South Dakota District Office 2329 N Career Ave

- Slides: 11

South Dakota District Office 2329 N. Career Ave. Sioux Falls, South Dakota 57107 (605) 330 -4243 Ext. 39 paul. gunderson@sba. gov www. sba. gov/for-lenders

Access to Capital • Grants NOT available from SBA • SBA offers loan guarantees to lenders – Partial refund for failed loan – Lender obtains guarantee • Lenders handle all loan transactions – – – Application Approval Disbursement Servicing Collection Visit us at www. sba. gov 2

Access to Capital So Why Go With an SBA Guarantee? ? Visit us at www. sba. gov 3

Access to Capital • Not everyone needs an SBA Guarantee • SBA Guaranteed Loan Program provides an alternative • If risk is too high - lender comes to SBA – SBA Guarantee reduces lender risk • Start-ups • Insufficient collateral • Non-standard repayment terms Visit us at www. sba. gov 4

7(a) Program • Use of Proceeds – Working capital – Inventory – Lines of credit – Expansion / renovation – Leasehold improvements – Land or buildings – Furniture / fixtures / equipment – Refinance debt for compelling reasons Visit us at www. sba. gov 5

Community Advantage Pilot Program South Dakota District Office 2/9/11 -V 1. 0

Community Advantage New 7(a) Pilot Program (3 -year duration) To meet the capital access needs of small businesses in underserved markets To increase the points of access for underserved markets To provide mission-oriented lenders access to 7(a) loan guarantees for loans of $250, 000 or less 2/9/11 -V 1. 0

Community Advantage Target: Primarily non-profit financial intermediaries focused on economic development in underserved markets Underserved markets include: Low-to-Moderate Income (LMI) communities Empowerment Zones Enterprise Communities HUBZones Start-up businesses (in business no more than two years) Veteran-owned businesses (including Patriot Express eligible) More than 50% of full time workforce is low-income or resides in LMI census tracts. 2/9/11 -V 1. 0

Community Advantage Eligible Lenders • SBA-authorized Certified Development Companies (CDC) • SBA-authorized Microloan Intermediaries • Non-Federally Regulated Community Development Financial Institutions To participate in the program eligible applicants will be evaluated on their organization’s expertise, capacity and infrastructure 2/9/11 -V 1. 0

Community Advantage Loans Basic Loan Terms and Conditions are the same as standard 7(a) loan (see SOP 50 10 5, Subpart B, Chapter 2 as amended), with the following exceptions: • • $250, 000 maximum loan size Prime + 4% maximum interest rate Revolving lines are not allowed Management and Technical Assistant will be encouraged when appropriate – Information will be collected on each loan at application 2/9/11 -V 1. 0

Visit us at www. sba. gov 11

Pequeña como una pera pero alumbra la casa entera que es

Pequeña como una pera pero alumbra la casa entera que es Great places great faces

Great places great faces South dakota seller's permit

South dakota seller's permit South dakota municipal league

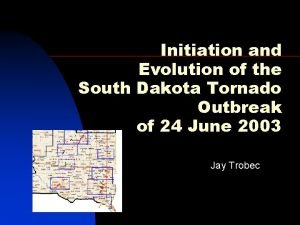

South dakota municipal league 2003 south dakota tornado outbreak

2003 south dakota tornado outbreak Embassy suites south dakota

Embassy suites south dakota South dakota perinatal association

South dakota perinatal association South dakota state university

South dakota state university North dakota state nickname

North dakota state nickname South dakota trust situs

South dakota trust situs Sdica

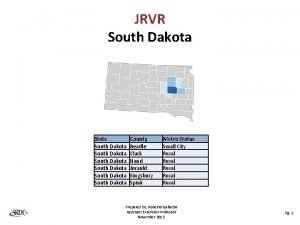

Sdica Northwest south dakota

Northwest south dakota