Structured Finance Synthetic ABS Prof Ian Giddy New

Structured Finance: Synthetic ABS Prof. Ian Giddy New York University

Structured Finance Asset-backed securitization l Corporate financial restructuring l Structured financing techniques l Copyright © 2002 Ian H. Giddy Structured Finance 2

Collateralized Debt Obligations Collateralized loan obligations (CLOs) l Collateralized bond obligations (CBOs) l Copyright © 2002 Ian H. Giddy Structured Finance 3

Collateralized Debt Obligations Cash flow backed CLOs and CBOs l Market value backed CBOs l Synthetic CLOs l Copyright © 2002 Ian H. Giddy Structured Finance 4

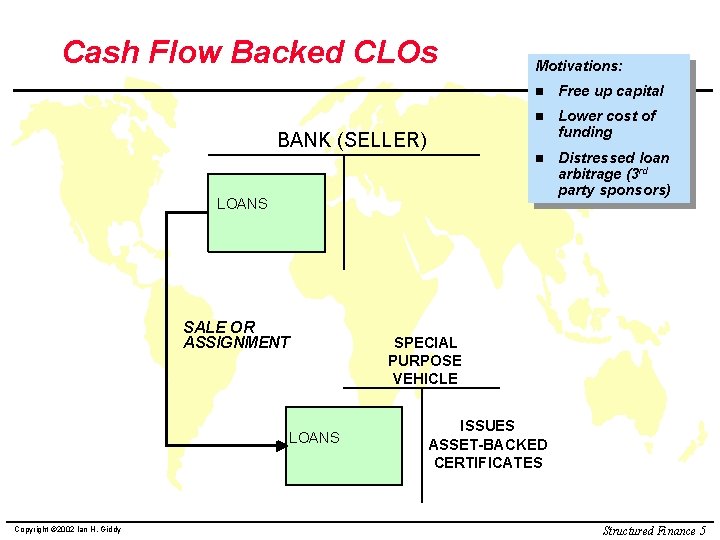

Cash Flow Backed CLOs Motivations: n Free up capital n Lower cost of funding n Distressed loan arbitrage (3 rd party sponsors) BANK (SELLER) LOANS SALE OR ASSIGNMENT LOANS Copyright © 2002 Ian H. Giddy SPECIAL PURPOSE VEHICLE ISSUES ASSET-BACKED CERTIFICATES Structured Finance 5

CLO Transaction Structure Copyright © 2002 Ian H. Giddy Structured Finance 6

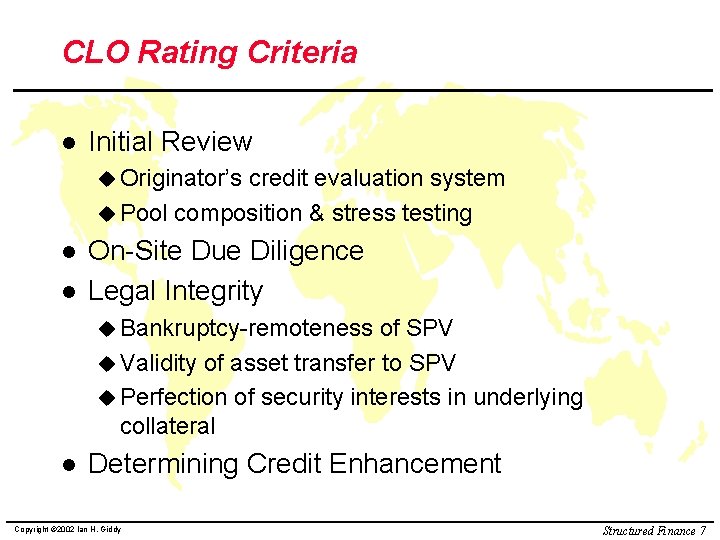

CLO Rating Criteria l Initial Review u Originator’s credit evaluation system u Pool composition & stress testing l l On-Site Due Diligence Legal Integrity u Bankruptcy-remoteness of SPV u Validity of asset transfer to SPV u Perfection of security interests in underlying collateral l Determining Credit Enhancement Copyright © 2002 Ian H. Giddy Structured Finance 7

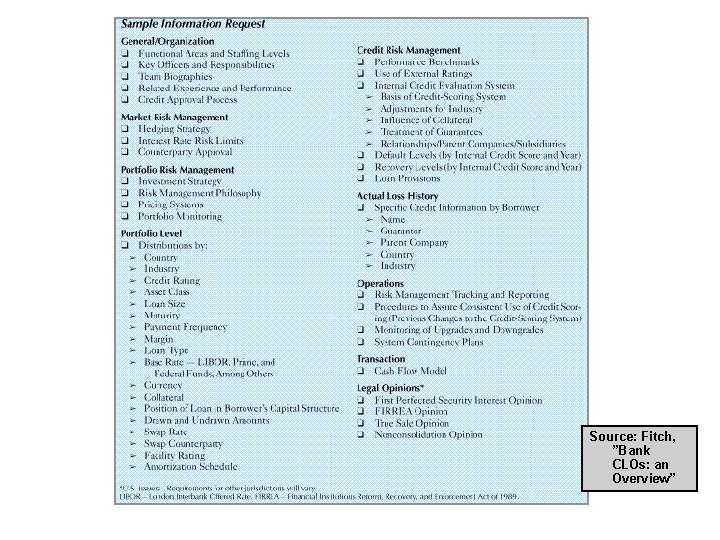

Source: Fitch, ”Bank CLOs: an Overview”

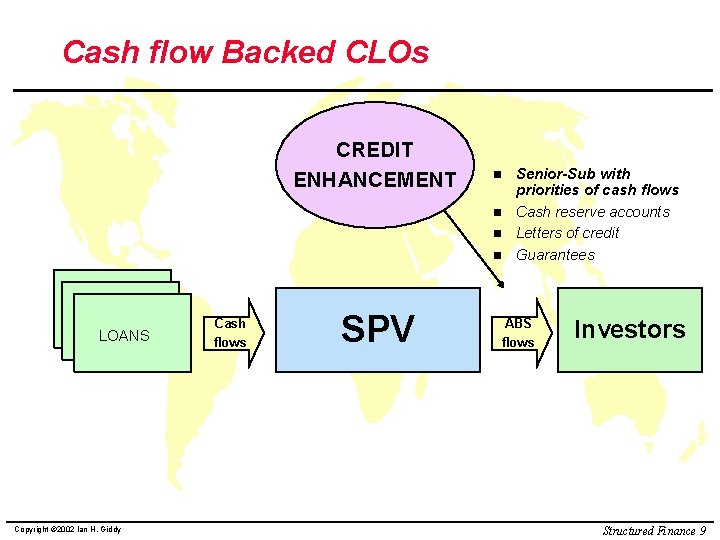

Cash flow Backed CLOs CREDIT ENHANCEMENT n n LOANS Copyright © 2002 Ian H. Giddy Cash flows SPV Senior-Sub with priorities of cash flows Cash reserve accounts Letters of credit Guarantees ABS flows Investors Structured Finance 9

Senior-Sub CLO Structure Copyright © 2002 Ian H. Giddy Structured Finance 10

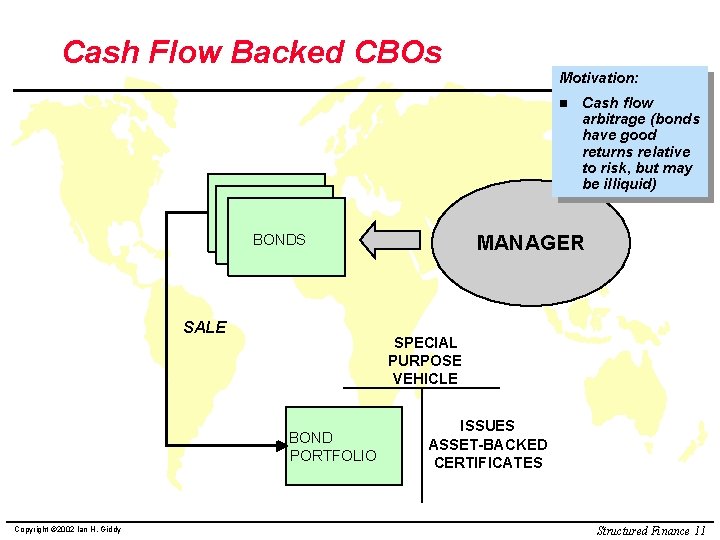

Cash Flow Backed CBOs Motivation: n MANAGER BONDS SALE SPECIAL PURPOSE VEHICLE BOND PORTFOLIO Copyright © 2002 Ian H. Giddy Cash flow arbitrage (bonds have good returns relative to risk, but may be illiquid) ISSUES ASSET-BACKED CERTIFICATES Structured Finance 11

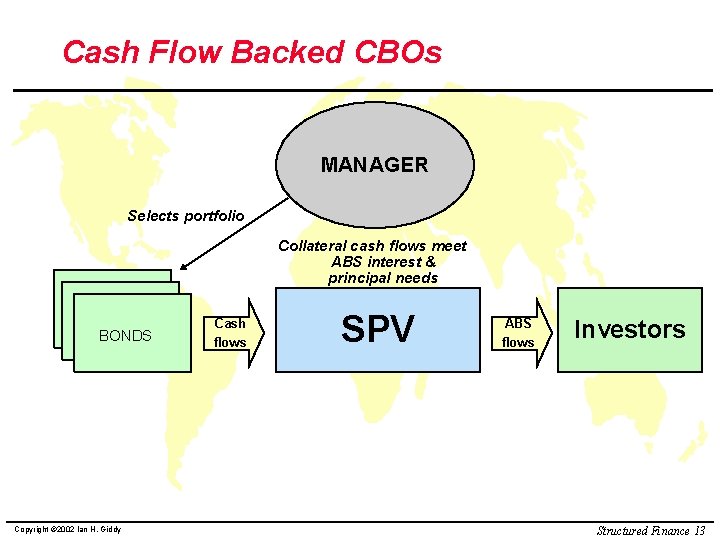

Cash Flow Backed CBOs Cash flow CBOs are built around a pool of assets with predictable cash flows. As such, these structures are restricted to investments that meet minimum credit quality, tenor and expected recovery characteristics. The analysis of a cash flow deal and determination of credit enhancement is based on the expected probability of default, severity of loss, and timing of default and recovery of the assets in the pool. The ongoing market price of collateral assets is not important in a cash flow deal. Instead, it is the ability of each asset to pay scheduled principal and interest that makes these deals Structured Finance 12 Copyright © 2002 Ian H. Giddy

Cash Flow Backed CBOs MANAGER Selects portfolio Collateral cash flows meet ABS interest & principal needs BONDS Copyright © 2002 Ian H. Giddy Cash flows SPV ABS flows Investors Structured Finance 13

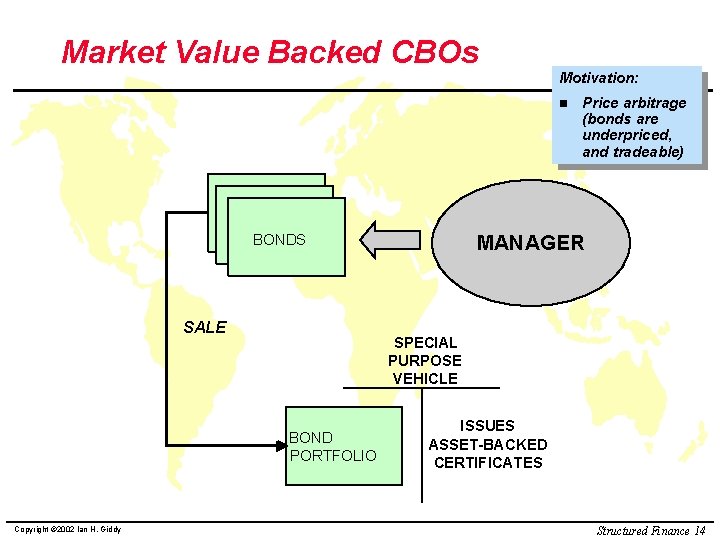

Market Value Backed CBOs Motivation: n MANAGER BONDS SALE SPECIAL PURPOSE VEHICLE BOND PORTFOLIO Copyright © 2002 Ian H. Giddy Price arbitrage (bonds are underpriced, and tradeable) ISSUES ASSET-BACKED CERTIFICATES Structured Finance 14

Market Value CBOs A market value CBO can be generally described as an investment vehicle that capitalizes on the arbitrage opportunities that exist between high yielding investments and the lower cost funds of highly rated debt. The transaction is typically capitalized with multiple classes of rated debt and a layer of unrated equity and invests in a pool of investments that is diverse in obligor, industry, and, frequently, asset class. In order to gauge the performance of the transaction, the asset manager will mark the value of each investment to market on a regular basis, Copyright © 2002 Ian H. Giddy Structured Finance 15

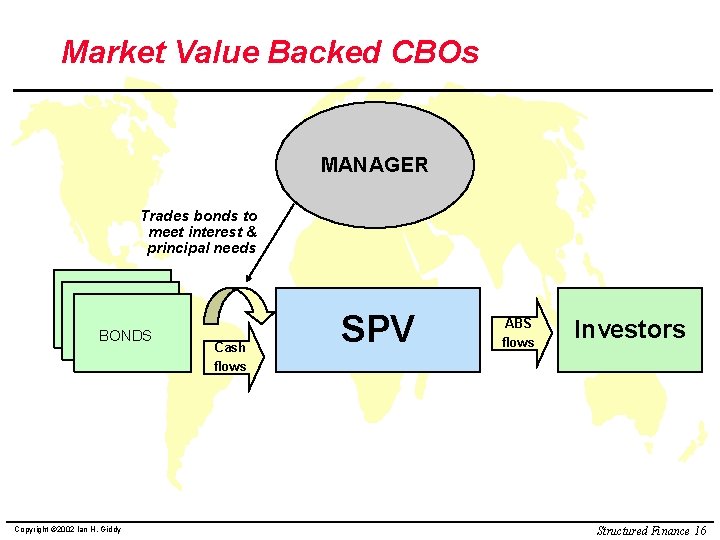

Market Value Backed CBOs MANAGER Trades bonds to meet interest & principal needs BONDS Copyright © 2002 Ian H. Giddy Cash flows SPV ABS flows Investors Structured Finance 16

Characteristics of Market Value CBOs Market value transactions are often collateralized by leveraged loans, highyield bonds, mezzanine debt, distressed debt, and public and even private equity. l Market value transactions are less restrictive with respect to cash flow requirements, credit quality, and maturity of the collateral. l The manager can trade the securities. l Copyright © 2002 Ian H. Giddy Structured Finance 17

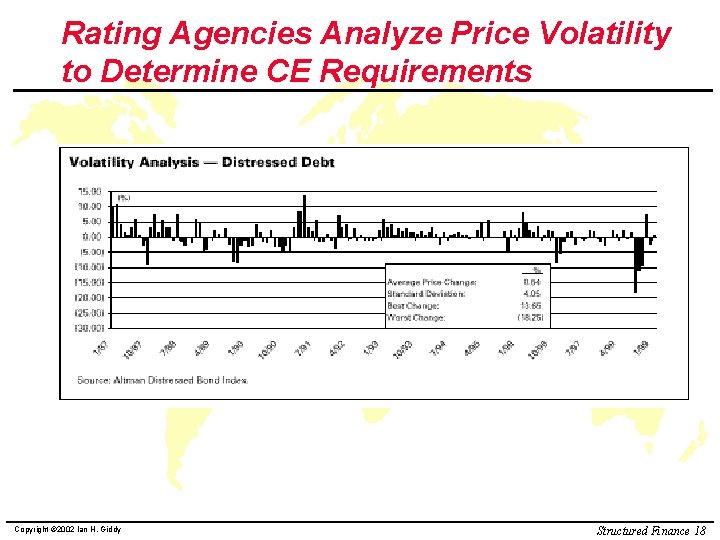

Rating Agencies Analyze Price Volatility to Determine CE Requirements Copyright © 2002 Ian H. Giddy Structured Finance 18

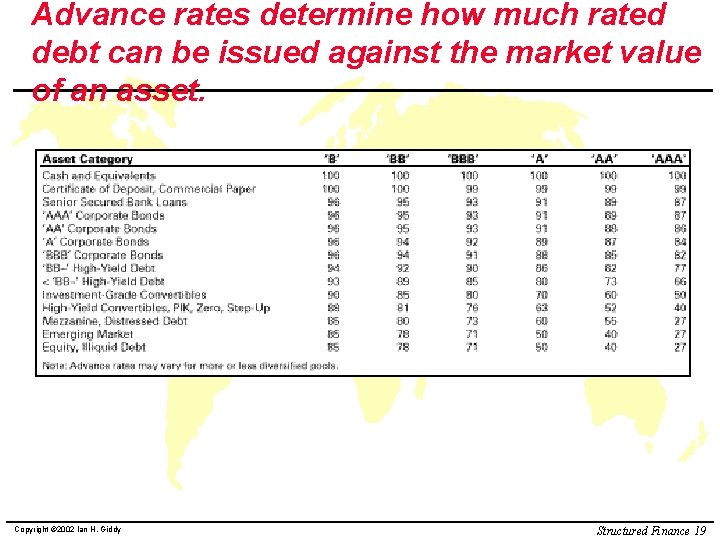

Advance rates determine how much rated debt can be issued against the market value of an asset. Copyright © 2002 Ian H. Giddy Structured Finance 19

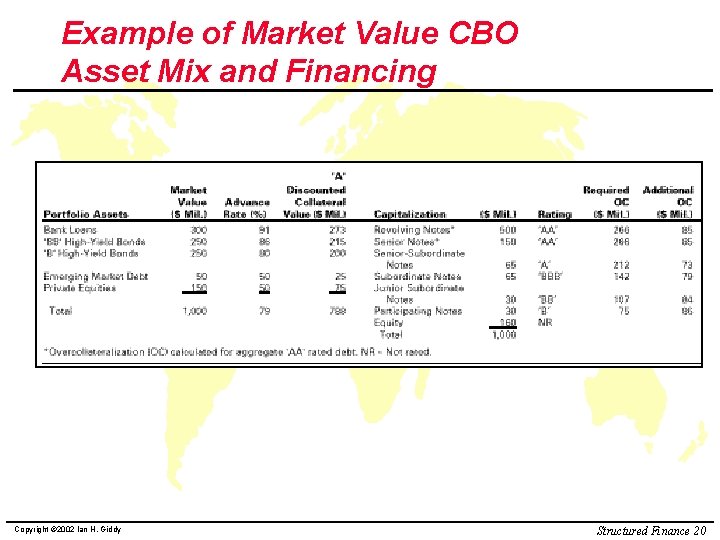

Example of Market Value CBO Asset Mix and Financing Copyright © 2002 Ian H. Giddy Structured Finance 20

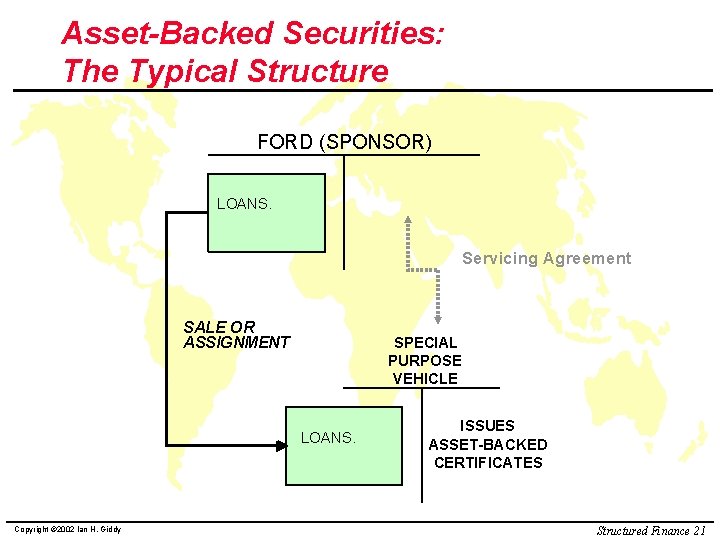

Asset-Backed Securities: The Typical Structure FORD (SPONSOR) LOANS. Servicing Agreement SALE OR ASSIGNMENT SPECIAL PURPOSE VEHICLE LOANS. Copyright © 2002 Ian H. Giddy ISSUES ASSET-BACKED CERTIFICATES Structured Finance 21

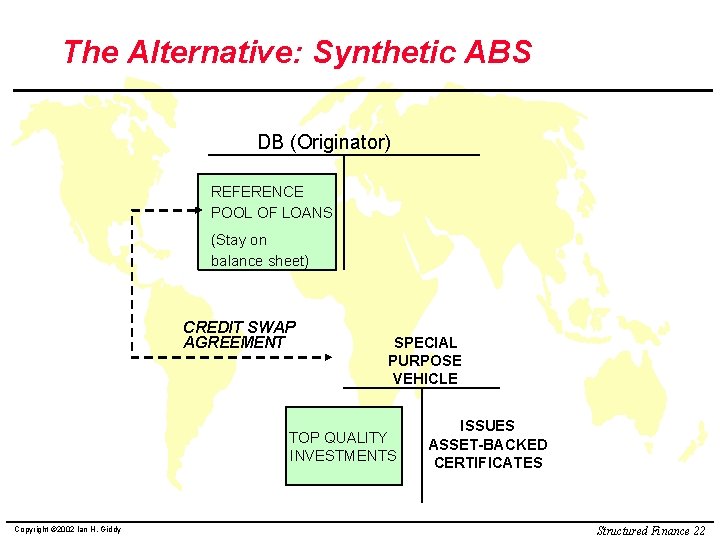

The Alternative: Synthetic ABS DB (Originator) REFERENCE POOL OF LOANS (Stay on balance sheet) CREDIT SWAP AGREEMENT SPECIAL PURPOSE VEHICLE TOP QUALITY INVESTMENTS Copyright © 2002 Ian H. Giddy ISSUES ASSET-BACKED CERTIFICATES Structured Finance 22

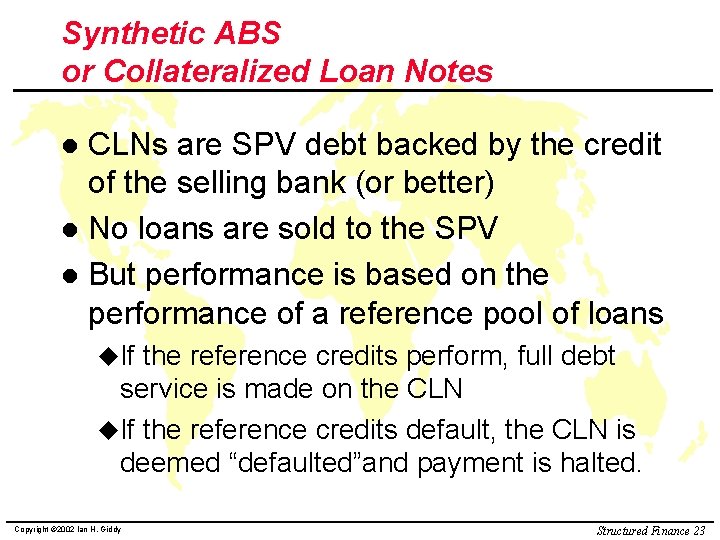

Synthetic ABS or Collateralized Loan Notes CLNs are SPV debt backed by the credit of the selling bank (or better) l No loans are sold to the SPV l But performance is based on the performance of a reference pool of loans l u. If the reference credits perform, full debt service is made on the CLN u. If the reference credits default, the CLN is deemed “defaulted”and payment is halted. Copyright © 2002 Ian H. Giddy Structured Finance 23

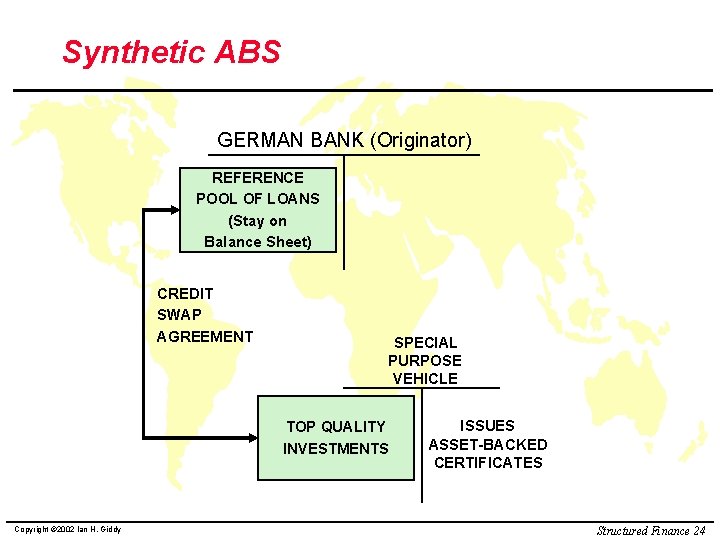

Synthetic ABS GERMAN BANK (Originator) REFERENCE POOL OF LOANS (Stay on Balance Sheet) CREDIT SWAP AGREEMENT SPECIAL PURPOSE VEHICLE TOP QUALITY INVESTMENTS Copyright © 2002 Ian H. Giddy ISSUES ASSET-BACKED CERTIFICATES Structured Finance 24

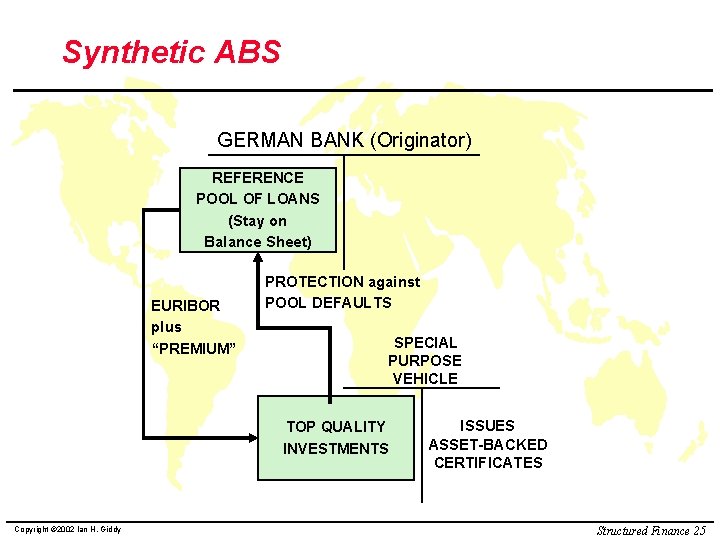

Synthetic ABS GERMAN BANK (Originator) REFERENCE POOL OF LOANS (Stay on Balance Sheet) EURIBOR plus “PREMIUM” PROTECTION against POOL DEFAULTS SPECIAL PURPOSE VEHICLE TOP QUALITY INVESTMENTS Copyright © 2002 Ian H. Giddy ISSUES ASSET-BACKED CERTIFICATES Structured Finance 25

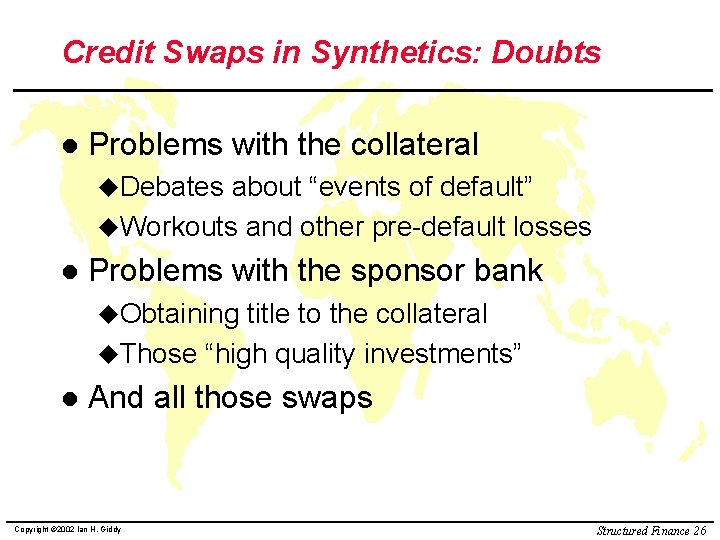

Credit Swaps in Synthetics: Doubts l Problems with the collateral u. Debates about “events of default” u. Workouts and other pre-default losses l Problems with the sponsor bank u. Obtaining title to the collateral u. Those “high quality investments” l And all those swaps Copyright © 2002 Ian H. Giddy Structured Finance 26

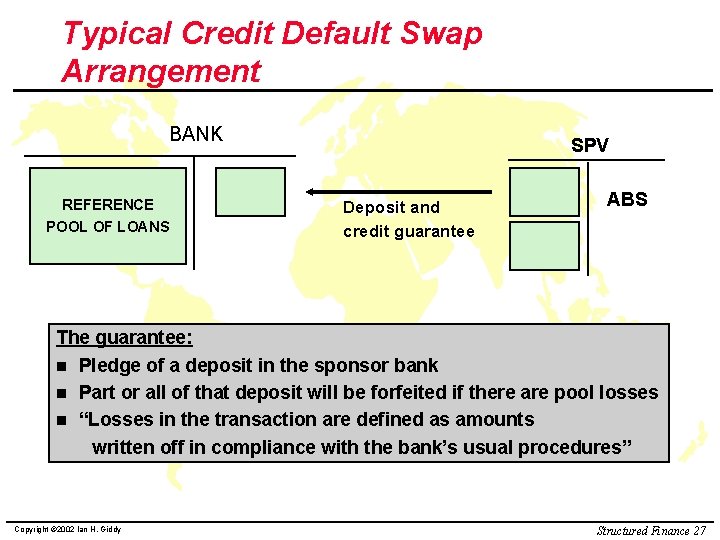

Typical Credit Default Swap Arrangement BANK REFERENCE POOL OF LOANS SPV Deposit and credit guarantee ABS The guarantee: n Pledge of a deposit in the sponsor bank n Part or all of that deposit will be forfeited if there are pool losses n “Losses in the transaction are defined as amounts written off in compliance with the bank’s usual procedures” Copyright © 2002 Ian H. Giddy Structured Finance 27

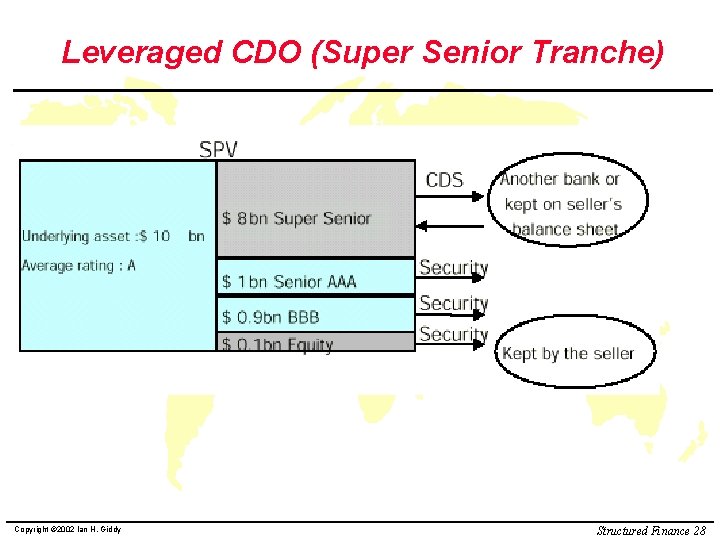

Leveraged CDO (Super Senior Tranche) Copyright © 2002 Ian H. Giddy Structured Finance 28

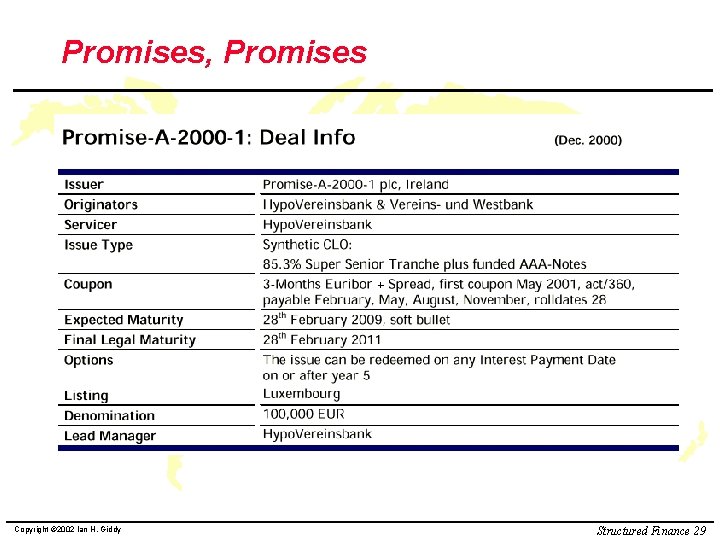

Promises, Promises Copyright © 2002 Ian H. Giddy Structured Finance 29

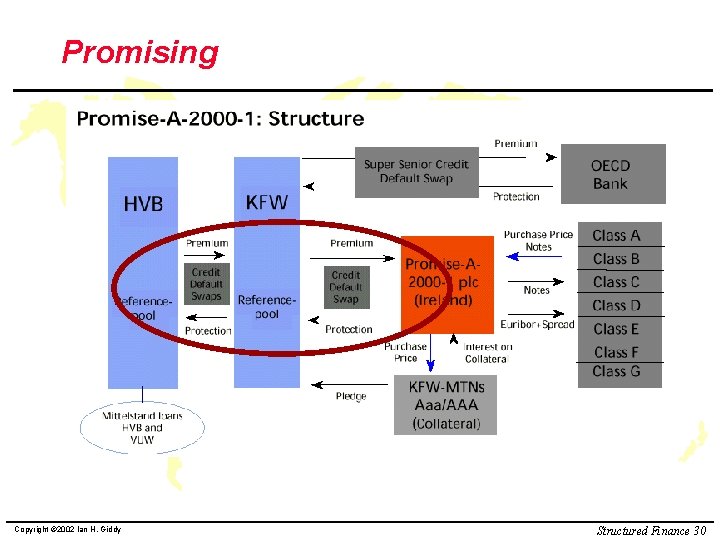

Promising Copyright © 2002 Ian H. Giddy Structured Finance 30

Case Study: Global High Yield Bond Trust What is the legal structure of this deal? l What are the assets? l What are the different classes of securities, and their terms? l How do the synthetic CLOs work? (Draw a diagram) l Should investors buy the subordinated tranche? l Copyright © 2002 Ian H. Giddy Structured Finance 31

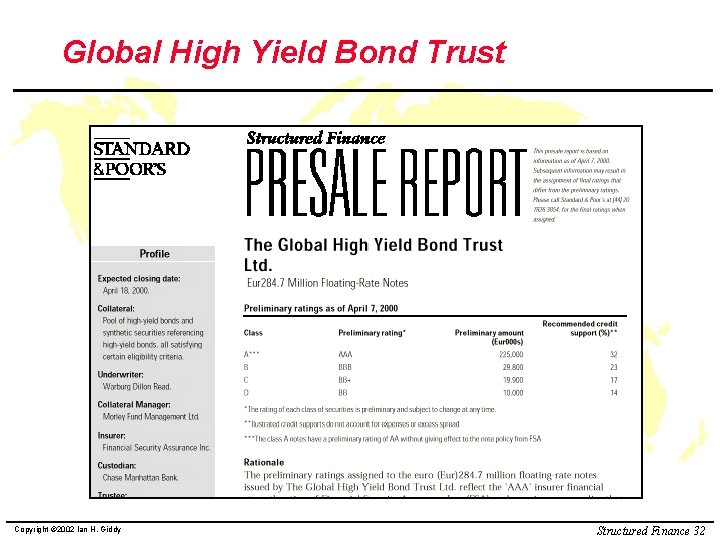

Global High Yield Bond Trust Copyright © 2002 Ian H. Giddy Structured Finance 32

n www. stern. nyu. edu

n www. giddy. org

- Slides: 36