Sole Proprietorships What role do sole proprietorships play

- Slides: 37

Sole Proprietorships • What role do sole proprietorships play in our economy? • What are the advantages of a sole proprietorship? • What are the disadvantages of a sole proprietorship? Chapter 8 Section Main Menu

The Role of Sole Proprietorships • A business organization is an establishment formed to carry on commercial enterprise. Sole proprietorships are the most common form of business organization. • Most sole proprietorships are small. All together, sole proprietorships generate only about 6 percent of all United States sales. A sole proprietorship is a business owned and managed by a single individual. Chapter 8 Section Main Menu

Characteristics of Proprietorships • Most sole proprietorships earn modest incomes. • Many proprietors run their businesses part-time. Chapter 8 Section Main Menu

Advantages of Sole Proprietorships Sole proprietorships offer their owners many advantages: Ease of Start-Up Sole Receiver of Profit • • With a small amount of paperwork and legal expenses, just about anyone can start a sole proprietorship. Relatively Few Regulations • A proprietorship is the leastregulated form of business organization. Chapter 8 Section After paying taxes, the owner of sole proprietorship keeps all the profits. Full Control • Owners of sole proprietorships can run their businesses as they wish. Easy to Discontinue • Besides paying off legal obligations, such as taxes and debt, no other legal obligations need to be met to stop doing business. Main Menu

Disadvantages of Sole Proprietorships • Sole proprietorships have limited access to resources, such as physical capital. Human capital can also be limited, because no one knows everything. • Sole proprietorships also lack permanence. Whenever an owner closes shop due to illness, retirement, or any other reason, the business ceases to exist. The biggest disadvantage of sole proprietorships is unlimited personal liability. Liability is the legally bound obligation to pay debts. Chapter 8 Section Main Menu

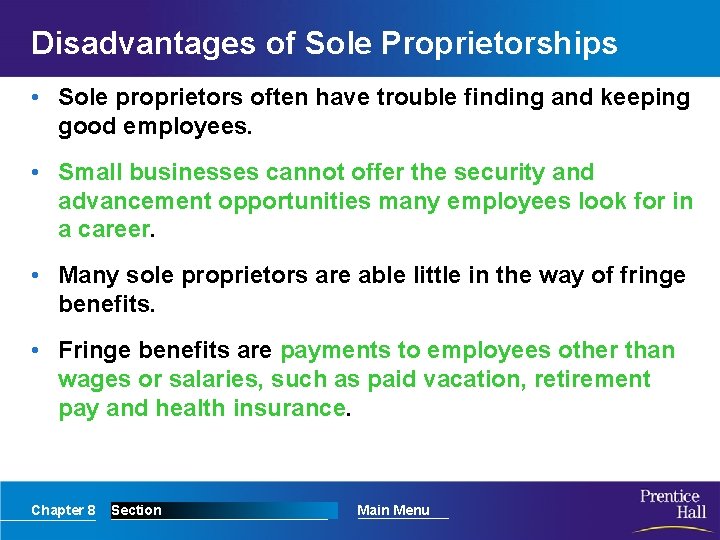

Disadvantages of Sole Proprietorships • Sole proprietors often have trouble finding and keeping good employees. • Small businesses cannot offer the security and advancement opportunities many employees look for in a career. • Many sole proprietors are able little in the way of fringe benefits. • Fringe benefits are payments to employees other than wages or salaries, such as paid vacation, retirement pay and health insurance. Chapter 8 Section Main Menu

Section 1 Assessment 1. Any establishment formed to carry on commercial enterprises is a (a) partnership. (b) business organization. (c) sole proprietorship. (d) corporation. 2. Sole proprietorships (a) are complicated to establish. (b) make up about 6 percent of all businesses. (c) are the most common form of business in the United States. (d) offer owners little control over operations. Want to connect to the PHSchool. com link for this section? Click Here! Chapter 8 Section Main Menu

Section 1 Assessment 1. Any establishment formed to carry on commercial enterprises is a (a) partnership. (b) business organization. (c) sole proprietorship. (d) corporation. 2. Sole proprietorships (a) are complicated to establish. (b) make up about 6 percent of all businesses. (c) are the most common form of business in the United States. (d) offer owners little control over operations. Want to connect to the PHSchool. com link for this section? Click Here! Chapter 8 Section Main Menu

Partnerships • What types of partnerships exist? • What are the advantages of partnerships? • What are the disadvantages of partnerships? Chapter 8 Section Main Menu

Types of Partnerships fall into three categories: • General Partnership – In a general partnership, partners share equally in both responsibility and liability. • Limited Partnership – In a limited partnership, only one partner is required to be a general partner, or to have unlimited personal liability for the firm. • Limited Liability Partnership – A newer type of partnership is the limited liability partnership. In this form, all partners are limited partners. Chapter 8 Section Main Menu

Advantages of Partnerships • Partnerships offer entrepreneurs many benefits. 1. Ease of Start-Up Partnerships are easy to establish. There is no required partnership agreement, but it is recommended that partners develop articles of partnership. 2. Shared Decision Making and Specialization In a successful partnership, each partner brings different strengths and skills to the business. 3. Larger Pool of Capital Each partner's assets, or money and other valuables, improve the firm's ability to borrow funds for operations or expansion. 4. Taxation Individual partners are subject to taxes, but the business itself does not have to pay taxes. Chapter 8 Section Main Menu

Disadvantages of Partnerships • Unless the partnership is a limited liability partnership, at least one partner has unlimited liability. • General partners are bound by each other’s actions. • Partnerships also have the potential for conflict. Partners need to ensure that they agree about work habits, goals, management styles, ethics, and general business philosophies. Chapter 8 Section Main Menu

Section 2 Assessment 1. What advantage does a partnership have over a sole proprietorship? (a) The responsibility for the business is shared. (b) The business is easy to start up. (c) The partners are not responsible for the business debts. (d) The business is easy to sell. 2. How is a general partnership organized? (a) Every partner shares equally in both responsibility and liability. (b) The doctors, lawyers, or accountants who form a general partnership hire others to run the partnership. (c) No partner is responsible for the debts of the partnership beyond his or her investment. (d) Only one partner is responsible for the debts of the partnership. Want to connect to the PHSchool. com link for this section? Click Here! Chapter 8 Section Main Menu

Section 2 Assessment 1. What advantage does a partnership have over a sole proprietorship? (a) The responsibility for the business is shared. (b) The business is easy to start up. (c) The partners are not responsible for the business debts. (d) The business is easy to sell. 2. How is a general partnership organized? (a) Every partner shares equally in both responsibility and liability (b) The doctors, lawyers, or accountants who form a general partnership hire others to run the partnership (c) No partner is responsible for the debts of the partnership beyond his or her investment (d) Only one partner is responsible for the debts of the partnership Want to connect to the PHSchool. com link for this section? Click Here! Chapter 8 Section Main Menu

Corporations, Mergers, and Multinationals • What types of corporations exist? • What are the advantages of incorporation? • What are the disadvantages of incorporation? • How can corporations combine? • What role do multinational corporations play? Chapter 8 Section Main Menu

Types of Corporations • A corporation is a legal entity, or being, owned by individual stockholders. • Stocks, or shares, represent a stockholder’s portion of ownership of a corporation. • A corporation which issues stock to a limited a number of people is known as a closely held corporation. • A publicly held corporation, buys and sells its stock on the open market. Chapter 8 Section Main Menu

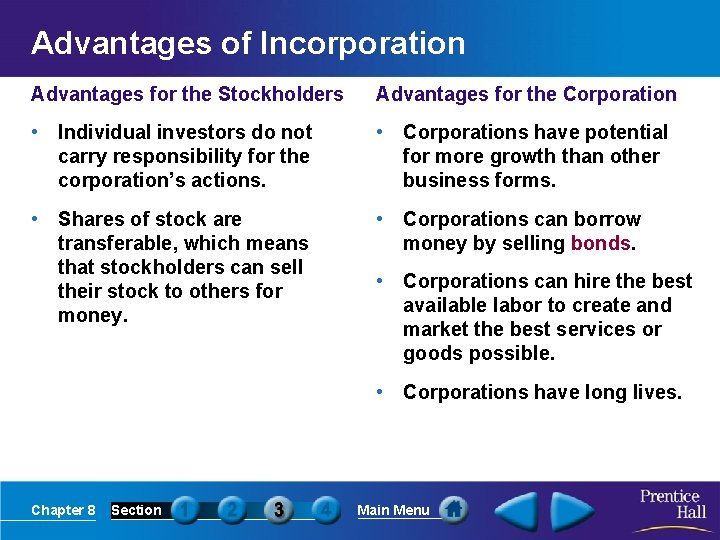

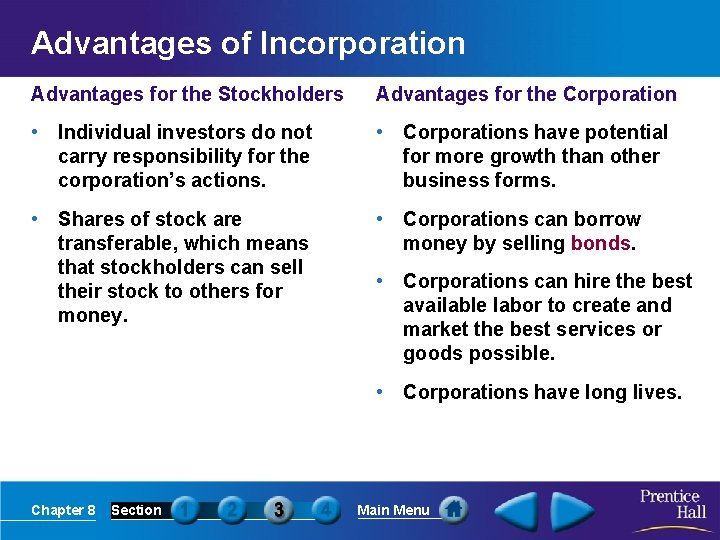

Advantages of Incorporation Advantages for the Stockholders Advantages for the Corporation • Individual investors do not carry responsibility for the corporation’s actions. • Corporations have potential for more growth than other business forms. • Shares of stock are transferable, which means that stockholders can sell their stock to others for money. • Corporations can borrow money by selling bonds. • Corporations can hire the best available labor to create and market the best services or goods possible. • Corporations have long lives. Chapter 8 Section Main Menu

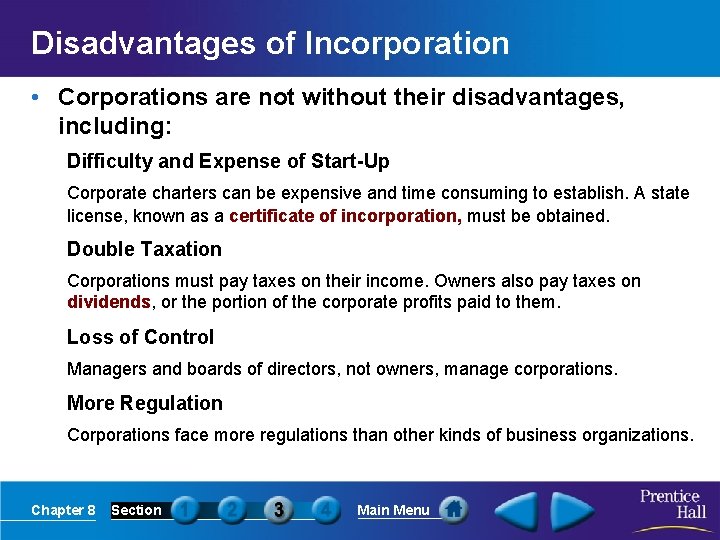

Disadvantages of Incorporation • Corporations are not without their disadvantages, including: Difficulty and Expense of Start-Up Corporate charters can be expensive and time consuming to establish. A state license, known as a certificate of incorporation, must be obtained. Double Taxation Corporations must pay taxes on their income. Owners also pay taxes on dividends, or the portion of the corporate profits paid to them. Loss of Control Managers and boards of directors, not owners, manage corporations. More Regulation Corporations face more regulations than other kinds of business organizations. Chapter 8 Section Main Menu

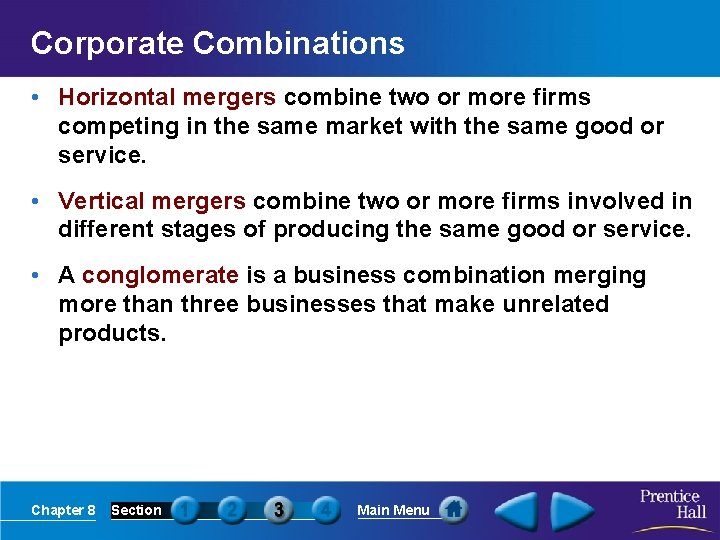

Corporate Combinations • Horizontal mergers combine two or more firms competing in the same market with the same good or service. • Vertical mergers combine two or more firms involved in different stages of producing the same good or service. • A conglomerate is a business combination merging more than three businesses that make unrelated products. Chapter 8 Section Main Menu

Multinationals Advantages of MNCs Disadvantages of MNCs • Multinationals benefit consumers by offering products worldwide. They also spread new technologies and production methods across the globe. • Some people feel that MNCs unduly influence culture and politics where they operate. Critics of multinationals are concerned about wages and working conditions provided by MNCs in foreign countries. Multinational corporations (MNCs) are large corporations headquartered in one country that have subsidiaries throughout the world. Chapter 8 Section Main Menu

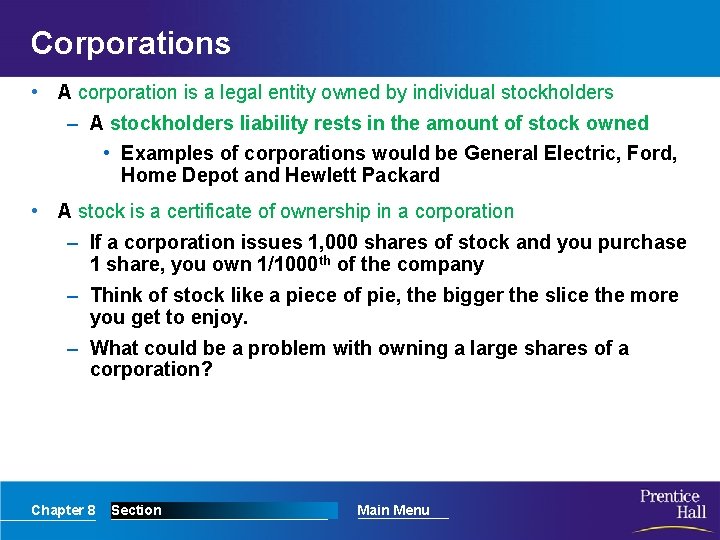

Corporations • A corporation is a legal entity owned by individual stockholders – A stockholders liability rests in the amount of stock owned • Examples of corporations would be General Electric, Ford, Home Depot and Hewlett Packard • A stock is a certificate of ownership in a corporation – If a corporation issues 1, 000 shares of stock and you purchase 1 share, you own 1/1000 th of the company – Think of stock like a piece of pie, the bigger the slice the more you get to enjoy. – What could be a problem with owning a large shares of a corporation? Chapter 8 Section Main Menu

Various Types of Corporation Stocks Chapter 8 Section Main Menu

Types of Corporations • Closely held corporations are corporations that distribute stock to a select few, such as family members – Also known as private corporations • Examples: Chapter 8 Section Main Menu

Types of Corporations • Publicly held corporation has many shareholders who can buy or sell stock on the open market – These types of corporations can be traded on the New York Stock Exchange, American Stock Exchange and the Nasdaq. – Example are: Chapter 8 Section Main Menu

Corporation Combinations • As a corporation continues to grow, owners, managers and stock holders may decide to merge with another company or companies • The two types of merges that we will be discussing are horizontal and vertical mergers • However, if the government decides that a merger would effect competition in the market place, the merger may be rejected if the government believes it would create a monopoly in the market. Chapter 8 Section Main Menu

Types of Mergers • Horizontal mergers join two of more firms competing in the same market with the same good or service – Reasons for a horizontal mergers: economies of scale, improved efficiency – Examples of horizontal mergers: GTE and Bell Atlantic merged to create – Delta and Northwest airlines merged to create Delta (Merge will be completed in 1 -2 yrs) Chapter 8 Section Main Menu

Types of Mergers • Vertical Mergers join two or more firms involved in different stages of producing the same good or service – Reasons for vertical mergers: fear of losing supplies from competitors – Examples of vertical mergers: Dell buying Intel, Microsoft buying Logitech, Chapter 8 Section Main Menu

Multinational Corporations • Multinational corporations are the world’s largest firms that produce and sell their goods and services worldwide. – Operate in more that one country – Usually have headquarters in one country and branches in another – Must obey laws and pay taxes in each country in which they operate • Examples of multinational corporations: Kodak, Ford and Sony Chapter 8 Section Main Menu

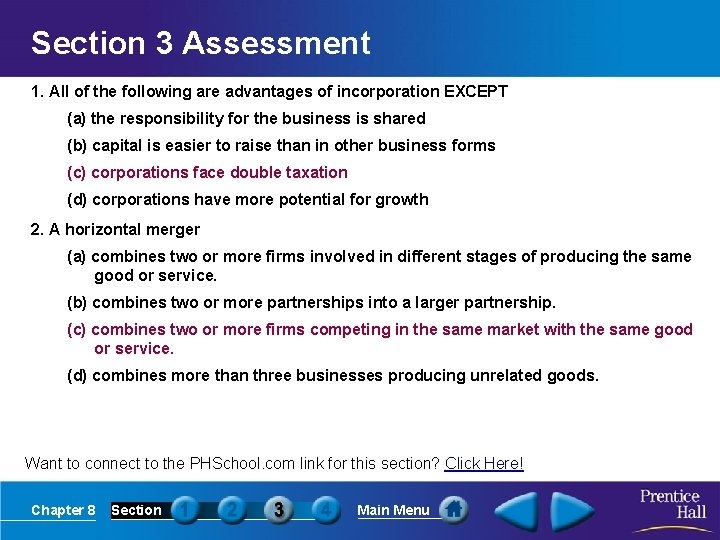

Section 3 Assessment 1. All of the following are advantages of incorporation EXCEPT (a) the responsibility for the business is shared (b) capital is easier to raise than in other business forms (c) corporations face double taxation (d) corporations have more potential for growth 2. A horizontal merger (a) combines two or more firms involved in different stages of producing the same good or service. (b) combines two or more partnerships into a larger partnership. (c) combines two or more firms competing in the same market with the same good or service. (d) combines more than three businesses producing unrelated goods. Want to connect to the PHSchool. com link for this section? Click Here! Chapter 8 Section Main Menu

Section 3 Assessment 1. All of the following are advantages of incorporation EXCEPT (a) the responsibility for the business is shared (b) capital is easier to raise than in other business forms (c) corporations face double taxation (d) corporations have more potential for growth 2. A horizontal merger (a) combines two or more firms involved in different stages of producing the same good or service. (b) combines two or more partnerships into a larger partnership. (c) combines two or more firms competing in the same market with the same good or service. (d) combines more than three businesses producing unrelated goods. Want to connect to the PHSchool. com link for this section? Click Here! Chapter 8 Section Main Menu

Other Organizations • How do business franchises work? • What are three types of cooperative organizations? • What are nonprofit organizations? Chapter 8 Section Main Menu

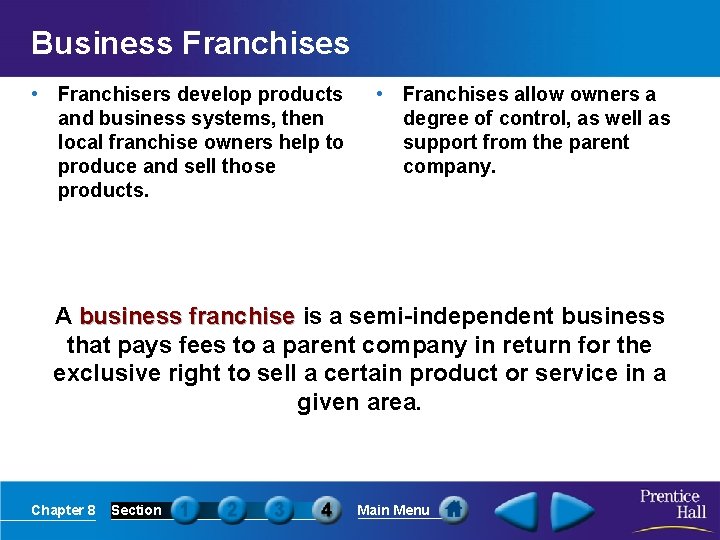

Business Franchises • Franchisers develop products and business systems, then local franchise owners help to produce and sell those products. • Franchises allow owners a degree of control, as well as support from the parent company. A business franchise is a semi-independent business that pays fees to a parent company in return for the exclusive right to sell a certain product or service in a given area. Chapter 8 Section Main Menu

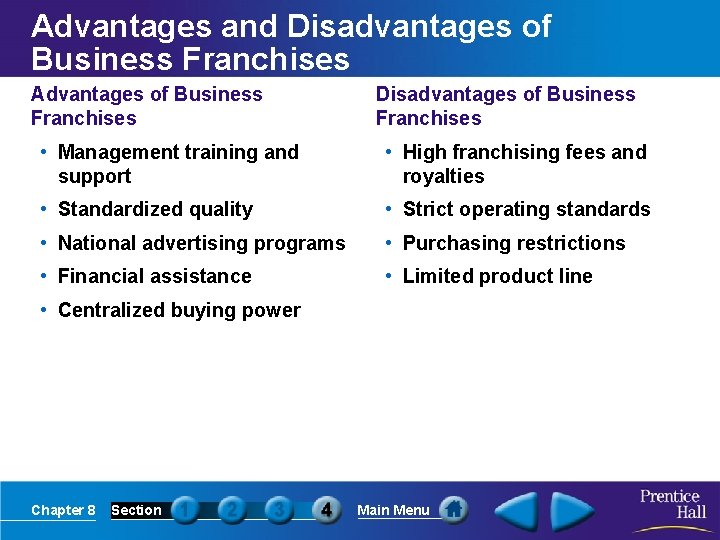

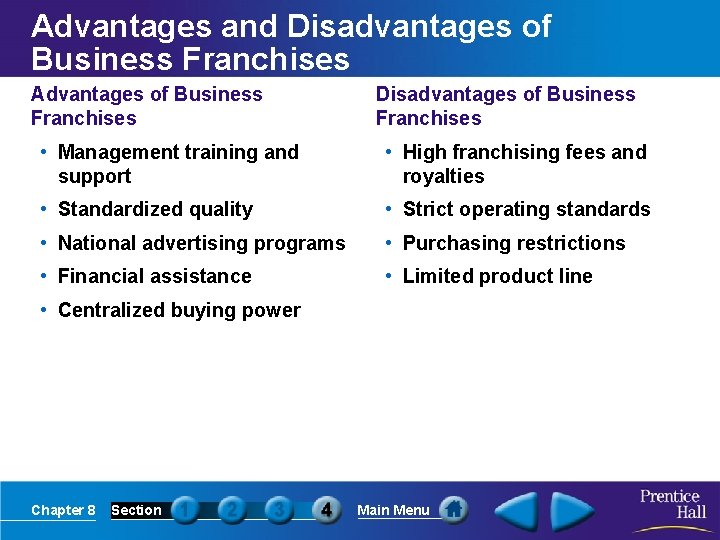

Advantages and Disadvantages of Business Franchises Advantages of Business Franchises Disadvantages of Business Franchises • Management training and support • High franchising fees and royalties • Standardized quality • Strict operating standards • National advertising programs • Purchasing restrictions • Financial assistance • Limited product line • Centralized buying power Chapter 8 Section Main Menu

Cooperatives • Consumer Cooperatives – Retail outlets owned and operated by consumers are called consumer cooperatives, or purchasing cooperatives. Consumer cooperatives sell their goods to their members at reduced prices. • Service Cooperatives – Cooperatives that provide a service, rather than goods, are called service cooperatives. • Producer Cooperatives – Producer cooperatives are agricultural marketing cooperatives that help members sell their products. A cooperative is a business organization owned and operated by a group of individuals for their shared benefit. Chapter 8 Section Main Menu

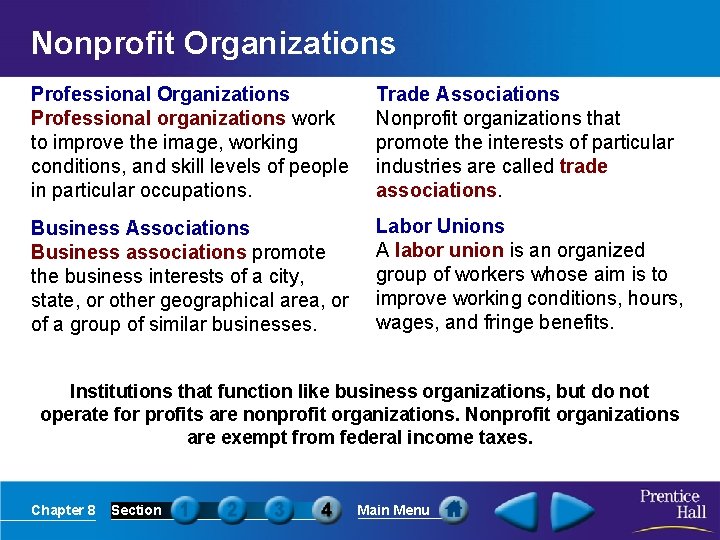

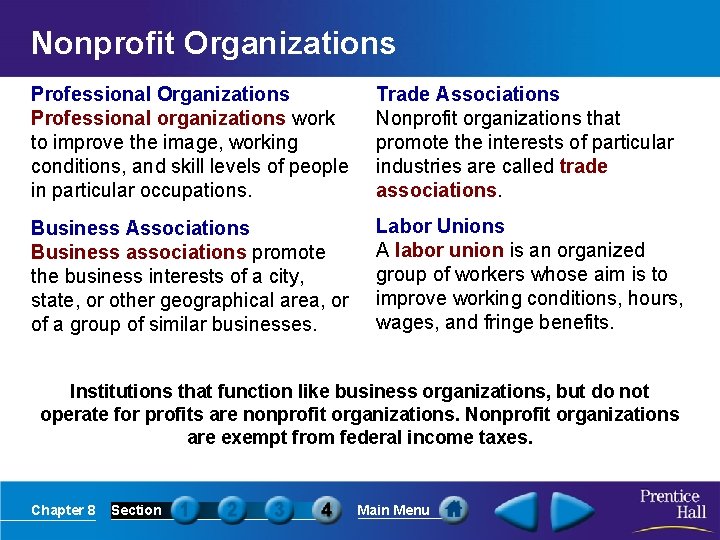

Nonprofit Organizations Professional organizations work to improve the image, working conditions, and skill levels of people in particular occupations. Trade Associations Nonprofit organizations that promote the interests of particular industries are called trade associations. Business Associations Business associations promote the business interests of a city, state, or other geographical area, or of a group of similar businesses. Labor Unions A labor union is an organized group of workers whose aim is to improve working conditions, hours, wages, and fringe benefits. Institutions that function like business organizations, but do not operate for profits are nonprofit organizations. Nonprofit organizations are exempt from federal income taxes. Chapter 8 Section Main Menu

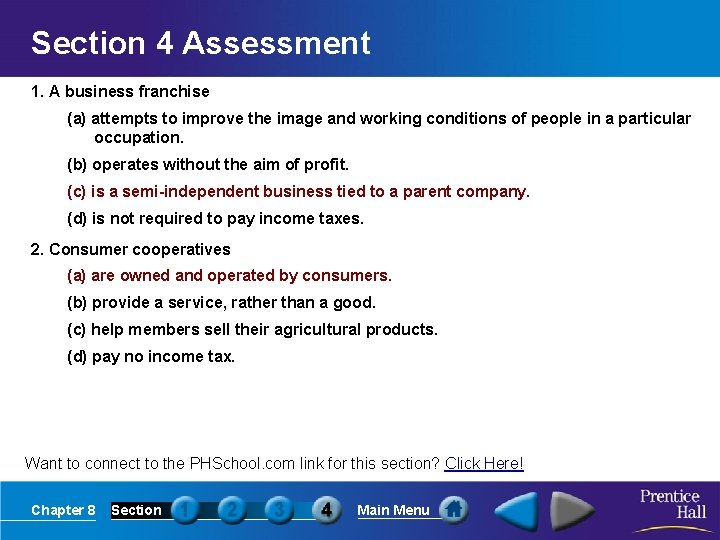

Section 4 Assessment 1. A business franchise (a) attempts to improve the image and working conditions of people in a particular occupation. (b) operates without the aim of profit. (c) is a semi-independent business tied to a parent company. (d) is not required to pay income taxes. 2. Consumer cooperatives (a) are owned and operated by consumers. (b) provide a service, rather than a good. (c) help members sell their agricultural products. (d) pay no income tax. Want to connect to the PHSchool. com link for this section? Click Here! Chapter 8 Section Main Menu

Section 4 Assessment 1. A business franchise (a) attempts to improve the image and working conditions of people in a particular occupation. (b) operates without the aim of profit. (c) is a semi-independent business tied to a parent company. (d) is not required to pay income taxes. 2. Consumer cooperatives (a) are owned and operated by consumers. (b) provide a service, rather than a good. (c) help members sell their agricultural products. (d) pay no income tax. Want to connect to the PHSchool. com link for this section? Click Here! Chapter 8 Section Main Menu

Chapter 8 section 1 sole proprietorships

Chapter 8 section 1 sole proprietorships Louise made the chocolate cake active or passive

Louise made the chocolate cake active or passive Play by play

Play by play Gozago

Gozago I've got a friend we like to play we play together

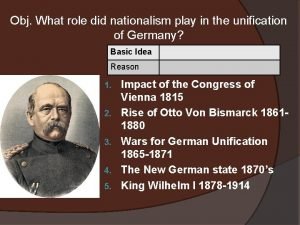

I've got a friend we like to play we play together What role did nationalism play

What role did nationalism play Hyperbole in the great gatsby

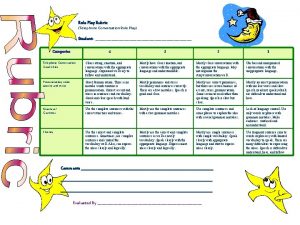

Hyperbole in the great gatsby Role play assessment

Role play assessment Crucial conversations role play exercises

Crucial conversations role play exercises How to win a deca role play

How to win a deca role play Enzyme involved in dna replication

Enzyme involved in dna replication Barbara reichenbach

Barbara reichenbach Role-play racional-emocional

Role-play racional-emocional Role play ventas

Role play ventas Poriferians

Poriferians Im adapt

Im adapt Play role meaning

Play role meaning What role did he play

What role did he play Shopping role play

Shopping role play Role play on healthy food and junk food

Role play on healthy food and junk food Constitutional convention role play

Constitutional convention role play What role do anthropologists play in solving crimes

What role do anthropologists play in solving crimes Feedback role play

Feedback role play Plural of fungus

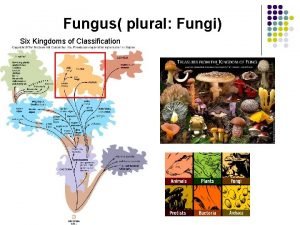

Plural of fungus Stem cell multiple choice questions

Stem cell multiple choice questions Deca role play scenarios

Deca role play scenarios What role should consumerism play in our economy

What role should consumerism play in our economy Assertive refusal skills

Assertive refusal skills Tour guide role play script

Tour guide role play script Mmi role play examples

Mmi role play examples Forecasts play an important role in

Forecasts play an important role in Telephone conversation role play script

Telephone conversation role play script Role play on healthy food and junk food

Role play on healthy food and junk food How did montresor know that the house would be empty

How did montresor know that the house would be empty Crucial conversations role play examples

Crucial conversations role play examples Five actors were competing for the leading role in the play

Five actors were competing for the leading role in the play What role does the ribosome play in assembling proteins?

What role does the ribosome play in assembling proteins? European role play

European role play