Sources of Comparative Advantage Chapter 3 Copyright 2009

- Slides: 24

Sources of Comparative Advantage Chapter 3 Copyright © 2009 South-Western, a division of Cengage Learning. All rights reserved.

Factor Endowment Theory economists Heckscher and Ohlin o explanation of: 1) determinants of comparative advantage 2) impact of trade on earnings of factors o nation will export goods which it produces with resources that are relatively abundant o nation will import goods which it produces with resources that are relatively scarce

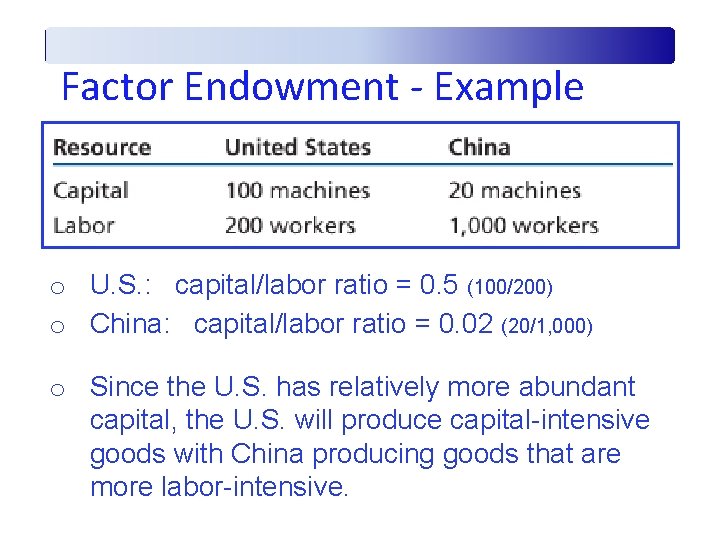

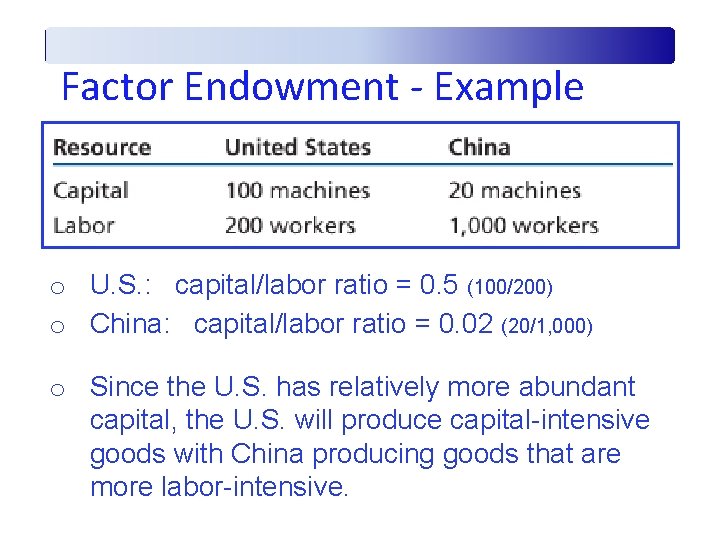

Factor Endowment - Example o U. S. : capital/labor ratio = 0. 5 (100/200) o China: capital/labor ratio = 0. 02 (20/1, 000) o Since the U. S. has relatively more abundant capital, the U. S. will produce capital-intensive goods with China producing goods that are more labor-intensive.

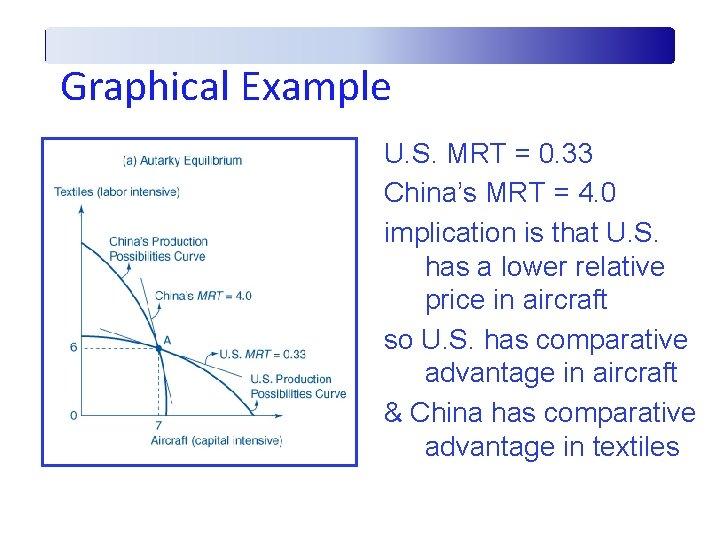

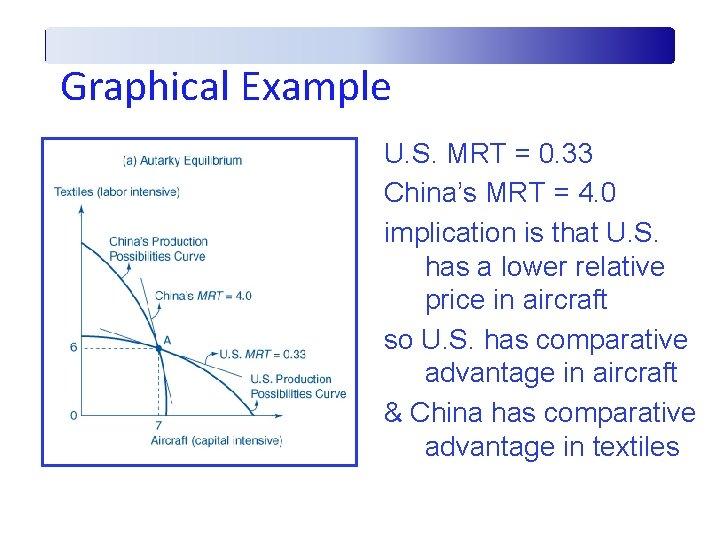

Graphical Example U. S. MRT = 0. 33 China’s MRT = 4. 0 implication is that U. S. has a lower relative price in aircraft so U. S. has comparative advantage in aircraft & China has comparative advantage in textiles

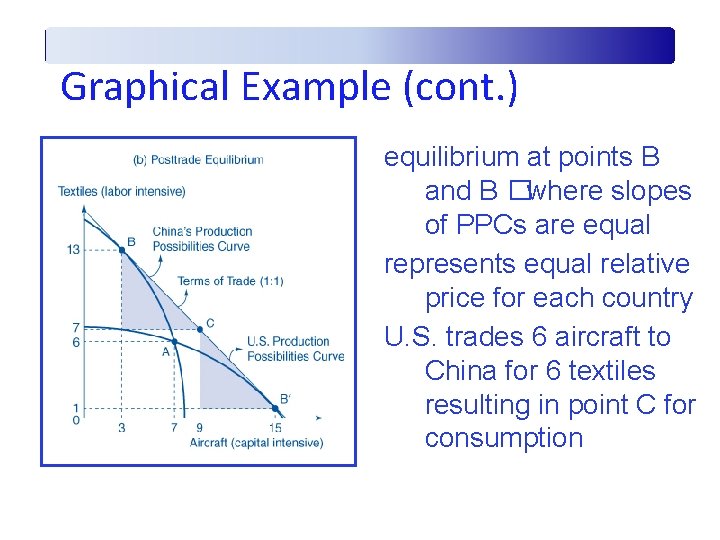

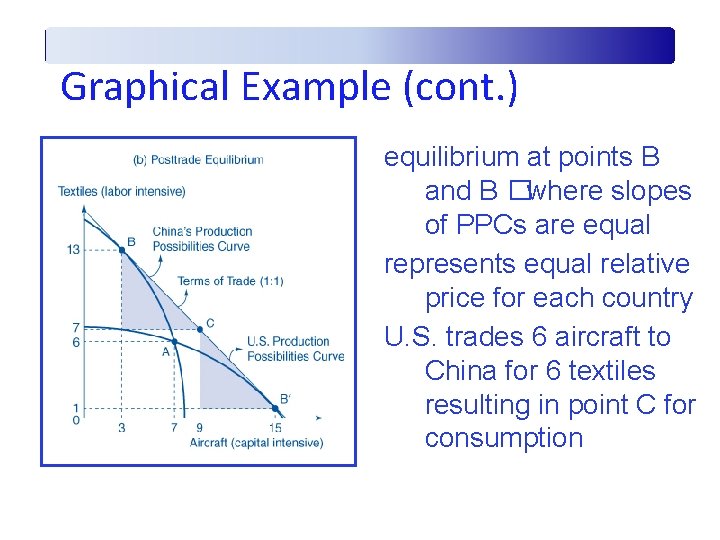

Graphical Example (cont. ) equilibrium at points B and B �where slopes of PPCs are equal represents equal relative price for each country U. S. trades 6 aircraft to China for 6 textiles resulting in point C for consumption

Implications of Factor Endowment o U. S. - relatively abundant capital China - relatively abundant labor o expectation – U. S. produces capital intensive goods and China produces labor intensive o list of top exports confirm theory’s suggestions

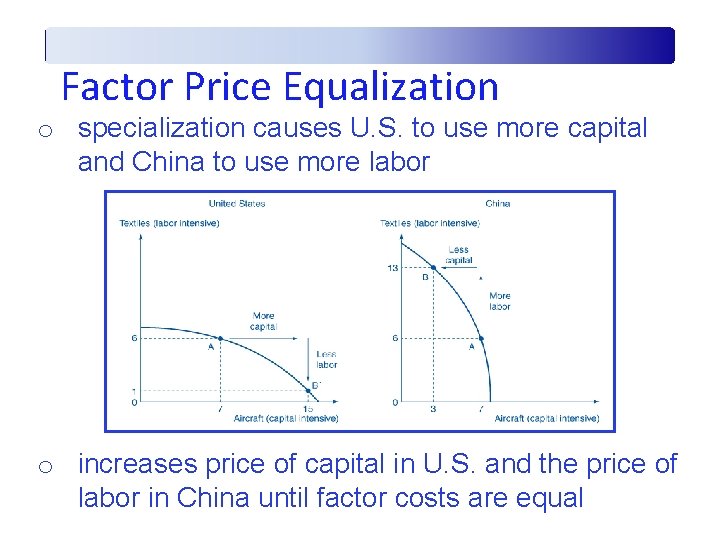

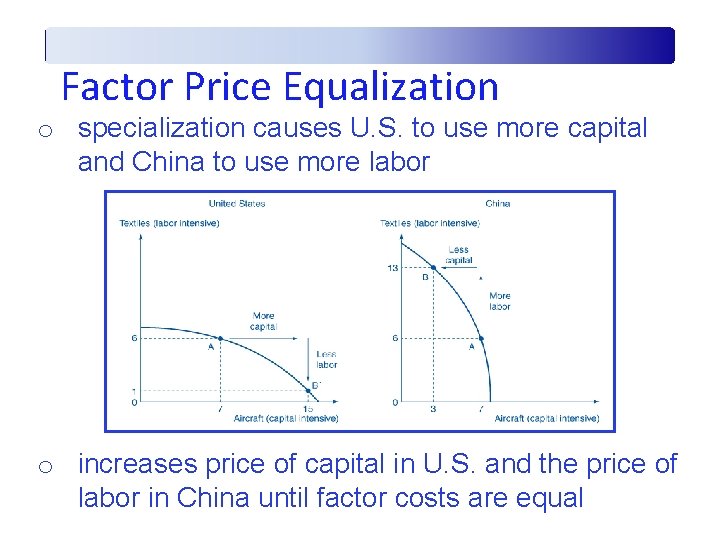

Factor Price Equalization o specialization causes U. S. to use more capital and China to use more labor o increases price of capital in U. S. and the price of labor in China until factor costs are equal

Stolper-Samuelson Theory o increased income for producers of goods associated with relatively abundant resources o decreased income for producers of goods associated with relatively scarce resources o magnification effect – change in price of the resource is greater than the change in the price of the good produced with that resource o implication: overall, free trade provides gains to a nation but specifically some parties gain while others lose

Specific Factor Theory o previous models assumed all resources were completely mobile within a country o in actuality specific factors may exist that cannot move easily from one industry to another o specific factor theory analyzes short run income distribution effects in contrast to previous theories focused on long term results assuming resource mobility among industries o conclusion: trade causes losses for resources specific to import-competing industries and gains for resources specific to export industries

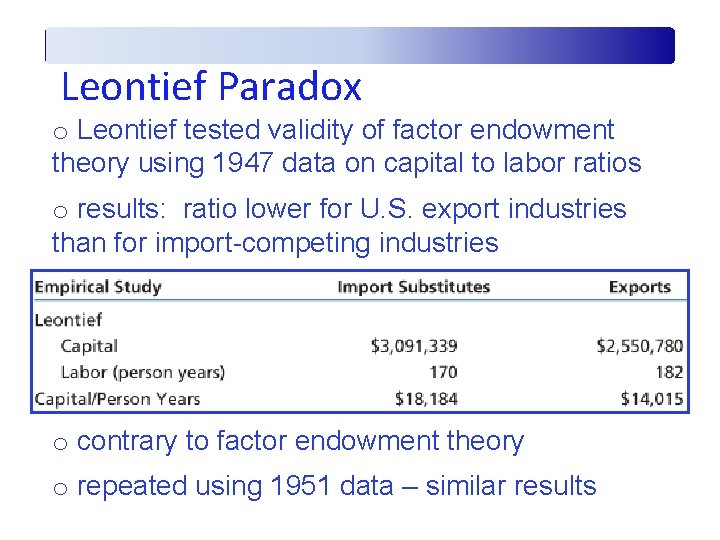

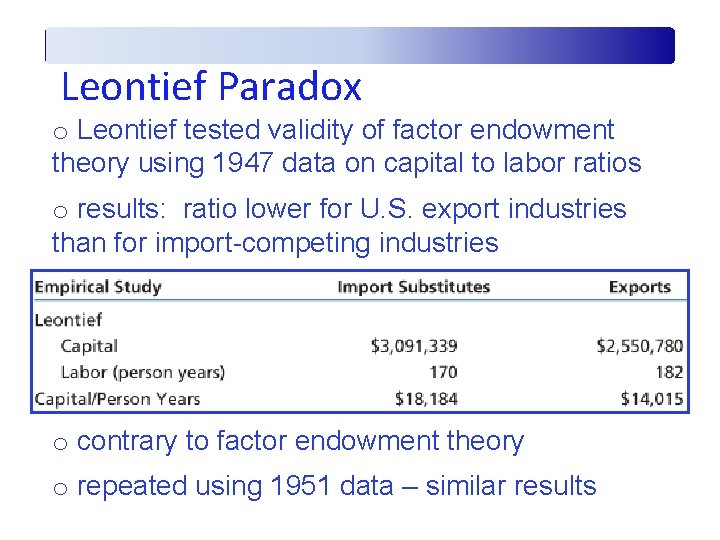

Leontief Paradox o Leontief tested validity of factor endowment theory using 1947 data on capital to labor ratios o results: ratio lower for U. S. export industries than for import-competing industries o contrary to factor endowment theory o repeated using 1951 data – similar results

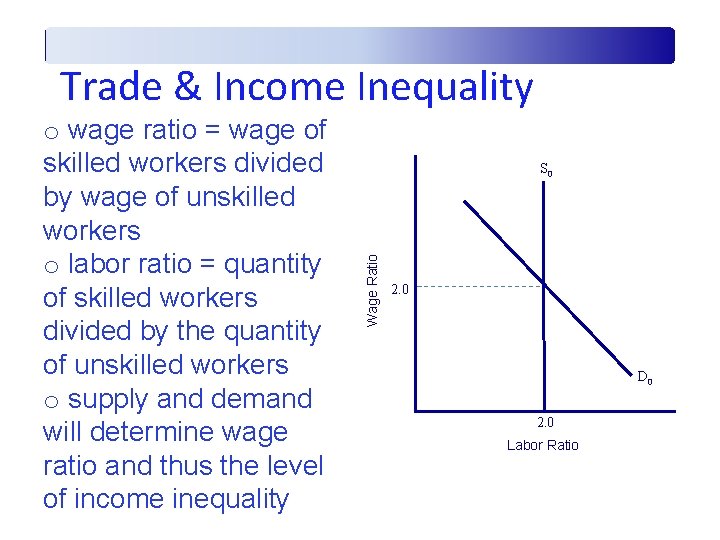

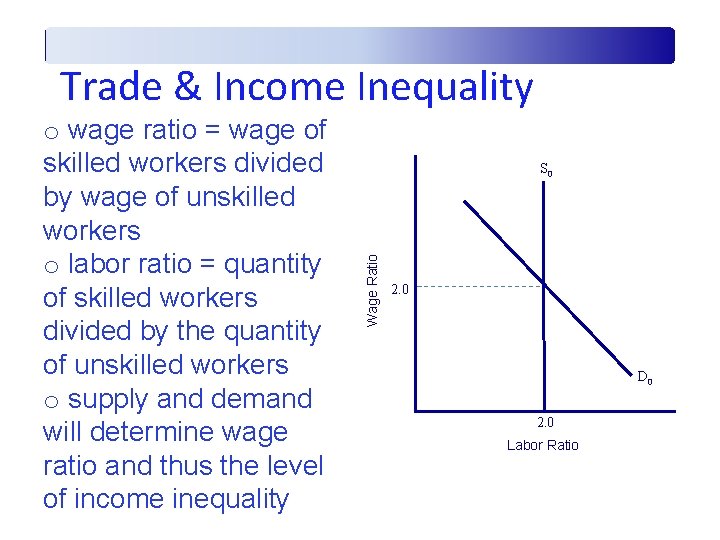

Trade & Income Inequality S 0 Wage Ratio o wage ratio = wage of skilled workers divided by wage of unskilled workers o labor ratio = quantity of skilled workers divided by the quantity of unskilled workers o supply and demand will determine wage ratio and thus the level of income inequality 2. 0 D 0 2. 0 Labor Ratio

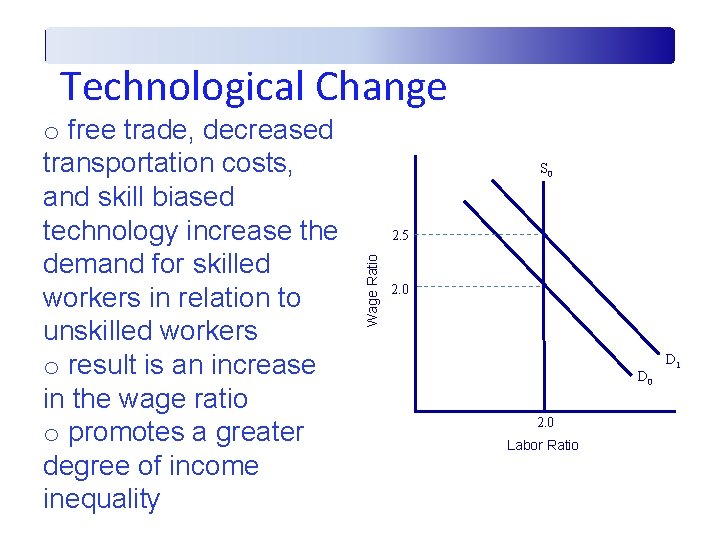

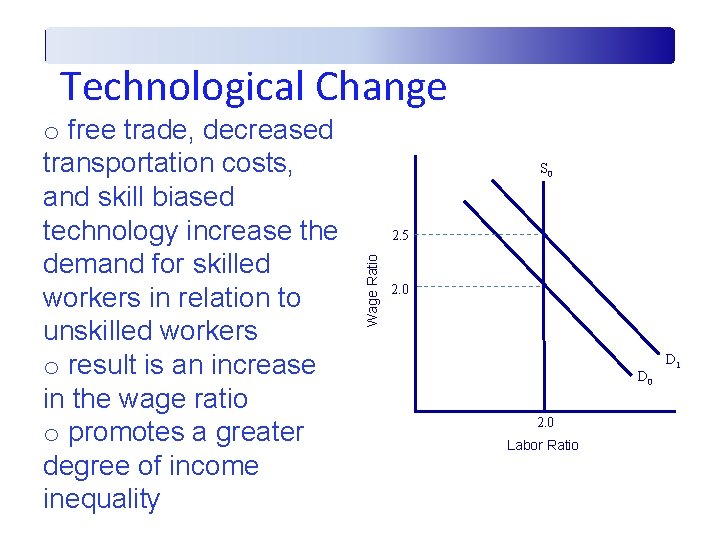

Technological Change S 0 2. 5 Wage Ratio o free trade, decreased transportation costs, and skill biased technology increase the demand for skilled workers in relation to unskilled workers o result is an increase in the wage ratio o promotes a greater degree of income inequality 2. 0 D 0 2. 0 Labor Ratio D 1

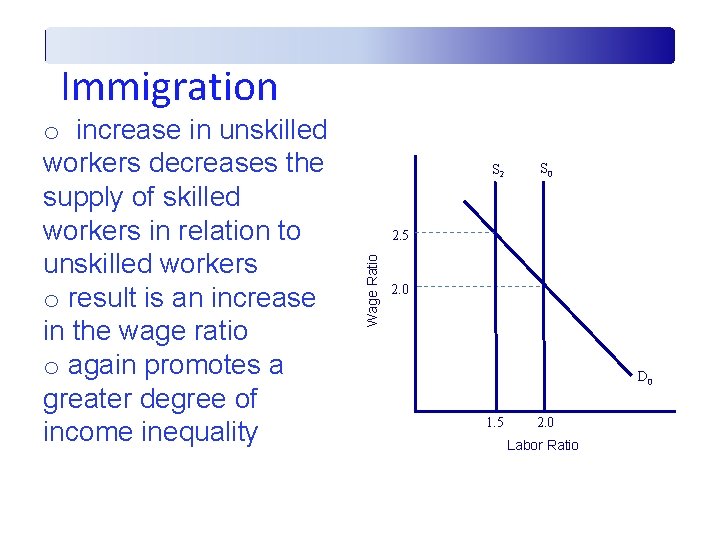

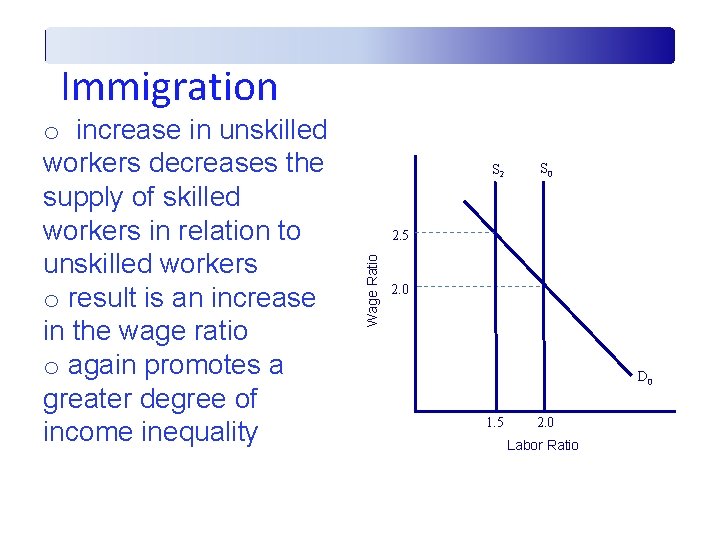

Immigration S 2 S 0 2. 5 Wage Ratio o increase in unskilled workers decreases the supply of skilled workers in relation to unskilled workers o result is an increase in the wage ratio o again promotes a greater degree of income inequality 2. 0 D 0 1. 5 2. 0 Labor Ratio

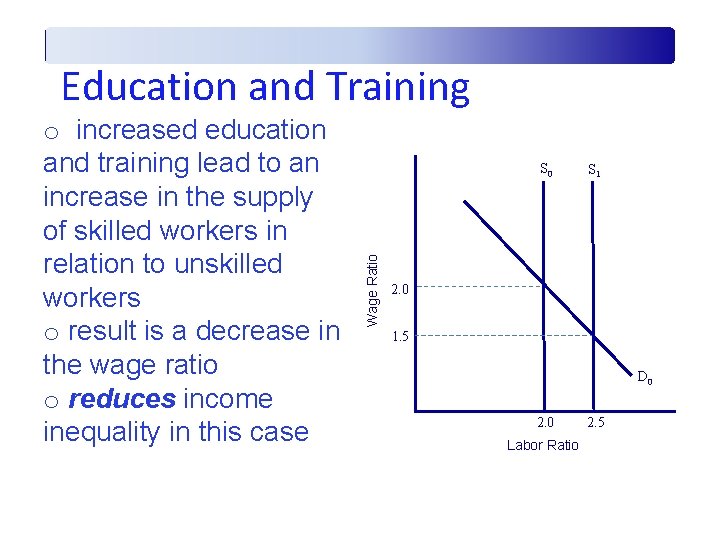

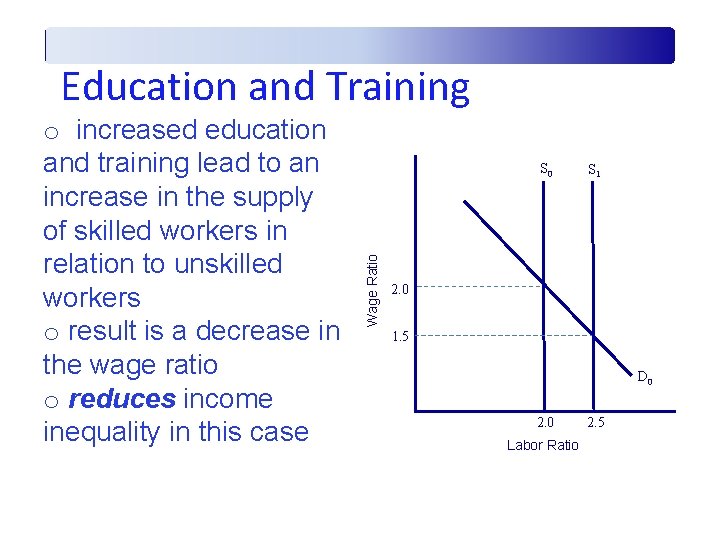

Education and Training S 0 Wage Ratio o increased education and training lead to an increase in the supply of skilled workers in relation to unskilled workers o result is a decrease in the wage ratio o reduces income inequality in this case S 1 2. 0 1. 5 D 0 2. 0 Labor Ratio 2. 5

Increasing Returns to Scale o increasing returns to scale also known as economies of scale imply lower costs per unit at higher levels of output o increasing returns theory – despite limited comparative advantage trade can be beneficial if trade leads to lower cost per unit associated with economies of scale o home market effect – countries will specialize in goods with large domestic demand since proximity will reduce transportation costs

Theory of Overlapping Demands economist Staffan Linder o firms produce goods with large domestic demand these goods are potential exports o export potential to countries with consumer tastes similar to domestic market o consumers conditioned by their income levels high income – demand higher quality goods; luxuries low income – demand lower quality goods; necessities o limited trade in goods between wealthy and poor nations because of limited overlap of demand

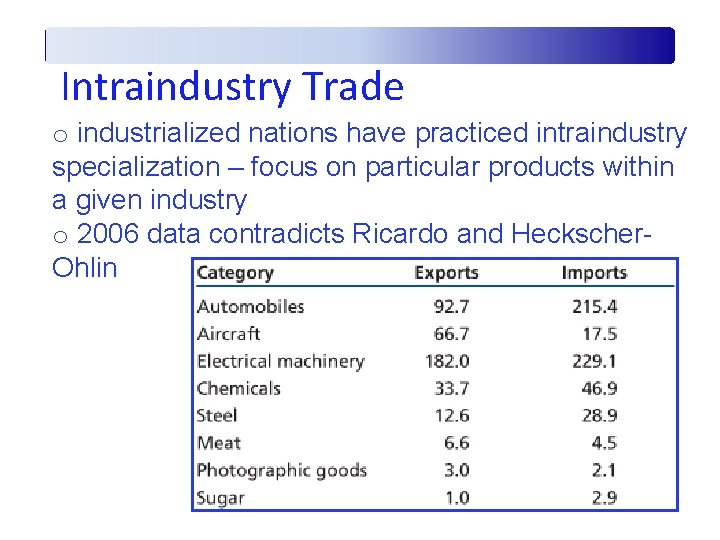

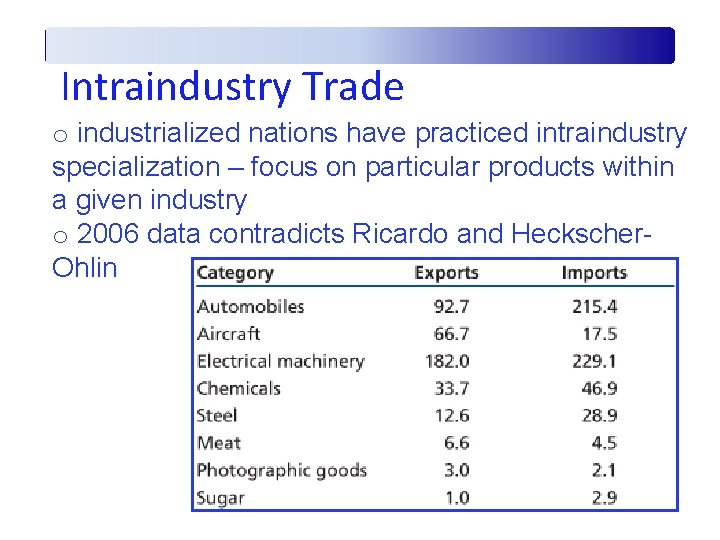

Intraindustry Trade o industrialized nations have practiced intraindustry specialization – focus on particular products within a given industry o 2006 data contradicts Ricardo and Heckscher. Ohlin

Intraindustry Trade (cont. ) Reasons for trade - homogeneous goods o lower transportation costs near borders o seasonal variations may impact both supply and demand Reasons for trade - differentiated goods o demand of the ‘minority’ consumers not met by domestic producers o overlapping demand segments o economies of scale associated with greater output of a specific type of good

Product Life Cycle Theory goods undergo a predictable trade cycle shifting from export to import over the following stages: 1) 2) 3) 4) 5) introduction of good in home market domestic industry exports foreign production begins domestic industry loses comparative advantage imports become more likely implications: • gains from trade are based on technological innovation and spread of that innovation to other countries • continual innovation needed to remain competitive

Dynamic Comparative Advantage o Ricardo’s analysis was static assuming that comparative advantage did not change. o In actuality, comparative advantage can and does change over time. o Industrial policy refers to government attempts to change or create comparative advantage. o Such policy is used to stimulate industries with high productivity, economic significance, and a possibility of long term growth.

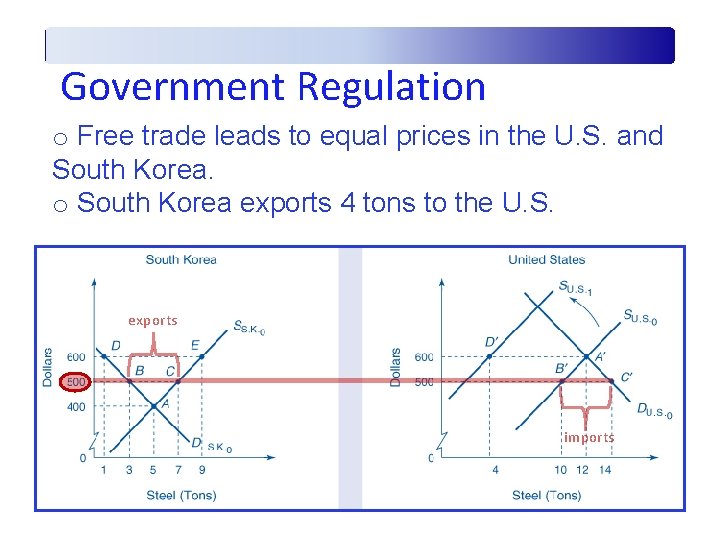

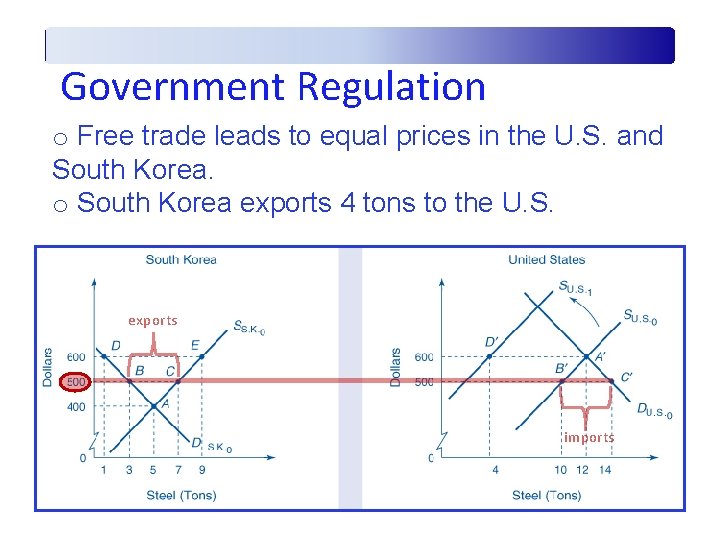

Government Regulation o Free trade leads to equal prices in the U. S. and South Korea. o South Korea exports 4 tons to the U. S. exports imports

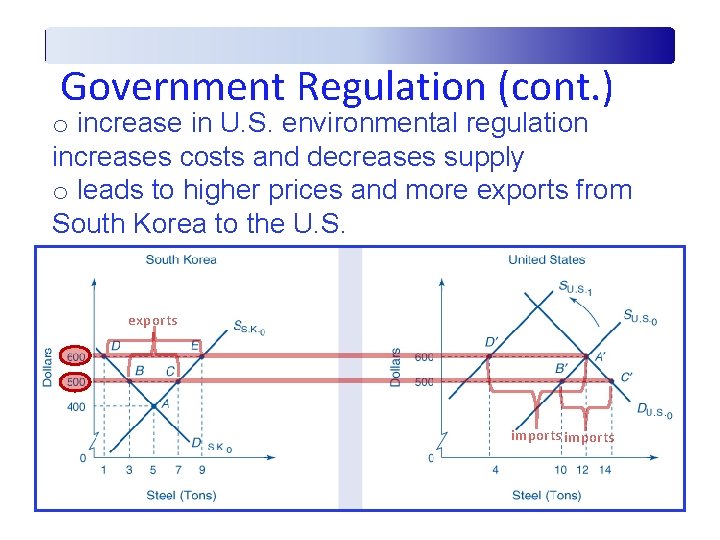

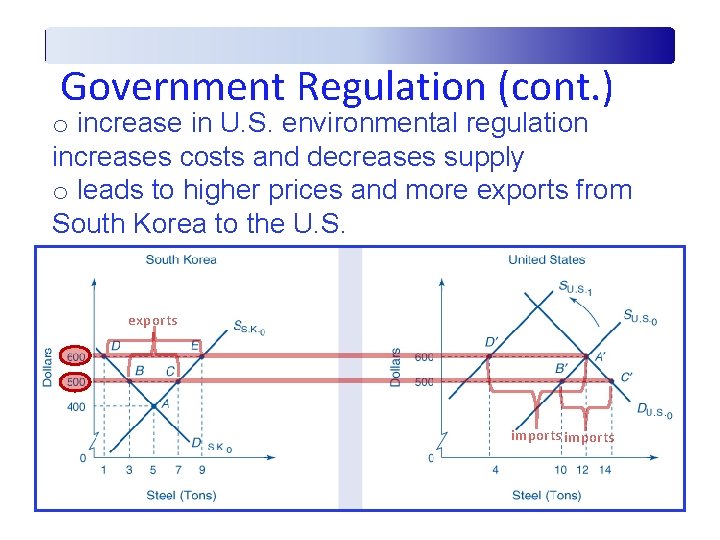

Government Regulation (cont. ) o increase in U. S. environmental regulation increases costs and decreases supply o leads to higher prices and more exports from South Korea to the U. S. exports imports

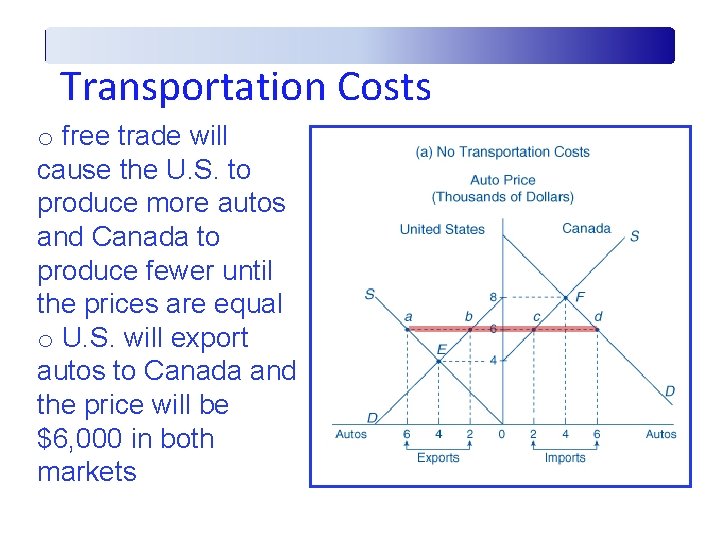

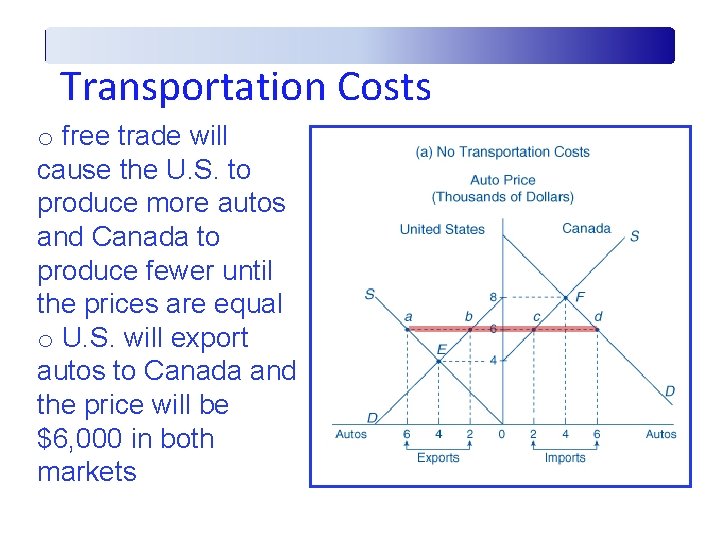

Transportation Costs o free trade will cause the U. S. to produce more autos and Canada to produce fewer until the prices are equal o U. S. will export autos to Canada and the price will be $6, 000 in both markets

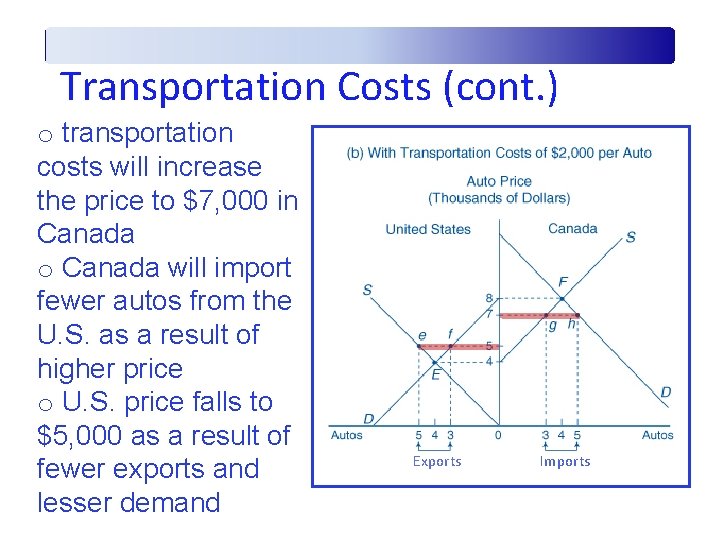

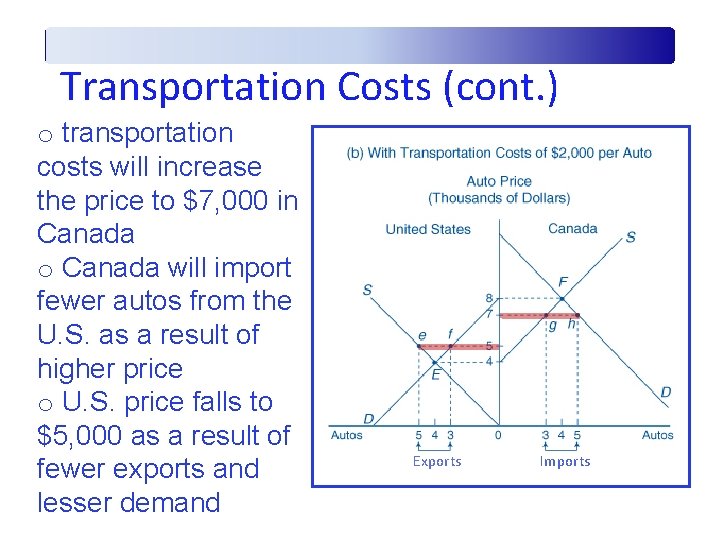

Transportation Costs (cont. ) o transportation costs will increase the price to $7, 000 in Canada o Canada will import fewer autos from the U. S. as a result of higher price o U. S. price falls to $5, 000 as a result of fewer exports and lesser demand Exports Imports