Sri Lanka Accounting Standard LKAS 01 LKAS 02

- Slides: 28

Sri Lanka Accounting Standard Ø Ø LKAS 01 LKAS 02 LKAS 16 LKAS 36

Members v S. G. S. Nuwanthika (GAL/AC/2016/F/0027) v M. H. D. Rasangika (GAL/AC/2016/F/0140) v M. A. Fasil Hussain (GAL/AC/2016/F/0090) v P. M. Umayangana Sandamali (GAL/AC/2016/F/0100)

LKAS 01 n a n i F f o s n t o n i t e a t m n e t e s a t e S r P l a ci

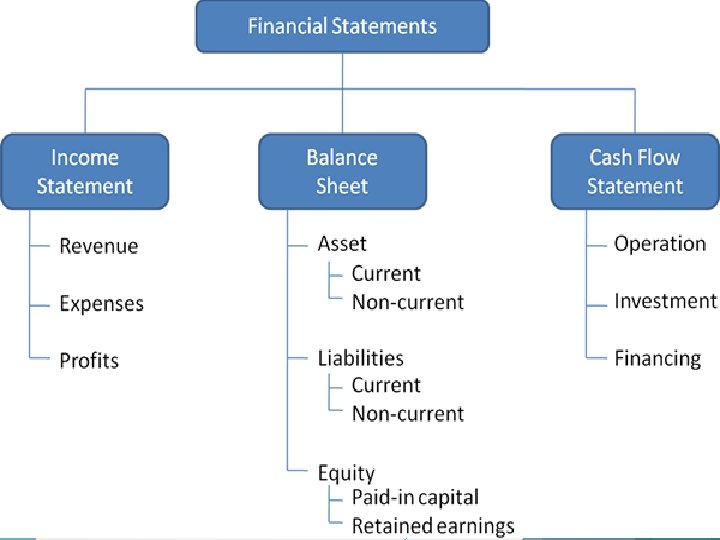

OBJECTIVE The objective of financial statement is to provide information about q The financial position q Financial q Cash performance flows of and equity That is useful to a wide range of users in making economic decisions.

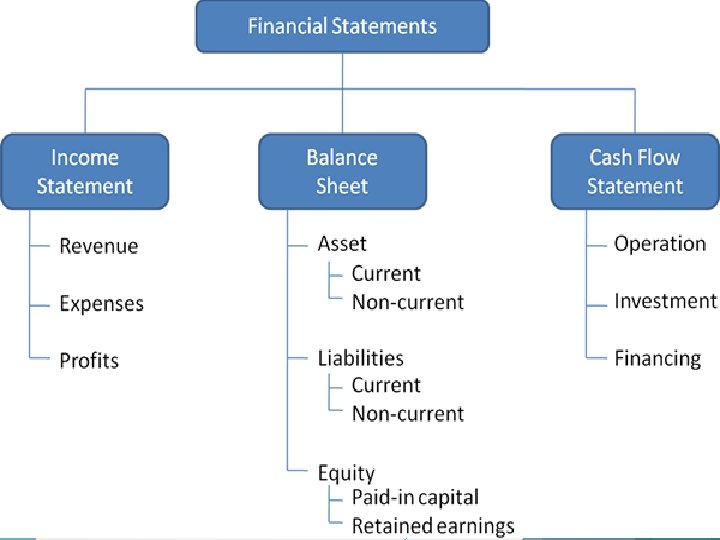

Complete set of financial statements A statement of financial position A statement of profit or loss A statement of changes in equity for the period A statement of cash flows for the period Notes, comprising significant accounting policies and other explanatory information

Elements of Financial Statements ØAssets ØLiabilities ØEquities ØIncome ØExpenditure

LKAS 02 r o s ie In t n e v

Objectives q Provides guidance on the determination of cost. q Prescribe the accounting for inventories. q Gives guidance on the cost formulas that are used to assign cost.

What are the inventories…. ? Inventories are assets Ø Held for sale in the ordinary course of business. Ø In the process of the production for such sale. Ø In the form of materials or supply to be consumed in the production process or in the rendering of service.

Cost of inventories q. Cost of purchase q. Cost of conversion q. Other cost

This Standard applies to all inventories

This Standard does not apply to all inventories q producers of agricultural and forest products, agricultural produce after harvest, and minerals and mineral products. q commodity broker-traders who measure their inventories at fair value less costs to sell.

Measurement of inventories q. Inventories shall be measured at the lower of cost and net realizable value.

Cost excluded from the cost of inventories q Abnormal amount of wasted materials. q Storage cost , unless those cost are necessary in the production process before a further production stage. q Administrative overhead that do not contribute to bringing inventories to their present location and condition. q Selling cost

Techniques for the measurement of cost q. Standard cost method. q. Retail method.

LKAS 16 d an t n a l P , t y n t e r e m p p i o r u P q E

Objective The principal issues in accounting for P. P. E prescribe the accounting treatment for P. P. E

Definition Property, plant and equipment are tangible item that : q are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes. q are expected to be used during more than one

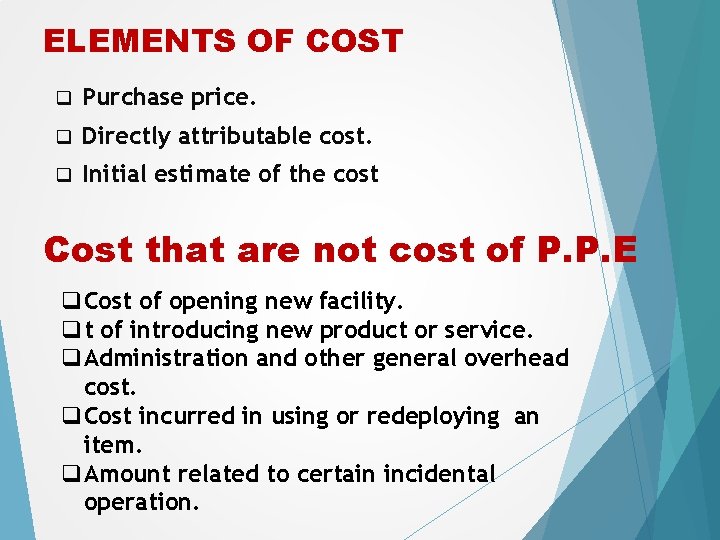

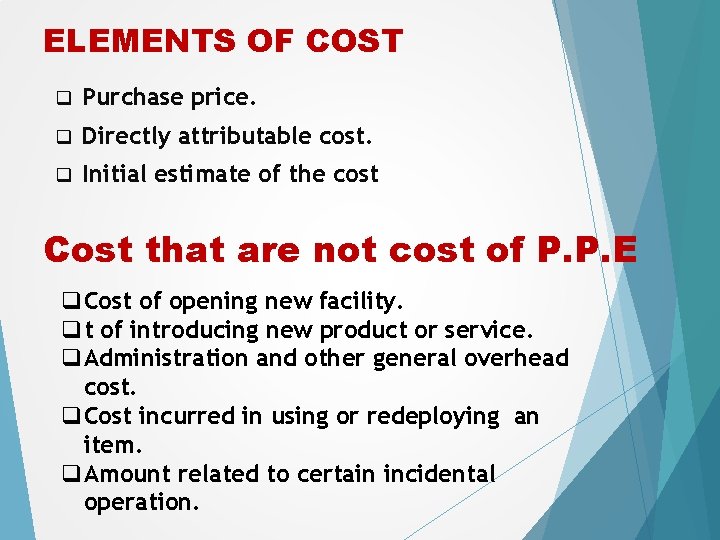

ELEMENTS OF COST q Purchase price. q Directly attributable cost. q Initial estimate of the cost Cost that are not cost of P. P. E q. Cost of opening new facility. qt of introducing new product or service. q. Administration and other general overhead cost. q. Cost incurred in using or redeploying an item. q. Amount related to certain incidental operation.

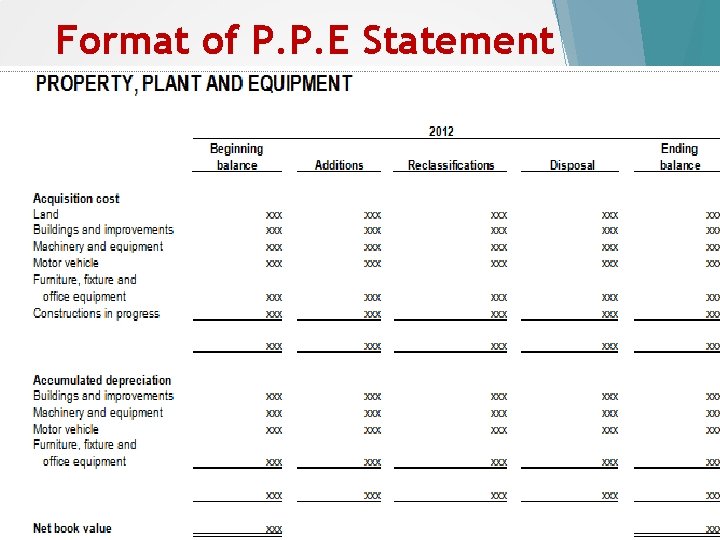

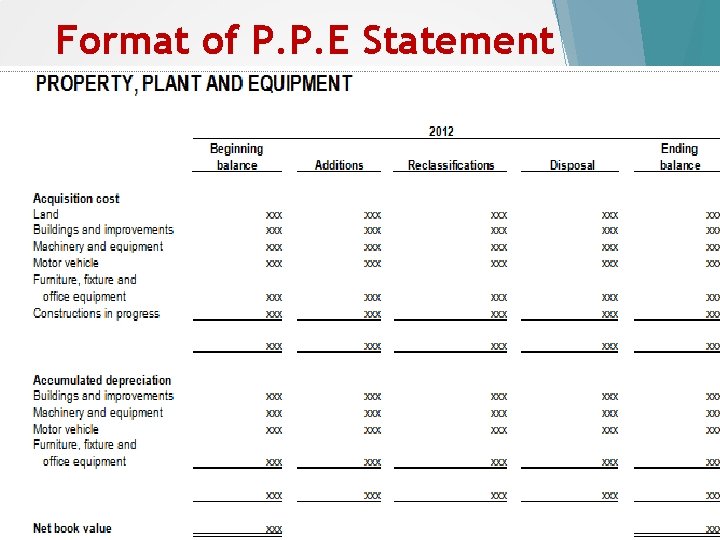

Format of P. P. E Statement

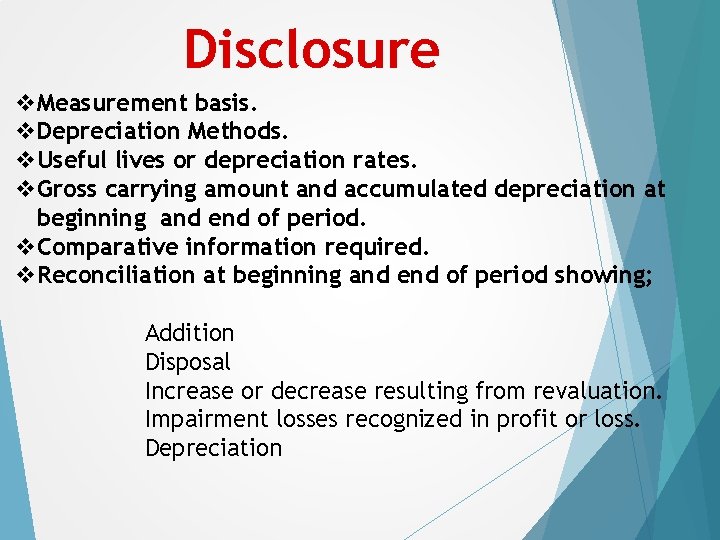

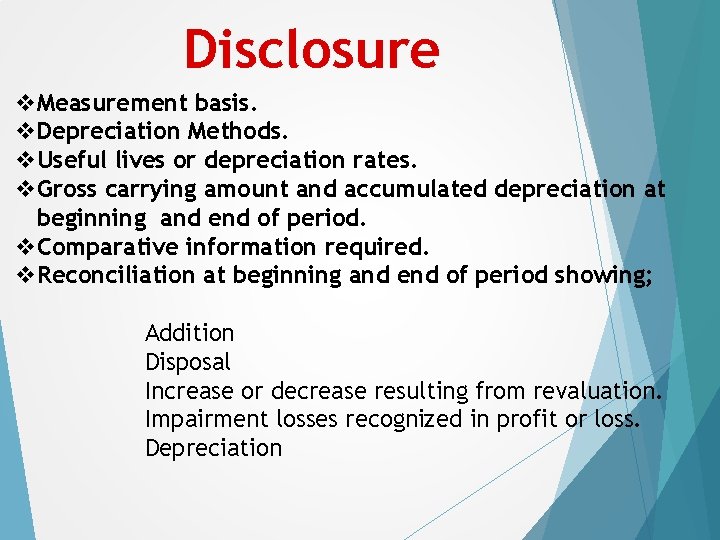

Disclosure v. Measurement basis. v. Depreciation Methods. v. Useful lives or depreciation rates. v. Gross carrying amount and accumulated depreciation at beginning and end of period. v. Comparative information required. v. Reconciliation at beginning and end of period showing; Addition Disposal Increase or decrease resulting from revaluation. Impairment losses recognized in profit or loss. Depreciation

LKAS 36 o t n e I m r i a p m s A f s t se

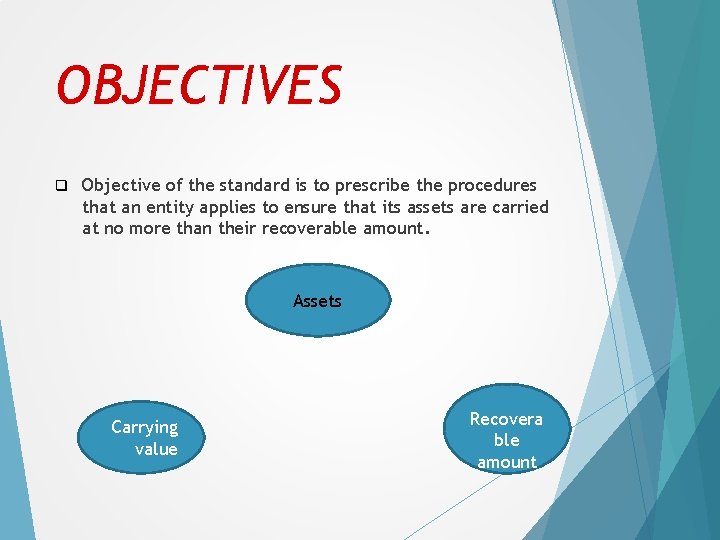

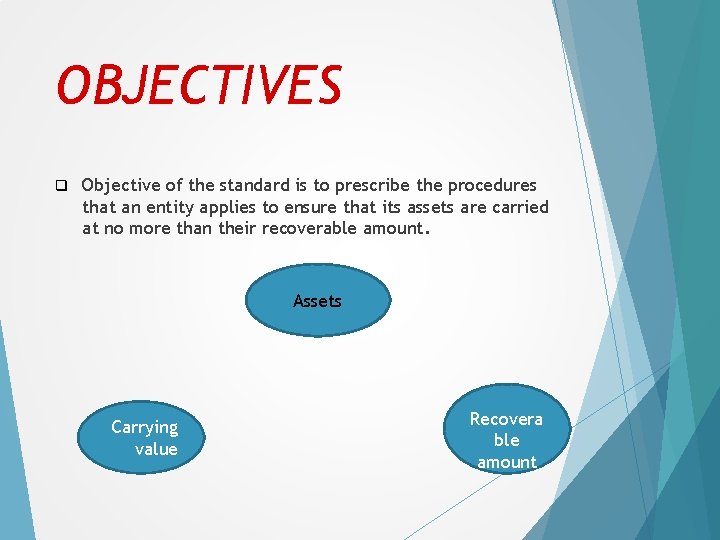

OBJECTIVES q Objective of the standard is to prescribe the procedures that an entity applies to ensure that its assets are carried at no more than their recoverable amount. Assets Carrying value Recovera ble amount

IDENTIFY IMPAIRED ASSESTS q An entity shall assets at each reporting whethere is any indication that assets may be impaired. q If indicators exist management is required to perform the impairment test.

q However following shall be tested for impairment annually irrespective of existence of any impairment indicators q Intangible assets with indefinite useful life. q Intangible assets not yet available for use. q Good will acquired in a business combination.

RECOGNISING AND MEASURING IMPAIRMENT LOSS q Impairment loss is recognized immediately in p & l (unless the assets is carried at revalued amount). q If carried at revalued amount impairment loss is treated as reduction in revaluation gain.

THANK YOU