Spousal Impoverishment Protections in Managed Long Term Care

- Slides: 7

Spousal Impoverishment Protections in Managed Long Term Care Evelyn Frank Legal Resources Program David Silva and Valerie Bogart June 2014 ELFRP@nylag. org 212 -613 -7310

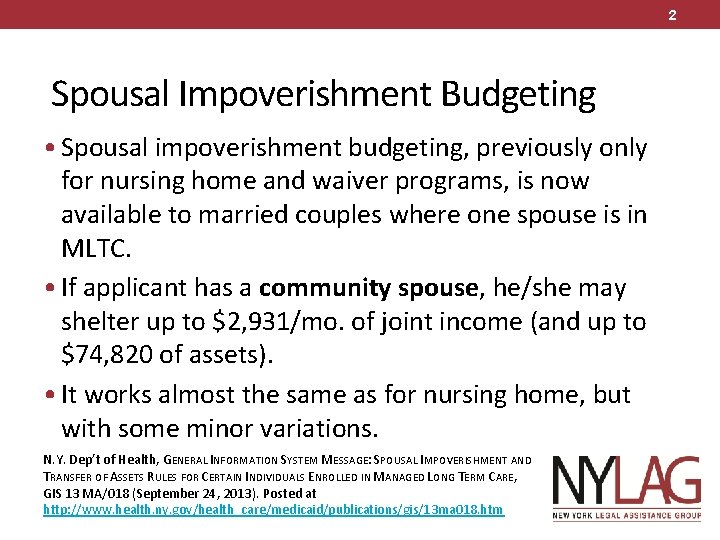

2 Spousal Impoverishment Budgeting • Spousal impoverishment budgeting, previously only for nursing home and waiver programs, is now available to married couples where one spouse is in MLTC. • If applicant has a community spouse, he/she may shelter up to $2, 931/mo. of joint income (and up to $74, 820 of assets). • It works almost the same as for nursing home, but with some minor variations. N. Y. Dep’t of Health, GENERAL INFORMATION SYSTEM MESSAGE: SPOUSAL IMPOVERISHMENT AND TRANSFER OF ASSETS RULES FOR CERTAIN INDIVIDUALS ENROLLED IN MANAGED LONG TERM CARE, GIS 13 MA/018 (September 24, 2013). Posted at http: //www. health. ny. gov/health_care/medicaid/publications/gis/13 ma 018. htm

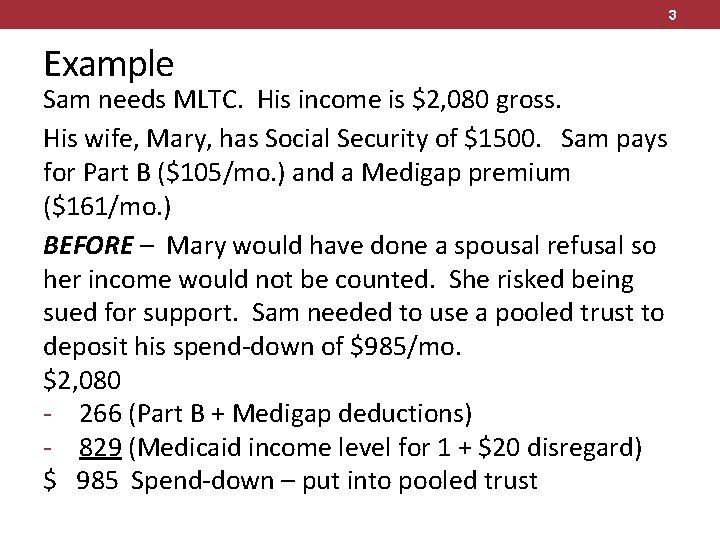

3 Example Sam needs MLTC. His income is $2, 080 gross. His wife, Mary, has Social Security of $1500. Sam pays for Part B ($105/mo. ) and a Medigap premium ($161/mo. ) BEFORE – Mary would have done a spousal refusal so her income would not be counted. She risked being sued for support. Sam needed to use a pooled trust to deposit his spend-down of $985/mo. $2, 080 - 266 (Part B + Medigap deductions) - 829 (Medicaid income level for 1 + $20 disregard) $ 985 Spend-down – put into pooled trust

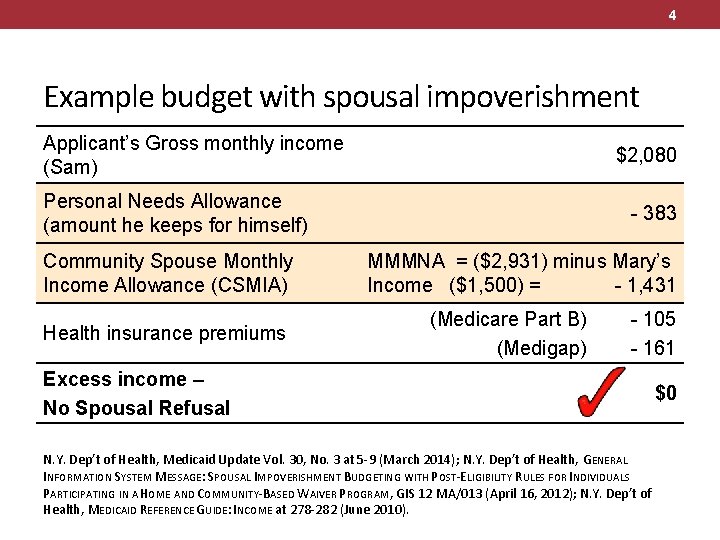

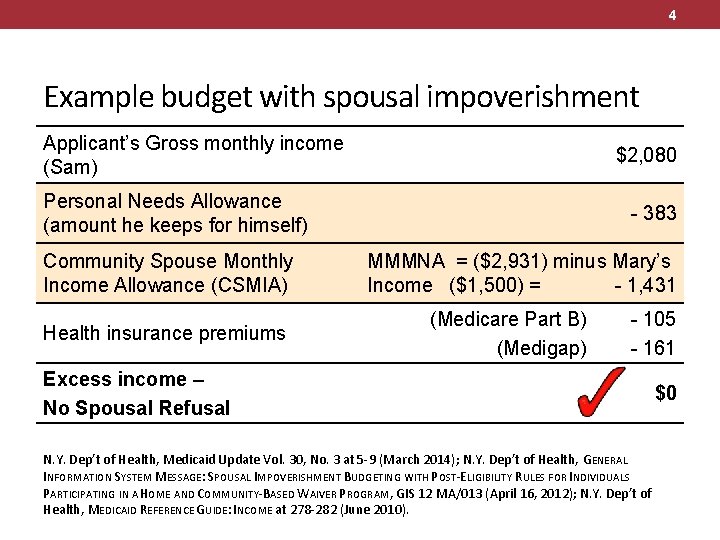

4 Example budget with spousal impoverishment Applicant’s Gross monthly income (Sam) $2, 080 Personal Needs Allowance (amount he keeps for himself) Community Spouse Monthly Income Allowance (CSMIA) Health insurance premiums Excess income – No Spousal Refusal - 383 MMMNA = ($2, 931) minus Mary’s Income ($1, 500) = - 1, 431 (Medicare Part B) (Medigap) - 105 - 161 $0 N. Y. Dep’t of Health, Medicaid Update Vol. 30, No. 3 at 5 -9 (March 2014); N. Y. Dep’t of Health, GENERAL INFORMATION SYSTEM MESSAGE: SPOUSAL IMPOVERISHMENT BUDGETING WITH POST-ELIGIBILITY RULES FOR INDIVIDUALS PARTICIPATING IN A HOME AND COMMUNITY-BASED WAIVER PROGRAM, GIS 12 MA/013 (April 16, 2012); N. Y. Dep’t of Health, MEDICAID REFERENCE GUIDE: INCOME at 278 -282 (June 2010).

5 Example -- con’d In the preceding example, Mary had $1500 of her own income. If the “community spouse, ” Mary, had no income of her own, Sam could have $1500 more income, which would in turn be allocated to Mary as her MMMNA (Minimum Monthly Maintenance Needs Allowance). This means his income could be $3, 580/month and he’d have: • No spend-down, and • No spousal refusal necessary. Figures change depending on amount of his Medigap, if any, and amount of her income

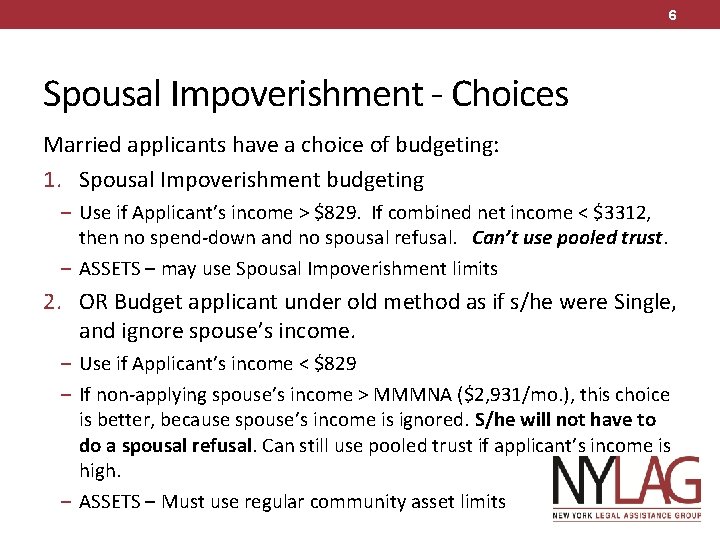

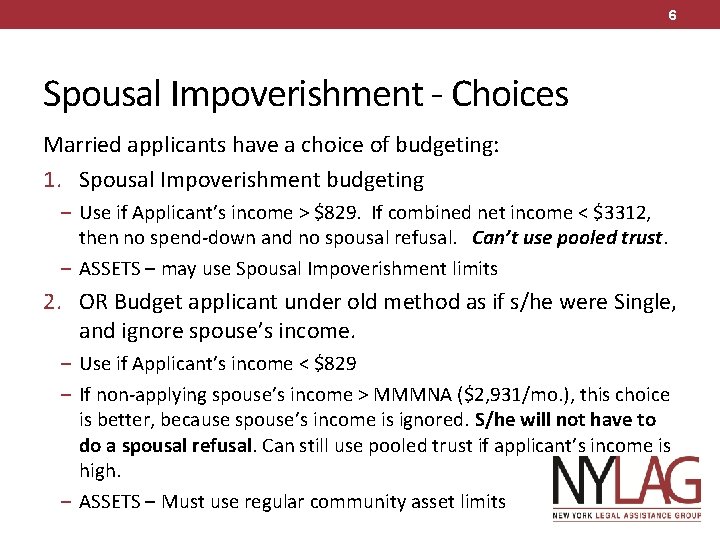

6 Spousal Impoverishment - Choices Married applicants have a choice of budgeting: 1. Spousal Impoverishment budgeting – Use if Applicant’s income > $829. If combined net income < $3312, then no spend-down and no spousal refusal. Can’t use pooled trust. – ASSETS – may use Spousal Impoverishment limits 2. OR Budget applicant under old method as if s/he were Single, and ignore spouse’s income. – Use if Applicant’s income < $829 – If non-applying spouse’s income > MMMNA ($2, 931/mo. ), this choice is better, because spouse’s income is ignored. S/he will not have to do a spousal refusal. Can still use pooled trust if applicant’s income is high. – ASSETS – Must use regular community asset limits

7 For More Info See NYLAG article - http: //www. wnylc. com/health/entry/165/ - has links to state directives: • MARCH 28, 2014 - in NYS DOH Medicaid Update March 2014, Vol. 30 No. 3 at pp. 5 -8. http: //www. health. ny. gov/health_care/medicaid/program/u pdate/2014/mar 14_mu. pdf • NYS DOH GIS 13 MA/018 Spousal Impoverishment and Transfer of Assets Rules for Certain Individuals Enrolled in Managed Long Term Care. Posted at http: //www. health. ny. gov/health_care/medicaid/publicatio ns/pub 2013 gis. htm