State of Arkansas Vehicle Acquisition Process Arkansas Department

- Slides: 36

State of Arkansas Vehicle Acquisition Process Arkansas Department of Finance and Administration – Office of Administrative Services

Who must follow the Vehicle Acquisition Process? �Executive Branch State Agencies �Institutions of Higher Education Who is not covered: �Constitutional Officers – Attorney General, Secretary of State, etc. �Constitutionally Created Agencies: Highways, Game & Fish, Lottery Arkansas Department of Finance and Administration

What Vehicles are covered through the Vehicle Acquisition Process? ◦ Ark. Code Ann. § 22 -8 -203 (1) "Automobile" means a motorized vehicle equipped with pneumatic tires used for the transportation of persons. . . ” ◦ Mainly, that means vehicles weighing less than one ton. Vehicles weighing more than one ton will use a shorter process. ◦ This does not cover construction equipment, ATVs, etc. Arkansas Department of Finance and Administration

When can you make a request to acquire a vehicle? When can an agency request a vehicle? �Answer: It depends…. . ◦ If the source of funding to be used to purchase the vehicle is special revenue �DFA-OAS will accept requests at any time ◦ If the source of the Funding to be used is the MMV (Motor Vehicle Acquisition Process) �DFA-OAS accepts MMV requests between July 1 and Sept. 15 Arkansas Department of Finance and Administration

Fleet Size Ark. Code Ann. § 19 -4 -906: Agency fleets are limited to the amounts set by the Arkansas Legislature �Will the agency increase the total size of its fleet? ◦ Fleet increases must comply with law and be justified �Will the agency provide a vehicle to be replaced? ◦ Replacement vehicles must meet minimum qualifications Arkansas Department of Finance and Administration

Increasing the size of an agency’s fleet All fleet increases must be requested in writing with appropriate justification for the increase. DFA-OAS will process the request and, if the request is approved, go forward with acquiring the vehicle Ark. Code Ann. § 19 -4 -906 limits the number of vehicles that an agency can own. Either amend the law to allow for additional vehicles or Obtain an emergency order of the Governor through DFA-OAS Arkansas Department of Finance and Administration

Replacement Vehicle Requirements Before DFA will consider a vehiclereplacement request: The replacement vehicle must be five years old or older Actual mileage must exceed 75, 000, or The projected repair cost of the vehicle over the next year must be more than half the wholesale value of the vehicle; Like-for-Like Requirement or justification for upgrade Arkansas Department of Finance and Administration

What Type of Vehicle Is being Acquired? State Contract If you are purchasing a vehicle off of the state contract: http: //www. dfa. arkansas. gov/offices/proc urement/contracts/Pages/default. aspx Example: ◦ ◦ TYPE ADA: Four (4) Door Mid-Size Sedan MFG & Model: Dodge Avenger SE $15, 620. 00 AWARDED TO: Springdale Dodge Jeep – Vendor Number: 100189963 Arkansas Department of Finance and Administration

What Type of Vehicle Is being Acquired? Non-Contract What if you aren’t buying off the state contract? �Used vehicles �Specialized vehicles not covered by the Contract See DFA - Office of State Procurement Rules on Acquisition of Vehicles outside the Contract. OSP’s approval of the acquisition will be necessary to continue the vehicle-acquisition process. Arkansas Department of Finance and Administration

What is the source of funds? Purchases through the Prioritized List Process (MMV) are funded through DFA. All other vehicles purchased must be made with “special revenue”, i. e. not general revenue. If special revenue is to be used, DFA-OAS will ask for confirmation of spending authority Arkansas Department of Finance and Administration

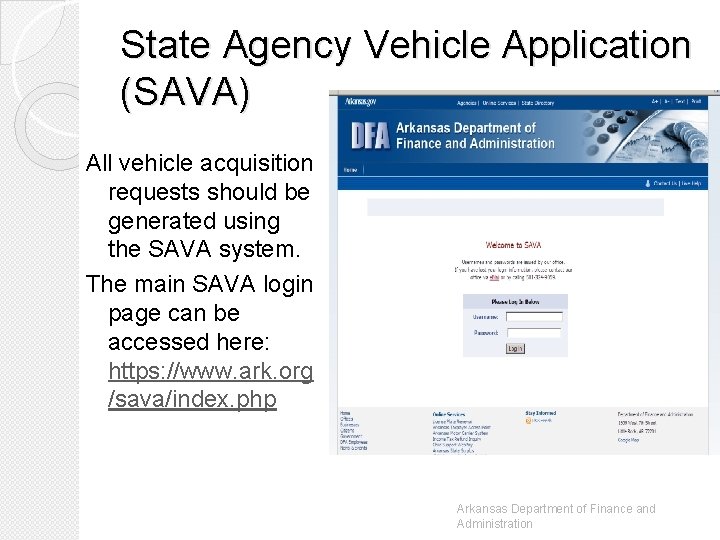

State Agency Vehicle Application (SAVA) All vehicle acquisition requests should be generated using the SAVA system. The main SAVA login page can be accessed here: https: //www. ark. org /sava/index. php Arkansas Department of Finance and Administration

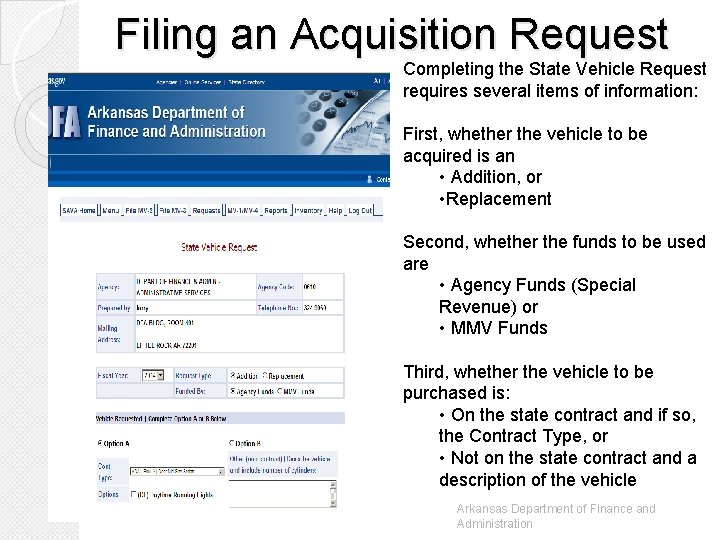

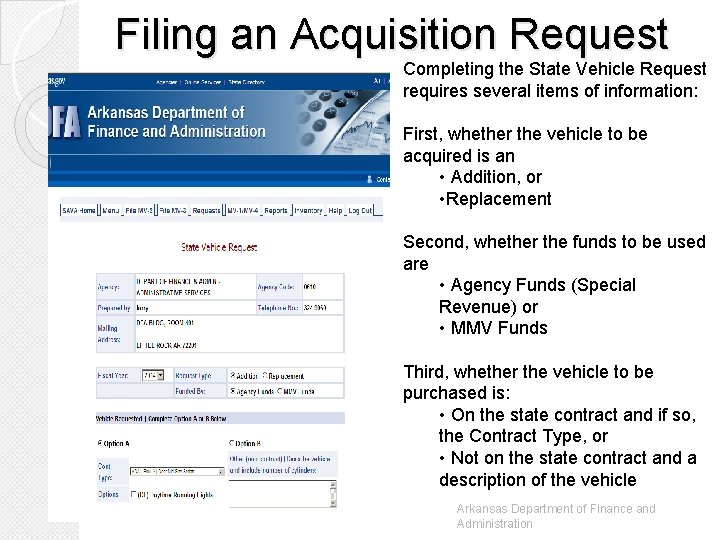

Filing an Acquisition Request To begin the process of requesting a vehicle, users must log into SAVA and select “State Vehicle Request” from the SAVA Main Menu Arkansas Department of Finance and Administration

Filing an Acquisition Request Completing the State Vehicle Request requires several items of information: First, whether the vehicle to be acquired is an • Addition, or • Replacement Second, whether the funds to be used are • Agency Funds (Special Revenue) or • MMV Funds Third, whether the vehicle to be purchased is: • On the state contract and if so, the Contract Type, or • Not on the state contract and a description of the vehicle Arkansas Department of Finance and Administration

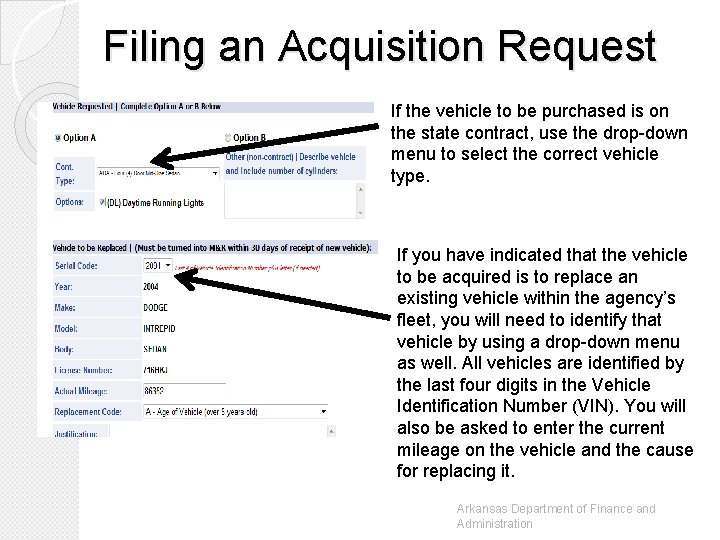

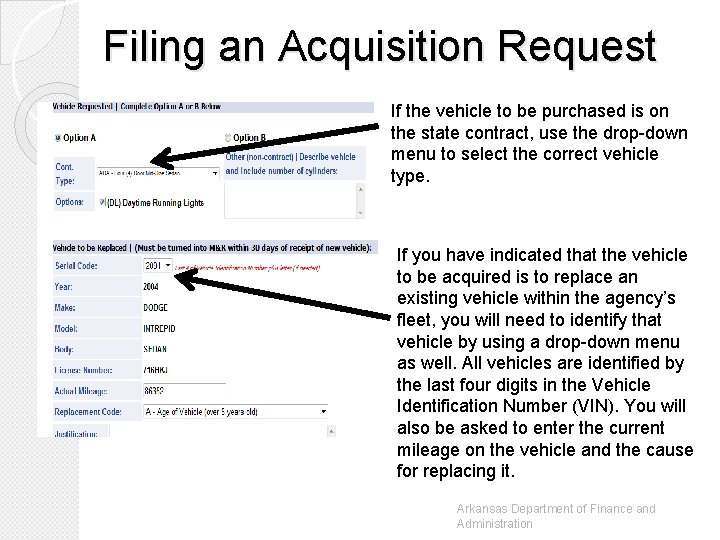

Filing an Acquisition Request If the vehicle to be purchased is on the state contract, use the drop-down menu to select the correct vehicle type. If you have indicated that the vehicle to be acquired is to replace an existing vehicle within the agency’s fleet, you will need to identify that vehicle by using a drop-down menu as well. All vehicles are identified by the last four digits in the Vehicle Identification Number (VIN). You will also be asked to enter the current mileage on the vehicle and the cause for replacing it. Arkansas Department of Finance and Administration

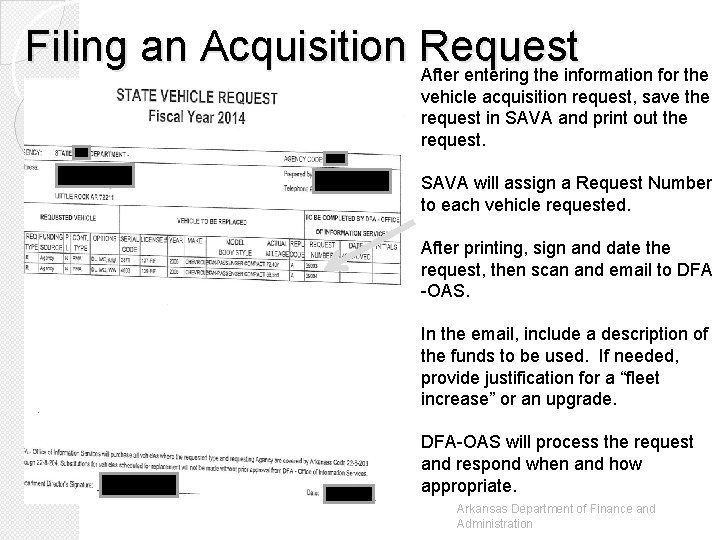

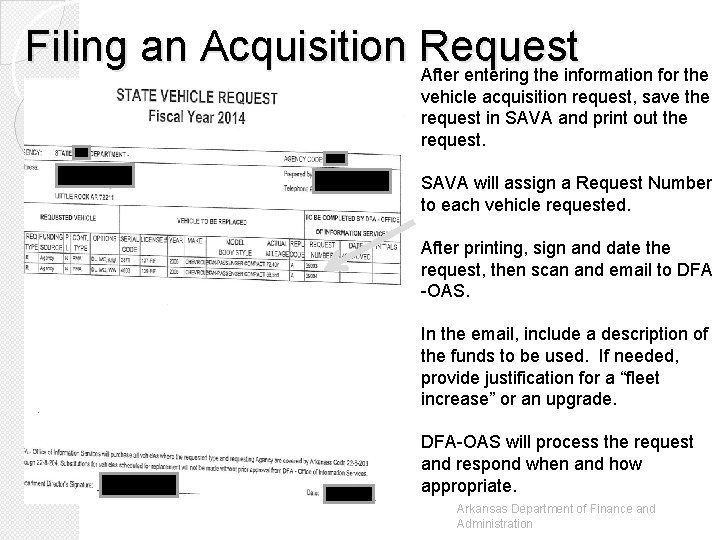

Filing an Acquisition Request After entering the information for the vehicle acquisition request, save the request in SAVA and print out the request. SAVA will assign a Request Number to each vehicle requested. After printing, sign and date the request, then scan and email to DFA -OAS. In the email, include a description of the funds to be used. If needed, provide justification for a “fleet increase” or an upgrade. DFA-OAS will process the request and respond when and how appropriate. Arkansas Department of Finance and Administration

Additional Information to Include Justification for: �An increase in the size of the Agency’s fleet �An upgrade of the vehicle, i. e. not “like for like” Also include: �If using Agency Funds, a description of the funds and authorization to use funds to purchase a vehicle Arkansas Department of Finance and Administration

The Prioritized List (MMV) Ark. Code Ann. § 22 -8 -205: . . . the Department of Finance and Administration shall prepare a prioritized ranking for then-current fiscal year based upon: (1) Age of the vehicle to be replaced; (2) Actual and projected mileage of the vehicle to be replaced; (3) A history of repair costs of the vehicle to be replaced; (4) Number and average of each state agency's fleet of vehicles; and (5) Condition of state agency fleet and cost of maintenance of its vehicles. One additional Criteria: DFA requires that all requests made under the Prioritized List process must be ranked in order of NEED. Arkansas Department of Finance and Administration

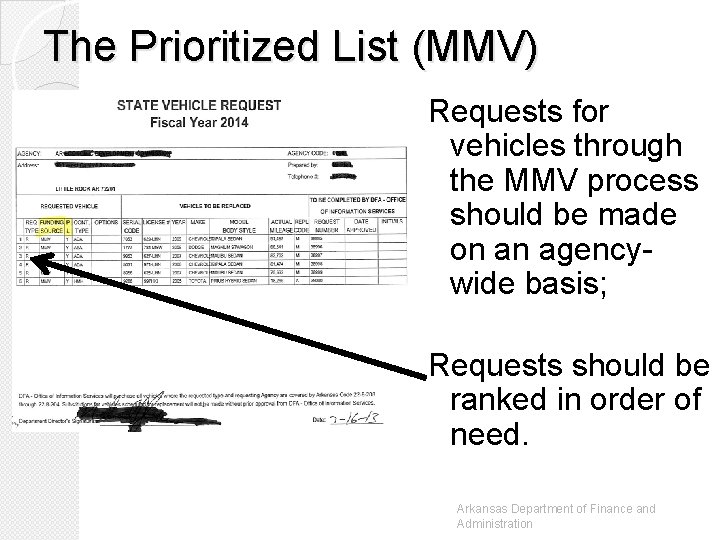

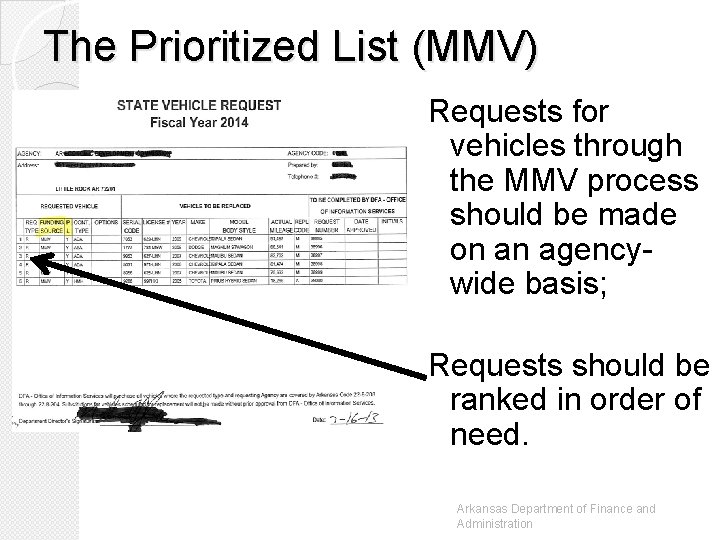

The Prioritized List (MMV) Requests for vehicles through the MMV process should be made on an agencywide basis; Requests should be ranked in order of need. Arkansas Department of Finance and Administration

The Prioritized List (MMV) The Prioritized List is: �Conducted annually in the late summer, early Fall �Uses State Funds (i. e. General Improvement Fund) �A competitive process designed to make the most-efficient use of State funding �The number of vehicles purchased depends on the availability of State funds. Arkansas Department of Finance and Administration

Agency-Funded Acquisitions Agencies can purchase vehicles outside the MMV process with special revenue. ◦ After approval of a vehicle-acquisition request, agencies will be asked to provide proof of authorization to purchase a vehicle with agency funds ◦ Can be filed at any time. Arkansas Department of Finance and Administration

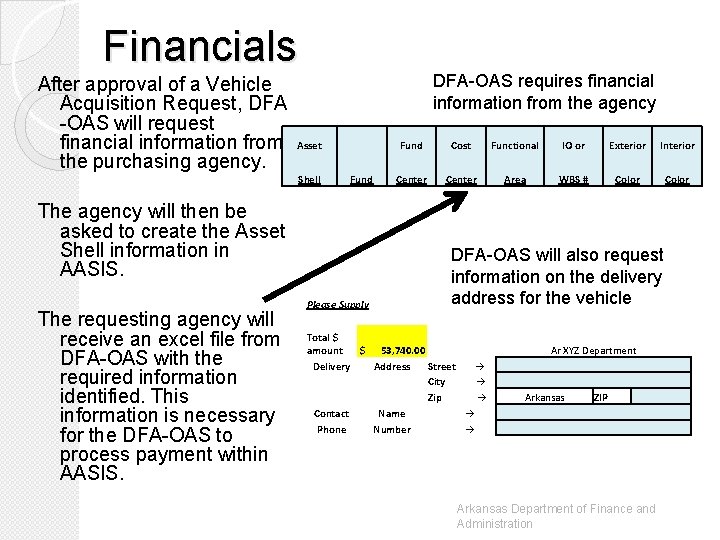

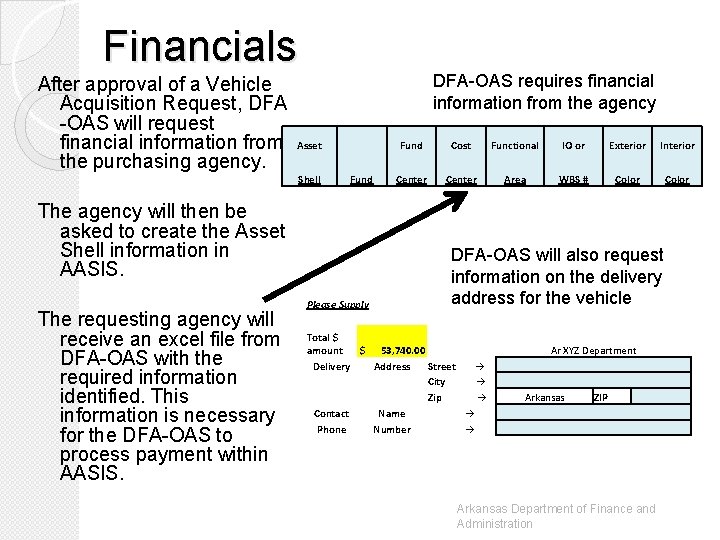

Financials After approval of a Vehicle Acquisition Request, DFA -OAS will request financial information from the purchasing agency. DFA-OAS requires financial information from the agency Asset Fund Cost Functional IO or Exterior Interior Shell Fund Center Area WBS # Color The agency will then be asked to create the Asset Shell information in AASIS. The requesting agency will receive an excel file from DFA-OAS with the required information identified. This information is necessary for the DFA-OAS to process payment within AASIS. Please Supply DFA-OAS will also request information on the delivery address for the vehicle Total $ amount $ 53, 740. 00 Delivery Address Street → City → Zip → Contact Name → Phone Number → Ar XYZ Department Arkansas ZIP Arkansas Department of Finance and Administration

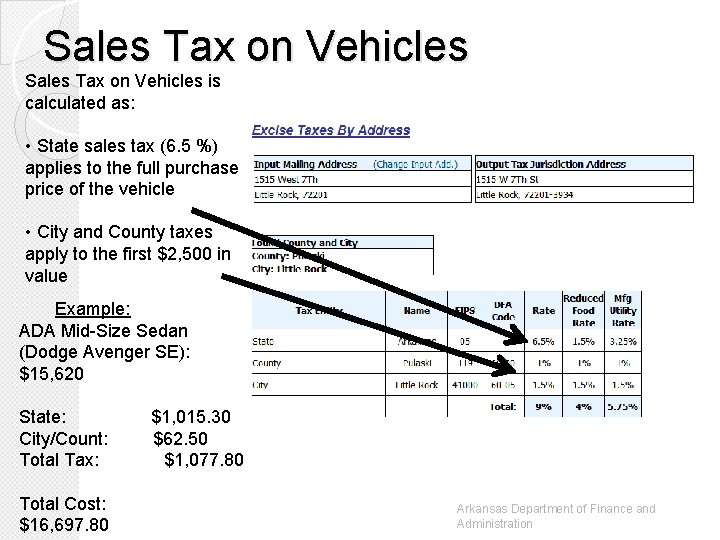

Sales Tax on Vehicles Under Act 1405 of 2013, the Motor Vehicle Acquisition Fund (MMV) will be providing appropriation necessary to pay both the purchase price of the vehicle and any applicable sales tax. Agencies will no longer be required to provide the appropriation for these funds “. . . he or she shall transfer on his or her books and on the books of the Auditor of State and the Treasurer of State an amount that is equal to the price of the vehicles and that includes applicable state and local sales and use taxes from the fund from which the funding is available to the Motor Vehicle Acquisition Revolving Fund. ” Agencies will be required to calculate the amount necessary in sales tax prior to submitting the necessary financial information to DFA for the purchase of the Vehicle. At the appropriate time, DFA will then transfer over an amount equal to both the price of the vehicle and any applicable sales taxes. Arkansas Department of Finance and Administration

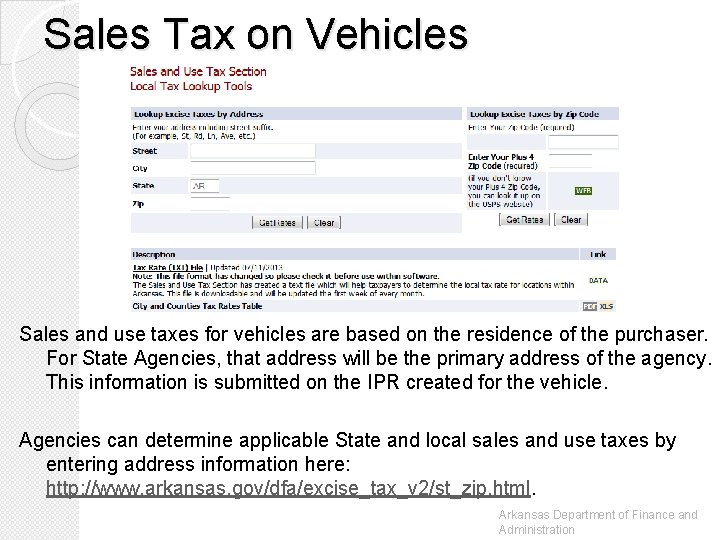

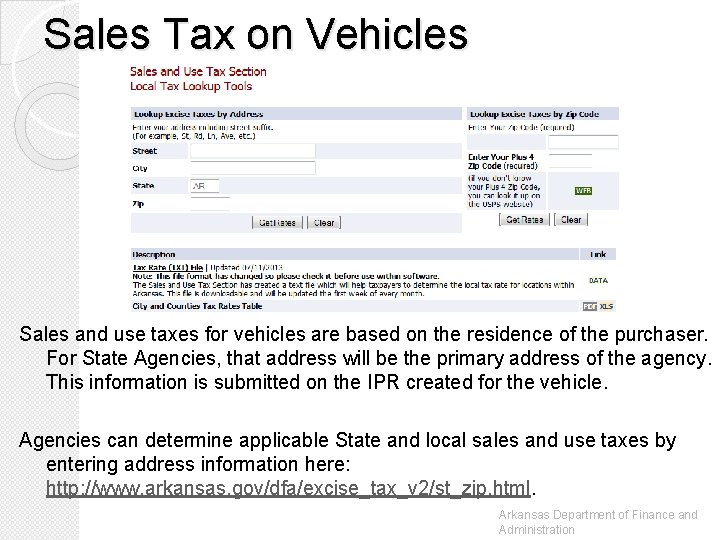

Sales Tax on Vehicles Sales and use taxes for vehicles are based on the residence of the purchaser. For State Agencies, that address will be the primary address of the agency. This information is submitted on the IPR created for the vehicle. Agencies can determine applicable State and local sales and use taxes by entering address information here: http: //www. arkansas. gov/dfa/excise_tax_v 2/st_zip. html. Arkansas Department of Finance and Administration

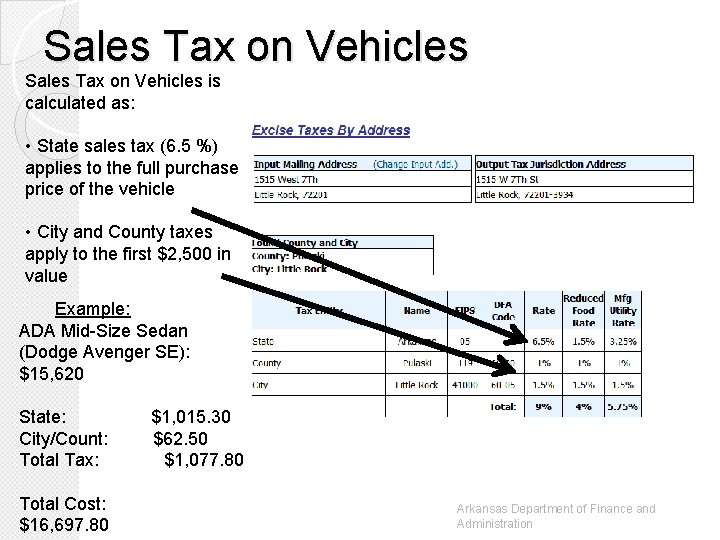

Sales Tax on Vehicles is calculated as: • State sales tax (6. 5 %) applies to the full purchase price of the vehicle • City and County taxes apply to the first $2, 500 in value Example: ADA Mid-Size Sedan (Dodge Avenger SE): $15, 620 State: $1, 015. 30 City/Count: $62. 50 Total Tax: $1, 077. 80 Total Cost: $16, 697. 80 Arkansas Department of Finance and Administration

What then? Once a request is completed and submitted correctly, DFA will respond with any questions or comments and will submit a copy of the signed request after approval. After submitting financial information: ◦ DFA-OAS will create the purchase order and place the order with the vendor ◦ Request agency will receive a copy of the PO ◦ DFA-OAS will pay the invoice with the money transferred from your Financial Spread Sheet Arkansas Department of Finance and Administration

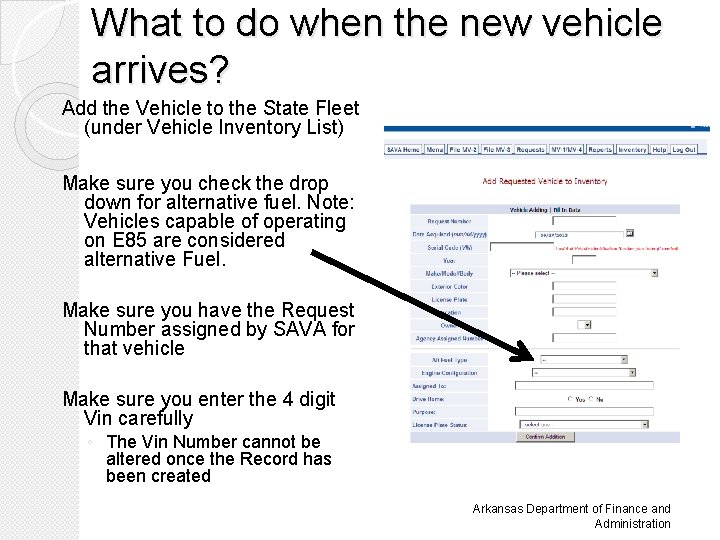

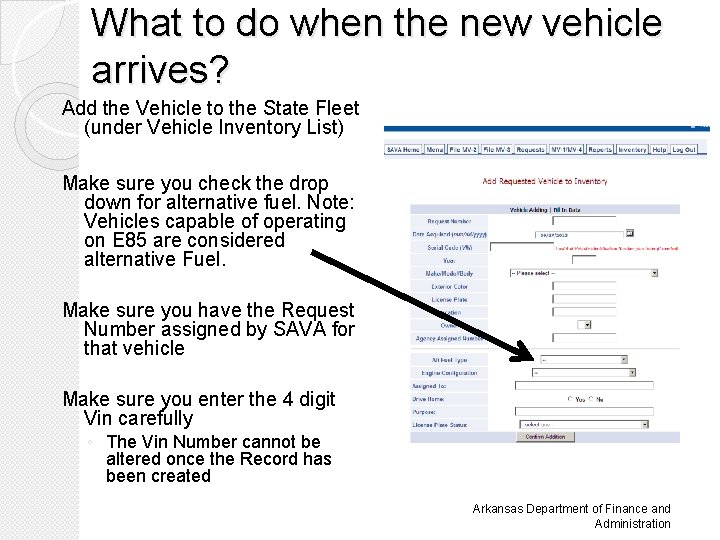

What to do when the new vehicle arrives? Add the Vehicle to the State Fleet (under Vehicle Inventory List) Make sure you check the drop down for alternative fuel. Note: Vehicles capable of operating on E 85 are considered alternative Fuel. Make sure you have the Request Number assigned by SAVA for that vehicle Make sure you enter the 4 digit Vin carefully ◦ The Vin Number cannot be altered once the Record has been created Arkansas Department of Finance and Administration

How to Turn in the Old Vehicle? How to Dispose of Vehicles through M & R The agency is required to submit a Surplus Disposal Form (SDF). Go to: www. ark. org/eforms/forms. php This is site password protected and you will need to contact M & R 501 -565 -8645 for a User Name and Password. After M & R receives your Surplus Disposal Form, someone from M & R will contact you to schedule the delivery of the vehicle.

How to Turn in the Old Vehicle? Once M&R has completed the SDF Form, a copy is sent to DFA-OAS. Upon receipt, DFA-OAS removes the vehicle from the State inventory. If the vehicle was used as part of a replacement request, the requesting agency has 30 days from receipt of the new vehicle to turn in the old vehicle to M&R. Arkansas Department of Finance and Administration

Before you deliver the vehicle to M & R � Clean the vehicle inside and out � Remove all agency and personal items � Remove Gas/Fleet Cards � Turn in two (2) ignition keys for each vehicle � When a vehicle is being pulled from service, TURN IT IN TO M & R don’t just park it until you have approval and money to replace it. � Please do not sign the front or back of titles Arkansas Department of Finance and Administration

What about a wrecked Vehicle? In the event of an accident. Contact the insurance company so a damage evaluation can be made on the vehicle. If the vehicle is a Total Loss, contact M & R for instructions. If the vehicle needs to be towed, ask for it to be taken to the nearest State owned property or deliver to M & R. Accident Reports must be made to the State insurance provider: Bancorp South Insurance Services For Claims Reporting between 8 a. m. and 4 p. m. , Monday - Friday: (501) 664 -7705 After Hours Claims Reporting: (501) 664 -9252 Arkansas Department of Finance and Administration

What about vehicles weighing one ton or more? Agencies will follow the same process for approval. However, agencies must handle the creation of the purchase order and payment of the invoice. Requests to acquire a vehicle of one-ton or greater must still be approved by DFA. However, the purchasing agency will handle the acquisition after approval of the Vehicle Acquisition Request. Arkansas Department of Finance and Administration

Where do you take your vehicle requests and questions? The Department of Finance and Administration – Office of Administrative Services �DFA-Office of Administrative Services, c/o Larry Dahlberg, State Vehicle Manager; larry. dahlberg@dfa. arkansas. gov; (501) 682 -6823 �Jake Bleed, Asst. Administrator; jake. bleed@dfa. arkansas. gov; (501) 3716006 Arkansas Department of Finance and Administration

Questions that were asked during the Forum There is a problem with STAR (vehicle registration) – This has been resolved! 2. Does an institution of higher education pay sales or use tax on a vehicle? No, ACA § 26 -52 -410 gives them an exemption 3. For agencies who only have cash funds, do they follow the same process as everyone else? Yes, see next slide for further explanation 1. Arkansas Department of Finance and Administration

3. continued � The process required to obtain DFA approval for the acquisition of a vehicle applies to “cash-only agencies”, aka those not funded through General Revenue, in most respects. Cash Fund Agencies must enter vehicle information into SAVA and submit requests according to the requirements described in this presentation. � However, after receiving DFA approval to acquire a vehicle, Cash Fund Agencies will not be asked to submit fund information and will instead handle the purchase transaction themselves. In addition, cash fund agencies cannot participate in the prioritized list process (MMV). See Ark. Code Ann. § 19 -4 -901 et. seq, which deals with fleet sizes and acquisition of vehicles generally and applies to all agencies except constitutional officers and official guests of the State. See also Ark. Code Ann. § 22 -8 -101, dealing with vehicle acquisitions and with specific limitations regarding the prioritized list process. Arkansas Department of Finance and Administration

November Forum �Thursday, November 14, 10: 00 – 11: 30 AGENDA: ◦ THINK Certification Program ◦ Periscope Holdings �Material Master Data Cleanup �Procurement Transformation

December 12, 2013 �There will not be a December Forum Meeting �AR NIGP is hosting a presentation: ◦ “Negotiation Strategies in the Public Sector” ◦ Phillip Ellison, C. P. M. , Executive Director of Supply Chain Services, Spring Independent School District, Houston, TX ◦ Holiday Inn Airport ◦ 10: 00 - Noon

Comprehensible input

Comprehensible input Child nutrition unit arkansas

Child nutrition unit arkansas Arkansas department of education child nutrition unit

Arkansas department of education child nutrition unit Cosmic superclass in java

Cosmic superclass in java Common core standards arkansas

Common core standards arkansas Arkansas state mammal

Arkansas state mammal Massachusetts department of motor vehicles

Massachusetts department of motor vehicles Georgia department of motor vehicle safety

Georgia department of motor vehicle safety Ipes certified carriers

Ipes certified carriers Language acquisition is a subconscious process

Language acquisition is a subconscious process Washington state department of social and health services

Washington state department of social and health services Nevada department of business and industry

Nevada department of business and industry State of nevada department of business and industry

State of nevada department of business and industry State of florida department of juvenile justice

State of florida department of juvenile justice State of alabama department of finance

State of alabama department of finance Texas state psychology program

Texas state psychology program Nysdot hdm chapter 5

Nysdot hdm chapter 5 Isabel darcy

Isabel darcy The state department us for

The state department us for Oklahoma state department of education standards

Oklahoma state department of education standards Penn state department of meteorology

Penn state department of meteorology Jackson state university finance department

Jackson state university finance department State of nevada department of business and industry

State of nevada department of business and industry Michigan state astronomy

Michigan state astronomy Arkansas career training institute

Arkansas career training institute Arkansas geographic regions

Arkansas geographic regions Arkansas.mycopa

Arkansas.mycopa Chapter 9 lawyer

Chapter 9 lawyer Six geographic regions of arkansas

Six geographic regions of arkansas Arkansas environmental federation

Arkansas environmental federation Cottage law arkansas

Cottage law arkansas Adfa contact

Adfa contact Heather beech arkansas

Heather beech arkansas Tess components

Tess components Tess domains arkansas

Tess domains arkansas National board certification arkansas

National board certification arkansas Kzhe 100.5

Kzhe 100.5