Other Stuff: Choice of Law, Specific Performance Useful Sites apps. americanbar. org/…/mspd-letter-of-I contracts. onecle. com PLI. edu Amsterdam Institute of Finance October, 2014 10

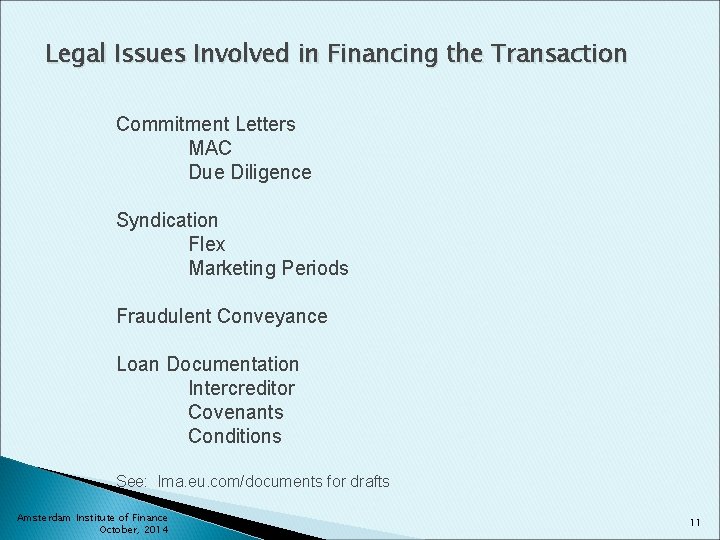

Legal Issues Involved in Financing the Transaction Commitment Letters MAC Due Diligence Syndication Flex Marketing Periods Fraudulent Conveyance Loan Documentation Intercreditor Covenants Conditions See: lma. eu. com/documents for drafts Amsterdam Institute of Finance October, 2014 11

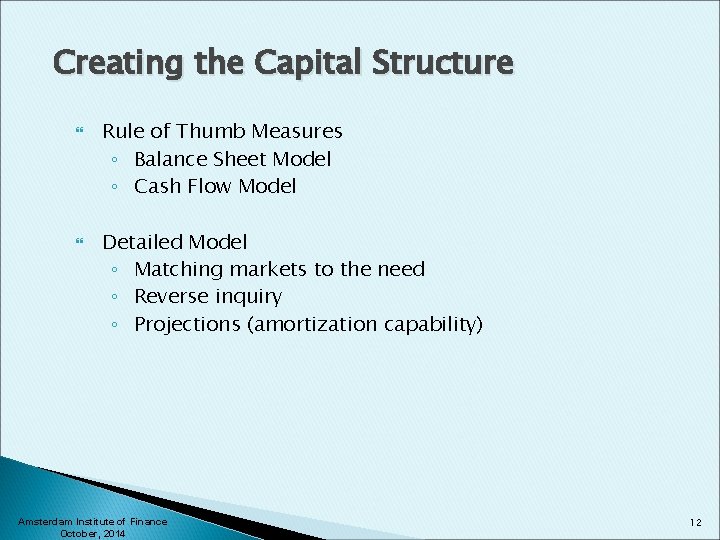

Creating the Capital Structure Rule of Thumb Measures ◦ Balance Sheet Model ◦ Cash Flow Model Detailed Model ◦ Matching markets to the need ◦ Reverse inquiry ◦ Projections (amortization capability) Amsterdam Institute of Finance October, 2014 12

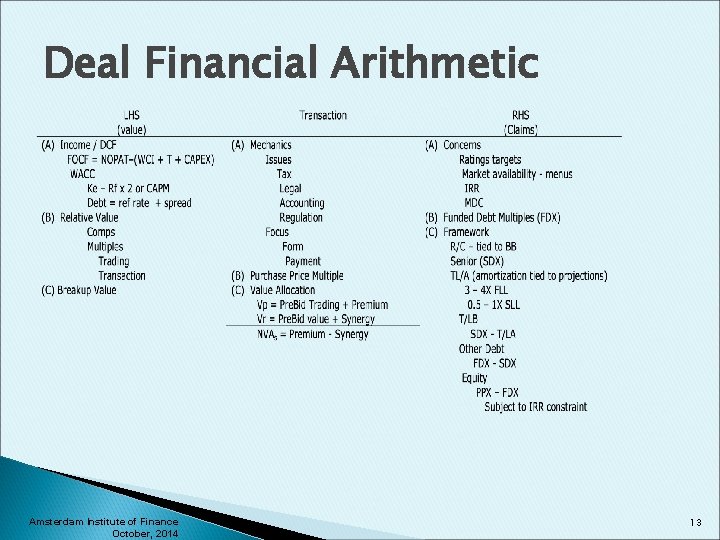

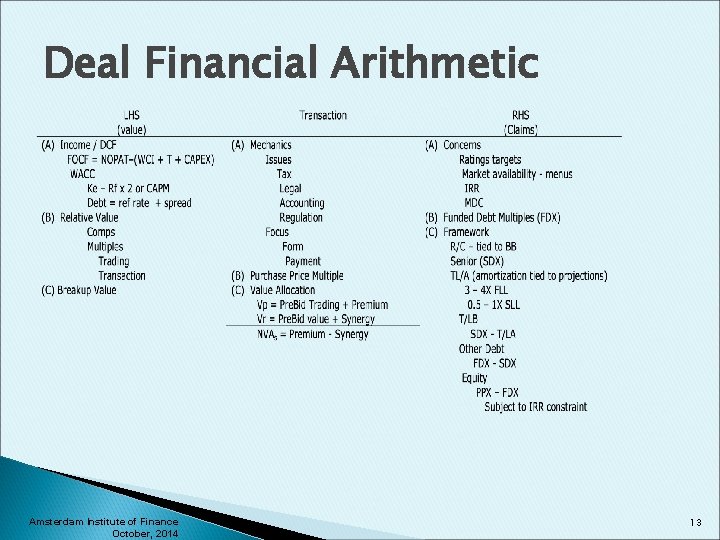

Deal Financial Arithmetic Amsterdam Institute of Finance October, 2014 13

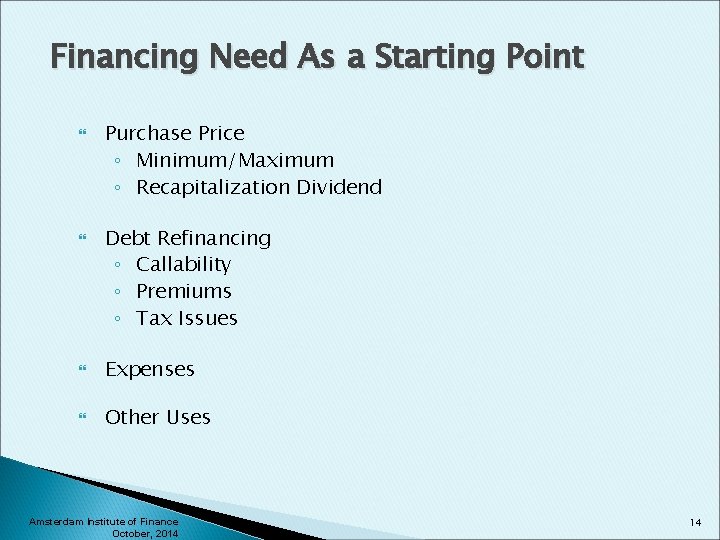

Financing Need As a Starting Point Purchase Price ◦ Minimum/Maximum ◦ Recapitalization Dividend Debt Refinancing ◦ Callability ◦ Premiums ◦ Tax Issues Expenses Other Uses Amsterdam Institute of Finance October, 2014 14

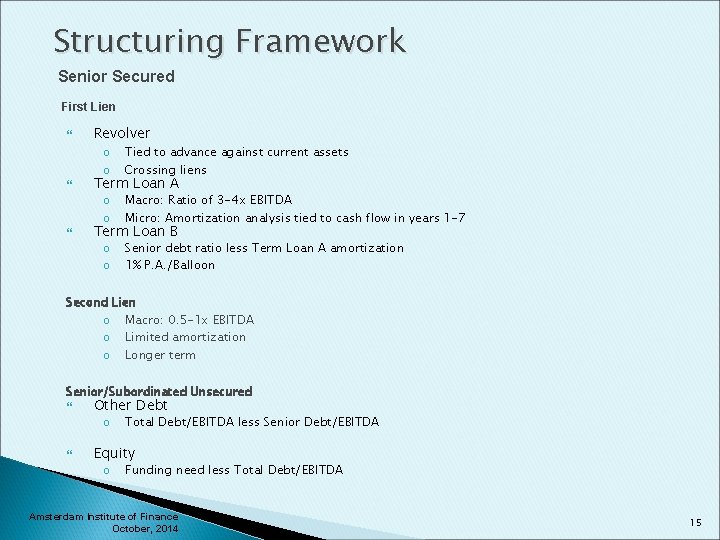

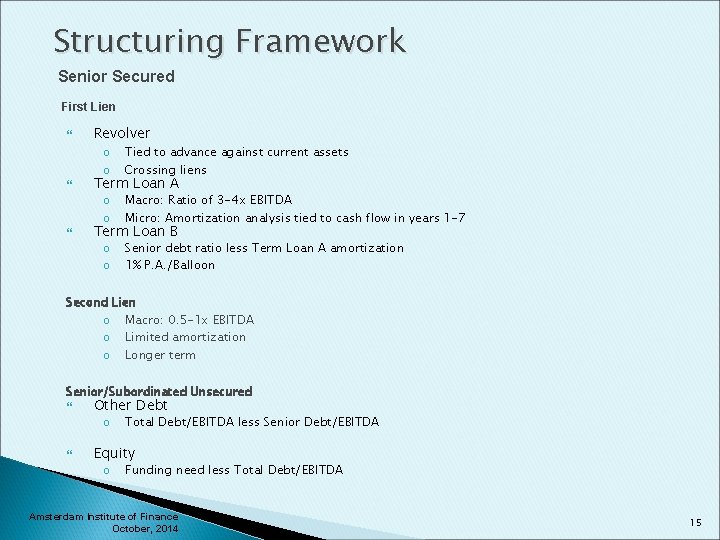

Structuring Framework Senior Secured First Lien Revolver o o Tied to advance against current assets Crossing liens o o Macro: Ratio of 3 -4 x EBITDA Micro: Amortization analysis tied to cash flow in years 1 -7 o o Senior debt ratio less Term Loan A amortization 1% P. A. /Balloon Term Loan A Term Loan B Second Lien o Macro: 0. 5 -1 x EBITDA o Limited amortization o Longer term Senior/Subordinated Unsecured Other Debt o Total Debt/EBITDA less Senior Debt/EBITDA Equity o Funding need less Total Debt/EBITDA Amsterdam Institute of Finance October, 2014 15

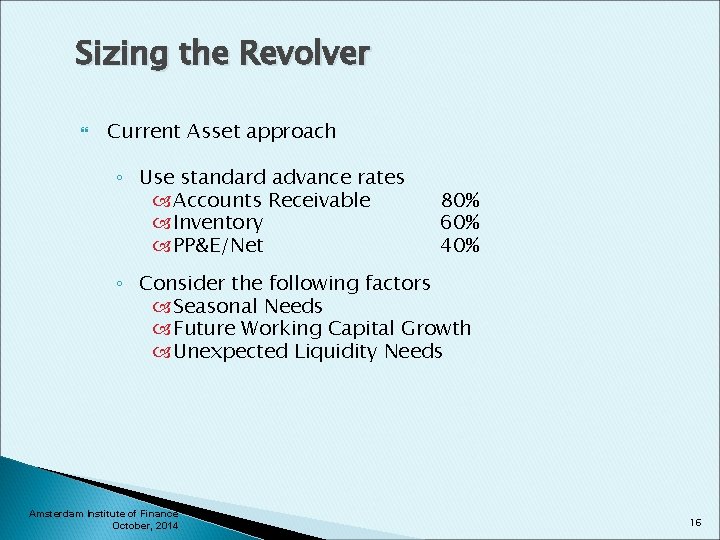

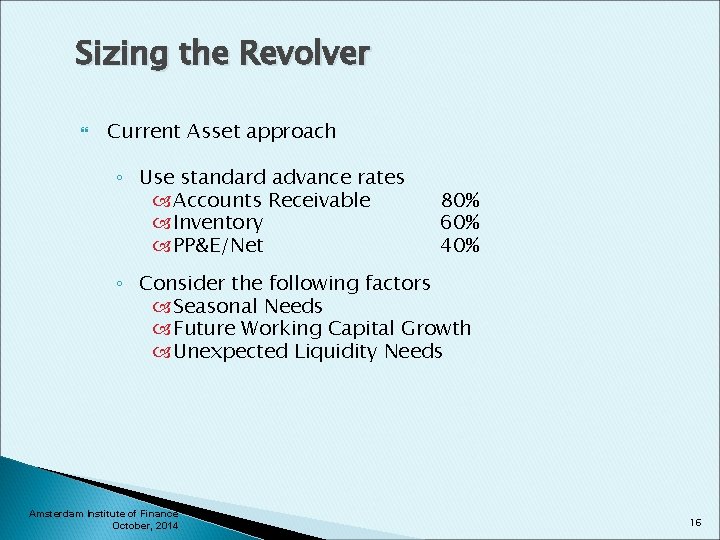

Sizing the Revolver Current Asset approach ◦ Use standard advance rates Accounts Receivable Inventory PP&E/Net 80% 60% 40% ◦ Consider the following factors Seasonal Needs Future Working Capital Growth Unexpected Liquidity Needs Amsterdam Institute of Finance October, 2014 16

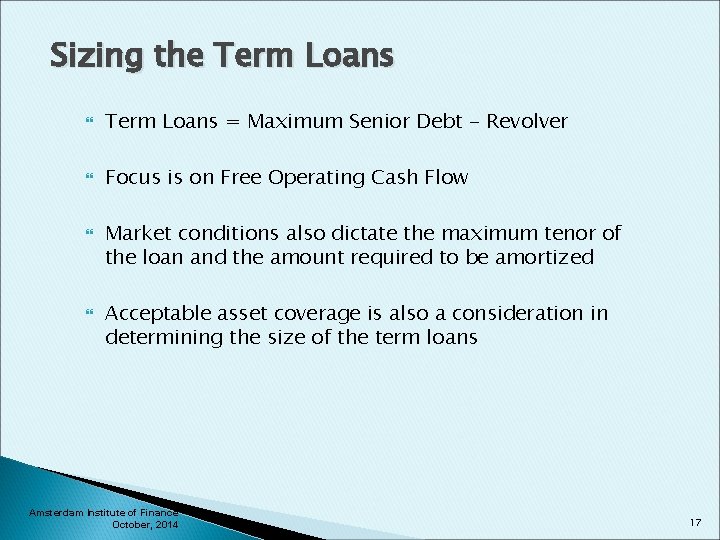

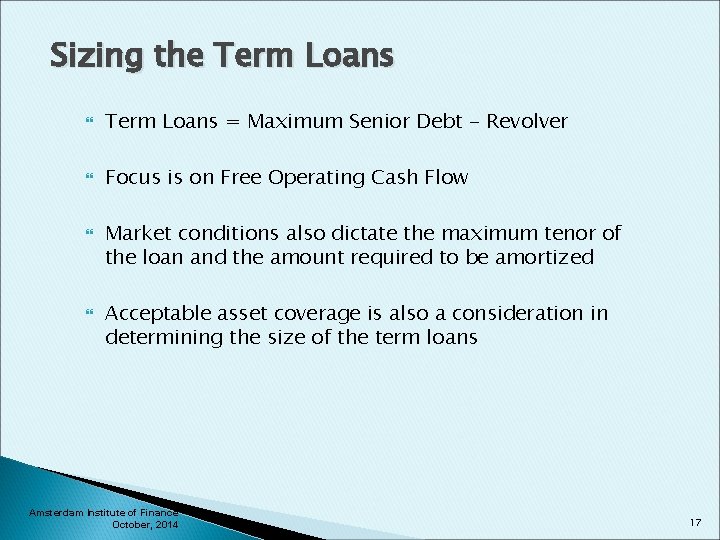

Sizing the Term Loans = Maximum Senior Debt - Revolver Focus is on Free Operating Cash Flow Market conditions also dictate the maximum tenor of the loan and the amount required to be amortized Acceptable asset coverage is also a consideration in determining the size of the term loans Amsterdam Institute of Finance October, 2014 17

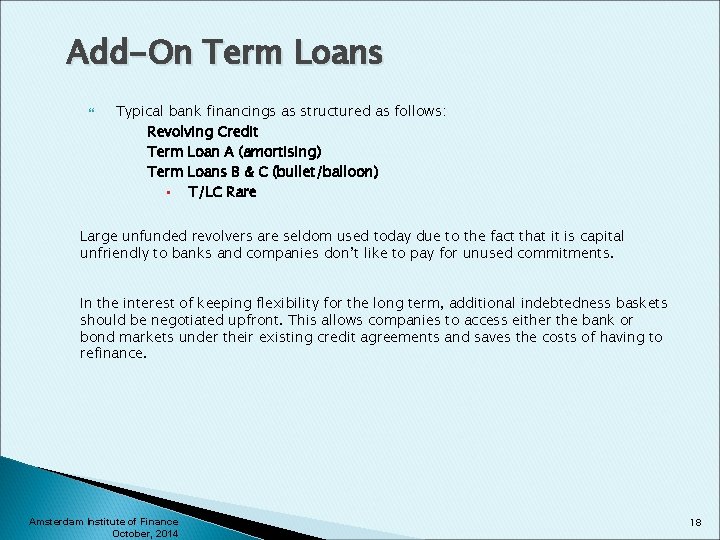

Add-On Term Loans Typical bank financings as structured as follows: Revolving Credit Term Loan A (amortising) Term Loans B & C (bullet/balloon) • T/LC Rare Large unfunded revolvers are seldom used today due to the fact that it is capital unfriendly to banks and companies don’t like to pay for unused commitments. In the interest of keeping flexibility for the long term, additional indebtedness baskets should be negotiated upfront. This allows companies to access either the bank or bond markets under their existing credit agreements and saves the costs of having to refinance. Amsterdam Institute of Finance October, 2014 18

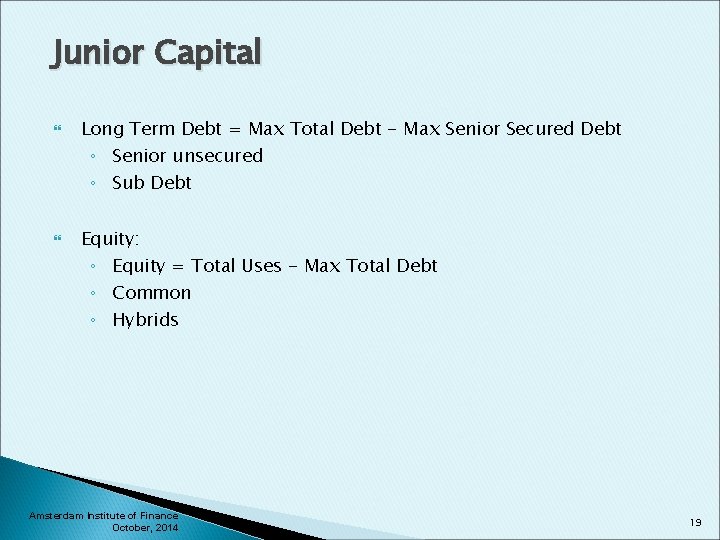

Junior Capital Long Term Debt = Max Total Debt - Max Senior Secured Debt ◦ Senior unsecured ◦ Sub Debt Equity: ◦ Equity = Total Uses - Max Total Debt ◦ Common ◦ Hybrids Amsterdam Institute of Finance October, 2014 19

Subordination Senior lenders are concerned with the implications of having high yield investors at the table during a restructuring. EURO High Yield investors to date have not been as vocal as senior bank lenders, viewing the issue as one of pricing rather than principle. All other things being equal, sophisticated investors will probably price structural subordination at 60 -120 bps premium. Amsterdam Institute of Finance October, 2014 20

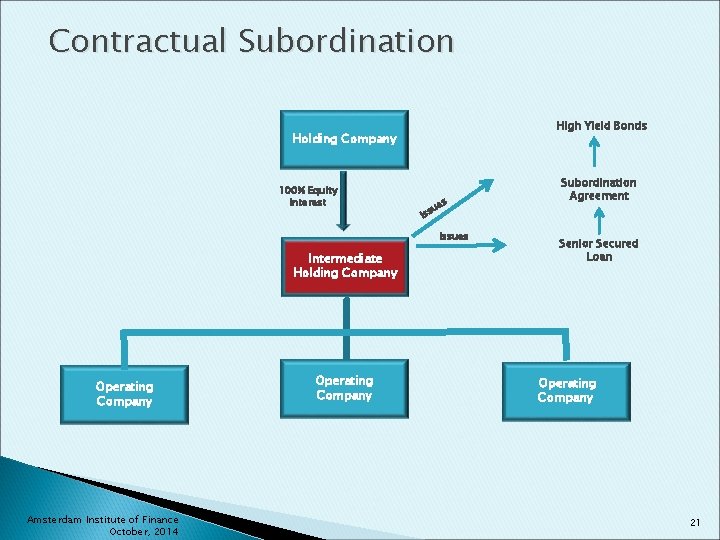

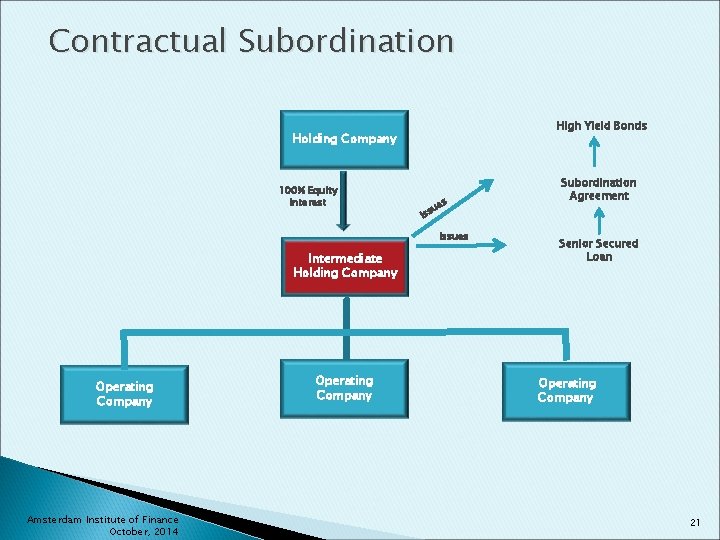

Contractual Subordination High Yield Bonds Holding Company 100% Equity Interest s ue Issues Intermediate Holding Company Operating Company Amsterdam Institute of Finance October, 2014 Operating Company Subordination Agreement Senior Secured Loan Operating Company 21

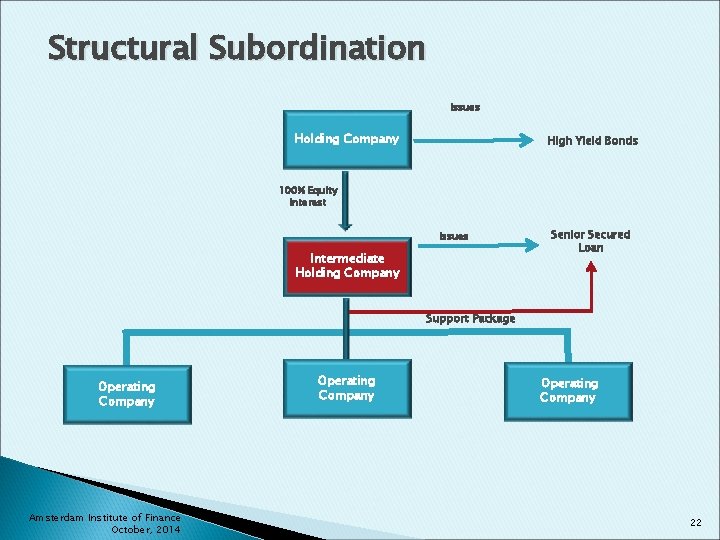

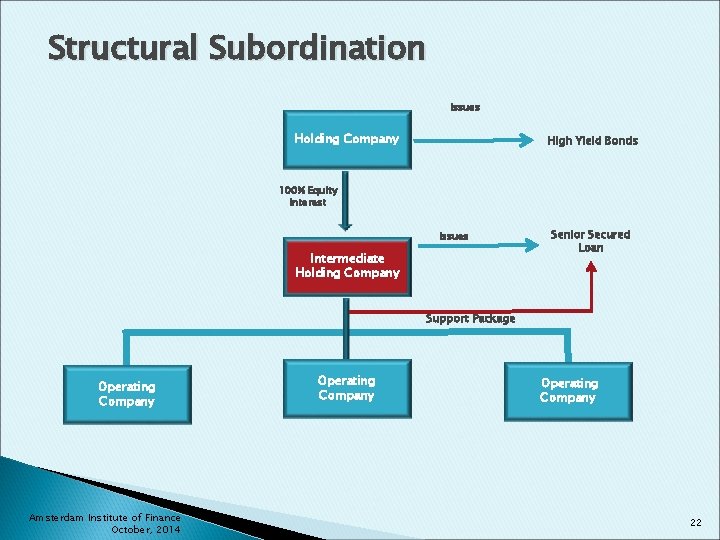

Structural Subordination Issues Holding Company High Yield Bonds 100% Equity Interest Issues Intermediate Holding Company Senior Secured Loan Support Package Operating Company Amsterdam Institute of Finance October, 2014 Operating Company 22

Structuring Covenants – Preserving the deal or – I love you just the way you are! Ø Ø Ø There are no standard covenants. They must be tailored to fit each deal and loan structure. The steps in structuring the covenants are: o Identify the risks (business, financial and structural) o Select Covenants to monitor the risks • Need to prioritize the risks to monitor because it will be impossible to monitor every risk • The time and cost to monitor the covenants must be considered (i. e. , sometimes one covenant can cover multiple risks) o Set Appropriate Levels • Want the covenants to trigger a warning before any principal or interest payments become delinquent. Need to factor in any seasonal needs to the covenant levels. Amsterdam Institute of Finance October, 2014 23

Financial Covenants as Endangered Species Major Covenants (financial maintenance) – Industry Variation CAPEX Debt Service Fixed Charge Funded Debt Reason for Decline Institutional Loan Investors High Yield Market Competition Amsterdam Institute of Finance October, 2014 24

Due Diligence • Making sure you get what you thought you were getting – Legal Contingencies: ABB – Accounting: Mc. Kesson/HBOC – Business Licenses Employment Leases EPA – Etc. Amsterdam Institute of Finance October, 2014 Earnings Revisions Study (Messod D. Beneish) Typical violations of U. S. GAAP include: – Recording revenues that are fictitious, unearned, or uncertain – Recording fictitious inventory – Improperly capitalizing costs Violators tend to be smaller (by sales and assets), more leveraged, and faster growing. Warning signs include: – Increase in days receivables – Decrease in gross margin – Increase in percentage of total assets represented by assets other the PP&E. – Comparatively hgh rate of sales growth – Increase in percentage of total assets represented by accruals. 25

Amsterdam institute of finance

Amsterdam institute of finance Amsterdam institute of finance

Amsterdam institute of finance Kelly rizzi

Kelly rizzi Prague finance institute

Prague finance institute Direct indirect observation

Direct indirect observation Structuring

Structuring Image erosion

Image erosion Dominance structuring example

Dominance structuring example Alternative investment structuring

Alternative investment structuring Transactional analysis group therapy

Transactional analysis group therapy Structuring element dapat berukuran

Structuring element dapat berukuran Structuring organizations for today's challenges

Structuring organizations for today's challenges Tax-efficient structuring

Tax-efficient structuring Drivers of supply chain management

Drivers of supply chain management The thickening of a set by a structuring element b

The thickening of a set by a structuring element b Framework for structuring drivers

Framework for structuring drivers Berne transaction analysis strength

Berne transaction analysis strength Requirements structuring

Requirements structuring Structuring element dapat berukuran

Structuring element dapat berukuran Organizing the business enterprise

Organizing the business enterprise Framework for structuring drivers

Framework for structuring drivers Time structuring in transactional analysis

Time structuring in transactional analysis Smart structuring

Smart structuring Islamic structuring

Islamic structuring Reverse triangular merger

Reverse triangular merger Structuring arguments

Structuring arguments