Strictly Private and Confidential Pension Fund Infrastructure Investments

- Slides: 25

Strictly Private and Confidential Pension Fund Infrastructure Investments in Nigeria Alternative, Impact and Growth May 2009

Table of contents 2 1. Overview of Project Financing 2. Public Private Partnerships (PPPs) 3. Case study – Shuaibah IWPP, Saudi Arabia Appendices A. Introduction to Stanbic IBTC Bank

Section 1: Overview of Project Financing

Project Financing Overview 4 n Project Finance is the financing of long-term infrastructure and industrial projects based upon a complex financial structure where project debt and equity are used to finance the project, rather than the balance sheets of project sponsors – providers of capital have full or limited recourse to the project’s cashflows, which are ring-fenced from its parent company – applicable in a variety of sectors including power & infrastructure, oil & gas, manufacturing & distribution, telecoms & technology and property ADVANTAGES Non-recourse § Loan repaid from project cashflows; assets are used as collateral § Lenders get comfort in terms of credit supports from guarantees, warranties and other covenants from the sponsor, its affiliates and other third parties Maximise leverage § Highly leveraged projects with c. 60 – 85% debt used to finance the costs of development and construction of the project Off-balance sheet treatment § Depends on the structure of the transaction § Can help the borrower manage its debt portfolio to ensure it can meet the covenants already in place with other lenders Maximise tax benefits § Project can be structured to maximise tax benefits

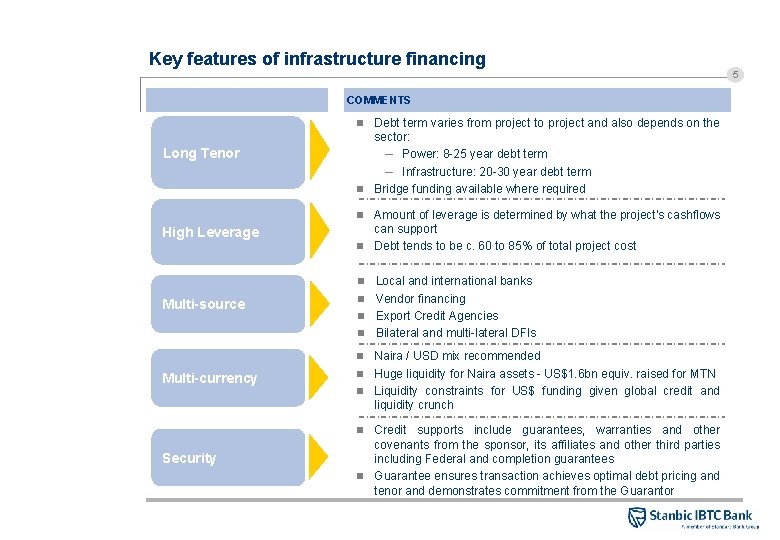

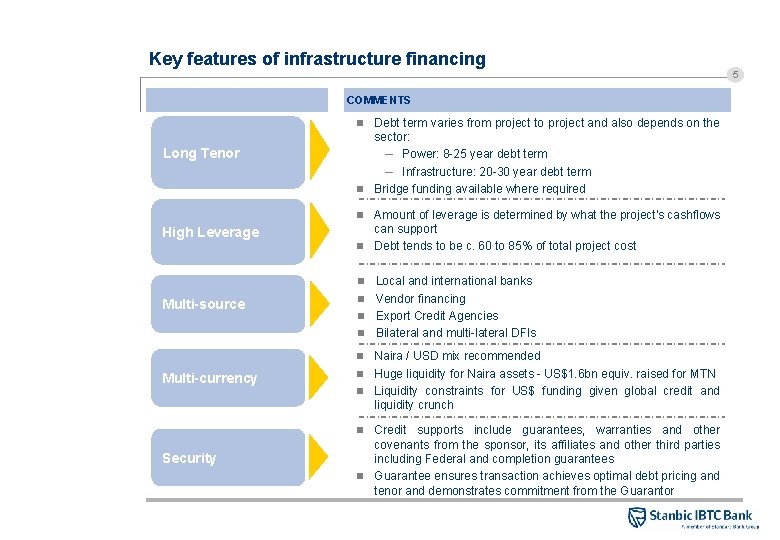

Key features of infrastructure financing 5 COMMENTS Debt term varies from project to project and also depends on the sector: – Power: 8 -25 year debt term – Infrastructure: 20 -30 year debt term n Bridge funding available where required n Long Tenor Amount of leverage is determined by what the project’s cashflows can support n Debt tends to be c. 60 to 85% of total project cost n High Leverage Local and international banks n Vendor financing n Export Credit Agencies n Bilateral and multi-lateral DFIs n Multi-source Naira / USD mix recommended n Huge liquidity for Naira assets - US$1. 6 bn equiv. raised for MTN n Liquidity constraints for US$ funding given global credit and liquidity crunch n Multi-currency Credit supports include guarantees, warranties and other covenants from the sponsor, its affiliates and other third parties including Federal and completion guarantees n Guarantee ensures transaction achieves optimal debt pricing and tenor and demonstrates commitment from the Guarantor n Security

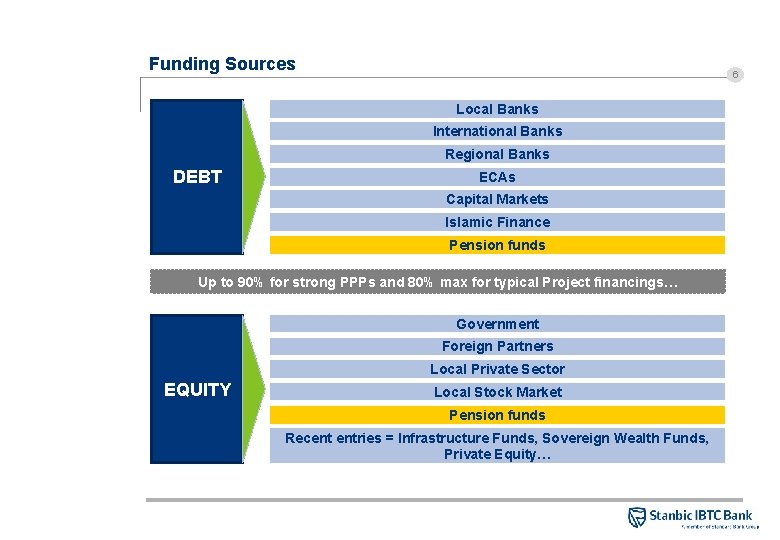

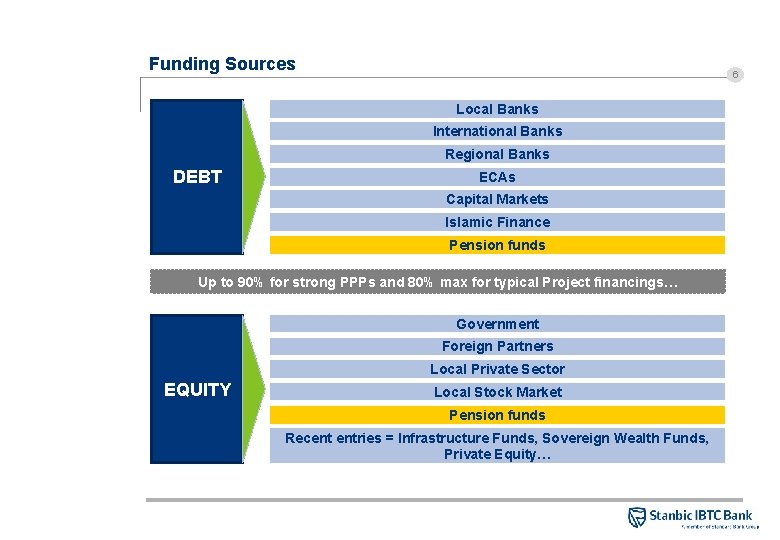

Funding Sources 6 Local Banks International Banks Regional Banks DEBT ECAs Capital Markets Islamic Finance Pension funds Up to 90% for strong PPPs and 80% max for typical Project financings… Government Foreign Partners Local Private Sector EQUITY Local Stock Market Pension funds Recent entries = Infrastructure Funds, Sovereign Wealth Funds, Private Equity…

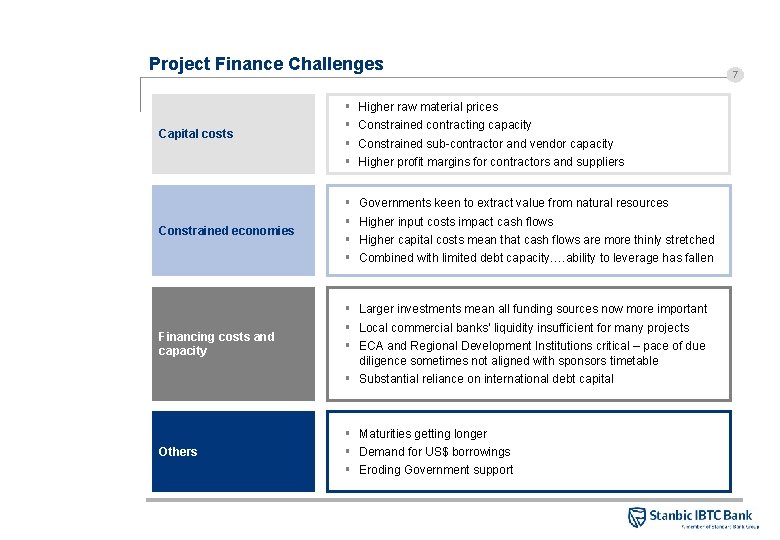

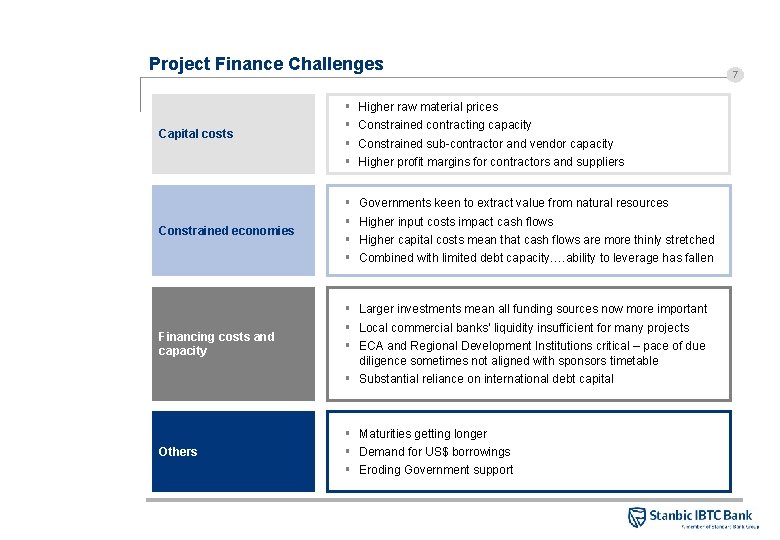

Project Finance Challenges Capital costs Constrained economies § § Higher raw material prices § § Governments keen to extract value from natural resources Constrained contracting capacity Constrained sub-contractor and vendor capacity Higher profit margins for contractors and suppliers Higher input costs impact cash flows Higher capital costs mean that cash flows are more thinly stretched Combined with limited debt capacity…. ability to leverage has fallen Financing costs and capacity § Larger investments mean all funding sources now more important § Local commercial banks’ liquidity insufficient for many projects § ECA and Regional Development Institutions critical – pace of due diligence sometimes not aligned with sponsors timetable § Substantial reliance on international debt capital Others § Maturities getting longer § Demand for US$ borrowings § Eroding Government support 7

Lessons learned 8 Government support critical for injecting confidence i. e. to get deals off the ground Spend time putting together robust structures before approaching bank market Market testing / sounding-out critical Shareholders to demonstrate tangible commitment throughout the life of the project i. e. not only pre-completion Crucial to engage and accommodate issues pertaining to all funding sources from a very early stage in the process (i) ECAs, (ii) Regional Developmental Institutions, (iii) Local banks, (iv) Regional Banks, (v) International banks and (vi) Islamic Financial Institutions Independent Opinions crucial (i. e. Market / Traffic, Technical, etc) – even on projects where limited and / or no demand or technical risks are apparent Tight / Bank friendly Term Sheets and Documentation - Generally relaxed terms possible via refinancing post completion where project reaches steady state

Role of Stakeholders Government 9 § § Policy formulation Transparent bidding process Funding Operation Regulators § Policy formulation and implementation § Transparent interactions with the various stakeholders § Consistent policies Operators § Assist in the planning, design and construction phase § May take on the role of sponsors and equity investors in the underlying project § Undertake maintenance and efficient operations of the public utility § Assists in maintaining the utility through long term maintenance contracts Financiers / Financial Advisors § § § Advise of the feasibility and assess the financing needs of projects Assist in structuring projects to make them bankable Provide finance on a non or limited recourse lending basis Assist in management of project-related exchange rate risks DFIs helpful in stretching lending terms and tenor of financing

10 Section 2: Public Private Partnerships (PPPs)

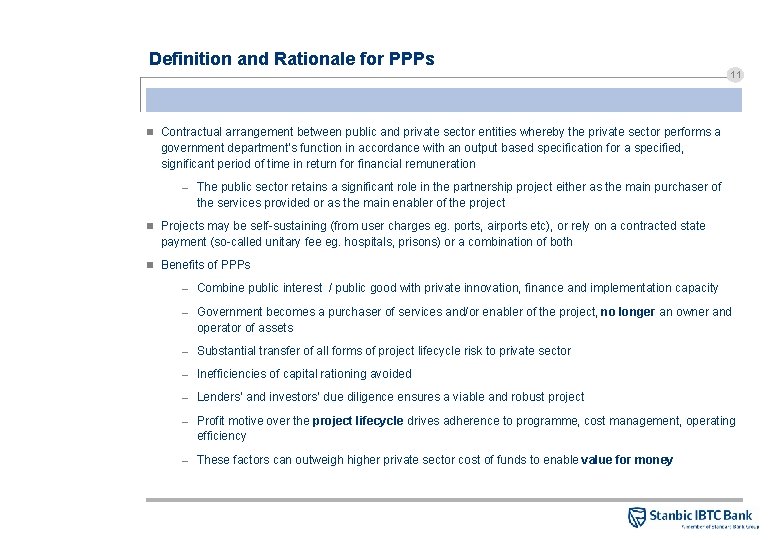

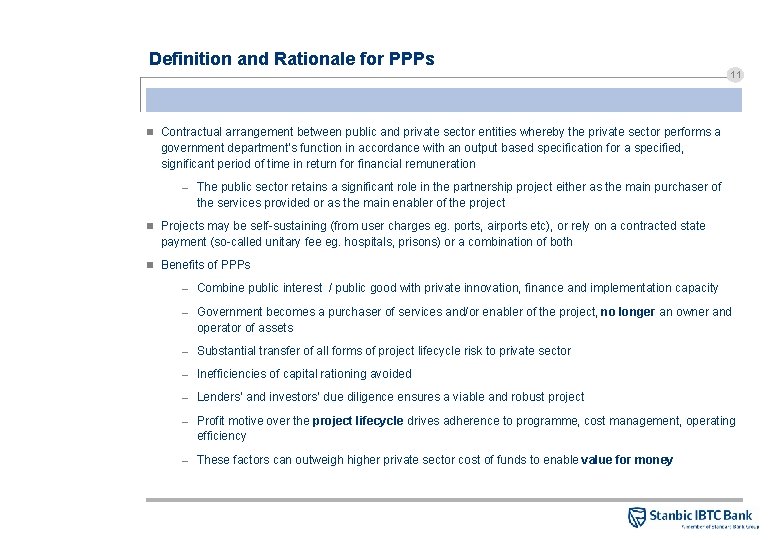

Definition and Rationale for PPPs 11 n Contractual arrangement between public and private sector entities whereby the private sector performs a government department’s function in accordance with an output based specification for a specified, significant period of time in return for financial remuneration – The public sector retains a significant role in the partnership project either as the main purchaser of the services provided or as the main enabler of the project n Projects may be self-sustaining (from user charges eg. ports, airports etc), or rely on a contracted state payment (so-called unitary fee eg. hospitals, prisons) or a combination of both n Benefits of PPPs – Combine public interest / public good with private innovation, finance and implementation capacity – Government becomes a purchaser of services and/or enabler of the project, no longer an owner and operator of assets – Substantial transfer of all forms of project lifecycle risk to private sector – Inefficiencies of capital rationing avoided – Lenders’ and investors’ due diligence ensures a viable and robust project – Profit motive over the project lifecycle drives adherence to programme, cost management, operating efficiency – These factors can outweigh higher private sector cost of funds to enable value for money

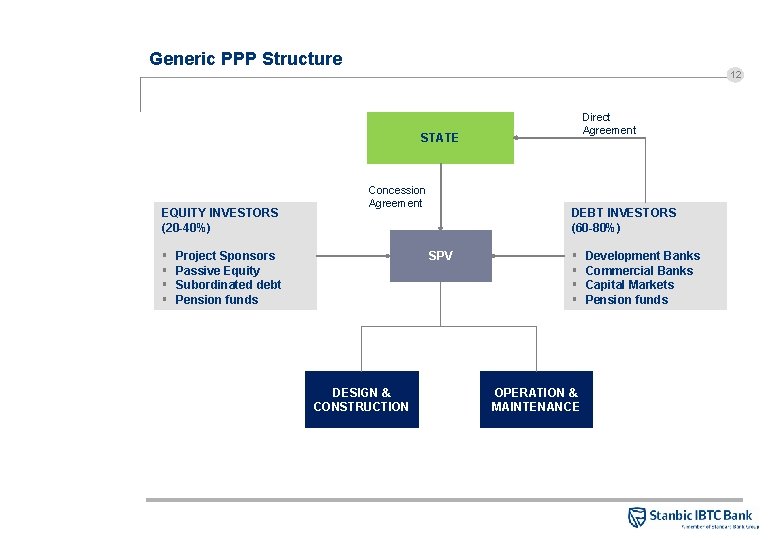

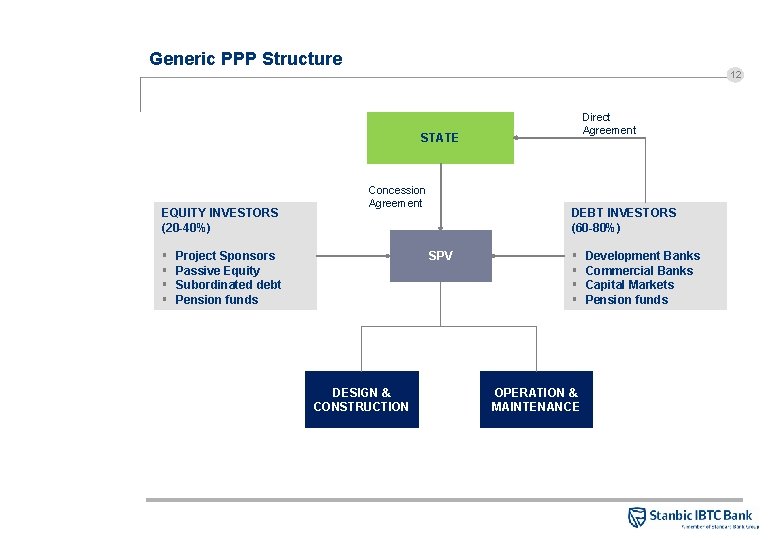

Generic PPP Structure 12 Direct Agreement STATE EQUITY INVESTORS (20 -40%) § § Concession Agreement Project Sponsors Passive Equity Subordinated debt Pension funds DEBT INVESTORS (60 -80%) SPV DESIGN & CONSTRUCTION § § OPERATION & MAINTENANCE Development Banks Commercial Banks Capital Markets Pension funds

Success Factors 13 Political Support § Notion of “the private sector providing a public service” must be understood and accepted at both national and local government levels, as well as traditional leadership § Willingness to overcome vested interests for the change in delivery mode, and, in some cases, motivate a new charging regime § Committed project champions in the concession granting authority to obtain support and approvals across the range of public stakeholders § State capital contributions and/or revenue support Legal and Institutional Capacity § Legal capacity to grant concessions § Necessary ownership of existing asset to confer a concession over it § Financial capacity to meet any financial liabilities under the concession (or else bind the State) § Institutional capacity to negotiate and manage concession agreements Willing and Able Developers § Need developers and contractors who respond to tenders with adequate resources and commitment – to get value for money and delivery § Too many tenders attract too few bidders – why? § A global boom in power and infrastructure – supply side constraints § Quality and efficiency of tender process critical

Success Factors (continued) Competitive Contractors & Operators § In some countries construction contracts often awarded on a negotiated basis § Pricing of civil works is higher than many other emerging markets - a challenge for project viability § Persuade contractors to act as sponsors and equity investors § Contractors get more influence over contracting terms and have greater certainty of payment § New business opportunities in maintenance and operations Willingness and Ability to Pay § In a user-pay scheme like a toll road, the willingness and ability to pay is a key issue § Willingness can be influenced by political players - need national and local leaders to give overt support for the user pay concept (where it is the appropriate solution) § Getting to the affordable charge for a user is a delicate process, and in public transport often requires a public subsidy or capital grant § Affordability also applies to take-or-pay PPPs such as waste, water or power deals § Off-taker’s credit-worthiness is key and may need to be enhanced § But understand the status quo e. g. Stand-by generation now costs US$0. 42/k. Wh >> don’t underestimate end-user’s willingness to pay! 14

Success Factors (continued) Bank and Capital Markets § Infrastructure needs long term finance on flexible terms, e. g. high gearing, interest and capital grace periods, sculpted repayments, etc. § Critically, non or limited recourse lending needed § Ideally, exchange rate and interest rate risk need to be managed/hedged § Pension Funds and Development Finance Institutions helpful in stretching lending terms § Depth and competitiveness of the banking market has improved e. g. Celtel and Nairobi Toll Road § Capital markets are the natural long-term investors § But regulatory hurdles can be a problem e. g. bond listing requirements exclude green-field projects 15

Lessons Learned – Let’s move on! Remember the “Partnership” in PPP? Infrastructure is everybody’s business! Understand what risks developers and funders will take Work out how to attract the right developers (LCC – Lagos State) Encourage innovation, don’t over-specify inputs Aid & development finance should supplement - not substitute - commercial lenders Keep it simple! 16

17 Section 3: Case study – Shuaibah IWPP, Saudi Arabia

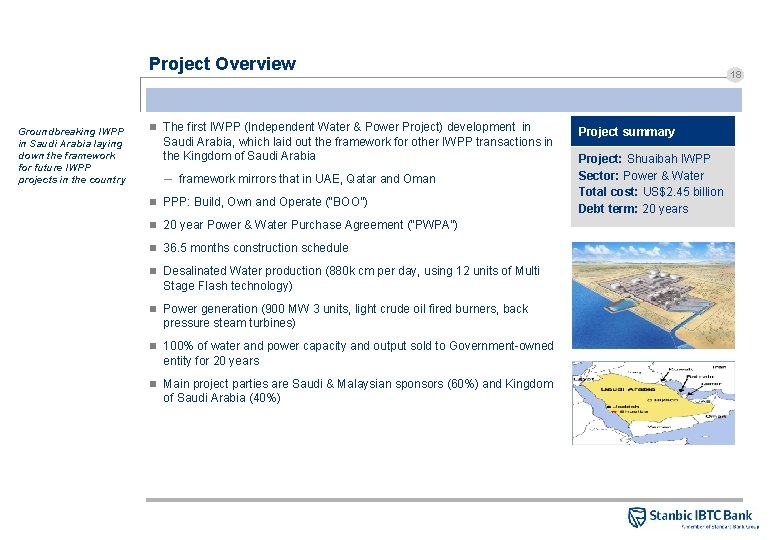

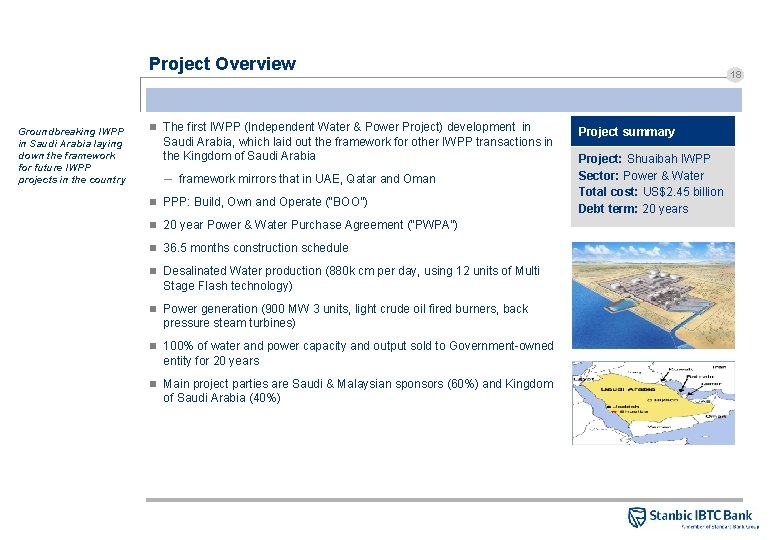

Project Overview Groundbreaking IWPP in Saudi Arabia laying down the framework for future IWPP projects in the country n The first IWPP (Independent Water & Power Project) development in Saudi Arabia, which laid out the framework for other IWPP transactions in the Kingdom of Saudi Arabia – framework mirrors that in UAE, Qatar and Oman n PPP: Build, Own and Operate (“BOO”) n 20 year Power & Water Purchase Agreement (“PWPA”) n 36. 5 months construction schedule n Desalinated Water production (880 k cm per day, using 12 units of Multi Stage Flash technology) n Power generation (900 MW 3 units, light crude oil fired burners, back pressure steam turbines) n 100% of water and power capacity and output sold to Government-owned entity for 20 years n Main project parties are Saudi & Malaysian sponsors (60%) and Kingdom of Saudi Arabia (40%) 18 Project summary Project: Shuaibah IWPP Sector: Power & Water Total cost: US$2. 45 billion Debt term: 20 years

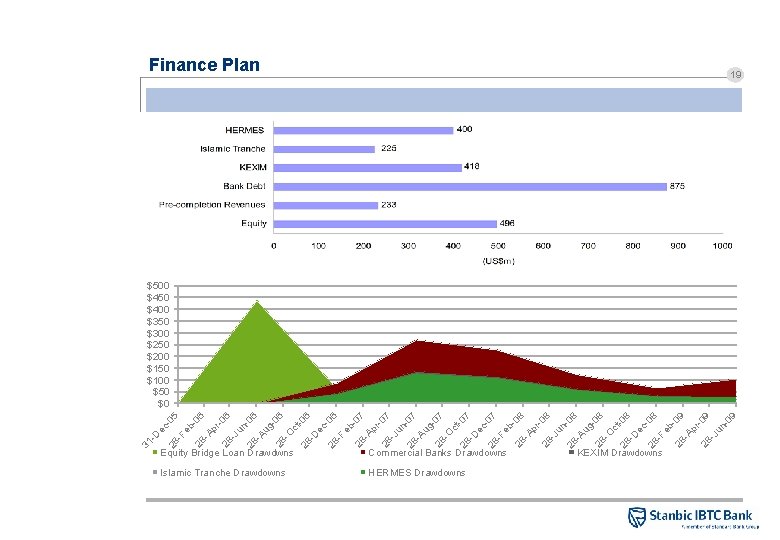

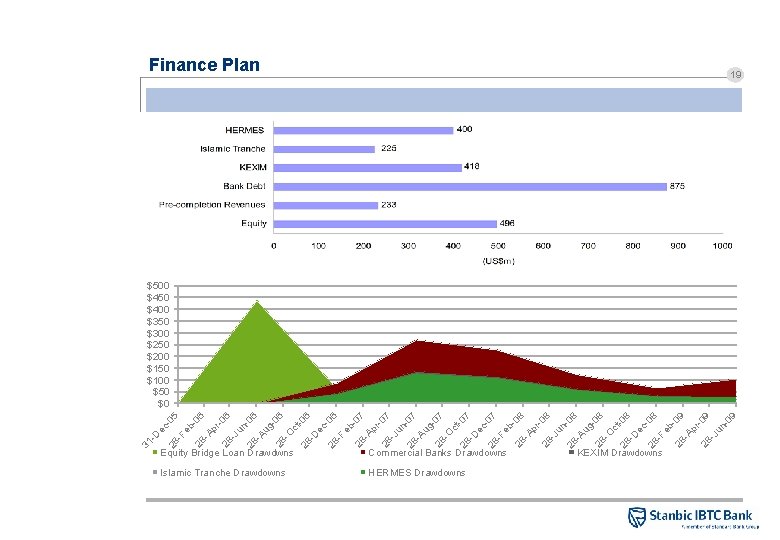

ec 28 -05 -F eb 28 -06 -A pr -0 28 6 -J un 28 -06 -A ug -0 28 6 -O ct 28 -06 -D ec 28 -06 -F eb 28 -07 -A pr -0 28 7 -J un 28 -07 -A ug -0 28 7 -O ct 28 -07 -D ec 28 -07 -F eb -0 28 8 -A pr -0 28 8 -J un 28 -08 -A ug -0 28 8 -O ct 28 -08 -D ec 28 -08 -F eb 28 -09 -A pr -0 28 9 -J un -0 9 -D 31 Finance Plan 19 $500 $450 $400 $350 $300 $250 $200 $150 $100 $50 $0 Equity Bridge Loan Drawdwns Commercial Banks Drawdowns Islamic Tranche Drawdowns HERMES Drawdowns KEXIM Drawdowns

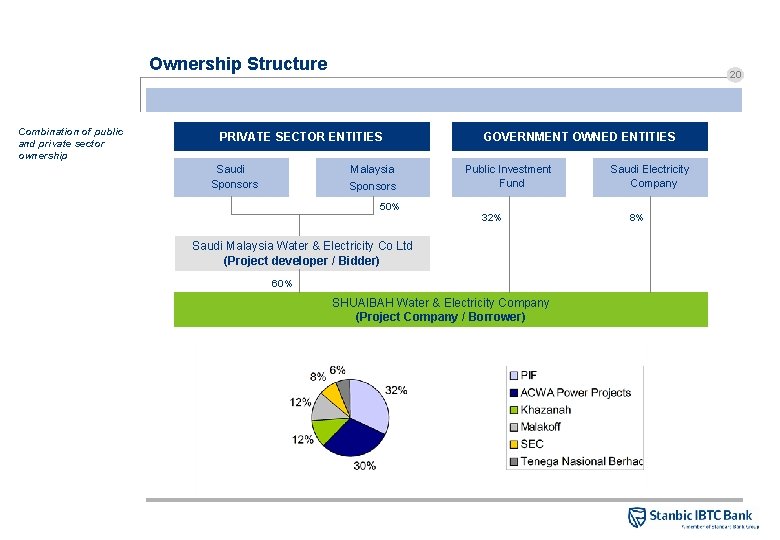

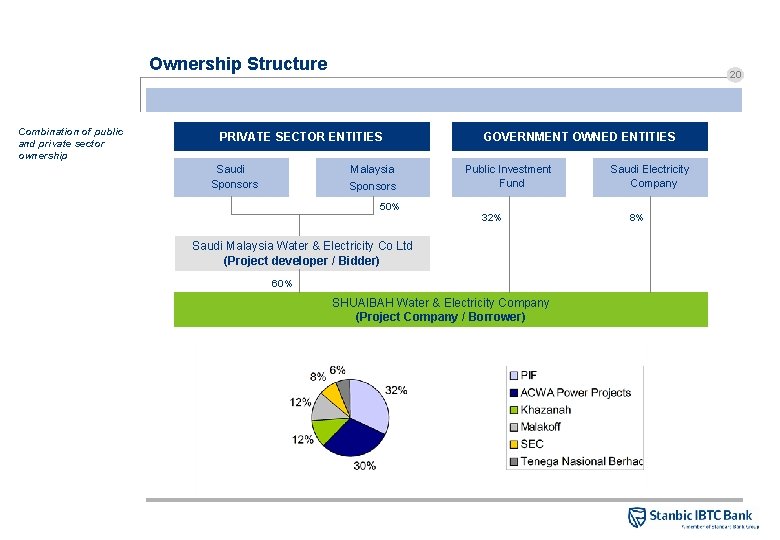

Ownership Structure Combination of public and private sector ownership 20 PRIVATE SECTOR ENTITIES Saudi Sponsors Malaysia Sponsors GOVERNMENT OWNED ENTITIES Public Investment Fund Saudi Electricity Company 50% 32% Saudi Malaysia Water & Electricity Co Ltd (Project developer / Bidder) 60% SHUAIBAH Water & Electricity Company (Project Company / Borrower) 8%

21 THANK YOU Patrick Okey Mgbenwelu – Head, Project Finance – Stanbic IBTC Bank Plc. Patrick. Mgbenwelu@Stanbic. com Nigeria: Stanbic IBTC Bank Plc, IBTC Place, Walter Carrington Crescent, P. O. Box 71707, Victoria Island, Lagos State Tel: Fax: Mob: 01 – 448 – 8900 01 – 448 – 8902 0703 – 413 – 6835 www. stanbicibtcbank. com

22 Appendix A Introduction to Stanbic IBTC Bank

Stanbic IBTC Bank 23 Overview Stanbic IBTC Bank is the parent of Stanbic IBTC Pension Managers, Nigeria’s largest PFA and Stanbic IBTC Asset management Limited, Nigeria’s largest nonpension asset managers n Stanbic IBTC Bank, a product of the merger between IBTC Chartered Bank Plc and Stanbic Bank Nigeria Limited, is Nigeria’s premier investment bank with a wealth of experience in advisory, privatisations and capital markets n The bank also has excellent corporate and retail banking capabilities and a network of over 60 branches in all the major cities and commercials centres spread across the geo-political zones of Nigeria n Being a member of the Standard Bank Group means that Stanbic IBTC is part of a strong global banking network n Fitch recently upgraded Stanbic IBTC’s National Long and Short-term ratings to 'AAA(nga)' from 'A(nga)' and to 'F 1+(nga)' from 'F 1(nga)', respectively – only local bank with a Fitch AAA rating n Stanbic IBTC Bank is the parent of Stanbic IBTC Pension Managers, Nigeria’s largest PFA and Stanbic IBTC Asset management Limited, Nigeria’s largest non-pension asset managers n Stanbic IBTC is among the 15 Primary Dealers / Market Makers recently appointed by the Debt Management Office to trade in government securities and appointed along with 13 other banks to manage Nigeria’s foreign reserves Selected Accolades Stanbic IBTC is the only local bank with a Fitch AAA rating n Best Debt House: Euromoney Excellence Award 2008 n Best Issuing House: Thisday Awards 2008 n Best Issuing House in Africa: African Banker Awards 2007 n Best Fund Manager, Nigeria: This. Day 2005 n Euromoney Project Finance Magazine ‘Deal of the Year’ Awards: – African PPP: Lekki-Epe Expressway (2008) – African Telecoms / Mobile: MTN Nigeria US$2 bn Fund raising (2007) Local knowledge supported by a global network and expertise

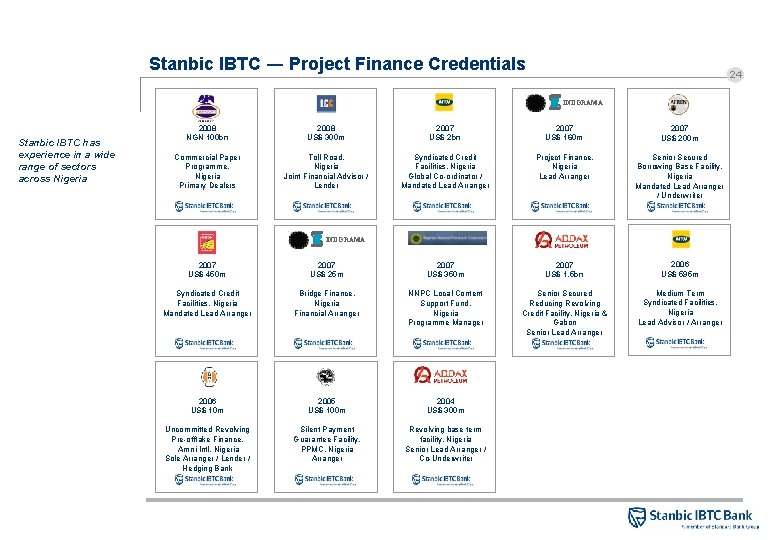

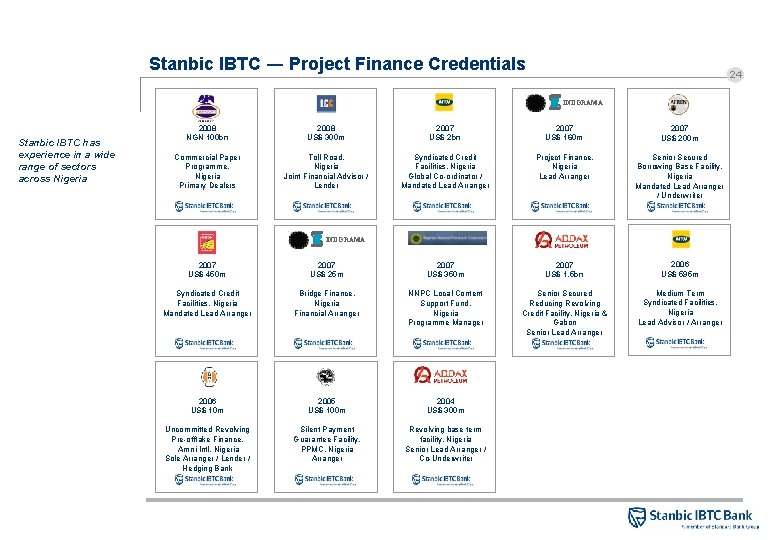

Stanbic IBTC ― Project Finance Credentials 24 INDORAMA Stanbic IBTC has experience in a wide range of sectors across Nigeria 2008 NGN 100 bn 2008 US$ 300 m 2007 US$ 2 bn 2007 US$ 160 m 2007 US$ 200 m Commercial Paper Programme, Nigeria Primary Dealers Toll Road, Nigeria Joint Financial Advisor / Lender Syndicated Credit Facilities, Nigeria Global Co-ordinator / Mandated Lead Arranger Project Finance, Nigeria Lead Arranger Senior Secured Borrowing Base Facility, Nigeria Mandated Lead Arranger / Underwriter INDORAMA 2007 US$ 450 m 2007 US$ 25 m 2007 US$ 350 m 2007 US$ 1. 5 bn 2006 US$ 595 m Syndicated Credit Facilities, Nigeria Mandated Lead Arranger Bridge Finance, Nigeria Financial Arranger NNPC Local Content Support Fund, Nigeria Programme Manager Senior Secured Reducing Revolving Credit Facility, Nigeria & Gabon Senior Lead Arranger Medium Term Syndicated Facilities, Nigeria Lead Advisor / Arranger 2006 US$ 10 m 2005 US$ 100 m 2004 US$ 300 m Uncommitted Revolving Pre-offtake Finance, Amni Intl, Nigeria Sole Arranger / Lender / Hedging Bank Silent Payment Guarantee Facility, PPMC, Nigeria Arranger Revolving base term facility, Nigeria Senior Lead Arranger / Co-Underwriter

Disclaimer 25 Confidentiality and disclaimer This document is provided on the express understanding that the information contained herein will be regarded and treated as strictly confidential and proprietary to Stanbic IBTC Bank Plc (“Stanbic IBTC”), its holding company Standard Bank of South Africa, and the subsidiaries of its holding company (“the Standard Bank Group”). By retaining it the recipient undertakes that it is not to be delivered and nor shall its contents be disclosed to anyone other than the intended recipient, and nor shall it be reproduced or used, in whole or in part, for any purpose other than for the purpose described herein, without the prior written consent of Standard Bank. Whilst every effort has been made to ensure the accuracy and completeness of the information contained in this document, no responsibility is accepted by the Standard Bank group for the treatment by any court of law, tax, banking or other authorities in any jurisdiction of any transaction based on the information contained herein. There may be tax implications to consider in any transaction and these should be identified and understood before investing. Separate tax advice should therefore be sought when appropriate. Should anything contained herein contribute to the acquisition of a financial product the following must be noted: there are intrinsic risks involved in transacting in any products; no guarantee is provided for the investment value in a product; any forecasts based on hypothetical data are not guaranteed and are for illustrative purposes only; returns may vary as a result of their dependence on the performance of underlying assets and other variable market factors and past performances are not necessarily indicative of future performances. Any client that is not a merchant banking client as defined in the Financial Advisory and Intermediary Services Act must note that unless a financial needs analysis has been conducted to assess the appropriateness of any product, investment or structure to its circumstances, there may be limitations on the appropriateness of any information provided by a member of the Standard Bank group and careful consideration must be given to the implications of entering into any transaction, with or without the assistance of an investment professional.

Strictly private and confidential 中文

Strictly private and confidential 中文 Strictly private and confidential

Strictly private and confidential Strictly private and confidential

Strictly private and confidential Strictly private and confidential

Strictly private and confidential Strictly private & confidential

Strictly private & confidential Strictly private and confidential

Strictly private and confidential Strictly private and confidential

Strictly private and confidential Strictly private & confidential

Strictly private & confidential Confidential

Confidential Suranne jones strictly confidential

Suranne jones strictly confidential Strictly confidential not for distribution

Strictly confidential not for distribution Salary head meaning

Salary head meaning Pension planning northamptonshire

Pension planning northamptonshire Iam national pension fund death benefit

Iam national pension fund death benefit Northumberland pension fund

Northumberland pension fund Teesside pension fund

Teesside pension fund Cpf iuoe

Cpf iuoe Northamptonshire pension fund

Northamptonshire pension fund Geoff snelgar net worth

Geoff snelgar net worth Private and confidential in bahasa malaysia

Private and confidential in bahasa malaysia Halla visteon hungary kft

Halla visteon hungary kft Petty cash replenishment process

Petty cash replenishment process Mcse private cloud

Mcse private cloud Iigf indonesia

Iigf indonesia Private wan

Private wan Oracle database appliance

Oracle database appliance