Strategic Sourcing in Banking A Framework Markus Lammers

Strategic Sourcing in Banking - A Framework Markus Lammers, E-Finance Lab University of Frankfurt October 08, 2004

Agenda Ø Problem, Research Questions, Definitions Ø A Qualitative Framework for Sourcing Decisions Ø The Banking Value Chain as Sourcing Subject Ø A Formalized Sourcing Decision Model Ø Conclusion and Further Research

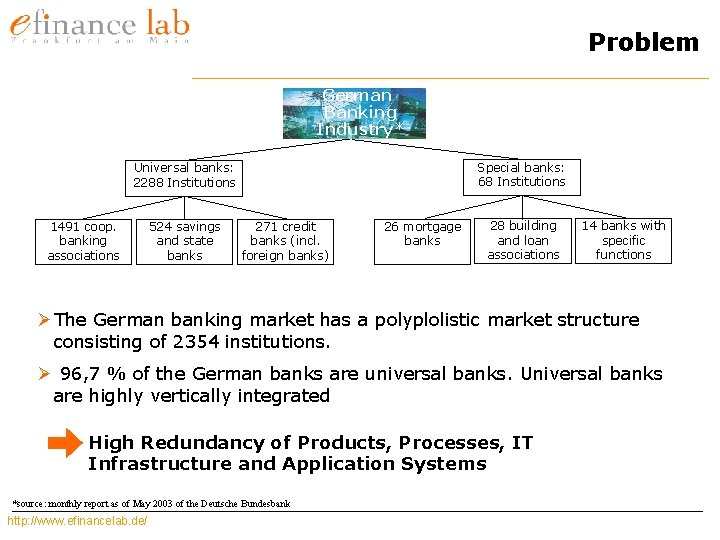

Problem German Banking Industry* Special banks: 68 Institutions Universal banks: 2288 Institutions 1491 coop. banking associations 524 savings and state banks 271 credit banks (incl. foreign banks) 26 mortgage banks 28 building and loan associations 14 banks with specific functions Ø The German banking market has a polyplolistic market structure consisting of 2354 institutions. Ø 96, 7 % of the German banks are universal banks. Universal banks are highly vertically integrated High Redundancy of Products, Processes, IT Infrastructure and Application Systems *source: monthly report as of May 2003 of the Deutsche Bundesbank http: //www. efinancelab. de/

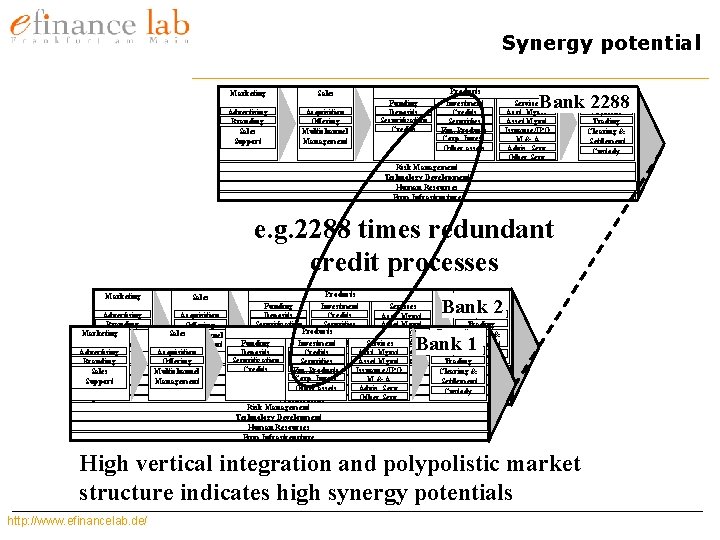

Synergy potential Marketing Advertising Branding Sales Support Sales Acquisition Offering Multichannel Management Funding Deposits Securitization Credits Products Investment Credits Securities Fin. Products Corp. Invest. Other assets Transactions Bank 2288 Services Acct. Mgmt. Asset Mgmt. Issuance/IPO M&A Advis. Serv. Other Serv. Risk Management Technology Development Human Resources Firm Infrastructure e. g. 2288 times redundant credit processes Marketing Advertising Branding Marketing Sales Support Advertising Branding Sales Support Sales Acquisition Offering Sales Multichannel Management Acquisition Offering Multichannel Management Products Investment Services Funding Deposits Credits Acct. Mgmt. Securitization Securities Asset Mgmt. Credits Products Fin. Products Issuance/IPO Corp. Invest. Services. M & A Investment Funding Other assets. Acct. Mgmt. Advis. Serv. Deposits Credits Other Serv. Securitization Securities Asset Mgmt. Credits Infrastructure Fin. Products Issuance/IPO Corp. Invest. M&A Technology Development assets Advis. Serv. Human. Other Resources Other Serv. Procurement Risk Management Technology Development Human Resources Firm Infrastreucture Transactions Bank 2 Payment Trading Transactions Clearing & Settlement Payment Custody Trading Clearing & Settlement Custody Bank 1 High vertical integration and polypolistic market structure indicates high synergy potentials http: //www. efinancelab. de/ Payment Trading Clearing & Settlement Custody

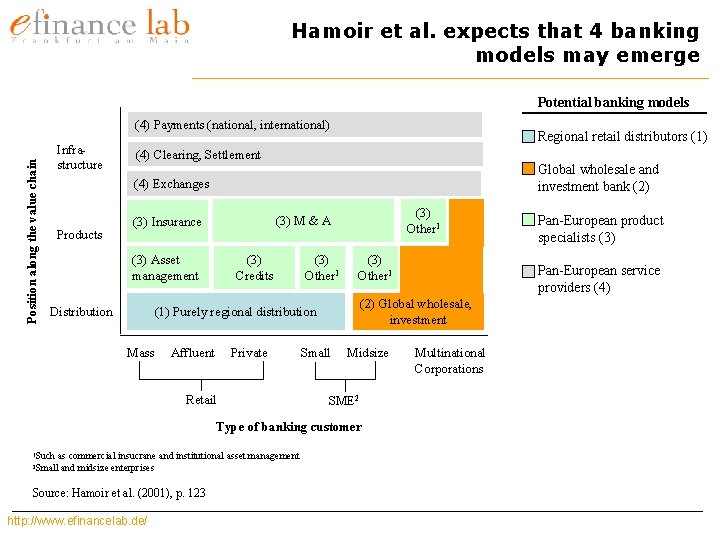

Hamoir et al. expects that 4 banking models may emerge Potential banking models Position along the value chain (4) Payments (national, international) Infrastructure Regional retail distributors (1) (4) Clearing, Settlement Global wholesale and investment bank (2) (4) Exchanges Products (3) Asset management Distribution (3) Other 1 (3) M & A (3) Insurance (3) Credits (3) Other 1 Mass Affluent Private Retail Small Midsize SME 2 Type of banking customer Such as commercial insucrane and institutional asset management Small and midsize enterprises 1 2 Source: Hamoir et al. (2001), p. 123 http: //www. efinancelab. de/ Pan-European service providers (4) (2) Global wholesale, investment (1) Purely regional distribution Pan-European product specialists (3) Multinational Corporations

Research Questions What is the optimal degree of vertical integration for a bank? Ø What activities should be made internally? Ø What activities should be made or produced by a (specialized) supplier? Ø What are drivers for in- or outsourcing an activity? http: //www. efinancelab. de/

Definitions Sourcing Analysis: Analysis of the combination of internal and external resources to improve the production mix of a bank by decreasing costs or increasing value generation. Outsourcing: Usage of (superior) resources outside the company. Outsourcer: A company that gives an activity to an external company, which was formerly produced inhouse. Insourcer: A company that takes over the activity from the outsourcer. http: //www. efinancelab. de/

Agenda Ø Problem, Research Questions, Defintions Ø A Qualitative Framework for Sourcing Decisions Ø The Banking Value Chain as Sourcing Subject Ø A Formalized Sourcing Decision Model Ø Conclusion and Further Research

Theoretic Foundation: An Introduction to Transaction Cost Economics (1/2) Transaction Costs Economics analyzes the efficiency of different governance forms using transactions as basic analysis unit. (Williamson 1981, p. 548) Transactions are defined as the transfer of goods or services between technologially separable interface (Williamson, 1981, p. 522) Governance forms are: Ø Hierarchy: governance is based on property rights of management, processes and administrative control mechanisms, i. e. companies. Ø Markets: Are steered by price mechanisms and hierarchical control is replaced by contractual agreements. Ø Hybrids: include governance elements from both markets and hierarchy, e. g. joint ventures, alliances, shared service organizations. http: //www. efinancelab. de/

Theoretic Foundation: An Introduction to Transaction Cost Economics (2/2) Increasing transaction costs are determined by: ØFrequency of Transactions: Transaction that are frequently processed will more likely produced internally. ØUncertainty: Increasing uncertainty imply higher transaction costs, e. g. in long-lasting outsourcing deals. ØAsset Specificity: Insourcer would have to make specific production investments when taking over highly specific assets. http: //www. efinancelab. de/

Theroretic Foundation: An Introduction to the Resource Based-View (1/2) The Resource Based-View (RBV) explains how companies can gain and sustain a competitive advantage having superior resources. Barney (1991) derives that a sustainable competitive advantage results from resources that are: Ø Valuable: Resources increase revenues or decrease costs Ø Rare: Resources are not freely availabe Ø Imperfectly imitable: it is not clear for a competitor how to build identical resources Ø Non-substitutable: no alternative resources providing identical value http: //www. efinancelab. de/

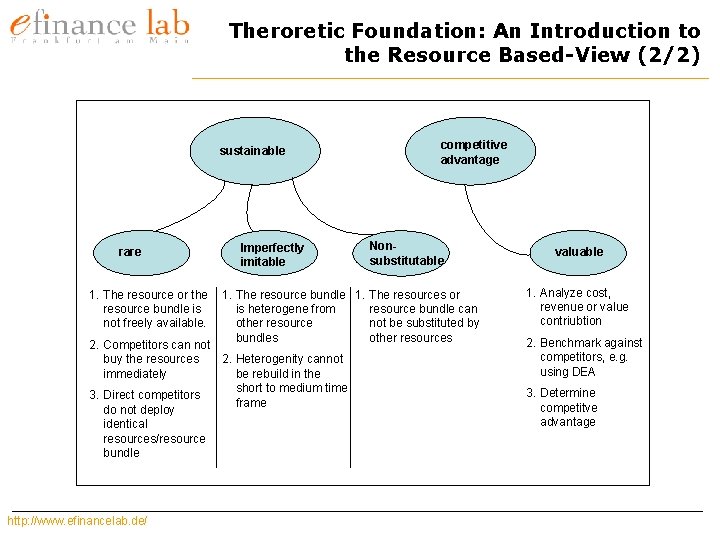

Theroretic Foundation: An Introduction to the Resource Based-View (2/2) sustainable rare 1. The resource or the resource bundle is not freely available. Imperfectly imitable Nonsubstitutable 1. The resource bundle 1. The resources or is heterogene from resource bundle can other resource not be substituted by bundles other resources 2. Competitors can not 2. Heterogenity cannot buy the resources be rebuild in the immediately short to medium time 3. Direct competitors frame do not deploy identical resources/resource bundle http: //www. efinancelab. de/ competitive advantage valuable 1. Analyze cost, revenue or value contriubtion 2. Benchmark against competitors, e. g. using DEA 3. Determine competitve advantage

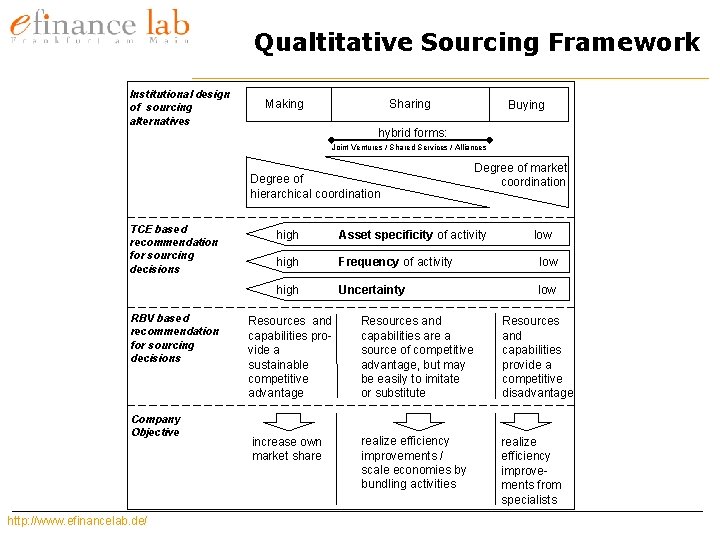

Qualtitative Sourcing Framework Institutional design of sourcing alternatives Making Sharing Buying hybrid forms: Joint Ventures / Shared Services / Alliances Degree of hierarchical coordination TCE based recommendation for sourcing decisions RBV based recommendation for sourcing decisions Company Objective http: //www. efinancelab. de/ Degree of market coordination high Asset specificity of activity low high Frequency of activity low high Uncertainty low Resources and capabilities provide a sustainable competitive advantage Resources and capabilities are a source of competitive advantage, but may be easily to imitate or substitute Resources and capabilities provide a competitive disadvantage increase own market share realize efficiency improvements / scale economies by bundling activities realize efficiency improvements from specialists

Agenda Ø Problem, Research Questions, Defintions Ø A Qualitative Framework for Sourcing Decisions Ø The Banking Value Chain as Sourcing Subject Ø A Formalized Sourcing Decision Model Ø Conclusion and Further Research

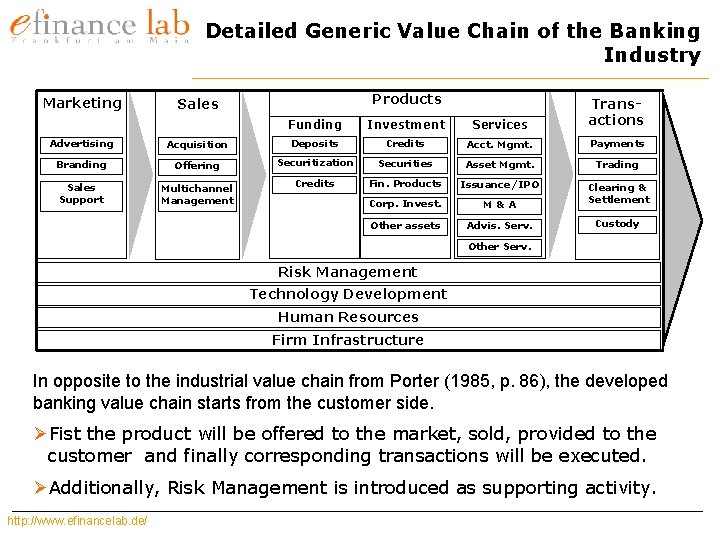

Detailed Generic Value Chain of the Banking Industry Marketing Products Funding Investment Services Transactions Sales Advertising Acquisition Deposits Credits Acct. Mgmt. Payments Branding Offering Securitization Securities Asset Mgmt. Trading Sales Support Multichannel Management Credits Fin. Products Issuance/IPO Corp. Invest. M&A Clearing & Settlement Other assets Advis. Serv. Custody Other Serv. Risk Management Technology Development Human Resources Firm Infrastructure In opposite to the industrial value chain from Porter (1985, p. 86), the developed banking value chain starts from the customer side. ØFist the product will be offered to the market, sold, provided to the customer and finally corresponding transactions will be executed. ØAdditionally, Risk Management is introduced as supporting activity. http: //www. efinancelab. de/

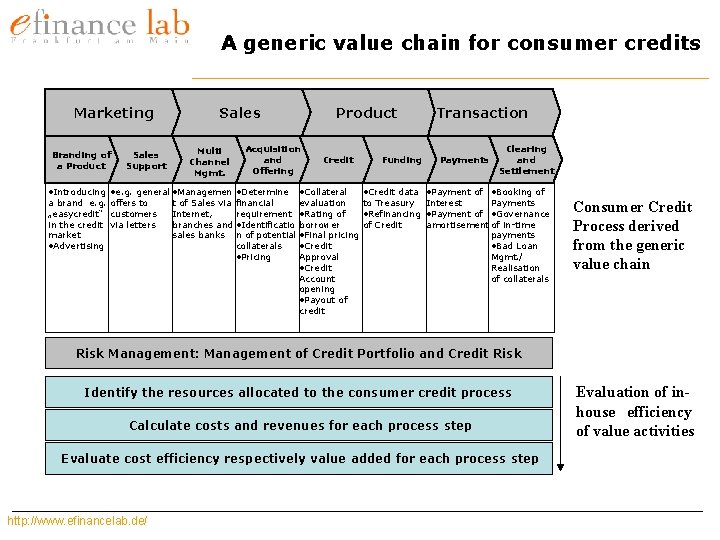

A generic value chain for consumer credits Marketing Branding of a Product Sales Support Sales Multi Channel Mgmt. Acquisition and Offering • Introducing • e. g. general • Managemen • Determine a brand e. g. offers to „easycredit“ customers in the credit via letters market • Advertising t of Sales via Internet, branches and sales banks Product financial requirement • Identificatio n of potential collaterals • Pricing Credit • Collateral Funding • Credit data evaluation to Treasury • Rating of • Refinancing borrower of Credit • Final pricing • Credit Approval • Credit Account opening • Payout of credit Transaction Payments Clearing and Settlement • Payment of • Booking of Interest Payments • Payment of • Governance amortisement of in-time payments • Bad Loan Mgmt. / Realisation of collaterals Consumer Credit Process derived from the generic value chain Risk Management: Management of Credit Portfolio and Credit Risk Identify the resources allocated to the consumer credit process Calculate costs and revenues for each process step Evaluate cost efficiency respectively value added for each process step http: //www. efinancelab. de/ Evaluation of inhouse efficiency of value activities

Mini Case Study: Norisbank Marketing: ØBranding of product “easycredit®” ØIndependently from corporate identity of Norisbank ØRegistered trademark: valuable and rare Sales: ØEffectively leveraging product via different sales channels ØNorisbank is able to invest 87% of all funds easycredit Products/Transactions: ØFully automated processing of consumer credit ØAverage processing-time reduced from 128 to 35 minutes http: //www. efinancelab. de/

Agenda Ø Problem, Research Questions, Defintions Ø A Qualitative Framework for Sourcing Decisions Ø The Banking Value Chain as Sourcing Subject Ø A Formalized Sourcing Decision Model Ø Conclusion and Further Research

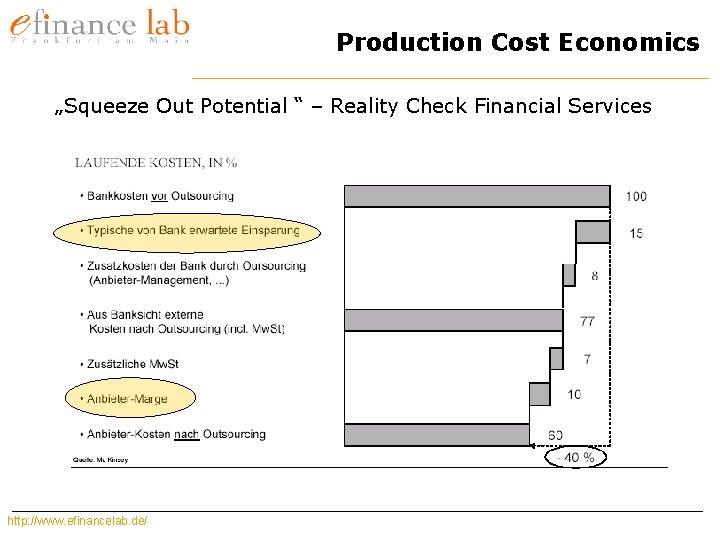

Production Cost Economics „Squeeze Out Potential “ – Reality Check Financial Services http: //www. efinancelab. de/

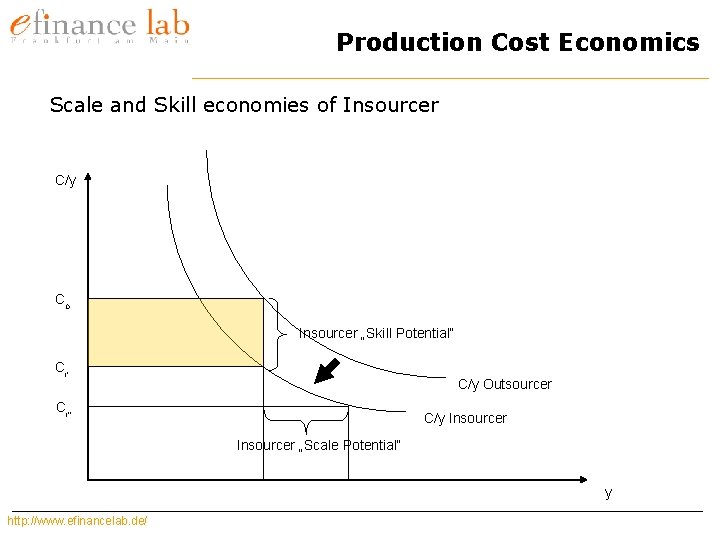

Production Cost Economics Scale and Skill economies of Insourcer C/y CO Insourcer „Skill Potential“ CI‘ C/y Outsourcer CI‘‘ C/y Insourcer „Scale Potential“ y http: //www. efinancelab. de/

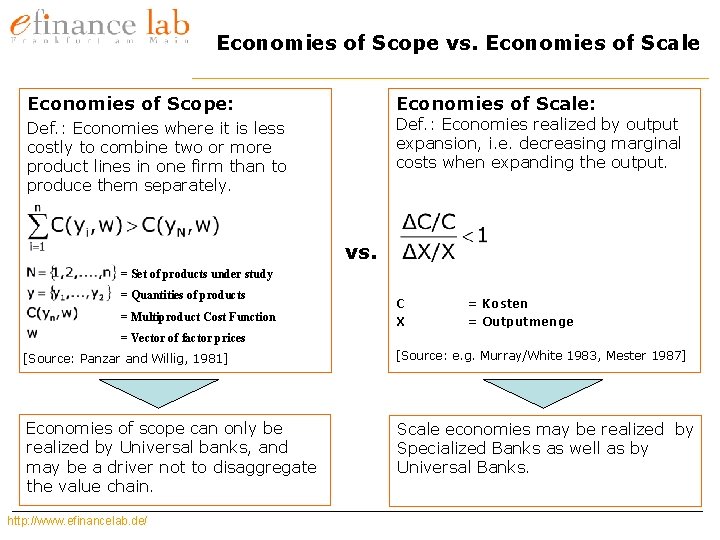

Economies of Scope vs. Economies of Scale Economies of Scope: Economies of Scale: Def. : Economies realized by output expansion, i. e. decreasing marginal costs when expanding the output. Def. : Economies where it is less costly to combine two or more product lines in one firm than to produce them separately. vs. = Set of products under study = Quantities of products = Multiproduct Cost Function C = Kosten X = Outputmenge = Vector of factor prices [Source: Panzar and Willig, 1981] [Source: e. g. Murray/White 1983, Mester 1987] Economies of scope can only be realized by Universal banks, and may be a driver not to disaggregate the value chain. Scale economies may be realized by Specialized Banks as well as by Universal Banks. http: //www. efinancelab. de/

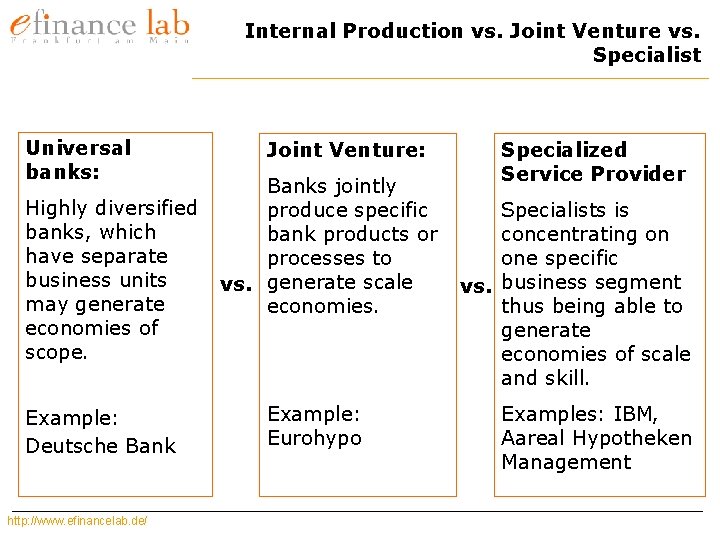

Internal Production vs. Joint Venture vs. Specialist Universal banks: Highly diversified banks, which have separate business units may generate economies of scope. Example: Deutsche Bank http: //www. efinancelab. de/ Joint Venture: Banks jointly produce specific bank products or processes to vs. generate scale economies. Example: Eurohypo Specialized Service Provider Specialists is concentrating on one specific vs. business segment thus being able to generate economies of scale and skill. Examples: IBM, Aareal Hypotheken Management

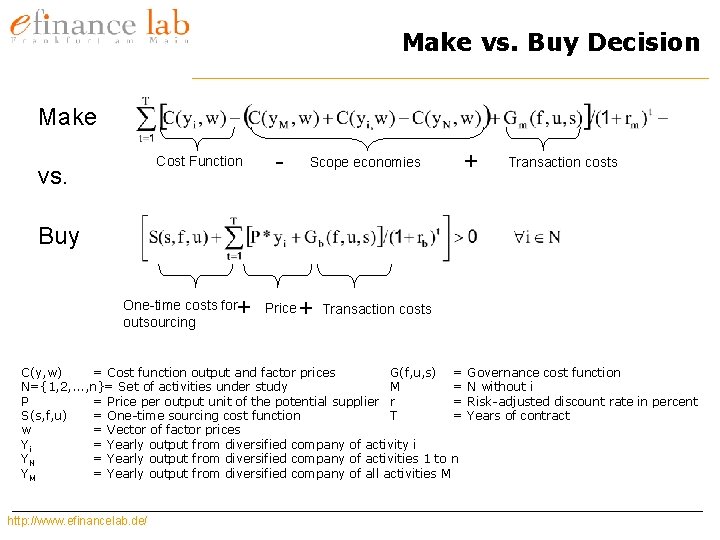

Make vs. Buy Decision Make Cost Function vs. - Scope economies + Transaction costs Buy + One-time costs for outsourcing Price + Transaction costs C(y, w) = Cost function output and factor prices G(f, u, s) = N={1, 2, . . . , n}= Set of activities under study M = Price per output unit of the potential supplier r = S(s, f, u) = One-time sourcing cost function T = w = Vector of factor prices Yi = Yearly output from diversified company of activity i YN = Yearly output from diversified company of activities 1 to n YM = Yearly output from diversified company of all activities M http: //www. efinancelab. de/ Governance cost function N without i Risk-adjusted discount rate in percent Years of contract

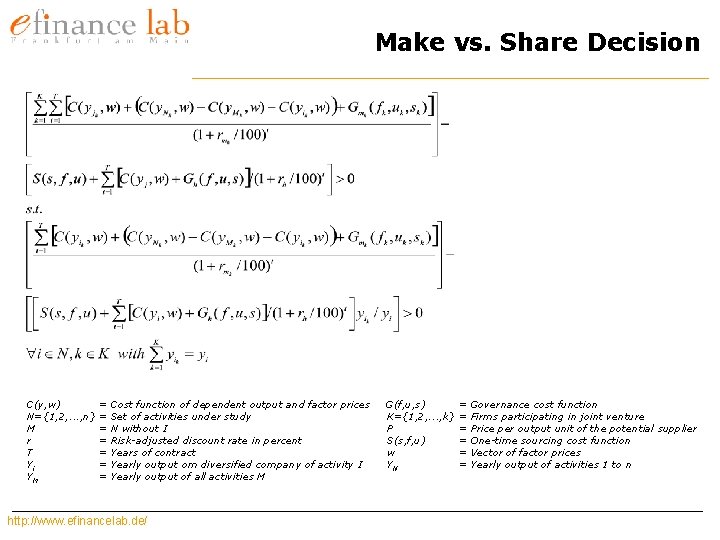

Make vs. Share Decision C(y, w) = N={1, 2, . . . , n} = M = r = T = Yi = YM = Cost function of dependent output and factor prices Set of activities under study N without I Risk-adjusted discount rate in percent Years of contract Yearly output om diversified company of activity I Yearly output of all activities M http: //www. efinancelab. de/ G(f, u, s) K={1, 2, . . . , k} P S(s, f, u) w YN = = = Governance cost function Firms participating in joint venture Price per output unit of the potential supplier One-time sourcing cost function Vector of factor prices Yearly output of activities 1 to n

Agenda Ø Problem, Research Questions, Defintions Ø A Qualitative Framework for Sourcing Decisions Ø The Banking Value Chain as Sourcing Subject Ø A Formalized Sourcing Decision Model Ø Conclusion and Further Research

Conclusion and Further Research Conclusion: Øa qualitative framework using RBV and TCE was introduced to identify: ØSuperior Skill Sets ØSuperior Governance Structures consequently supporting a make, buy or share decision. ØA top-down approach for identifying and analyzing activities in banking was introduced using the generic banking value chain ØCo-opetition/Share is a possible sourcing solution for activities and a way to increase production efficiency ØInfluencing variables of a sourcing decision were formalized to show interrelation and impact on a sourcing decision Further Research: ØExtending the Model by Uncertainty and Risk ØSensitivity Testing of the Model Variables http: //www. efinancelab. de/

Backup

Literature Barney, J. B. (1991): Firm resources and sustained competitive advantage, in: Journal of Management, 17, 99 -120. Barron, T. (1992) “Some new results in testing for Economies of Scale in Computing” Decision Support Systems, 4/8, 405 -429 Lacity, M; Willcocks, L. (1996): Editorial; Information Systems Outsourcing in Theory and Practice, in: Journal of Information Technology, 10, 203 -207 Lacity, M; Willcocks, L. (1996): The Value of Selective IT Outsourcing, Sloan Manangement Review, 13 -25 Porter, Michael, E. (1985): Competitive Advantage: Creating and Sustaining Superior Performance, Free Press, New York. Williamson, O. E. (1981): The Economics of Orgnaization: The Transaction Cost Approach, in: American Journal of Sociology, 87, p. 548 -577. http: //www. efinancelab. de/

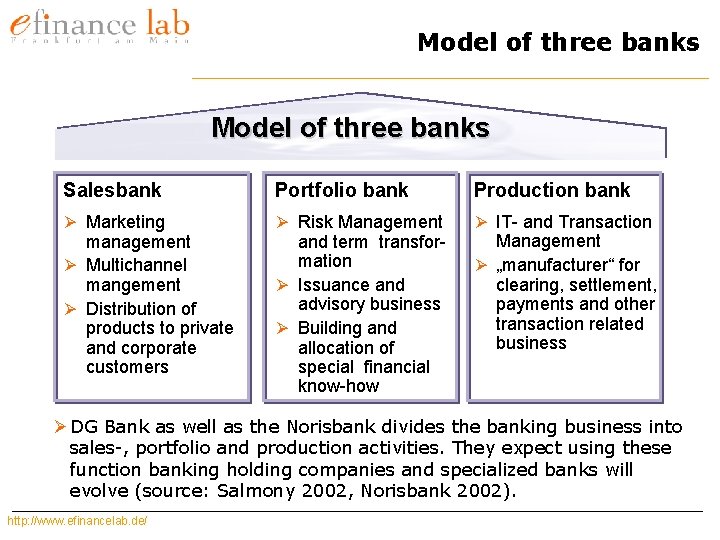

Model of three banks Salesbank Portfolio bank Production bank Ø Marketing Ø Risk Management Ø IT- and Transaction management Ø Multichannel mangement Ø Distribution of products to private and corporate customers and term transformation Ø Issuance and advisory business Ø Building and allocation of special financial know-how Management Ø „manufacturer“ for clearing, settlement, payments and other transaction related business Ø DG Bank as well as the Norisbank divides the banking business into sales-, portfolio and production activities. They expect using these function banking holding companies and specialized banks will evolve (source: Salmony 2002, Norisbank 2002). http: //www. efinancelab. de/

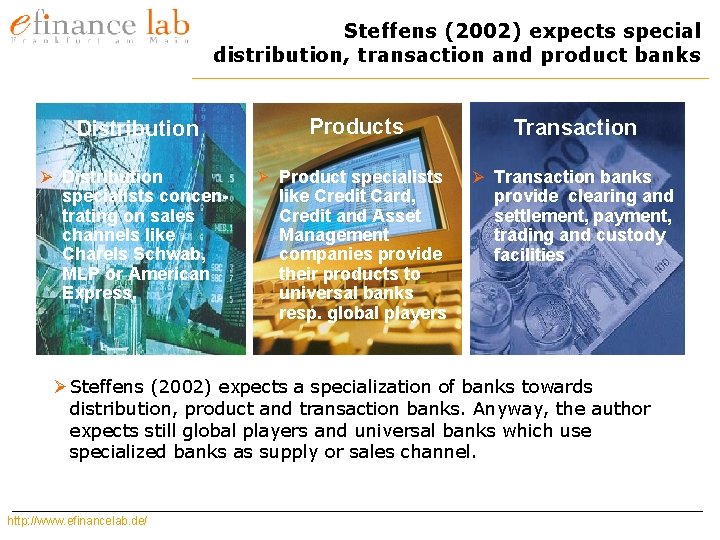

Steffens (2002) expects special distribution, transaction and product banks Distribution Ø Distribution specialists concentrating on sales channels like Charels Schwab, MLP or American Express. Products Ø Product specialists like Credit Card, Credit and Asset Management companies provide their products to universal banks resp. global players Transaction Ø Transaction banks provide clearing and settlement, payment, trading and custody facilities Ø Steffens (2002) expects a specialization of banks towards distribution, product and transaction banks. Anyway, the author expects still global players and universal banks which use specialized banks as supply or sales channel. http: //www. efinancelab. de/

- Slides: 30