Specialty Asset Concentrations Understanding the Whole Picture 1

- Slides: 8

Specialty Asset Concentrations Understanding the Whole Picture 1

Specialty Asset Concentrations Role of Specialty Asset Management: provide information to the portfolio management process • Description of the subject asset • Marketability of the subject asset (supply, demand, costs) • Summary of the cash flow on the subject asset and related outlook • Alternative strategies for the property (sale, exchange, modification) Role of Portfolio Manager: ensure alignment of portfolio assets with investment objective • Asset allocation should support return requirements • Keep portfolio within client risk tolerance • Keep portfolio within liquidity boundaries Role of the Trust Officer • Keep portfolio within client risk tolerance Provide timely information on client needs and objectives • Maintain adherence with governing document 2

Specialty Asset Concentrations in Specialty Assets Threshold is (____) % of account’s market value • This threshold suggests a review is warranted • However, it does not suggest or imply that portfolio changes are needed or disposition of an asset is warranted All Specialty Assets have some degree of market inefficiency • There may be no market for some assets, particularly private business assets • Market conditions are critical in successfully selling real property 3

Specialty Asset Concentrations in Specialty Assets Specific Investment Considerations • Some specialty assets have low-to-negative correlation to financial assets thus increasing diversification • Many specialty assets provide critical cash returns in low interest rate periods • Some specialty assets are depleting while others are renewable • Real property return characteristics range from growth stock to fixed-income Proper evaluation of a specialty asset concentration requires information tailored to the asset, which may include: • Asset description, return characteristics, and marketability • Relevant duties and restrictions from the trust document • Capital market expectations 4

Specialty Asset Concentrations Process for handling concentrations in fiduciary accounts • Process should be linked to the scheduled annual investment review date • Specialty Asset Manager should provide overview of subject asset to TO & PM prior to the annual investment review • Portfolio Manager and Trust Officer should integrate the information on the concentrated asset into the annual investment review • Specialty Asset Manager remains available to consult with the Portfolio Manager and/or Trust Officer throughout the process • Portfolio Manager, Trust Officer, and Specialty Asset Manager should discuss the concentration strategy before any final sign-off of investment review if specific action is recommended 5

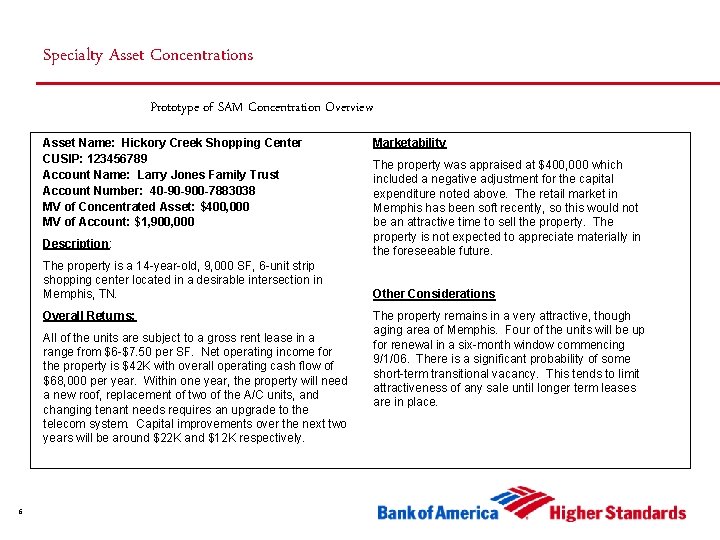

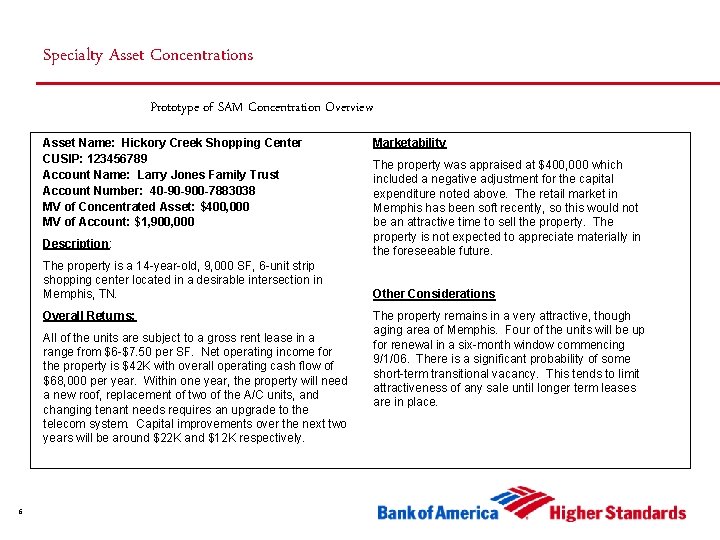

Specialty Asset Concentrations Prototype of SAM Concentration Overview Asset Name: Hickory Creek Shopping Center CUSIP: 123456789 Account Name: Larry Jones Family Trust Account Number: 40 -90 -900 -7883038 MV of Concentrated Asset: $400, 000 MV of Account: $1, 900, 000 Description: The property is a 14 -year-old, 9, 000 SF, 6 -unit strip shopping center located in a desirable intersection in Memphis, TN. Overall Returns: All of the units are subject to a gross rent lease in a range from $6 -$7. 50 per SF. Net operating income for the property is $42 K with overall operating cash flow of $68, 000 per year. Within one year, the property will need a new roof, replacement of two of the A/C units, and changing tenant needs requires an upgrade to the telecom system. Capital improvements over the next two years will be around $22 K and $12 K respectively. 6 Marketability The property was appraised at $400, 000 which included a negative adjustment for the capital expenditure noted above. The retail market in Memphis has been soft recently, so this would not be an attractive time to sell the property. The property is not expected to appreciate materially in the foreseeable future. Other Considerations The property remains in a very attractive, though aging area of Memphis. Four of the units will be up for renewal in a six-month window commencing 9/1/06. There is a significant probability of some short-term transitional vacancy. This tends to limit attractiveness of any sale until longer term leases are in place.

Specialty Asset Concentrations Other issues to cover (? ): 7 • Considerations for source of funds, capital gain/loss, management • Characteristics of an assets – fixed or equity/both • Alternatives for diversification

8