Strategic Procurement Consulting srm Extending the value of

- Slides: 35

Strategic Procurement Consulting srm + Extending the value of traditional SRM applications + SRM focuses on the value created by the combination of traditional SRM applications “+” best of breed, niche, third-party solutions.

Contents g e. Procurement Space Maturity Assessment • • • Introduction Models & Evolution Model Overview Matrix Model Maturity Assessment Appendix

Contents g Introduction • • e. Procurement Defined The Current State Opportunities & Focus Solution Drivers

Introduction g What is e. Procurement? • Wiki defines “procurement” as “the acquisition of appropriate goods and/or services at the best possible total cost of ownership to meet the needs of the purchaser in terms of quality and quantity, time, and location”. • Procurement typically involves tasks such as sourcing, requesting, approving, ordering, receiving, and settling • e. Procurement is the automation of the those same tasks as well as the integration of all related parties so as to minimize the total cost of ownership to the procuring org.

Introduction g The Current State of e. Procurement • Models continue to mature, but at slower pace – e. Procurement not so much a finished state, more of a continual evolution – Fewer newer e. Procurement companies/solutions being created – Fewer existing e. Procurement companies/solutions failing – Most dramatic value being created by third-party solutions – Niche software products providing superior tools/functionality – Managed services allowing buying orgs to share resources – External settlement tools allowing buying orgs to reduce invoice/payment labor while simultaneously creating revenue (up to 1. 4% of contract spend) • e. Procurement’s current advances are less about a technology revolution and more about a business revolution enabled by technologies and managed services • Today’s best practice offerings stable, reliable, 100+ installs, quantifiable and repeatable value proposition across all industries

Introduction g Opportunities & Focus • Focus on non-production procurement, > 10% of spend (trillions) • Current CEO & CFO direction driven by increasing value with decreasing amounts of spend and resources – – – – Driving ever-increasing amounts of spend on contract Reducing order-processing cost and cycle times Providing intuitive, enterprise-wide access to professionally negotiated content Empowering desktop requisitioning through employee self-service Achieving procurement s/w integration with back office systems Elevating procurement function to strategic importance within organization Maximizing solution value via alignment; IT, operations, 3 rd party partnering

Introduction g Solution Drivers • All e. Procurement models attempting to solve similar business problems – reduce complexity and overall cost structure (i. e. total cost) while increasing content availability – Increase exposure of spend under management; low-hanging fruit maxed out – Decrease operational support requirements – Supplier information – Content Mgt – Transactional – Managing by transaction rather than exception – Decrease change mgt support requirements – Reduce search algorithm complexity – Reduce org communications for new content – Decrease maverick buying (AKA rogue spend) – Increase and/or generate settlement revenue

Contents g e. Procurement Space Maturity Assessment • • • Introduction Models & Evolution Model Overview Matrix Model Maturity Assessment Appendix

Contents g Models & Evolution • e. Procurement Model Overview • The EDI Model – Functionality Assessment – Pros/Cons – Scorecard • The Internet Model – Functionality Assessment – Pros/Cons – Scorecard • The Direct Connect Model – Functionality Assessment – Pros/Cons – Scorecard • The Third-Party Model – Functionality Assessment – Pros/Cons – Scorecard

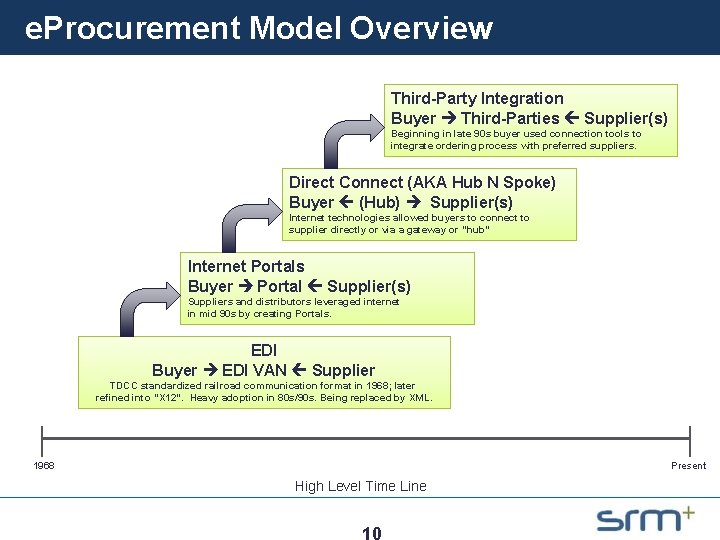

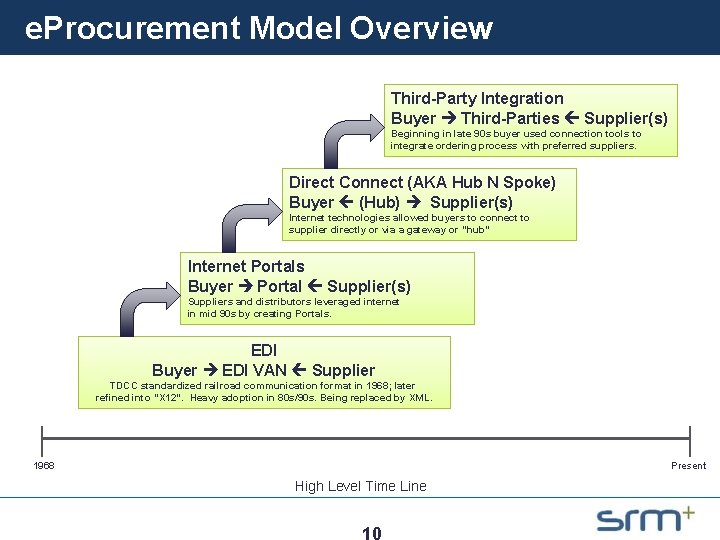

e. Procurement Model Overview Third-Party Integration Buyer Third-Parties Supplier(s) Beginning in late 90 s buyer used connection tools to integrate ordering process with preferred suppliers. Direct Connect (AKA Hub N Spoke) Buyer (Hub) Supplier(s) Internet technologies allowed buyers to connect to supplier directly or via a gateway or “hub” Internet Portals Buyer Portal Supplier(s) Suppliers and distributors leveraged internet in mid 90 s by creating Portals. EDI Buyer EDI VAN Supplier TDCC standardized railroad communication format in 1968; later refined into “X 12”. Heavy adoption in 80 s/90 s. Being replaced by XML. 1968 Present High Level Time Line

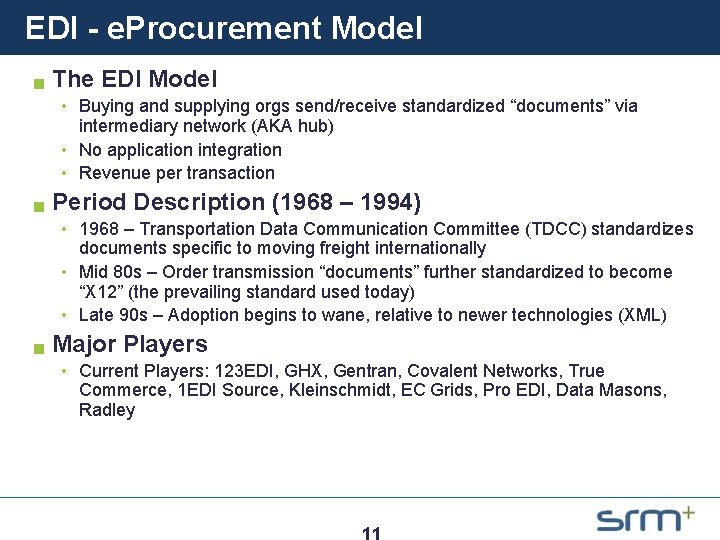

EDI - e. Procurement Model g The EDI Model • Buying and supplying orgs send/receive standardized “documents” via intermediary network (AKA hub) • No application integration • Revenue per transaction g Period Description (1968 – 1994) • 1968 – Transportation Data Communication Committee (TDCC) standardizes documents specific to moving freight internationally • Mid 80 s – Order transmission “documents” further standardized to become “X 12” (the prevailing standard used today) • Late 90 s – Adoption begins to wane, relative to newer technologies (XML) g Major Players • Current Players: 123 EDI, GHX, Gentran, Covalent Networks, True Commerce, 1 EDI Source, Kleinschmidt, EC Grids, Pro EDI, Data Masons, Radley

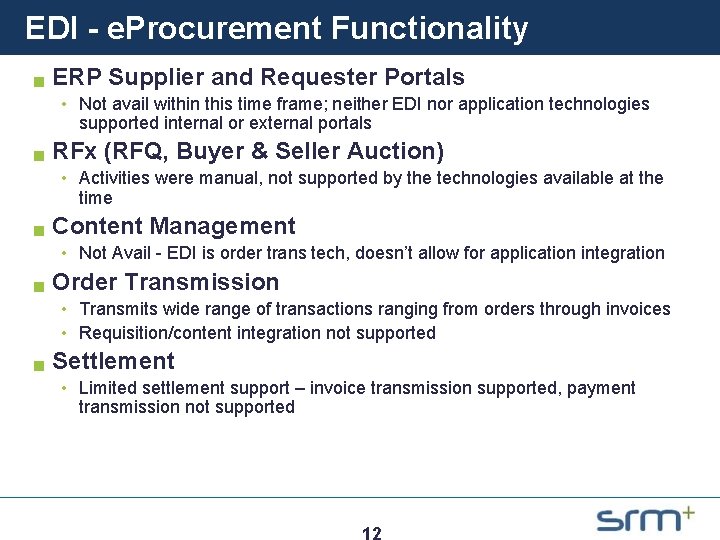

EDI - e. Procurement Functionality g ERP Supplier and Requester Portals • Not avail within this time frame; neither EDI nor application technologies supported internal or external portals g RFx (RFQ, Buyer & Seller Auction) • Activities were manual, not supported by the technologies available at the time g Content Management • Not Avail - EDI is order trans tech, doesn’t allow for application integration g Order Transmission • Transmits wide range of transactions ranging from orders through invoices • Requisition/content integration not supported g Settlement • Limited settlement support – invoice transmission supported, payment transmission not supported

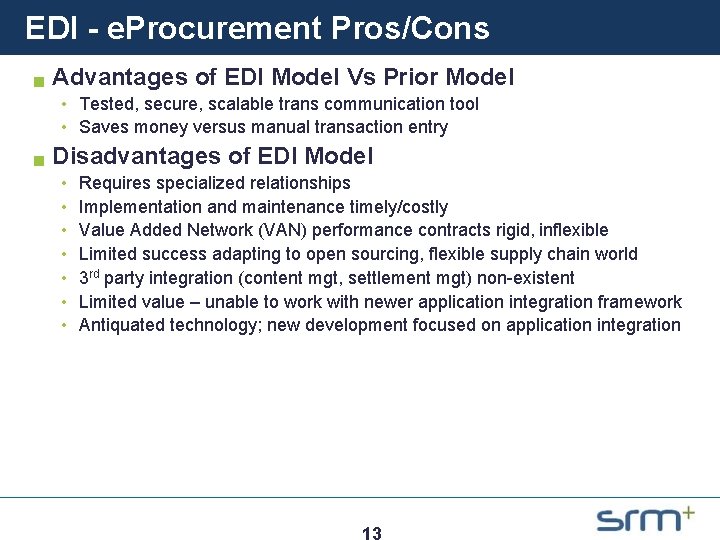

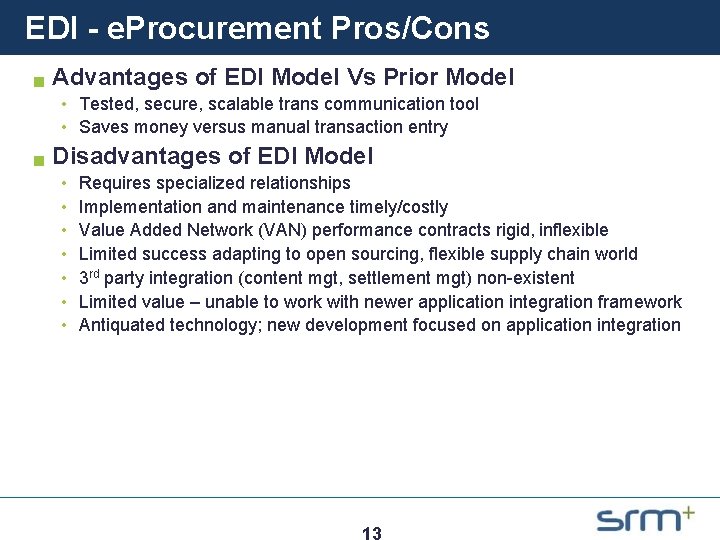

EDI - e. Procurement Pros/Cons g Advantages of EDI Model Vs Prior Model • Tested, secure, scalable trans communication tool • Saves money versus manual transaction entry g Disadvantages of EDI Model • • Requires specialized relationships Implementation and maintenance timely/costly Value Added Network (VAN) performance contracts rigid, inflexible Limited success adapting to open sourcing, flexible supply chain world 3 rd party integration (content mgt, settlement mgt) non-existent Limited value – unable to work with newer application integration framework Antiquated technology; new development focused on application integration

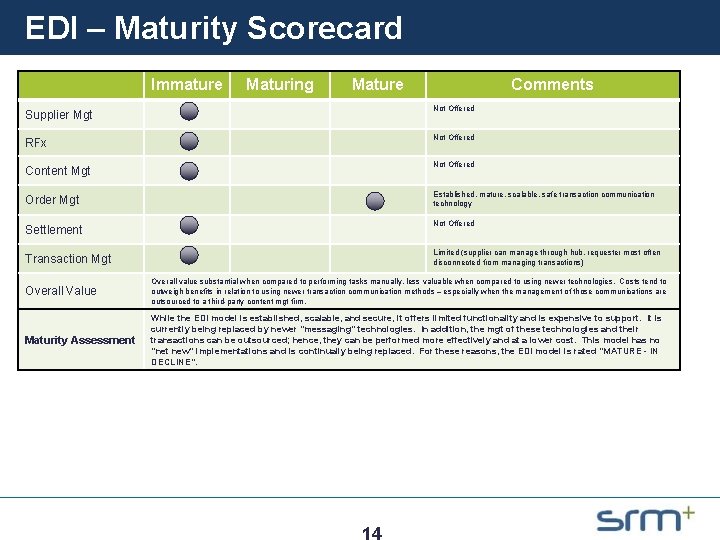

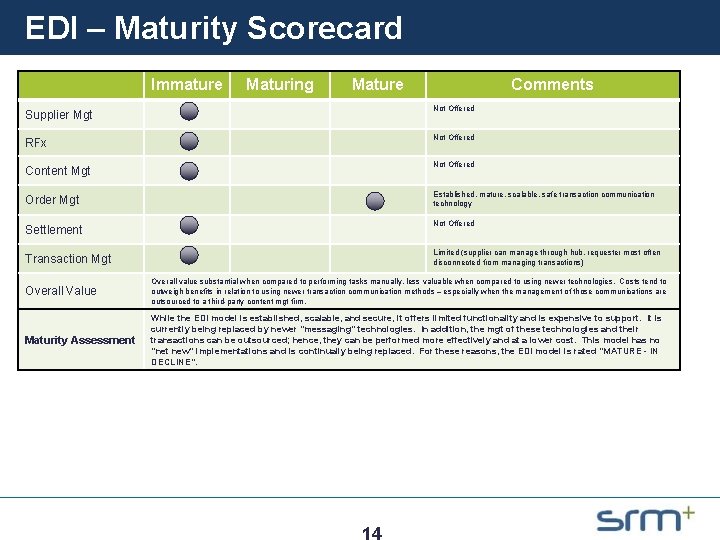

EDI – Maturity Scorecard Immature Supplier Mgt RFx Content Mgt Order Mgt Settlement Transaction Mgt Maturing Mature Comments Not Offered Established, mature, scalable, safe transaction communication technology Not Offered Limited (supplier can manage through hub, requester most often disconnected from managing transactions) Overall Value Overall value substantial when compared to performing tasks manually, less valuable when compared to using newer technologies. Costs tend to outweigh benefits in relation to using newer transaction communication methods – especially when the management of those communications are outsourced to a third-party content mgt firm. Maturity Assessment While the EDI model is established, scalable, and secure, it offers limited functionality and is expensive to support. It is currently being replaced by newer “messaging” technologies. In addition, the mgt of these technologies and their transactions can be outsourced; hence, they can be performed more effectively and at a lower cost. This model has no “net new” implementations and is continually being replaced. For these reasons, the EDI model is rated “MATURE - IN DECLINE”.

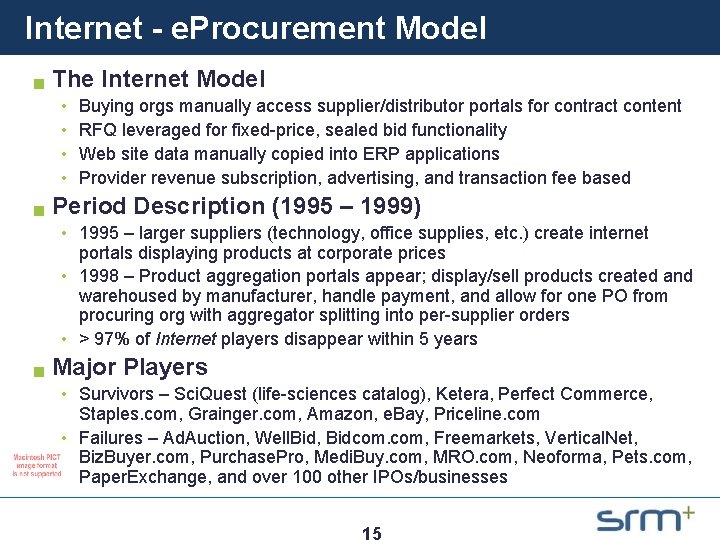

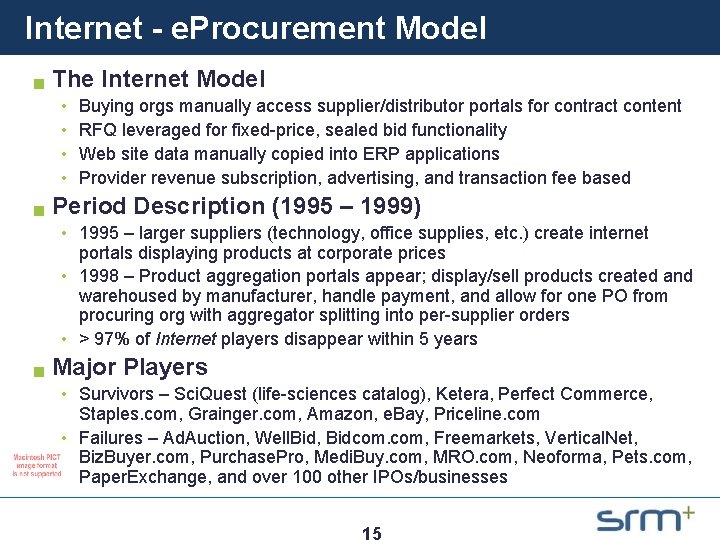

Internet - e. Procurement Model g The Internet Model • • g Buying orgs manually access supplier/distributor portals for contract content RFQ leveraged for fixed-price, sealed bid functionality Web site data manually copied into ERP applications Provider revenue subscription, advertising, and transaction fee based Period Description (1995 – 1999) • 1995 – larger suppliers (technology, office supplies, etc. ) create internet portals displaying products at corporate prices • 1998 – Product aggregation portals appear; display/sell products created and warehoused by manufacturer, handle payment, and allow for one PO from procuring org with aggregator splitting into per-supplier orders • > 97% of Internet players disappear within 5 years g Major Players • Survivors – Sci. Quest (life-sciences catalog), Ketera, Perfect Commerce, Staples. com, Grainger. com, Amazon, e. Bay, Priceline. com • Failures – Ad. Auction, Well. Bid, Bidcom. com, Freemarkets, Vertical. Net, Biz. Buyer. com, Purchase. Pro, Medi. Buy. com, MRO. com, Neoforma, Pets. com, Paper. Exchange, and over 100 other IPOs/businesses

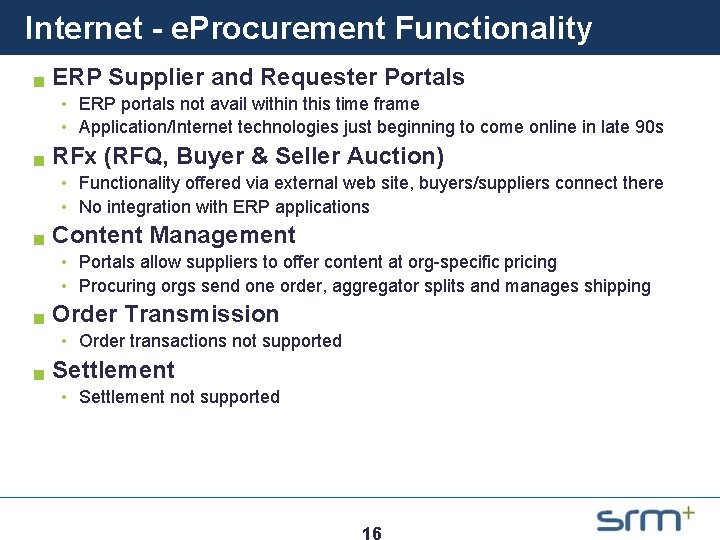

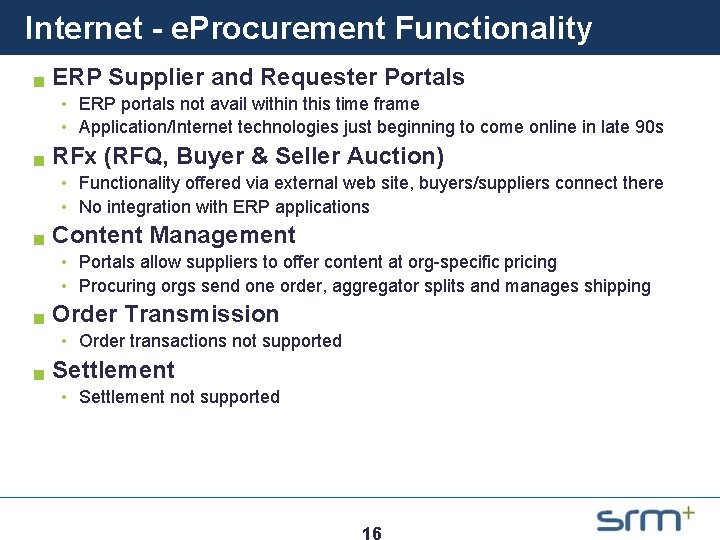

Internet - e. Procurement Functionality g ERP Supplier and Requester Portals • ERP portals not avail within this time frame • Application/Internet technologies just beginning to come online in late 90 s g RFx (RFQ, Buyer & Seller Auction) • Functionality offered via external web site, buyers/suppliers connect there • No integration with ERP applications g Content Management • Portals allow suppliers to offer content at org-specific pricing • Procuring orgs send one order, aggregator splits and manages shipping g Order Transmission • Order transactions not supported g Settlement • Settlement not supported

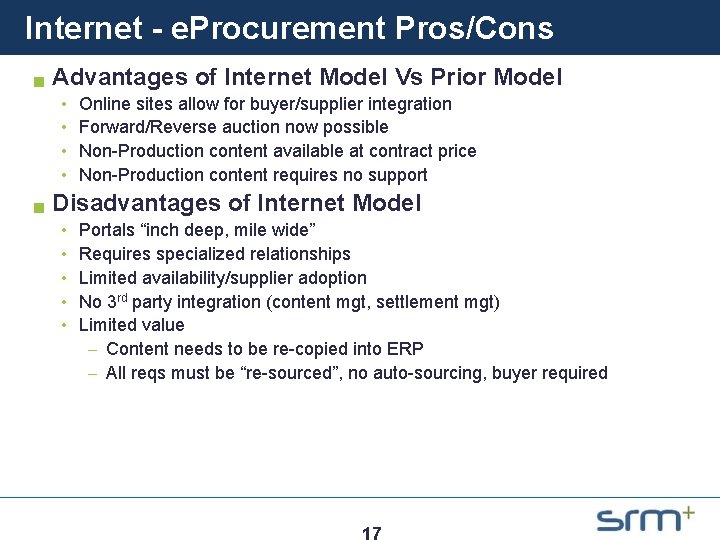

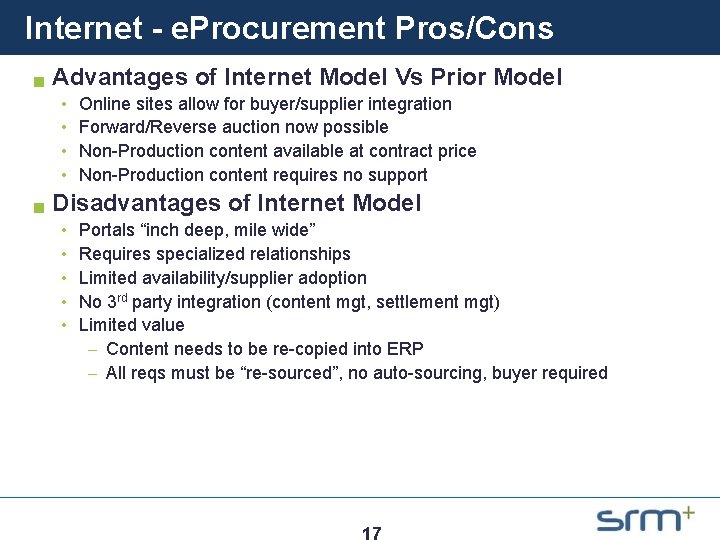

Internet - e. Procurement Pros/Cons g Advantages of Internet Model Vs Prior Model • • g Online sites allow for buyer/supplier integration Forward/Reverse auction now possible Non-Production content available at contract price Non-Production content requires no support Disadvantages of Internet Model • • • Portals “inch deep, mile wide” Requires specialized relationships Limited availability/supplier adoption No 3 rd party integration (content mgt, settlement mgt) Limited value – Content needs to be re-copied into ERP – All reqs must be “re-sourced”, no auto-sourcing, buyer required

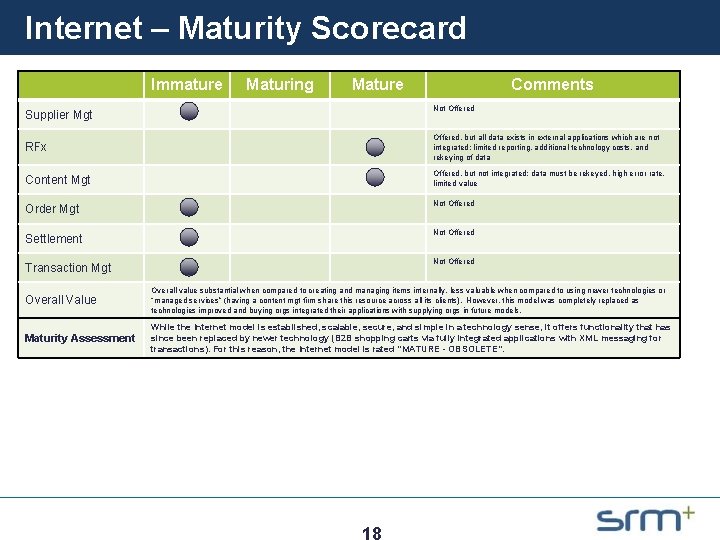

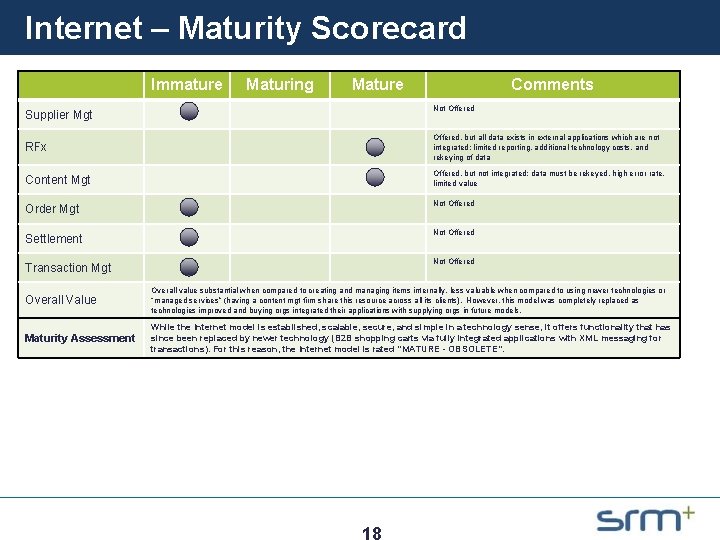

Internet – Maturity Scorecard Immature Supplier Mgt Maturing Mature Comments Not Offered RFx Offered, but all data exists in external applications which are not integrated; limited reporting, additional technology costs, and rekeying of data Content Mgt Offered, but not integrated; data must be rekeyed, high error rate, limited value Order Mgt Settlement Transaction Mgt Not Offered Overall Value Overall value substantial when compared to creating and managing items internally, less valuable when compared to using newer technologies or “managed services” (having a content mgt firm share this resource across all its clients). However, this model was completely replaced as technologies improved and buying orgs integrated their applications with supplying orgs in future models. Maturity Assessment While the Internet model is established, scalable, secure, and simple in a technology sense, it offers functionality that has since been replaced by newer technology (B 2 B shopping carts via fully integrated applications with XML messaging for transactions). For this reason, the Internet model is rated “MATURE - OBSOLETE”.

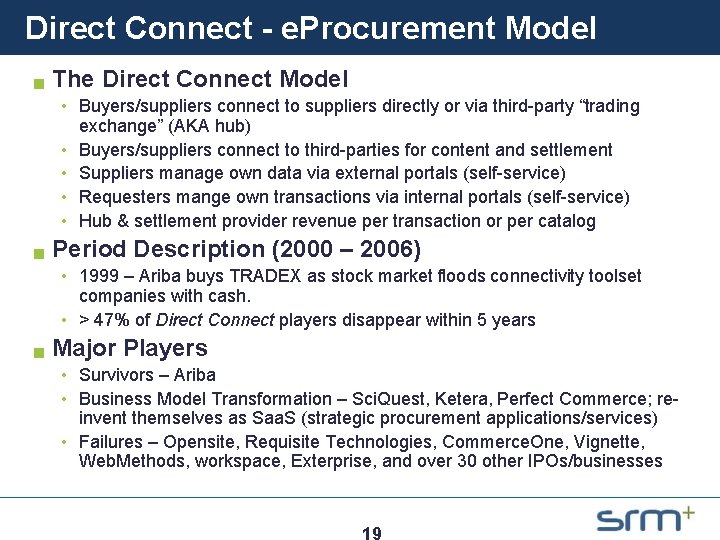

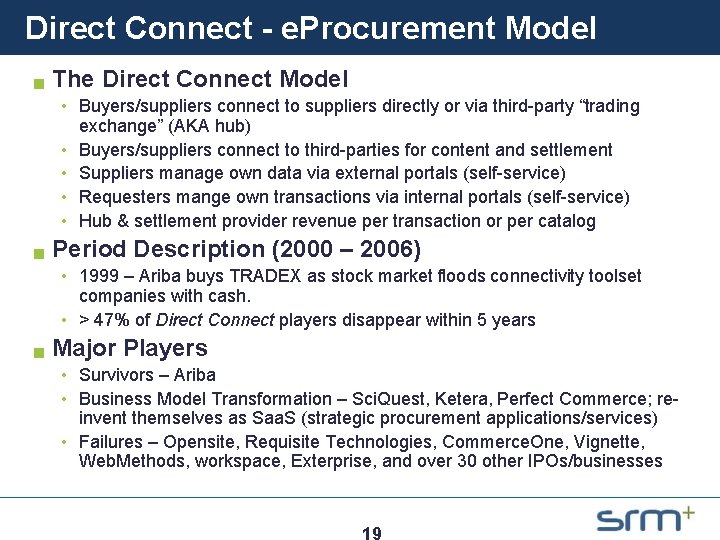

Direct Connect - e. Procurement Model g The Direct Connect Model • Buyers/suppliers connect to suppliers directly or via third-party “trading exchange” (AKA hub) • Buyers/suppliers connect to third-parties for content and settlement • Suppliers manage own data via external portals (self-service) • Requesters mange own transactions via internal portals (self-service) • Hub & settlement provider revenue per transaction or per catalog g Period Description (2000 – 2006) • 1999 – Ariba buys TRADEX as stock market floods connectivity toolset companies with cash. • > 47% of Direct Connect players disappear within 5 years g Major Players • Survivors – Ariba • Business Model Transformation – Sci. Quest, Ketera, Perfect Commerce; reinvent themselves as Saa. S (strategic procurement applications/services) • Failures – Opensite, Requisite Technologies, Commerce. One, Vignette, Web. Methods, workspace, Exterprise, and over 30 other IPOs/businesses

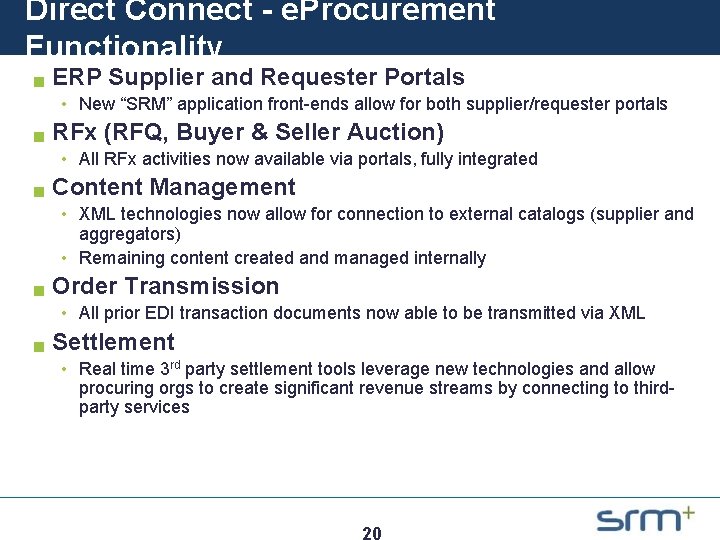

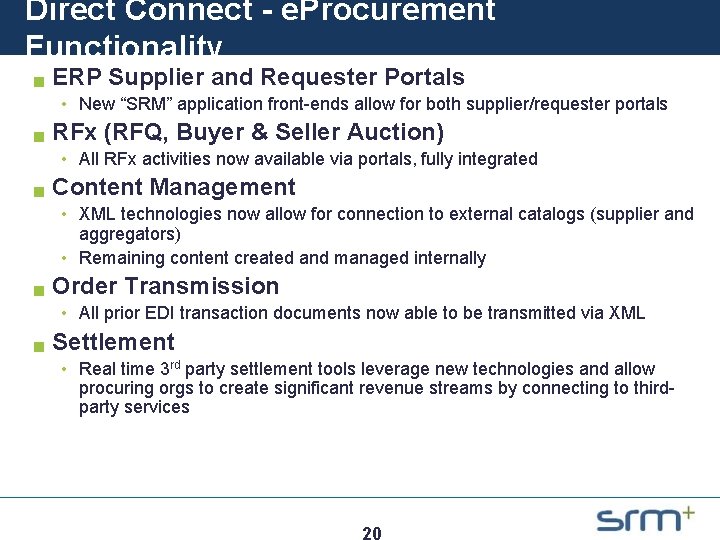

Direct Connect - e. Procurement Functionality g ERP Supplier and Requester Portals • New “SRM” application front-ends allow for both supplier/requester portals g RFx (RFQ, Buyer & Seller Auction) • All RFx activities now available via portals, fully integrated g Content Management • XML technologies now allow for connection to external catalogs (supplier and aggregators) • Remaining content created and managed internally g Order Transmission • All prior EDI transaction documents now able to be transmitted via XML g Settlement • Real time 3 rd party settlement tools leverage new technologies and allow procuring orgs to create significant revenue streams by connecting to thirdparty services

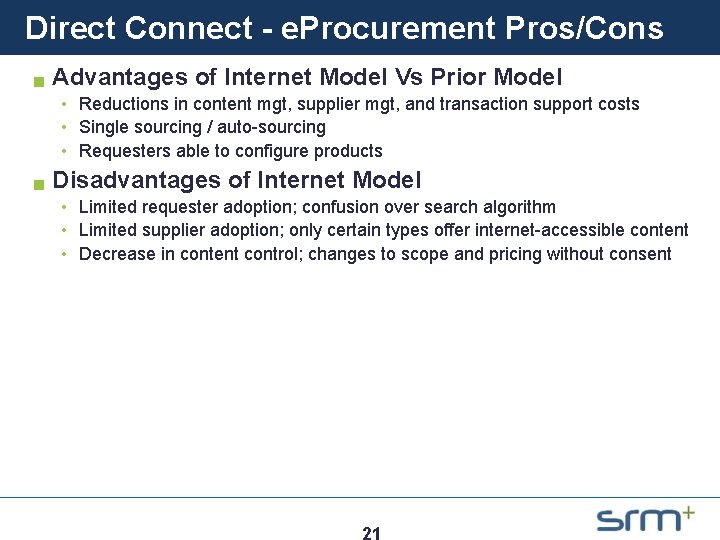

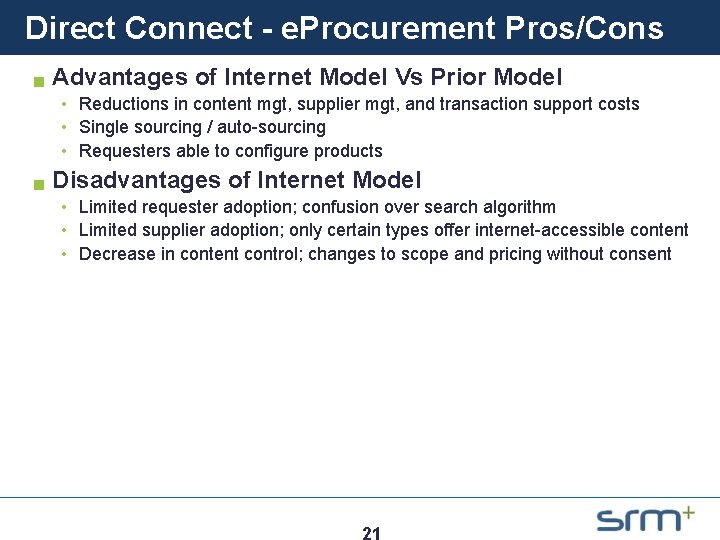

Direct Connect - e. Procurement Pros/Cons g Advantages of Internet Model Vs Prior Model • Reductions in content mgt, supplier mgt, and transaction support costs • Single sourcing / auto-sourcing • Requesters able to configure products g Disadvantages of Internet Model • Limited requester adoption; confusion over search algorithm • Limited supplier adoption; only certain types offer internet-accessible content • Decrease in content control; changes to scope and pricing without consent

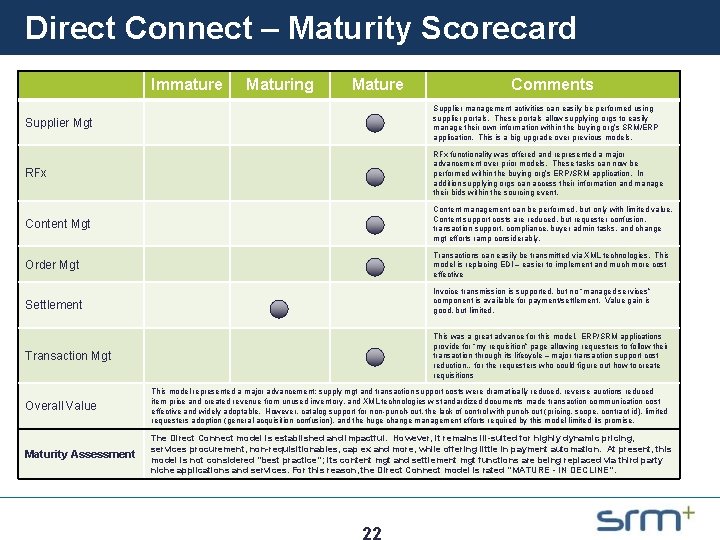

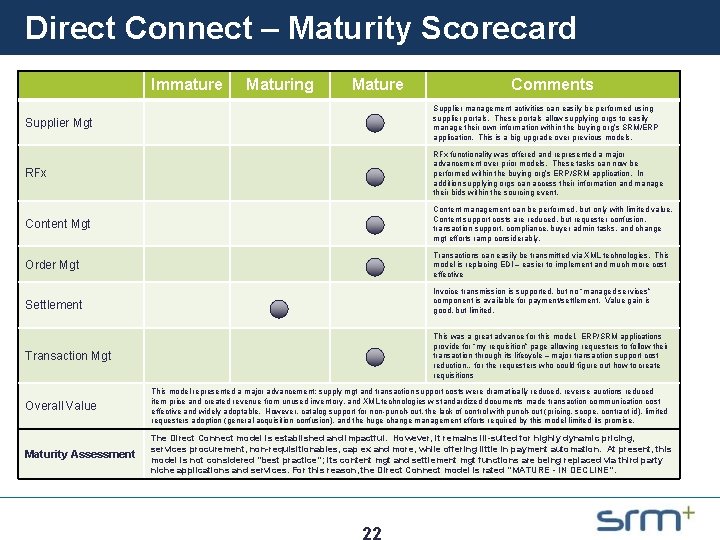

Direct Connect – Maturity Scorecard Immature Maturing Mature Comments Supplier Mgt Supplier management activities can easily be performed using supplier portals. These portals allow supplying orgs to easily manage their own information within the buying org’s SRM/ERP application. This is a big upgrade over previous models. RFx functionality was offered and represented a major advancement over prior models. These tasks can now be performed within the buying org’s ERP/SRM application. In addition supplying orgs can access their information and manage their bids within the sourcing event. Content Mgt Content management can be performed, but only with limited value. Content support costs are reduced, but requester confusion, transaction support, compliance, buyer admin tasks, and change mgt efforts ramp considerably. Order Mgt Transactions can easily be transmitted via XML technologies. This model is replacing EDI – easier to implement and much more cost effective Settlement Transaction Mgt Invoice transmission is supported, but no “managed services” component is available for payment/settlement. Value gain is good, but limited. This was a great advance for this model. ERP/SRM applications provide for “my requisition” page allowing requesters to follow their transaction through its lifecycle – major transaction support cost reduction…for the requesters who could figure out how to create requisitions Overall Value This model represented a major advancement; supply mgt and transaction support costs were dramatically reduced, reverse auctions reduced item price and created revenue from unused inventory, and XML technologies w standardized documents made transaction communication cost effective and widely adoptable. However, catalog support for non-punch-out, the lack of control with punch-out (pricing, scope, contract id), limited requesters adoption (general acquisition confusion), and the huge change management efforts required by this model limited its promise. Maturity Assessment The Direct Connect model is established and impactful. However, it remains ill-suited for highly dynamic pricing, services procurement, non-requisitionables, cap ex and more, while offering little in payment automation. At present, this model is not considered “best practice”; its content mgt and settlement mgt functions are being replaced via third party niche applications and services. For this reason, the Direct Connect model is rated “MATURE - IN DECLINE”.

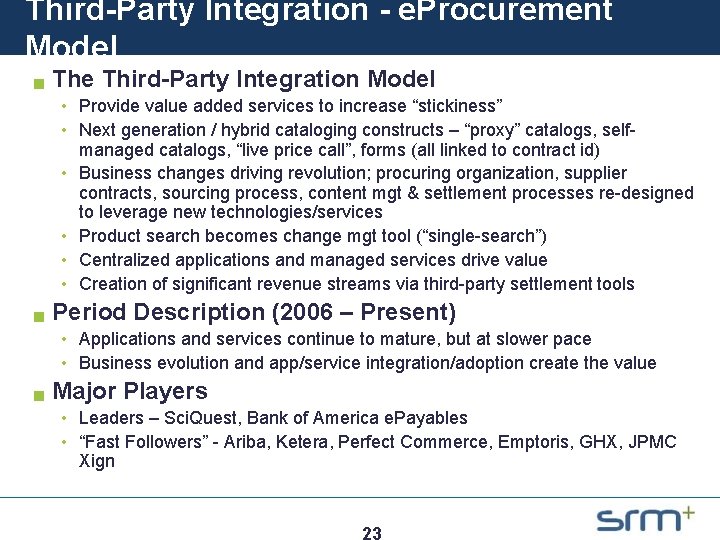

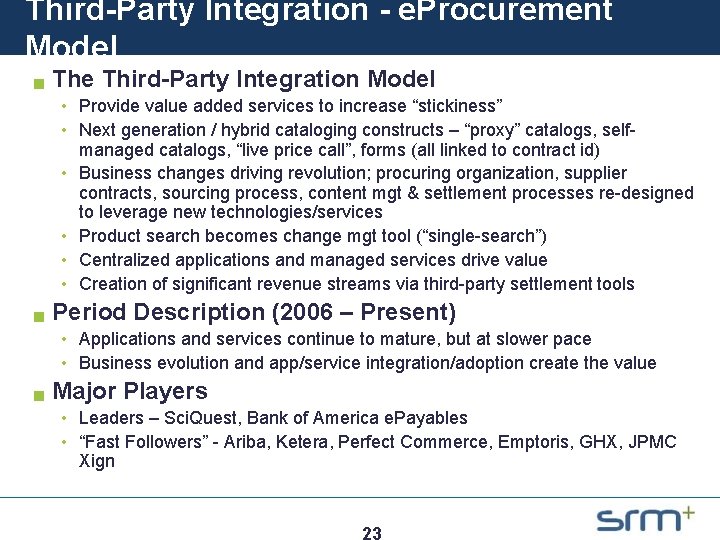

Third-Party Integration - e. Procurement Model g The Third-Party Integration Model • Provide value added services to increase “stickiness” • Next generation / hybrid cataloging constructs – “proxy” catalogs, selfmanaged catalogs, “live price call”, forms (all linked to contract id) • Business changes driving revolution; procuring organization, supplier contracts, sourcing process, content mgt & settlement processes re-designed to leverage new technologies/services • Product search becomes change mgt tool (“single-search”) • Centralized applications and managed services drive value • Creation of significant revenue streams via third-party settlement tools g Period Description (2006 – Present) • Applications and services continue to mature, but at slower pace • Business evolution and app/service integration/adoption create the value g Major Players • Leaders – Sci. Quest, Bank of America e. Payables • “Fast Followers” - Ariba, Ketera, Perfect Commerce, Emptoris, GHX, JPMC Xign

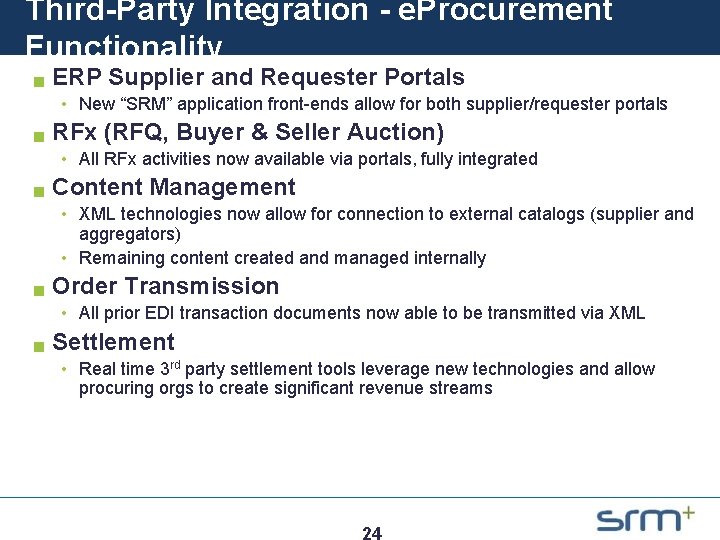

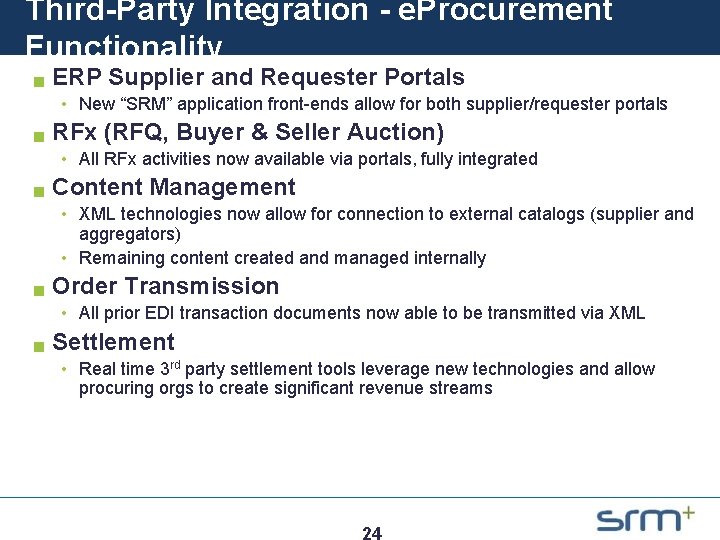

Third-Party Integration - e. Procurement Functionality g ERP Supplier and Requester Portals • New “SRM” application front-ends allow for both supplier/requester portals g RFx (RFQ, Buyer & Seller Auction) • All RFx activities now available via portals, fully integrated g Content Management • XML technologies now allow for connection to external catalogs (supplier and aggregators) • Remaining content created and managed internally g Order Transmission • All prior EDI transaction documents now able to be transmitted via XML g Settlement • Real time 3 rd party settlement tools leverage new technologies and allow procuring orgs to create significant revenue streams

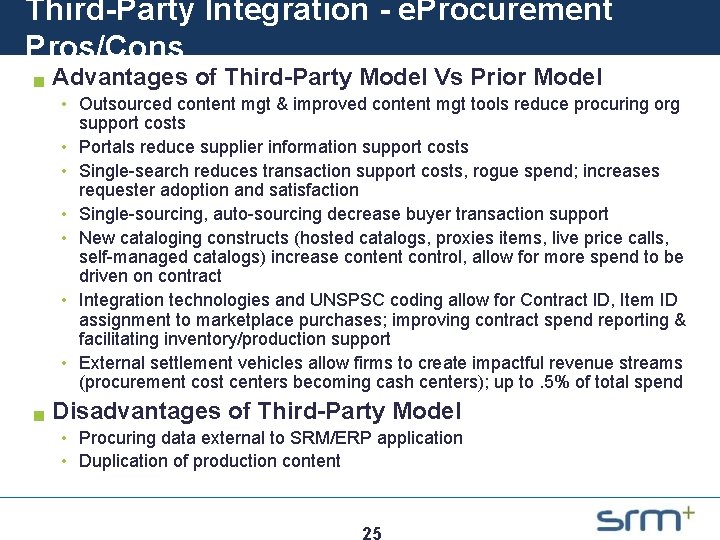

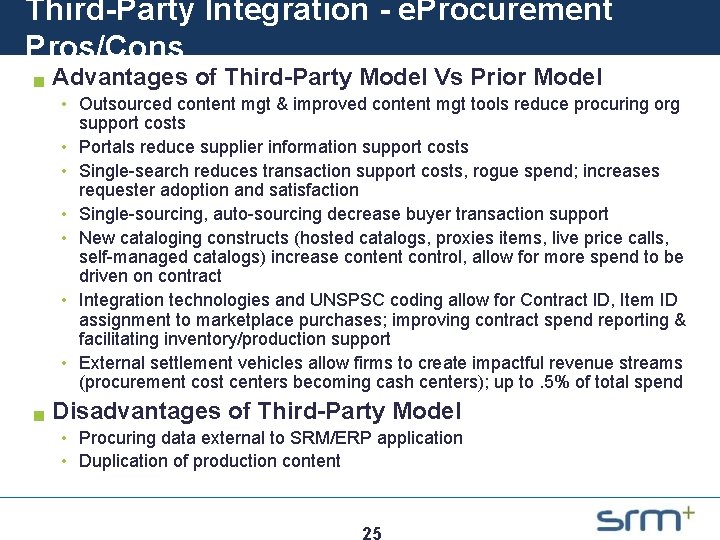

Third-Party Integration - e. Procurement Pros/Cons g Advantages of Third-Party Model Vs Prior Model • Outsourced content mgt & improved content mgt tools reduce procuring org support costs • Portals reduce supplier information support costs • Single-search reduces transaction support costs, rogue spend; increases requester adoption and satisfaction • Single-sourcing, auto-sourcing decrease buyer transaction support • New cataloging constructs (hosted catalogs, proxies items, live price calls, self-managed catalogs) increase content control, allow for more spend to be driven on contract • Integration technologies and UNSPSC coding allow for Contract ID, Item ID assignment to marketplace purchases; improving contract spend reporting & facilitating inventory/production support • External settlement vehicles allow firms to create impactful revenue streams (procurement cost centers becoming cash centers); up to. 5% of total spend g Disadvantages of Third-Party Model • Procuring data external to SRM/ERP application • Duplication of production content

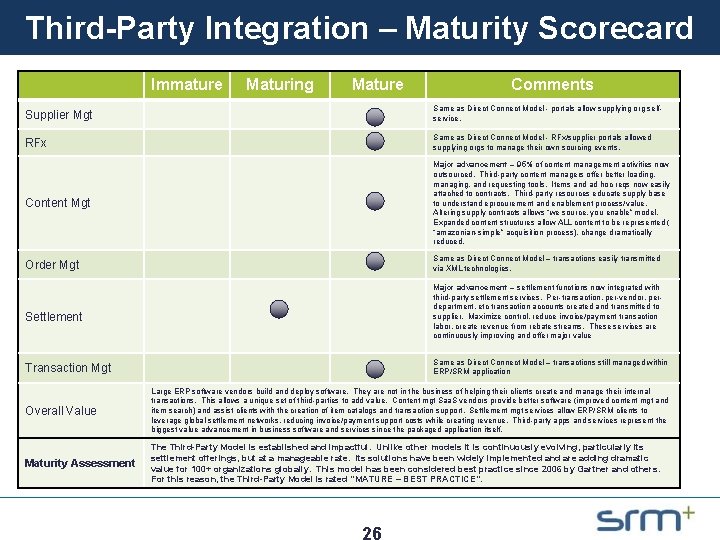

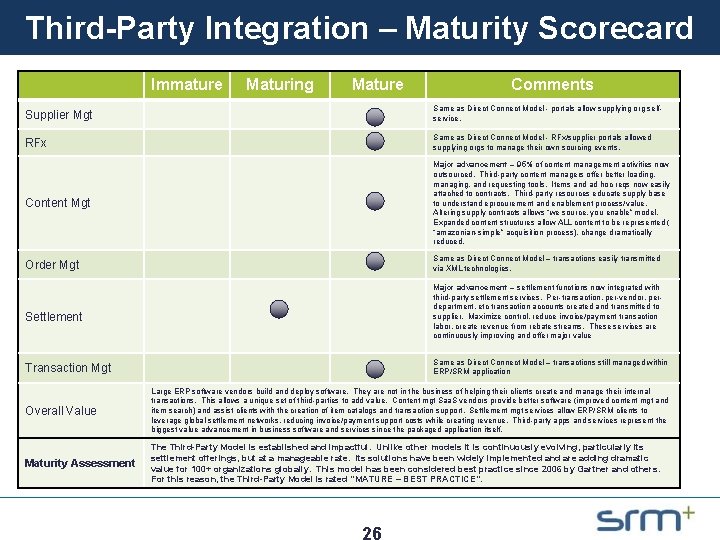

Third-Party Integration – Maturity Scorecard Immature Maturing Mature Comments Supplier Mgt Same as Direct Connect Model - portals allow supplying org selfservice. RFx Same as Direct Connect Model - RFx/supplier portals allowed supplying orgs to manage their own sourcing events. Content Mgt Major advancement – 95% of content management activities now outsourced. Third-party content managers offer better loading, managing, and requesting tools. Items and ad hoc reqs now easily attached to contracts. Third-party resources educate supply base to understand eprocurement and enablement process/value. Altering supply contracts allows “we source, you enable” model. Expanded content structures allow ALL content to be represented ( “amazonian-simple” acquisition process), change dramatically reduced. Order Mgt Same as Direct Connect Model – transactions easily transmitted via XML technologies. Settlement Transaction Mgt Major advancement – settlement functions now integrated with third-party settlement services. Per-transaction, per-vendor, perdepartment, etc transaction accounts created and transmitted to supplier. Maximize control, reduce invoice/payment transaction labor, create revenue from rebate streams. These services are continuously improving and offer major value Same as Direct Connect Model – transactions still managed within ERP/SRM application Overall Value Large ERP software vendors build and deploy software. They are not in the business of helping their clients create and manage their internal transactions. This allows a unique set of third-parties to add value. Content mgt Saa. S vendors provide better software (improved content mgt and item search) and assist clients with the creation of item catalogs and transaction support. Settlement mgt services allow ERP/SRM clients to leverage global settlement networks, reducing invoice/payment support costs while creating revenue. Third-party apps and services represent the biggest value advancement in business software and services since the packaged application itself. Maturity Assessment The Third-Party Model is established and impactful. Unlike other models it is continuously evolving, particularly its settlement offerings, but at a manageable rate. Its solutions have been widely implemented and are adding dramatic value for 100+ organizations globally. This model has been considered best practice since 2006 by Gartner and others. For this reason, the Third-Party Model is rated “MATURE – BEST PRACTICE”.

Contents g e. Procurement Space Maturity Assessment • • • Introduction Models & Evolution Model Overview Matrix Model Maturity Assessment Appendix

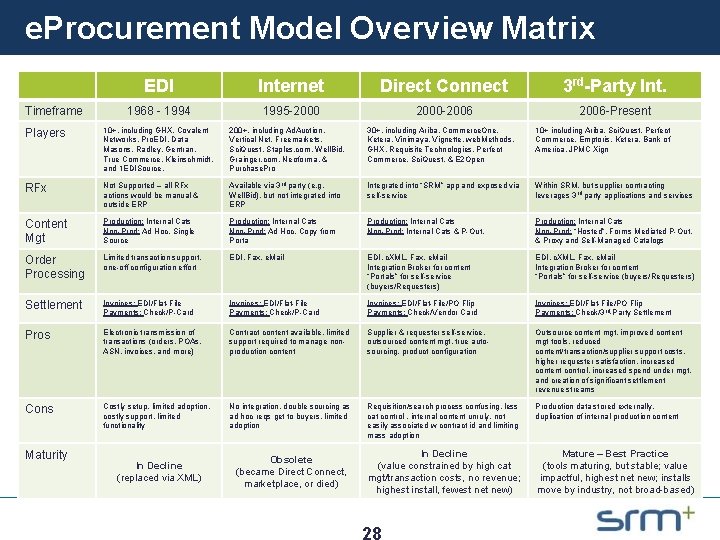

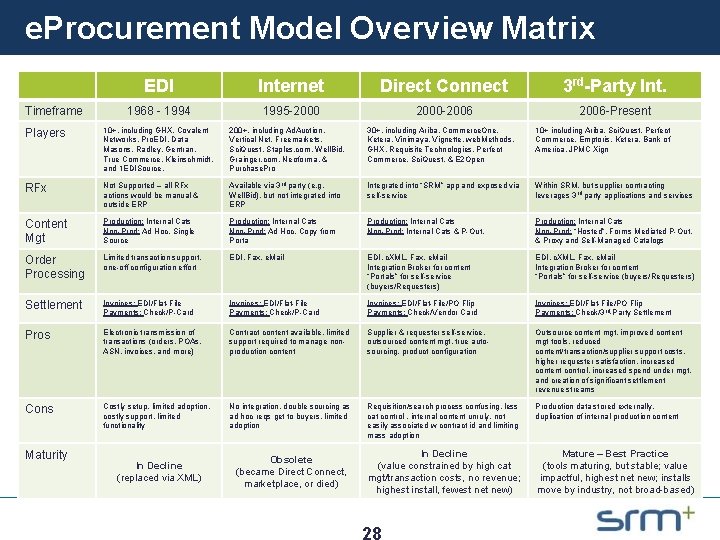

e. Procurement Model Overview Matrix Timeframe EDI Internet Direct Connect 3 rd-Party Int. 1968 - 1994 1995 -2000 -2006 -Present Players 10+, including GHX, Covalent Networks, Pro. EDI, Data Masons, Radley, Gentran, True Commerce, Kleinschmidt, and 1 EDISource. 200+, including Ad. Auction, Vertical Net, Freemarkets, Sci. Quest, Staples. com, Well. Bid, Grainger. com, Neoforma, & Purchase. Pro 30+, including Ariba, Commerce. One, Ketera, Vinimaya, Vignette, web. Methods, GHX, Requisite Technologies, Perfect Commerce, Sci. Quest, & E 2 Open 10+ including Ariba, Sci. Quest, Perfect Commerce, Emptoris, Ketera, Bank of America, JPMC Xign RFx Not Supported – all RFx actions would be manual & outside ERP Available via 3 rd party (e. g. Well. Bid), but not integrated into ERP Integrated into “SRM” app and exposed via self-service Within SRM, but supplier contracting leverages 3 rd party applications and services Content Mgt Production: Internal Cats Non-Prod: Ad Hoc, Single Source Production: Internal Cats Non-Prod: Ad Hoc, Copy from Porta Production: Internal Cats Non-Prod: Internal Cats & P-Out, Production: Internal Cats Non-Prod: “Hosted”, Forms Mediated P-Out, & Proxy and Self-Managed Catalogs Order Processing Limited transaction support, one-off configuration effort EDI, Fax, e. Mail EDI, c. XML, Fax, e. Mail Integration Broker for content “Portals” for self-service (buyers/Requesters) Settlement Invoices: EDI/Flat-File Payments: Check/P-Card Invoices: EDI/Flat-File/PO Flip Payments: Check/Vendor Card Invoices: EDI/Flat-File/PO Flip Payments: Check/3 rd-Party Settlement Pros Electronic transmission of transactions (orders, POAs, ASN, invoices, and more) Contract content available, limited support required to manage nonproduction content Supplier & requester self-service, outsourced content mgt, true autosourcing, product configuration Outsource content mgt, improved content mgt tools, reduced content/transaction/supplier support costs, higher requester satisfaction, increased content control, increased spend under mgt, and creation of significant settlement revenue streams Cons Costly setup, limited adoption, costly support, limited functionality No integration, double sourcing as ad hoc reqs get to buyers, limited adoption Requisition/search process confusing, less cat control , internal content unruly, not easily associated w contract id and limiting mass adoption Production data stored externally, duplication of internal production content In Decline (value constrained by high cat mgt/transaction costs, no revenue; highest install, fewest new) Mature – Best Practice (tools maturing, but stable; value impactful, highest new; installs move by industry, not broad-based) Maturity In Decline (replaced via XML) Obsolete (became Direct Connect, marketplace, or died)

Contents g e. Procurement Space Maturity Assessment • • • Introduction Models & Evolution Model Overview Matrix Model Maturity Assessment Appendix

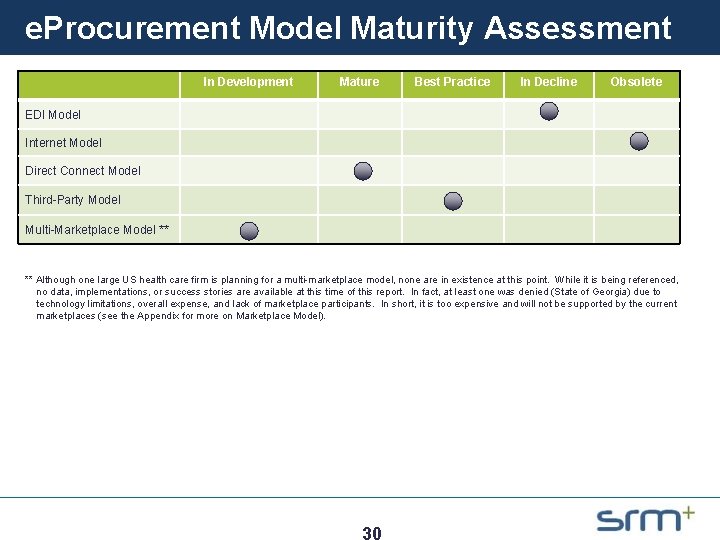

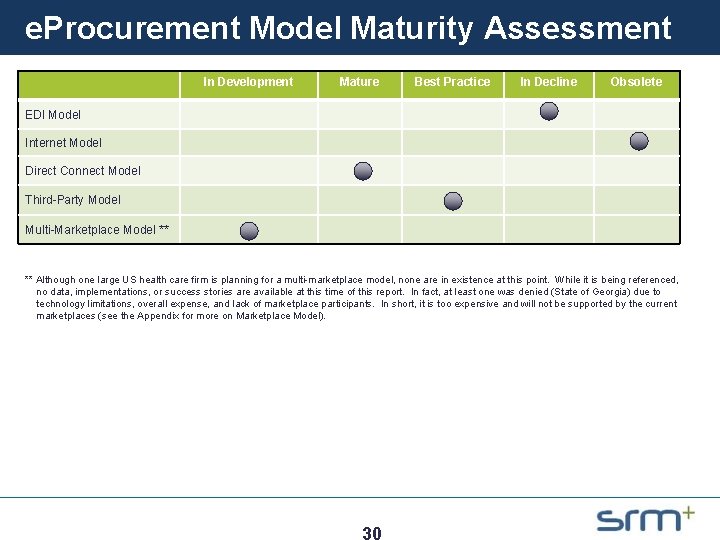

e. Procurement Model Maturity Assessment In Development Mature Best Practice In Decline Obsolete EDI Model Internet Model Direct Connect Model Third-Party Model Multi-Marketplace Model ** ** Although one large US health care firm is planning for a multi-marketplace model, none are in existence at this point. While it is being referenced, no data, implementations, or success stories are available at this time of this report. In fact, at least one was denied (State of Georgia) due to technology limitations, overall expense, and lack of marketplace participants. In short, it is too expensive and will not be supported by the current marketplaces (see the Appendix for more on Marketplace Model).

Contents g e. Procurement Space Maturity Assessment • • • Introduction Models & Evolution Model Overview Matrix Model Maturity Assessment Appendix

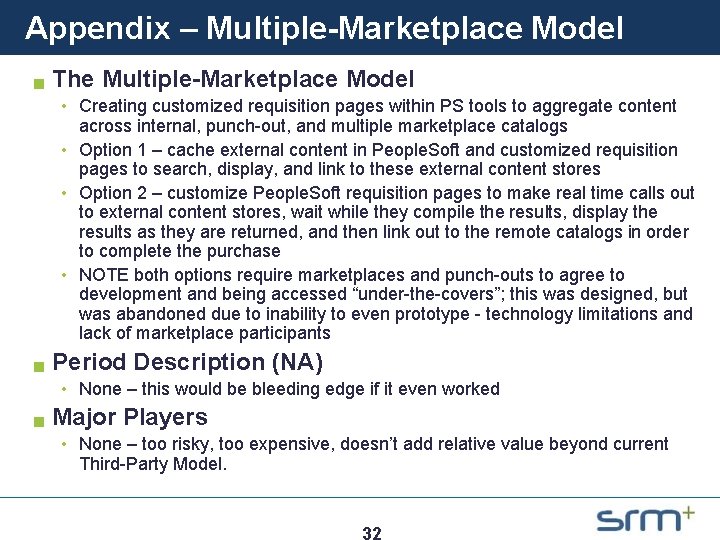

Appendix – Multiple-Marketplace Model g The Multiple-Marketplace Model • Creating customized requisition pages within PS tools to aggregate content across internal, punch-out, and multiple marketplace catalogs • Option 1 – cache external content in People. Soft and customized requisition pages to search, display, and link to these external content stores • Option 2 – customize People. Soft requisition pages to make real time calls out to external content stores, wait while they compile the results, display the results as they are returned, and then link out to the remote catalogs in order to complete the purchase • NOTE both options require marketplaces and punch-outs to agree to development and being accessed “under-the-covers”; this was designed, but was abandoned due to inability to even prototype - technology limitations and lack of marketplace participants g Period Description (NA) • None – this would be bleeding edge if it even worked g Major Players • None – too risky, too expensive, doesn’t add relative value beyond current Third-Party Model.

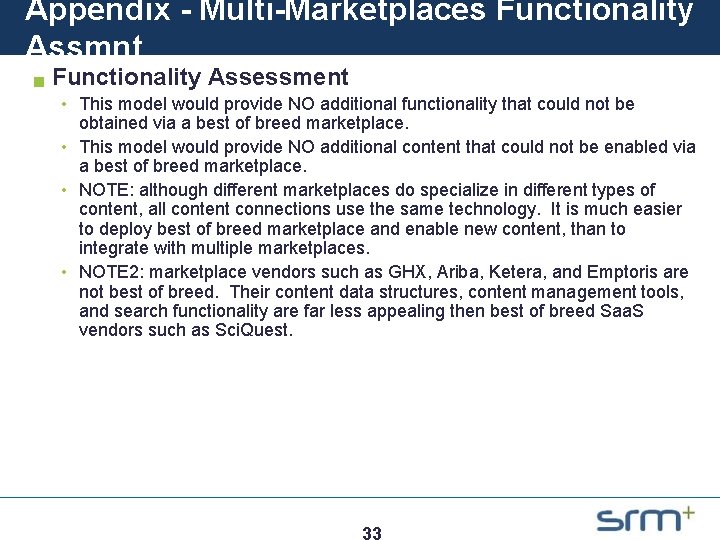

Appendix - Multi-Marketplaces Functionality Assmnt g Functionality Assessment • This model would provide NO additional functionality that could not be obtained via a best of breed marketplace. • This model would provide NO additional content that could not be enabled via a best of breed marketplace. • NOTE: although different marketplaces do specialize in different types of content, all content connections use the same technology. It is much easier to deploy best of breed marketplace and enable new content, than to integrate with multiple marketplaces. • NOTE 2: marketplace vendors such as GHX, Ariba, Ketera, and Emptoris are not best of breed. Their content data structures, content management tools, and search functionality are far less appealing then best of breed Saa. S vendors such as Sci. Quest.

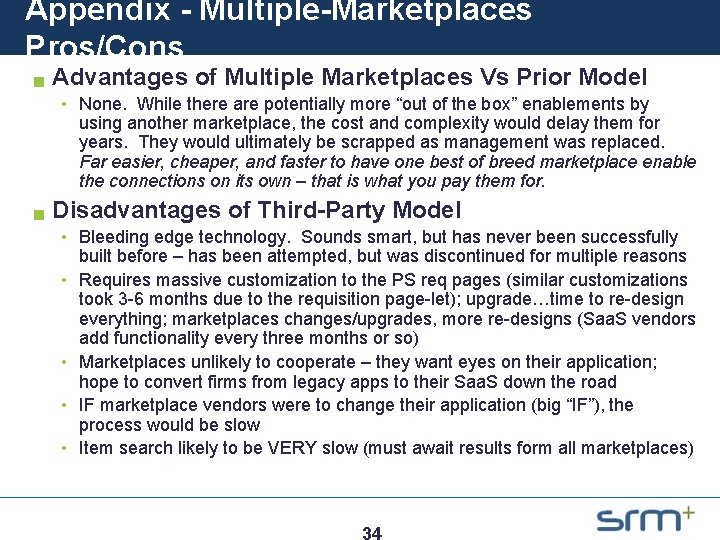

Appendix - Multiple-Marketplaces Pros/Cons g Advantages of Multiple Marketplaces Vs Prior Model • None. While there are potentially more “out of the box” enablements by using another marketplace, the cost and complexity would delay them for years. They would ultimately be scrapped as management was replaced. Far easier, cheaper, and faster to have one best of breed marketplace enable the connections on its own – that is what you pay them for. g Disadvantages of Third-Party Model • Bleeding edge technology. Sounds smart, but has never been successfully built before – has been attempted, but was discontinued for multiple reasons • Requires massive customization to the PS req pages (similar customizations took 3 -6 months due to the requisition page-let); upgrade…time to re-design everything; marketplaces changes/upgrades, more re-designs (Saa. S vendors add functionality every three months or so) • Marketplaces unlikely to cooperate – they want eyes on their application; hope to convert firms from legacy apps to their Saa. S down the road • IF marketplace vendors were to change their application (big “IF”), the process would be slow • Item search likely to be VERY slow (must await results form all marketplaces)

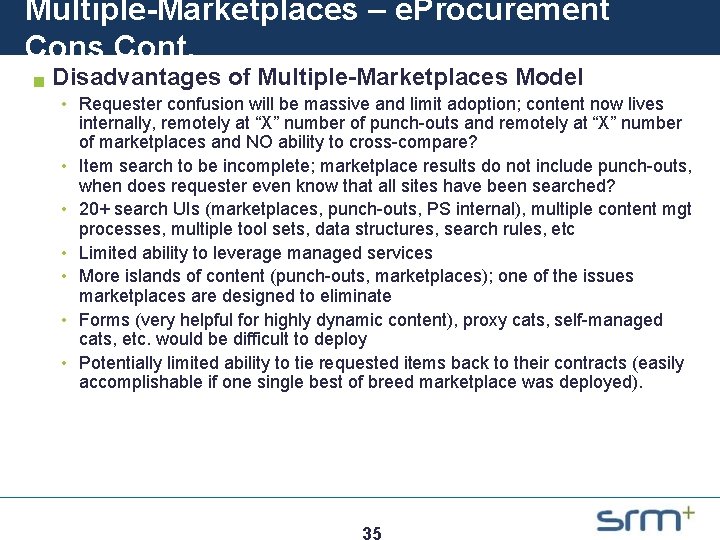

Multiple-Marketplaces – e. Procurement Cons Cont. g Disadvantages of Multiple-Marketplaces Model • Requester confusion will be massive and limit adoption; content now lives internally, remotely at “X” number of punch-outs and remotely at “X” number of marketplaces and NO ability to cross-compare? • Item search to be incomplete; marketplace results do not include punch-outs, when does requester even know that all sites have been searched? • 20+ search UIs (marketplaces, punch-outs, PS internal), multiple content mgt processes, multiple tool sets, data structures, search rules, etc • Limited ability to leverage managed services • More islands of content (punch-outs, marketplaces); one of the issues marketplaces are designed to eliminate • Forms (very helpful for highly dynamic content), proxy cats, self-managed cats, etc. would be difficult to deploy • Potentially limited ability to tie requested items back to their contracts (easily accomplishable if one single best of breed marketplace was deployed).